Most people start the month feeling confident about their finances, only to wonder where all the money went halfway through. According to a report, nearly 58% of Indians struggle to keep track of their expenses, often relying on last-minute borrowing to fill the gap.

That’s where cost management helps. It’s simply about planning and tracking your spending so your money lasts the whole month, without stress or surprises. Whether you’re a student, a working professional, or self-employed, learning to manage your costs effectively can make a big difference in how secure and confident you feel about your finances.

In this blog, we’ll explore what cost management really means, why it matters, how to get it right, and a few tips to manage your costs.

Key Takeaways

- Cost management is about planning, tracking, and controlling your spending to stay within income and avoid financial stress.

- Building smart habits like budgeting, monitoring cash flow, maintaining an emergency fund, and managing credit ensures financial stability.

- Staying aware of financial trends, rising expenses, and regulations helps young Indians make smarter spending and borrowing decisions.

- Short-term credit tools like Pocketly can help bridge unexpected cash gaps responsibly without disrupting your budget.

What is Cost Management?

Cost management is the process of planning, tracking, and controlling how you spend your money so your expenses stay within your income. In simple terms, it helps you use your money wisely instead of wondering where it went.

For individuals, it means knowing where your money goes, setting clear priorities, and trimming unnecessary costs. When you track what you spend on food, subscriptions, or travel, you start spotting patterns, and that awareness helps you save more and spend smarter.

In India, young professionals typically spend between ₹20,000 and ₹40,000 a month, depending on their lifestyle and city. Without a plan, it’s easy to overspend, rely on credit cards, or fall into short-term debt traps.

If you often find yourself short on cash before the month ends, that’s a clear sign you need better cost management. And that’s exactly why understanding its importance is the first step toward taking real control of your finances.

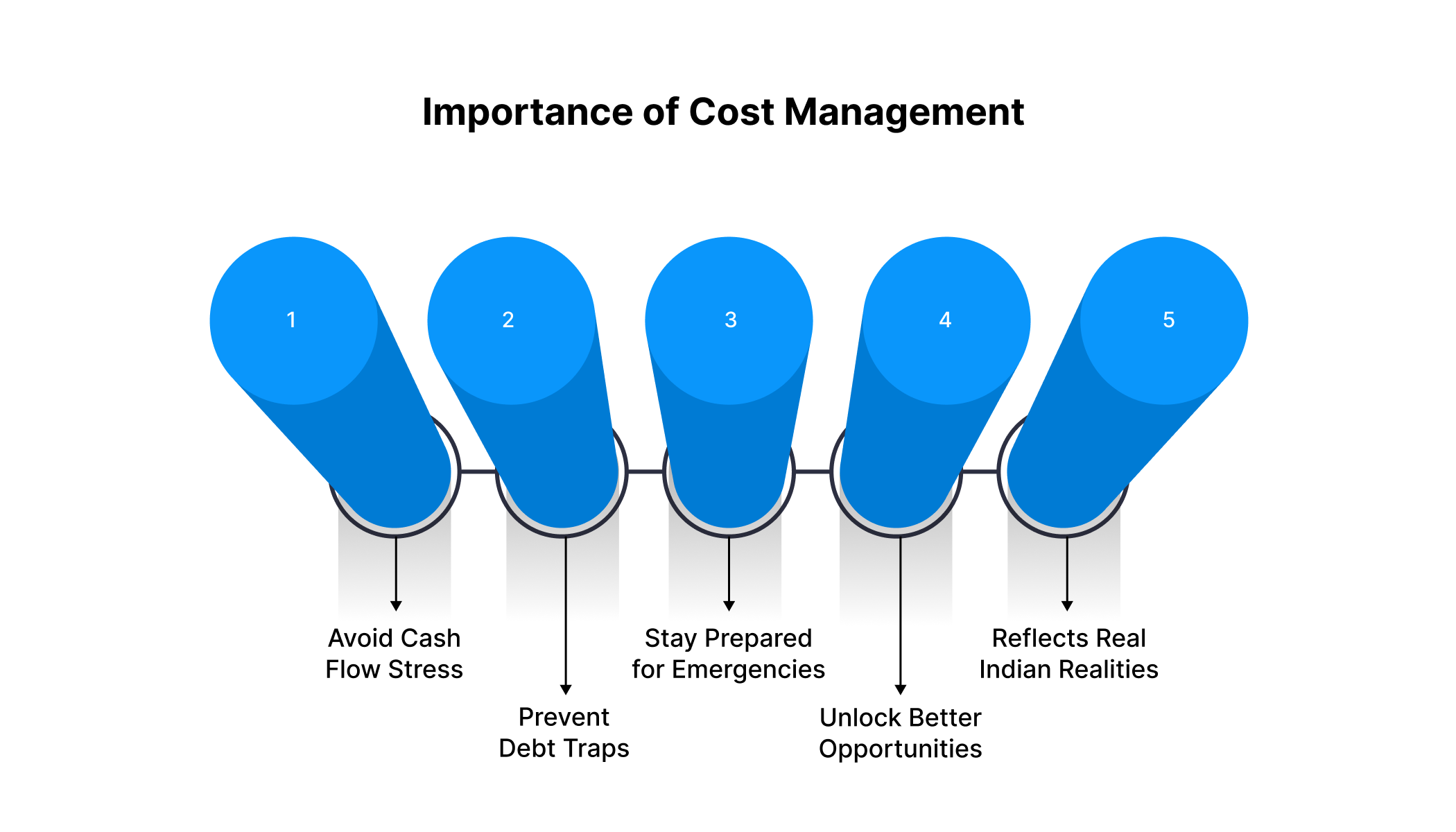

Importance of Cost Management

Unexpected expenses can throw your budget off balance if you haven’t planned ahead, showing exactly why managing your costs matters. Here are the key reasons why keeping a close eye on your spending can make a real difference to your financial health.

1. Avoid Cash Flow Stress

When you don’t track spending, it’s easy to run out of money before the month ends. This leads to delayed bills, late payments, or borrowing at high interest rates. Over time, that pressure takes a toll on your mental health. According to the Indian Journal of Psychiatry, financial stress is among the top causes of anxiety for young adults.

2. Prevent Debt Traps

Without proper planning, you might rely on credit cards or instant loans for everyday expenses. While short-term borrowing can help in emergencies, repeated use increases interest costs and affects your credit score. The Reserve Bank of India (RBI) notes that late repayments directly impact your creditworthiness, making it harder to access credit in the future.

3. Stay Prepared for Emergencies

Life doesn’t always go as planned: sudden medical bills or unexpected repairs can happen anytime. With proper cost management, you maintain an emergency fund to handle these shocks without borrowing.

4. Unlock Better Financial Opportunities

When you control your spending, you free up money to save and invest. That’s how you move from just “getting by” to achieving goals like higher education, travel, or buying a home.

5. Reflects Real Indian Realities

In India, where living costs keep rising, from rent to groceries, managing every rupee matters. A report revealed that nearly 50% of Indians use personal loans for lifestyle or urgent needs, often due to poor spending discipline. For students and self-employed individuals, consistent cost management is key to financial stability.

Understanding why it matters sets the foundation for what makes it work. Let’s look at the three pillars that keep your finances steady.

The Three Building Blocks of Smart Money Management

Before you start managing costs effectively, it helps to understand three key concepts that form the foundation of strong financial control.

Budgeting

A budget is your financial roadmap. It helps you plan how much to spend, save, and invest each month. The key is to track your expenses and adjust them based on income changes. In India, many people follow the 50-30-20 rule — 50% for essentials, 30% for lifestyle, and 20% for savings and investments.

Cash Flow Monitoring

Cash flow is the movement of money in and out of your account. When your outflow regularly exceeds inflow, it creates financial pressure. Keeping a record of daily or weekly expenses, using apps, spreadsheets, or even a simple notebook, helps spot leaks and maintain control over your finances.

Credit Score & Borrowing

Your credit score shows how responsibly you handle borrowed money and is one of the first things lenders check before approving loans or credit cards. Timely payments, low credit utilisation, and avoiding unnecessary borrowing help maintain a healthy score. Surprisingly, 45 % of Indians have never checked their credit score, despite its impact on borrowing.

These building blocks may seem straightforward, but applying them consistently is where many struggle. Now, we’ll break down the practical steps to put them into action.

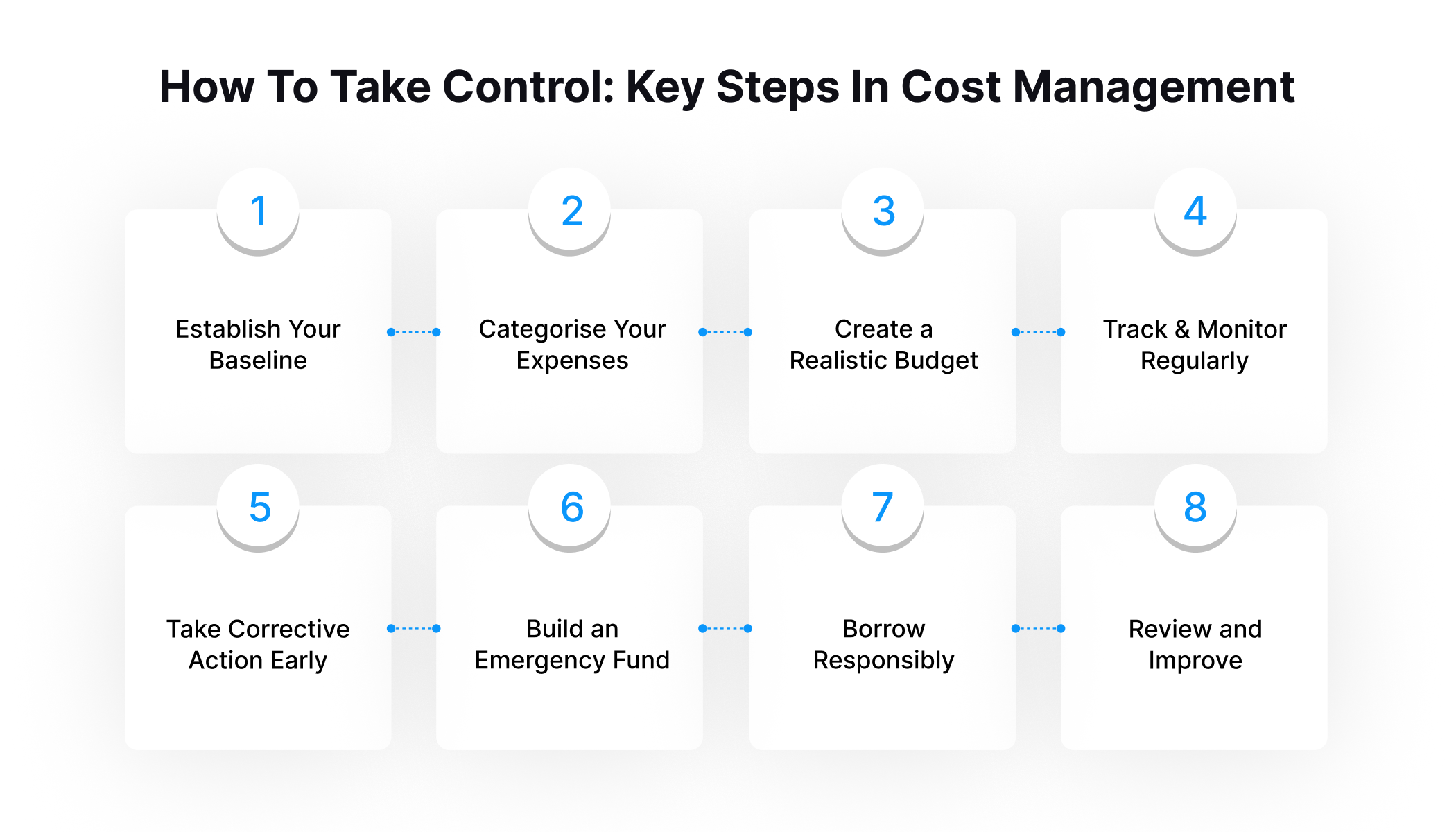

How to Take Control: Key Steps in Cost Management

Now that you know why cost management matters, here’s a single, practical roadmap you can use this month. Each step is short, actionable and geared to students, salaried professionals and self-employed individuals in India.

Step 1: Establish Your Baseline

Before you can manage your money, you need to know where it’s going.

- List all sources of income: salary, freelance work, side gigs, or allowances.

- Track all expenses: rent, EMIs, groceries, subscriptions, travel, and leisure.

Do this for at least one or two months to get a clear picture of your spending habits.

Example: You earn ₹40,000 a month. ₹12,000 goes to rent, ₹6,000 to food, ₹3,000 to transport, and ₹5,000 to subscriptions and shopping. That leaves ₹14,000 for other expenses, a signal to review and plan carefully.

Step 2: Categorise and Prioritise Your Expenses

Divide your expenses into three buckets:

- Fixed costs: rent, EMIs, insurance premiums.

- Variable costs: food, fuel, electricity, and entertainment.

- Discretionary costs: online shopping, dining out, hobbies, or travel.

Prioritise essentials first. If your income fluctuates, cover essentials before any other spending.

Step 3: Create a Realistic Budget

A budget structures your finances. Allocate funds to each category and stick to it.

Simple method: 50/30/20 rule

- 50% for essentials (rent, bills, groceries)

- 30% for lifestyle and wants

- 20% for savings or emergency funds

Example: If your income is ₹30,000 — ₹15,000 for essentials, ₹9,000 for flexible spending, ₹6,000 for savings. Adjust your budget as priorities or income change.

Step 4: Track and Monitor Regularly

Tracking helps you stay aware before things spiral. Check your spending weekly instead of waiting until the month ends. You can use budgeting apps, spreadsheets, or even jot things down in a notebook.

Example: Mid-month, you notice ₹3,000 spent on dining out; a cue to slow down before overspending.

Step 5: Take Corrective Action Early

If one category overshoots, adjust immediately. Cut non-essentials, find cheaper alternatives, or postpone non-urgent expenses.

Example: You overspent on entertainment? Balance it out by cooking at home more often or pausing an unused subscription.

The idea isn’t to deprive yourself; it’s to regain balance before it becomes a financial strain.

Step 6: Build an Emergency Fund

Life throws surprises: a medical bill, a broken phone, or a delayed salary. An emergency fund saves you from borrowing at high interest. Aim to save at least three to six months’ worth of your basic expenses.

Keep it in a liquid account you can access easily.

Example: If your monthly expenses are ₹25,000, your goal is to build an emergency fund of ₹75,000 to ₹1.5 lakh over time.

Step 7: Borrow Responsibly When Needed

Even with careful planning, short-term gaps may occur. Using a small, short-term loan like Pocketly can help, as long as borrowing is responsible.

- Compare interest rates and repayment terms.

- Borrow only what you can repay comfortably.

Loans should act as a safety net, not a routine solution.

Step 8: Review and Improve Every Month

At month-end, reflect:

- Did you stick to your budget?

- Where did you overspend?

- Can you increase savings next month?

Regular reviews turn cost management into a habit, helping you make smarter decisions and feel more confident about your money.

Even with a solid plan, small mistakes can quietly derail progress. Identifying these early makes all the difference.

Avoid These Common Cost Management Mistakes

Even the most disciplined people slip up when it comes to managing money. Here are some common mistakes, and how to avoid them.

- Checking Spending Too Late: Waiting until the end of the month to review your expenses means you’re reacting, not managing. Track your spending weekly to stay in control.

- Treating All Costs the Same: Not all expenses are equal. Separate your fixed costs (like rent or EMIs) from variable and discretionary ones to see where you can adjust.

- Skipping an Emergency Fund: Without a buffer, even minor emergencies can push you toward high-interest borrowing. Set aside a small portion of your income each month, even a few hundred rupees, helps.

- Over-Cutting Costs: Trying to slash every expense often backfires and affects your quality of life. Smart cost management isn’t about perfection; it’s about awareness, planning, and steady improvement.

- Using Loans as a First Resort: Borrowing should be a backup, not a habit. Always review your expenses and explore other options before turning to credit.

Without a buffer, even minor emergencies can push you toward high-interest borrowing. Set aside a small portion of your income each month, even a few hundred rupees helps.

What’s Changing: Trends and Rules Shaping Cost Management in India

India’s financial era is changing fast. Digital payment tools like UPI, credit cards, and online lending platforms have made transactions faster and more convenient than ever. But this convenience comes with a catch, easy access to credit can result in overspending if not managed carefully.

Buy-now-pay-later services, small-ticket loans, and instant credit apps are increasingly popular, particularly among young professionals. While these tools can help in emergencies, overreliance without planning can quickly create debt. RBI data shows that India’s personal loan market has seen significant growth, underlining how accessible, yet potentially risky, credit has become.

At the same time, regulations are tightening. The Reserve Bank of India now requires lenders to be transparent about charges and loan terms, protecting borrowers from hidden fees and irresponsible lending.

Research from PwC shows that mandatory expenses rise from around 34% of spending for entry-level earners to about 45% for higher-income groups. In other words, as you earn more, more of your income goes to essentials, making cost management even more important. Data also shows that 93% of salaried Indians earning under ₹50,000 rely on credit cards or BNPL services, reinforcing the need for careful financial planning.

With these changes in mind, adopting practical habits and using the right tools has never been more important.

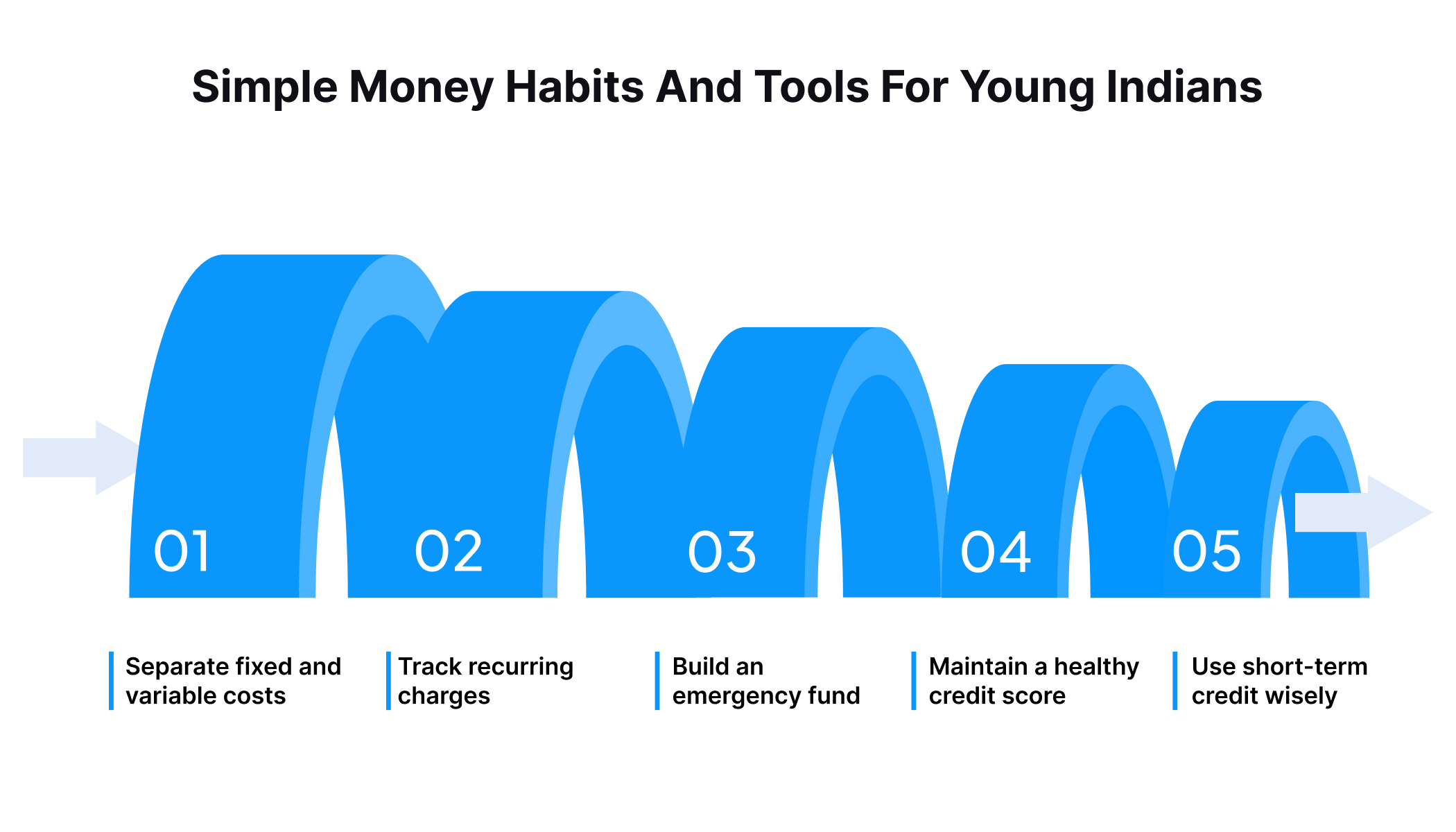

Simple Money Habits and Tools for Young Indians

Managing costs becomes easier when you adopt the right habits and use helpful tools. Here are some practical steps:

- Separate fixed and variable costs: Fixed costs remain consistent each month, while variable expenses like groceries or fuel need closer attention.

- Track recurring charges: Small subscriptions for apps or streaming services can add up; keep an eye on them.

- Build an emergency fund: Save one to three months’ worth of expenses to handle unexpected costs without borrowing.

- Maintain a healthy credit score: Pay bills on time and keep credit use low to strengthen your financial profile.

- Use short-term credit wisely: Tools like Pocketly can help bridge unavoidable expenses, just ensure repayment is timely.

Also Read: 6 Simple Budgeting Tips for Better Money Management

Once these habits become part of your routine, managing money becomes second nature, and you stay in control of your finances. Let’s learn more about Pocketly.

Pocketly: A Solution for Short-Term Gaps

Even with good cost management, unexpected expenses happen, a delayed salary, medical bill, or late client payment. Instead of resorting to expensive credit cards or stressful borrowing, Pocketly offers a simple, digital-first solution for young Indians.

Pocketly helps students, salaried professionals, and self-employed individuals manage short-term cash-flow gaps responsibly, without disrupting financial plans.

How Pocketly Helps You

- Loan range: ₹1,000 to ₹25,000

- 100% digital process: Apply and get approved through the app with no paperwork

- Instant approval & quick disbursal: Funds credited within minutes

- Flexible repayment: Choose no-cost EMI options that fit your budget

- No collateral required: Accessible for anyone with a stable income or allowance

- Credit-building opportunity: Timely repayments can help improve your credit score

Why Pocketly Works

Pocketly complements budgeting; it doesn’t replace it. Used wisely, it acts as a financial buffer during tight situations:

- Prevents panic borrowing, avoiding high-interest debt

- Keeps you in control with manageable loan amounts and flexible repayment

- Supports budgeting discipline by aligning EMIs with your expense plan

- Strengthens long-term financial health through responsible usage

How to Apply

Download the Pocketly app (iOS or Android), complete digital KYC with Aadhaar and PAN, enter your employment and income details, check your eligibility, and get your loan instantly. It’s quick, easy, and stress-free.

Click here to download the Pocketly app today to experience hassle-free access to funds when you need them most.

Wrapping Up

Cost management isn’t about cutting out everything you enjoy; it’s about being smart with your money. Whether you’re a student, salaried employee, or self-employed, learning to plan, track, and manage your expenses can help you avoid stress, stay out of debt, and save more.

Take charge of your expenses with smart cost management. Track your spending, set clear budgets, and make every rupee count. And when you need quick financial support, Pocketly is here to help, fast, flexible, and reliable.

Download Pocketly today and manage your money with confidence.

Frequently Asked Questions (FAQs)

1. What is the definition of cost management?

Cost management is the process of planning, tracking, and controlling your expenses to make sure your spending aligns with your income and financial goals.

2. What are the steps of cost management?

The main steps include planning and estimating expenses, setting a budget, monitoring actual spending, taking corrective actions, and reviewing results regularly to improve your financial habits.

3. What is the importance of cost management?

Effective cost management helps you avoid debt, reduce financial stress, and save for emergencies or future goals. It gives you control and clarity over your financial decisions.

4. How is cost management different from budgeting?

Budgeting is a part of cost management. A budget sets your spending limits, while cost management is the ongoing process of tracking, adjusting, and reviewing your spending to stay within those limits.

5. What makes Pocketly different from other loan apps?

Pocketly offers small, short-term loans from ₹1,000 to ₹25,000 designed for young professionals and students. It’s completely digital, quick to approve, and easy to repay, perfect for short-term financial needs.

6. How quickly can I get the loan amount in Pocketly?

Once your KYC and eligibility check are complete, the loan amount is usually credited to your bank account within minutes.