Ever got rejected for a loan even when you thought your finances were in order? You’re not alone. Many young earners face the same confusion, and the missing link is often their credit score.

But don't worry, it’s not as complicated as it sounds. Understanding credit score meaning is not just about getting loans, but about knowing how lenders see your financial habits. With a solid score, borrowing becomes smoother with quicker approvals, but a weak one often leads to delays and higher costs.

If you’re a student, young professional, or budding entrepreneur, this guide will help you decode credit scores. Keep reading to see how your score affects borrowing and pick up tips to make building good credit less confusing and more doable.

Quick Look:

- A good credit score (750+) improves loan approval chances and better interest rates.

- Credit scores are calculated from payment history, credit mix, debt, and credit length.

- The main types of credit scores in India include CIBIL, Experian, Equifax, and CRIF.

- Timely repayments, low credit utilization, and diverse credit types help improve your score.

- Regularly checking your credit report prevents errors and helps track financial progress.

What Is The Meaning Of A Credit Score?

A credit score is a 3-digit number that shows how responsibly you’ve managed borrowed money in the past. It usually ranges from 300 to 900, with higher numbers showing a stronger repayment behaviour.

Understanding the credit score meaning can help you plan your finances better, especially if you rely on loans or credit cards. This number is especially crucial for lenders, as it helps them assess how likely you are to repay a loan on time.

What Is A Good Credit Score?

A good credit score means that you are a responsible borrower and more likely to secure credit easily. Here’s a general range:

- Below 550: Poor; your loan approval chances are lower, and you may face higher interest rates.

- 550-649: Average, indicating occasional delays or financial struggles.

- 650-749: Good, reflecting mostly timely payments and responsible credit usage.

- 750-900: Excellent, demonstrating a strong repayment history and eligibility for the best rates.

In general, a score above 750 is usually considered very good, offering better loan approvals and credit options.

Also Read: Minimum Credit Score Required for Personal Loan

What Are The Different Types Of Credit Scores?

India has 4 major credit bureaus licensed by the Reserve Bank: CIBIL, Experian, Equifax, and CRIF High Mark. Each bureau calculates scores slightly differently, all ranging from 300 to 900. Let’s take a look at these:

- CIBIL Score: CIBIL Score is the most commonly used credit score in India. It’s based on your loan repayment history, credit card usage, and other financial behaviour.

- Equifax Score: Equifax calculates your score using similar criteria to CIBIL, focusing on repayment patterns and credit utilisation. Lenders use it to evaluate your reliability as a borrower.

- Experian Score: Experian Score highlights your overall credit behaviour, including loans and credit cards. It helps banks and financial institutions understand your repayment habits and borrowing patterns.

- CRIF High Mark Score: CRIF High Mark considers your loan and credit card activity to compute your score. It’s used for both personal and business credit assessments to determine financial responsibility.

Checking scores from multiple bureaus can give you a complete picture of your credit health.

Also Read: Differences Between Experian and CIBIL Score

Why Does Your Credit Score Matter?

Understanding the value of your credit score can save you from financial setbacks. Here’s why:

Interest Rates

Your credit score rating has a direct impact on the interest rates you pay. Higher scores often qualify you for lower rates, reducing the overall cost of borrowing. Conversely, a lower score signals risk, leading lenders to charge higher rates and making borrowing more expensive.

Loan Approvals

A good credit score improves the odds of getting loans approved. Lenders see you as a low-risk borrower, which makes them more willing to offer personal loans, home loans, or credit cards. A lower score may lead to rejections or additional scrutiny, delaying the approval process.

Credit Card Options

Credit card issuers closely examine your credit score before offering cards. A good score enhances your chances of being approved for premium credit cards. This way, you get higher limits, better rewards, and added benefits such as cashback, travel perks, or exclusive offers. A strong credit score opens up more financial options with better perks.

Other Uses

Credit scores aren’t just used by banks. Many employers, landlords, and even insurance companies check your credit score to analyse your financial reliability. For instance, landlords might review it before renting you a property, while employers may consider it during the hiring process to judge your management skills.

Also Read: Credit Card for Low CIBIL Score in India

How Are Credit Scores Calculated?

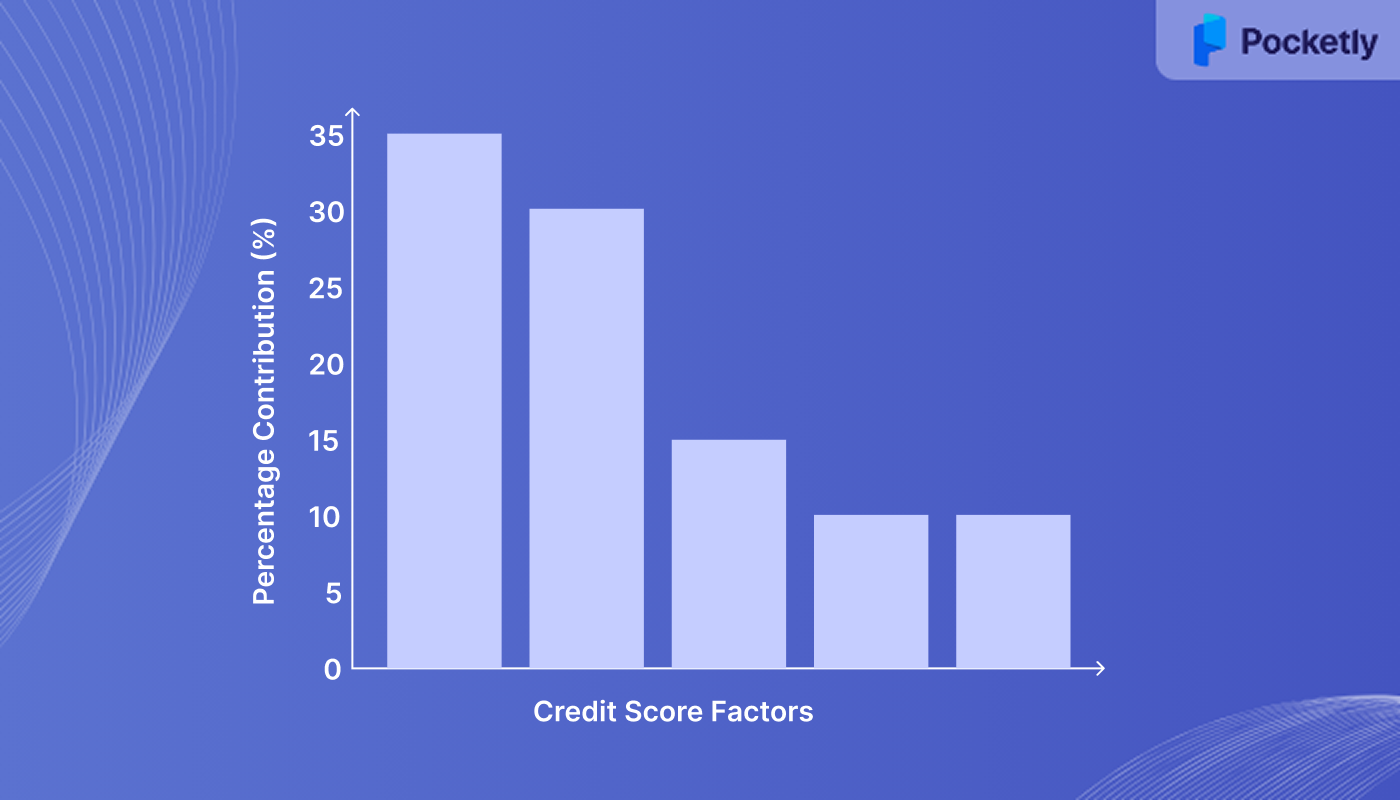

Understanding credit score meaning starts with knowing how your credit score is calculated. There are several key factors that impact your score, with some being more influential than others. Here's how it all breaks down:

- Payment History (35%): The most significant factor is your payment history. Timely payments show lenders that you’re reliable, while missed payments, defaults, or bankruptcy can seriously harm your credit score.

- Amounts Owed (30%): This measures how much of your available credit you’ve used. If you’re using a large percentage of your credit limit, it may indicate you’re overextending yourself, which lowers your score.

- Length of Credit History (15%): The longer your credit history, the better it is for your score. Lenders prefer borrowers with a stable repayment pattern, so older accounts typically improve your score.

- Types of Credit (10%): This looks at whether you have a mix of credit types, like revolving credit (credit cards) and instalment loans (car loans or mortgages). A good mix suggests you can handle different types of credit responsibly.

- New Credit (10%): Opening multiple credit accounts within a brief span can negatively impact your score. Lenders may see this as a sign of financial distress or an attempt to accumulate more debt.

How To Check Your Credit Score?

Checking your credit score can be done online easily in a few steps. You can get your score through the four RBI-licensed credit bureaus: CIBIL, Experian, Equifax, and CRIF High Mark. Each bureau offers online portals where you can download your personal or business credit report.

Some websites partnered with these bureaus also provide quick access to your credit score. For instance, obtaining your CRIF Score online involves filling in your details, verifying your identity, and authenticating your account.

How To Improve Your Credit Score?

Your credit score changes whenever new information is reported on your account. Improving your credit score requires steady effort, but there are several practical steps you can take to boost it over time:

Increase Your Credit Limit

If you have an existing credit card, request that your bank raise your credit limit. An increased limit can reduce your credit utilisation rate, which can positively impact your score. However, avoid using this extra credit to rack up more debt.

Pay Bills On Time

Timely payments are the most effective way to improve your credit score. Make sure all your bills, including loans and credit cards, are paid before the due date. A consistent record of punctual payments can significantly improve your score within a few months.

Correct Errors On Your Credit Report

Mistakes on your credit report can harm your score. Be sure to regularly check your credit report for errors, such as incorrect balances or payments marked late. Disputing and fixing these errors can have a quick, positive impact on your score.

Keep Old Credit Accounts Open

Even if you're not using a particular credit card, it's better to leave it open rather than close it. Closing accounts can shorten your credit history, which negatively impacts your score. As long as the account isn't costing you in fees, keeping it open can be beneficial.

Consider Professional Help

If you don’t have the time or knowledge to improve your score, you might consider hiring a credit repair company. These companies negotiate with creditors to remove negative marks from your report, but may charge a monthly fee.

How Pocketly Helps Build Credit With Borrowing Smart?

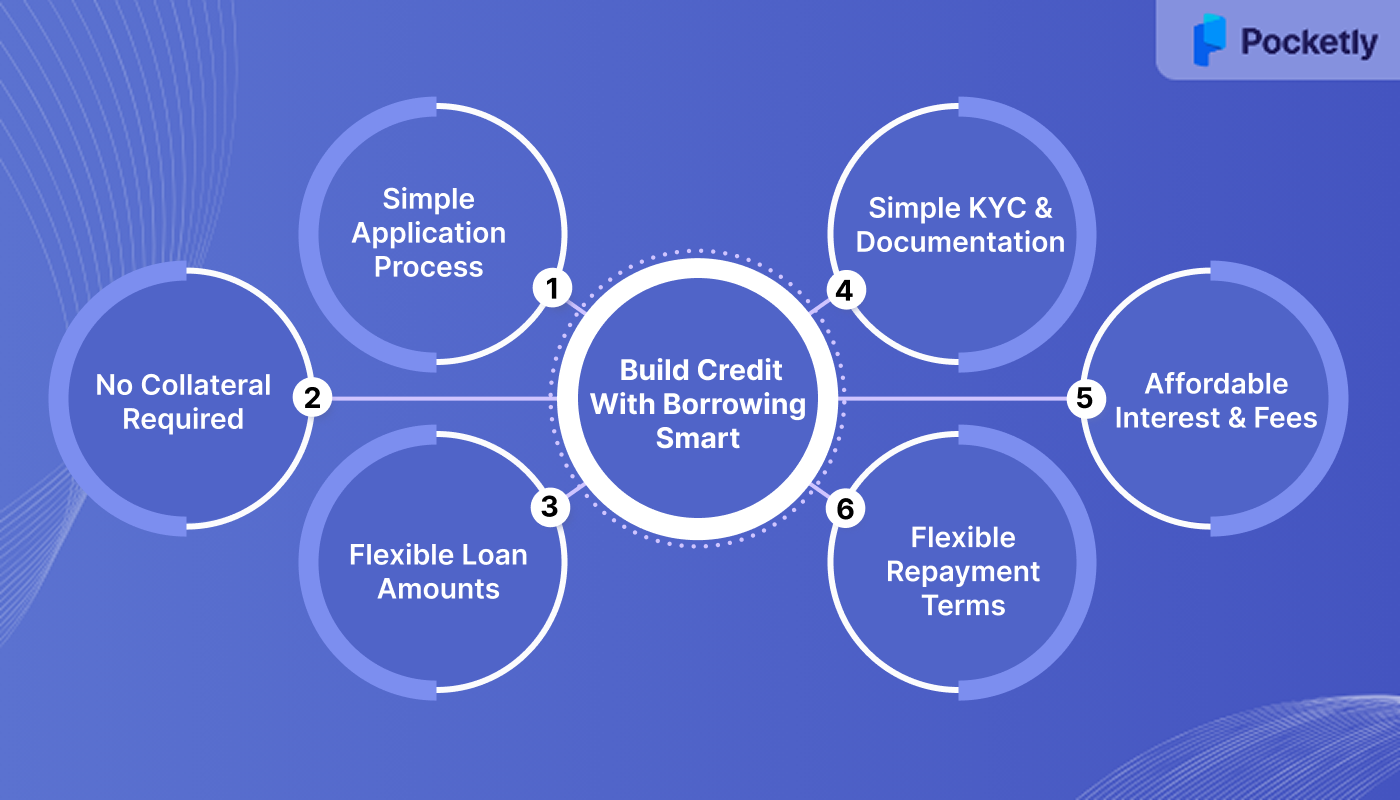

Building and maintaining a good credit score often depends on how you handle unexpected expenses. Pocketly is an ideal solution for young Indians facing short-term financial shortages without having to worry about collateral or a high credit score.

Why Pocketly Works For You:

- Simple Application Process: Sign up in two clicks, complete hassle-free KYC, provide bank details, and receive funds within minutes.

- No Collateral Required: Whether you're a student or starting a new job, you don’t need to pledge assets to access a loan.

- Flexible Loan Amounts: Borrow from ₹1,000 to ₹25,000 to cover emergency expenses, education fees, or urgent needs.

- Simple KYC & Documentation: A hassle-free KYC process with only scanned copies of your documents required. No physical paperwork is needed.

- Affordable Interest & Fees: Interest rates start as low as 2% per month, with processing fees ranging from 1-8% of the loan amount.

- Flexible Repayment Terms: Pay as much as you can, above the minimum due each month, and close your loan whenever you're ready.

Pocketly isn’t an NBFC but acts as a trusted digital lending platform on behalf of registered NBFCs. By providing flexible, transparent loans, it helps you cover emergencies while strengthening your credit profile over time.

The Bottom Line

The meaning of a good credit score goes beyond just a number; it reflects how financially reliable you are. A good credit score can open doors to better loan offers and favourable terms. Building and maintaining it requires consistent habits like timely payments, managing credit usage, and avoiding too many new accounts at once. Regularly checking your score and understanding the factors that affect it can help you stay on top of your financial goals.

Need financial flexibility in times of need? With Pocketly, you don’t have to worry about your credit score holding you back. From flexible short-term loans to instant approvals and transparent costs, Pocketly ensures quick access to funds without unnecessary financial stress.

Download the Pocketly app today on Android or iOS and take a smarter step toward financial independence.

FAQ’s

1. How much is a 750 credit score worth?

A 750 credit score is considered very good in India. It increases the chances of getting loan approvals with lower interest rates and better terms.

2. What is the CIBIL full form?

CIBIL refers to Credit Information Bureau (India) Limited. It is one of India’s leading credit information companies that maintains credit records of individuals and businesses.

3. How do I calculate my credit score?

You don’t calculate your credit score manually. Instead, credit bureaus like CIBIL, Experian, and Equifax assess your repayment history, outstanding debt, and credit mix to generate your credit score.

4. What is a poor credit score?

A poor credit score usually lies between 300-549. It signals high risk to lenders, making it harder to get loans or credit cards approved.