Managing money often feels harder than earning it, especially when your expenses shift every month. One week, you feel in control, and the next, you’re wondering how your balance dropped so quickly. If this sounds familiar, you’re not the only one trying to make sense of where your income really goes.

India’s per-capita net national income touched nearly ₹2 lakh in FY 2025, growing at 8.6% from the previous year. Yet many young earners still feel stretched by mid-month. If income is rising, why doesn’t financial comfort rise with it? The answer often lies in how you organise, track, and use your earnings, not how much you make.

This blog will help you understand income management in a simple, relatable way. Read along to plan smarter, build better habits, and make your income work for you, no matter where you are in your journey. Let’s get started.

At A Glance:

- Income management matters as India handles 19 billion monthly UPI payments, but has only 27% financial literacy.

- Knowing active, passive, mandatory, and discretionary categories helps you plan your earnings more deliberately.

- Practical income management strategies include budgeting clearly, building an emergency buffer, increasing income, and planning taxes early.

- Students should automate savings, mid-career earners must control housing costs, and pre-retirees should rebalance income assets.

- Managing irregular income becomes easier with buffers, scheduling expenses, and planning predictable earning windows.

Why Income Management Matters In India

Getting a handle on your income is becoming more important than ever. But what has changed, and why should you pay closer attention to where your money goes each month? Let’s break it down so it actually feels relatable to your everyday decisions.

Shift In How Indians Use Their Income

India’s digital payment boom has changed how people manage their monthly earnings. Digital payments, especially UPI, are now everywhere, with over 19 billion transactions happening every month, making it the biggest real-time payment system globally.

With every transfer and payment recorded instantly, you get a clearer view of where your income goes. This transparency helps you plan your spending better, spot unnecessary expenses, and stay aware of your financial patterns.

Low Financial Awareness In India

Digital tools may have grown, but financial understanding hasn’t kept up. Recent reports show that only 27% of adults are financially literate, which means a lot of account holders aren’t sure how to use their money efficiently.

This gap often leads to guesswork and short-term decisions instead of a clear income plan. Learning basic income management early helps you stay stable, handle surprises better, and build healthy financial habits for the long run.

Also Read: Simple Money Management Tips for Personal Finances

What Are The Main Types Of Income And Expenses?

You might think income is straightforward, but it comes in more forms than just your salary. Understanding these helps you decide how to use each source wisely.

Quick Comparison:

| Category | What It Means | How It Affects Income Planning |

| Active Income | Earned through work | Needs regular budgeting |

| Passive Income | Earned with little ongoing effort | Helps long-term goals |

| Mandatory Expenses | Essentials you must pay | Hard to reduce |

| Discretionary Expenses | Wants and lifestyle costs | Easy to adjust |

Types Of Income

- Active Income: Earnings from your job, freelancing, or business activities. This stops when work stops.

- Passive Income: Money from investments, dividends, or rental properties. It keeps coming even if you take a break.

Focusing on passive income over time can help build financial stability while reducing dependency on active earnings.

Types Of Expenses

- Mandatory/Non-Discretionary Expenses: Necessary spending for survival and routine life. Examples include rent, utilities, groceries, and loan payments.

- Discretionary Expenses: Spending on wants and lifestyle choices, such as eating out, subscriptions, or hobbies.

Reducing discretionary expenses is the easiest way to save more and increase surplus income for investing or emergencies.

Once you know what your money comes from and where it goes, income management becomes far easier.

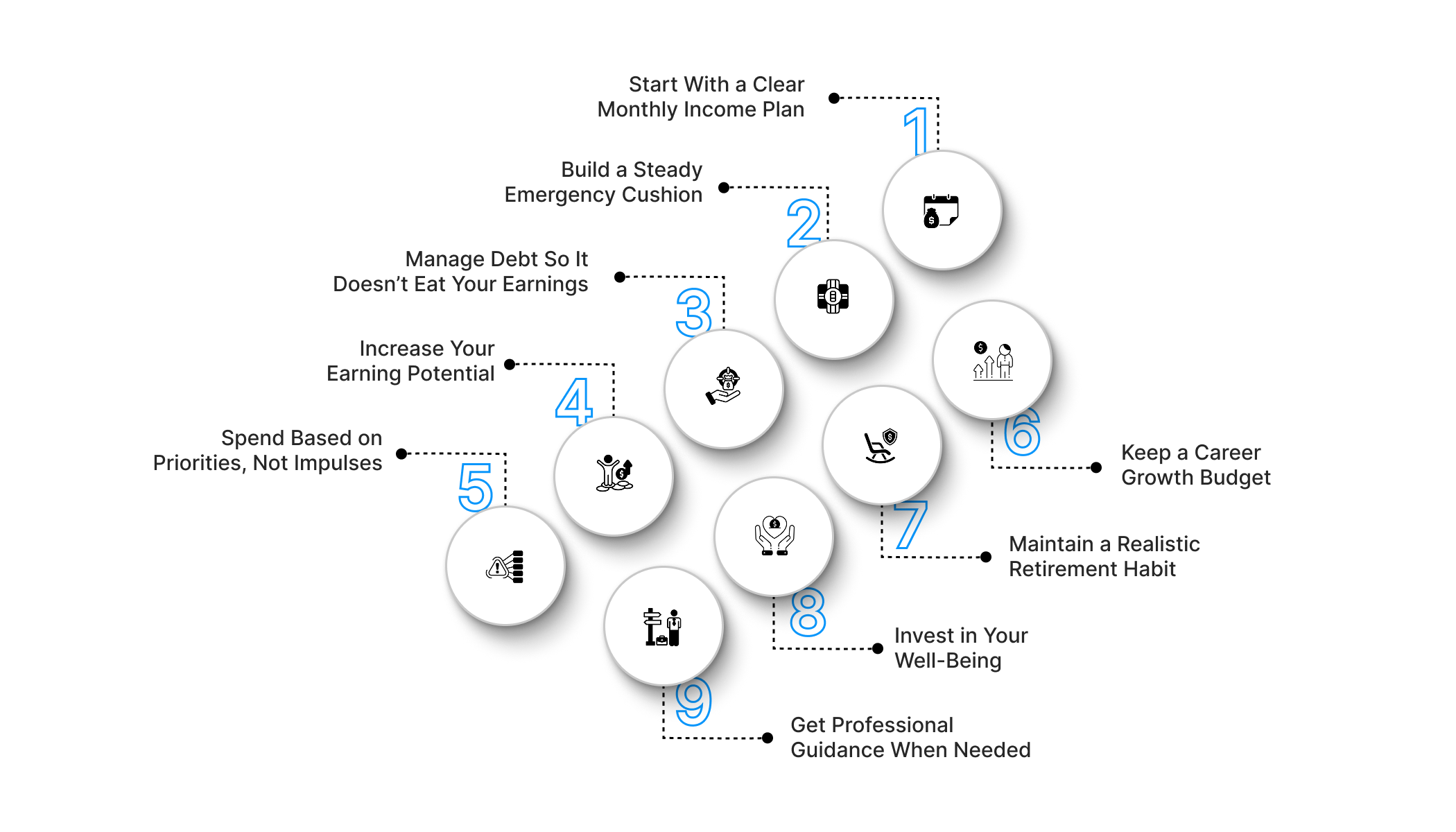

9 Effective Strategies For Better Income Management

Managing income does not mean you have to restrict yourself. Instead, it means making every rupee work smarter. Here are 9 strategies to master your finances:

1. Start With a Clear Monthly Income Plan

A simple income plan helps you decide how to use your earnings before they slip away. It removes guesswork and gives your money a clear purpose.

- Track Your Cash Flow: Note your actual monthly income and list essentials first.

- Set Spending Boundaries: Fix limits for wants so they don’t eat into your savings.

- Plan for Unfixed Income: If you freelance, work with your average income, not the highest month.

Example: If your monthly earnings are ₹25,000, set ₹12,000 for needs, ₹6,000 for wants, and ₹7,000 for savings or dues.

2. Build a Steady Emergency Cushion

Emergency funds protect your income from sudden hits like bike repairs, medical bills, or hostel shifts. It keeps your monthly plan stable.

- Start Small, Stay Consistent: Even ₹300-₹500 weekly builds a buffer over time.

- Automate Your Savings: Use standing instructions, so you save without thinking.

- Keep It Accessible: Store the fund in a basic savings account for quick use.

Example: A student saving ₹1,000 every month can build ₹12,000 in a year, which can be helpful when a laptop repair pops up.

3. Manage Debt So It Doesn’t Eat Your Earnings

Debt can drain a big chunk of your income if not handled smartly. Clean, timely repayments free up money for better priorities.

- Know What You Owe: Track interest rates and due dates in one place.

- Pay Extra When Possible: Even ₹200 extra reduces interest over time.

- Avoid Compounding Debt: Don’t borrow again to clear old dues unless necessary.

Example: Paying ₹500 extra on a ₹5,000 credit card bill reduces interest and shortens your repayment time by several months.

4. Increase Your Earning Potential

Your income grows when you invest time and effort into improving your skills. Better earnings make income management easier.

- Try Small Freelance Gigs: Tutoring, editing, and design jobs add extra income.

- Use Your Existing Skills: Turn a hobby into a small side income.

- Ask for Growth at Work: If you’re performing well, request more responsibility or a raise.

Example: A student doing weekend graphic design work earns an extra ₹4,000 monthly, which is great for savings or fees.

5. Spend Based on Priorities, Not Impulses

Income management improves when you know what matters to you. It helps you spend with clarity instead of reacting to urges.

- Sort Needs and Wants Weekly: Your priorities change, so review regularly.

- Use the Pause Rule: Wait 24 hours before buying non-essential items.

- Assign a Monthly “Fun Limit”: Stay controlled without feeling restricted.

Example: If you want new headphones, waiting a day often shows you if it’s a real need or just a passing mood.

6. Keep a Career Growth Budget

A part of your income should quietly work toward improving your skills. This boosts long-term income stability.

- Save for Courses: Set aside a small monthly chunk for learning.

- Track Career Costs: Books, workshops, and certifications count as growth.

- Review Every 6 Months: Adjust based on goals.

Example: Saving ₹500 monthly for a year gives you ₹6,000. This is enough for an online certification that boosts earning potential.

7. Maintain a Realistic Retirement Habit

Retirement may seem far, but income habits start early. You protect your future income by preparing today.

- Start with Tiny Contributions: Saving ₹200-₹300 monthly builds the habit.

- Increase as Income Rises: Add 5-10% when you get a salary bump.

- Use Simple Instruments: Recurring deposits or NPS are beginner-friendly.

Example: If you save ₹500 monthly in NPS at the age of 24, you can build a strong retirement corpus over decades.

8. Invest in Your Well-Being

Your income is closely tied to your health and energy. Staying well helps you earn steadily and avoid unexpected expenses.

- Budget for Self-Care: Gym, hobbies, or therapy count as growth.

- Avoid Burnout: Enough rest improves productivity and earning ability.

- Use Workplace Benefits: Many companies offer wellness support.

Example: Spending ₹600 on a monthly fitness class might help you avoid medical bills later.

9. Get Professional Guidance When Needed

As your earnings grow or responsibilities change, a little guidance can prevent mistakes.

- Talk to a Financial Mentor: Even occasional advice helps refine your plan.

- Use Simple Tools: Trackers or apps help monitor income flow.

- Learn Regularly: Short YouTube lessons or workshops can upgrade your knowledge.

Example: If you’ve just switched to a commission-based job, a financial planner can help you manage high and low-income months without mistakes.

Those strategies work best when adapted to your life stage, so let’s see how to apply them across ages.

Also Read: 6 Simple Budgeting Tips for Better Money Management

Income Management Tips For Different Age Groups

Income management is not one-size-fits-all. How you handle money in your 20s differs significantly from your approach in your 40s. Here’s a practical guide for each stage:

Students and Young Professionals

For early earners, focus on habits that build future income stability and visible creditworthiness.

- Build a credit base: Keep credit utilisation below thirty per cent and pay card bills on time.

- Invest in skills: Allocate three to five per cent of income for courses that improve long-term earnings.

- Automate savings: Set monthly transfers to savings and investment accounts immediately after payday.

- Tax-smart choices: Use ELSS or other Section 80C options to reduce taxable income while investing.

Mid-Career Earners (30s–40s)

At this stage, balance income growth with protection for dependants and sensible housing decisions.

- Protect income: Buy life and health cover equal to ten to fifteen times your annual income.

- Limit housing cost: Keep total housing expenses close to thirty per cent of your gross monthly income.

- Prioritise high-interest debt: Pay off expensive loans before increasing investment contributions.

- Plan education funding: Start early to spread costs and reduce monthly pressure on your income.

Pre-Retirement (Within 15 Years of Retirement)

This period needs income smoothing so you can switch from accumulation to reliable, lower-risk returns.

- Adjust portfolio: Shift a portion of income-directed investments into stable, income-generating assets.

- Create medical reserves: Build a dedicated healthcare fund separate from pension savings for easier access.

- Run withdrawal simulations: Check different income scenarios to understand safe withdrawal rates in retirement.

Now, what if your income isn’t steady? Let’s see some solid tactics for handling irregular earnings.

How Can You Manage Irregular Income?

Irregular paychecks need different rules. With a few smart practices, you can smooth out fluctuations and make your earnings work for you.

- Calculate a conservative baseline: Use a six-month average income to set reliable monthly expenses and savings targets.

- Create two buckets: Separate money into essentials and flexible funds the day you receive payment.

- Prioritise fixed costs: Pay rent, utilities and EMIs first, then allocate leftovers to savings and discretionary spending.

- Use a buffer account: Keep one month’s essential expenses in a dedicated account to smooth lean months.

- Invoice and payment discipline: For freelancers, invoice promptly and chase slower clients politely but firmly for predictable cash flow.

Irregular Income Rule of Thumb:

| Rule | Purpose | Action |

| Baseline Income | Stability | Use 6-month average to budget essentials |

| Buffer Fund | Liquidity | Keep one month's essentials aside |

| Split on Receipt | Control | Divide money into essentials and flexibility |

Also Read: How to Manage Monthly Expenses Smartly in 2025

How Pocketly Helps You Manage Sudden Income Gaps

Income isn’t always predictable, and when an unexpected bill or emergency shows up, a small buffer can make all the difference. That’s where Pocketly, a digital lending platform, becomes genuinely useful; not as a financial tool, but as a quick, short-term support system.

Pocketly offers flexible personal loans from ₹1,000 to ₹25,000, with interest starting at 2% per month and a processing fee of 1–8%. With no collateral and no hidden charges, the entire process is online, backed by simple KYC, fast approval, and 24/7 support.

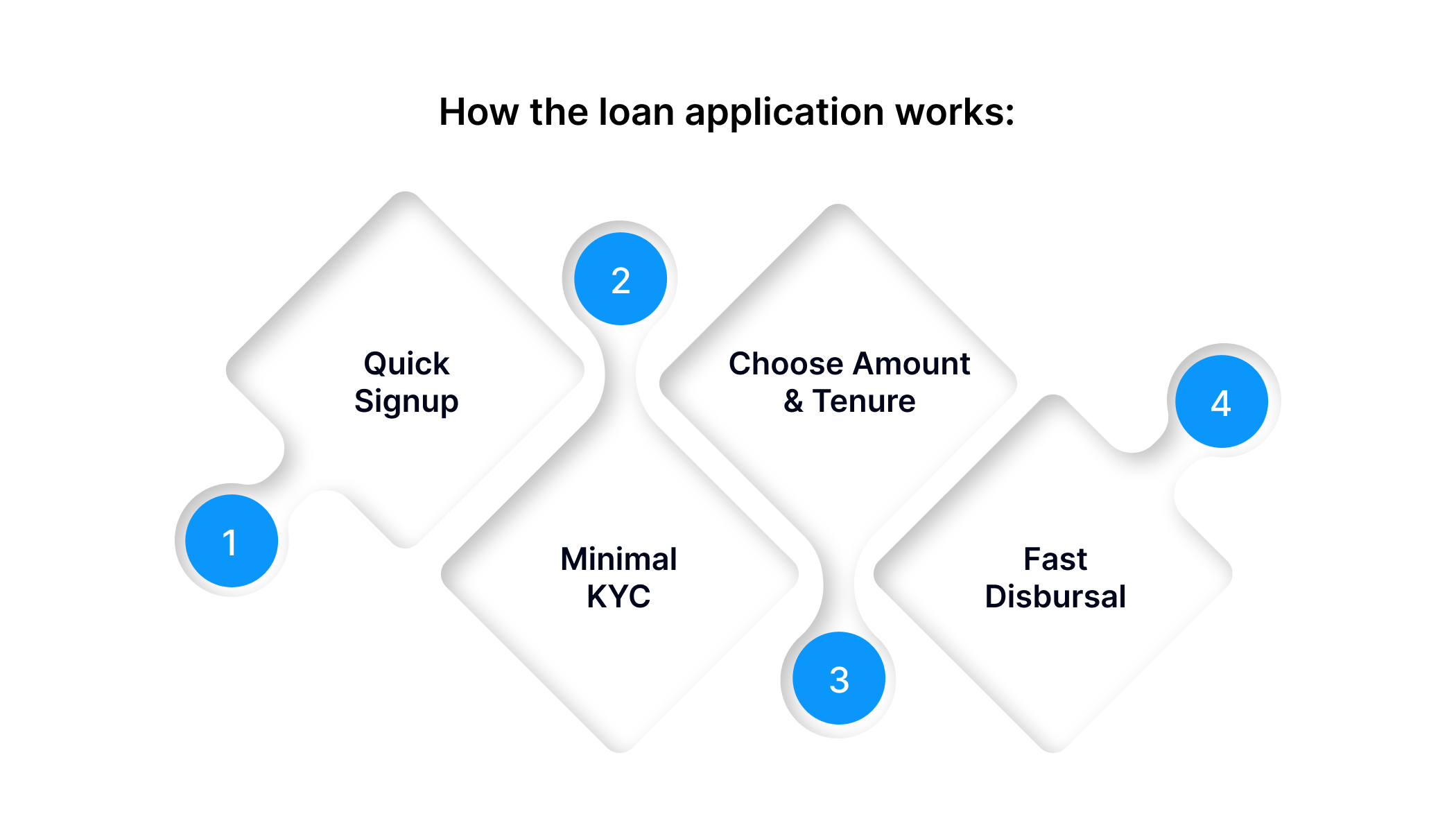

How the loan application works:

- Quick Signup: Register in just 2 clicks using your mobile number.

- Minimal KYC: Upload Aadhaar, PAN, and basic details for verification.

- Choose Amount & Tenure: Select a loan amount between ₹1,000–₹25,000 and a repayment plan.

- Fast Disbursal: Funds are transferred directly to your bank account in minutes.

Pocketly helps you stay steady during short-term cash shortages, so you can focus on managing your income without stress.

Final Thoughts

Income management becomes easier when you break it down into simple habits, whether you're budgeting, tracking expenses, or planning for different stages of life. The goal is to understand where your money goes and make choices that help you stay steady, even when your income changes.

Simple steps like automating savings, building an emergency fund, and planning for irregular income ensure your money works for you consistently. By applying these strategies, you can make informed decisions, maximise savings, and maintain control over your finances.

And, if you ever need short-term support while you get your finances back on track, Pocketly can help. It’s a simple, fully online way to handle sudden cash needs. Download Pocketly on iOS or Android and stay confident managing your income.

FAQ’s

What is managed income?

Managed income means organising how your earnings are received, allocated, and monitored each month. It helps you stay in control of spending and savings with a clear structure.

What is the best management of income?

The best approach is to track your inflows and prioritise essential expenses before anything else. Keeping a simple monthly plan helps you stay consistent and avoid overspending.

Are Income Management payments included on the Payment Summary?

Income Management payments may appear separately and are not always included in the standard payment summary. It depends on how the issuing authority reports your benefits or allocations.

How to use digital tools for monthly income tracking?

Use budgeting apps or banking features that automatically categorise your expenses. Review the insights weekly to adjust your plan and keep your spending on track.

How To Manage Salary?

Divide your salary into fixed expenses, savings, and flexible spending as soon as you receive it. Automating transfers ensures discipline and keeps your monthly budget stable.