It’s not always the big-ticket expenses that drain your money, it’s the daily spending that often goes unnoticed. A ₹200 delivery, a cab when you could’ve waited for the bus, a subscription you forgot to cancel, these small decisions stack up fast. And by the time you check your balance, you're left wondering where half your salary went.

That’s the real problem: it’s not that you don’t earn enough, but that there's no clear plan for what you’re earning.

Budgeting isn’t just about managing money, it’s about protecting yourself from the stress of financial uncertainty. When you don’t know how much is coming in, where it’s going, or how to stretch it until the next payday, it becomes harder to avoid late fees, missed EMIs, and last-minute borrowing. Over time, these patterns don’t just hit your savings, they affect your credit health, your peace of mind, and your ability to grow financially.

In this article, we will learn about budgeting tips to manage your spending and stay two steps ahead.

Budgeting isn't about cutting back, it's about spending with clarity. These tips are designed to shift your habits without overwhelming you.

- Managing money on a weekly basis gives you more control than a monthly, guesswork approach.

- You don’t need to track every rupee, just group and review categories regularly.

- Saving at the start of the month works better than trying to save what’s left.

- Unexpected expenses aren’t unpredictable, they’re just unaccounted for. Plan for them.

- When borrowing, make repayment part of the budget, not an afterthought. Tools like Pocketly support this without derailing your finances.

What is Money Management?

Money management is about understanding where your money goes and making strategic decisions to keep your financial life on track. It involves managing daily expenses, planning for long-term financial goals, and adjusting your spending habits to ensure you're not just surviving paycheck to paycheck but actively building wealth.

Effective money management starts with a clear understanding of your income and expenses. It's not just about reducing costs, but about making informed decisions that allow you to enjoy your life today, while also setting yourself up for financial security tomorrow. By setting aside time to evaluate your spending patterns and making adjustments where necessary, you can begin to take control of your financial future.

Having a clear understanding of money management sets the stage for making more informed financial decisions. Now, let's explore why budgeting is such a critical component of money management and how it directly impacts your financial health.

Why Budgeting is Essential for Financial Health

A budget is the foundation of your financial well-being. Without a clear budget, it's easy to lose track of where your money is going, which can lead to unnecessary debt and missed opportunities for saving and investing. Budgeting provides the structure needed to manage your income effectively, helping you cover essentials, save for your goals, and ensure long-term financial stability.

1. Gives You Control Over Your Finances

Budgeting allows you to take control of your financial future by setting realistic spending limits and saving for important life goals. By knowing exactly how much you can allocate toward each expense category, you ensure that your financial resources are used efficiently and responsibly.

2. Helps You Avoid Debt

When you have a budget in place, you're more likely to live within your means. A clear financial plan helps you avoid impulse purchases, unnecessary borrowing, and overspending, which in turn prevents the accumulation of debt. Without this structure, it’s all too easy to rely on credit cards or loans to cover gaps, which can lead to financial strain.

3. Builds an Emergency Fund

One of the key benefits of budgeting is the ability to plan for the unexpected. Life is full of surprises, from medical emergencies to sudden car repairs. A budget ensures you have money set aside for these situations, giving you a financial cushion to fall back on when the unexpected happens.

4. Facilitates Long-Term Financial Goals

Whether it's buying a home, funding a child's education, or building your retirement savings, budgeting makes it easier to plan and save for big goals. By regularly setting aside money for future expenses, you create a roadmap to achieve financial milestones without compromising your current lifestyle.

5. Enhances Financial Discipline

Budgeting instills discipline by encouraging you to be mindful of your spending habits. It’s not about restricting yourself; it’s about making intentional choices with your money. With a well-planned budget, you can strike a balance between living in the present and preparing for the future.

Once you understand the critical role budgeting plays in your financial health, it's time to put that knowledge into action. Let's explore the strategies that can truly transform how you manage your money day-to-day.

6 Strategies Which Can Help You With Your Money Management

A good budget puts you in control. It helps you cover essentials, enjoy life guilt-free, and still have something set aside when the unexpected shows up. And no, you don't need to track every chai or count every recharge. You just need a simple system that fits your lifestyle and keeps you two steps ahead of your spending.

Break Your Month into Weekly Budgets

Instead of trying to stretch your entire salary across the whole month, break it down into weekly limits. For instance, if you earn ₹20,000 a month, divide it into ₹5,000 per week. This way, even if you overspend early on, you still have three other checkpoints to adjust and regain control, rather than realising too late that you’ve burned through everything. Weekly pacing makes your budget feel more manageable and less overwhelming.

Set a Non-Negotiable Expense Cap

There will always be spending on non-essential items, such as delivery apps, streaming subscriptions, and impulse purchases. The key is to define how much of that is okay. Set a personal spending limit, such as ₹3,000 to ₹5,000 per month, and once you reach that, stop. It's not about cutting out fun, but about setting boundaries that allow you to enjoy small luxuries without losing sight of the bigger picture. This kind of structured flexibility is what keeps your budget sustainable.

Also Read: Financial Planning Tips for Young Adults

Start Saving Before You Spend

Most people save whatever is left at the end of the month, but often, that's nothing. Flip the formula. As soon as your salary arrives, transfer a fixed amount, such as ₹500, ₹1000, or even ₹200 if that's all you can afford, to a separate account or wallet. Because when your savings are removed from your main balance at the start, they're no longer part of your mental “spending money.” This subtle shift makes saving feel automatic, not forced.

Categories, Don't Itemise

Tracking every ₹40 spent is exhausting, and honestly, most people drop the habit in a week. Instead, group your expenses into broader categories, such as groceries, bills, travel, entertainment, and miscellaneous. Then, do a quick review every week. You won't get lost in the details, but you'll still see where the money's going. This lighter system gives you visibility without the burnout of obsessive budgeting.

Prepare for One "Oops" Expense Every Month

There’s always something unexpected: a birthday, a doctor’s visit, or a last-minute trip. Set aside ₹1,000 to ₹2,000 every month for that one thing you didn’t plan for. It’s not the same as a long-term emergency fund, it's just a cushion to absorb life’s small surprises without messing up your rent, bills, or savings goals. Budgeting for the unexpected is what makes the rest of your budget realistic.

If You Borrow, Budget the Repayment First

Borrowing can be helpful when appropriately managed; ensure you include repayments in your budget to avoid financial strain and credit issues. If you've taken a short-term loan from a friend, an app, or a platform like Pocketly, block out the repayment in your budget before you plan any other spending. This keeps you from falling behind, protects your credit score, and avoids the end-of-month panic when your payment is due but your wallet is already empty.

Suggested Read: Understanding the Basics of Financial Planning and Its Importance

Understanding the importance of budgeting is just the first step. To ensure your efforts are successful, it's equally crucial to avoid common budgeting mistakes that can derail your financial goals.

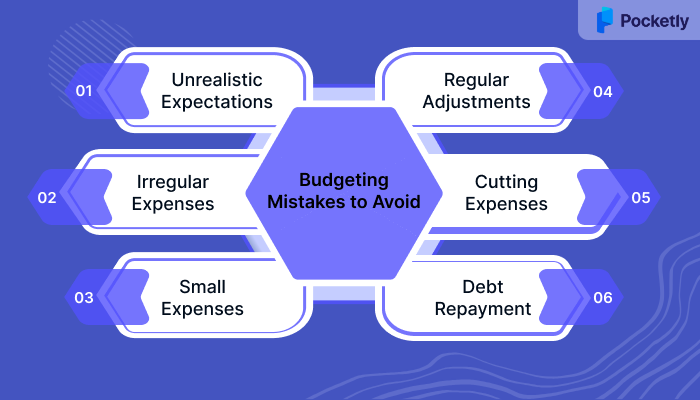

Common Budgeting Mistakes to Avoid

Budgeting can seem straightforward, but even the most well-intentioned plans can go off track. Many people start strong with a budget, only to find themselves slipping back into old habits. The key to long-term success lies in recognizing and avoiding some of the most common budgeting pitfalls. Here are a few mistakes that could derail your progress and how to steer clear of them:

1. Setting Unrealistic Expectations

One of the biggest budgeting mistakes is setting goals that are too ambitious. Whether it's trying to save an overly high percentage of your income or drastically cutting expenses, aiming for unrealistic targets can lead to frustration and ultimately result in the abandonment of your budget. Start small and gradually increase your savings or cutbacks to ensure that you can maintain your goals over time.

2. Forgetting to Account for Irregular Expenses

Many budgets fail because people only account for regular, monthly expenses, such as rent and utilities. However, life is full of irregular expenses, such as annual subscriptions, holiday gifts, or car repairs, that don't always fit into the budget. These expenses can sneak up on you if they're not anticipated. Create a "miscellaneous" or "emergency" category in your budget to account for these costs.

3. Failing to Track Small Expenses

While it's easy to track large, recurring bills, it’s the small, daily expenses that often go unnoticed. A coffee here, a delivery there, or a spontaneous snack can add up quickly. Many people neglect to track these small purchases, leading to overspending. Keeping an eye on even the smallest purchases can prevent this leakage and help you stay on track.

4. Not Adjusting Your Budget Regularly

Your financial situation will change over time, and so should your budget. Whether it's a raise, a new expense, or unexpected financial changes, sticking to a rigid budget without adjustments can lead to overspending or missed savings opportunities. Make it a habit to review and adjust your budget every few months to reflect any changes in income, expenses, or goals.

5. Focusing Too Much on Cutting Expenses

While trimming down unnecessary spending is important, focusing solely on cutting expenses can leave you feeling deprived and frustrated. Instead, aim for balance. Ensure that your budget allows for both savings and enjoyment. It’s about prioritizing needs over wants but not eliminating everything that brings you happiness or satisfaction. A budget should allow you to live comfortably without sacrificing all your small pleasures.

6. Not Having a Clear Plan for Debt Repayment

Many people include debt payments in their budget but fail to create a clear strategy for tackling debt. If you’re only making minimum payments, it can take years to pay off your balance. Focus on prioritizing high-interest debts first or explore strategies like the debt snowball or debt avalanche method to expedite the process. Having a clear repayment plan can save you money on interest and help you achieve financial freedom.

Recognizing and avoiding these common budgeting mistakes will help you stay on track with your financial goals. With the right approach, you can build a budget that works for you and ensures long-term financial success.

Where Pocketly Fits In When Your Budget Needs Backup

Even the most careful budget can fall short due to unexpected bills, medical expenses, or a timing mismatch between your income and expenses. That doesn't always mean you've managed your money poorly; it just means life doesn't always run on a fixed calendar.

That’s where Pocketly helps. It gives you access to small personal loans, starting from ₹1,000, that you can borrow instantly through a completely digital process. No need to submit heavy documentation or wait for approvals from traditional lenders. The idea isn’t to replace budgeting but to support it by providing a financial buffer when you need it the most.

What makes it practical:

- Borrow only what you need (₹1,000–₹25,000) so that your repayment stays manageable

- No annual or joining fees, just a clear one-time processing charge

- Interest starts as low as 2% per month, with full cost shown upfront

- Processing fee ranging from 1-8%

- Flexible repayment lets you close the loan early or pay in parts

- Completely app-based with 24/7 availability, no paperwork, no branch visits

And every repayment you make through Pocketly is reported to credit bureaus, such as CRIF, so you're not just borrowing smart, you're also building a better credit profile over time.

If budgeting is your game plan, Pocketly is your safety net. Download the Pocketly app or visit our website to apply in minutes.

Conclusion

If you still think that money management will restrict your spending, you will no longer be able to buy your basic needs or favorite things. In reality, it’s the opposite.

When you give your money a clear direction, you reduce the mental load of every small decision, whether it's spending on a need, a want, or an unexpected emergency. You stop reacting to your finances and start taking ownership of them, and that kind of control doesn’t limit your lifestyle, it protects it.

And if a tight month ever puts pressure on your plans, Pocketly can step in as that extra layer of support. It's not a replacement for good budgeting, but it can help you stay consistent when your finances need some breathing space.

FAQs

What if I have irregular income? Can I still follow these tips?

Absolutely. Start by setting your minimum income as the baseline for your budget. Allocate essentials first, then divide the remaining amount across weekly or category-based spending.

Can budgeting impact my credit score?

Yes. Consistent budgeting helps avoid missed payments and unnecessary borrowing, both of which directly affect your credit score over time. Financial discipline shows up in your credit history, even if you're not using credit constantly.

Which budgeting method fits best for me?

Not every budget suits everyone. The 50/30/20 rule balances essentials, savings, and wants. The envelope method (using cash for each spending category) offers strong visual control. Zero-based budgeting assigns every rupee a specific purpose. Choose the one that aligns with your discipline level, goals, and lifestyle.

How can I track casual, unplanned expenses without overthinking it?

Always carry a small notebook or use a notes app. Log casual expenses like ₹50 for tea or ₹200 for delivery as they occur. At the end of the day, categorize them according to your budget categories. This practice builds awareness without becoming overwhelming.