The shift to digital payments from a tangible form of payment has fundamentally changed the way we think about money. Digital wallets, once a novelty, are now embedded in our daily lives. They offer a seamless way to store, send, and receive funds without the physical constraints of cash or cards. While their convenience is often highlighted, the actual value lies in their ability to streamline the entire payment process, making transactions faster, secure, and accessible.

In this blog, we'll take a close look at the digital wallet benefits and features and also examine how they’ve evolved from simple storage tools to essential, multifunctional platforms for modern financial management.

Key Takeaways

- Digital Wallets Enhance Convenience: With features like contactless payments and instant transfers, digital wallets simplify financial transactions and reduce the need for physical cash or cards.

- Security with Advanced Technology: Digital wallets use encryption, biometric authentication, and tokenization to provide secure transactions and protect sensitive data.

- Real-Time Expense Tracking: Many digital wallets allow users to track spending in real-time, helping to manage budgets and avoid overspending.

- Financial Inclusion: Digital wallets help bring unbanked populations into the system, offering access to financial services with just a smartphone and internet.

- Instant Loans with Pocketly: Just like digital wallets provide instant payments, Pocketly offers instant loan approvals, helping students and young professionals access funds quickly and easily.

What is a Digital Wallet?

A digital wallet is a financial platform that securely stores payment information and allows for electronic transactions, both online and in-person. It eliminates the need for physical cards or cash, enabling users to pay for goods, services, or transfer money directly to their bank account using methods like QR code scanning or mobile phones.

Examples of digital wallets include Google Pay, Apple Pay, and Paytm, where you can make quick payments.

The digital wallets have opened doors to millions of users worldwide to switch from traditional payment methods. The compelling advantages these platforms offer extend far beyond simple payment processing.

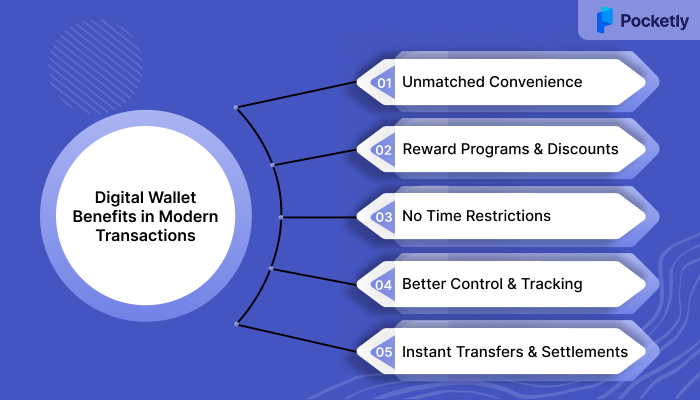

What are the Digital Wallet Benefits in Modern Transactions?

Digital wallets have transformed how we handle payments, making them not just a tool for transactions but also a strategic asset for managing finances. Let’s explore some key benefits that make digital wallets an important part of modern financial life:

1. Unmatched Convenience

With digital wallets, you can make payments instantly with your mobile phone, eliminating the need to carry cash or cards. You can also pay for groceries, transfer money, all in a few taps. Thus, making it fast and extremely convenient, especially when you’re on the go.

2. Reward Programs and Discounts

Many digital wallets come with built-in reward programs, offering cashback, loyalty points, or exclusive discounts. These incentives make everyday purchases rewarding and redeem discounts. It’s an easy way to save money while you shop.

3. No Time Restrictions

Unlike traditional banking hours, digital wallets provide 24/7 access to your funds, allowing transactions at any time, anywhere. Whether it’s a late-night online shopping spree or an emergency payment, you don’t have to worry about banking hours or waiting for business hours to complete your transaction.

4. Better Control and Tracking

Managing your finances becomes more organised with digital wallets. Most platforms provide detailed spending reports and real-time transaction updates, helping users track their expenses more easily. You can categorise purchases and set budgets, making it easier to stay on top of your finances and avoid overspending.

5. Instant Transfers and Settlements

Digital wallets enable instant peer-to-peer transfers, allowing you to send or receive money in real-time. This eliminates delays often associated with traditional bank transfers, making it easier to share money with friends, pay bills, or settle payments quickly without waiting for clearing times.

In a similar vein, Pocketly ensures that when you need quick access to funds, you don't have to deal with long waiting periods. Offering instant personal loan approvals, directly to your account in just minutes.

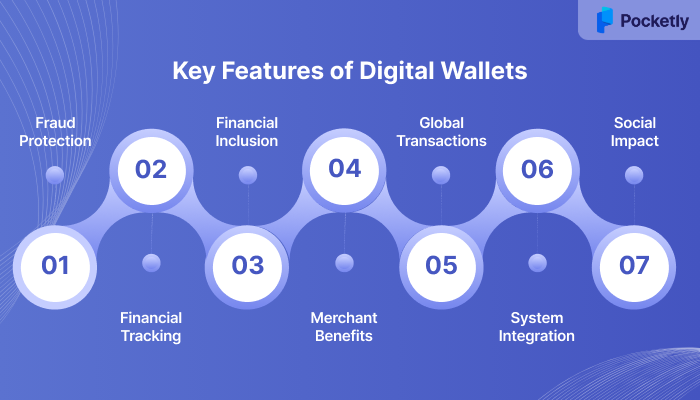

Key Features of Digital Wallets

The digital wallet market is growing, with an expected value of $4.14B by 2030, driven by the rise of smartphones and cashless payment systems. As younger generations lead the charge in embracing digital payments, digital wallets are becoming an essential tool for managing money easily and securely.

Let’s dive into the key features of digital wallets that are making them so popular among today’s users.

1. Enhanced Security & Fraud Protection

Digital wallets use tokenization and biometric authentication (like fingerprint or facial recognition) to protect transactions. Real-time fraud monitoring also ensures higher security than traditional payment methods.

2. Financial Management & Tracking

Digital wallets help you track your expenses, categorise transactions, and manage your budget with real-time updates and notifications. They also integrate with your bank accounts to automatically sync financial data.

3. Financial Inclusion & Accessibility

Digital wallets provide financial services to unbanked and underbanked individuals, especially in remote areas, by requiring only a smartphone and an internet connection. They enable access to the digital economy for people without traditional bank accounts.

4. Business Advantages for Merchants

Merchants benefit from higher checkout conversions and lower processing costs. Digital wallets also give businesses insights into customer data, allowing for targeted marketing and better strategies.

5. Global Reach & Cross-Border Transactions

Digital wallets make international transfers quicker and cheaper than traditional banking, offering multi-currency support for seamless cross-border transactions.

6. Integration & Versatility

Modern digital wallets are compatible with e-commerce platforms, point-of-sale systems, and services like public transportation. They also store various digital documents such as tickets and IDs.

7. Environmental & Social Impact

By reducing the need for paper receipts and physical infrastructure like ATM and POS machines, digital wallets contribute to environmental sustainability and financial inclusion in emerging markets.

These feature of digital wallets reflects the varied ways consumers and businesses interact with financial technology. This diversity also has led to the emergence of specialised wallet types as per specific use cases and user preferences.

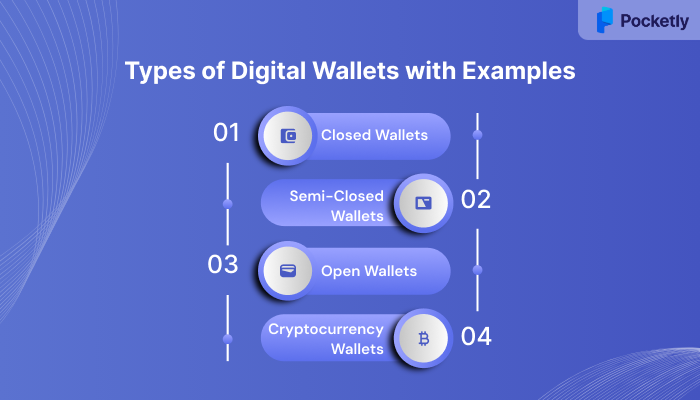

Types of Digital Wallets with Examples

Digital wallets can be classified into different types based on their functionality and the way they are used. Here’s a breakdown of the main types of digital wallets:

1. Closed Wallets

These wallets are issued by specific brands or businesses and can only be used within that brand's ecosystem. They store money that can be used for a limited range of transactions, such as buying goods or services within the brand's platform.

Example: Amazon Pay, where the funds stored can only be used to shop on Amazon or partner merchants.

2. Semi-Closed Wallets

It allows users to make transactions at a set of designated merchants or service providers, but they are not restricted to a single brand. These wallets allow payments for goods, services, and bills within the partner network.

Example: Paytm and PhonePe, which can be used for a variety of online purchases, bill payments, and peer-to-peer transfers.

3. Open Wallets

Open wallets are the most versatile type, where you can make payments across a wide range of merchants and service providers. You can also do direct transfers to and from a bank account. These wallets are fully integrated with the financial system, offering a broader scope of financial transactions.

Example: Google Pay and Apple Pay, which allow users to make payments both online and at physical stores, as well as send money to others and link to bank accounts for withdrawals.

4. Cryptocurrency Wallets

This type of digital wallet is used for storing, sending, and receiving cryptocurrencies like Bitcoin, Ethereum, or other digital currencies. These wallets store private keys that are used to access and manage cryptocurrency assets securely.

Example: Coinbase Wallet and MetaMask, which store cryptocurrency and allow for trading or transferring between users.

The functionality and versatility of these different wallet types are made possible by a sophisticated technological infrastructure operating behind the scenes.

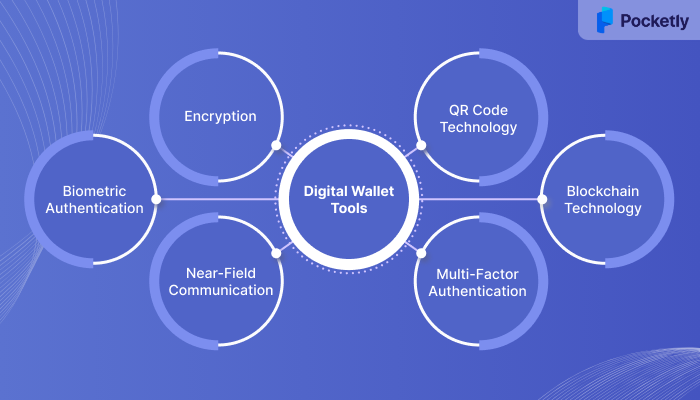

What Technological Tools are used in Digital Wallets?

Digital wallets rely on a variety of advanced technologies to provide secure, fast, and seamless payment experiences. These tools ensure the protection of sensitive data, ease of use, and convenience in transactions.

Let's explore the key technologies that make digital wallets an integral part of modern payments.

- Encryption: Encryption secures user data, such as payment details and transaction history, making it unreadable to unauthorised parties. This ensures that sensitive information is protected during storage and transmission.

- Biometric Authentication: Features like fingerprint scanning, face recognition, and iris scanning offer an added layer of security by verifying the user's identity before completing transactions.

- Near-Field Communication (NFC): NFC enables contactless payments with just a tap of your phone or card. The technology allows secure and quick payments at NFC-enabled terminals.

- QR Code Technology: QR codes allow users to scan codes to make payments or receive money instantly, making the payment process easy and fast.

- Blockchain Technology: Some digital wallets, particularly those for cryptocurrencies, use blockchain for secure, decentralised transactions. Blockchain offers transparency and security by recording all transactions on a public ledger.

- Multi-Factor Authentication (MFA): MFA adds extra layers of security by requiring multiple verification (such as a password plus a one-time code sent to your phone) to access the wallet or complete transactions.

Despite these impressive technological safeguards and innovations, the digital wallet ecosystem faces several persistent challenges that both users and service providers must navigate.

Challenges of Digital Wallets

Although digital wallets' benefits are immense in convenience and efficiency, security remains a significant challenge. Despite high-level encryption and features like tokenization and biometric authentication, cybercriminals continue to find ways to exploit vulnerabilities. Let’s dive into other key challenges.

- Security Risks: Despite strong encryption, digital wallets are still vulnerable to hacking and fraud. If a user's phone is compromised, sensitive payment information could be at risk.

- Limited Acceptance: While digital wallets are growing in popularity, not all merchants or service providers accept them, limiting their usability in certain places.

- Device and Data Dependency: Digital wallets rely on smartphones or computers with an internet connection. If you lose your device, experience a dead battery, or face poor connectivity, you may be unable to make transactions.

- Regulation: Digital wallets are still evolving in terms of regulatory frameworks. Different countries have varying regulations in terms of anti-money laundering, data privacy. These further limit the wallet’s functionality in cross-border transactions.

While these challenges represent real considerations for digital wallet users, innovative financial platforms are emerging to complement and enhance the digital payment ecosystem.

How Pocketly Enhances Your Financial Flexibility

When managing finances, quick and easy access to funds can make all the difference. Pocketly, a digital lending platform, simplifies the loan process with a range of features designed to meet the needs of borrowers. Here are some key ways Pocketly supports you in managing finances effectively:

- Instant Loan Disbursement: Get approved and receive funds directly in your account within minutes, ensuring you have access to money when you need it.

- Low-Interest Rates: Pocketly offers competitive interest rates starting at just 2% per month.

- Flexible Loan Amounts: Borrow amounts ranging from ₹1,000 to ₹25,000, depending on your needs, with easy repayment terms.

- Transparent Processing Fees: With processing fees between 1% and 8%, Pocketly ensures no hidden charges, making the loan process clear and straightforward.

- Documentation: Apply without any documents or income proof, just complete the digital KYC process, saving you from lengthy paperwork.

- No Collateral Required: Pocketly offers unsecured loans, so you don’t need to pledge any assets.

Conclusion

Digital wallets have become an essential part of modern financial transactions, offering convenience, security, and efficiency. By eliminating the need for cash or cards, they allow users to make quick, secure payments, manage finances easily, and track spending. As digital payment continues to evolve, embracing these tools provides a smarter way to handle your money in today’s fast-paced world.

For those seeking instant access to funds for emergencies or planned expenses, download Pocketly today on Android or iOS and experience financial solutions at your fingertips.

FAQs

1. Are digital wallets free?

Digital wallets are generally free to download, but some transactions, like fund transfers or currency conversions, may incur fees.

2. Is UPI a digital wallet?

No, UPI is a payment system, not a wallet. It allows instant bank-to-bank transfers and is integrated with wallets like Google Pay and PhonePe.

3. Which digital wallet is best in India?

Popular digital wallets in India include Google Pay, PhonePe, and Paytm, each offering unique features like UPI integration, wide merchant acceptance, and service variety.

4. Is it possible to use a digital wallet without linking a bank account?

Most digital wallets require a linked bank account, but some allow limited transactions or use of prepaid balances without one.

5. Can I access an ATM with a digital wallet?

Some wallets, like Paytm and Google Pay, offer ATM cash withdrawals using QR codes, but this depends on the wallet and bank partnerships.