Managing your personal expenses is not just about writing down numbers. It is a financial habit that helps you understand where your money goes, control your cash flow, and make better spending decisions. Without a clear system to track and manage expenses, many individuals end up overspending, missing saving targets, and feeling stressed about money by the end of the month.

One of the biggest reasons expense management matters is because most people underestimate how much they actually spend. When you track every rupee that comes in and goes out, you gain visibility into hidden spending habits that quietly drain your budget and prevent you from meeting your financial goals. Expense management gives you a real-time view of your financial behaviour, helping you make informed decisions rather than guesswork.

According to financial experts, regularly tracking your spending and expenses is essential for personal financial health because it helps you understand cash flow, reduce wasteful expenses, and plan more effectively for savings and future goals.

In this guide, you will learn what effective expense management looks like in everyday life, why it matters, and how to build a simple, structured system to manage your expenses confidently and sustainably.

Key Takeaways

- Expense management is a daily financial habit that helps you control cash flow, reduce stress, and make informed spending decisions.

- Tracking expenses alone is not enough. Expensing adds context by categorising each spend, which improves awareness and future planning.

- Small and frequent transactions often cause the biggest budget leaks because they go unnoticed and unreviewed.

- Fragmented spending across UPI apps, cards, cash, and subscriptions makes it harder to see total expenses in one place.

- Manual expense tracking fails when it relies on memory, delayed reviews, or bank balances instead of category-level insight.

- Expensing helps you evaluate spending in real time, protect priorities, and prevent lifestyle costs from impacting essentials or savings.

- A strong expense management system needs simple capture methods, consistent categories, spending limits, review checkpoints, and buffers for unexpected costs.

- Tools like bank insights, expense tracking apps, spreadsheets, alerts, and separate accounts work best when they fit your routine and reduce effort.

- Short-term expenses can disrupt even good systems. Planning in advance for these moments prevents panic decisions and financial setbacks.

- Platforms like Pocketly support responsible management of short-term cash gaps with small-ticket loans, transparent charges, and flexible repayment options.

- Smart expense management is about designing systems that guide behaviour, not restricting spending.

- With consistent habits and regular reviews, expense management builds confidence and long-term financial stability.

What Is Expensing Expense Management?

Expense management is the process of tracking, organising, and reviewing how you spend your money. It helps you stay aware of your cash flow and make better decisions without feeling restricted.

Expensing expenses means recording and categorising your spending as it happens, instead of trying to recall it later. Each expense is tagged with a purpose so it does not get lost or misjudged.

The difference matters:

- Tracking shows what you spent

- Expensing assigns meaning to the spend

- Management helps you adjust future spending

Everyday examples of expensing:

- Marking food delivery under dining

- Tagging travel costs separately

- Recording medical bills as urgent expenses

When expenses are expensed correctly and reviewed regularly, small spends stay visible, spending patterns become clear, and month-end surprises reduce.

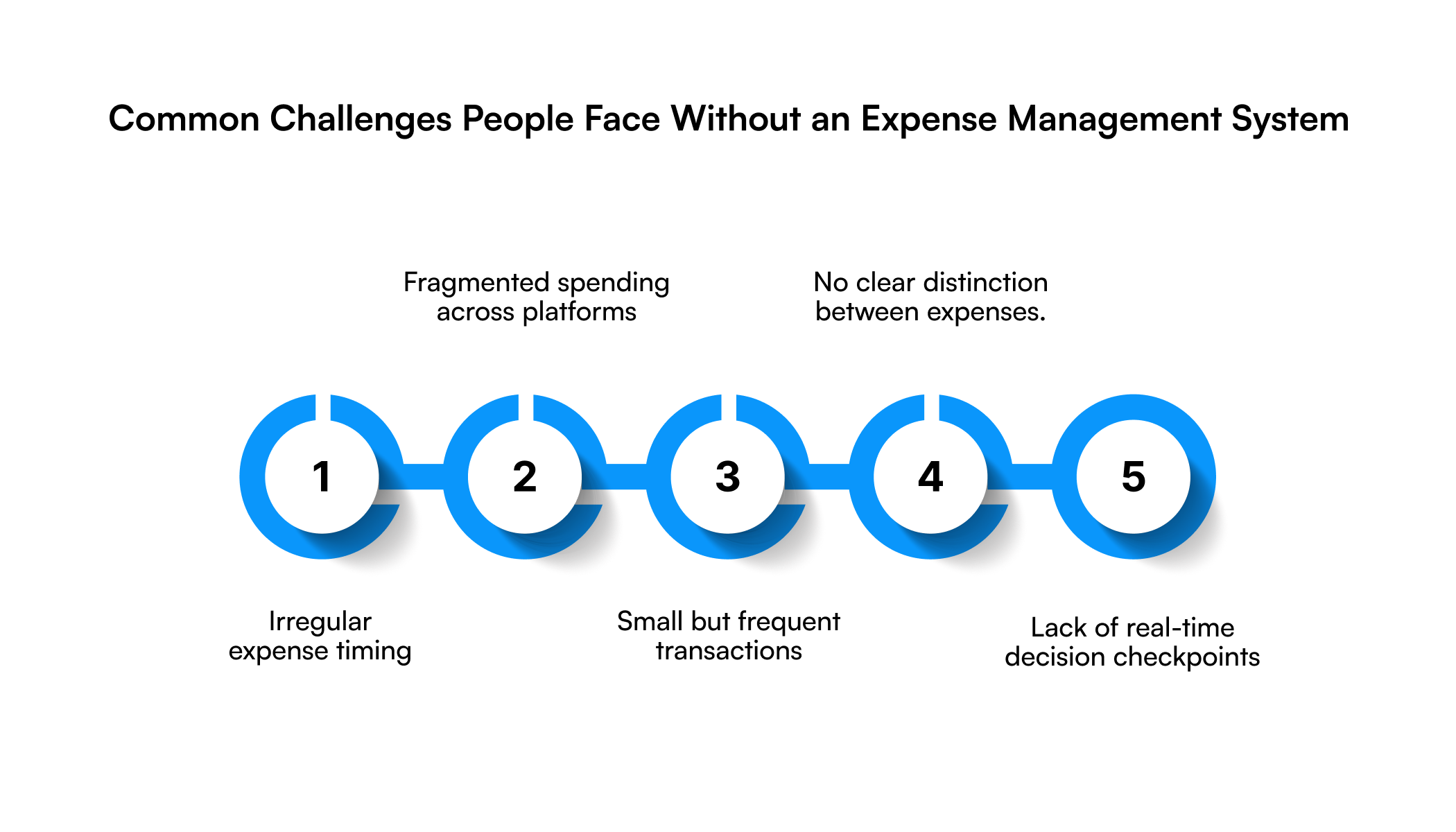

Common Challenges People Face Without an Expense Management System

Even with awareness and tracking, many people struggle to manage expenses effectively because of structural and behavioural gaps, not lack of intent.

Irregular expense timing

- Expenses rarely follow a clean monthly pattern.

- Medical visits, travel, repairs, and annual subscriptions often arrive unexpectedly.

- Without planning for these, monthly budgets break easily.

Fragmented spending across platforms

- Expenses are spread across UPI apps, cards, wallets, cash, and subscriptions.

- This fragmentation makes it hard to see total spending in one place.

- As a result, people underestimate how much they have already spent.

Small but frequent transactions

- Low-value spends like snacks, rides, or quick online orders feel harmless.

- Over time, these become the largest drain on disposable income.

- Because they feel minor, they are rarely reviewed or corrected.

No clear distinction between essential and flexible expenses

- Many expenses are treated the same, regardless of urgency or importance.

- This leads to lifestyle spending competing with essentials and savings.

- When cash runs low, savings are usually the first to be impacted.

Lack of real-time decision checkpoints

- Expenses are often reviewed only at month-end.

- By then, corrective action is no longer possible.

- Without weekly or ongoing checks, overspending goes unnoticed.

These challenges are common and fixable. Recognising them is the first step toward building a more reliable and sustainable expense management system.

Why Manual Expense Tracking Often Fails

Manual expense tracking breaks down not because people stop caring, but because it depends too much on memory and delayed review.

Small expenses are easy to miss

- Quick UPI payments, cash spends, or minor daily purchases often go unrecorded.

- These gaps reduce accuracy and make totals misleading.

Bank balance replaces expense insight

- Many people rely on their remaining balance to judge spending.

- This shows what is left, not how money was used or misused.

No real-time feedback while spending

- Manual tracking usually happens after transactions are complete.

- Without immediate visibility, there is no chance to pause or adjust decisions.

Problems surface too late

- Expenses are reviewed only at the end of the week or month.

- By then, overspending has already happened and options are limited.

Manual tracking records history but does not guide behaviour. Without timely categorisation and review, expense management stays reactive instead of preventative.

How Expensing Improves Expense Management Decisions

Expensing works because it changes how you interact with your spending, not just how you record it. Instead of looking at expenses after the damage is done, expensing introduces structure at the moment money leaves your account.

Expenses are evaluated, not just recorded

- When you expense a transaction, you consciously decide what it represents.

- This creates a pause that forces awareness before spending becomes habitual.

Spending patterns become visible early

- Expensed data shows category-level movement over days, not months.

- This helps you spot imbalances while there is still time to correct them.

Priorities stay protected

- When expenses are categorised clearly, essential and priority spends remain distinct.

- This reduces the risk of lifestyle spending quietly eating into savings or fixed commitments.

Short-term expenses stop disrupting long-term plans

- Expensing separates one-off or urgent costs from routine spending.

- This makes it easier to handle unexpected expenses without losing control of the larger budget.

Decision-making improves over time

- With consistent expensing, patterns repeat themselves clearly.

- This allows you to adjust limits, plan buffers, and spend with intent instead of reacting later.

Expensing does not add complexity. It adds clarity. By giving every expense context, it turns raw spending data into actionable insight that supports better financial decisions.

Key Components of an Effective Expensing Expense Management System

An effective expense management system does not need to be complex. It needs a few core components that work together to give you control, visibility, and flexibility.

A simple expense capture method

- Expenses should be recorded easily, without friction.

- Whether through an app, bank insights, or a simple sheet, the method should make logging automatic or effortless.

Clear and consistent categorisation

- Every expense should fall into a defined category such as essentials, lifestyle, or short-term needs.

- Consistency matters more than the number of categories.

Spending limits by category

- Limits act as guardrails, not restrictions.

- They help you recognise when spending is drifting off track before it becomes a problem.

Regular review checkpoints

- Weekly or bi-weekly reviews keep spending patterns visible.

- This allows small corrections instead of large adjustments at month-end.

A buffer for unexpected expenses

- An effective system always includes space for irregular or urgent costs.

- This prevents one-off expenses from disrupting your overall plan.

When these components work together, expense management becomes proactive. You are no longer reacting to what happened, but guiding what happens next.

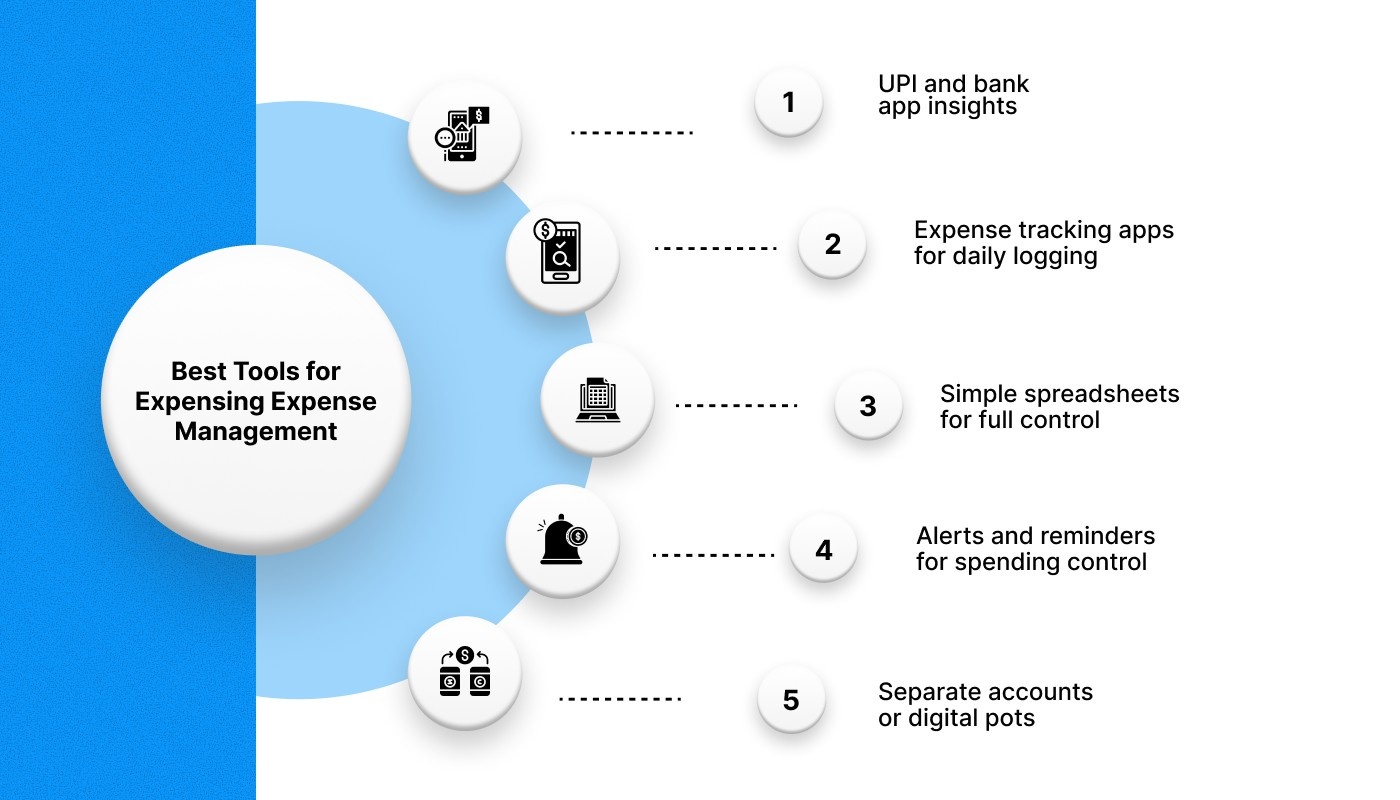

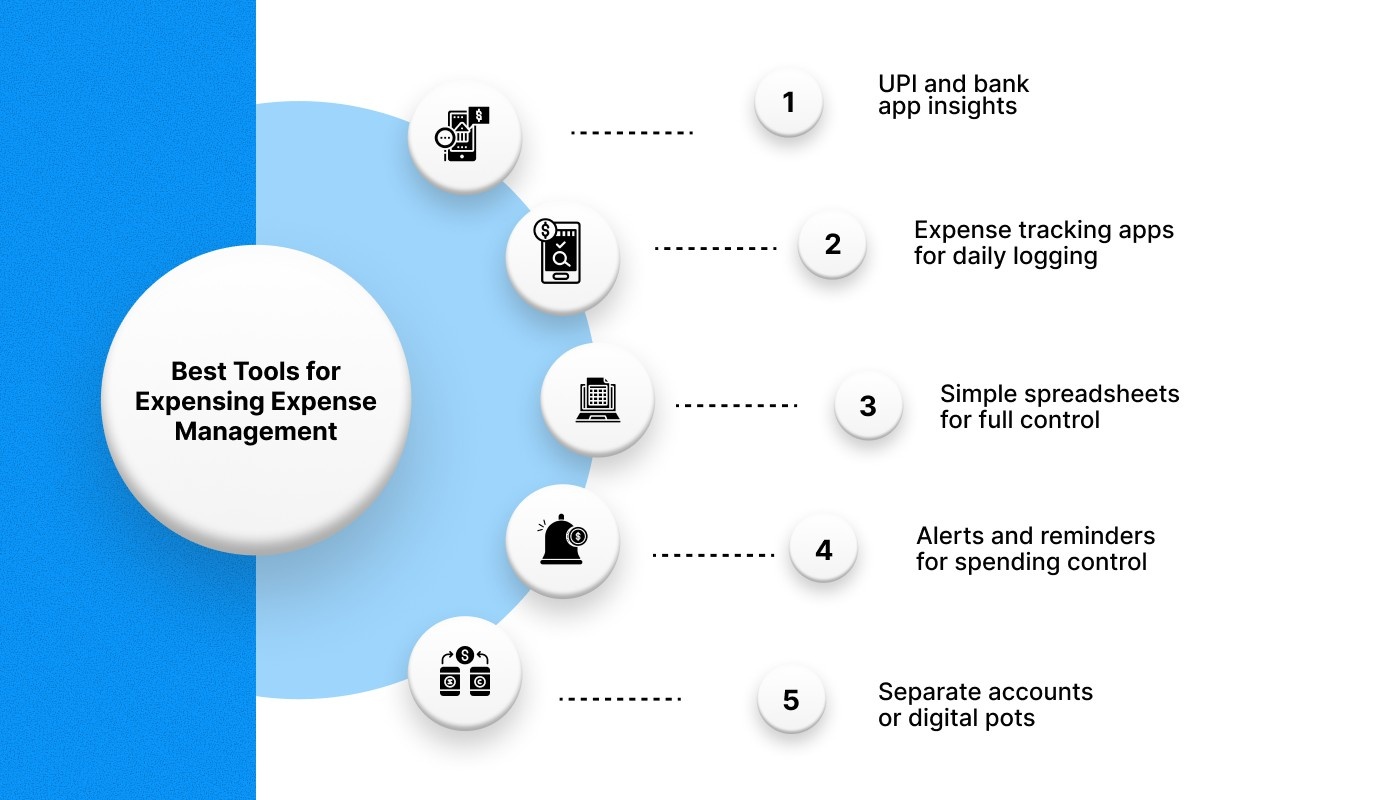

Best Tools for Expensing Expense Management

You do not need advanced software to manage expenses effectively. The right tools are the ones that fit into your daily routine and reduce the effort needed to stay consistent.

UPI and bank app insights

- Most banking and UPI apps now show category-wise spending summaries.

- These insights help you quickly review where money is going without manual entry.

- They work well as a first layer of expense visibility.

Expense tracking apps for daily logging

- Apps like Money Manager, Walnut, or similar tools help record transactions automatically.

- They are useful for capturing small, frequent spends that are easy to forget.

- Choose one that keeps categories simple and easy to review.

Simple spreadsheets for full control

- A basic Google Sheet or Excel file works well if you prefer manual oversight.

- It allows you to customise categories, limits, and review cycles.

- This option suits people who want flexibility without app dependency.

Alerts and reminders for spending control

- Spending alerts act as real-time checkpoints.

- Notifications when a category reaches its limit help prevent overspending.

- Reminders also ensure bills and planned expenses are handled on time.

Separate accounts or digital pots

- Using different accounts or wallets for essentials, lifestyle, and buffers adds clarity.

- This reduces accidental overspending and keeps priorities protected.

The best tool is not the most advanced one. It is the one you will actually use consistently. When tools support your habits instead of complicating them, expense management becomes sustainable.

How to Handle Short-Term Expenses Without Disrupting Your Budget

Even with a solid expense management system, short-term gaps can still appear. A delayed salary, medical expense, urgent travel, or repair cost can disrupt your plan and force you to dip into savings or miss commitments. How you handle these moments matters.

Why short-term expenses are tricky

- They are unplanned but time-sensitive.

- Using savings repeatedly slows down long-term progress.

- Credit cards can push expenses into high-interest cycles if not managed carefully.

How Pocketly Supports Responsible Expensing Expense Management

Pocketly is a digital lending app owned by Speel Finance Company Private Limited, an RBI registered NBFC, and offers small-ticket personal loans designed specifically for short-term needs, not ongoing spending.

- Loan amounts range from ₹1,000 to ₹25,000, suitable for temporary expense gaps.

- The process is fully digital with quick KYC and direct bank disbursal.

- Charges and repayment details are shown upfront, with no hidden surprises.

- Flexible repayment options allow early closure when your cash flow stabilises.

How Pocketly supports better expense management

- Helps you manage urgent expenses without disrupting savings or emergency funds.

- Keeps short-term costs separate from routine spending.

- Encourages planned repayment instead of reactive borrowing.

Pocketly works best when used intentionally, for genuine short-term needs, and repaid on time. When used this way, it becomes a support tool that protects your expense system rather than weakening it.

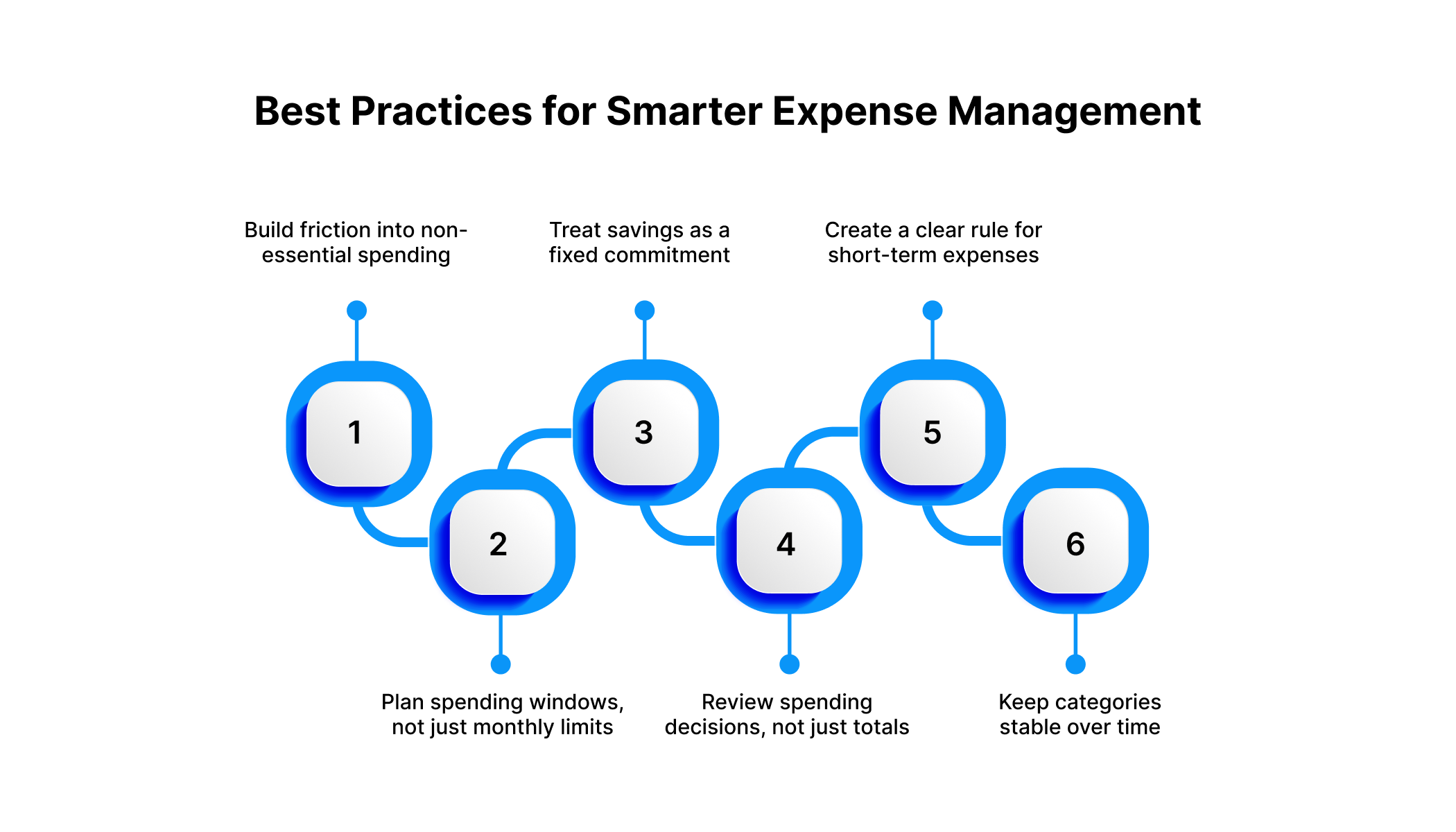

Best Practices for Smarter Expense Management

Smart expense management is less about tracking harder and more about designing systems that reduce decision fatigue and prevent mistakes before they happen. These practices help expenses stay controlled even when life gets busy.

Build friction into non-essential spending

- Not all spending needs to be equally easy.

- Keep lifestyle expenses slightly harder to access than essentials. For example, limit your daily spend wallet or keep entertainment budgets separate. This creates a pause before impulse purchases without banning them completely.

Plan spending windows, not just monthly limits

- Instead of only setting monthly caps, define weekly or bi-weekly spending windows.

- This prevents front-loading your budget in the first half of the month and running short later, especially for food, travel, and personal expenses.

Treat savings as a fixed commitment

- Savings should be treated like a bill, not a leftover.

- Move savings out of your spending account as soon as income arrives. What remains becomes your actual spending limit, not a theoretical one.

Review spending decisions, not just totals

- Do not only ask how much you spent. Ask why you spent it.

- Short reviews focused on decision patterns help you identify habits such as stress spending, convenience spending, or social spending that numbers alone cannot explain.

Create a clear rule for short-term expenses

- Decide in advance how you will handle urgent but temporary costs.

- Having a predefined option for short-term needs prevents panic decisions, high-interest borrowing, or repeated withdrawals from savings.

Keep categories stable over time

- Changing categories frequently makes trends harder to spot.

- Stable categories allow you to compare spending month after month and make meaningful adjustments instead of starting fresh every cycle.

Expense management works best when it removes uncertainty. Clear rules, simple boundaries, and consistent review turn spending from a reaction into a controlled process.

Conclusion

Effective expense management is not about cutting back on everything. It is about building awareness, structure, and control over how money flows through your daily life. When expenses are captured clearly, categorised correctly, and reviewed regularly, financial decisions become intentional instead of reactive.

A simple system that fits your routine will always work better than a complex one you cannot maintain. By setting clear boundaries, planning for irregular costs, and reviewing spending patterns consistently, you reduce stress and avoid surprises at the end of the month.

There will still be moments when short-term expenses disrupt your plan. In such situations, having responsible support matters. Used thoughtfully, tools like Pocketly can help you manage temporary cash gaps without compromising your long-term financial stability.

With the right habits and a practical approach, expense management becomes less about control and more about confidence.

FAQs

Q: What is expense management?

A: Expense management is the process of tracking, categorising, and reviewing your spending so you know where your money goes and can make better financial decisions. It helps you control costs, avoid unnecessary spending, and plan for future goals with clarity.

Q: Why is expense management important?

A: Expense management gives you visibility into your spending patterns so you can prevent surprises and reduce wasteful expenses. By organising and reviewing expenses regularly, you improve your financial control and make savings goals easier to achieve.

Q: How do you manage expenses effectively?

A: Start by recording every rupee you earn and spend, categorise it into needs, wants, and savings, and set spending limits for each category. Regularly review your spending, adjust your budget based on real patterns, and use tools or reminders to stay on track.

Q: What is the difference between expense tracking and expense management?

A: Expense tracking is simply recording spending, while expense management includes tracking, categorising, reviewing, and adjusting your budget to make better financial decisions. Management gives you a broader system to guide behaviour, not just a list of transactions.

Q: How often should you review your expenses?

A: It is best to review your expenses weekly or bi-weekly to catch trends early and adjust before month-end. This helps you make small corrections in real time rather than reacting after overspending has already happened.