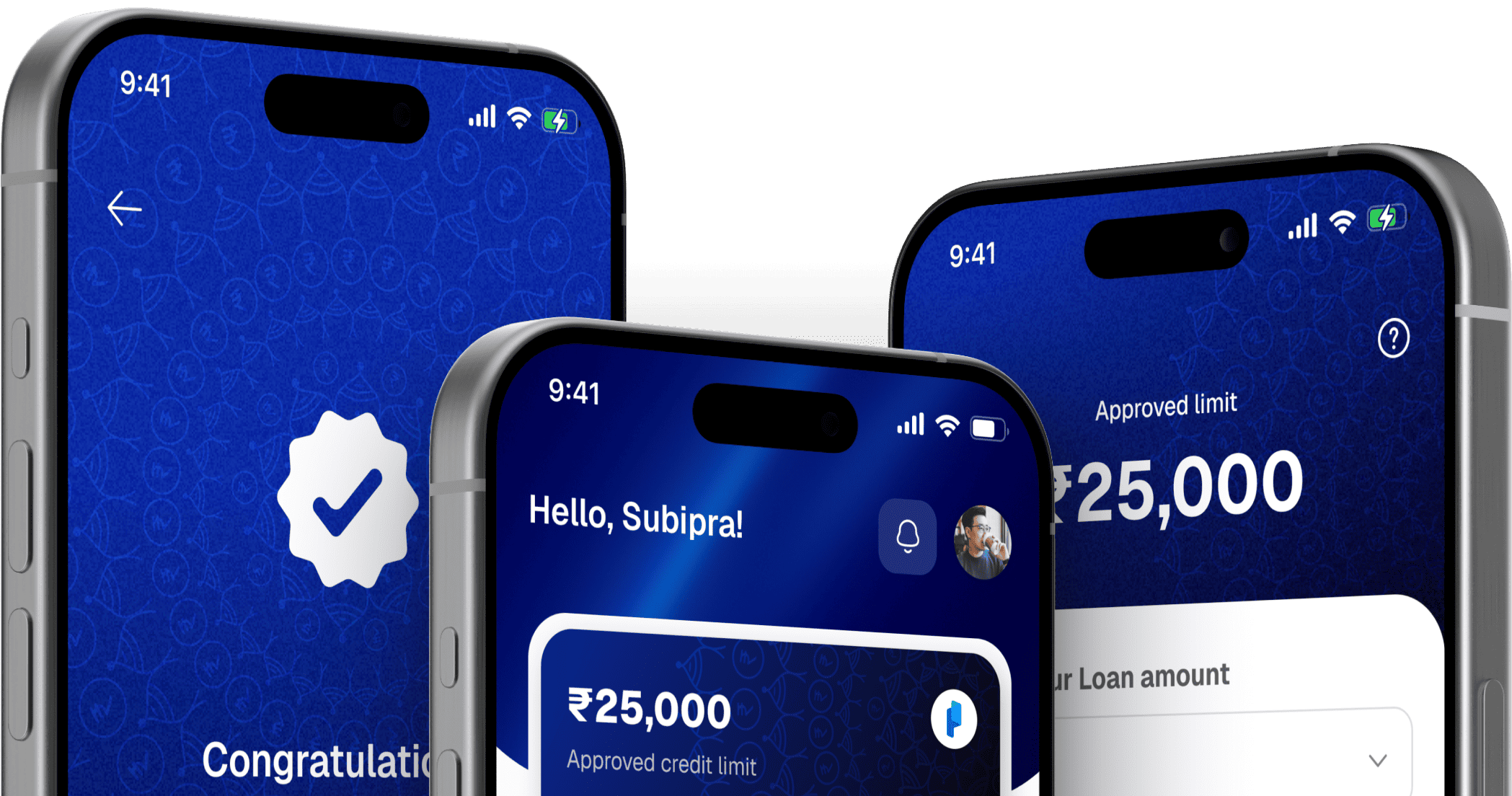

Get funds of up to

₹25,000 in just

few

minutes

Help Us With Your Details

Download Pocketly App now!

From vision to value – discover how pocketly empowers you to take control of your financial future.

Our Objectives

Our Objectives

The primary objective of Pocketly is to foster financial independence among young Indians, empowering them to utilise their time effectively. Unlike traditional lending institutions, our platform eliminates the requirement for collateral, which is often a major hurdle for borrowers.

We offer small loans, with a maximum credit amount of Rs. 25,000, which can be conveniently repaid within a short timeframe. Furthermore, our emphasis lies in facilitating quick access to funds through instant transfers directly into the user's bank account, following a streamlined KYC process.

Our app's appeal is attributed to its interactive nature, characterised by a clean and user-friendly UI. The onboarding process has been deliberately simplified to ensure a seamless user experience.

Our values define who we are—driving innovation, transparency, and accessibility in every financial solution we create.

We believe finance grows stronger with trust and transparency.

We make money management simple, clear, intuitive, and effortless.

Driven by innovation, we simplify and secure modern finance.

A global-first approach ensures accessibility for every user.

Drop us an email at : care@support.pocketly.in

Call us on : +91 8064893000