Do you ever feel your finance team spends money without knowing where it truly goes or what value it brings? Most businesses still lack complete visibility into supplier payments and purchasing patterns.

Spend analytics is about collecting, cleaning, and analysing all spend data, from invoices and purchase orders to vendor payments, to show what is bought, who it’s bought from, and how efficiently the money is used.

Organisations using spend analytics often see real cost reductions: typical adopters report 5–15% savings through better supplier contracts and spend consolidation.

Further, firms that embed spend analytics programs tend to cut procurement cycle costs by over 50%, and run far leaner procurement operations with fewer resources wasted.

In this blog, we will see how spend analytics works in 2026, outline the process for implementing it, and show how analytics-driven procurement decisions deliver measurable value.

Key Takeaways

- Spend analytics transforms disconnected procurement data into actionable insight, helping organisations cut indirect spend by 10–15% and improve supplier accountability.

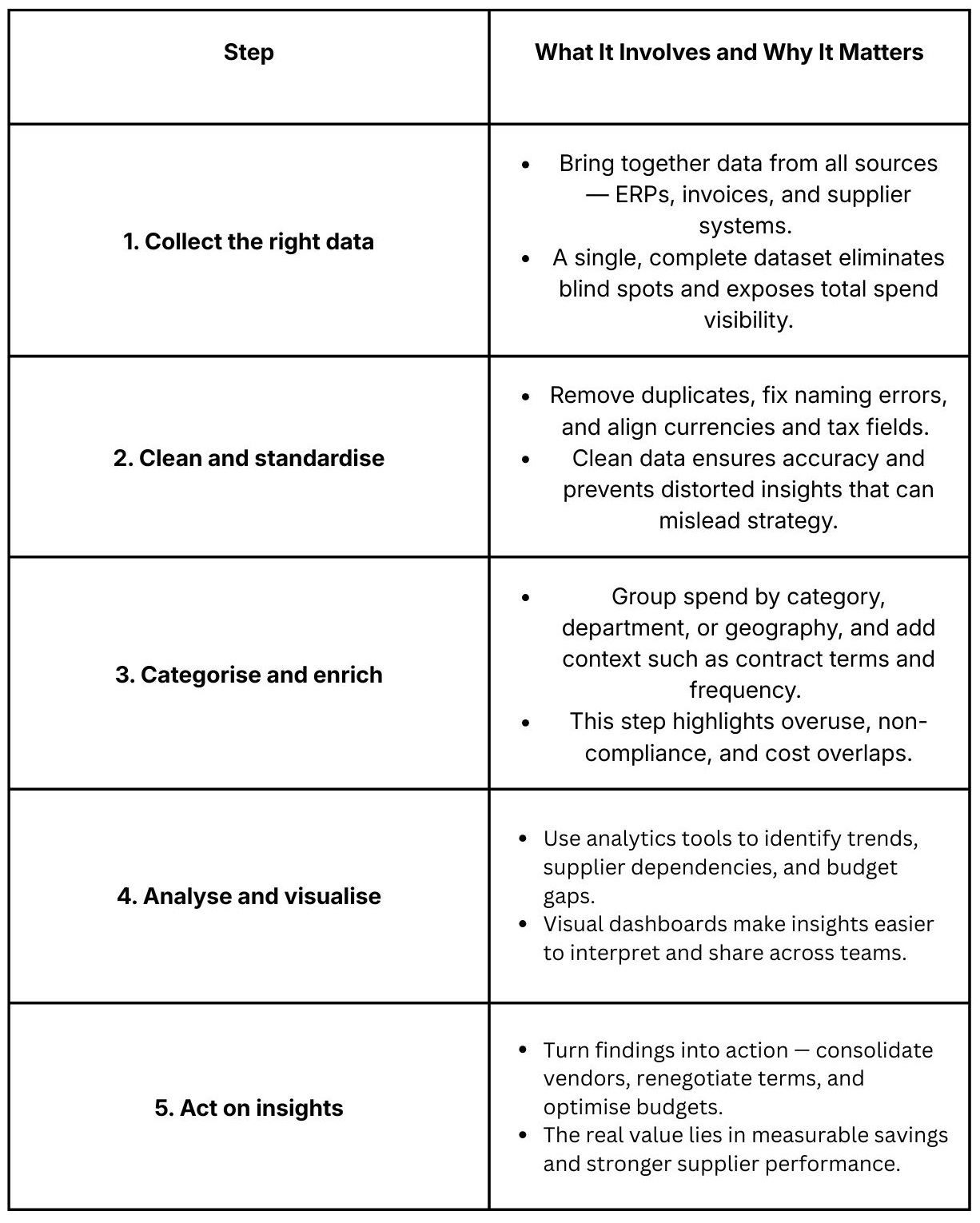

- A structured five-step process — data gathering, cleansing, classification, analysis, and action — ensures every rupee is traceable, measurable, and strategically allocated.

- Modern spend analytics technology (2026) delivers real-time visibility, AI-driven risk detection, and predictive intelligence for proactive cost control.

- The right operating model depends on data maturity — hybrid outsourcing now dominates, combining internal strategy with external analytical expertise.

- Procurement and spend analytics together drive smarter buying, align spending with ESG goals, and reduce maverick purchases through policy-backed data insights.

- A 2025 survey reveals that procurement teams using digital tools and analytics see greater success in cost savings, avoidance, stakeholder satisfaction, and supplier performance.

What Is Spend Analytics and Why Does It Matter More in 2026

Procurement and finance leaders are under rising pressure to prove that every rupee spent creates measurable value. With supplier costs fluctuating and sustainability demands intensifying, blind spots in spending are no longer tolerable.

Spend analytics closes that gap by converting scattered purchase data into clear insights that reveal inefficiencies, strengthen supplier strategy, and guide smarter sourcing.

How spend analytics differs from related terms:

- Spend analytics: the practice of analysing past and present expenditure to uncover savings and inefficiencies.

- Spend data analytics: the technical process and methods used to model, cleanse, and interpret large volumes of spend data.

- Spend management analytics combines analytics with ongoing spend control—budget monitoring, supplier compliance, and policy enforcement.

Why it matters in 2026

Modern procurement teams face pressures that make spend visibility indispensable:

- Inflation and cost volatility make forecasting and cost control difficult unless spending is tracked precisely.

- ESG and compliance expectations require transparency into supplier choices and spend categories.

- Supplier risk and supply-chain disruptions demand early visibility into vendor dependencies.

Market data shows a strong shift toward analytics-driven procurement. The global procurement analytics market, for instance, is projected to grow from USD 5.89 billion in 2025 to USD 21.50 billion by 2032

Moreover, a 2025 Deloitte survey finds that procurement functions investing in digital tools and analytics report significantly higher success in cost savings, cost avoidance, stakeholder satisfaction, and supplier performance than their peers.

Also Read: Guide on Types of Short-Term Sources of Finance

To understand how spend analytics actually creates a measurable impact, it helps to look at the process that turns raw numbers into strategic decisions.

What is the Spend Analytics Process

Many organisations are uncovering hidden inefficiencies simply by analysing how money moves through their procurement systems. According to a market analysis summary, 84% of CPOs cited spend/savings analytics as impactful, highlighting strong adoption among procurement leaders.

Research by APQC also shows that companies running a structured spend analysis programme reduced procurement cycle costs dramatically.

In one comparison, an organisation with roughly US $5 billion in revenue spent about US $8.5 million on procurement activities, whereas a similar organisation without spend analysis spent about US $19.5 million, that is an extra US $11 million simply from lacking spend analytics.

A structured spend analytics process changes that. It converts scattered data into clarity, giving procurement teams a single, reliable view of how funds are being used and where savings can be unlocked.

Also Read: Legal Interest Rates in India: What Professionals Should Know Before Borrowing

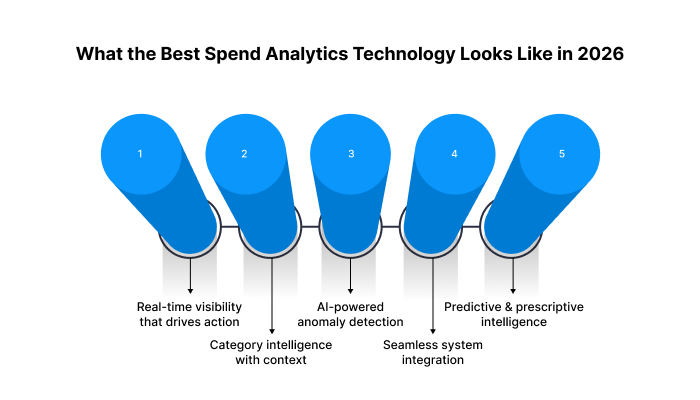

What the Best Spend Analytics Technology Looks Like in 2026

Procurement teams in 2026 expect data precision, speed, and foresight, not just dashboards. The most effective spend analytics technology gives them a live, unified view of spend, linking every supplier, contract, and transaction in real time.

It helps leaders make fast decisions grounded in evidence, not estimates.

1. Real-time visibility that drives action

Static monthly reports are obsolete. Modern tools pull live data from ERP, procurement, and finance systems, giving instant visibility into spend by supplier, category, or project.

When anomalies arise, such as an off-contract purchase or a cost spike, teams can intervene immediately rather than reviewing them weeks later.

2. Category intelligence with context

Leading platforms automatically classify spend data and benchmark supplier performance across price, reliability, and contract compliance.

Procurement can identify overlapping vendors, consolidate categories, and negotiate from a position of evidence.

3. AI-powered anomaly detection

Machine learning scans millions of transactions to detect duplicate invoices, off-cycle payments, or unexpected cost movements.

These alerts prevent leakage, strengthen controls, and free analysts from manual audit checks.

4. Seamless system integration

Top spend analytics tools integrate directly with existing ERP and accounting systems, removing manual uploads or reconciliation errors. Integration ensures a single version of truth across procurement, finance, and operations.

5. Predictive and prescriptive intelligence

Next-generation tools go beyond describing the past, they anticipate the future. Predictive analytics forecast category-level trends, while prescriptive models suggest specific actions such as supplier diversification or contract renegotiation to prevent overspend.

Ready to make smarter financial choices with instant access to credit? Pocketly gives young professionals and students the freedom to manage cash flow without hassle or hidden fees.

Download the Pocketly app today and take control of your finances — fast, transparent, and built for your goals.

Also Read: Digital Lending In India: Future Trends and Insights

Even with strong tools, success depends on how analytics is managed. The question many organisations face is whether to build it internally or outsource it for scale and speed.

Outsourcing vs In-House: Which Spend Analytics Model Wins in 2026

As spend data grows across systems and geographies, many organisations are reassessing whether to build analytics capabilities internally or outsource them to specialised partners.

The choice depends on control, cost, and data complexity.

1. When outsourcing delivers stronger results

Enterprises with fragmented systems or limited analytics bandwidth often see faster results with managed analytics partners.

Outsourced teams bring advanced tools, data scientists, and proven frameworks, allowing quicker setup and cleaner insights across multiple regions.

Key advantages of outsourcing

- Speed and scalability: Insights are delivered in weeks instead of quarters.

- Lower overhead: No need to maintain full-time analysts or infrastructure.

- Specialised expertise: Providers bring cross-industry benchmarks that sharpen negotiation and performance tracking.

2. Risks that need tight control

- Data confidentiality: Procurement data is sensitive. Firms must ensure encryption, compliance, and restricted access at every level.

- Integration friction: Poor alignment with internal systems can create reporting delays or incomplete analysis.

3. Hybrid models are now the norm

In 2026, most mature organisations combine both approaches, outsourcing data cleansing and reporting while retaining strategic interpretation internally. This ensures agility without losing ownership of insights.

The winning model is one in which analytics capacity flexes with business needs, while strategy and decision-making remain firmly in-house.

Also Read: Expense Tracking Categories for Budgeting

Furthermore, when analytics and procurement work together, spending decisions become sharper and more strategic.

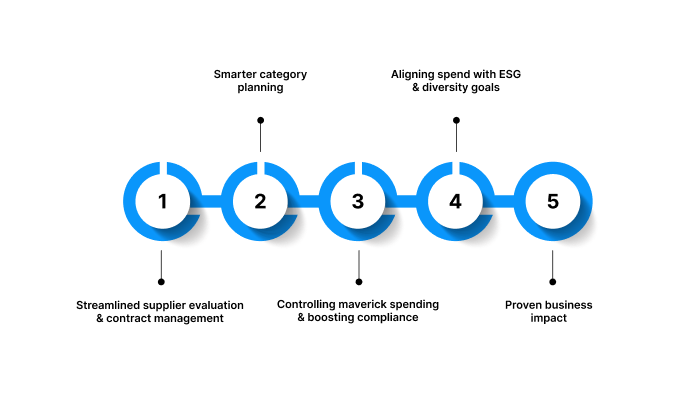

How Procurement and Spend Analytics Combine to Drive Smarter Buying

Procurement and spend analytics are no longer separate disciplines, together, they create a cycle of informed decision-making. Procurement defines what to buy and from whom; spend analytics reveals how those decisions perform financially.

When both align, purchasing moves from a transactional to a strategic approach.

1. Sharper supplier evaluation and contract management

Analytics provides data-backed visibility into supplier performance, tracking delivery times, pricing consistency, and adherence to contract terms. This evidence lets procurement teams reward high-performing vendors, flag underperformers early, and negotiate from a stronger position.

2. Smarter category planning

Spend data highlights which categories consume the most budget and which offer savings potential. For example, identifying overlap in marketing or logistics vendors often leads to category consolidation and cost efficiency.

Analytics turns category planning into a measurable, continuous process.

3. Controlling maverick spending and boosting compliance

Spend analytics detects off-contract purchases and policy breaches in real time. By comparing transaction data with approved supplier lists and budgets,

it ensures teams buy within policy limits, reducing unplanned costs and improving financial discipline.

4. Aligning spend with ESG and diversity goals

Modern analytics tools now tag suppliers based on sustainability and diversity credentials.

Procurement teams can track what percentage of total spend supports ESG-compliant or diverse vendors, ensuring that financial performance aligns with corporate responsibility targets.

5. Proven business impact

Organisations using integrated procurement and spend analytics consistently report measurable results, improved supplier accountability, a 10–15% reduction in indirect spend, and faster procurement cycles.

This integration turns purchasing into a proactive value function rather than a cost centre.

Also Read: What Is Credit Underwriting in Digital Lending?

Pocketly: Helping Entrepreneurs and Young Professionals Manage Spending Smartly

Entrepreneurs and self-employed professionals often face unpredictable cash flow as payments get delayed, expenses pile up, or new opportunities arise. Pocketly helps quickly and easily manage these short-term gaps.

It is a digital lending platform offering collateral-free loans from ₹1,000 to ₹25,000 with interest starting at 2% per month. With quick KYC, clear fees, and instant transfers, it keeps your business running without interruption.

How It Works:

- Sign up with your mobile number.

- Upload PAN and Aadhaar for quick KYC verification.

- Enter bank details for a secure transfer.

- Select the loan amount and repayment period that fits your plan.

- Get funds credited to your account within minutes.

Poketly’s 24/7 support, fast approval process, and transparent structure make it a reliable partner for entrepreneurs who want flexibility without financial stress.

Conclusion

Procurement and spend analytics together give organisations something every leader values. When data guides buying decisions, cost efficiency stops being reactive and becomes part of daily operations.

Teams gain the clarity to negotiate better, plan smarter, and align every rupee with business goals.

And when individuals need the same clarity in their personal finances, Pocketly delivers it, helping entrepreneurs and young professionals manage short-term expenses quickly, transparently, and confidently.

Download Pocketly on iOS and Android to get instant access to flexible, collateral-free loans built for modern financial needs.

FAQs

Q: How can procurement teams measure ROI from spend analytics?

A: Track metrics such as cost savings, supplier consolidation rate, and contract compliance. Comparing spend data before and after implementation shows a quantifiable financial impact.

Q: What type of data delivers the most insight in spend analytics?

A: Transaction-level data from invoices, POs, and supplier payments gives the clearest visibility. Enriching it with contract and category details turns it into decision-grade intelligence.

Q: How do predictive analytics enhance procurement decisions?

A: Predictive models forecast price fluctuations, supplier risks, and demand shifts, enabling procurement to act early instead of reacting to unexpected changes.

Q: What’s the first step for companies new to spend analytics?

A: Start with a pilot project in one spend category. Use it to refine data quality, set benchmarks, and prove value before expanding organisation-wide.

Q: Can spend analytics improve ESG and sustainability reporting?

A: Yes. Modern platforms tag suppliers by sustainability and diversity indicators, helping companies track how much they spend to support ESG-aligned partners and compliance goals.