Introduction

Do you sometimes feel like your cash goes away faster than you can find it? You're not by yourself. It's hard for many people to figure out where their monthly income goes, which makes it hard to save or plan. The truth is that budgeting is often just guesswork if you don't have a straightforward way to keep track of your spending.

That's where the categories for keeping track of expenses come in. These are the most essential parts of a sound budgeting system because they help you separate every rupee or dollar you spend into groups that are easy to handle. These categories make it clear where your money goes and where you can save it, whether it's for groceries, rent, transportation, or fun.

This blog post will talk about how to organise your spending properly, why this is important for your financial health, and how the right tools can make budgeting easier and less stressful.

At a Glance

- Expense tracking categories help you organise your spending into clear sections, making budgeting simple and stress-free.

- Categorising expenses improves financial awareness, showing exactly where your money goes and how you can save more effectively.

- Common categories like housing, food, transportation, debt repayment, and savings cover most day-to-day needs, but custom categories make budgeting more personal.

- Consistency matters. Track your spending regularly and review it monthly to stay on top of your goals.

What are Expense Tracking Categories?

Labels or groups of things can help you keep track of your spending by separating it into sections that make sense. You don't write down every single expense at random; instead, you put them into groups, such as housing, utilities, entertainment, savings, food, and so on. This method helps you see where your money is going and figure out better ways to handle it.

These groups are like buckets that hold different kinds of costs. For instance, when you pay your electric bill, it goes under "Utilities." "Food and Groceries" includes things like buying food. These records help you see where you can save money and where you spend too much over time by giving you a clear picture of your spending habits.

Keeping track of spending by category is an essential part of budgeting because it turns numbers into information that can be used.

It helps you:

- Find areas that spend a lot of money and need your attention.

- Set reasonable spending limits for each type of cost.

- Compare what you spent with what you planned to spend.

- Be responsible and strict with your money.

Now that you know what expense tracking categories are, let's talk about why it's so important to put your expenses into these groups if you want to stay on budget and keep your finances in order.

Must Read: Understanding Personal Finance and Budgeting for Financial Needs

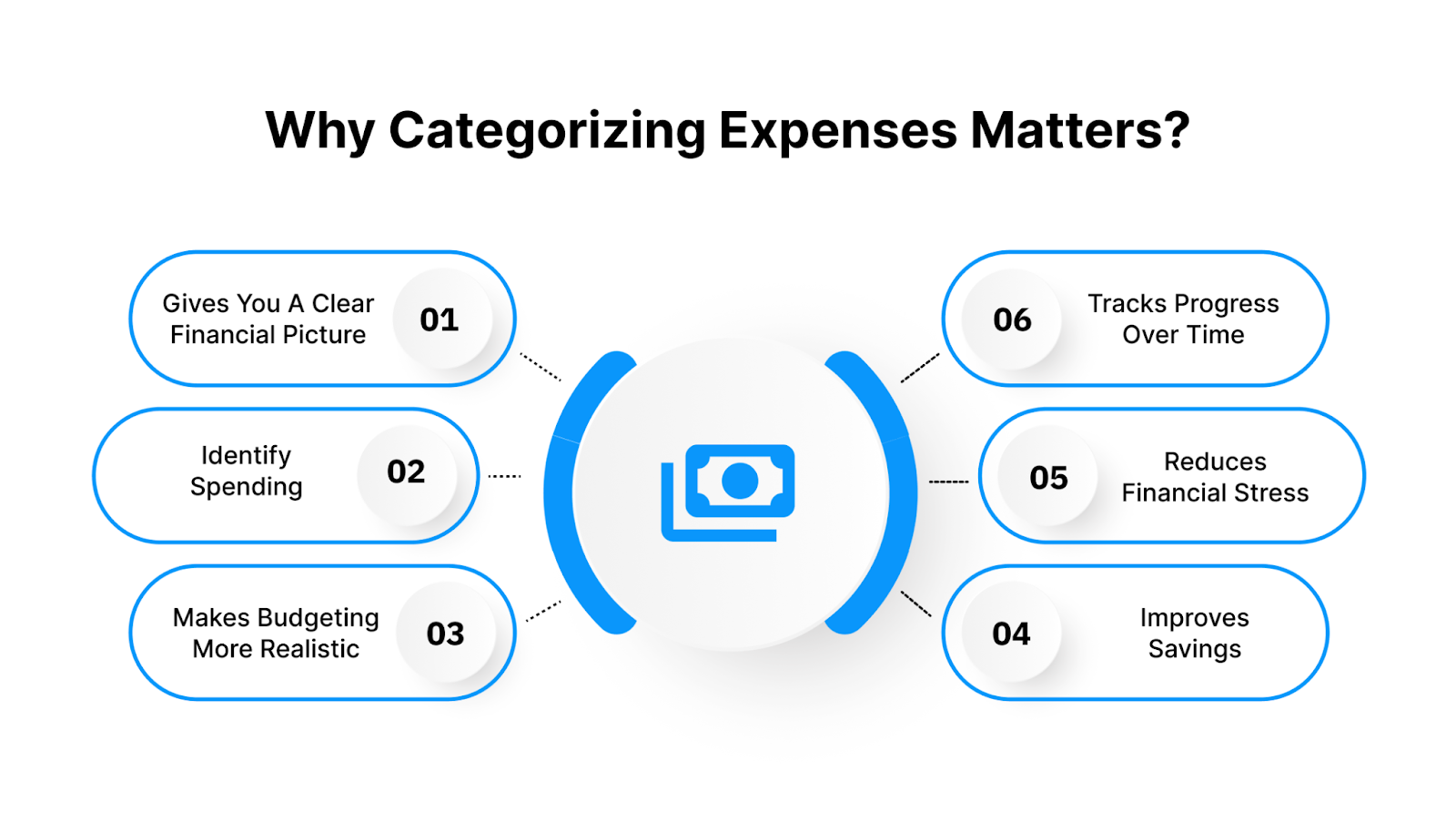

Why Categorising Expenses Matters?

Putting your expenses into groups isn't just a way to organise numbers; it's a way to take back control of your money. When you divide your monthly spending into well-defined expense tracking categories, you can see what's necessary and what can be cut. This awareness underpins more innovative budgeting and financial planning.

This is why categorising expenses matters:

1. Gives You a Clear Financial Picture

Spending categories help you see your finances. Instead of wondering where your money went, you'll see patterns like food, travel, and entertainment spending. This clarity helps you decide where to cut or invest.

2. Helps You Identify Unnecessary Spending

Once you group your expenses, you can easily spot spending patterns that don’t align with your priorities. Maybe you’re spending more on takeout than you realise or paying for subscriptions you rarely use. Identifying these small leaks helps prevent money waste.

3. Makes Budgeting More Realistic

Budgeting without categories is like trying to navigate without a map. Divide your expenses into logical groups and set realistic limits for each to ensure your budget matches your lifestyle and priorities.

4. Improves Savings and Goal Planning

Knowing where your money goes helps you reallocate funds more efficiently. If you notice that one category consistently exceeds your budget, you can adjust your plan and redirect extra funds toward savings or specific goals like travel, education, or emergency reserves.

5. Reduces Financial Stress

When your expenses are organised, managing money becomes less overwhelming. You no longer have to guess or panic at month-end. Instead, you gain a sense of control and confidence in your financial decisions.

6. Tracks Progress Over Time

Categorisation allows you to compare your spending month by month. Seeing whether you're improving, overspending, or meeting your budget goals keeps you accountable and motivated to stick to your financial plan.

Now that you understand why categorising your expenses is essential, let’s look at the different types of expense tracking categories you can use to organise your budget effectively.

Must Read: Understanding the Basics of Financial Planning and Its Importance

Common Expense Tracking Categories

When you start tracking your expenses, dividing them into clear categories makes your budget easy to understand and manage. Each category represents a specific area of your life where money flows regularly.

Here’s a comprehensive breakdown of the most common expense tracking categories that can help you organise your finances effectively.

1. Housing and Utilities

This category usually takes up the largest portion of a monthly budget. It includes all the costs associated with maintaining your living space. Typical expenses include:

- Rent or home loan (EMI or mortgage payments)

- Property taxes and maintenance fees

- Electricity, water, and gas bills

- Internet, cable, and phone bills

Tracking housing and utility costs helps keep essential living costs within 25–30% of income. If this category starts taking up too much, it might be time to reconsider your housing choices or reduce energy consumption.

2. Food and Groceries

Food expenses can vary widely depending on lifestyle and eating habits, which makes tracking this category essential.

It includes:

- Groceries and household food items

- Dining out, takeout, and snacks

- Beverages (coffee, juice, etc.)

- Meal delivery subscriptions

Recording every food-related expense helps you identify habits like frequent takeout or overspending on non-essential items. You can also set a separate subcategory for “Dining Out” to make adjustments more easily if you find this area consuming a large part of your budget.

3. Transportation

Whether you own a vehicle or use public transport, transportation is a key recurring cost.

Common expenses include:

- Fuel and vehicle maintenance

- Public transportation passes (bus, metro, train)

- Ride-sharing or cab services

- Parking fees and tolls

- Car insurance and servicing

Transportation costs can fluctuate, especially with fuel price changes or vehicle repairs. Keeping this category well-documented helps you plan ahead and set aside money for maintenance instead of being caught off guard.

4. Insurance and Healthcare

Health and protection-related expenses often feel optional until an emergency arises. Tracking these helps ensure you’re covered and prepared.

This category includes:

- Health insurance premiums

- Life insurance and other coverage (vehicle, home, etc.)

- Doctor consultations, medicines, and routine checkups

- Emergency medical expenses

Having a clear record of healthcare spending also helps you evaluate whether your insurance plans are sufficient or if adjustments are needed to better safeguard your future.

5. Debt Repayment

If you have loans or credit card dues, this category is critical for staying financially healthy.

It includes:

- Loan EMIs (personal, education, car, or home loans)

- Credit card payments

- Overdraft or line-of-credit repayments

Tracking debt repayments lets you see how much of your income goes to debt and plan how to pay it off faster. Stay consistent and avoid missed payments that can hurt your credit score by organising this category.

6. Savings and Investments

This category focuses on building wealth and securing your future. It includes all forms of saving and investing, such as:

- Monthly savings deposits

- Emergency fund contributions

- Mutual funds, SIPs, or stock investments

- Retirement accounts and insurance-linked plans

Allocating money to savings before spending elsewhere is a smart financial move. Tracking this category ensures you stay committed to your long-term goals while balancing short-term needs.

7. Entertainment and Leisure

Fun is important in a balanced life, as long as it fits your budget. This category covers:

- Subscriptions (Netflix, Spotify, OTT platforms)

- Outings, movies, and concerts

- Hobbies and sports activities

- Vacations or weekend getaways

Tracking these expenses prevents overspending on fun and leisure while still allowing you to enjoy guilt-free relaxation. You can set a fixed percentage of your budget (around 5–10%) for entertainment to keep things balanced.

8. Education and Skill Development

Investing in your personal growth pays off long-term. This category includes:

- Tuition fees or online course payments

- Books, stationery, and learning materials

- Skill development programs or workshops

- Software or educational subscriptions

Monitoring education-related spending helps ensure that your investment in learning aligns with your career goals and budget.

9. Miscellaneous / Personal Expenses

The “everything else” category covers irregular or unpredictable spending. It may include:

- Gifts and donations

- Personal care (salon, grooming, skincare)

- Clothing and accessories

- Pet care or household help

- Unexpected one-time expenses

While it’s essential to allow for flexibility, keep an eye on how much you’re spending in this area. If your miscellaneous category keeps growing, it might be worth breaking it down into smaller, specific groups.

By categorising your expenses into these key areas, you gain a complete view of your financial life. Next, let’s explore some smart tips for managing and optimising your expense tracking categories to make your budgeting process even more effective.

Must Read: What is Debt Trap and How to Avoid It?

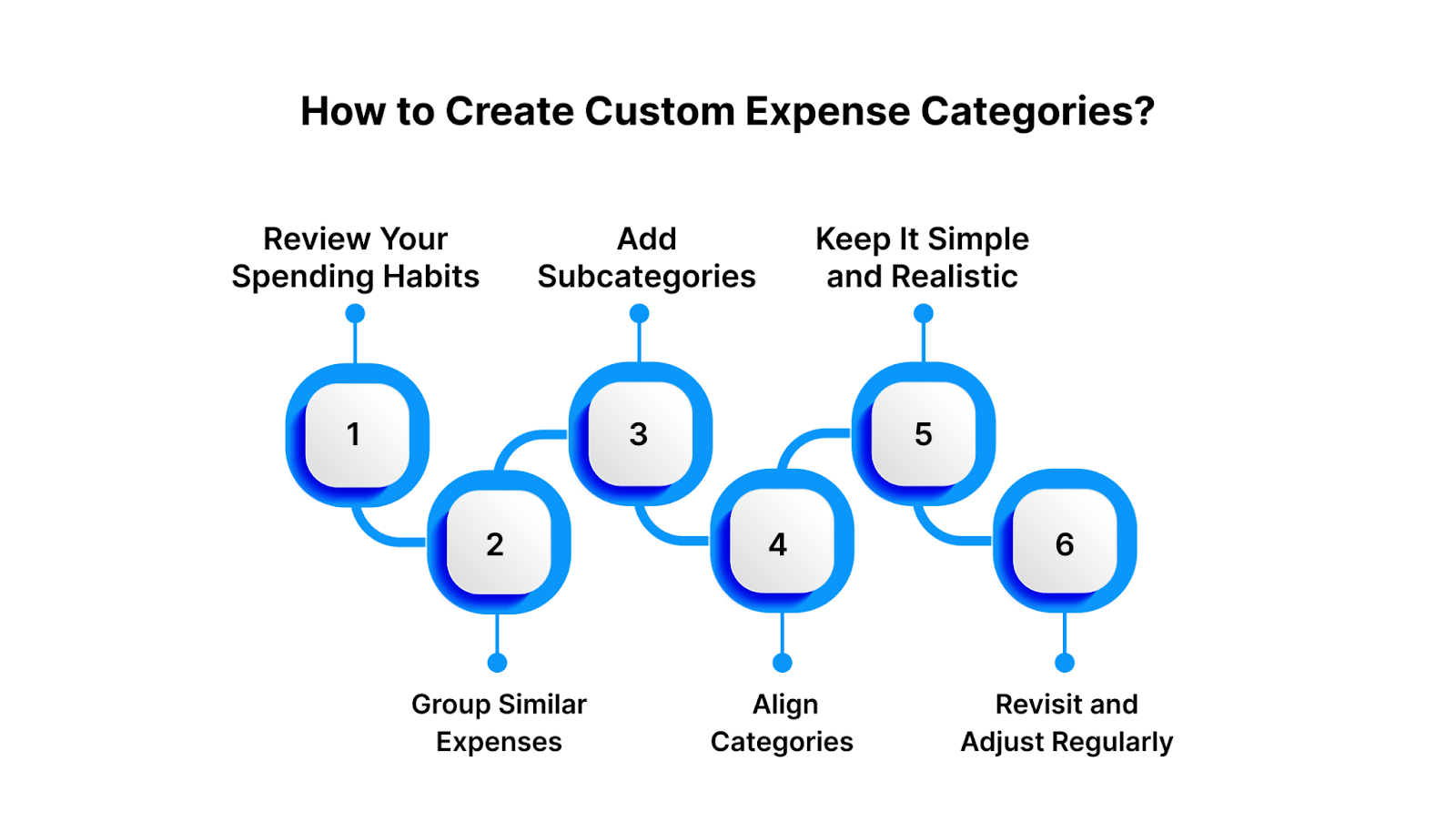

How to Create Custom Expense Categories?

Everybody spends differently, so a one-size-fits-all budget rarely works. Customising expense tracking categories lets you create a budget that fits your lifestyle, goals, and priorities. Create personalised categories to make your budget more relevant and manageable.

1. Review Your Spending Habits

Examine your past three to six months of expenses. Go through your bank statements, digital wallets, and credit card records. You'll quickly notice patterns like frequent food delivery, shopping, and travel costs.

These patterns will help you decide which categories deserve their own space. For instance, if you often spend on hobbies or gadgets, it makes sense to create a separate category for them instead of lumping them under “Miscellaneous.”

2. Group Similar Expenses Together

Once you identify where your money goes, group related expenses under broader labels.

For example:

- Combine “Fuel,” “Car Service,” and “Parking Fees” under Transportation.

- Combine “Streaming Subscriptions,” “Concerts,” and “Hobbies” under Entertainment.

You want categories that are easy to track but detailed enough to show where your money goes.

3. Add Subcategories for More Detail

If you want more clarity, add subcategories under your main categories. For example:

- Food and Groceries: Groceries, Eating Out, Coffee, Snacks

- Education: Tuition Fees, Online Courses, Books, Skill Development

- Healthcare: Doctor Visits, Medicines, Health Insurance

Subcategories help pinpoint overspending areas. You can immediately see if you’re spending too much on takeout or subscriptions instead of guessing where your budget went off track.

4. Align Categories with Financial Goals

Your expense categories should reflect your short-term and long-term financial goals.

If your goal is to save for a trip, create a category named Travel Savings. If you’re working toward paying off a loan, add Debt Repayment or EMI Tracker.

When your categories align with your goals, it’s easier to stay focused and track progress. You start seeing your budget as a tool for achieving something meaningful rather than just recording numbers.

5. Keep It Simple and Realistic

Though tempting, 30+ categories can make budgeting overwhelming. Limit yourself to 8–12 main categories and add subcategories as needed.

The key is simplicity. You should be able to update your expense tracker without spending hours categorising every transaction. The easier it feels, the more likely you are to stick with it consistently.

6. Revisit and Adjust Regularly

Life and expenses change. Review your categories every few months to see if they still fit your current lifestyle. For instance, you might add a new Fitness category if you’ve started gym memberships or remove Commute if you’re working from home.

Regular adjustments keep your expense tracker relevant and ensure your budgeting system evolves with your goals.

By creating custom expense tracking categories, you make your budget truly personal and actionable. Once you’ve set them up, the next step is to learn how to track, analyse, and manage these expenses effectively for better financial control.

Tips for Maintaining an Effective Budget Using Categories

You stay financially organised and in control by effectively maintaining expense tracking categories. A budget works best when it evolves with your lifestyle and spending habits. Below are some practical tips to make sure your budgeting system remains effective, realistic, and easy to follow.

1. Track Every Expense Consistently

No matter how small an expense seems, record it. A daily coffee or quick online purchase can add up over time. Consistency helps you see the complete picture of where your money goes.

Use digital expense tracker apps or spreadsheets to simplify the process. Automation through apps can categorise transactions automatically, saving time and effort while keeping your records accurate.

2. Set Monthly Limits for Each Category

Assign a spending limit to every category based on your income and priorities. For instance, you might allocate 30% to housing, 20% to savings, 15% to food, and 10% to entertainment.

Having clear limits keeps your budget balanced and helps prevent overspending in non-essential areas. Review these limits monthly to ensure they still make sense for your financial goals.

3. Review and Adjust Categories Regularly

Your expenses won’t remain the same every month. Maybe your rent changes, you start a new hobby, or you reduce eating out. Regularly reviewing your categories ensures your budget reflects your current reality.

Every month, review your budget and adjust limits, remove irrelevant categories, and add new ones as needed.

4. Use Visual Tools for Better Insights

Charts and graphs make it easier to understand your spending patterns. Visual tools in budgeting apps or spreadsheets help you quickly identify which categories consume most of your income.

Seeing that “Entertainment” takes up a large chunk of your monthly spending might motivate you to cut back and redirect funds toward savings or debt repayment.

5. Include a “Miscellaneous” Buffer Category

Unexpected gifts, repairs, and outings always happen, no matter how well you plan. Having a “Miscellaneous” category ensures such costs don’t disrupt your entire budget.

This small buffer keeps your finances flexible without forcing you to adjust other categories mid-month.

6. Focus on Progress, Not Perfection

Budgeting is about awareness and control, not restrictions. Don’t stress if you overspend in one category occasionally. The goal is to learn from patterns and improve gradually.

Celebrate small wins, like staying within limits or saving more than planned. These positive reinforcements make budgeting feel rewarding instead of restrictive.

7. Connect Budgeting with Your Financial Goals

Always tie your categories and spending limits to bigger goals, like emergency funds, debt repayment, or travel.

When your categories directly support your financial aspirations, budgeting feels more purposeful. Every spending choice becomes a step toward something meaningful.

Maintaining an adequate budget using well-defined expense tracking categories helps you stay accountable, reduce wasteful spending, and achieve long-term financial stability. Next, let’s see how digital tools and apps can make managing your expense categories even easier.

Must Read: Understanding Line of Credit: Definition, Types and How it Works

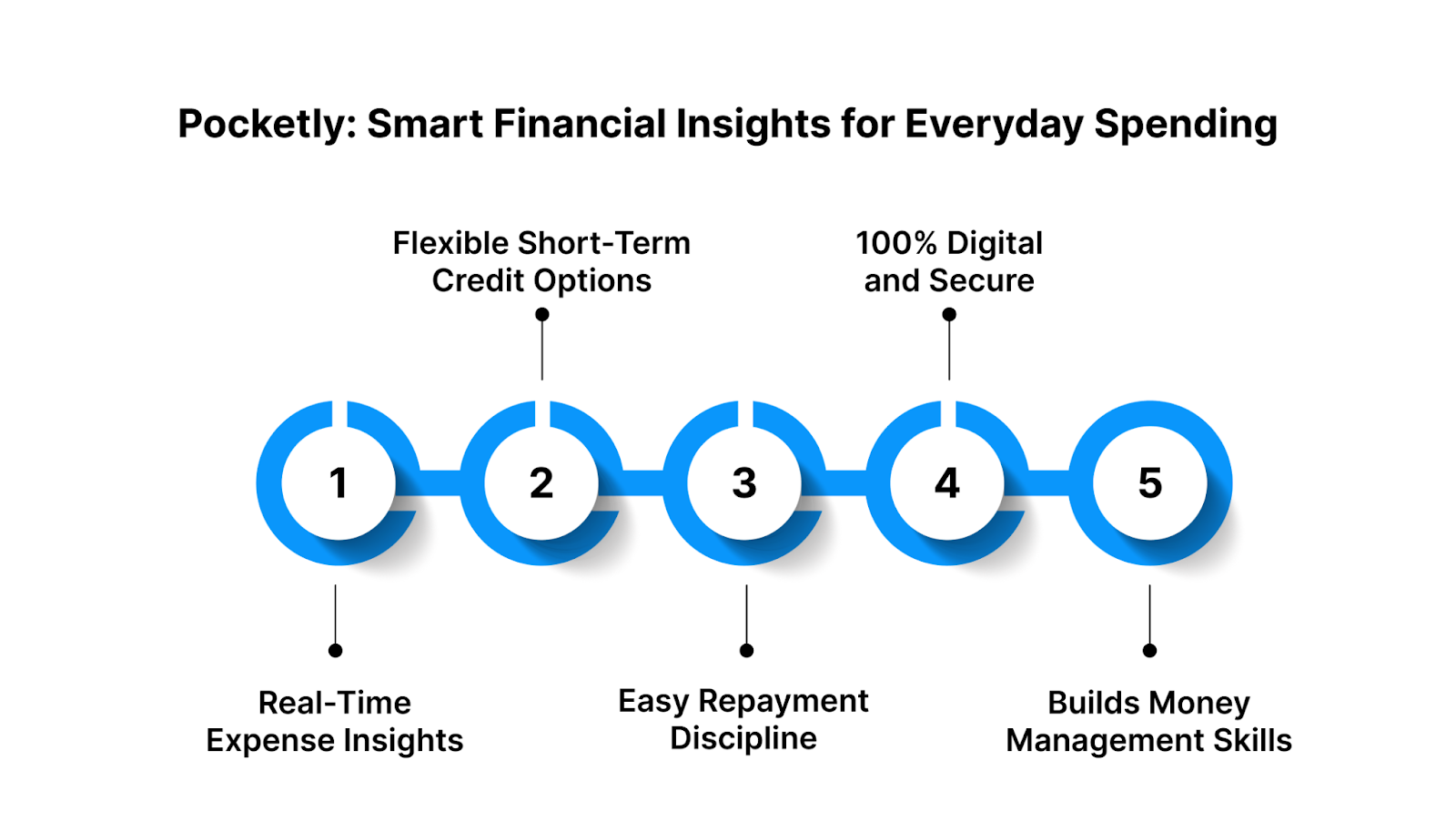

Pocketly: Smart Financial Insights for Everyday Spending

Manually tracking expenses can be overwhelming when juggling school, work, and other obligations.

Here’s how Pocketly supports financial management and expense awareness:

- Real-Time Expense Insights: Pocketly makes it easy to track where your money goes. It helps you identify your biggest spending categories, such as food, travel, and entertainment. This insight allows you to make minor but powerful adjustments to your financial habits.

- Flexible Short-Term Credit Options: Running short on cash before your next allowance or paycheck? Pocketly lets you borrow small, manageable amounts (₹1,000–₹25,000) instantly to handle short-term expenses without falling into debt traps. You only borrow what you need, helping you maintain a better balance across your expense tracking categories.

- Easy Repayment and Financial Discipline: Pocketly encourages responsible borrowing through flexible repayment options ranging from 2 to 6 months. With clear terms and no hidden fees, you build trust, confidence, and financial discipline.

- 100% Digital and Secure: Everything from application to repayment happens online through the Pocketly app. The fully digital process is fast, paperless, and designed to fit seamlessly into your modern lifestyle.

- Builds Long-Term Money Management Skills: Pocketly helps teens budget, track, and repay by providing short-term credit and spending insights. Learn to manage money wisely every day, not just borrow.

Conclusion

Financial management begins with awareness, and categorising expenses is the first step. Clear expense tracking categories show where your money goes, what habits drain your budget, and where you can save more. It's not just numbers that lead to long-term stability; financial clarity and control do too.

By creating custom categories, reviewing your spending, and changing your habits, you can make your budget more purposeful and goal-oriented. Pocketly makes managing daily expenses and short-term credit easy. It helps you achieve financial discipline, avoid debt, and manage money for life. Start tracking, saving, and spending smarter today to gain financial freedom tomorrow.

Download the Pocketly app on iOS or Android to take control of your short-term credit and everyday spending with confidence.

FAQs

1. What are expense tracking categories?

Expense tracking categories are groups that help you organise your spending into meaningful sections like food, transportation, rent, or entertainment. They make it easier to see where your money goes and identify areas where you can cut back or save.

2. Why is it important to categorise expenses?

Categorising expenses helps you understand your spending habits, avoid overspending, and plan better for future goals. It gives you a clearer financial picture, ensuring that every rupee you spend aligns with your priorities.

3. How many expense categories should I have?

There’s no fixed number. Most people use 6–10 categories such as housing, food, transport, savings, and entertainment. The key is to keep your list simple and relevant to your lifestyle so that tracking doesn’t feel overwhelming.

4. Can I create custom expense categories?

Yes, you can customise categories to fit your specific needs. For example, if you’re a student, you might create a “college supplies” or “online learning” category. The goal is to make tracking more accurate and personal.

5. What’s the best way to track expenses regularly?

You can use budgeting apps, digital wallets, or even a simple spreadsheet to track expenses daily or weekly. The more consistent you are, the more useful your data becomes for long-term budgeting and savings.