Money becomes real the moment you start managing life on your own.

Month-end feels like a countdown, and one unexpected expense, a phone repair, a sudden trip home, a medical bill, or a college project, can throw off your entire plan.

Living costs continue to rise, internships barely cover the basics, and keeping up with friends socially can feel like a pressure game.

With UPI making spending effortless, tracking where your money actually goes becomes even harder. If this sounds familiar, you’re not alone; it’s the financial reality for most young Indians today.

When you know how your finances work, everyday decisions become easier. Money clarity builds confidence and helps you stay independent without constant stress.

In this guide, you’ll learn practical, modern money skills that everyone should know, from handling unexpected expenses to building better habits. We’ll also explore when short-term financial support can genuinely help, and how to use it responsibly.

Think of this as your starting point to build a healthier, more confident relationship with money.

Key Takeaways

- Money influences your daily life, opportunities, and independence far more than most people realise early on.

- Understanding how money works, from spending triggers to budgeting, helps you stay in control instead of reacting to financial stress.

- Digital India has changed how money moves, making awareness of UPI, subscriptions, EMIs, and credit scores more important than ever.

- Building simple, consistent financial habits early makes emergencies easier to handle and creates long-term stability.

- For genuine short-term gaps, quick and responsible support from platforms like Pocketly can help you manage unavoidable expenses smoothly.

What Money Really Means in Your Life

For most young adults, money can feel like pressure, but instead, it’s simply a tool.

It gives you choices: where you live, what you learn, and which opportunities you pursue. Seeing money through this lens shifts it from something that weighs you down to something that supports your goals.

It doesn’t define your worth, but it does impact how freely you can make decisions and build the life you want.

Growing up means moving from receiving money to managing it yourself. This transition can feel overwhelming, but it’s a defining moment; it marks the start of real independence and shapes how confidently you handle your finances going forward.

The Link Between Financial Readiness and Mental Well-Being

Knowing you’re financially prepared, even in a small way, instantly reduces stress. When you have a basic safety net, you don’t panic every time something unexpected happens.

This sense of readiness creates mental breathing room. It allows you to focus on studies, work, or personal goals without constantly worrying about “what if something comes up?”

Financial stability is all about feeling calm and in control of your life.

Short-Term vs. Long-Term Financial Stability

Short-term stability means being able to manage your month without stress, covering bills, handling small surprises, and maintaining a steady routine.

Long-term stability is the confidence that your future plans won’t collapse because of one setback.

Both matter.

Short-term readiness keeps you grounded today; long-term stability helps you move forward with clarity.

When both are in place, life feels far less chaotic and far more secure.

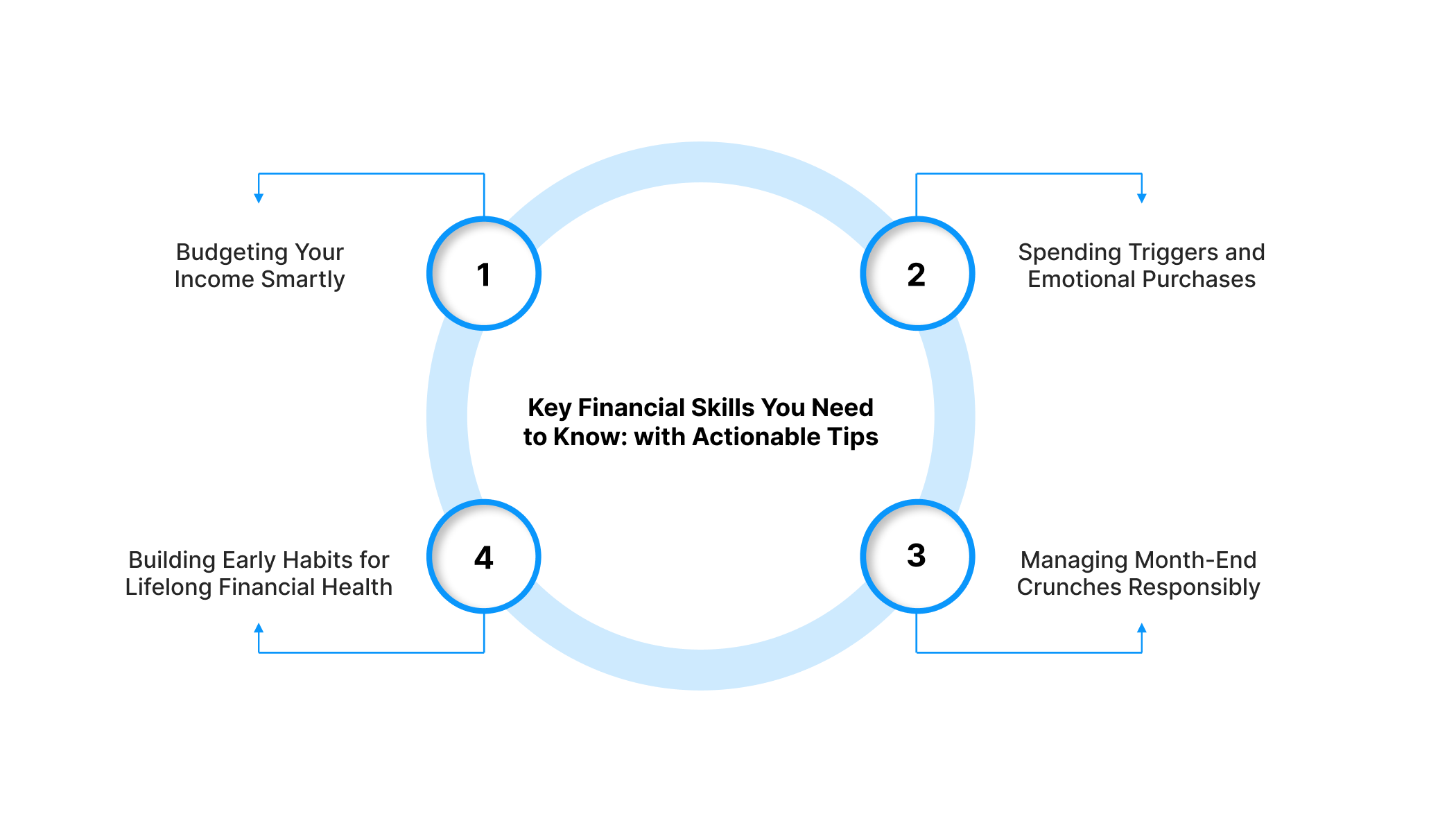

Key Financial Skills You Need to Know: with Actionable Tips

Budgeting Your Income Smartly

Budgeting, in simple terms, is knowing where your money goes. With UPI payments, subscriptions, and small daily spends, money slips away faster than you realise. A budget helps you stay aware, not controlled.

You don’t overspend because you’re careless.

You overspend because you don’t see it happening.

Actionable takeaway:

Use a simple rule: Before spending, check your balance once. After spending, note the amount mentally. This tiny habit fosters awareness without relying on apps or spreadsheets.

Understanding Spending Triggers and Emotional Purchases

Many of us spend out of boredom, stress, or social pressure, not genuine need. Offers, peer influence, and “fear of missing out” often push you to buy things on impulse.

For example: Ordering food after a long day, not because you’re hungry, but because it feels like a reward.

Actionable takeaway:

When you feel the urge to buy something instantly, pause for 60 seconds and ask, “Do I want this, or am I trying to feel better?”

This one-minute gap helps cut half your impulse purchases naturally.

Managing Month-End Crunches Responsibly

Month-end struggles happen because money isn’t spaced out; it’s front-loaded early in the month.

You’re comfortable for the first two weeks, then suddenly every payment feels heavy.

Actionable takeaway:

Divide your money mentally into three simple buckets:

- Essentials (the must-pays)

- Flex (food, outings, personal spends)

- Buffer (small amount for surprises)

You don’t need strict limits, just knowing your buckets prevents the last-week panic.

Building Early Habits That Shape Lifelong Financial Health

Small, consistent habits matter far more than big saving plans. When you build clarity early, managing money becomes second nature.

Note: Tracking your money for even one week shows you patterns you didn’t realise existed.

Actionable takeaway:

Choose any one micro-habit, noting daily spending, limiting impulse buys, or keeping a mini buffer, and stick to it. One small habit done consistently will improve your financial confidence more than a complicated system you never use.

The New Money Challenge: Staying in Control in a Digital India

Digital India has changed how money moves.

UPI makes payments so quick that you barely register how often you spend.

Subscriptions, streaming, fitness apps, and cloud storage quietly renew in the background and reduce your balance before you notice.

EMIs and Buy Now Pay Later options make purchases feel lighter upfront, but create commitments you must track every month.

At the same time, many people earn from side gigs or freelance work, which means income can fluctuate.

Managing money today means keeping track of how quickly digital payments move your money around.

Credit Score:

Your credit score may not feel important right now, but it becomes relevant earlier than most people expect.

A good score can help you when renting a flat, applying for a postpaid SIM, getting an education loan, or upgrading your lifestyle with financial products.

On the other hand, having no credit history limits your options.

Building a healthy credit profile early, through responsible repayments and small credit behaviour, makes future decisions smoother and more flexible.

Borrowing Smart: Knowing When It Makes Sense

Borrowing isn’t always a bad thing.

It can be useful when you face a genuine short-term gap like a medical expense, urgent travel, or a critical academic requirement.

But borrowing becomes harmful when it replaces your regular income or funds for impulse purchases.

The key is understanding why you’re borrowing.

If it solves a real need and you can repay on time, it supports your financial flow. If it adds pressure or becomes a habit, it works against you.

Awareness is what keeps borrowing responsible in a digital-first world.

When you understand the difference between helpful and harmful borrowing, it becomes easier to recognise the moments when short-term support is actually useful.

And for those specific situations, having access to a quick, transparent solution can make a meaningful difference.

The Solution: How Pocketly Steps In

Pocketly is designed for speed and simplicity.

The entire process is digital, starting with a quick KYC that requires no physical documents. Once your profile is approved, the funds are transferred directly to your bank account within minutes.

You don’t need to provide collateral, and the platform is built to keep the experience clear and straightforward.

Loan Amounts, Interest Rates, and Processing Fees

Pocketly offers small personal loans ranging from ₹1,000 to ₹25,000, suitable for short-term needs.

- Interest rate: starting at 2% per month

- Processing fee: 1–8%, depending on the loan amount and profile

These details are shown upfront so you always know what you’re signing up for, no hidden charges or complicated terms.

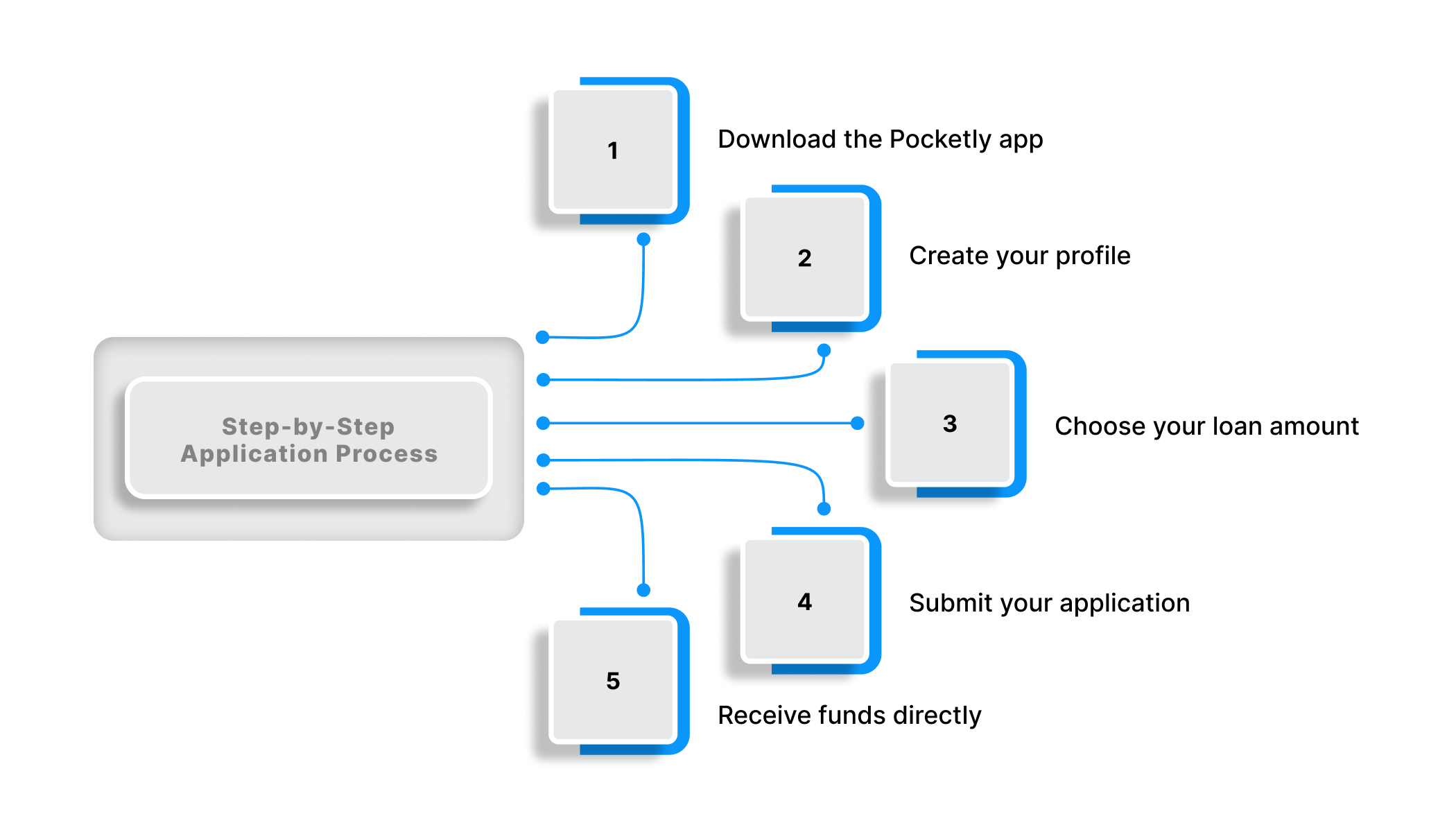

Step-by-Step Application Process

- Download the Pocketly app from the Play Store or App Store.

- Create your profile and complete the quick digital KYC.

- Choose your loan amount based on what you need.

- Submit your application and get instant approval.

- Receive funds directly in your bank account within minutes.

Pocketly Is a Digital Lending Platform, Not an NBFC

Please note: Pocketly does not lend money directly. It acts as a digital lending platform on behalf of partnered NBFCs, including:

- Fairassets Technologies India Private Limited

- NDX Financial Services Private Limited

- Speel Finance Company Private Limited

All loans are issued by these NBFCs, while Pocketly provides the technology and user experience.

So, if you ever face a genuine short-term gap, Pocketly is here to help.

Download the app to get started.

Conclusion

Managing money isn’t about doing everything perfectly; it’s about understanding how it fits into your life and using it in a way that supports your goals.

When you recognise how money influences your choices, the skills you build around it start to feel natural rather than forced. Little shifts in awareness, spending behaviour, and financial planning can make everyday life smoother and help you stay prepared for whatever comes next.

With the right mindset and practical habits, you can create a relationship with money that feels balanced, confident, and genuinely useful.

1. What are the most important roles money plays in life?

Money helps you meet everyday needs, manage unexpected expenses, and access opportunities like education and skill-building. It also gives you the freedom to make choices that support your lifestyle and goals.

2. Why should young adults learn about money early?

Learning about money early builds confidence and reduces stress as responsibilities grow. It helps you make better decisions around spending, saving, and planning your next steps in life.

3. What financial habits help improve stability?

Simple habits like tracking your spending, avoiding impulse purchases, and keeping a small buffer for surprises can make your finances more predictable. Consistency matters more than strict rules.

4. How can students or young earners handle emergencies?

Setting aside even a small emergency amount can help. If that isn’t possible, responsible short-term support can bridge the gap for genuine, unavoidable needs.

5. When is borrowing a practical option?

Borrowing makes sense when you face a real short-term gap and have a clear plan to repay on time. It becomes risky when used for non-essentials or when it replaces your regular income.