Your 30s are often the most decisive decade of your financial life. You are likely earning more than you did in your 20s, but responsibilities also expand quickly. Many people in this phase balance career growth with new obligations such as housing loans, marriage, children, or supporting parents.

This is the decade where your money habits begin to shape your long-term stability. Building a strong foundation now determines whether you will achieve financial independence later or continue living paycheck to paycheck.

Financial planning in your 30s is not only about saving more but also about structuring your finances strategically. The right mix of budgeting, investing, insurance, and debt management can help you create a clear roadmap for your 40s and beyond.

Financial experts often emphasise that your 30s and 40s are the years to “adjust, adapt, and align” your finances with retirement and family goals. This guide helps you do exactly that: build structure, discipline, and clarity in your personal finances.

Key Takeaways

- Start financial planning early in your 30s to benefit from compounding.

- Maintain an emergency fund covering 6–12 months of expenses.

- Use SIPs, PPF, and NPS for goal-based investing.

- Keep insurance and investments separate.

- Manage short-term gaps responsibly through transparent tools like Pocketly.

Assess Where You Stand Financially

Before making any financial move, you need to know your current position. Think of it as building your personal balance sheet. This step provides visibility into your income, spending, and assets, helping you identify gaps or risks.

1. Evaluate Your Income and Expenses

Start by calculating your total monthly inflow, including salary, bonuses, freelance work, or passive income. Then list your fixed and variable expenses.

- Fixed expenses: rent or EMIs, utilities, insurance premiums, and groceries.

- Variable expenses: dining, subscriptions, travel, and discretionary purchases.

Tracking your expenses for three consecutive months can reveal spending patterns. Apps or simple spreadsheets can help you visualize where your money goes.

Tip: If your expenses consistently exceed 70 percent of your income, review non-essential costs or explore secondary income sources.

2. Review Debts and Liabilities

Make a complete list of all your financial obligations. This includes credit card balances, personal loans, vehicle loans, or education loans.

Categorize them as:

- High-interest (above 12 percent): typically credit cards or personal loans.

- Low-interest (below 10 percent): home or education loans.

Your goal should be to reduce high-interest debt first, as it compounds faster than most investments can grow.

3. Review Assets and Investments

List your savings, mutual funds, fixed deposits, provident funds, and any property or equity holdings.

Assess whether your investments align with your financial goals and risk tolerance. If most of your savings are sitting idle in a bank account, it may be time to redirect them into higher-yield instruments.

4. Build or Strengthen Your Emergency Fund

Every sound financial plan begins with an emergency fund. Aim to have at least 6 to 12 months of essential living expenses saved in liquid instruments such as savings accounts, short-term debt mutual funds, or fixed deposits.

An emergency fund prevents you from taking high-cost loans during crises such as medical emergencies or job loss.

5. Assess Insurance Coverage

Insurance is your financial safety net. Verify if you have adequate coverage across:

- Health insurance (family floater plans with ₹10–20 lakh coverage for urban households).

- Term life insurance (10 to 15 times your annual income).

- Accident and disability coverage (often overlooked but essential).

Insurance protects your long-term goals by shielding your savings from unexpected shocks.

Also read: Understanding the Basics of Financial Planning and Its Importance.

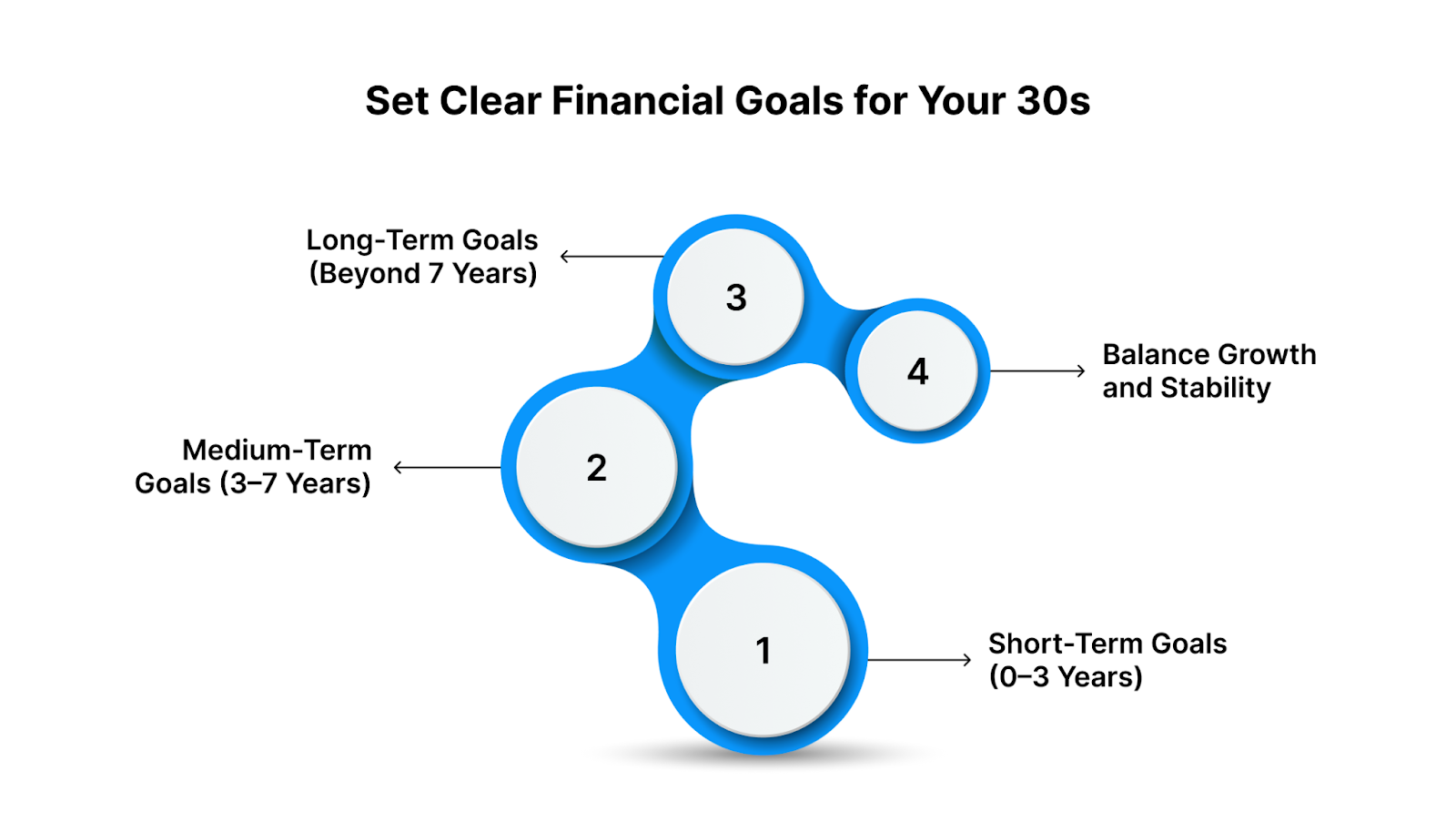

Set Clear Financial Goals for Your 30s

Once you have a complete picture of your finances, the next step is to decide what you are working toward. Goal-based planning gives direction to your saving and investing decisions.

1. Short-Term Goals (0–3 Years)

These are goals that require liquidity and safety.

Examples include building your emergency fund, repaying credit card debt, or saving for a vacation or down payment.

For such goals, avoid equities and stick to stable options such as recurring deposits, short-term mutual funds, or liquid funds. The focus here is accessibility, not high returns.

2. Medium-Term Goals (3–7 Years)

This phase may include buying a home, funding higher education, or starting a family.

At this stage, diversification becomes important. A balanced mix of equity and debt can help your money grow without excessive risk.

For example:

- 60 percent in equity mutual funds (preferably SIPs in diversified or index funds).

- 30 percent in fixed-income instruments such as PPF or debt funds.

- 10 percent in gold or other non-correlated assets.

Regular SIP contributions during your 30s can compound significantly over a decade. Even a ₹10,000 monthly SIP at 12 percent annual return can grow to ₹23 lakh in 10 years.

3. Long-Term Goals (Beyond 7 Years)

Your biggest long-term objective should be retirement planning. While it may feel distant, every year of delay in starting costs you exponential growth potential due to compounding.

If you invest ₹10,000 per month starting at 30, you could accumulate ₹3.5 crore by age 60 (assuming a 10 percent return). Start at 40, and you’ll have less than half of that.

Other long-term goals may include children’s education or building a second income stream. Align each with a dedicated investment vehicle and timeline.

4. Balance Growth and Stability

Financial planning in your 30s is about balancing growth with protection.

- Growth ensures wealth creation through equities, SIPs, and retirement funds.

- Stability ensures liquidity and safety through fixed income and insurance.

Together, they create a resilient structure that helps you progress toward financial independence without overexposure to risk.

Also read: 6 Simple Budgeting Tips for Better Money Management

Smart Investing Strategies for Your 30s

Your 30s are the perfect decade to start or strengthen your investment journey. You have time on your side, but you also need to balance ambition with risk awareness. The goal is to create a portfolio that compounds steadily while protecting you against market volatility.

1. Follow an Asset Allocation Strategy

A balanced portfolio ensures growth and stability. A widely used formula is the “100 minus age” rule, which allocates 100 minus your current age to equities and the rest to debt or fixed-income instruments.

For example, at 32, you could hold roughly 70 percent in equities and 30 percent in debt.

Typical allocation for someone in their 30s:

- 60–70 percent in equities (mutual funds, index funds, ETFs)

- 20–30 percent in debt (PPF, NPS, fixed deposits, short-term bonds)

- 5–10 percent in alternative or hybrid assets (gold ETFs, REITs, or liquid cash)

This mix balances long-term returns with risk absorption during short-term corrections.

2. Use SIPs and Automation to Build Consistency

Systematic Investment Plans (SIPs) are one of the most effective ways to build wealth in your 30s. Investing small, regular amounts creates discipline and smoothens out market fluctuations through rupee-cost averaging.

For example, a ₹15,000 monthly SIP in a diversified equity fund growing at 11 percent annually can build over ₹1 crore in 20 years. Automate your SIPs to ensure consistency and reduce emotional decision-making.

3. Diversify and Review Annually

Avoid over-reliance on a single asset or sector. Include both domestic and international exposure if possible. Review your portfolio at least once a year to rebalance your allocations and maintain your risk profile.

4. Leverage Tax-Saving Instruments

Use tax-efficient investments under Section 80C and 80CCD(1B) of the Income Tax Act. Popular options include:

- Equity-Linked Savings Schemes (ELSS)

- Public Provident Fund (PPF)

- National Pension System (NPS)

- Life insurance premiums (term plans only)

These instruments help you reduce taxable income while contributing to long-term savings.

Related: Understanding Cash Flow: Definition, Types, and Analysis

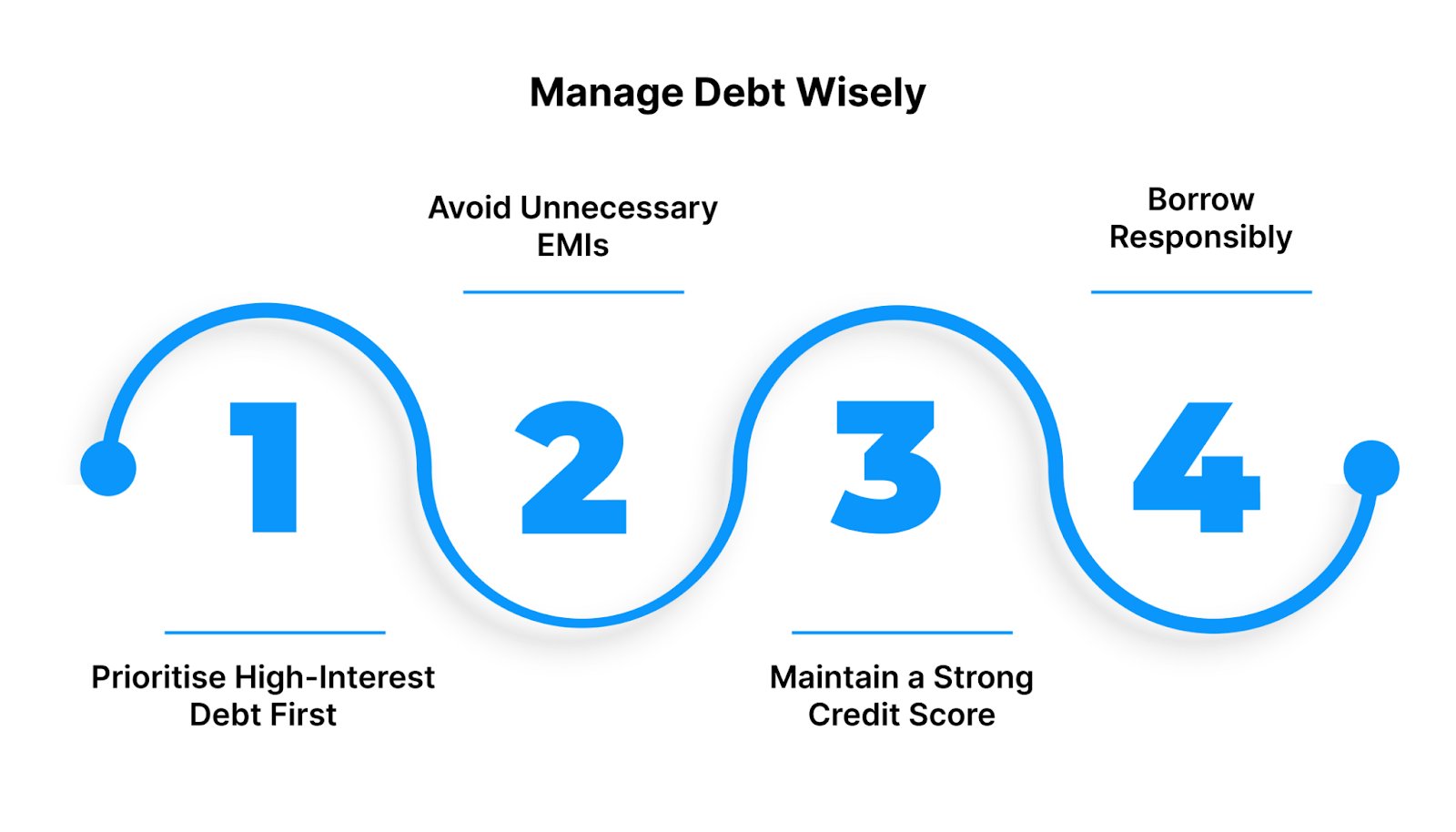

Manage Debt Wisely

In your 30s, debt can either be a strategic financial tool or a serious liability, depending on how you manage it. The objective is to use debt productively for building assets, not financing lifestyle inflation.

1. Prioritise High-Interest Debt First

Start by clearing credit card balances and unsecured personal loans. Even a 2–3 percent monthly interest rate on credit cards translates to over 30 percent annually, which can destroy wealth over time.

Use either of the following methods:

- Avalanche method: Pay off the highest-interest loan first while maintaining minimum payments on others.

- Snowball method: Clear the smallest debt first to build momentum, then move to larger ones.

Whichever method you choose, make sure you consistently pay above the minimum due amount.

2. Avoid Unnecessary EMIs

“Buy now, pay later” schemes and frequent EMIs on non-essential products can derail long-term planning. Only use EMI options for assets that appreciate in value or significantly improve productivity (such as education or home improvements).

3. Maintain a Strong Credit Score

Your credit score affects loan eligibility, interest rates, and approval speed.

To maintain a score above 750:

- Pay EMIs and credit card bills on time.

- Keep credit utilisation below 30 percent.

- Avoid too many loan applications within short intervals.

A high CIBIL score provides leverage when applying for larger loans later, such as home or education financing.

4. Borrow Responsibly

Debt is not inherently bad. A home loan or education loan can be considered “productive debt” if it builds long-term value.

However, keep your total EMI-to-income ratio below 40 percent to maintain financial flexibility.

Protect Yourself and Your Family

Financial protection is an inseparable part of financial planning in your 30s. While investments grow your wealth, insurance and contingency planning protect it.

1. Secure Comprehensive Health Insurance

Rising medical inflation in India makes health insurance indispensable.

Choose a family floater plan that covers at least ₹10–20 lakh, depending on your city and family size.

Look for features like cashless hospitalisation, pre- and post-hospitalisation coverage, and critical illness riders.

If your employer provides group health insurance, consider a top-up plan for better protection.

2. Get a Term Life Insurance Plan

A pure term life plan is the most cost-effective way to protect your family’s financial future.

The coverage should ideally be 10 to 15 times your annual income. For example, if you earn ₹12 lakh annually, a ₹1.5 crore term cover is a reasonable benchmark.

Avoid expensive endowment or ULIP plans; they combine investment and insurance poorly.

3. Add Disability and Accident Coverage

Many people overlook income protection through disability insurance. A temporary or permanent injury can disrupt your earning ability, and general health policies may not cover such losses.

A personal accident policy ensures income continuity during such setbacks.

4. Create a Will and Nominee Structure

Estate planning is not just for the elderly.

Add nominees for all financial accounts, mutual funds, and insurance policies. Consider creating a basic will to clarify asset distribution. This small step prevents disputes and ensures smooth transitions for your dependents.

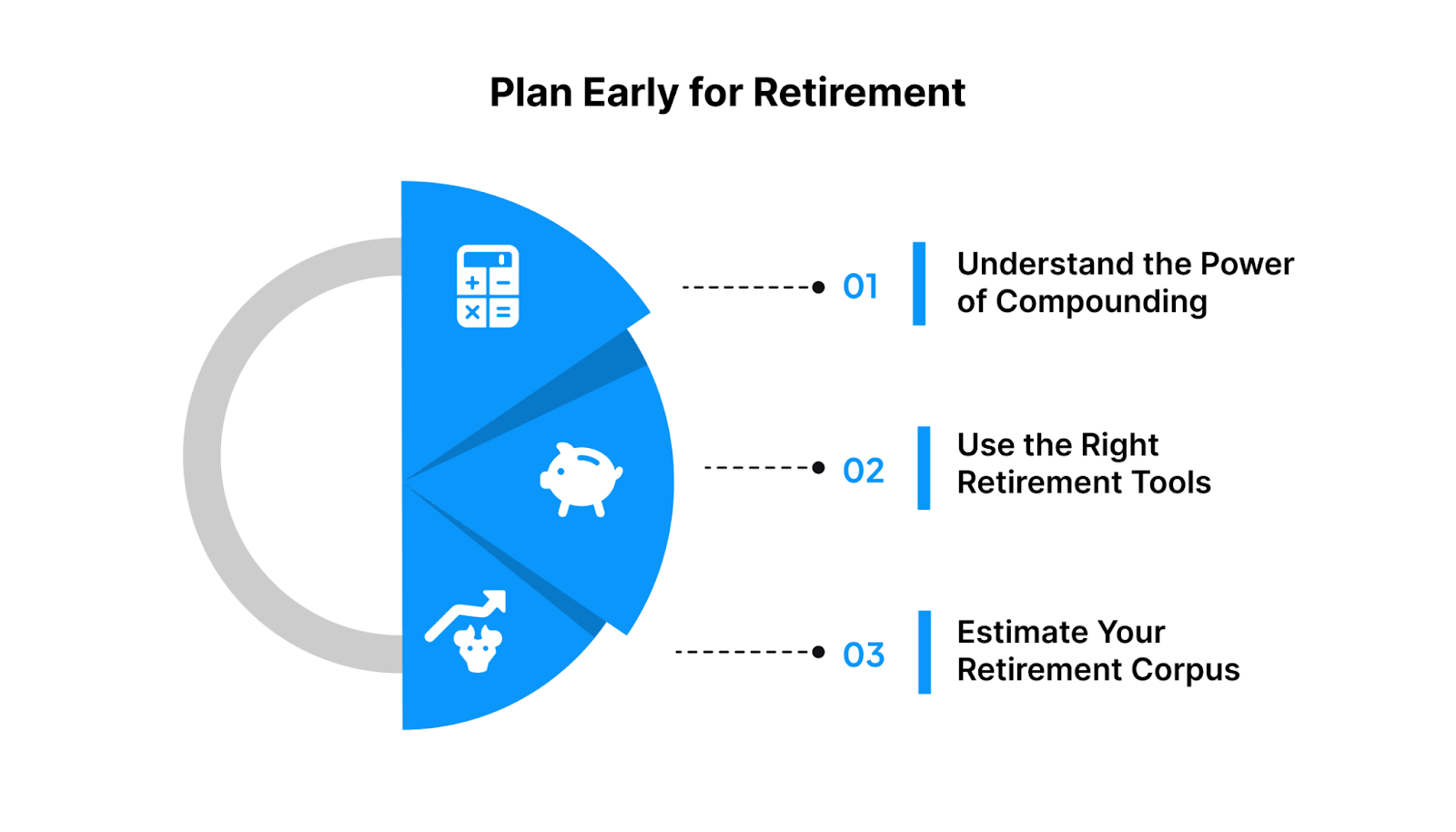

Plan Early for Retirement

Your 30s offer a crucial advantage: time. Every year that you delay retirement savings means you need to invest substantially more later to reach the same target.

1. Understand the Power of Compounding

Money grows exponentially over time when returns are reinvested. For example, investing ₹10,000 per month at a 10 percent return rate yields:

- ₹76 lakh in 20 years

- ₹2.3 crore in 30 years

Starting early maximises this compounding effect and reduces the pressure to save aggressively later.

2. Use the Right Retirement Tools

For Indian investors, the most effective retirement instruments include:

- National Pension System (NPS) is tax-efficient and flexible.

- Employee Provident Fund (EPF) is mandatory for salaried employees, ideal for stable growth.

- Mutual funds, particularly index or balanced advantage funds, are suitable for long-term equity exposure.

- Public Provident Fund (PPF) for risk-free, tax-saving returns.

Combining these ensures stability, tax benefits, and inflation-beating growth.

3. Estimate Your Retirement Corpus

Use a simple formula:

Future corpus = Annual expenses × 12 × (Expected retirement years) × Inflation factor

For example, if your current expenses are ₹60,000 per month and you plan to retire in 30 years, you may need ₹5–6 crore to maintain your lifestyle (assuming 6 percent inflation).

This figure can guide how much you should invest monthly to stay on track.

Related: Understanding the Meaning of Credit Score

Plan for Life Goals: Home, Children, and Education

Your 30s often mark the beginning of long-term commitments, such as purchasing a home, raising children, or saving for education. Each of these goals requires deliberate financial planning, not emotional decision-making.

1. Buying a Home

A home loan is typically the largest liability you’ll take on. Before committing:

- Ensure your EMI does not exceed 30–35 percent of your monthly income.

- Keep an emergency buffer of at least 6 months’ EMIs before signing the agreement.

- Compare interest rates across lenders, and review prepayment penalties.

- Avoid using all your savings for a down payment; maintain liquidity for contingencies.

If you already own property, consider channeling surplus funds into higher-return investments rather than repaying your home loan aggressively. Equity often outperforms loan interest rates over long horizons.

2. Planning for Children and Education

Children’s education costs in India are rising 8–10 percent annually. A postgraduate degree that costs ₹10 lakh today may cost over ₹40 lakh in 20 years.

Start early through goal-based SIPs in equity mutual funds or child-specific investment plans.

Example:

Investing ₹10,000 per month at 12 percent annual growth for 15 years can create a corpus of around ₹45 lakh.

If your child is already in school, consider increasing SIP contributions annually to stay aligned with inflation.

3. Family Protection and Health Goals

Alongside children’s future, factor in parental healthcare costs. A separate medical contingency fund prevents draining your long-term savings.

Also, reassess insurance coverage whenever your family size changes. Add maternity, dependent parents, or child riders where needed.

Also read: 6 Simple Budgeting Tips for Better Money Management

Pocketly Perspective: Managing Short-Term Gaps Responsibly

Even with strong financial planning, unexpected short-term gaps can occur, such as a delayed salary, a medical emergency, or a sudden relocation.

These situations shouldn’t force you to liquidate investments or take on unmanageable debt.

This is where Pocketly offers responsible, transparent short-term credit solutions. The platform provides instant, small-ticket digital loans between ₹1,000 and ₹25,000, designed to help users navigate immediate cash needs without hidden costs.

Why Pocketly stands apart:

- 100% transparent APR disclosure, no hidden processing fees.

- Simple, paperless KYC and quick disbursal to your bank account.

- Flexible repayment periods, with early closure options available anytime.

- Compliant with RBI’s Digital Lending Guidelines, ensuring responsible lending practices.

Pocketly’s mission is to promote financial stability, not impulsive borrowing. When used wisely, short-term credit can prevent missed payments, maintain your credit score, and safeguard long-term investments.

Related: Understanding Digital Payments: Meaning, Types, and Functions

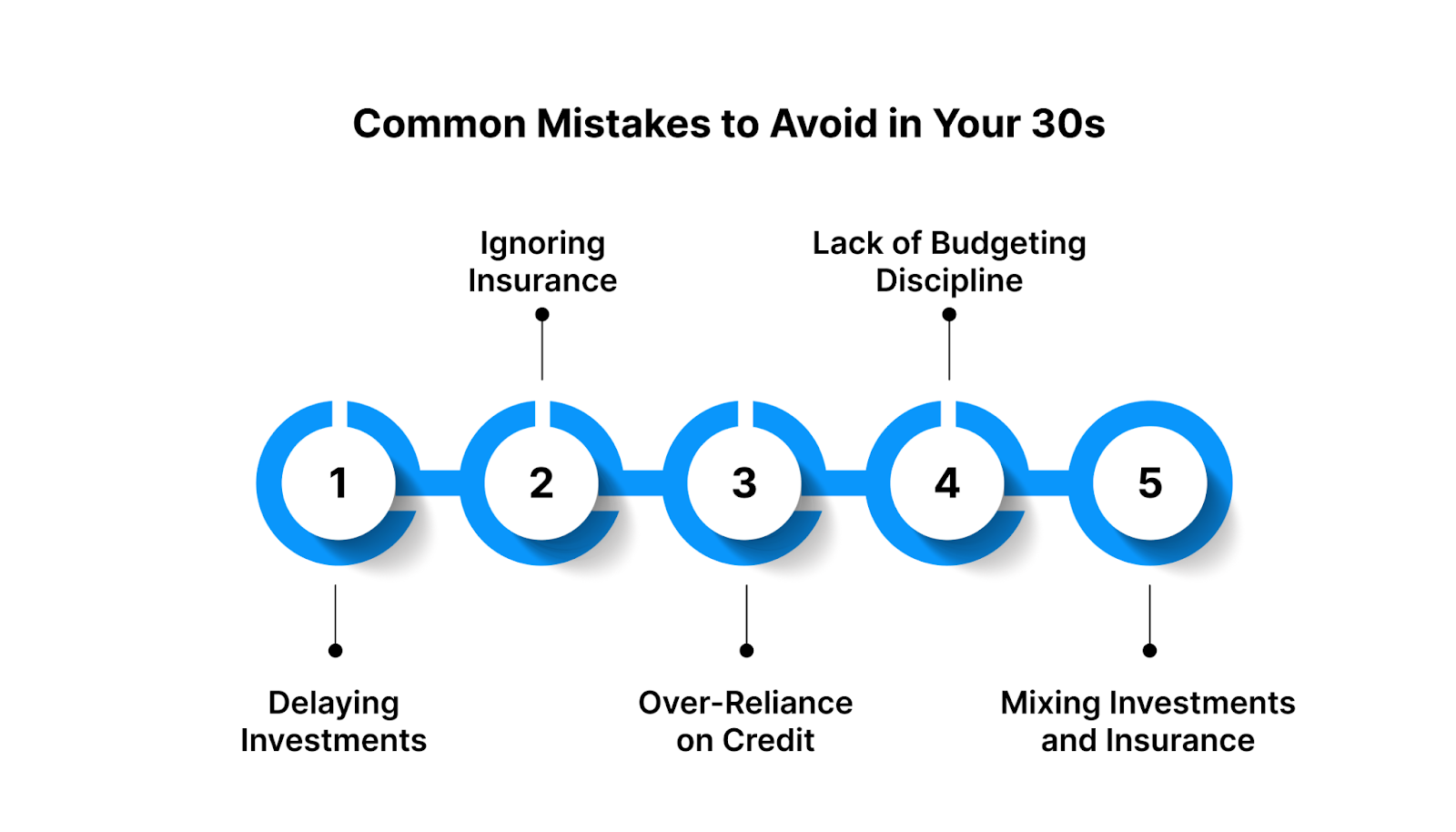

Common Mistakes to Avoid in Your 30s

Many individuals make costly financial mistakes in their 30s, often due to optimism or overconfidence. Recognising and avoiding them early can save years of correction later.

1. Delaying Investments

Waiting for a “perfect time” to invest costs you compounding years. Even small, consistent SIPs started early can create substantial long-term value.

2. Ignoring Insurance

Skipping health or term insurance is one of the most common errors. One medical emergency can wipe out years of savings.

3. Over-Reliance on Credit

Using credit for lifestyle spending or unnecessary EMIs creates repayment stress and impacts your credit score. Borrow only when it serves a purpose, such as asset building or skill enhancement.

4. Lack of Budgeting Discipline

Not tracking expenses leads to lifestyle inflation. Regularly review and adjust your spending patterns to align with evolving financial goals.

5. Mixing Investments and Insurance

Endowment or ULIP plans offer poor returns and inadequate protection. Keep investment and insurance separate for clarity and efficiency.

Conclusion

Your 30s are not about chasing the highest returns; they are about building financial structure, clarity, and control.

A sound plan balances four pillars: saving, investing, protection, and responsibility.

If you:

- Track your income and expenses carefully.

- Invest regularly and diversify wisely.

- Protect your family through insurance.

- Manage debt responsibly.

- Stay disciplined regardless of market cycles.

Then, by your 40s, you will have already built a foundation for financial independence.

Still, even the most disciplined financial plans can face short-term pressures — from medical emergencies to delayed salaries or sudden travel expenses. In such moments, having a reliable, transparent credit partner matters.

Pocketly provides instant access to short-term loans ranging from ₹1,000 to ₹25,000, helping you manage temporary gaps without disrupting your investments or long-term goals. With a 100% digital KYC process, transparent APR disclosure, and flexible repayment options, it ensures financial flexibility when you need it most — without hidden fees or complex paperwork.

Financial freedom isn’t about perfection. It’s about structure, consistency, and knowing where to turn when life brings the unexpected. Plan wisely, invest steadily, and when you need quick, transparent support — Pocketly is there to keep your financial journey on track.

Download the Pocketly app and experience how responsible credit can complement smart financial planning in your 30s and beyond.

FAQs About Financial Planning in Your 30s

1. How much should I save every month in my 30s?

Aim to save at least 25–30 percent of your monthly income. Allocate 10–15 percent for long-term investments and the rest for emergency and short-term goals.

2. What are the best investment options for someone in their 30s?

A diversified mix of equity mutual funds, PPF, NPS, and fixed deposits works best. Equities provide growth, while fixed-income instruments provide stability.

3. Should I prioritise repaying loans or investing?

Clear high-interest debt first (credit cards, personal loans). Once managed, direct surplus funds toward investments for long-term compounding.

4. How much life insurance should I have?

A minimum of 10 to 15 times your annual income ensures your family’s financial security in your absence.

5. Can I still build wealth if I’m starting late in my 30s?

Yes. Focus on increasing savings rate, investing systematically, and avoiding unnecessary debt. Consistency matters more than timing.