Do your projects ever look financially sound on paper but still struggle to stay funded at the right moments? Managing cash flow in project management often decides whether a project keeps moving or stalls mid-way. Many well-planned initiatives fail not because of poor execution, but because cash inflows and outflows aren’t aligned with milestones.

In fact, nearly 55% of project managers cite budget overruns as a primary cause of project failure.

This blog explains how cash flow analysis works in project management . We will also explore how to assess it step by step, the tools that make it easier, and the methods that help ensure every phase of your project stays financially on track.

Key Takeaways:

- Cash flow decides project survival — even profitable projects fail when money doesn’t arrive at the right time.

- Weekly cash tracking beats yearly budgeting — it reveals when to spend, when to pause, and where liquidity is tightening.

- Forecasting cash inflows and outflows turns uncertainty into control, helping teams plan confidently around real numbers, not assumptions.

- Smart tools and automation give project managers live visibility into spending, upcoming shortages, and funding opportunities.

- Cash flow analysis builds profitable discipline — it keeps every project grounded, predictable, and financially self-sustaining.

What Cash Flow Really Means in Project Management

In project management, cash flow is the movement of funds in and out of a project as it progresses. It shows when money is received and when it’s spent, giving a real-time view of liquidity. Many teams confuse profitability with financial stability. A project can be profitable yet still fail if cash doesn’t arrive when needed.

Project performance data supports this link between financial control and outcomes. 41% of underperforming organisations cite inadequate sponsor support as a key reason for project failure, compared to 17% among high performers. Weak sponsorship and delayed funding go hand in hand with poor cash visibility.

To understand how this concept shapes project outcomes, consider these three distinctions that define effective cash flow management:

1. Cash flow tracks liquidity, not profit

Profitability reflects financial success at completion, but cash flow measures the project’s ability to stay funded while running. A project with delayed receivables may look profitable, but it can’t sustain daily operations without liquidity.

2. Timing determines momentum

Smooth cash flow aligns payments and expenses with the project schedule. When inflows and outflows are mismatched, teams experience idle periods, delayed materials, or halted tasks.

3. Stability ensures completion

Cash stability builds predictability, allowing managers to plan ahead, maintain supplier trust, and avoid unnecessary borrowing. Projects with stable cash flow have a measurable edge in staying on budget and schedule.

Also Read: Importance of Cash Budget: Definition and Benefits

Once the fundamentals are clear, the next step is recognising what happens when cash flow isn’t actively monitored or managed.

Why Projects Fail When Cash Flow Is Ignored

Ignoring cash flow is one of the most common causes of project breakdowns. When the timing of money movements doesn’t align with project milestones, operations slow, suppliers withdraw, and progress stalls. Strong forecasts mean little if cash isn’t available when commitments are due.

1. Early Warning Signs of Cash Flow Stress

The first indicators are usually operational rather than financial. Vendors aren’t paid on time, procurement requests sit pending, and teams start borrowing informally to cover short-term gaps. These signals show liquidity slipping out of sync with the project schedule.

2. A Case Example: Forecasted Profit, Actual Shortfall

A mid-scale infrastructure project in South Asia appeared profitable based on revenue projections. Yet, delays in milestone payments created a funding gap that halted site work for three months.

Ongoing equipment rentals, labour payments, and penalty charges consumed over 20% of the project budget, eliminating projected profits.

3. Consequences of Poor Cash Forecasting

When cash flow forecasting fails, the impact is direct:

- Payment delays trigger supplier disengagement.

- Material costs rise due to interrupted schedules.

- Delivery times extend, leading to contractual penalties.

- Morale drops as teams face uncertainty in resource availability.

4. How Timely Tracking Prevents Project Disruptions

Regular monitoring of inflows and outflows enables quick intervention. Weekly tracking allows managers to adjust expense priorities, negotiate more favorable payment terms, and reallocate funds to critical activities.

This discipline ensures that funding aligns with execution, preventing cascading delays and protecting both schedule and profitability.

Also Read: Effective Debt Management Strategies and Tips

Knowing the risks is only useful if you can act on them, and that starts with a structured approach to cash flow analysis.

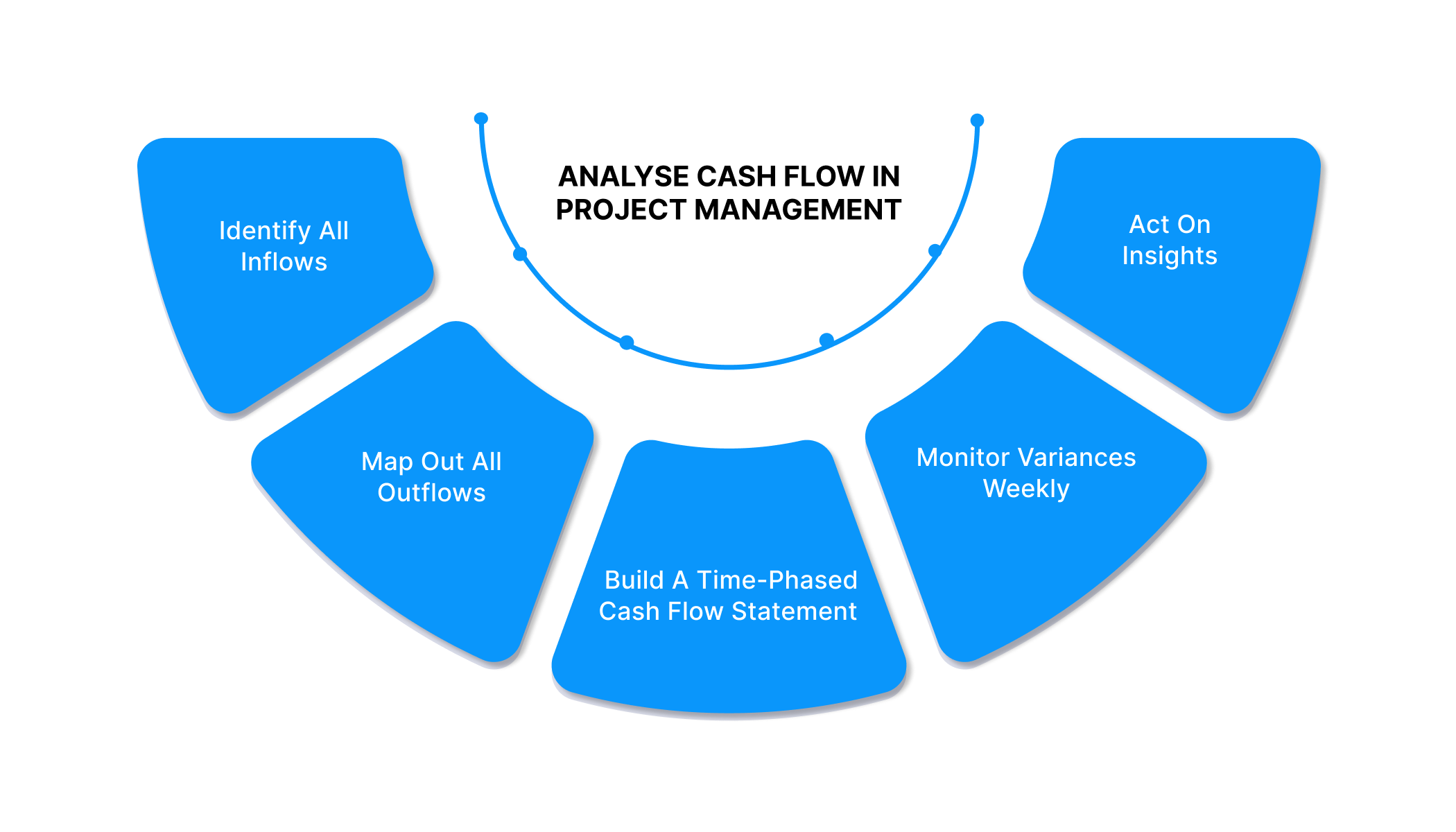

How to Analyse Cash Flow in Project Management (Step-by-Step)

Analysing cash flow in project management is critical across industries, from construction and IT to manufacturing and infrastructure, where delayed payments or poor timing can halt progress.

The process below outlines how to turn raw financial data into a clear, actionable cash flow plan.

Step 1: Identify All Inflows

- List every source of funds tied to the project — client advances, milestone payments, grants, loans, or internal funding.

- Record expected dates and amounts for each inflow.

- Ensure assumptions are based on actual payment histories or realistic forecasts rather than optimistic estimates.

Step 2: Map Out All Outflows

- Catalogue every outgoing expense tied to the project: labour costs, material purchases, subcontractor bills, overheads, equipment rentals, and contingency allowances.

- Track both fixed and variable costs separately — this helps anticipate costs that fluctuate with workload or procurement delays.

Step 3: Build a Time-Phased Cash Flow Statement

- Create a table (e.g. monthly or weekly) that lines up expected inflows and outflows against project timelines. Resource schedule, deliverables, and payment milestones should drive the timing.

- Start with the opening cash balance. Then for each period: Beginning Balance + Inflows − Outflows = Ending Balance. That gives visibility into liquidity at every stage.

Step 4: Monitor Variances Weekly (Forecast vs Actual)

- Every week (or at least every month), compare actual cash inflows and outflows to the forecasted numbers. This variance analysis reveals discrepancies early.

- Track deviations by category, e.g., supplier costs, labour, client payments, to identify recurring gaps or delays

Step 5: Act on Insights — Adjust Schedules, Budgets, Funding Needs

- When inflows lag or outflows spike, revise payment schedules, delay non-critical procurements, or secure bridge funding before problems escalate.

- Use updated cash flow forecasts to negotiate payment terms with clients or suppliers, or adjust milestone expectations.

- Maintain a rolling forecast, constantly update assumptions, and reproject cash flow based on actuals.

Sample Project Cash Flow Template

| Period | Opening Balance (₹) | Inflows (₹) | Outflows (₹) | Net Cash Flow (₹) | Closing Balance (₹) | Notes / Actions |

| Week 1 | 5,00,000 | 1,50,000 (Client advance) | 2,00,000 (Material purchase) | –50,000 | 4,50,000 | Delay next procurement to Week 2 |

| Week 2 | 4,50,000 | 3,00,000 (Milestone payment) | 2,20,000 (Labour + site costs) | +80,000 | 5,30,000 | Allocate ₹50,000 to supplier retention |

| Week 3 | 5,30,000 | 0 | 1,80,000 (Subcontractor payment) | –1,80,000 | 3,50,000 | Review inflow timing with client |

| Week 4 | 3,50,000 | 2,00,000 (Internal transfer) | 1,50,000 (Overheads) | +50,000 | 4,00,000 | Maintain buffer for next milestone |

| Total | — | 6,50,000 | 7,50,000 | –1,00,000 | — | Adjust milestone billing to close gap |

Also Read: Short-Term Business Loans: Understanding Tenure, Interest Rates, and Benefits

After building the process, the focus shifts to the tools and methods that improve tracking and forecasting accuracy and efficiency.

Tools and Techniques That Simplify Cash Flow Tracking

When you need clear visibility of cash flow in project management, the right tools and methods make tracking and forecasting far easier, saving time and reducing risk. Below is a practical breakdown of what to use and how it adds value.

1. Use purpose-built cash-flow & forecasting tools over spreadsheets

- Dedicated software, such as the top cash-flow forecasting tools reviewed in 2025, provides real-time integration with accounting, invoicing, accounts payable/receivable, and ERP systems.

- These tools automate data imports (billing, expenses, supplier payments), reducing human error and ensuring forecasts always reflect live financial status.

2. Use automation for early warning of cash shortages

- Modern cash-forecasting platforms use algorithms to project upcoming cash positions by analysing past and current flows. This helps alert teams to potential shortfalls before they occur.

- Automation frees up finance and project staff from manual reconciliation — letting them focus on planning and corrective action rather than spreadsheet maintenance.

3. Integrate cash-flow tools with project scheduling and ERP modules

- Systems like treasury management tools or ERP-linked forecasting modules can combine cash flow data, purchase orders, payables, and project schedules to reflect how liquidity ties to project milestones and deliverables.

- This integration supports timely decisions: for example, aligning supplier payments with completion of project phases or procurement cycles, preventing delays due to liquidity gaps.

4. Track key financial metrics for deeper insight

- Metrics such as Net Cash Position, Cash Conversion Cycle, and Cost-to-Completion Ratio provide clarity on liquidity health, cash efficiency, and financial risks associated with project delivery. These metrics help anticipate funding needs and resource constraints.

How Smart Teams Use Cash Flow Insights to Stay Profitable

For effective project teams, cash flow is more than a record of income and expenses. It is a source of insight that guides every operational and financial choice.

When used well, it shows where funds are tied up, which activities drive the most value, and how future projects can stay profitable without disruptions.

1. Link cash flow data to project phasing and resource planning

Teams base resource allocation, procurement, and vendor payments on actual cash availability rather than estimates, ensuring each phase only starts when funding is secured. This avoids overcommitment and helps deliver projects on schedule while controlling costs.

2. Anticipate and mitigate financial risk before issues arise

By running regular cash-flow forecasts and variance analyses, teams can spot potential funding gaps early, renegotiate payment terms with clients or suppliers, or rearrange spend priorities — avoiding costly emergencies or unplanned borrowing.

3. Improve communication and alignment between finance and project managers

Shared dashboards and real-time liquidity reports provide a common ground for finance and project leads. Everyone sees the same data — enabling better planning, transparent decision-making, and collective accountability for financial health and project progress.

4. Use real data to negotiate better vendor and client terms

With clear visibility of cash cycles and payment schedules, teams can negotiate milestone-based payments, flexible supplier terms, or staggered procurement. This reduces working capital strain while maintaining supplier trust and project flow.

5. Combine cash-flow discipline with operational agility

Firms that combine proactive cash-flow tracking, timely forecasting and responsive planning handle unexpected expenses, delays or scope changes better, keeping profitability and delivery timelines intact even under volatility.

Pocketly: Keeping Your Cash Flow Steady When It Matters Most

Managing cash flow isn’t only a business challenge, it’s also a daily reality for young professionals, freelancers, and entrepreneurs balancing income cycles, client payments, and unexpected expenses.

Pocketly is a digital lending platform that offers instant, collateral-free personal loans ranging from ₹1,000 to ₹25,000. Pocketly provides a quick, transparent way to stay financially stable when short-term funding gaps appear.

How It Works:

- Sign up using your mobile number.

- Upload PAN and Aadhaar for instant KYC verification.

- Add your bank details for secure transfers.

- Select the desired loan amount and repayment tenure.

- Receive the amount directly in your bank account within minutes.

Download Pocketly on iOS or Android and keep a dependable option ready for unexpected needs, and get instant access to funds when you need them most.

Conclusion

With the rise of startups and project-based ventures, managing cash flow has become as important as managing timelines. Fast-moving teams can no longer rely on delayed funding cycles or vague forecasts; every rupee needs to be timed as carefully as every deliverable. Projects that maintain steady liquidity adapt faster, pay on time, and scale with confidence.

Pocketly helps bridge short-term funding gaps with quick, collateral-free loans, giving you the flexibility to stay focused on growth instead of cash constraints.

Stay financially ready for every opportunity — manage your cash flow smartly with Pocketly today.

FAQs

Q: How does poor cash flow management affect project timelines?

A: When payments to vendors or staff are delayed, procurement and progress slow down. Cash shortages ripple through every stage, causing schedule slips and higher recovery costs.

Q: What’s the most common mistake teams make in cash flow analysis?

A: Teams often focus on total costs instead of timing. Projects run into trouble when inflows are assumed to match outflows without verifying payment schedules.

Q: How can digital tools improve cash flow forecasting accuracy?

A: Automated platforms sync data from invoices, payroll, and project schedules to produce live forecasts, cutting manual errors and improving financial visibility.

Q: How should project managers communicate cash flow risks to sponsors?

A: Use variance reports and short summaries showing where actual spending diverges from the forecast. Sponsors value clarity and early alerts over dense reports.

Q: Can consistent cash flow tracking improve vendor relationships?

A: Yes. When vendors are paid predictably, they prioritise your projects, offer better terms, and collaborate more effectively — strengthening long-term delivery outcomes.