Introduction

Debt can quickly become overwhelming when it keeps adding up. Late payments, high interest, and the pressure of managing multiple loans often create stress in both finances and daily life. This is where debt management plays an important role.

Debt management is about more than just repaying what you owe. It is a smart way of planning and handling debt so that it feels manageable. With the right approach, you can reduce financial pressure, protect your credit score, and move step by step toward becoming debt-free.

In this blog, we will explain what debt management means, why it is important, how it works, and the strategies you can use. We will also look at professional debt management solutions, the advantages and disadvantages of debt management plans, and useful tips to stay debt-free once you are out of debt.

At a Glance

- Debt management means organised plan to repay loans and reduce stress.

- Helps save on interest/fees and protects your credit score.

- Common issues include high-interest credit cards, multiple EMIs, low income, emergencies.

- Key strategies include budget wisely, avalanche/snowball repayment, consolidate loans, cut expenses, avoid new debt.

- Pocketly provides small, flexible, transparent short-term loans to manage emergencies safely.

What is Debt Management?

Debt management is the process of organising and handling your debts in a way that makes them easier to pay off. It means creating a plan to deal with the money you owe, keeping track of payments, and finding ways to reduce financial stress.

It usually covers common types of debt such as credit cards, personal loans, student loans, and medical bills. Instead of letting multiple loans and high-interest loans pile up, debt management helps you take control with a structured repayment plan.

A good debt management plan focuses on:

- Paying off debts in order of priority.

- Negotiating with lenders to reduce interest rates or extend repayment timelines.

- Combining multiple debts into a single manageable payment when possible.

- Building habits that prevent new debt from adding up.

Understanding the basics is only the first step. Let’s look at why debt management is such an important part of financial health.

Must Read: How Secured Credit Cards Build Credit Score

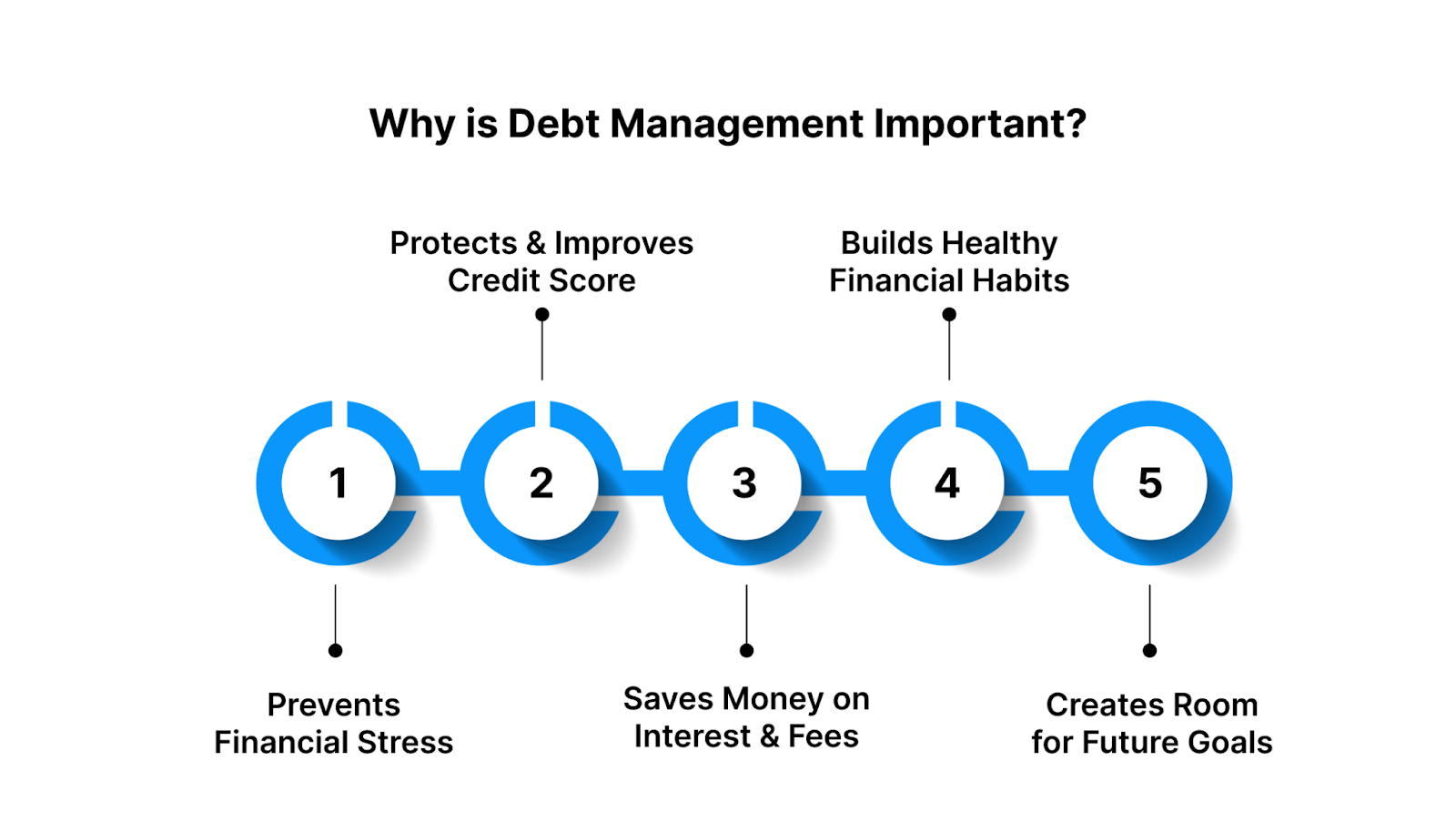

Why is Debt Management Important?

Debt management is important because it protects both your finances and your peace of mind. Without a clear plan, debt can grow quickly and become difficult to control. Managing it properly helps you stay on top of payments and avoid unnecessary stress.

Here are some key reasons why debt management matters:

1. Prevents Financial Stress

Unpaid debts can feel overwhelming and cause constant worry. Having a structured plan reduces that pressure by giving you a clear path to repayment.

2. Protects and Improves Credit Score

Making payments on time is one of the biggest factors in building a good credit history. A good credit score makes it easier to borrow in the future and may help you get lower interest rates.

3. Saves Money on Interest and Fees

Poor debt management leads to accumulating late fees and high interest charges. Debt management helps you avoid these extra costs, so more of your money goes toward clearing the actual debt.

4. Builds Healthy Financial Habits

Through budgeting, prioritising debts, and avoiding unnecessary borrowing, you start developing money habits that will keep you financially stable in the long run.

5. Creates Room for Future Goals

When debt is under control, you can focus on saving for other goals such as buying a home, investing, or building an emergency fund.

With the importance clear, the next step is to understand how debt management actually works in practice.

Must Read: Money Management Tips for College Students 2025

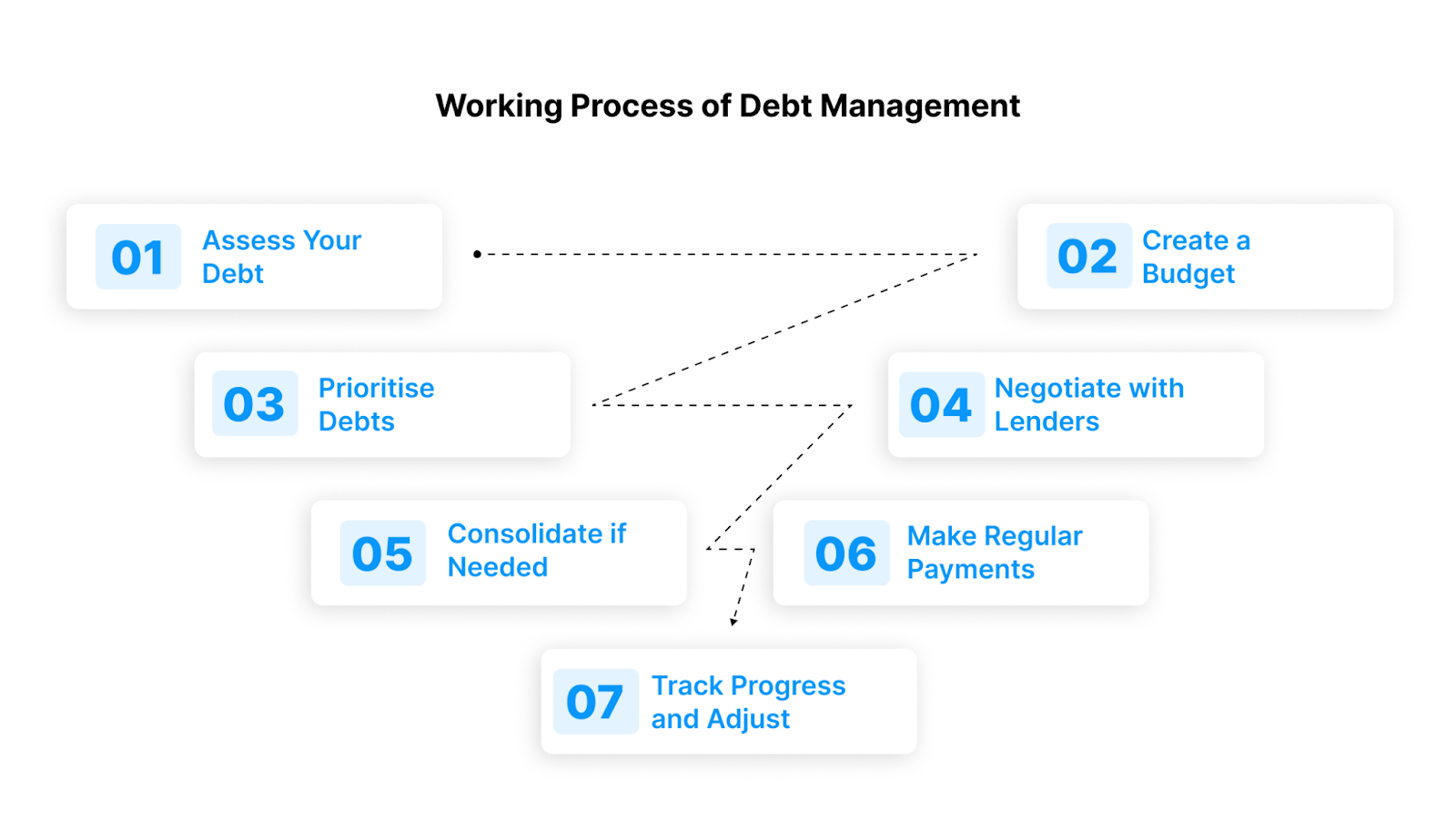

Working Process of Debt Management

Debt management works by creating a structured plan that helps you pay off what you owe in a way that feels manageable. It is not a quick fix but a step-by-step process that makes repayment easier and reduces stress.

Here’s how it usually works:

1. Assess Your Debt

The first step is to list all your debts. This includes credit cards, personal loans, student loans, or any other money you owe. Knowing exactly how much you owe and to whom gives you a clear starting point.

2. Create a Budget

Next, compare your monthly income with your expenses. A realistic budget helps you see how much money you can set aside for debt payments without ignoring essentials like rent, food, or bills.

3. Prioritise Debts

Not all debts are equal. Some carry higher interest rates, like credit cards, while others may be smaller but easier to clear quickly. You can use methods like the debt avalanche (focus on high-interest debts first) or debt snowball (clear the smallest debts first), depending on what motivates you most.

4. Negotiate with Lenders

In some cases, you can talk to your bank or creditors to reduce interest rates, extend repayment timelines, or waive penalties. Lenders often prefer a clear repayment plan over missed payments.

5. Consolidate if Needed

Some people choose to combine multiple debts into one single loan with a lower interest rate. This makes repayment simpler since you only have one EMI to track each month.

6. Make Regular Payments

Once the plan is in place, the key is consistency. Making payments on time builds trust with lenders and improves your credit score over time.

7. Track Progress and Adjust

Debt management is not static. As your income or expenses change, you may need to adjust your budget, increase payments, or set new priorities.

While the process provides a clear structure, many people still face common challenges when dealing with debt. Let’s look at them closely.

Must Read: How to Transfer Loan Balance from One Person to Another

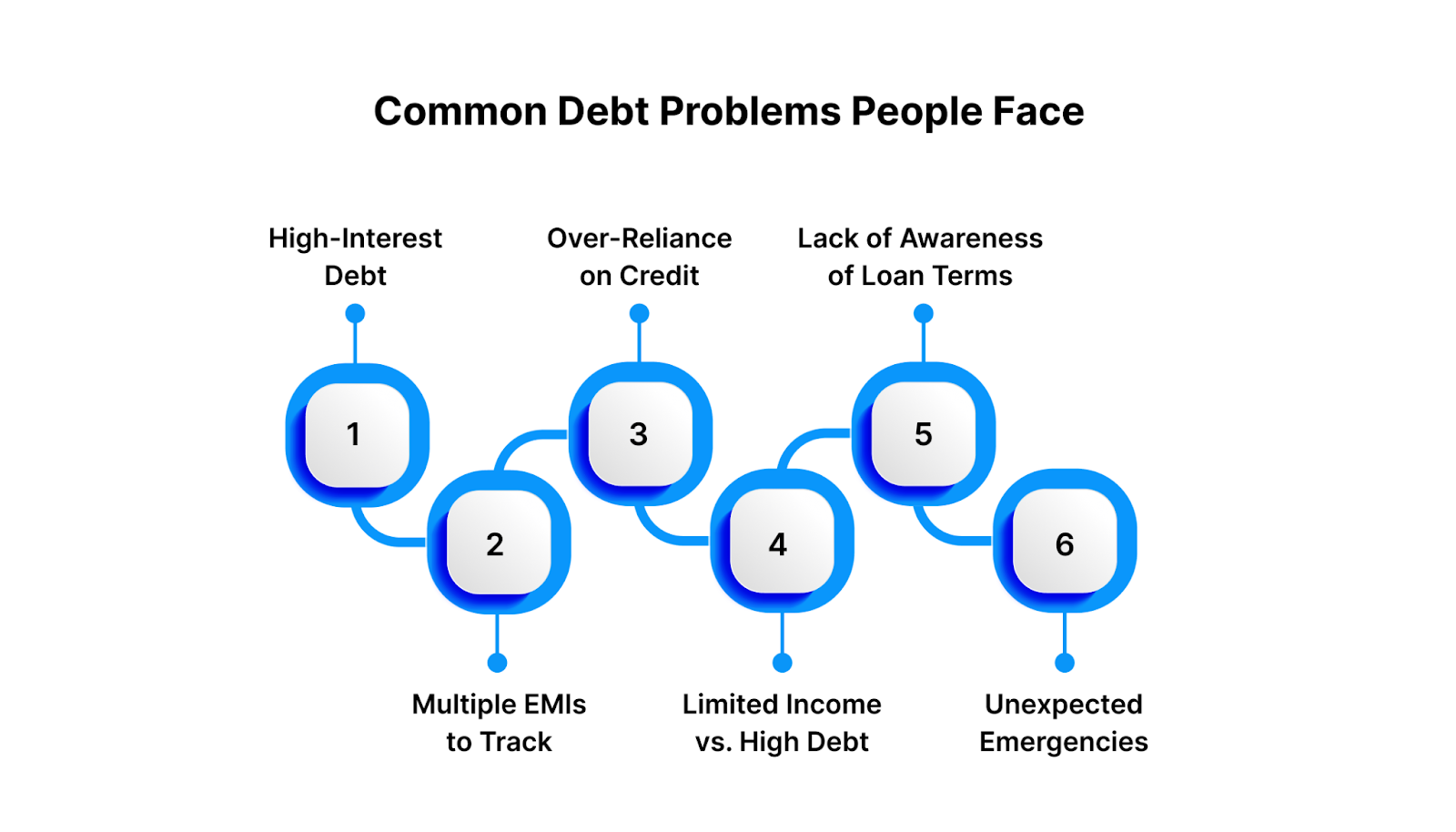

Common Debt Problems People Face

Many people struggle with debt because it can build up silently and feel challenging to control.

Here are some of the most common problems borrowers experience:

1. High-Interest Debt

Credit card debt is a major issue because of its high interest rates. Even small unpaid balances can grow quickly and become difficult to manage.

2. Multiple EMIs to Track

Having several loans or credit cards often means juggling different EMI dates. Missing just one payment can lead to penalties and affect your credit score.

3. Over-Reliance on Credit

When people depend too much on borrowing to cover daily expenses, the debt keeps growing. This creates a cycle where repayment becomes harder each month.

4. Limited Income vs. High Debt

If monthly income is not enough to cover loan repayments along with basic living costs, the financial pressure can feel overwhelming.

5. Lack of Awareness of Loan Terms

Many borrowers don’t fully understand interest rates, penalties, or repayment timelines when they take loans. This lack of awareness often leads to surprises and financial stress later.

6. Unexpected Emergencies

Medical bills, job loss, or urgent family needs can add new debt when there is already existing debt to manage. Without an emergency fund, this can quickly spiral out of control.

Understanding the issues is just half the fight. Now it’s time to see what strategies can help you overcome them and move toward financial stability.

Effective Debt Management Strategies

Managing debt takes discipline, planning, and consistent effort. The following strategies can help you take control of your debt and move closer to financial stability:

1. Create a Realistic Budget

The first step to managing debt is knowing where your money goes. Track all your income and expenses, then separate needs from wants. A practical budget allows you to set aside a fixed amount for debt repayment each month without sacrificing essentials like rent, food, or utilities. Even small savings from cutting back on non-essential spending can make a big difference in the long run.

2. Prioritise Your Debts

Not all debts carry the same weight. Some have higher interest rates, while others may be smaller but easier to clear quickly.

You can choose:

- Avalanche Method: Focus on paying off the highest-interest debt first to save money on interest charges.

- Snowball Method: Pay off the smallest debts first to build motivation and gain quick wins. Pick the method that works best for you, but always ensure you’re making at least the minimum payments on all debts.

3. Consolidate Debts When Possible

If you are struggling with multiple EMIs, debt consolidation can help. By combining several loans into one with a lower interest rate, you simplify repayment and reduce the overall burden. This means fewer due dates to track and smaller monthly payments, making it easier to stay consistent.

4. Negotiate with Creditors

Many people do not realise that banks and lenders are often open to negotiation. You can request lower interest rates, ask for an extension on repayment timelines, or seek a waiver on penalties. This reduces pressure and shows lenders that you are committed to paying back your debt.

5. Build an Emergency Fund

Unexpected events like medical expenses or job loss often push people deeper into debt. Setting aside even a small portion of your income each month can create a safety net. Over time, this emergency fund will reduce your dependence on borrowing whenever sudden expenses arise.

6. Cut Back on Unnecessary Expenses

Impulse purchases, frequent dining out, and excessive use of credit cards can add to financial stress. By identifying and cutting down on non-essential expenses, you can redirect more money toward debt repayment. Simple lifestyle changes can speed up your journey to becoming debt-free.

7. Avoid Taking on New Debt

While you are focused on clearing existing loans, resist the urge to borrow more. Adding new loans or increasing credit card usage only deepens the problem. Commit to living within your means until your existing debts are under control.

8. Use Extra Income Wisely

You should use any extra money you get, like from bonuses, tax refunds, or side jobs, to pay down your debt. Making additional payments helps cut down the total interest and shortens the repayment period, bringing you closer to financial freedom faster.

Even with the best strategies, some situations call for professional support. This is where experienced debt management solutions come in.

Must Read: What is Debt Trap and How to Avoid It?

Professional Debt Management Solutions

Sometimes, even after careful budgeting and planning, debt can feel overwhelming. In such cases, professional debt management solutions can provide structured support to help you regain control. These services are usually offered by credit counselling agencies, financial advisors, or debt management companies.

Here are the most common solutions:

1. Credit Counselling

Credit counselling is often the first step toward professional help. A counsellor will review your income, expenses, and debts, then guide you on creating a repayment plan. They may also teach you better money management skills and suggest ways to avoid future debt. The advice is usually affordable or even free, depending on the provider.

2. Debt Management Plan (DMP)

A Debt Management Plan is a formal agreement between you, a credit counselling agency, and your creditors. Instead of making multiple payments to different lenders, you make a single monthly payment to the agency. The agency then distributes it to your creditors. Many lenders agree to lower interest rates, waive penalties, or extend repayment timelines under a DMP, making it easier to repay over time.

3. Debt Consolidation Services

Professional agencies sometimes help consolidate multiple debts into one larger loan with a lower interest rate. This reduces the complexity of tracking multiple payments and can ease the financial burden. While this option can be helpful, it requires discipline to ensure you don’t fall into new debt.

4. Negotiation and Settlement

In some situations, debt settlement agencies may negotiate with your creditors to reduce the overall amount you owe. While this can offer relief, it could negatively affect your credit score, so it should only be utilised as a final option.

5. Legal Assistance

If debt spirals out of control and creditors take legal action, professional financial or legal advisors can help you navigate the situation. They can explain your rights, represent you, and work toward the most manageable solution.

One of the most common professional solutions is a Debt Management Plan (DMP). Let’s examine its advantages first.

Pros of Debt Management Plan

A Debt Management Plan (DMP) can be a practical way to handle overwhelming debt. It offers several advantages that make repayment easier and less stressful:

1. Simplified Payments

Instead of juggling multiple EMIs and due dates, you only make one consolidated payment each month to the agency. This reduces confusion and ensures you don’t miss payments.

2. Lower Interest Rates

Many creditors agree to reduce interest rates when you enrol in a DMP. Paying less interest means more of your money goes toward reducing the actual debt, helping you become debt-free faster.

3. Waived Fees and Penalties

Agencies often negotiate with lenders to remove late fees, penalties, or extra charges. This can significantly lower your overall debt burden.

4. Structured Repayment Plan

A DMP provides a clear, step-by-step plan for paying off debt within a set time frame. Having this structure helps you stay disciplined and committed to repayment.

5. Reduced Stress

When you know professionals are handling negotiations and payments, the stress of constant creditor calls and reminders reduces. This gives you peace of mind while focusing on repayment.

6. Improved Financial Habits

Most agencies also offer counselling and money management advice alongside the DMP. This helps you build better financial habits, so you don’t fall back into debt in the future.

While DMPs have many benefits, they also come with certain drawbacks. It’s important to be aware of these before making a decision.

Cons of Debt Management Plan

While a Debt Management Plan (DMP) can make repayment easier, it also has some drawbacks that you should carefully consider before enrolling:

1. Impact on Credit Score

Enrolling in a DMP may temporarily lower your credit score because it signals to lenders that you are struggling with debt. However, consistent on-time payments over time can improve it again.

2. Limited Access to Credit

Most DMPs require you to stop using your credit cards or taking new loans while enrolled. This limits your borrowing options in case of emergencies.

3. Commitment to a Long-Term Plan

A DMP typically lasts 3 to 5 years. While this structured approach is useful, it requires discipline and consistent payments. Missing payments can cause the plan to fail.

4. Possible Service Fees

Some credit counselling agencies charge monthly fees to manage the plan. While these fees are usually small, they still add to your repayment costs.

5. Not All Creditors May Agree

Although many lenders cooperate with DMPs, some may refuse to lower interest rates or waive penalties. This means you could still face higher costs on certain debts.

6. No Immediate Debt Forgiveness

A DMP, unlike bankruptcy or settlement, does not get rid of or lower your debt; it just changes the way it is structured to make it easier to pay back. You still need to repay the full amount owed.

If you complete a DMP or manage to clear your debts, the next challenge is staying debt-free. Let’s see how you can achieve that.

Must Read: Dealing with Delayed Salary: Reasons and Solutions

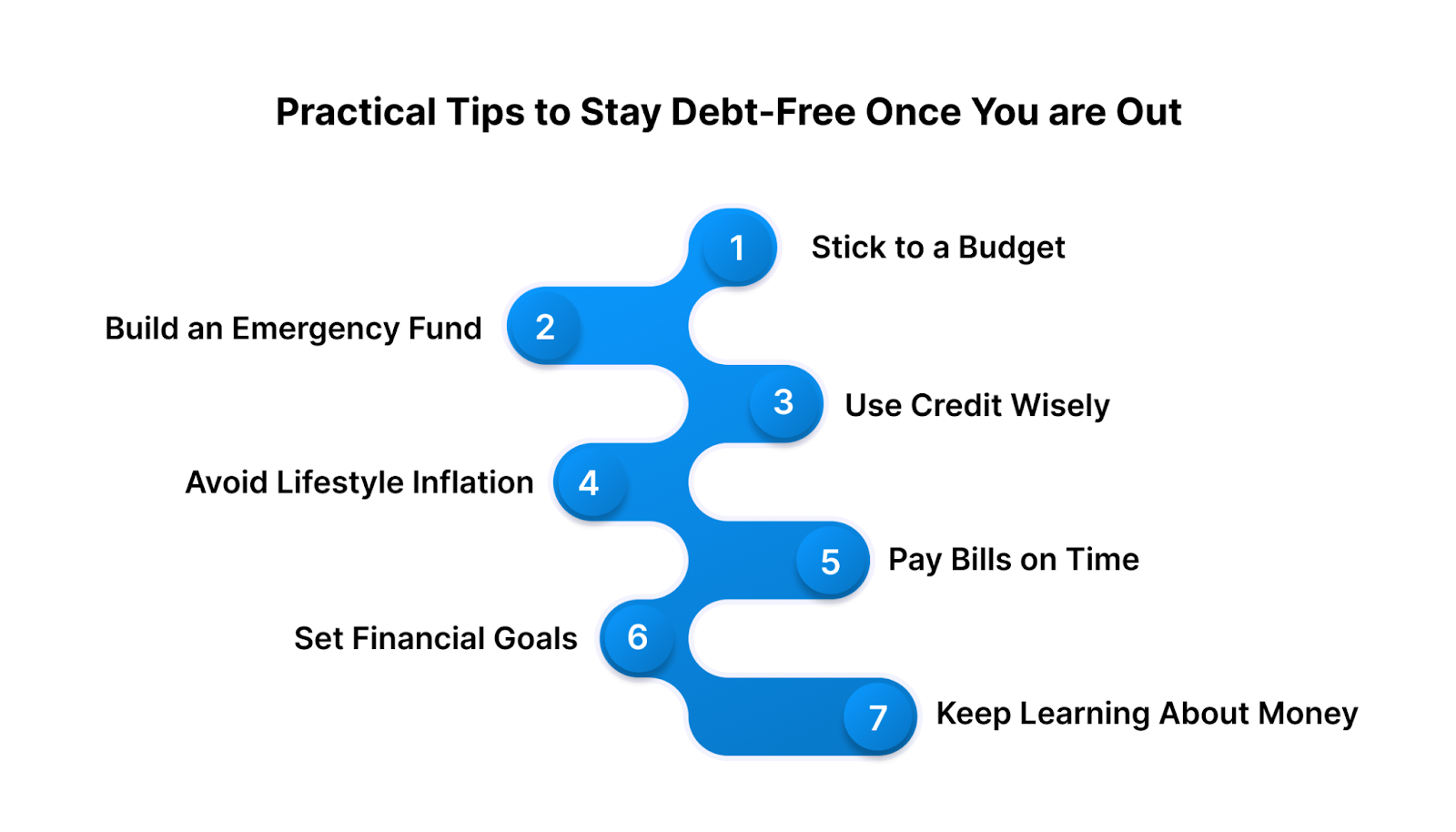

Practical Tips to Stay Debt-Free Once You are Out

Getting out of debt is a big achievement, but staying debt-free requires smart financial habits.

Here are some tips to help you maintain control of your money and avoid falling back into debt:

1. Stick to a Budget

Continue tracking your income and expenses, even after you clear your debts. A budget helps you live within your means and ensures you don’t overspend.

2. Build an Emergency Fund

Set aside money regularly for emergencies. Having a fund of at least 3–6 months of expenses can save you from relying on loans or credit cards during tough times.

3. Use Credit Wisely

Credit cards are useful, but should be handled carefully. Pay off the balance in full each month and avoid using them for unnecessary purchases.

4. Avoid Lifestyle Inflation

As your income grows, it can be tempting to spend more on luxuries. Instead, try to save or invest the extra money rather than increasing expenses unnecessarily.

5. Pay Bills on Time

Late payments can hurt your credit score and lead to extra charges. Set reminders or automate payments to ensure you never miss a due date.

6. Set Financial Goals

Clear goals can help you stay motivated. For example, buy a house. You should save for travel. You should consider building retirement funds. These goals can encourage you to save. They can also help you avoid reckless spending.

7. Keep Learning About Money

Financial literacy is key to staying debt-free. Read, take courses, or follow credible financial advice to keep improving your money management skills.

Apart from personal strategies, using the right financial tools can also help. Pocketly is one such platform that supports smart debt management.

Pocketly: A Smarter Way to Manage Short-Term Credit

When it comes to debt management, the biggest challenge for many young people is avoiding high-interest credit cards or unplanned borrowing. This is where Pocketly can make a real difference.

Pocketly is a fintech platform designed to give students, young professionals, and self-employed individuals quick access to small-ticket loans. By focusing on short-term, flexible credit, it helps users meet urgent needs without falling into a long-term debt trap.

Small, Flexible Loan Amounts

Borrow between ₹1,000 and ₹25,000 based on your actual needs. This prevents over-borrowing and keeps repayment manageable.

Instant Disbursement

Funds are approved and transferred in minutes, helping you cover emergencies without depending on costly credit cards.

Easy Repayment Options

Choose repayment terms between 2 and 6 months. Flexible EMIs make it easier to stay on track without straining your monthly budget.

Minimal Documentation

Only basic KYC is required. There is no lengthy paperwork. No collateral is needed. This makes access to credit quick and stress-free.

Transparent Terms

Interest rates and processing fees are clearly stated upfront, with no hidden costs. This ensures you can plan repayments confidently.

Digital Convenience

From applying to repaying, the entire process happens online through the Pocketly app, available anytime, anywhere.

By borrowing responsibly with Pocketly, users can meet short-term needs, avoid expensive borrowing options, and even begin building a stronger credit history. It’s a practical tool for anyone looking to manage debt effectively while staying financially disciplined.

Conclusion

Dealing with debt is more than just paying off what you owe. It's also about making long-term money habits that will protect you. By creating a realistic budget, prioritising repayments, and using strategies like consolidation or negotiation, you can steadily work your way toward financial freedom. Professional solutions such as Debt Management Plans can also provide structure and relief when debt feels overwhelming.

The key is to stay consistent, avoid unnecessary borrowing, and prepare for the unexpected with savings and smart planning. With discipline and the right tools, staying debt-free is not only possible but also empowering.

Also, if you want a safe, clear, and adaptable way to handle short-term loans, sites like Pocketly can help you. They can help you borrow responsibly while keeping your future finances safe.

FAQs

1. What is debt management in simple terms?

Debt management is creating a plan to repay your loans in an organised way. It helps you reduce financial stress and pay off debt more efficiently.

2. Can debt management improve my credit score?

Yes, making consistent on-time payments under a debt management plan can gradually improve your credit score. However, missing payments can harm it.

3. Is debt consolidation a good idea for everyone?

Debt consolidation works best if it lowers your interest rate and simplifies repayments. But it requires discipline to avoid taking on new debt.

4. What’s the difference between debt settlement and a debt management plan?

Debt settlement reduces the total amount you owe, but it can hurt your credit score. A debt management plan restructures payments without reducing the actual debt.

5. How long does it take to become debt-free with a Debt Management Plan (DMP)?

Most DMPs last between 3 and 5 years, depending on your debt amount. Staying consistent with payments is key to completing them on time.

6. Can I manage debt on my own without professional help?

Yes, with budgeting, prioritising debts, and disciplined repayment, many people manage debt on their own. Professionals are helpful if debt feels unmanageable.

7. How does Pocketly help with debt management?

Pocketly offers small, flexible loans with clear terms and instant access. This prevents reliance on costly credit and helps build a positive credit history.