Your salary is crucial; it helps you pay bills, take care of your family, and plan for the future. But what happens when that paycheck doesn't come on time? Recently, the Delhi cabinet approved a Rs 17 crore grant to clear pending salaries of DSFDC employees, shedding light on how salary delays impact people like you across different sectors.

Unfortunately, this isn't a rare situation. Salary delays occur in many industries, leaving employees stressed, financially strained, and uncertain about their next steps. If you've ever faced a delay in your salary, you know how much it can affect your day-to-day life and long-term plans.

In this blog, we will examine the reasons behind salary delays, their impact on employees, and the solutions available to manage such situations effectively. If you've ever faced this issue or are currently dealing with it, this guide will help you understand the root causes, your rights, and the best ways to manage the situation.

TL;DR (Key Takeaways)

- Salary delays occur when an employer fails to pay an employee on the agreed-upon date. Causes can include cash flow problems, administrative issues, or external market conditions.

- Salary delays can lead to legal actions under the Payment of Wages Act, 1936, allowing employees to seek compensation and take legal steps.

- Employees can address salary delays by communicating with their employers, documenting the issue, and seeking legal or financial assistance if necessary. In severe cases, short-term loans like Pocketly can help bridge the gap.

- Delayed salaries can cause financial stress, lower morale, and negatively impact an employee's overall well-being. Taking proactive steps can help reduce stress during these times.

What Is a Salary Delay?

Salary delay refers to the situation where an employee does not receive their salary on the agreed-upon payday. It can occur in various forms, such as a delay of a few days, weeks, or even months. It may be due to several reasons, like cash flow issues, administrative delays, or financial difficulties within the company. In any case, salary delay is problematic for employees who rely on their earnings to cover personal expenses, bills, and savings.

Under the Payment of Wages Act, 1936, employers are legally obligated to pay employees within a specific time frame. For most industries, wages must be paid within 7 days from the end of the wage period for employees who are paid monthly and 10 days for those on a daily or weekly payment cycle. If the payment isn't made within this time frame, the employer may violate the law, and the employee has the right to take action.

Common Industries and Sectors Where Salary Delays Occur:

While salary delays can happen in any industry, they tend to be more prevalent in specific sectors, including:

- Startups and Small Businesses – New or smaller businesses often struggle with cash flow, which can lead to delayed payments.

- Government Agencies – Bureaucratic delays, such as administrative bottlenecks, can sometimes result in salary delays within public sector organizations.

- Freelance and Contract Work – Freelancers and contractors are at risk due to clients' inconsistent payment schedules.

- Manufacturing and Construction – These industries may experience delays due to project-related cash flow issues.

- Non-Profit Organizations – NGOs may face delayed salaries due to dependency on grants and external funding.

Salary delays, regardless of the sector, can have profound implications on an employee’s financial health and mental well-being, which is why addressing and managing these issues promptly is crucial. Let’s now look into the causes of these delays and how they can impact employees.

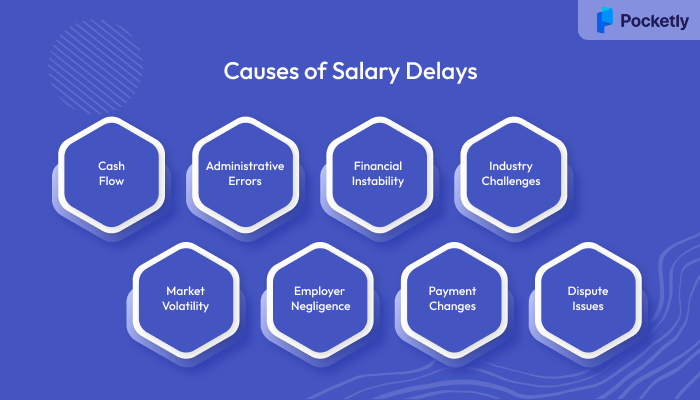

Causes of Salary Delays

Salary delays can stem from a variety of factors, some internal to the company, while others might be external or market-driven. Understanding these reasons can help employees better manage the situation and find potential solutions. Here are some of the primary causes of salary delays:

1. Cash Flow Problems

One of the most common reasons for salary delays, especially in small businesses and startups, is cash flow issues. Companies may have pending payments from clients, or they might be dealing with temporary liquidity problems that prevent them from paying employees on time. While this is often temporary, it can create significant financial strain on workers.

2. Administrative Bottlenecks

In larger organizations, salary delays might be the result of administrative errors or inefficiencies. These can include delays in payroll processing, errors in the data entry of employee details, or mismanagement of the company's payroll system. Sometimes, a simple clerical error can lead to a delay in payment processing, and it can take a few extra days for the issue to be resolved.

3. Financial Mismanagement

In some cases, companies may face financial instability due to poor management practices. Mismanagement of company funds, extravagant spending, or lack of proper financial planning can result in an inability to pay employees on time. This is especially common in organizations with poor financial oversight.

4. Industry-Specific Challenges

Specific industries are more prone to salary delays due to the nature of their business model. For example, construction companies or project-based industries may experience payment delays when funds for a particular project are delayed. Similarly, businesses relying on government grants or funding may face delays in payments to employees if there are delays in receiving these funds.

5. Unpredictable Market Conditions

Unforeseen circumstances, such as economic downturns, natural disasters, or global supply chain disruptions, can severely affect businesses' ability to meet their financial obligations, including paying employees on time. Market volatility, especially in industries like retail, manufacturing, or hospitality, may result in delayed earnings for the business, which then delays salary payments.

6. Employer Negligence

Unfortunately, salary delays can sometimes be attributed to simple negligence or intentional oversight by the employer. While this might be rare, it happens in situations where employers either don’t prioritize timely payment or fail to manage their financial responsibilities effectively. This can cause unnecessary stress among employees and lead to disputes within the workplace.

7. Change in Payment Structures

In some cases, businesses may change their payment structure or payroll system, which can cause delays. Transitioning from weekly to monthly payments or switching payroll systems might lead to processing delays, even though it may be part of an organizational change.

8. Dispute Between Employer and Employee

Sometimes, salary delays occur due to ongoing disputes between the employer and employee, where employers might withhold payment as a way to resolve grievances, or employees might refuse to accept payment because of dissatisfaction with their compensation.

To ensure a smooth flow, it’s important to not only understand the reasons for salary delays but also the potential legal implications that employees and employers may face. In India, salary delays are not just a financial inconvenience; they can have serious legal consequences for both parties involved.

Explore more about how to handle salary delays and stay financially secure. Read our blog on What to Do When Your Salary Is Not Credited.

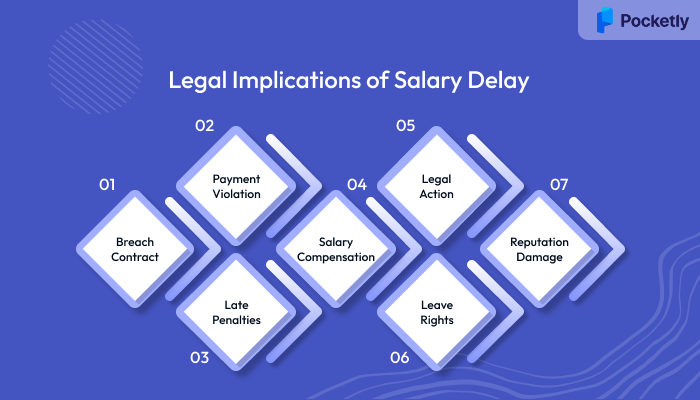

Legal Implications of Salary Delay

When salary delays occur, they don’t just affect an employee’s financial stability; they can also lead to legal repercussions. Employees are entitled to receive their wages within a reasonable time frame, and any violation of this entitlement could lead to disputes that may require legal intervention. Below are the key legal implications employees and employers should be aware of:

1. Breach of Contract

The terms of employment contracts often specify the agreed-upon salary payment dates. When an employer delays salary payments, it could be considered a breach of contract. Under the Indian Contract Act, 1872, a breach of the employment agreement could result in legal action. Employees have the right to approach labor courts to claim compensation for any damages caused by such breaches, including loss of income and emotional distress.

2. Violation of the Payment of Wages Act, 1936

According to the Payment of Wages Act, 1936, employers are legally obligated to pay their employees on time, specifically within the 7th day of the month for wages paid monthly. For wages paid on a daily or weekly basis, payment must be made within 10 days after the wage period ends. If an employer fails to adhere to these timelines, they could face legal consequences, including penalties and fines imposed by the labor authorities.

3. Penalties for Late Payment

Employers who fail to pay their employees within the stipulated time frame may be penalized under the Payment of Wages Act. A penalty can be imposed for every day the wages are delayed beyond the due date. These penalties could be up to Rs. 50 for each default day, with a maximum penalty of Rs. 1,000, depending on the circumstances.

4. Compensation for Delayed Salary

In cases where salary delays lead to financial hardship or legal disputes, employees may seek compensation for the delay. Compensation may cover the actual salary owed, interest on the delayed amount, and any additional financial loss incurred due to the delay. Employees can file a complaint in the labor court or tribunal to recover the compensation owed to them.

5. Legal Action by Employees

If an employee's salary is delayed for an extended period, they may have the right to initiate legal proceedings. Employees can file a complaint with the Labor Commissioner or even approach a labor court for redressal. If the employer fails to settle the issue, the court may order the employer to pay the overdue salary along with any applicable fines or damages.

6. Employee's Right to Leave and Employment Termination

In extreme cases, persistent salary delays can also lead employees to seek termination of their employment, considering it a justifiable reason for quitting. Employees may be entitled to severance pay or other benefits, depending on the terms of their contract and labor laws.

7. Reputation Damage to Employer

Employers who repeatedly delay salary payments may face damage to their reputation. Not only could this impact relationships with current employees, but it could also harm the employer's ability to attract top talent. In industries with competitive labor markets, an employer's failure to pay on time may result in negative publicity and a loss of goodwill, ultimately affecting business performance and future hiring decisions.

Facing delays in salary payments?

The legal implications can be overwhelming, but you don't have to wait for things to get worse. If you've experienced unpaid wages or delays, it's time to take action. Whether it's through legal channels or alternative solutions, taking control of your financial situation is crucial. Get the help you need with Pocketly's fast and flexible loans, no lengthy paperwork or long waits. Get your finances back on track today!

Impact of Delayed Salary on Employees

The delay in receiving a salary is far more than just a financial inconvenience. It can trigger a chain reaction that affects an employee's day-to-day life, personal obligations, and overall work satisfaction. Below are the key impacts of salary delays on employees:

1. Financial Stress and Instability

One of the most immediate effects of salary delays is the financial strain it causes. Employees rely on their monthly income to cover their rent, bills, loan EMIs, and everyday expenses. When this income is delayed, it can cause significant disruptions in their financial planning.

Example: An employee who has to make mortgage payments or pay for their child's education may find themselves scrambling for funds, leading to additional stress.

2. Decreased Job Satisfaction and Morale

Repeated salary delays can lower employee morale and job satisfaction. Employees who feel their hard work is not being compensated on time may begin to feel undervalued and demotivated. This can lead to disengagement, affecting productivity and overall job performance.

Example: An employee who experiences continuous salary delays might lose motivation to meet targets or contribute to team goals, knowing that their compensation isn’t guaranteed.

3. Erosion of Trust Between Employees and Employers

Trust is a cornerstone of any successful workplace relationship. Delayed salary payments can erode this trust and damage the employer-employee relationship. Employees may start feeling insecure, wondering whether they will continue to receive their salaries on time in the future.

Example: When employees feel that they cannot depend on their employer for timely payments, they may become less loyal and seek alternative employment.

4. Increased Debt and Financial Strain

Employees may be forced to rely on credit cards or loans to meet their financial obligations while waiting for their salary. This reliance on borrowed money can lead to debt accumulation, with high-interest rates adding to their financial burden.

Example: An employee might start using credit cards to pay for essentials, leading to credit card debt, which eventually affects their credit score.

5. Impact on Mental Health and Well-being

The stress caused by salary delays can take a toll on an employee’s mental health. Constant financial worry can lead to anxiety, depression, and other mental health issues. It also strains personal relationships, as financial stress often spills over into family life.

Example: Employees under financial stress due to delayed payments may experience sleepless nights, irritability, and difficulty focusing at work, all of which contribute to a decrease in well-being.

6. Loss of Motivation to Perform

When employees feel undervalued due to salary delays, they may lose their drive to excel at their jobs. This can lead to a reduction in overall productivity, as employees no longer feel motivated to go above and beyond in their roles.

Example: A skilled employee who consistently works hard but faces repeated salary delays might begin to underperform and show a lack of enthusiasm toward achieving company goals.

7. Increase in Employee Turnover

If salary delays continue, employees may seek more stable employment opportunities elsewhere. High turnover rates are costly for organizations, leading to recruitment expenses and a potential loss of talent.

Example: After experiencing multiple delays in salary payments, employees may start looking for new jobs, leading to an increase in attrition that can harm the organization's culture and productivity.

8. Difficulty in Maintaining Professional Image

Salary delays can also affect employees' ability to maintain a professional image in their personal lives. When employees are not paid on time, they may struggle to meet their financial commitments outside of work, which can reflect poorly on their professional image.

Example: Employees may be unable to cover business-related expenses or attend work events due to financial constraints resulting from delayed salary payments.

Having understood the wide-ranging effects of delayed salaries, employees must take actionable steps to address the situation.

Dealing with salary delays can lead to significant financial strain, and traditional solutions may not always be sufficient to bridge the gap. If you're facing such a situation, Pocketly offers a quick and flexible solution to help manage your financial needs.

With Pocketly, you can access personal loans up to ₹25,000 with minimal documentation. Whether you need to cover urgent expenses or manage everyday costs, Pocketly is your go-to solution.

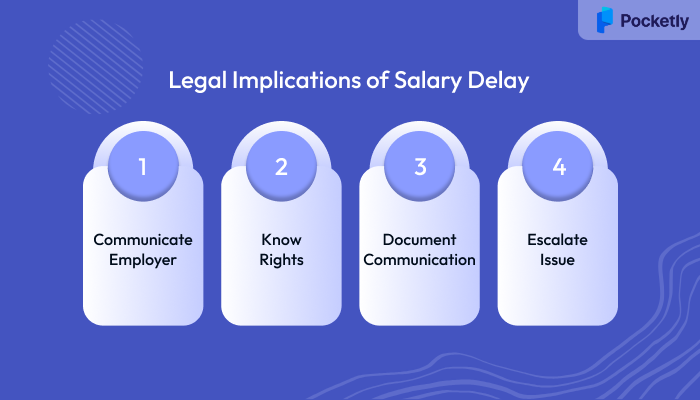

How to Handle a Salary Delay

Rather than letting financial stress and frustration build up, employees can take several strategic actions to mitigate the impact and find a resolution. Below, we break down key steps employees can take to manage salary delays effectively:

1. Communicate with Your Employer

The first step in resolving a salary delay is to communicate directly with your employer. Addressing the issue calmly and professionally can help uncover the reasons behind the delay. It may be a simple administrative error or perhaps a problem related to cash flow that the employer is actively working to resolve.

Tip: Approach your employer with a positive attitude, stating that you’re seeking clarification on the payment delay, and inquire about a resolution timeline.

2. Understand Your Rights

Being aware of your legal rights is essential when dealing with a salary delay. In India, the Payment of Wages Act, 1936 mandates the timely payment of salaries, and employees are entitled to receive their wages within a specified period after the due date. Understanding these rights ensures you can take appropriate action if the situation persists.

Tip: Familiarize yourself with labor laws related to salary payments to understand your legal standing better in case the issue escalates.

3. Document Everything

It's crucial to keep a thorough record of all correspondence, emails, and communication related to the delayed salary. This documentation serves as evidence should you need to escalate the matter to HR, labor authorities, or seek legal advice.

Tip: Maintain a salary payment log, including agreed-upon dates, amounts owed, and any interactions with your employer regarding the delay.

4. Escalate the Issue

If initial communication with your employer does not resolve the issue, take the next step by escalating the matter. Contact your HR department to seek further clarification. If that still doesn’t yield results, consider seeking legal advice to determine the following appropriate actions.

Tip: If necessary, file a formal complaint with the appropriate labor authority or seek mediation for dispute resolution.

By following these steps, employees can address salary delays in a systematic and efficient manner, minimizing the stress and disruption caused by delayed payments. Taking action early can also ensure that employers recognize the seriousness of the issue and resolve it promptly.

Solutions for Managing Salary Delays

While salary delays can cause significant stress, there are practical solutions that can help employees manage their finances during such times. These proactive steps can help ease the strain, maintaining financial stability even when income is temporarily disrupted.

1. Build an Emergency Fund

An emergency fund serves as a financial safety net, providing peace of mind when facing delayed salary payments. This fund should cover essential living expenses, such as rent, utilities, and groceries, for a few months.

- Why It Helps: It ensures you have immediate access to funds without needing to rely on your salary for survival.

- How to Start: Aim to save at least three to six months’ worth of living expenses. Start small and gradually build this fund over time.

2. Create a Realistic Budget

Effective budgeting is essential for managing your finances, especially when there’s uncertainty about when your salary will arrive. Prioritizing essential expenses and reducing discretionary spending can prevent overspending and alleviate the impact of a salary delay.

- Why It Helps: A budget provides clarity on your spending and allows you to plan for leaner months.

- How to Start: Use budgeting apps or spreadsheets to track monthly income and expenses. Identify non-essential items that can be deferred during a salary delay.

3. Negotiate Payment Terms

If salary delays are a recurring issue, consider negotiating terms with your employer to ensure more timely payments. This might include requesting partial payments or setting up a schedule that better aligns with your financial needs.

- Why It Helps: Negotiating better terms can reduce the financial uncertainty and avoid delays in essential payments like rent or utilities.

- How to Start: Schedule a meeting with HR or your supervisor to discuss potential solutions. Be clear and professional when presenting your case.

4. Explore Alternative Income Streams

Relying solely on your salary can leave you vulnerable to delays. Exploring alternative income streams, whether freelance work, consulting, or part-time jobs, can provide the financial buffer needed during times of salary disruptions.

- Why It Helps: Additional income sources reduce dependence on one income stream and can help meet financial obligations on time.

- How to Start: Identify skills or hobbies that could be monetized, such as graphic design, writing, or tutoring. Consider using platforms like Upwork, Fiverr, or local job boards.

5. Consider Short-Term Loans or Credit

If a salary delay creates an urgent financial gap, short-term loans or credit can help bridge the gap until you receive your income. However, this should be used cautiously, as interest rates and repayment terms can add to your financial burden.

- Why It Helps: Quick loans provide immediate access to cash, helping you manage urgent expenses.

- How to Start: Consider easy-to-use loan apps like Pocketly, which offer quick, flexible loan options with minimal documentation. Be sure to check the interest rates and repayment terms before borrowing.

These strategies, when implemented effectively, can help you manage salary delays more smoothly. Whether it’s preparing in advance with an emergency fund, negotiating terms, or exploring supplementary income streams, these solutions help you to maintain control of your finances, even during uncertain times.

While taking proactive steps to prevent salary delays is essential, the unexpected can still occur, leaving employees in financial distress. In such cases, having a quick and reliable financial solution can make all the difference. That's where Pocketly comes in!

Pocketly: A Smart Financial Solution During Salary Delays

While taking proactive steps to prevent salary delays is essential, sometimes unexpected financial challenges still arise. If you find yourself in a situation where your salary is delayed, Pocketly can be the perfect solution to help you manage your financial needs without additional stress.

Here's how Pocketly can assist:

- No Need to Wait for Salaries: Don't Let Salary Delays Hold You Back. Pocketly offers loans ranging from ₹1,000 to ₹25,000, available for immediate disbursement, so you can cover any unexpected expenses until your salary comes through.

- Minimal Documentation: Pocketly simplifies the loan application process. All you need are basic KYC details, and you can apply directly through their app, without the need for additional documents or a guarantor.

- Interest Rate: Starting from 2% per month.

- Processing Fee: 1-8% of the loan amount, depending on the loan type and amount.

- Flexible Repayment Terms: Pocketly offers flexible repayment options, so you can choose terms that best suit your financial situation, making it easier to manage your finances even during periods of uncertainty.

Pocketly's app provides you with access to funds from anywhere, at any time, offering true financial flexibility. Whether you're dealing with an emergency or just need help bridging the gap while waiting for your salary, Pocketly's solutions are designed to offer peace of mind during tough times.

Contact us today to take control of your financial situation with instant access to personal loans.

Conclusion

Salary delays can disrupt your financial well-being, but they are a reality many employees face at some point in their careers. While it's essential to address the issue directly with your employer and be aware of your rights, financial security shouldn't rely solely on the timing of salary payments. Being proactive in managing your finances and understanding the steps you can take when salary delays occur will provide you with peace of mind and stability.

Sometimes, despite our best efforts, life's unpredictability requires a quick solution. In those moments, having access to fast financial support, like Pocketly, can make a significant difference in your ability to manage until the situation is resolved. Pocketly provides a straightforward and efficient way to bridge the gap, ensuring you're never left in a financial bind due to salary delays.

Download Pocketly today and experience financial flexibility with instant loans. Available for Android and iOS.

FAQs

What is considered a salary delay in India?

A salary delay occurs when an employer fails to pay an employee's wages on the agreed-upon date, typically resulting in financial strain for the employee.

How do I handle salary delays legally in India?

Employees have the right to seek legal remedies under the Payment of Wages Act, 1936, which mandates the timely payment of wages. Employees can file a complaint with the labor commissioner if wages are delayed.

Can I claim unpaid salary if I leave my job?

Yes, you can claim unpaid salary if you leave your job, and your employer is legally bound to settle all dues, including pending salary and any other benefits.

What steps should I take if my salary is delayed repeatedly?

If salary delays become a recurring issue, employees should first communicate with their employer, document the problem, and escalate the matter to HR or seek legal advice if needed.

How can I prevent salary delays in the future?

Employees can prevent salary delays by ensuring clear communication with employers, understanding labor laws, and, if necessary, joining a union for added support in some sectors.