Understanding what a secured and unsecured loan is, and why it is essential for young Indians, students, and anyone starting their financial journey. With a wide choice of loan options available, it can be overwhelming to know which one suits your needs best. Secured loans require collateral, which the lender can claim if you default on payments, as opposed to unsecured loans, where it depends on your credit history and financial standing.

Let’s now dive into the blog and examine the differences between these two types of loans, and which scenarios they are most suitable for. By the end, you’ll have a clear understanding of what works best for your financial goals.

At a Glance

- Secured Loans require collateral, offering lower interest rates and higher borrowing limits.

- Unsecured Loans don’t require collateral and offer flexibility, but come with higher interest rates and smaller loan amounts.

- The main benefit of secured loans is affordability and easier access, while unsecured loans are faster and easier to qualify for.

What is a Secured Loan?

In this type of loan you offer something valuable, such as property documents, as a guarantee. If you don’t repay the loan, the lender can take your property or assets to recover the money you owe. Because the loan is backed by something valuable, lenders offer cheaper interest rates compared to unsecured loans.

For Example, If you take out a car loan to buy a vehicle, the car acts as collateral. Failing to make the payments can lead to the lender repossessing the car to recover its money. This is what makes it a secured loan; the lender has something they can take if you don’t pay back the loan.

What is an Unsecured Loan?

This type of loan doesn't require you to offer any property or asset as a guarantee. Instead, the lender decides whether to give you the loan based on your income, credit score, and repayment history. Since there's no collateral, the interest rates are usually higher, as the lender is taking on more risk.

For Example, if you apply for a personal loan without needing to offer anything like your house or car, that’s an unsecured loan. The lender trusts you to repay the loan based on your financial history, but if you don’t, they (lenders) may take legal action to recover the money.

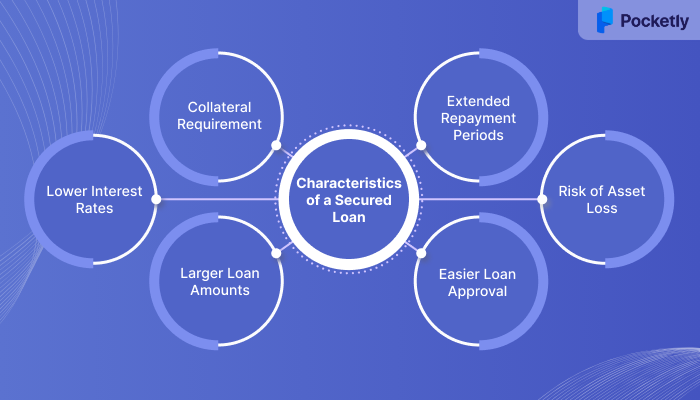

Characteristics of a Secured Loan

Unsecured loans are more of a straightforward way to borrow money without the need to pledge any assets as collateral. While these loans provide flexibility and ease of access, they also come with certain risks and higher costs.

Let’s explore the key characteristics of unsecured loans:

- No Collateral Needed: Unsecured loans don’t require you to pledge assets like a house or car. The approval process focuses on your credit score and financial history.

- Higher Interest Rates: Because there’s no collateral, lenders see more risk, which leads to higher interest rates compared to secured loans.

- Flexible Loan Usage: The funds from unsecured loans can be used for a variety of purposes, such as education, medical bills, or personal expenses, without any restrictions.

- Approval Depends on Credit: Lenders assess credit score, and debt-to-income ratio to determine loan eligibility. A stronger credit score increases your approval chances.

- Fixed Repayment Plans: These loans usually have set loan repayment time periods, making it easier for you to budget and plan your payments.

- Effect on Credit Score: Paying back an unsecured loan can boost your credit score, while missed or late payments may harm it.

- Examples of Unsecured Loans:

- Personal Loans: Used for general expenses like home improvements, weddings, or emergencies.

- Student Loans: To cover the cost of education, including tuition fees and living expenses.

- Credit Cards: Let you borrow money up to a credit limit for purchases, with the option to repay over time.

Understanding these characteristics provides the groundwork, but making the right choice requires weighing the real-world advantages against potential drawbacks.

Pros and Cons of Secured Loans

Secured loans come with the advantage of lower interest rates, as the lender’s risk is reduced by the collateral offered. This makes them a cost-effective option for borrowers. Now, let’s take a look at the table to compare the benefits and drawbacks of secured loans in more detail.

| Pros | Cons |

| Secured loans offer interest rates 2-5% lower than unsecured loans due to the collateral. | Failure to repay loans could lead to losing your collateral, such as your car or house. |

| Borrow larger sums, often up to 80-95% of collateral value, compared to unsecured loan limits. | Approval can take 1-4 weeks due to asset evaluation and paperwork. |

| Easier to qualify for, even with poor credit, since the loan is backed by collateral. | Collateral remains pledged, limiting your ability to sell or refinance until the loan is repaid. |

| Extended terms, like 30 years for mortgages, reduce monthly payments. | May include appraisal, legal, and higher processing fees. |

| It can be used for various purposes like home improvements, business expansion, or debt consolidation. | Some loans, like vehicle or home loans, may limit how funds are used. |

| You can improve your credit score by making timely payments over time. | Long repayment terms can lead to higher total interest paid. |

| Available for those with lower credit scores due to collateral. | Requires detailed paperwork, including asset ownership and legal agreements. |

Must Read: Getting a Loan of INR 3 Lakhs from a Bank

Pros and Cons of Unsecured Loans

Unsecured loans gives you the convenience of borrowing without collateral. However, they come with higher interest rates due to the increased risk for lenders. Now, let's take a closer look at the table to clearly differentiate the pros and cons of unsecured loans.

| Pros | Cons |

| Your assets are safe, providing peace of mind if loan repayment issues arise. | Rates are 3-10% higher than secured loans, ranging from 9.99% to 44% annually. |

| Instant personal loan approvals in 72 hours, with funds often disbursed within 24-48 hours. | Borrowing limits are smaller (typically ₹25,000 to ₹40 lakh) compared to secured loans. |

| Minimal paperwork with just an ID proof, income, and bank statements. | Best rates require a 750+ credit score, making it difficult for those with a poor credit score to qualify. |

| Funds can be used for purposes like debt consolidation, medical expenses, or personal emergencies. | Loan terms are 5-7 years, resulting in higher monthly payments. |

| Existing customers often receive instant pre-approved offers, speeding up the process. | Repayments are rigid, with fixed EMIs that cannot be adjusted during the loan term. |

| Digital applications allow same-day funding, with no need for asset valuation or legal procedures. | Some lenders may ask for a personal guarantee, exposing the guarantor to legal action. |

| Timely payments help improve your credit score, boosting future borrowing options. | Processing fees (0.5% to 5%), prepayment penalties, and late fees increase overall borrowing costs. |

Also Read: Documents Required for Personal Loan Application

Pocketly provides instant personal loans with interest rates starting at just 2% per month, requiring no collateral and minimal paperwork. Plus, enjoy a low 1%-8% processing fee on the loan amount.

Which Loan Type is Better: Secured or Unsecured?

Now that we understand what a secured and unsecured loan, choosing between these two depends on your financial situation and needs. Secured loans require collateral like property or a vehicle and also come with lower interest rates and higher loan amounts, making them suitable for significant expenses.

On the other hand, unsecured loans don’t require any collateral, offering more flexibility and a quicker approval process, but they often come with higher interest rates and lower borrowing amounts. If you need a large sum and have assets to pledge, a secured loan could be a better option. If you prefer no collateral and need smaller amounts, an unsecured loan might suit you best.

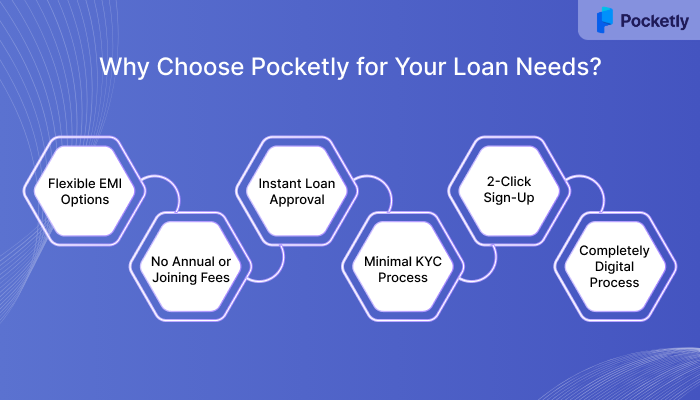

Why Choose Pocketly for Your Loan Needs?

Pocketly offers a hassle-free borrowing experience with features designed to simplify the loan process. Unlike traditional loan options, Pocketly focuses on convenience, flexibility, and transparency, ensuring that students and young professionals can access funds without unnecessary complications.

- Flexible EMI Options: Choose a repayment plan that suits your budget and lifestyle, with easy monthly payments.

- No Annual or Joining Fees: Enjoy a loan without hidden charges, making it an affordable choice.

- Instant Loan Approval: Receive approval in just minutes and have the funds transferred directly to your account without any holdups.

- Minimal KYC Process: Complete your loan application with just basic documents, making it quick and easy.

- 2-Click Sign-Up: Sign up with ease in just two clicks, and get started with your loan application in no time.

- Completely Digital Process: Enjoy a paperless, seamless experience from application to disbursement.

Conclusion

Understanding the differences between secured and unsecured loans is crucial for making informed financial decisions. Secured loans offer lower interest rates and higher borrowing limits, but they come with the risk of losing your collateral if you fail to repay. Unsecured loans, on the other hand, are more flexible and don’t require collateral, although they do have higher interest rates.

If you’re a salaried professional or self-employed and in need of quick loans without lengthy paperwork or documentation, Pocketly offers instant loans in minutes.

As a digital lending platform partnering with trusted NBFCs, Pocketly provides personalized loans with no collateral and a simple application process. Download Pocketly today on Android or iOS to experience fast, reliable financial support.

FAQs

1. Which loan has the highest risk?

Secured loans, though generally offering lower interest rates, come with the highest risk for the borrower. If you fail to repay the loan, your asset can be seized (such as your home or car) to recover the amount, which can lead to significant financial loss.

2. Which type of loan should always be avoided?

Avoid loans with excessive interest rates and hidden fees, such as payday loans. These type of loans can trap borrowers in a debt cycle, making it hard to pay them off.

3. What is a good interest rate for an unsecured loan?

A good interest rate for an unsecured loan typically ranges between 10% to 20% annually. However, the rate depends on your credit score, financial history, and the lender’s terms. Lower rates are available for those with strong credit histories.

4. What is the age limit for an unsecured loan?

For unsecured loans, the typical age range is 21 to 60 years, although this may differ based on the lender's requirements and the borrower's financial status.

5. Does a loan defaulter go to jail?

In India, defaulting on a loan doesn’t directly result in jail time. However, if the default leads to legal action, a borrower may face court proceedings or wage garnishment. Jail time can only occur if there is a fraudulent intent or criminal activity involved.