Planning to take a loan of ₹3 lakhs but not sure where to begin? Whether it’s for a big family event, an urgent medical need, or simply managing cash flow, getting that amount from a bank can feel overwhelming at first.

But here’s the good news- a bank gives a loan of amount INR 3 lakhs to eligible applicants based on their income, credit score, and repayment capacity. Before you apply, though, it’s important to understand how these loans work.

This guide breaks it all down for you, from understanding your eligibility to calculating repayment and everything in between. If you're planning to apply soon, make sure you read till the end.

TL;DR

- To get a ₹3 lakh loan, meet the age, income, and credit score requirements.

- Compare multiple banks to find the most suitable interest rates and lowest fees.

- Keep documents like ID, address proof, and income slips ready for submission.

- Apply online/offline, submit documents, undergo a credit check, and await approval.

- Apply for the exact amount and avoid multiple simultaneous applications.

Understand the Purpose and Use Case

Before applying for a ₹3 lakh loan, it’s important to know exactly why you need it. Banks are more likely to approve applications when the loan purpose is clearly defined and supported by valid documents.

Matching your purpose with the right loan type can also boost approval chances. For example, personal loans are ideal for travel or medical expenses, while home renovation loans might offer better terms for property improvements.

When applying, be as specific as possible. Also, include documents like salary slips, bank statements, or ITRs to prove your ability to repay. If you’re renovating your home, attach a contractor’s estimate. For debt consolidation, share statements of all existing loans or EMIs.

Lenders also look for signs of stability, like a consistent job, regular income, and a fixed address. These factors can add credibility to your application and make you a stronger candidate for approval.

Check Your Eligibility

Before you apply for a ₹3 lakh loan, it’s smart to check if you meet the basic eligibility criteria. This helps avoid surprises and improves your chances of getting approved.

Nationality

You must be an Indian citizen living in India to be eligible for most personal loans. Lenders typically require a valid ID and proof of address to confirm your nationality and residential status.

Age

Applicants usually need to be between 21 and 60 years of age. Some lenders may allow older applicants, especially professionals or pensioners, but you must always check the upper age limit for the loan term.

Employment Status

If you’re salaried, lenders look for at least 12 months of continuous work with your current employer. For self-employed individuals or professionals, most lenders want at least two years of business or practise continuity. Supporting documents like professional degrees, GST filings, or business licences may be required to verify your income source and stability.

Income Verification

Your monthly income plays a major role in loan approval. While the minimum requirement varies, most lenders expect at least ₹15,000–₹25,000 per month.

Salaried applicants are usually asked to provide salary slips, bank statements, or Form 16. Self-employed individuals may need ITRs or audited financials. Lenders may also assess your debt-to-income ratio to ensure your existing EMIs and new loan repayment can be comfortably managed.

Credit Score

Your credit score reflects how responsibly you've handled debt in the past. A score of 720+ improves your chances of getting approved with better interest rates.

If your score falls between 650–700, you might still qualify, but at a higher rate. Anything lower may reduce your chances unless other factors like income or collateral strengthen your profile. It's wise to review your score before applying.

A clear understanding of your eligibility brings you one step closer to approval. Once that's in place, focus on finding a lender that fits your needs.

Research and Compare Lenders

Choosing the right lender is just as important as meeting the eligibility criteria. In India, your options go beyond just banks; you can also explore NBFCs and digital lending platforms.

Compare Interest Rates

Interest rates directly affect how much you repay over time, so even a slight difference matters. Public sector banks often offer the lowest rates but may be harder to qualify for. Private banks and NBFCs, on the other hand, may approve you faster but usually charge higher rates to balance the risk.

Rather than picking the first option you come across, compare at least 3–4 lenders. Use loan aggregator websites or visit lender websites directly to review their rate slabs. Make sure to read the fine print and check if the interest rate is fixed or reducing balance, as that affects the total repayment amount.

Evaluate Processing Fees

Processing fees are one-time charges added to your loan cost and are usually deducted upfront. Some lenders charge a flat percentage (like 1–3% of the loan amount), while others may have tiered fees based on your loan profile or repayment tenure.

Also, look out for other hidden costs such as GST, prepayment charges, late payment penalties, or foreclosure fees. These can make a significant difference if you plan to repay early or restructure your loan later. Transparent lenders usually list all these costs clearly, so don’t skip the fee breakdown.

Check Customer Feedback

Online reviews and real borrower experiences can reveal what a lender won’t tell you on their website. Look for common queries: Is customer service helpful? Are disbursals quick? Is repayment tracking easy? These insights help you understand what to expect once the loan is sanctioned.

You can also explore financial forums or trusted aggregator platforms that compare lenders based on user ratings. If a lender shows repeated issues, like hidden charges or delays, it’s a red flag, regardless of how attractive the interest rate looks.

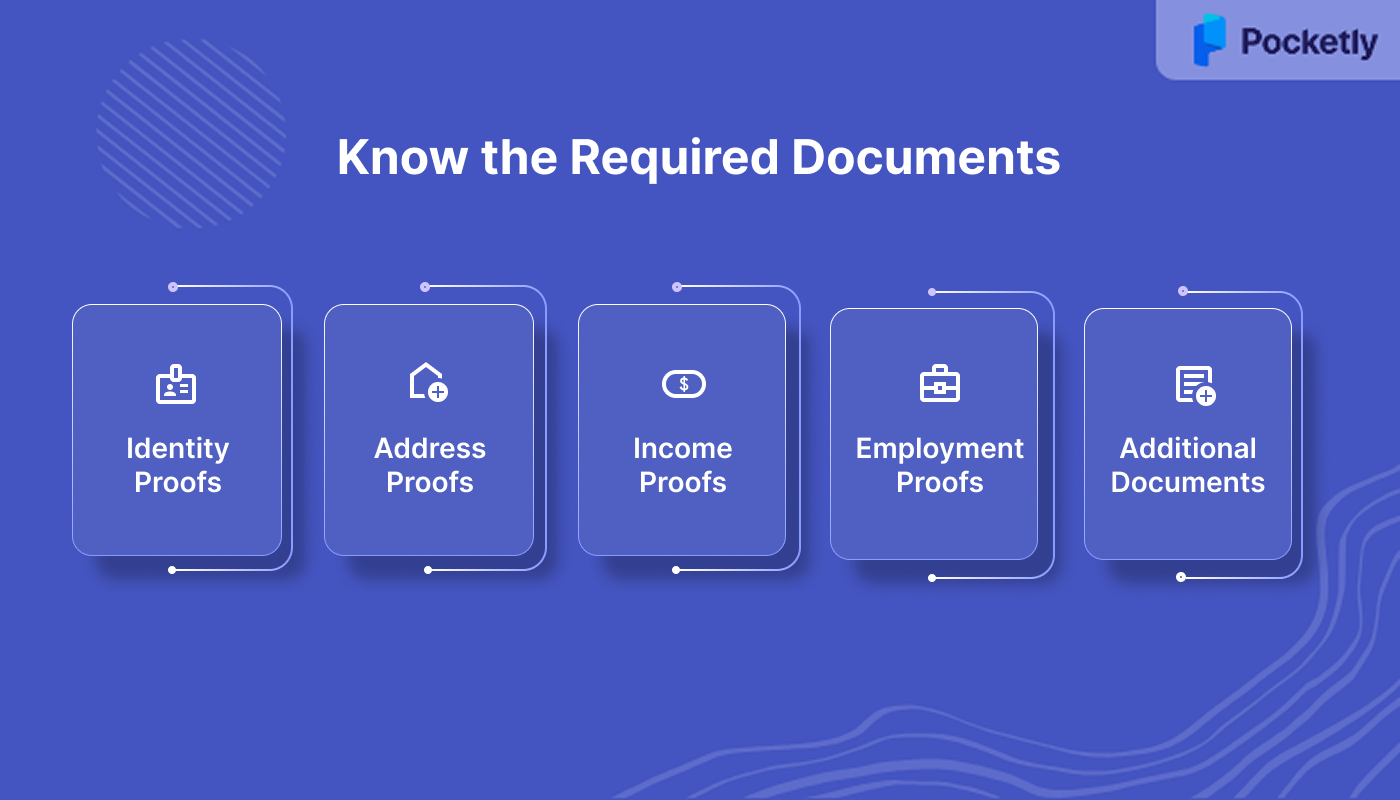

Know the Required Documents

Before you apply, it’s important to have your paperwork in order. It helps the bank verify your details and improve your chances of getting approved without back-and-forth delays.

- Identity Proofs: To verify your identity, submit any one government-issued document such as an Aadhaar card, PAN card, Voter ID, Passport, or Driving Licence. These confirm who you are to the lender.

- Address Proofs: Lenders require documents that confirm your residential address. Acceptable proofs include utility bills, Aadhaar card, bank statements, ration card, or your passport with your address clearly mentioned.

- Income Proofs: Salaried applicants should provide 2–3 months of recent payslips and bank statements showing salary credit. Self-employed individuals may submit ITRs, Form 16, or basic financial records to prove steady income.

- Employment or Business Proofs: To verify your job or business, provide an employee ID card, offer letter, or salary certificate. Self-employed applicants can use trade licences or registration documents as proof of business.

- Additional Documents: A recent passport-size photo is usually required. You may also need to complete an NACH or ECS form so the bank can auto-debit your monthly EMIs from your account.

Good documentation builds momentum early on. So now that you’ve got everything sorted, how do you actually go about applying for the loan? Keep reading to find out.

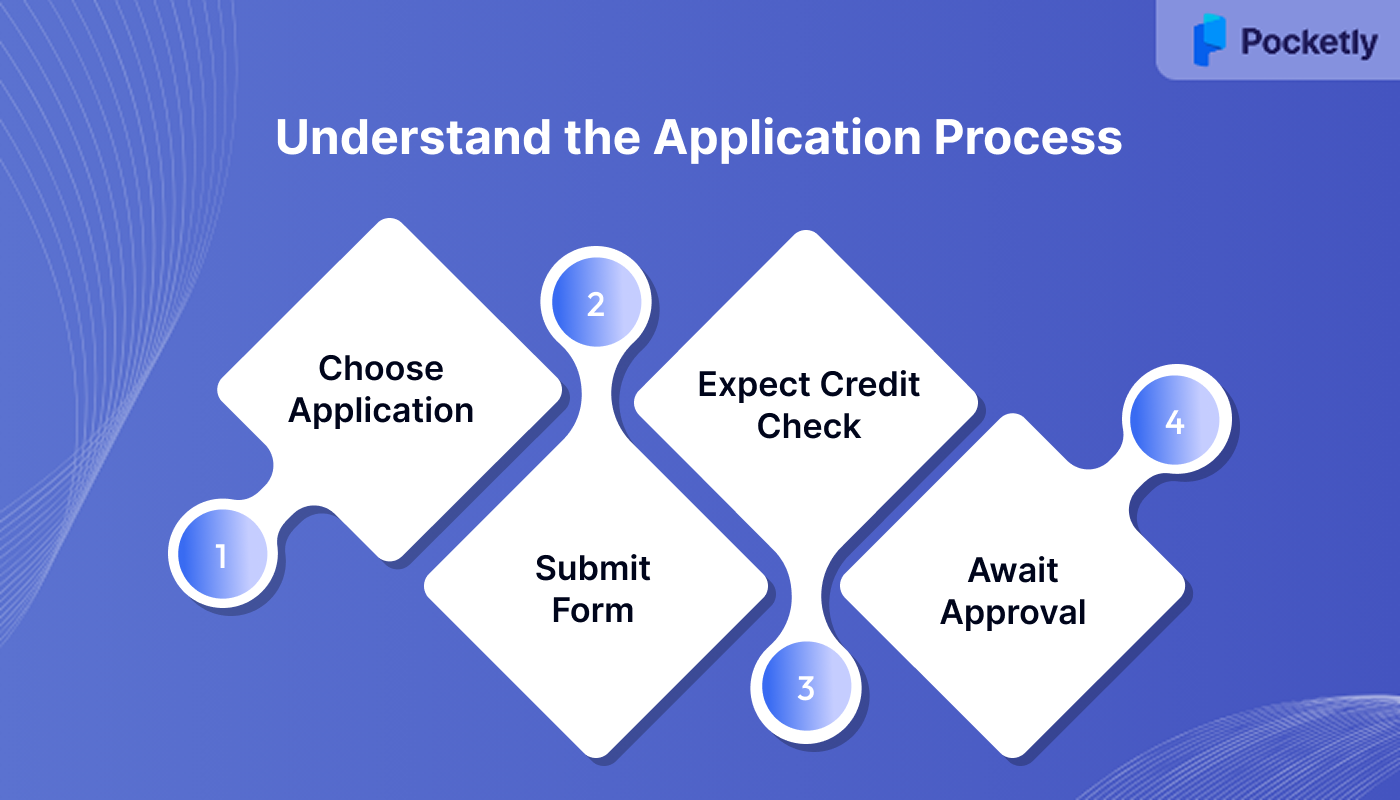

Understand the Application Process

The actual loan process moves quickly if you know what’s coming. Here’s a simple step-by-step breakdown to guide you.

Step 1. Choose How You Want to Apply

Your first step is to decide whether you’ll apply online or walk into a bank branch. Online applications are faster and more convenient, especially if you’re comfortable using digital platforms for personal finance tasks.

In-person applications allow face-to-face interaction with staff who can guide you through the process. If you’re unsure about eligibility, documents, or form details, visiting the bank might offer added clarity and peace of mind.

Step 2. Fill the Form and Submit Your Documents

Whether online or offline, filling out the loan form accurately is critical. Make sure your personal, employment, and income details are current and error-free. Even a small mistake can delay processing or result in rejection.

Alongside the form, attach required documents like Aadhaar, PAN, address proof, and income statements. Ensure all files are clear, complete, and self-attested where needed. Keep both soft copies and physical copies handy, depending on the application mode.

Step 3. Prepare for a Credit Check

Banks will review your credit history to assess your ability to repay the loan. A CIBIL score of 685 or above generally helps you qualify for better terms, though slightly lower scores may still be considered.

Check your credit report beforehand to catch errors or old accounts. If needed, take corrective steps before applying. A strong credit score signals financial discipline and helps you negotiate better interest rates.

Step 4. Wait for the Approval and Disbursal

Once your form and documents are submitted, the bank begins reviewing your application. This includes checking your employment details, income consistency, credit report, and overall repayment capacity.

If everything looks good, the funds are disbursed directly into your account. The process usually takes a few working days, but accurate documentation and good credit can speed it up considerably.

Be Aware of Interest Rates and Fees

When a bank gives a loan of amount INR 3 lakhs, the total cost isn’t limited to just the interest. Your rate depends on your credit score and income, but even a small difference in rate can affect how much you repay overall.

Banks may also charge processing fees, late payment penalties, or prepayment charges. Some of these costs are deducted from the loan amount or added to your EMIs.

Read the agreement carefully to avoid hidden charges like bundled insurance or documentation fees. Knowing the full cost upfront helps you plan better and borrow smartly. You can also visit the RBI’s data portal to stay updated on standard lending rates and guidelines.

Plan Your Loan Repayment Wisely

Smart planning helps you avoid financial strain during repayment. Knowing your limits and loan flexibility keeps your ₹3 lakh loan manageable from day one.

Calculate Your EMI and Repayment Capacity

- Estimate your monthly EMI: Use an online EMI calculator by entering the loan amount, interest rate, and tenure. For instance, a ₹3 lakh loan over 5 years at 11% interest gives an EMI of about ₹6,500, helping you plan better from the start.

- Keep EMIs within budget: Try to keep total EMIs under 40% of your monthly income. If you earn ₹50,000, an EMI of ₹20,000 or below allows room for essentials like rent, bills, and groceries, preventing financial stress.

- Review your monthly expenses: Before borrowing, list fixed expenses (rent, groceries, bills) and variable ones (shopping, dining). If your EMI stretches your budget too tight, cut back on non-essentials like subscriptions or weekend plans to avoid payment delays.

Consider Loan Tenure and Flexibility

- Choose tenure wisely: A short tenure (1–2 years) means higher EMIs but lower total interest. A longer tenure reduces your EMI but increases the total cost. Choose based on your income stability, for example, salaried workers often prefer 3–5 years for balance.

- Check for prepayment options: If your income increases or you get a bonus, prepaying your loan can reduce your interest burden. Some banks charge fees for early payment, while others don’t. Clarify terms before signing to avoid surprises later.

- Look for flexible terms: Some lenders offer features like step-up EMIs, where instalments rise with your income, or an EMI holiday for the first few months. These options can ease pressure, especially if you're starting a new job or business.

Common Pitfalls You Should Avoid

Even if you're eligible for that ₹3 lakh loan, small missteps can lead to costly consequences. Stay alert and avoid these common traps when applying.

- Don’t apply with multiple lenders at once:

- Submitting several applications simultaneously can hurt your credit score. Each triggers a hard inquiry, signalling financial stress and reducing your chances of approval or better terms.

- Always read the fine print:

- Loan agreements may include hidden fees, penalties, or inflexible terms. Review everything, from interest, processing charges, to late payment fines, before signing. This protects you from unpleasant surprises later.

- Only borrow what you need:

- Avoid the urge to over-borrow just because you're eligible. Higher loan amounts mean larger EMIs and more interest. Stick to the essentials to keep your repayments manageable.

Pocketly: Your Go-To for Instant, Small Loans

Getting a loan of ₹3 lakhs from a bank can take time- paperwork, approvals, and eligibility checks. But what if your financial need is urgent and the clock’s ticking?

That’s where Pocketly steps in. Whether it's a medical bill, travel expense, or end-of-month crunch, Pocketly offers quick personal loans of up to ₹25,000, designed to cover your immediate needs while you plan for bigger loans like ₹3 lakhs. No collateral, minimal KYC, and fast digital disbursal, so you’re not stuck when you need funds the most.

Why Choose Pocketly?

- Loan amounts from ₹1,000 to ₹25,000

- Interest rates starting at 2% per month

- 100% digital process with no physical documents

- Transparent fees of 1–8% processing charge, no hidden costs

- Flexible EMIs, partial repayments, and early closure allowed

- 24/7 support whenever you need help

How to Apply:

- Sign up using your mobile number on the Pocketly app.

- Upload your PAN and KYC documents digitally without any physical paperwork.

- Verify your profile to confirm your identity and eligibility.

- Enter your bank account details securely within the app.

- Choose your loan amount and tenure as per your current financial needs.

- Receive funds directly in your bank account once approved.

Please note that Pocketly is not an NBFC, but a secure and trusted digital lending platform that partners with RBI-approved NBFCs. So, if your bigger loan is stuck or delayed, Pocketly gives you a reliable way to manage your immediate cash flow needs.

Conclusion

When a bank gives a loan of amount INR 3 lakhs, it carefully evaluates your eligibility, credit score, and documents. With the right preparation, you can approach the process confidently and improve your chances of approval.

From planning your loan purpose to comparing lenders and calculating EMIs, every step plays a role in keeping your finances on track. Staying informed helps you to avoid slip-ups and choose the right loan confidently.

And if you're ever in need of smaller, instant loans for urgent expenses, Pocketly can help. Download the app on iOS or Android and get started within minutes- no brokers, no delays.

FAQ’s

1. How to get a 3 lakh loan immediately?

To get a ₹3 lakh loan quickly, apply through a bank’s digital platform or an approved lending app that supports instant disbursal. Make sure your documents, credit score, and income proofs are ready for faster approval.

2. How much salary is required for a 3 lakh loan?

While exact requirements vary, most banks prefer a monthly income of ₹15,000–₹25,000 or higher. Your repayment capacity, existing debts, and credit score also influence approval.

3. What is the monthly EMI for a 3 lakh loan?

The EMI depends on the loan tenure and interest rate. For example, at a 12% annual rate over 3 years, your EMI would be approximately ₹9,958 per month.

4. What is the new 3 lakh loan scheme?

The PM Vishwakarma Scheme offers a ₹3 lakh collateral-free loan to support traditional artisans and craftspeople. It’s disbursed in two phases- ₹1 lakh and ₹2 lakh, with flexible repayment terms.

5. How to clear a 3 lakh loan?

Create a realistic monthly repayment plan based on your income and expenses. If possible, make partial prepayments to reduce interest and close the loan faster without affecting your savings.