A credit score might look like a three-digit number, but it holds the power to shape your financial decisions, often without you realising it. For many, it remains just another score on a report until it quietly blocks access to something important: an emergency loan, a credit card upgrade, or even a phone on an EMI plan. And when it’s a CRIF credit score, lenders pay close attention to it.

Whether you're applying for a personal loan or planning to build a stronger financial profile, a low CRIF score can slow you down. But the good part? It's not permanent. With a few deliberate habits and some timely adjustments, improving your score is not only possible but also straightforward.

In this blog, we’ll explore practical tips to help you steadily increase your CRIF credit score while also understanding why it matters in the first place.

Key Takeaways

- What the CRIF credit score is, how it's calculated, and how it compares to other credit bureaus like CIBIL

- Why even a small unpaid amount or lack of credit activity can hold your score back

- The real-life impact of maintaining a low CRIF score, beyond just loan rejections

- Practical, scenario-based strategies to improve your CRIF score steadily, not just theoretically

What is a CRIF (Centre for Research in International Finance High Mark) Credit Score?

The CRIF credit score is a three-digit number that reflects your creditworthiness, indicating how reliable you are in repaying borrowed money. It typically ranges from 300 to 900, and the closer you are to 900, the stronger your chances of loan or credit card approval will be. Your CRIF score is calculated based on multiple factors, including your repayment patterns, current credit exposure, the types of credit you've used, and how frequently you apply for new loans.

Many of you might think that CRIF and CIBIL (Credit Information Bureau India Limited) scores mean the same thing, as both are approved by the RBI (Reserve Bank of India) and rely on similar financial data points, such as your repayment history, loan types, and credit usage. However, they function independently and maintain separate scoring systems. So, if a lender checks your CRIF score, he doesn’t need to be looking at your CIBIL record.

Here’s a basic score breakdown:

- 750–900: Excellent – Higher approval chances, better loan terms

- 700–749: Good – Usually accepted, possibly with standard interest rates

- 600–699: Fair – May face tighter scrutiny or limited options

- Below 600: Low – Harder to access credit, higher chances of rejection

Note: The CRIF score globally is generally the same, specifically 700.

Now, if you are also seeing a score of 600 on your CRIF score, then you need to understand the type of financial risks you are prone to now.

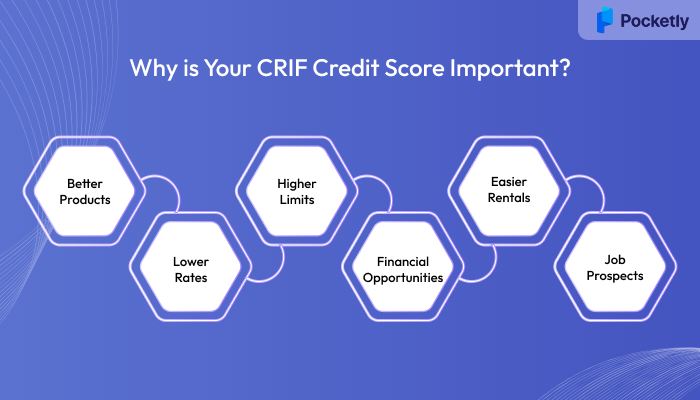

Why is Your CRIF Credit Score Important?

Your CRIF credit score is a key factor that influences your financial journey. It reflects your creditworthiness and plays a significant role in how lenders evaluate you. Understanding the importance of your CRIF score is crucial, as it impacts numerous aspects of your financial life.

Here's why maintaining a strong CRIF credit score matters:

1. Access to Better Financial Products

A higher CRIF score gives you better access to a wide range of financial products. Whether you’re applying for a personal loan, a car loan, or a credit card, a strong score increases your chances of approval and provides access to more competitive terms.

Benefit: Easier approval for loans with more attractive rates and conditions.

2. Lower Interest Rates

Lenders view individuals with higher CRIF scores as less risky, which often leads to lower interest rates on loans and credit cards. Over time, this can result in substantial savings, particularly on large loans like home or auto financing.

Benefit: Saving money on interest over the life of loans.

3. Higher Credit Limits

A strong CRIF score can result in higher credit limits from credit card issuers. Higher limits allow for greater financial flexibility and can improve your credit utilization ratio, further boosting your credit profile.

Benefit: Increased purchasing power and improved credit score due to better credit utilization.

4. Increased Financial Opportunities

A good CRIF score benefits not only your loan applications. It can open doors to better credit cards, higher limits, and financial products with improved benefits. With access to premium financial products, you can make smarter financial decisions.

Benefit: Access to better financial products, perks, and rewards.

5. Easier Approvals for Housing and Rentals

Landlords and property managers increasingly use a good CRIF score to assess potential tenants. A high score signals your reliability in managing finances, which can make it easier to secure rental properties or housing.

Benefit: Easier rental and housing approvals with better rental terms.

6. Potential Employment Benefits

Certain employers may check your credit score, particularly if the job involves handling money or sensitive financial information. A good CRIF score can give you an edge in the job market by demonstrating your financial responsibility.

Benefit: Enhanced job prospects, especially for roles that require financial responsibility.

Your CRIF score affects many aspects of your financial life, from loan approvals to job opportunities. Maintaining a good score opens up more options and helps you secure better terms.

What Consequences Might You Face for Not Maintaining Your CRIF Credit Score?

A weakened CRIF score changes how lenders evaluate your overall financial reliability, often affecting decisions and outcomes you may not immediately link to your credit profile. Here's what that can lead to:

- Higher Interest Rates: Even if your loan or credit card does get approved, lenders may consider you a high-risk borrower and compensate by charging a higher interest rate. Over time, this means you end up paying significantly more for the same amount compared to someone with a better score.

- Lower Credit Limits: Credit card issuers and lenders offer limited credit limits to individuals with weak credit scores. That can restrict your ability to manage emergencies or make planned purchases, especially if you’re relying on credit for flexible spending.

- Difficulty in Upgrading Financial Products: Whether it's upgrading to a premium credit card or accessing better loan terms, a poor score can delay or deny these options, even if your income has improved. Financial progress is often tied to credit behaviour, not just earnings.

- Impact on Co-applicants and Guarantors: If you're applying with a guarantor or as a co-applicant in the future, your low score could affect their eligibility, too. Lenders review the full profiles of all involved parties, and a single weak link may jeopardize the entire application.

- Limited Access to Emergency Credit: In time-sensitive situations, such as medical expenses or job loss, you may find it harder to access instant credit. Many digital lenders perform soft checks before approval, and a weak CRIF score can result in delayed or declined disbursals when you need funds the most.

- Negative Influence on Credit History Building: The longer your score remains low, the harder it becomes to build a healthy credit history. Missed opportunities to improve your score early on can make it more difficult to qualify for competitive offers later, even after your income or employment situation improves.

Also Read: Getting a Personal Loan with a Low CIBIL Score

Building your credit score is not an overnight process, but it needs time and an equal amount of effort. And to make that effort, you need practical strategies.

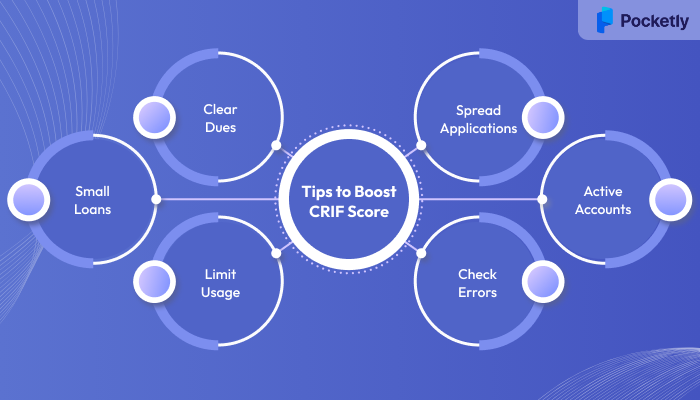

What Tips Can You Follow to Increase Your CRIF Credit Score

Many think avoiding mistakes improves their score. But credit scoring works differently. Unless there's visible, trackable credit activity on your profile, your score won’t move.

Tip 1: Clear any unpaid dues immediately

If you’ve ever missed a credit card payment, EMI, or even a buy-now-pay-later amount, it’s still visible in your CRIF report. Many borrowers assume small unpaid amounts don’t matter, especially if it's just a ₹500 charge, but they do. These dues get recorded as overdue, and until they are cleared, your score remains stuck.

Tip 2: Start with small loans that are easy to repay

If you're new to credit or your score is already low, avoid applying for big-ticket loans right away. A ₹10,000-₹50,000 loan might get rejected, or worse, become difficult to repay and further damage your profile. Take a ₹1,000-₹2,000 loan via a digital lending app and repay it in full within the timeline. Once that repayment gets reported, it starts building your score positively, even if the amount was small.

Tip 3: Don’t max out your credit card limit

Let’s say you have a credit card with a ₹20,000 limit and you use ₹19,000 every month. Even if you clear it fully, it gives the impression that you’re highly dependent on credit. Try to keep your monthly usage within 30-40% of the limit. If your limit is ₹20,000, aim to stay around ₹6,000-₹8,000. This simple adjustment can boost your score over time.

Tip 4: Avoid applying for multiple loans or cards in a short span

It’s natural to feel stuck after a loan rejection and try your luck with multiple lenders. But doing this all at once creates a string of "hard enquiries" in your CRIF report. What you can do is space out your applications. If rejected once, wait for at least 2–3 months, work on improving your profile in the meantime, and then apply again strategically.

Tip 5: Keep your oldest credit accounts active

If you got your first card five years ago and never defaulted, don’t shut it down just because you now have a newer one with better rewards. Instead, use it occasionally and repay on time; it helps maintain a strong credit age and stability in your score. A long credit history demonstrates that you've managed credit effectively over time.

Tip 6: Review your CRIF report regularly for errors

Even if you’ve done everything right, your score might still be low due to incorrect data, like a paid loan still marked as unpaid, or an account that doesn’t belong to you. To check that, request your CRIF credit report (you’re allowed one free report per year). Check for incorrect entries. If you find something off, raise a dispute with CRIF directly. Fixing even one error can make a noticeable difference.

Suggested Read: Understanding the Ideal CIBIL Score Range for Personal Loan Applications

Financial crises are not predictable; you can get stuck with one anytime without notice, so even though you are still in the process of fixing your credit score, you need help with an urgent loan. That’s why you need a platform like Pocketly.

How Pocketly Can Help Improve Your CRIF Score Even With a Low Rating

Improving your CRIF score takes time, but financial needs can’t always wait. If you're a student, salaried, or self-employed, the Pocketly platform offers access to small personal loans starting from ₹1,000, without requiring collateral or lengthy paperwork. These loans are easier to manage and repay, making them a smart option for building or repairing your credit profile.

Pocketly collaborates with trusted NBFC partners and employs flexible eligibility criteria. Even if your score isn’t ideal, your repayment behaviour on small loans through Pocketly gets reported to credit bureaus like CRIF. So every on-time repayment helps you strengthen your score over time.

Here’s how Pocketly makes borrowing easier and smarter:

- Loan amounts that match your starting point: Whether it’s an urgent bill or a short-term personal expense, you can borrow as little as ₹1,000, going up to ₹25,000, based on your need and repayment comfort.

- Minimal paperwork, no long processes: You don’t need to submit stacks of documents or visit any branch. Pocketly uses a fully digital KYC process. Most approvals happen quickly, so if you're short on time or managing things solo, it's still manageable.

- No hidden costs or surprise deductions: Unlike some platforms that charge joining or annual fees, Pocketly doesn’t. The charges are straightforward: a one-time processing fee (ranging from 1% to 8%) and a monthly interest rate starting at 2%. Everything is shown upfront before you confirm the loan.

- Access anytime, from anywhere: With 24/7 app-based access, you can apply for a loan whenever the need arises, without needing to wait for working hours or office approvals. And support is always available if you get stuck.

How to apply:

- Download the Pocketly app or visit the website

- Complete your KYC online (no physical docs needed)

- Choose the loan amount

- Get funds instantly upon approval

Download the Pocketly app on iOS or Android or visit the website to get started today.

Conclusion

While good credit habits are important, being aware of how the financial system works is equally important. Lending terms, interest structures, and eligibility rules can change, and not every lender adheres to the same standards. So, before applying for any loan, take a moment to review the platform, understand the repayment terms, and ensure everything checks out. Smart borrowing doesn’t start with the loan, it starts with knowing who you’re borrowing from.

And if you’re looking for a reliable way to start small and build steady credit, Pocketly gives you that head start with flexibility, transparency, and access even when your score is still finding its ground.

Your credit journey doesn’t have to wait for the perfect moment. Download Pocketly on iOS or Android and start with what works now.

FAQs

Q1. What do those exclusion codes (11–18) on my CRIF report mean?

A1. CRIF uses special codes, such as 11–18, to indicate specific cases, including "No History" (no loan data), "Multiple IDs linked," or "Closed accounts over 36 months ago." These aren't scores per se; they indicate reasons why your profile may not have an active score.

Q2. Can I correct errors in my credit report, and how long does it take for the correction to be updated?

A2. Yes. If you spot mistakes, such as a loan showing as overdue despite having been fully paid, you can raise a dispute via the CRIF portal. Credit bureaus in India are required to investigate and resolve disputes within 30 days of receipt.

Q3. Why do I see different scores on different platforms?

A3. Your CRIF score may differ slightly from your CIBIL score because some apps assess similar data in distinct ways. Apps like Avail, Cred, and Paytm pull scores from different bureaus (CRIF, CIBIL, Experian), where each bureau uses its own algorithm.

Q4. Is CRIF RBI approved?

A4. Yes, CRIF High Mark is an RBI-approved credit bureau operating in India. It holds a registered license under the Reserve Bank of India and is one of the country’s four licensed credit bureaus, alongside CIBIL, Experian, and Equifax