Artificial intelligence is becoming a familiar part of everyday money tasks. Many banking apps, payment tools, and digital lending platforms already use it to make services faster and safer.

You may notice it when an app alerts you about unusual spending, shows personalised offers, or predicts your monthly expenses. These small moments are powered by simple AI systems that learn from data.

AI is shaping how people save, spend, and access financial help in India. This guide explains what AI in finance really means and how it affects young Indians, early professionals, and anyone curious about modern financial tools.

Key Takeaways

- AI simplifies money tasks: It helps you track spending, manage budgets, and understand your financial habits with less effort.

- AI strengthens safety: It detects suspicious activity quickly and makes digital transactions more secure for everyday users.

- AI improves access: It supports fairer decisions for young or new-to-credit borrowers, making financial services more inclusive.

- AI needs wise use: It is a helpful guide, but personal judgment, safe app choicesAand responsible financial habits remain essential.

What Is AI in Finance?

AI in finance refers to technology that learns from data and helps financial systems make smarter decisions. Instead of relying only on fixed rules, AI studies patterns in payments, spending, behaviour, and risk. This helps banks, fintechs, and digital platforms offer safer, faster, and more personalised services.

AI in finance usually works through three simple elements:

- Data: Information about transactions, spending, and user behaviour.

- Learning: Algorithms that notice patterns and update themselves over time.

- Decisions: Small actions like predicting risk, suggesting offers, or alerting you to unusual activity.

AI does not replace humans in finance. It supports them by handling repetitive tasks, reducing errors, and improving accuracy.

Most people interact with AI without realising it, such as when an app predicts your monthly bill or blocks a suspicious transaction. These tools make digital finance easier and more secure for everyday users.

Also Read: Recent Financial Services Trends of 2025

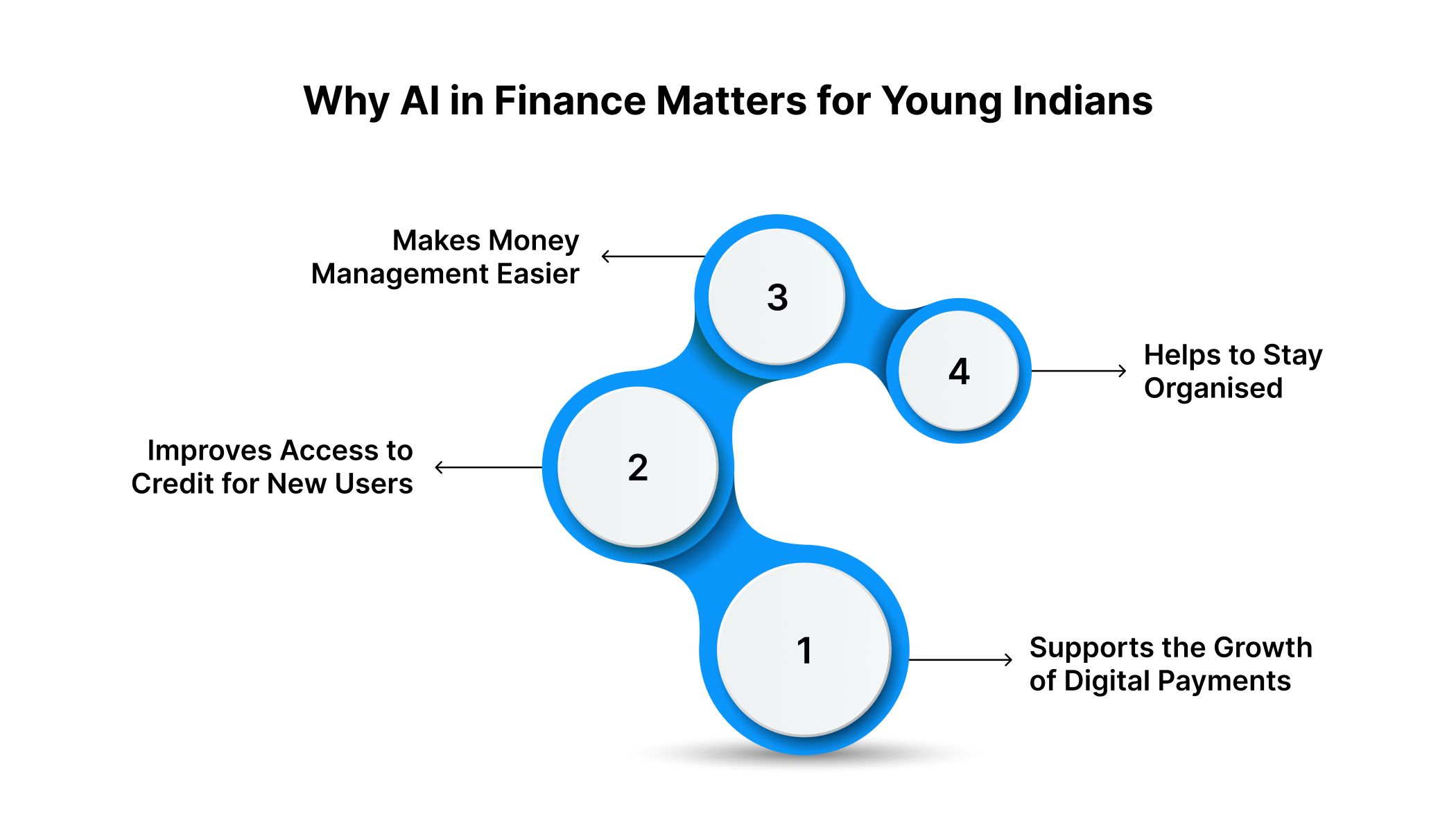

Why AI in Finance Matters for Young Indians

AI is shaping how young Indians manage their money. With rapid growth in digital payments and financial apps, AI plays a role in almost every step of the financial journey. It helps reduce errors, speed up applications, and make tools easier for first-time users.

1. Supports the Growth of Digital Payments

UPI, wallets, and online banking platforms use simple AI models to manage transaction load, spot errors, and ensure smoother payments. This helps students and young professionals make quick payments without delays.

2. Improves Access to Credit for New Users

Many young Indians have limited financial history. AI helps digital platforms understand spending patterns and assess risk in a fairer way. This gives new users a better chance to access short-term credit, even without a long credit record.

3. Makes Money Management Easier

AI-powered apps send reminders, track expenses, and identify unusual spending. These small nudges help users control their monthly budget, which is especially useful for people starting their financial journey.

4. Helps Self-Employed and Freelancers Stay Organised

Irregular income makes money planning difficult. AI tools can predict incoming payments, track invoices, and suggest ways to manage cash flow. This supports young entrepreneurs who rely on variable earnings.

AI matters because it makes financial tasks simple, safe, and accessible. It helps young Indians build confidence while handling money digitally.

Also Read: Understanding Cash Flow: Definition, Types, and Analysis

Everyday Examples of AI in Personal Finance

AI already plays a role in many daily money tasks, even if you do not notice it. These tools help you manage spending, track bills, and make better decisions with less effort. They work quietly in the background to create a smoother experience.

Smart Budgeting and Spending Insights

Many financial apps use AI to sort your expenses into clear groups such as travel, food, groceries, and shopping. This helps you see where your money goes and what you can adjust.

Example: An app may alert you if your food spending is higher than last month or if a bill is due soon.

AI-Powered Saving Suggestions

Some apps study your spending behaviour and suggest small saving goals. They may recommend saving a small amount weekly or monthly based on your usual spending pattern.

Subscription and Bill Tracking

AI can spot recurring payments and remind you before the next cycle. It can also alert you to services you no longer use, helping you reduce unnecessary expenses.

Personalised Offers and Rewards

Banks and payment apps use AI to show offers that match your habits. For example, you may receive a travel offer if you often book buses or trains.

These tools help young Indians stay organised and aware of their financial choices.

Also Read: 6 Simple Budgeting Tips for Better Money Management

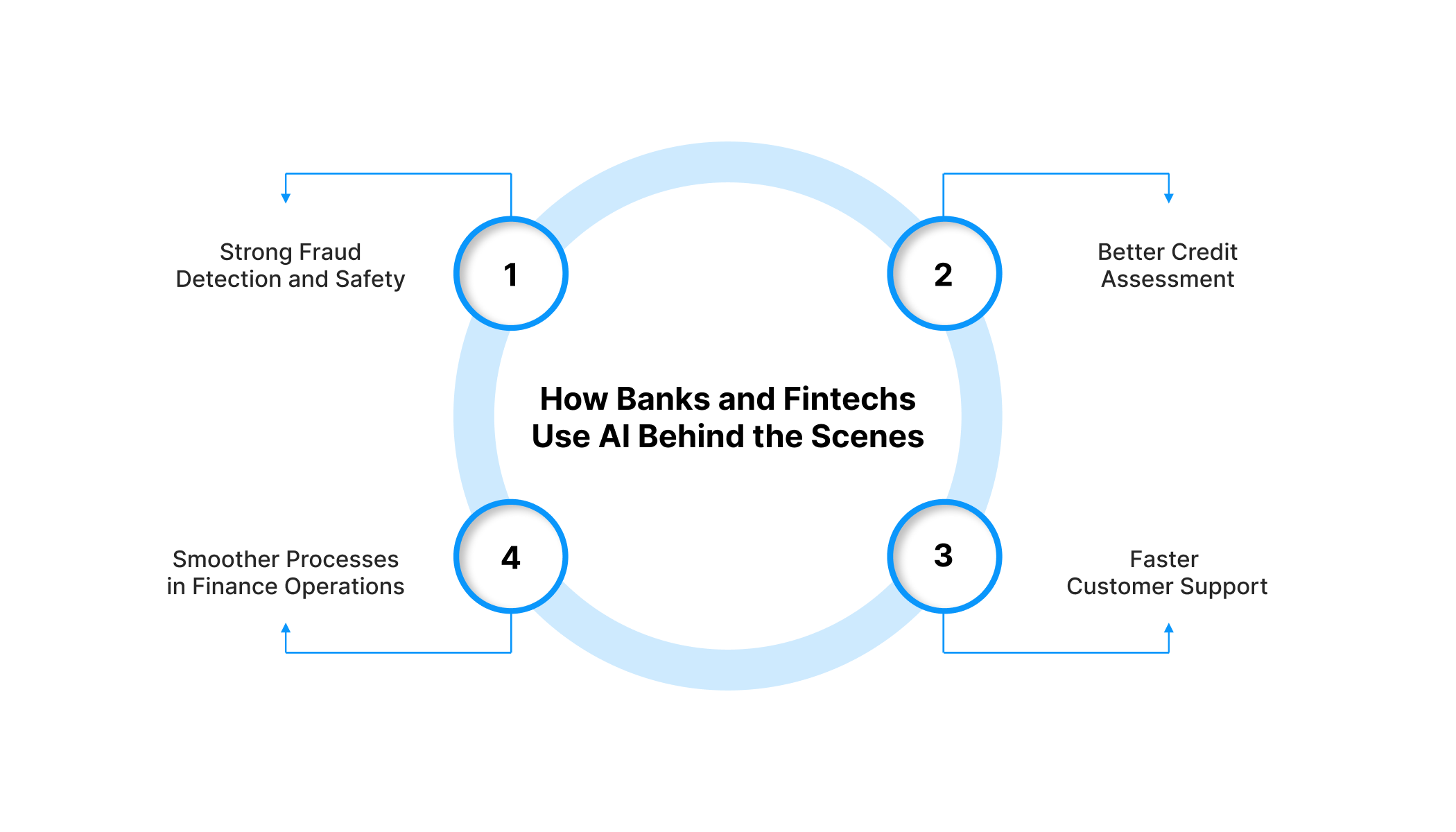

How Banks and Fintechs Use AI Behind the Scenes

Banks and fintech companies use AI to make their systems faster, safer, and more reliable. Customers may not always see how it works, but AI supports many essential tasks.

1. Strong Fraud Detection and Safety

AI studies spending behaviour and identifies unusual activity within seconds. If a transaction looks suspicious, the system alerts you or blocks it to keep your money safe.

Example: If your card is used in another city within minutes of a local purchase, AI may flag it for review.

2. Better Credit Assessment

Earlier, banks depended mostly on credit history to judge eligibility. AI improves this process by looking at behaviour, transaction patterns, and repayment habits.

This helps people with limited credit history access financial products more easily.

3. Faster Customer Support

Many apps use AI-driven support systems to answer questions, guide users, and resolve simple issues quickly. This reduces waiting time and improves the overall experience.

4. Smoother Processes in Finance Operations

AI helps banks process documents, verify information, and manage large volumes of transactions.

This reduces human error and speeds up approval times for services such as loans or account updates.

AI works quietly in the background, but its impact is visible in faster services, safer transactions, and more accurate decisions.

Also Read: Understanding Lending in Banking: Types and Importance

Key Benefits of AI in Finance for Customers

AI brings several practical advantages that improve how people manage their money. These benefits can be seen in daily tasks such as paying bills, tracking expenses, applying for loans, and using banking apps.

Each improvement helps users save time, reduce errors, and make better choices without needing advanced financial knowledge.

1. Faster and Smoother User Experiences

AI processes information quickly, which makes approvals, payments, and transactions run more smoothly. This reduces delays and helps young users complete urgent tasks without stress. It also lowers the chances of errors that sometimes occur during manual checks.

2. Better Insights Based on Your Behaviour

AI studies spending patterns and highlights small changes that may affect your budget. For example, an app may show that your food or travel spending increased last month.

These simple insights help you understand your habits and adjust your choices without much effort or confusion.

3. More Personalised Services

Banks and fintech apps use AI to create offers and suggestions that match your behaviour. This may include reminders, credit limits, rewards, or loan recommendations that suit your lifestyle.

Personalisation helps you pick products that support your needs instead of navigating many generic options.

4. Improved Access for New to Credit Users

AI looks beyond traditional credit history to understand behaviour, stability and spending patterns.

This helps first-time borrowers or young earners access financial products with fewer barriers. It gives people a fair chance to build their credit profile while using services that fit their situation.

Also Read: The Rise and Benefits of Fintech Lending

Risks and Challenges of Using AI in Finance

AI improves many financial services, but it also brings certain risks that users should understand.

Knowing these risks helps you stay cautious, especially when sharing information or using new financial tools. It also ensures that you rely on AI wisely instead of depending on it fully.

Data Privacy Concerns

AI systems learn from large sets of data, which often include personal details and transaction patterns.

If a platform does not follow strong security practices, your information may become unsafe. Choosing trusted and regulated financial apps reduces this risk.

Bias in Automated Decisions

AI models learn from the data they are trained on. If the data has gaps or unfair patterns, the decisions may also be unfair.

For example, an automated risk check may judge stability incorrectly if it does not understand your complete financial behaviour. This is why responsible companies monitor their systems closely.

AI-Powered Scams and Fake Messages

Scammers use AI tools to create realistic messages, voice calls, and fake advertisements. These attempts can look genuine and may mislead users into sharing personal information. Staying alert and verifying anything unusual can help you avoid such scams.

Overdependence on Automated Advice

AI helps with budgeting and planning, but it does not replace personal judgment. Automated suggestions may not always consider your goals or responsibilities.

Using AI as support, rather than your only guide, leads to better decisions and a safer approach to money management.

Also Read: How Credit Risk Models Help Loan Apps Approve First-Time Borrowers Faster

How to Use AI Tools to Manage Your Money Smarter

AI tools can make money management simple, especially when your schedule is busy or your income is unpredictable.

These tools guide you through budgeting, tracking, saving, and planning. When used well, they help you stay organised without spending too much time on manual checks.

For Students: Build Awareness and Small Habits

Students often deal with limited budgets and irregular spending. AI tools help them stay aware of where their money goes. Useful features include:

- Automatic expense categorisation

- Reminders for upcoming payments

- Weekly summaries of spending trends

- Simple saving suggestions

Example: An app showing that your food spending increased last week helps you adjust your choices early instead of facing a shortage later.

For Salaried Professionals: Plan and Optimise Income

A steady salary gives you room to plan better. AI tools help you:

- Set monthly budgets

- Identify unnecessary expenses

- Schedule savings on salary day

- Track subscriptions and recurring bills

These systems reduce manual effort and keep your financial routine consistent.

For Self-Employed Workers: Manage Irregular Cash Flow

Freelancers and business owners often work with unpredictable income. AI tools help create clarity by:

- Predicting expected payments

- Tracking overdue invoices

- Highlighting slow and high-earning months

- Suggesting cash flow adjustments

This helps you plan spending and saving without constant guesswork.

How to Choose Safe and Reliable AI Apps

Before downloading any AI-powered finance tool, check for:

- A clear privacy policy

- Secure login features

- Transparent data usage statements

- Strong user reviews

- Verified developers or registered companies

These checks ensure your information stays safe while you use the app.

Also Read: Top Instant and Safe Personal Loan Apps in India

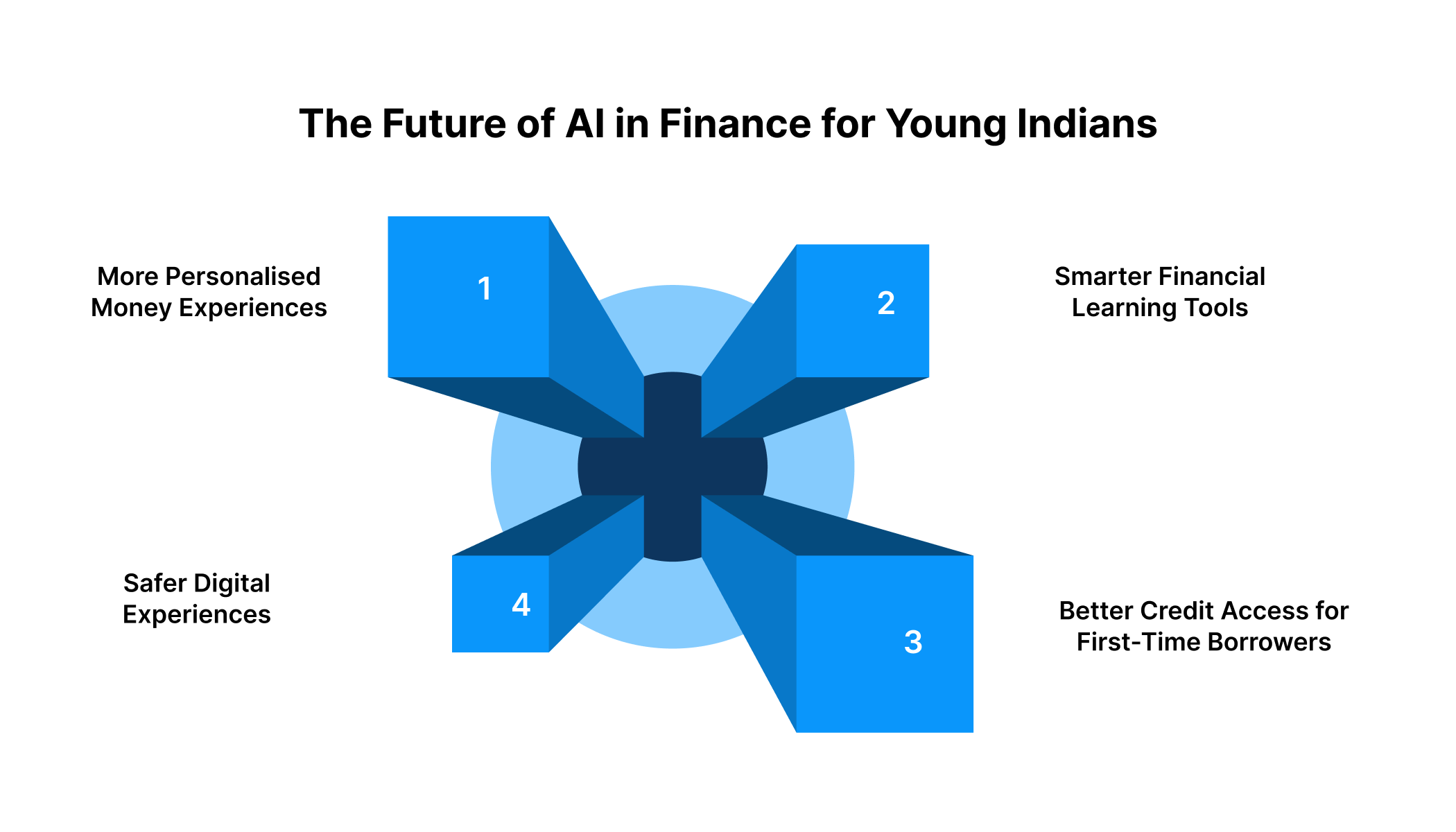

The Future of AI in Finance for Young Indians

AI will continue shaping how young Indians interact with money. As digital tools grow smarter, financial journeys will become more personalised, faster, and easier to understand.

This shift will support people who are new to credit, working with irregular income or trying to build better habits.

1. More Personalised Money Experiences

AI will analyse spending behaviour and suggest tailored financial actions. This may include budget recommendations, saving reminders, or early warnings about upcoming shortages. These insights will help users make confident decisions without relying on guesswork.

2. Smarter Financial Learning Tools

Future AI systems will guide users through money concepts in simple ways. They may explain interest, budgeting, or savings targets using examples based on real behaviour. This makes financial learning more relatable for students and new earners.

3. Better Credit Access for First-Time Borrowers

More lenders may use AI to understand risk in a balanced way. This can help young professionals or self-employed workers who lack long credit histories.

AI-based assessments may consider their digital behaviour, spending stability, and repayment patterns, offering fairer access to credit.

4. Safer Digital Experiences

AI will also improve fraud detection and security. As scams grow more advanced, AI tools will help identify suspicious activity faster and alert users early. This builds trust in digital payments and online borrowing.

AI will continue to influence how people manage, save, and borrow money. Staying informed helps young Indians use these tools wisely and make decisions that support long-term stability.

Pocketly’s: Supporting Smart and Responsible Financial Choices

AI tools can help people understand their spending and plan their monthly budgets. However, even with good planning, unexpected situations can create short-term money gaps.

In such moments, responsible access to small credit can help users manage essential expenses without long delays. This is where Pocketly becomes useful for young Indians facing real emergencies.

Pocketly is a digital lending platform that offers short-term personal loans for urgent needs.

It is designed for students, young professionals, and self-employed individuals who require quick financial support. Pocketly partners with registered NBFCs to provide these loans and does not operate as an NBFC itself.

Pocketly offers:

- Small personal loans between ₹1,000 and ₹25,000

- No collateral requirement

- Fast fund access after eligibility checks

- Interest rates start at 2% per month

- Processing fees range between 1% and 8% of the loan amount

- A fully digital, simple, and transparent journey

Pocketly aims to help young Indians handle genuine short-term expenses, such as medical visits, urgent travel, or essential repairs.

It is not intended for everyday spending or lifestyle choices. Used responsibly, it can act as a temporary bridge during an emergency while users continue building good financial habits.

Conclusion

AI is shaping how people manage, save, and understand their money. It helps users make sense of spending patterns, track bills, and receive insights that support better decisions.

Banks and fintech companies use it to build smoother, safer, and more reliable services. These changes benefit young Indians who depend on digital tools for their daily financial tasks.

However, AI is only a guide. It cannot replace careful judgment or responsible planning. Using the right apps, staying aware of risks, and choosing trusted platforms helps you manage your finances with more confidence.

When real emergencies appear, short-term credit from reliable platforms can offer temporary support while you continue building healthy financial habits.

If you need short-term help during an urgent situation, you can download the Pocketly app from Google Play or the App Store.

FAQs

What does AI do in finance?

AI studies patterns in data and helps fintech companies automate simple tasks. It supports decisions, improves safety, and creates smoother digital experiences for customers.

Is AI safe to use in financial apps?

Yes, when the platform follows strong security practices and protects user data. Choosing trusted apps helps ensure that your information remains secure.

Does AI replace human advice in finance?

AI offers suggestions and insights, but it does not replace human judgment. It works best as a supportive tool that helps you understand your spending and make informed choices.

How do banks use AI behind the scenes?

Banks use AI to detect fraud, review transactions, support customer queries, and streamline internal operations. These steps help them offer faster and safer services.

How can I use AI tools to manage my money better?

You can use AI-powered apps for budgeting, tracking expenses, receiving reminders, and understanding your spending behaviour. These tools help you build good habits with less effort.

Is AI useful for people with irregular income?

Yes. AI tools can track cash flow, predict upcoming payments, and highlight slow income periods. This helps self-employed individuals plan their monthly spending more confidently.