Have you ever wondered how banks decide who gets a loan and who doesn’t? Banks don’t just hand out money! They assess your creditworthiness, financial history, and even your future plans before deciding whether or not to approve your loan.

The process might seem confusing, especially if you’re a young professional trying to manage unexpected expenses. Understanding the basics of lending can help you see how money flows from banks to people and businesses.

This blog will clarify what is lending in banking, covering the essentials from the process to tips for getting approved. Learn the ins and outs of lending so you can access money quickly, confidently, and without surprises.

At A Glance:

- Lending in banking is when financial institutions provide money, expecting repayment with interest.

- Common types of lending include personal, commercial, and real estate loans, each serving different needs.

- The lending process involves application, underwriting, approval, and closing to ensure responsible borrowing.

- When choosing a lender, compare interest rates, fees, and repayment terms to find the best fit.

- To improve loan approval chances, maintain a good credit score, keep a steady income, and have low debt levels.

What Is Lending In Banking?

Wondering what exactly lending in banking means and how it affects you? Simply put, lending is when a bank or financial institution provides money to someone with the understanding that it will be repaid, usually with interest. This system allows people to access funds for emergencies, education, or other important needs.

Who is a Lender?

A lender is anyone giving out this money, be it a bank, a credit union, or even a peer-to-peer lending platform. Lenders make funds available so borrowers can meet personal or business needs efficiently.

Before approving a loan, lenders usually check a borrower’s creditworthiness. This can include reviewing your credit score, income, or existing debts. By doing this, they ensure that both the borrower and the lender benefit from the lending process.

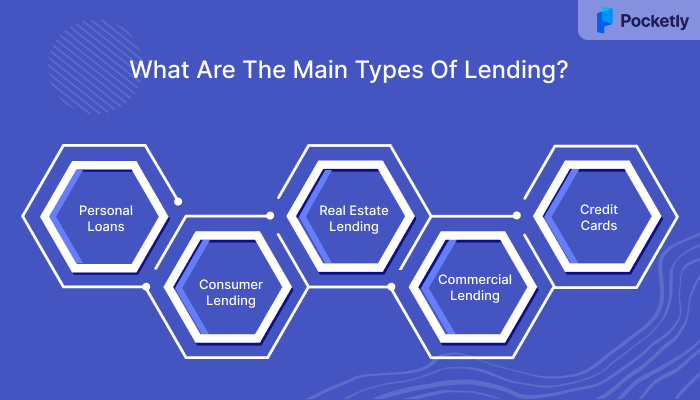

What Are The Main Types Of Lending?

There are several types of lending, each suited to different needs and circumstances. Here's a breakdown of the main types:

- Personal Loans

- Personal loans are usually unsecured and ideal for covering smaller, urgent expenses like medical bills, debt consolidation, or home repairs. They are flexible and do not require collateral.

- Consumer Lending

- This type of lending is meant for personal needs, such as buying a car, funding your education, or covering emergency expenses. It allows you to manage costs without waiting to save.

- Real Estate Lending

- Real estate lending provides funds to buy, build, or renovate residential and commercial properties. It supports both personal property investment and business real estate ventures, making large purchases more accessible.

- Commercial Lending

- Businesses use commercial lending to finance operations, purchase equipment, or fund expansion projects. These loans help companies grow, create jobs, and maintain a steady cash flow for smoother operations.

- Credit Cards

- Credit cards offer revolving credit, letting you borrow up to a set limit for daily purchases, emergencies, or short-term needs. They provide convenience but require timely repayments to avoid high interest.

Also Read: Understanding the Process and Meaning of Credit Control

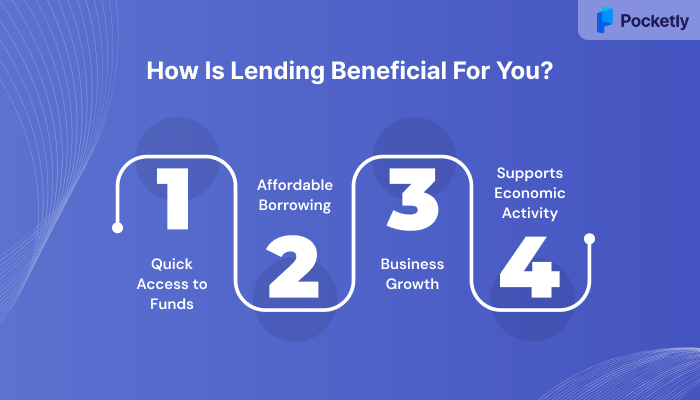

How Is Lending Beneficial For You?

Banks do more than provide loans; they open opportunities for you. With lending, you get the chance to manage cash flow smoothly and achieve your goals without waiting to save large amounts. Here’s how lending in banking can benefit you:

- Quick Access to Funds: Lending helps you get money when you need it the most, whether it's for an emergency or a planned purchase.

- Affordable Borrowing: With lower interest rates and flexible repayment options, lending makes large expenses more manageable.

- Business Growth & Job Creation: Lending helps businesses expand, which can create job opportunities and a healthier economy.

- Supports Economic Activity: With access to credit, consumers spend more, which boosts economic growth and drives demand in the market.

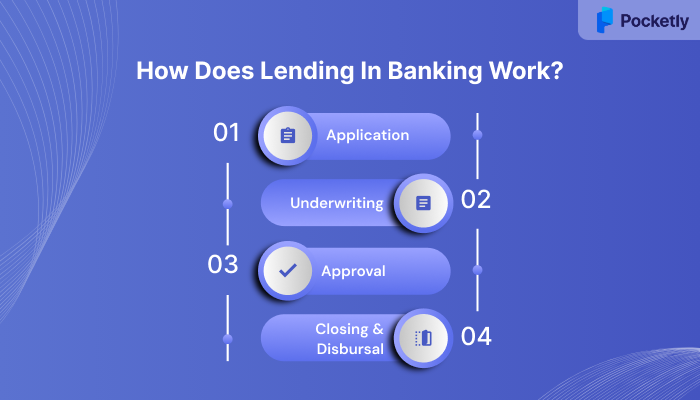

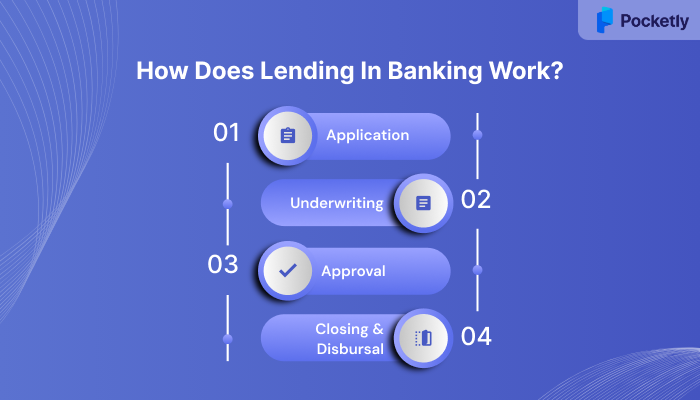

How Does Lending In Banking Work?

Understanding what is lending in banking also means knowing the steps involved to get a loan. Here’s a quick step-by-step process:

Application

The first step is applying for a loan. Depending on your lender, you can apply in person, via phone, or online. This typically requires personal details.

- Your personal details, including name, address, and government ID.

- Employment and income information to verify your repayment capacity.

- Details of existing debts and credit cards to assess financial obligations.

- Your credit history and payment track record are used to determine reliability.

Underwriting

During underwriting, the lender analyses your application to assess your creditworthiness. This step helps determine the loan’s terms and conditions.

- Evaluating your income, debts, and employment history to gauge risk.

- Reviewing your credit score to assess repayment reliability.

- Deciding whether to approve the loan and at what interest rate.

Approval

Once your application passes underwriting, the lender sends a loan offer. This outlines the amount, interest rate, and repayment terms.

- Understanding the terms ensures you can manage repayments comfortably.

- You have the option to accept or decline the offer.

- Any conditions or contingencies are clearly stated in the offer.

Closing And Disbursal

Once you agree to the loan offer, the final step is signing the agreement. This formalises the loan and sets all the terms in place.

- You review and sign the loan agreement detailing all terms and fees.

- The lender sends the funds directly to your account.

- You begin repayment according to the agreed schedule.

How Do You Choose The Right Lender?

Choosing the right lender ensures manageable repayments and a smooth borrowing experience. Consider the following factors:

Interest Rates

Interest rates determine how much you pay on top of the borrowed amount. Comparing rates from different lenders helps you choose the most affordable option, reducing overall repayment costs.

Fees

Lenders often charge various fees, such as application fees, processing charges, and prepayment penalties. Understanding these fees upfront helps you avoid unexpected costs and pick the best deal.

Repayment Terms

Repayment terms specify the length of time you have to repay your loan. Selecting terms that match your budget ensures you can make regular payments without financial strain.

Reputation

A lender’s reputation reflects reliability and trustworthiness. Checking ratings, online reviews, and feedback from other borrowers ensures you choose a lender with a proven track record.

Also Read: Applying for Short-Term Loans Online at Lowest Interest Rates

How Can You Improve Your Chances Of Getting Loan Approval?

Now that you know what is lending in banking, here’s how you can improve your odds of getting a loan approved:

- Show Consistent Income: Lenders look for proof that you can repay the loan reliably. Submitting pay stubs, bank statements, or tax documents shows stable earnings.

- Keep a Healthy Credit Score: A strong credit score signals responsibility with borrowing. Paying bills on time, clearing debts, and avoiding defaults all help improve your creditworthiness.

- Lower Your Debt-to-Income Ratio: This ratio shows how much of your income goes toward current debts. Keeping it low makes you a more attractive borrower with capacity for new loans.

- Provide a Down Payment: Some loans require an upfront payment, which reduces the borrowed amount. Making this payment lowers the lender’s risk and increases your approval chances.

Simplifying Lending For Emergencies With Pocketly

Lending in banking is all about providing access to funds when you need them, and Pocketly brings this concept to life for young Indians. Whether it’s an unexpected expense or a short-term cash shortage, Pocketly offers flexible personal loans from ₹1,000 to ₹25,000 with no collateral.

Approval is fast, and funds are transferred directly to your account. The platform is fully transparent, with rates starting at 2% per month and processing fees ranging from 1-8% of the loan amount.

Simple Loan Application Process:

- Sign up in just 2 clicks.

- Upload KYC documents and verify your profile.

- Provide bank account details.

- Choose your loan amount and repayment tenure.

- Get funds disbursed directly into your account.

With flexible EMIs, 24/7 support, and perks for timely repayments, Pocketly helps you manage emergency finances efficiently. As a digital lending platform, it ensures quick, short-term loans whenever you need them.

In Summary

Lending in banking helps both businesses and individuals to achieve their financial goals. From knowing what is lending in banking to choosing the right lender, being informed ensures smarter borrowing decisions. Always compare offers, read the guidelines carefully, and make sure repayments fit your budget.

Short-term loans can be simple and reliable when you choose the right platform. Pocketly can assist you with quick, flexible personal loans designed to help you in times of need. With minimal documentation and 24/7 support, you can get your loan approved in minutes.

Download the Pocketly app on iOS or Android and take control of your finances today.

FAQ’s

1. What do you mean by lending in banking?

Lending in banking is when banks or financial institutions give money to someone with the promise that it will be paid back with interest. This helps people and businesses access funds quickly. Knowing what is lending in banking makes it easier to borrow wisely.

2. What's the difference between lending and a loan?

Lending is the act of giving money, while a loan is the actual money you borrow. In other words, lending is the process, and a loan is the result.

3. What are the 4 stages of lending money?

The four main steps are applying for the loan, checking your financial background (underwriting), approving the loan, and finalising it (closing). Each step makes sure both you and the lender are protected.

4. What are the 3 C's of lending?

The 3 C's are Character, Capacity, and Capital (or Collateral). They help lenders check your reliability, ability to repay, and financial backup before giving a loan.