Ever wondered why some loan applications get approved instantly while others take longer? For first-time borrowers or those with limited credit history, this can feel confusing. Knowing how to build a credit risk model allows lenders to make faster, fairer decisions, which directly affects how quickly you can get your loan.

A strong credit risk model can mean quicker access to funds, fairer interest rates, and a smoother borrowing experience for you. By using the right data and tools, lenders can identify reliable borrowers, even if they have little or no credit history.

In this guide, we’ll break down the basics of credit risk models and the key factors that influence them. Read along to use this knowledge to improve your chances of faster loan approvals and better terms.

In A Nutshell

- A credit risk model predicts how likely a borrower is to repay their loan.

- Lenders assess risks like default probability, loss at default, and overall financial stability.

- Assessment includes credit history, financial stability, credit rating, and debt-to-income ratio.

- Alternative data improves risk evaluation for first-time borrowers with limited or no credit history.

What Is A Credit Risk Model?

In simple terms, a credit risk model helps lenders estimate the likelihood of a borrower repaying their loan on time. Knowing how to build a credit risk model helps lenders make fair and informed decisions, especially when working with first-time borrowers.

Types of Credit Risk Models:

- Credit Default Risk: Focuses on whether a borrower may fail to make interest or principal payments.

- Concentration Risk: Evaluates risk when a lender or borrower is heavily dependent on a single sector or counterparty.

- Country Risk: Considers potential defaults due to political instability or economic conditions in a borrower’s country.

Using these risks, lenders take informed decisions about loan approvals, while keeping the chances of default low.

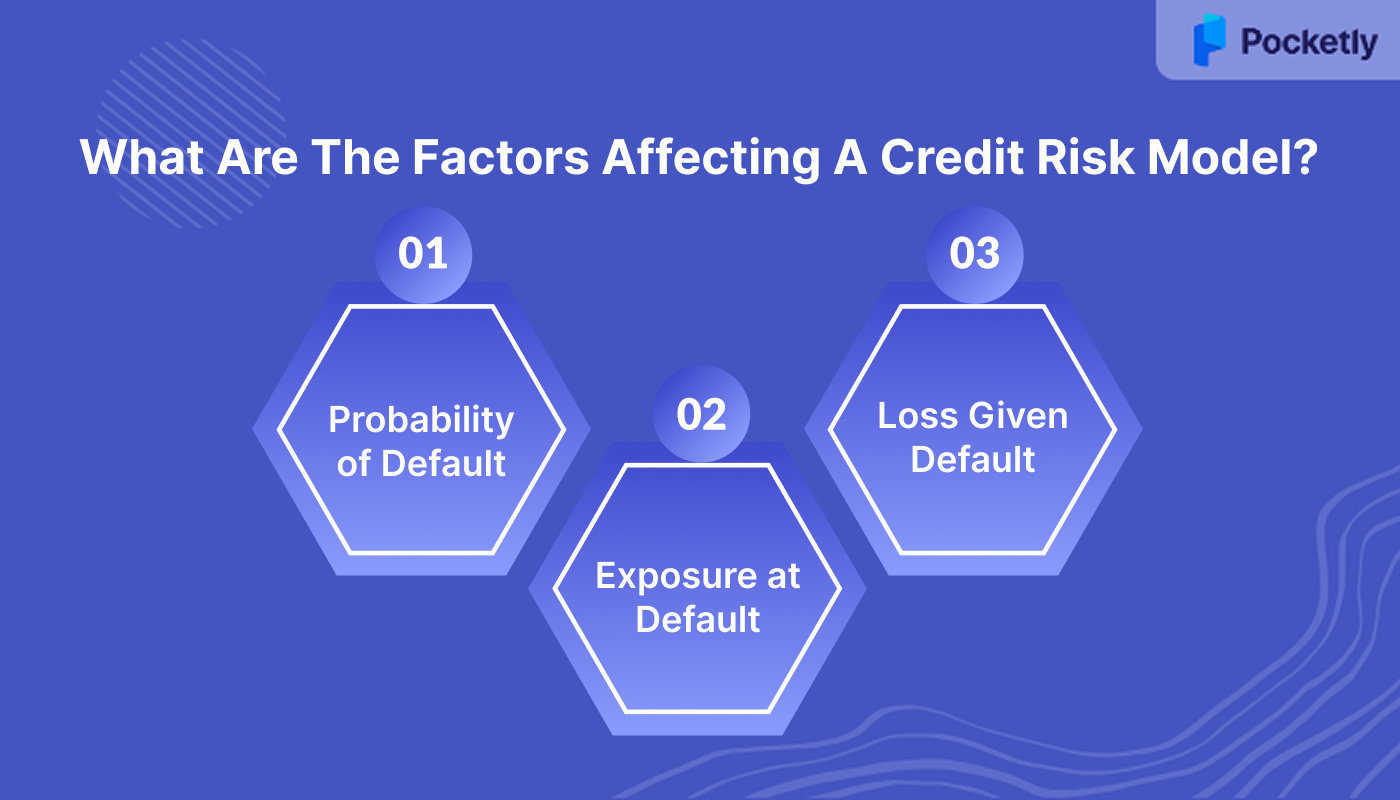

What Are The Factors Affecting A Credit Risk Model?

Before approving a loan, lenders look at several factors that shape how a credit risk model works. Understanding these can also help you see what impacts your loan approval.

Probability of Default (PD)

PD estimates the likelihood that you may fail to repay your loan within the agreed tenure. Lenders analyse your past repayment behaviour, credit history, and outstanding debts to calculate this risk. A higher PD may lead to stricter loan terms or higher interest rates.

Exposure at Default (EAD)

EAD measures the total outstanding loan amount you would owe at the time of default. It helps lenders understand their financial exposure and manage potential losses if repayment stops unexpectedly. This value changes with every repayment you make.

Loss Given Default (LGD)

LGD represents the portion of the loan that may remain unrecovered if you default. Lenders calculate this after considering any repayments, collateral, or other recoverable assets. This ensures they estimate potential losses accurately before approving a loan.

Also Read: Getting Personal Loan with Low CIBIL Score

How Do Lenders Build A Credit Risk Model?

To understand how to build a credit risk model, lenders use advanced techniques to look at patterns in financial behaviour. These methods go beyond traditional credit scores and help borrowers get fairer assessments.

Common approaches include:

- Machine Learning: ML helps computers find patterns that humans might miss. For example, it can analyse your digital transactions, payment history, and spending behaviour to estimate the likelihood of repayment. Over time, the system improves its predictions as it learns from new data.

- Artificial Intelligence: AI allows lenders to make faster, data-driven decisions. It can suggest whether to approve a loan, the interest rate, and the loan amount, based on your credit risk. This technology is especially helpful for quick approvals of short-term or smaller loans.

How Is A Credit Risk Model Assessed?

Once we’ve built the model, it’s time to check how well it predicts repayment behaviour. Assessing a credit risk model involves looking at different aspects to ensure accuracy:

- Credit History: Lenders examine your past repayments, credit utilisation, and how long you’ve maintained active credit accounts.

- Financial Stability: Your assets, liabilities, and income consistency are evaluated to check your ability to meet loan obligations without defaulting.

- Credit Rating: A numerical score indicates your creditworthiness. Higher scores suggest lower risk, while lower scores may result in higher rates or denial of the loan.

- Debt-to-Income Ratio: Lenders compare your monthly obligations to your income to see if you can comfortably manage additional loan repayments.

Also Read: Credit Card for Low CIBIL Score in India

What Is The Role Of Alternative Data In Credit Risk Management?

When you apply for a loan, we don’t just rely on your traditional credit history. Alternative data helps us see a more complete picture of your financial reliability, especially if you have little or no credit record.

By looking at factors like mobile payment history, utility bill payments, rental records, and even employment patterns, we can:

- Expand access: Approve loans for people without prior credit history or formal employment.

- Optimise risk checks: Analyse hundreds of data points for a detailed view of your repayment potential.

- Prevent fraud: Use verification tools to flag suspicious applications before they cause harm.

For first-time borrowers, this means faster approvals and fairer assessments.

How Pocketly Ensures Quick Approvals While Managing Risk

A borrower’s credit risk profile naturally affects how quickly loans are approved. At Pocketly, we combine this understanding with smart assessment processes to ensure that even first-time borrowers can access short-term funds.

Pocketly offers flexible personal loans from ₹1,000 to ₹25,000 with no collateral, fast approval, and instant bank transfers. Interest rates start at 2% per month, with processing fees between 1–8%. Minimal KYC, flexible EMIs, no hidden charges, and 24/7 support make borrowing simple and reliable.

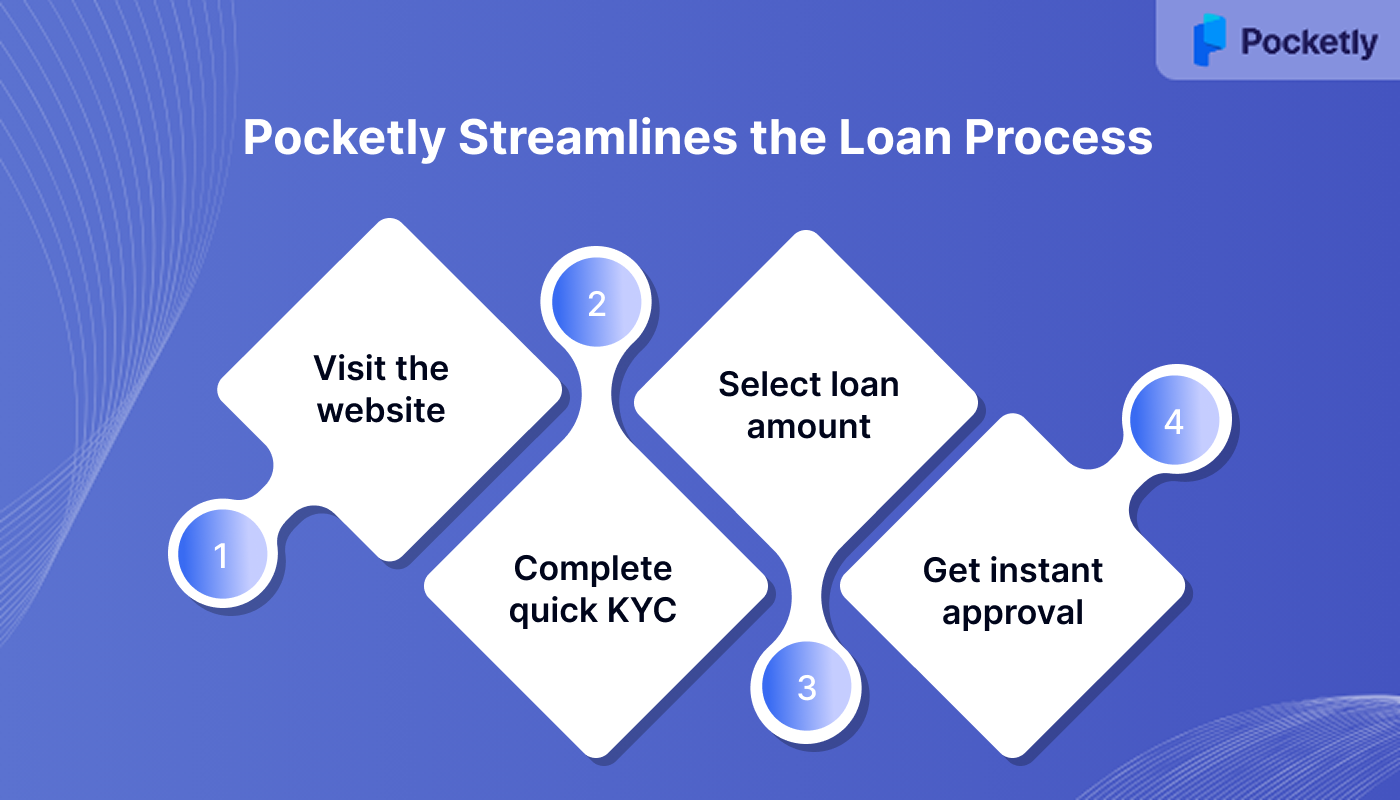

As a digital lending platform, Pocketly streamlines the loan process:

- Download the app or visit the website.

- Complete quick KYC with no physical documents.

- Select your loan amount.

- Get instant approval and funds transferred directly to your account.

By carefully assessing credit risk and your creditworthiness, Pocketly ensures faster approvals while keeping borrowing safe and reliable.

Final Thoughts

Understanding how to build a credit risk model gives you insight into why lenders approve loans differently and how your financial behaviour matters. By knowing the key factors like credit history, probability of default, and alternative data, you can better manage your creditworthiness.

At Pocketly, we apply these principles to ensure quick, transparent, and reliable short-term loans without unnecessary barriers. Our simple process, flexible amounts, and round-the-clock support make it easier to manage unexpected expenses.

Turn your credit profile into quick loan approvals. Download Pocketly on iOS or Android today and take control of your finances.

FAQ’s

1. What are the 5 C's of credit risk?

The 5 Cs of credit risk are Character, Capacity, Capital, Collateral, and Conditions. Lenders use these factors to evaluate a borrower’s reliability and structure loans effectively. They help mitigate potential defaults and ensure informed lending decisions.

2. What is a credit assessment on a loan?

A credit assessment is a detailed evaluation of a borrower’s financial history and repayment ability. Lenders use it to determine whether to approve a loan and under what terms. It forms the foundation for responsible lending decisions.

3. What is an acceptable credit risk?

An acceptable credit risk usually refers to borrowers with credit scores of 660 and above. These individuals are considered lower-risk and more likely to receive favourable loan terms. Borrowers below this threshold may face stricter conditions or higher interest rates.