A broken laptop the week before submission, an exam fee due tomorrow, or a sudden hostel payment are expenses that do not wait. When money is needed, most students and young earners get stuck between two options: a student loan or a personal loan. The problem is not choosing at random but choosing wrongly for the situation.

The right option depends on how big the expense is, how fast you need the money, and whether it is a one-time urgency or part of a long academic plan. Is your need for this week or for the academic year ahead? This blog helps you understand student loan vs personal loan clearly so you can choose correctly.

In Short:

- Student loans suit planned, high-value, academic expenses, while personal loans suit urgent, low-value, time-sensitive expenses.

- A student loan demands documents, co-applicants and waiting, whereas a personal loan is fast, independent and flexible in use.

- For a deadline expense like exam fees or repairs, a personal loan is more practical because the clock matters more than the amount.

- For a full academic year or multi-lakh fee, only a structured student loan aligns with the size and commitment of that cost.

- If you want to establish an early credit trail, small short-tenure personal loans update your bureau more actively than long education loans.

What Is a Student Loan and When Is It Usually Taken?

A student loan is typically issued by a bank or NBFC for long-term academic fees such as tuition, hostel and study-linked costs. You are required to submit academic proof, offer letters, fee structures and identity documents. The lender may also ask for a co-applicant and security, and the approval usually takes time.

Pocketly does not issue traditional education loans. Instead, you get short-term student personal loans that cover near-term academic expenses when you do not have days or weeks to wait for a bank sanction.

You can use Pocketly for:

- Exam registration fees

- Hostel dues

- Books and devices

- Small relocation or internship expenses

Loan availability on Pocketly:

- Ticket size: ₹1,000 to ₹25,000

- Disbursal: quick digital KYC, no physical documents

- Tenure: short term repayment

- No collateral or co-applicant

If you are evaluating costs, it helps to know the charges clearly before applying. Pocketly publishes these openly.

Interest

- Starts from 2 per cent per month, depending on repayment tenure and your profile

Processing Fee

- Deducted at approval

- Ranges between 1 to 8 per cent of the sanctioned amount

Penalties

- Late EMI attracts overdue charges

- Bounced NACH mandates attract a separate fee

Also Read: Applying for Instant Student Loan Online in India

Pocketly keeps the cost structure visible so you do not deal with surprises after disbursal. And if your expense is not tied to a classroom but to your calendar, the conversation moves from student loans to personal loans.

What Is a Personal Loan and Who Should Consider It?

A personal loan is an unsecured credit line you can use for any lawful purpose without linking it to a specific course or institution. You do not need collateral or a co-applicant, and the approval cycle is short. Students, salaried employees and self-employed individuals use it to close near-term gaps such as device purchase, rent balance, travel, medical bills or subscription renewals.

Pocketly issues short-term personal loans designed for young users who need smaller amounts on short notice.

You get:

- ₹1,000 to ₹25,000 ticket size

- Instant digital KYC with no physical paperwork

- Funds are released quickly to your bank account

- Flexible use across academic and personal costs

Cost structure on Pocketly:

- Interest: starts from 2 per cent per month

- Processing fee: 1 to 8 per cent of the approved amount

Pocketly maintains 24/7 support so you can resolve loan-linked queries without waiting for business hours.

Get a short-term personal loan only when the expense is real and finish it with clean closure to keep your profile strong. Apply now for ₹1,000–₹25,000 and choose a repayment plan that fits your timing.

Now that you know how each one behaves in isolation, it is easier to judge them side by side instead of guessing in the dark.

Student Loan vs Personal Loan: Key Differences at a Glance

Before you choose either option, it helps to see both on one page. Use the table to assess whether your need fits a structured academic loan or a short-term multi-purpose loan.

| Parameter | Student Loan | Personal Loan |

| Purpose | Academic fees and education-linked use only | Any lawful expense including academics and living |

| Ticket Size | Higher amounts for full course years | Small-ticket amounts for short needs |

| Approval Time | Slow, with layered verification | Fast, with simple digital checks |

| Co-Applicant | Commonly required | Not required |

| Collateral | Often needed for large amounts | Not required |

| Repayment Tenure | Long tenure with fixed use | Short tenure with flexible use |

| Flexibility of Use | Restricted to education costs | Free use across categories |

Also Read: Smart Financial Tips for College Students

Seeing the differences on paper is helpful, but the real test is how these choices behave when money is needed in actual situations.

Student Loan vs Personal Loan: What Should You Pick In These Situations?

Choosing between the two becomes easier when you apply the decision to real conditions rather than theory. The following cases show how the correct option changes depending on the size and timing of the expense.

1. If you need ₹15,000 in 72 hours for exam fees or laptop repair

A student loan will not meet a hard deadline because the verification, academic proof and co-applicant steps take time. When the need is immediate, you need a short-term personal loan that can release funds without paperwork delays.

Pocketly fits this type of situation because:

- Approval is digital without branch visits

- Funds cover small urgent expenses

- No co-applicant or collateral is required

2. If your need is ₹3–₹5 lakh for an academic year

When the amount runs into lakhs and covers a full term or year, the correct instrument is a structured student loan from a bank or NBFC. These products are designed for tuition and long study costs and match the repayment schedule to academic timelines.

Short-term personal loans are not meant to replace high-value education finance because:

- The ticket size on such products is limited

- Repayment cycles are short

- The purpose is not aligned with multi-year fees

3. If you want to build early credit history in small steps

Repaying a student loan does not build month-level repayment behaviour because disbursal is large and long-cycle. Credit bureaus observe recurring repayment patterns to assign predictability.

Personal loans in small amounts create that data trail because:

- You take and close short loans repeatedly

- Bureaus receive multiple punctual closure signals

- Your profile matures before you apply for larger credit

Also Read: Pocket Money Tips for Students: Smart Saving Strategies

Once you map the right choice to real scenarios, the only thing left is avoiding the classic mistakes that undo that logic.

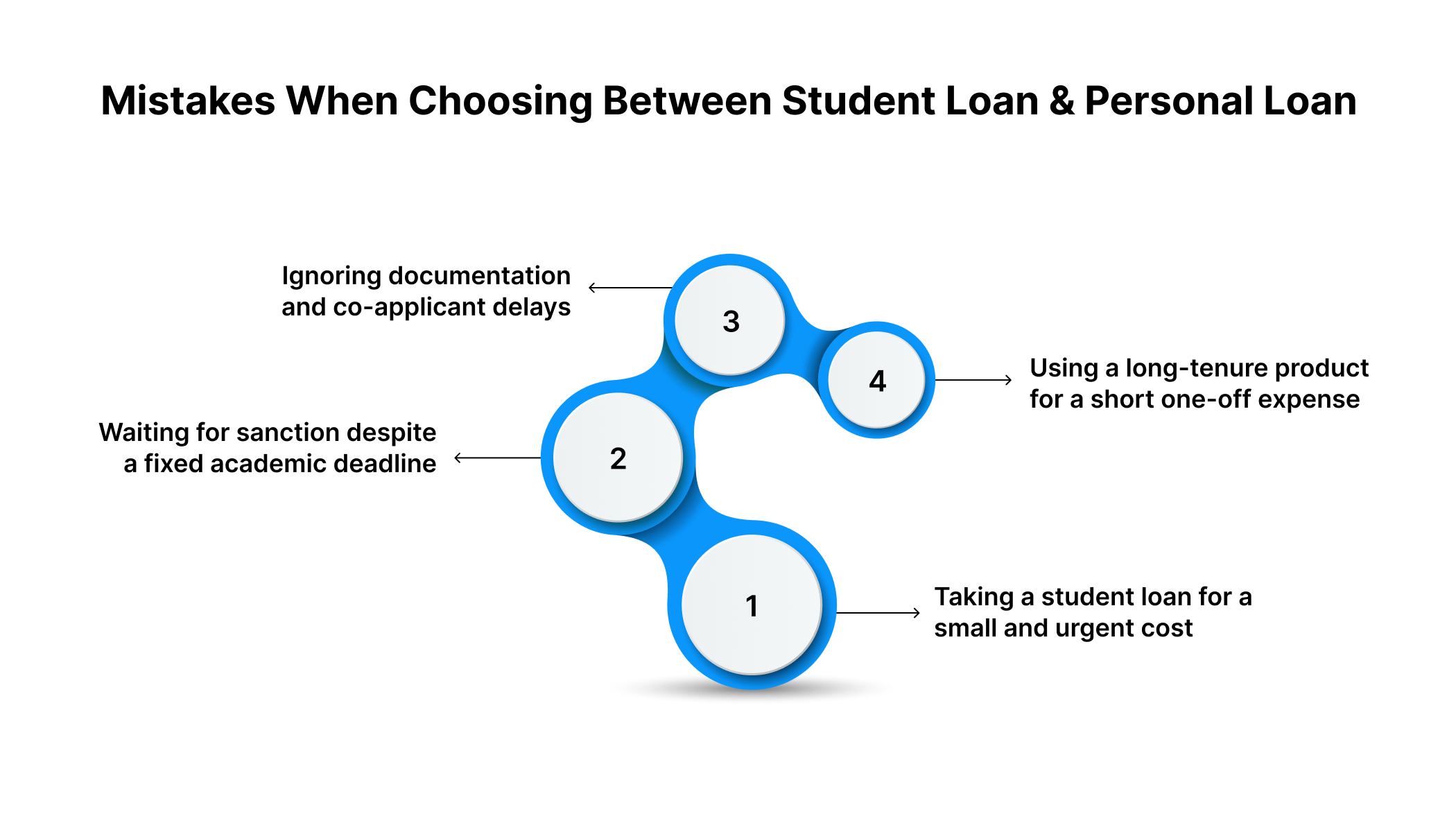

Common Mistakes When Choosing Between Student Loan and Personal Loan

Many people do not get denied credit; they get delayed by choosing the wrong product for the timing and the amount. These are the most frequent errors and what you should do instead.

- Taking a student loan for a small and urgent cost

- Example: Needing ₹12,000 for an exam entry this week, but applying for a student loan that releases in weeks.

- Better action: Use a short-term personal loan designed for small-ticket and quick release.

- Waiting for sanction despite a fixed academic deadline

- Example: Hostel due on Friday, but you are still waiting for an education loan file review.

- Better action: Use a faster instrument if the due date cannot be moved.

- Ignoring documentation and co-applicant delays

- Example: You applied, but your co-applicant has not uploaded income docs, so the file is dormant.

- Better action: Choose a product that does not depend on someone else’s paperwork when the cost is yours.

- Using a long-tenure product for a short one-off expense

- Example: Taking a multi-year loan for a laptop repair or short travel.

- Better action: Use a short-term personal loan and close it early so you do not carry a long liability for a one-time cost.

Once you strip away those avoidable errors, the pattern becomes obvious: short-term needs favour short-term credit.

If Your Need Is Short-Term, Personal Loan Usually Wins

When the expense is small and the timing is tight, a personal loan fits the problem more accurately than a full student loan product. You do not need to collect documents from your college, involve a co-applicant, or wait for layered approval.

Short-term personal loans work better for urgent needs because:

- They release funds quickly without multi-stage verification

- You do not depend on a parent or guarantor to sign with you

- You repay in a short window instead of carrying a long contract

- You are free to apply it to any lawful cost, not just tuition

Examples of correct use-cases include a laptop repair two days before a submission, an exam fee due before portal closure, or rent arrears that cannot wait. In all such cases, the constraint is time more than the loan size, which is why a personal loan is the more practical pick.

Conclusion

Student loans and personal loans are built for different roles. One is suited to long-term academic expenses across a year or more, while the other solves short and urgent gaps that cannot wait. You should pick based on the timeline and the size of the cost rather than by habit or assumption.

Pocketly is relevant when:

- You need a low-ticket amount without waiting weeks

- You want short-term repayment without a co-applicant

- You want freedom to use the funds for academic or living costs

- You need 24/7 support without depending on branch hours

Download the Pocketly app on iOS or Android to get access to short-term personal loans with a simple digital process. Apply, verify and receive funds directly in your bank without physical paperwork.

FAQs

Q: Can a student apply for a personal loan without showing salary proof?

A: Yes, lenders often evaluate other factors such as repayment behaviour, consistency of small credits and KYC validity instead of salary alone. Each lender sets its own internal filters.

Q: Will taking a personal loan stop me from getting an education loan later?

A: No, lenders assess those files independently. What matters is whether you have managed previous credit without delays.

Q: What is a practical approach if I only need ₹10,000 for one month?

A: Use a short-tenure product with early closure so you do not carry the liability longer than necessary. Avoid large, long-cycle products for such sums.

Q: Can a short personal loan improve my credit profile if I repay on time?

A: Yes, completed small loans add repayment signals to your bureau file. This helps lenders see evidence of controlled borrowing.

Q: Do all lenders demand a co-applicant for any kind of loan?

A: No, co-applicants are only requested in products where the contract demands a second liable party. Short-term products are usually independent.

Q: Is it sensible to split a large education cost into multiple small loans instead of one big loan?

A: That usually raises cost and increases handling overhead. Structured large loans are built to carry bulk academic fees efficiently in one track.