Money decisions can feel difficult when your income is limited and expenses keep shifting each month.

Many young Indians face the same concern. Should the next part of your money go into an emergency fund or towards paying existing debt? Both choices matter because each one protects you differently. An emergency fund provides a safety net when life surprises you.

Clearing debt frees up more money for future goals. The real challenge is knowing which step to take first.

This guide explains a clear and practical way to decide, using examples that match the daily lives of students, salaried workers and self-employed individuals.

Key Takeaways

- Start Small: A basic emergency fund of a few thousand rupees can protect you from new debt during sudden expenses.

- Kill Interest: Clear high-interest debt early because it grows fast and reduces your future income.

- Balance Smart: Mix saving and repayment based on your income pattern, whether you are a student, a salaried employee, or self-employed.

- Borrow Wisely: Use short-term loans only for real emergencies. Your emergency fund is still your strongest defence.

The Core Question: Should You Save First or Pay Off Debt First?

Many young Indians face this question when trying to manage a limited income. The simple answer is that both actions matter. A small emergency fund protects you from new borrowing. Clearing high-interest debt helps you save more in the long run.

The right balance depends on your current savings, the type of debt you carry, and how steady your income is each month.

The Simple Rule of Thumb

A practical approach is to follow a simple order.

- Build a starter emergency fund that covers a few essential expenses.

- Focus on clearing high-interest debt as your next priority.

- Increase your emergency fund slowly once expensive debt begins to reduce.

This structure gives you safety while also reducing the cost of borrowing.

Why Most People Need a Balance, Not a Single Choice

Saving only and ignoring debt can be costly when the interest keeps growing each month. On the other hand, paying debt aggressively without even a small buffer can pull you back into debt whenever an emergency arises.

For example, a medical visit or a laptop repair may push you to borrow again if you have no savings at all. Balancing both helps you avoid this cycle.

How Indian Income Patterns Change the Decision

Students often depend on parents or part-time work, so they may need a small buffer to avoid unexpected borrowing. Salaried individuals have a steady income and can divide their monthly budget between savings and debt.

Self-employed workers deal with uneven earnings, so they benefit from a wider buffer before reducing debt faster. These differences can guide your choice.

Now that you understand the main decision, let us explore what an emergency fund truly means for young Indians.

Also Read: Effective Debt Management Strategies and Tips

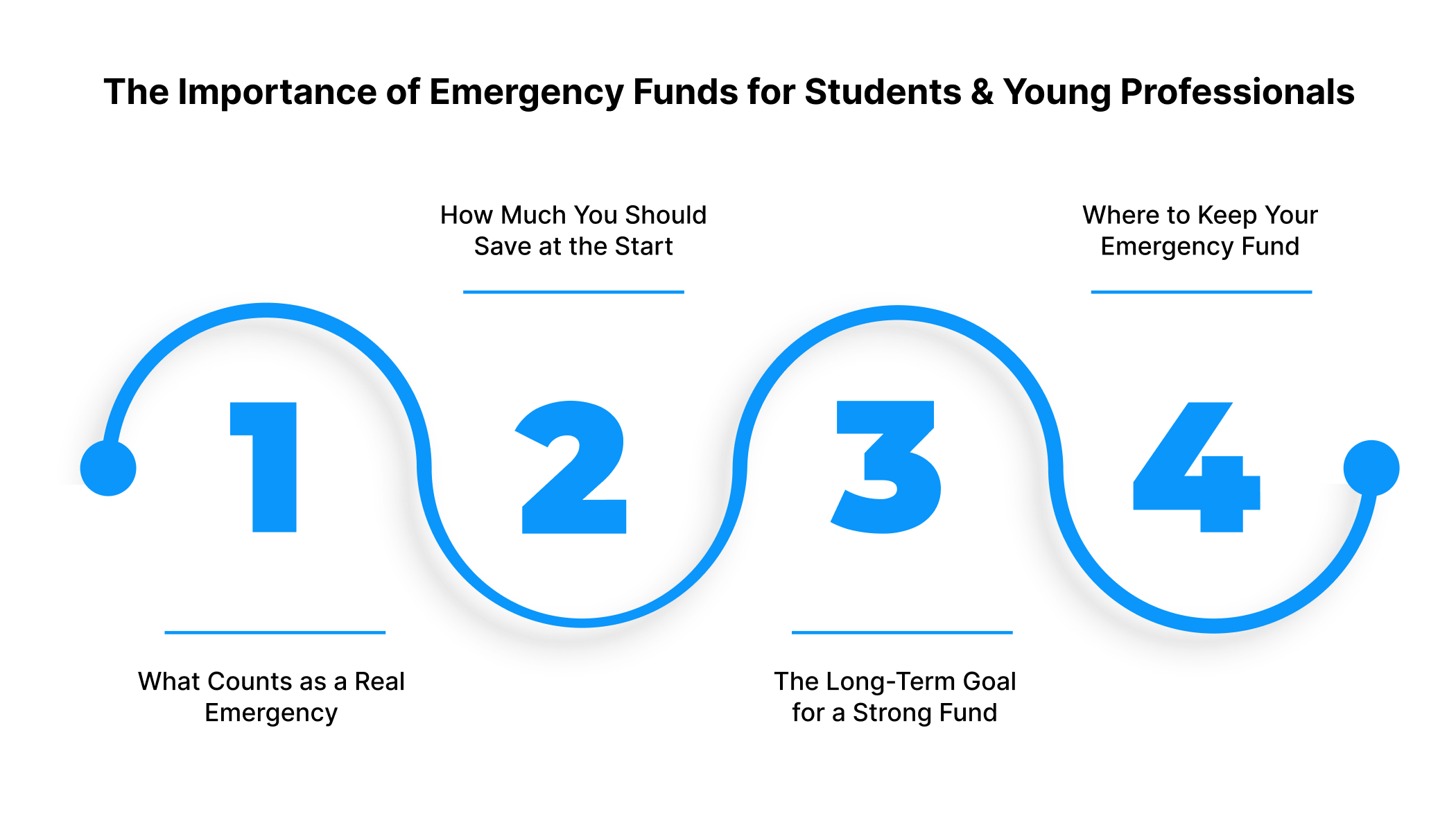

What an Emergency Fund Really Means for Students and Young Professionals

An emergency fund is a small financial buffer that helps you manage sudden expenses without taking on new debt. It gives you stability when your income is limited or your monthly budget already feels tight. This fund protects your basic needs and helps you stay in control when unexpected events disrupt your plans.

What Counts as a Real Emergency

A real emergency affects your health, safety, or ability to earn. For example:

- A medical visit that cannot be delayed.

- A broken laptop or phone that you need for work or studies.

- An unavoidable travel requirement.

- A short income gap due to a delayed salary or reduced freelance work.

Expenses like shopping, dining out, or upgrades are not emergencies.

How Much You Should Save at the Start

A starter emergency fund should be simple and realistic. Many young Indians begin with an amount between five thousand and twenty-five thousand rupees.

This range creates enough support to handle small surprises. It also prevents new borrowing for minor issues. The idea is to build a base, not to save everything at once.

The Long-Term Goal for a Strong Fund

A fully built fund usually covers three to six months of essential expenses. This target takes time and requires steady effort.

You can reach it gradually by increasing your savings once your high-interest debt is reduced. A slow and steady approach works better than rushing.

Where to Keep Your Emergency Fund

Your emergency money should be safe, simple, and easy to access. A regular savings account or a low-risk liquid fund works well.

Avoid locking this money in long-term deposits or risky investments. The goal is to reach the money quickly whenever an unexpected situation arises.

Now that you understand the true purpose of an emergency fund, the next step is to look at how your debt influences this decision.

Also Read: Understanding Unsecured Loans: Meaning and Benefits

Understanding Your Debt and Why Its Type Changes Your Priority

Debt may look simple on the surface, but different types of debt affect your budget in different ways. Some grow quickly and become costly.

Others give you more time and space to manage your money. Understanding this difference helps you decide whether to save first or clear your debt first.

High-Interest Debt That Needs Faster Repayment

High-interest debt increases quickly. The longer you keep it, the more it eats into your income. Examples include:

- Credit card balances

- Short personal loans

- Delayed buy now pay later payments

These debts often feel small at first, but grow when you pay only the minimum amount. Clearing them early protects your monthly budget. It also reduces the pressure you feel when managing other expenses.

Example: If you owe a small amount on a credit card, the interest can grow each month even when you make regular payments. Clearing it early helps you save more later.

Lower Interest Debt That Allows a Balanced Approach

Some debts do not grow as fast. They offer predictable monthly payments and lower interest rates. Common examples include:

- Education loans

- Long-term instalment plans

- Some loans are provided by employers or family members

These debts do not always demand urgent repayment. You can use part of your money to build a starter emergency fund while still paying these debts on time.

How Debt Affects Your Monthly Flow

Your debt influences how much money you have left each month.

- If your repayments take most of your income, saving becomes difficult.

- If your repayments are manageable, you can divide your income between saving and reducing debt.

Simple Comparison Table

| Type of debt | Interest rate | Priority | Suggested action |

| Credit cards | High | Very high | Clear early after building a small emergency buffer |

| Personal loans | Medium to high | High | Repay steadily and avoid delays |

| Education loans | Low to medium | Moderate | Build savings while paying consistently |

| Family loans | Low or flexible | Low | Save more unless repayment is urgent |

Knowing the type of debt you carry helps you avoid guesswork. It also prepares you for the next step: deciding your priority with a simple method.

Also Read: What is Debt Trap and How to Avoid It?

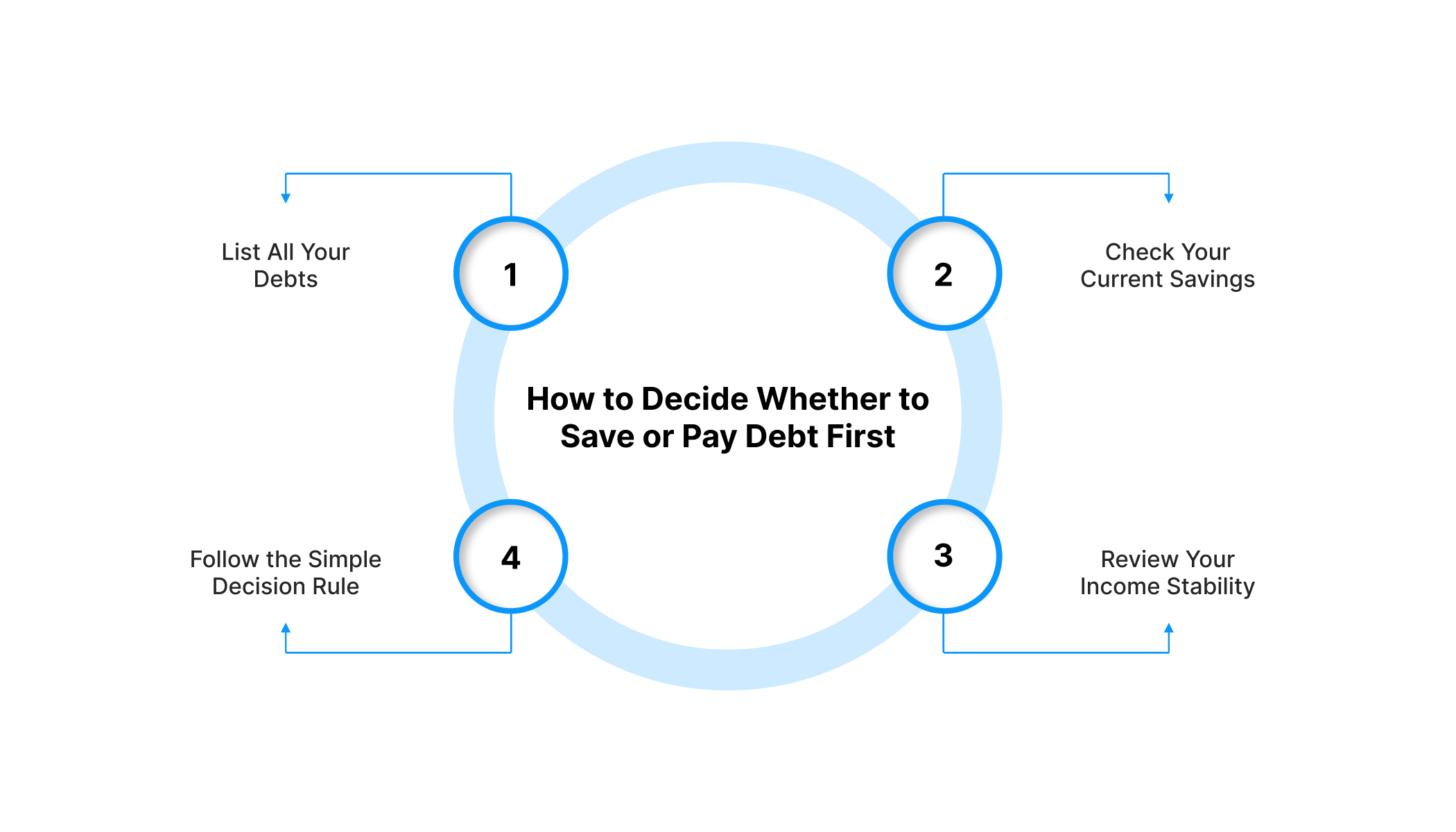

Step-by-Step: How to Decide Whether to Save or Pay Debt First

This method helps you understand your situation clearly before making a decision. It removes confusion and gives you a simple path to follow, whether you are a student, a salaried worker, or self-employed.

Step 1: List All Your Debts

Start by writing down each debt you owe. Include:

- Total amount

- Interest rate

- Monthly payment

- Any penalty for late payment

This small step gives you a complete picture. It also highlights which debt costs you more each month.

Quick example: A credit card charging high interest will need faster repayment than a steady loan with a fixed plan.

Step 2: Check Your Current Savings

Look at the money available for emergencies.

- If you have almost no savings, even a small surprise can force you to borrow again.

- If you have a small buffer, you can shift some focus to your debt.

This step helps you understand how protected you are during sudden expenses.

Step 3: Review Your Income Stability

Your income shape matters.

- A salaried worker can manage both savings and repayment together.

- A student may need a small buffer before clearing debt.

- A freelancer or gig worker may need a larger buffer due to unpredictable earnings.

This shows how much safety you need before increasing your repayments.

Step 4: Follow the Simple Decision Rule

Once you understand your debt, savings, and income, use this rule:

- Build a small emergency fund if your savings are low.

- Focus on high-interest debt once you have that small buffer.

- Grow your emergency fund slowly as your expensive debt reduces.

This method creates balance and protects you from new borrowing during emergencies.

Now that you know how to assess your situation, the next section explains when saving should come first and when debt deserves your full attention.

Also Read: Understanding the Debt Restructuring Process and Its Importance

When You Should Prioritise Building an Emergency Fund First

Some situations make saving more important than paying off debt. This usually happens when you have little protection from unexpected expenses.

A small buffer gives you breathing room. It also stops you from borrowing again when life surprises you.

When Your Savings Are Very Low

If your savings are between zero and five thousand rupees, even a small expense can disrupt your month.

A medical visit or sudden repair can push you into new debt. Building a starter fund helps you avoid this cycle. It also gives you confidence when planning your budget.

When Your Income Is Unpredictable

Unpredictable income increases the need for a safety net. This often applies to:

- Students relying on pocket money or part-time work

- Freelancers with inconsistent payments

- Gig workers affected by the monthly demand

A small reserve helps you manage slow months without turning to new loans or credit cards.

When One Emergency Can Set You Back

If a single surprise expense can disrupt your entire plan, saving first is the safer choice.

Examples include:

- A family health issue

- A phone or laptop repair is needed for classes or work

- Short salary delays

- Urgent travel for personal reasons

These situations appear without warning. A small fund helps you stay stable through them.

How to Build a Starter Fund on a Tight Budget

You can build a simple emergency fund even with a limited income by:

- Saving a small fixed amount each week or month

- Cutting one or two non-essential expenses temporarily

- Using festival gifts or bonus income to add to the fund

- Setting a small target, such as five thousand or ten thousand rupees

A small buffer brings stability. Once it is ready, you can shift more focus to reducing expensive debt.

Also Read: Get Debt Consolidation Loan Online: How it Works

When You Should Prioritise Paying Off Debt First

There are times when debt demands faster attention. This usually happens when the debt grows quickly or affects your monthly flow. Clearing it early helps you save more later. It also reduces the stress that comes from watching outstanding bills grow.

When You Carry High-Interest Debt

High-interest debt becomes costly the longer you keep it. Credit card balances, some personal loans, and delayed payments on short-term credit fall into this category.

These debts increase your monthly burden, and clearing them early frees up more money for your savings and expenses.

Example: A credit card balance can grow faster than your savings. Clearing it early is often more effective than trying to grow a large fund.

When Repayments Consume Most of Your Income

If your repayments take a big share of your monthly earnings, you may feel stuck. Clearing even one debt creates room in your budget. This extra space allows you to save without feeling pressured.

When You Often Roll Over Payments

Rolling over credit card payments or delaying instalments increases your total cost. If this happens often, paying off debt first helps you regain control. It also reduces the risk of late fees and penalties.

Choosing a Repayment Strategy That Works for You

Two simple approaches help you clear debt steadily.

- Clear the debt with the highest interest first to reduce long-term cost.

- Clear the smallest debt first to build motivation through quick progress.

Both methods work. The best choice is the one you can follow consistently.

Knowing when to save and when to repay helps you build a stable foundation. The next section explains how to balance both actions realistically.

Also Read: How to Pay Off Loans Quickly and Easily

How to Balance Both: Smart Strategies for Indian Youth

Saving and paying off debt does not have to be a strict either–or plan. Many young Indians follow a balanced approach that fits their income, lifestyle, and financial responsibilities.

A balanced plan protects you from emergencies while reducing long-term debt pressure.

If You Are a Student

Students often have limited or irregular income. A simple and steady plan works best.

- Build a small buffer for essential emergencies.

- Avoid adding new debt unless it is necessary.

- Use pocket money, stipend, or part-time income for small but consistent savings.

Example: A student saving five hundred rupees each week can build a ten thousand rupee safety fund in a few months.

If You Are a Salaried Professional

A steady income allows you to manage both goals together. You can follow a simple split.

- Use a small portion of your salary for emergency savings.

- Pay a bit extra towards high-interest debt whenever possible.

- Cut one or two non-essential expenses to create more room in your budget.

This approach helps you build stability without disrupting your daily routine.

If You Are Self-Employed

Irregular income means you need slightly more protection.

- Build a wider buffer before speeding up debt repayment.

- Save more during high-income months.

- Use low-income months to focus on essential expenses only.

This pattern helps you handle slow periods without stress.

Easy Behavioural Habits That Improve Both

Small habits can make your plan easier.

- Automate a fixed amount for savings.

- Keep your emergency fund in a separate account.

- Use reminders to track repayment dates.

- Review your plan every month and adjust if needed.

A balanced approach works well because it supports your long-term goals while keeping emergencies in check.

Also Read: Short Term vs Long Term Loans: Key Differences

Common Mistakes Indians Make When Choosing Between Saving and Paying Debt

Balancing saving and repayment can feel confusing at first. Many young Indians make similar mistakes during this process. Understanding these mistakes helps you avoid setbacks and stay on track.

1. Saving Too Much While Paying Only the Minimum on High-Interest Debt

Saving is important, but keeping a large amount idle while debt grows quickly can slow your progress. High-interest debt increases each month. Clearing it early improves your financial health faster.

2. Ignoring Basic Protection Like Health Cover

A single medical issue can wipe out your savings. Even a basic health plan can protect your emergency fund. It also prevents you from borrowing during health-related situations.

3. Treating Wants as Emergencies

It is easy to confuse wants with needs. A real emergency affects your health, safe, ty or ability to earn. A new gadget, weekend plan, or sale offer does not fall into this category.

4. Using New Loans to Pay Old Debt Without a Plan

This approach creates more stress. If you borrow without a clear repayment plan, you may end up in a cycle of ongoing debt.

5. Avoiding Financial Conversations

Many people feel uncomfortable discussing money challenges. Speaking to a trusted friend, mentor, or financial support representative can help you make better decisions when you feel stuck.

Where a Short-Term Loan Fits in Your Financial Plan When Used Responsibly

A short-term loan can support you during genuine emergencies, but it should not replace your emergency fund.

When used responsibly, it helps you manage sudden needs without disrupting your budget. When used casually, it can increase your financial pressure.

When a Short-Term Loan Can Help

A small loan can be useful when you face an unavoidable and urgent expense.

Examples include:

- A medical consultation

- A phone or laptop repair is needed for work or classes

- Travel required for family reasons

- A short delay in salary

In these cases, a short loan protects you from borrowing at a higher interest or delaying important tasks.

How Pocketly Supports Young Indians in These Situations

Pocketly offers short-term personal loans ranging from ₹1,000 to ₹25,000. These loans are designed for young Indians who need quick help during emergencies.

The interest rate starts at 2%, and the processing fee ranges between 1–8% of the loan amount. The process is designed to be simple and convenient.

- Download the app (Google Play, App Store) or visit the website.

- Complete a basic KYC process.

- Choose your loan amount.

- Receive quick approval and funds.

Pocketly works as a digital lending platform and is not an NBFC. It partners with registered NBFCs to provide short-term credit.

When You Should Avoid Borrowing

Borrowing should not be used for lifestyle purchases or to fund activities you can delay. It should also not be used to repay other loans without a clear plan. Using loans this way can create stress and disrupt your financial progress.

Short-term credit can support you during urgent moments, but your emergency fund remains your strongest protection.

Conclusion

Managing money during your early years can feel challenging, especially when you are trying to save and repay debt at the same time. The most effective approach is usually a balanced one.

A small emergency fund protects you from unexpected events. Clearing high-interest debt frees your future income. Both steps work together to create stability.

You do not need to make big changes at once. Small and steady actions help you stay in control. Over time, your savings grow, your debt reduces, and your confidence increases. This balanced method supports your long-term goals without creating pressure.

If you ever face a genuine emergency and need short-term support, Pocketly offers quick and simple personal loans for young Indians.

You can access funds between ₹1,000 to ₹25,000 through a fast and secure process. Use this option responsibly and only for real emergencies.

Download the Pocketly app: Google Play or the App Store to get started.

FAQs

How much should I save in my emergency fund if I already have debt?

Start with a small target that fits your budget. Many young Indians begin with five thousand to twenty-five thousand rupees. Once you have this buffer, you can focus more on reducing high-interest debt.

Is it safe to use my emergency fund to pay off debt?

You can use part of your fund if your debt carries a high interest and grows quickly. However, keep a small buffer in place to avoid borrowing again during a sudden expense.

Should I repay debt first if my income is unstable?

Unstable income increases the need for a safety net. Build a small emergency fund first, then repay debt at a steady pace. This protects you during slow income periods.

Is a starter fund of five thousand rupees enough for a student?

Yes, it is a good start. Students often face small but sudden expenses. A small buffer reduces the need to borrow for such situations.

How do I stop relying on credit cards for emergencies?

Build a small emergency fund, track your expenses, and plan for regular savings. Keeping your emergency money in a separate account helps you avoid unnecessary card use.

How do I know if my plan is working?

You will see signs like fewer surprises affecting your budget, lower credit card use, and a growing emergency fund. Your debt will reduce smoothly without affecting your daily expenses.