Introduction

There are times when monthly payments, bank messages, and the constant thought, "how to clear a loan fast?" weigh heavily on our minds. To reach big goals like buying a house, paying for school, or dealing with emergencies, loans are often necessary. But once the thrill of getting approved wears off, the real challenge is paying back the loan.

The good news? You don't have to be in debt for a long time. You can pay off your loan faster and save a lot of money on interest if you plan and keep working at it. It doesn't matter if you have a personal loan, a home loan, or an education loan. The key is to plan your payments and make small changes that add up over time.

We'll talk about helpful tips and simple plans that you can use to pay off your loans quickly and without too much stress in this blog.

At a Glance

- Understanding your total debt, income, and repayment capacity helps you build a realistic plan and stay consistent.

- Small extra payments, even once a month or during bonuses, can significantly reduce your loan tenure and total interest paid.

- Prioritize clearing debts that cost you more in the long run, such as credit cards or personal loans, to save money faster.

- Focus on clearing existing loans before taking new ones to prevent your debt-to-income ratio from increasing.

- Setting up auto-pay ensures timely EMIs, avoids penalties, and improves your credit score over time.

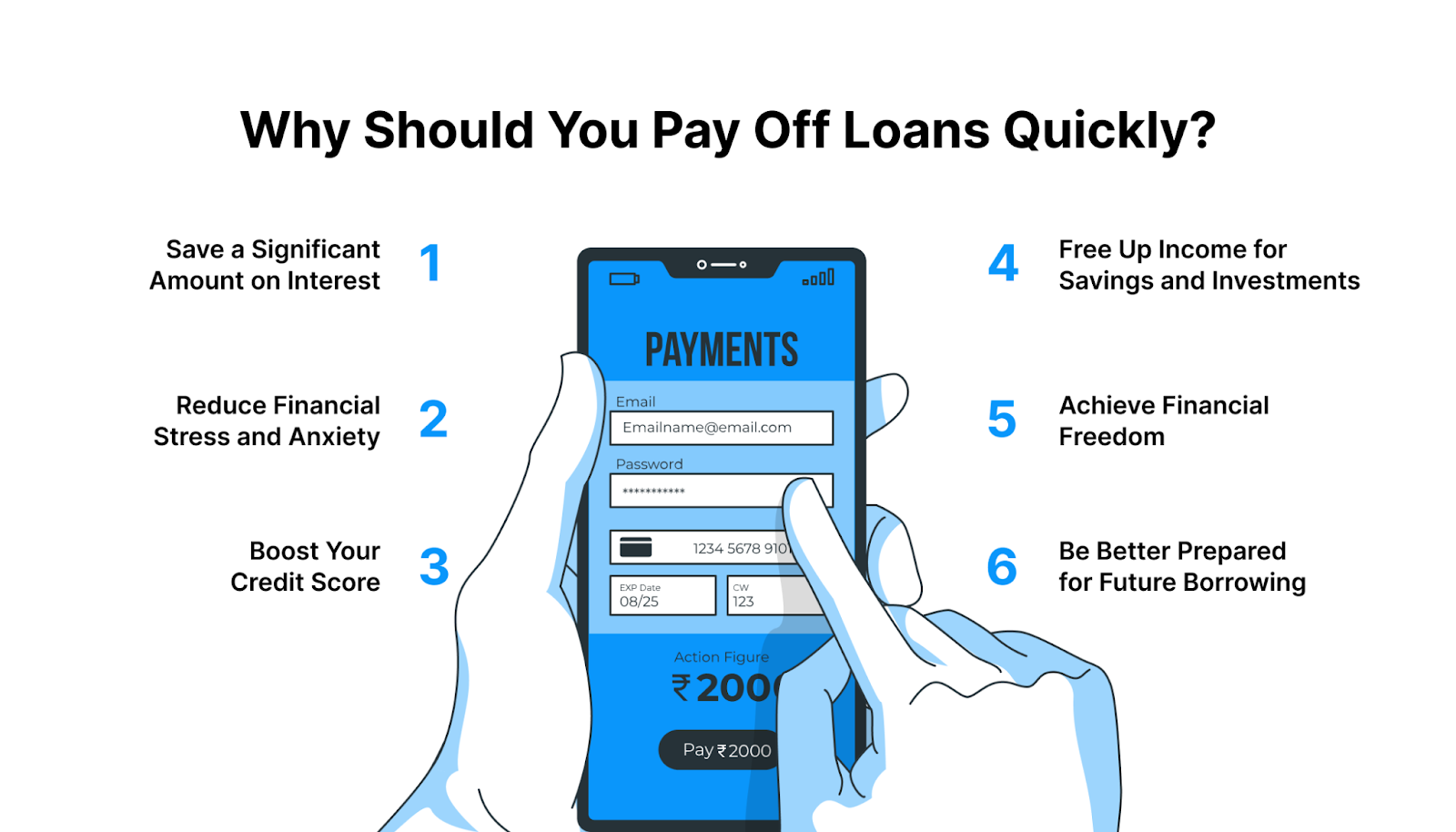

Why Should You Pay Off Loans Quickly?

One of the best ways to get back in control of your money and feel at ease in the long term is to pay off your loans quickly. You can borrow money to meet short-term needs like buying a car, paying for school, or dealing with emergencies, but if you stay in debt for too long, it can stop your money from growing. When you pay off your loans early, you not only save money but also gain more economic freedom and stability.

Here’s why paying off your loans faster is so essential:

Save a Significant Amount on Interest

You pay interest on the loan balance every month that you keep it open. This can add up to a lot of money over time. You pay less interest overall if you pay more than your minimum EMI or pay off your loan early. Extra money can add up to a lot in the long run.

Reduce Financial Stress and Anxiety

Debt can wear you down mentally. The thought of having to make payments every month, meeting deadlines, and having financial obligations can cause constant stress. When you pay off your loans early, you feel relieved of stress, proud of your work, and less stressed about money.

Boost Your Credit Score

It is suitable for your credit history when you consistently make payments on time or pay off loans early. People see you as a responsible borrower if your credit score is high. This means you can get better deals and lower interest rates on loans in the future.

Free Up Income for Savings and Investments

That money you were putting toward EMIs can be put toward savings, an emergency fund, or investments once your loan is paid off. This helps you get richer and get ready for bigger financial goals, like starting a business or buying a house.

Achieve Financial Freedom

When you don't have any debt, you can make your own financial decisions. EMIs used to cut into your income, but now they don't have to. You can plan your future without having to worry about payments all the time.

Be Better Prepared for Future Borrowing

Paying off your loans on time makes your credit score better. Lenders are more likely to give you new loans or better terms in the future if they see that you've handled past debts responsibly.

In short, paying off your loans early isn't just a way to save money; it's also a way to lower your stress, improve your financial health, and set yourself up for future opportunities.

There are clear benefits to paying off loans early, such as saving money on interest and having peace of mind. The next step is to learn how to do it in real life by using good strategies and planning your money well.

Must Read: Getting Personal Loans with a 650 Credit Score

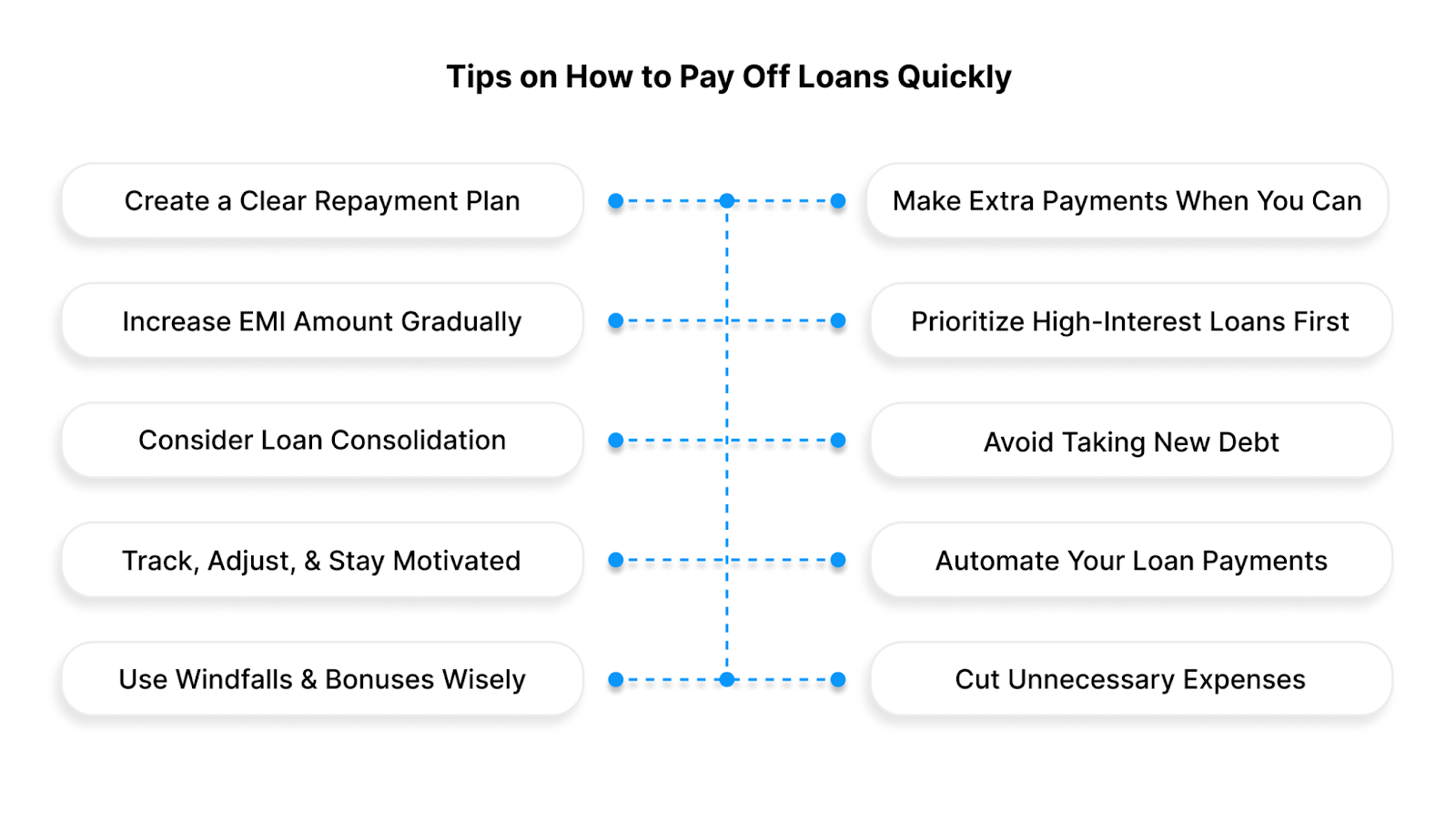

Tips on How to Pay Off Loans Quickly

It's not always necessary to make enormous sacrifices to pay off loans faster. You just need to form the proper habits, stick to them, and make smart financial decisions.

Here are some helpful, tried-and-true tips that can help you get out of debt faster and improve your overall financial health.

1. Create a Clear Repayment Plan

Making sure you know where you stand is the first thing you need to do to pay off your loan quickly. Start by making a list of all the loans you still owe, including the amounts you owe, the interest rates, and the dates of your payments. It helps you set priorities and see how much debt you have overall.

After you know what you owe, make a plan for paying it back that works with your income. Set reasonable monthly goals, keep track of when payments are due, and make sure you never miss one. A structured plan helps you stay on track and avoids confusion, especially if you are responsible for more than one loan.

2. Make Extra Payments Whenever Possible

Making extra payments is one of the easiest ways to get out of debt faster if you have the money to do so. You can shorten the length of your loan and save a lot of money on interest by making even small extra payments toward your principal every month.

For instance, if your EMI is ₹10,000 and you pay an extra ₹1,000 every month, you not only pay off your loan faster, but you also save a lot of money in interest over time. Before you start, check with your lender to make sure there are no fees for paying off the loan early.

3. Increase EMI Amount Gradually

If your income goes up, you should raise your EMI amount. Many lenders don't charge you extra if you change your EMI in the middle of the loan term. Your loan will be paid off much faster if you raise your EMI by even a small amount each year, like 5% to 10%.

This plan makes sure that as your income grows, you use that extra money to pay off your debt faster instead of spending it on things you don't need.

4. Prioritize High-Interest Loans First

If you have more than one loan, pay off the ones with the highest interest rates first. This could be a personal loan or a credit card debt. Over time, this plan, called the "avalanche method," helps you save more money.

Some people also like the "snowball" method, in which they pay off smaller loans first to get motivated and feel like they're making progress. No matter which method works best for you, make sure you always make at least the minimum payments on all of your other debts.

5. Consider Loan Consolidation or Refinancing

If you have more than one loan, consolidating them might make it easier for you to pay them back. This means putting all of your loans together into one with a lower interest rate and just one EMI. It makes your finances easier and may lower your overall interest costs.

You could also refinance, which is a good idea if you find a better rate on your current loan from another lender. Putting your balance on a loan with lower interest rates can save you a lot of money and cut down on the time it takes to pay it back.

6. Avoid Taking New Debt

Don't take on any more debt while you're trying to pay off your old ones. When you take on more debt, it can slow you down and put more strain on your income.

Instead, work on getting out of debt first. When you really need to, and when you're sure you can pay back the loan, only borrow again.

7. Track, Adjust, and Stay Motivated

To clear loans quickly, you need to be consistent. Keep track of your monthly payments and celebrate small wins, like paying off 25% or 50% of your debt. These small steps forward keep you going.

Don't be afraid to change your plan if your income or expenses change. Being flexible helps you stay on track and not feel too stressed out. Remember that paying off a loan isn't just about the numbers; it's also about taking care of your feelings.

8. Automate Your Loan Payments

You may have to pay fines and have your credit score drop if you miss payments. By setting up automatic EMI payments, you can be sure that your payments will always be made on time. It's possible to link an auto-debit feature from most banks and apps to your salary or savings account.

Not only does automation give you peace of mind, it also improves your payment history, which is a key part of keeping your credit score high.

9. Use Windfalls and Bonuses Wisely

You can make lump-sum payments on your loan with any extra money you get, like a bonus, a tax refund, a gift, or work-from-home pay. Instead of spending it on something you don't need, use these windfalls to lower your outstanding principal.

Significant prepayments can make a big dent in your balance and shorten the length of your loan by months or even years. It's a quick way to get rid of debt that won't mess up your regular budget.

10. Cut Unnecessary Expenses and Redirect Savings

Look at how much you spend and find places you can cut back, like eating out less, cancelling subscriptions, or not buying things you don't need. You can use the 500 to 1000 rupees a month that you save from these cuts to pay off your loan.

When you use your savings to make extra payments, you pay off your debt faster and learn better money management at the same time. This habit will help you get out of debt and get better at managing your money in general over time.

To get out of debt faster, you need to plan, stick to your plans, and be self-disciplined. If you follow these tips, like making extra payments on your loans and being careful with your bonuses, you can pay off your debt faster and save a lot of money on interest. You'll also have peace of mind and be able to focus on your long-term financial goals.

Once you start spending wisely and paying your debts back on time, it will be much easier to get out of debt. However, having access to responsible, flexible credit can make borrowing even easier to handle. This is where Pocketly can come in handy.

Must Read: Loans at Work: A Simple Guide to Getting Personal Loans for Employees

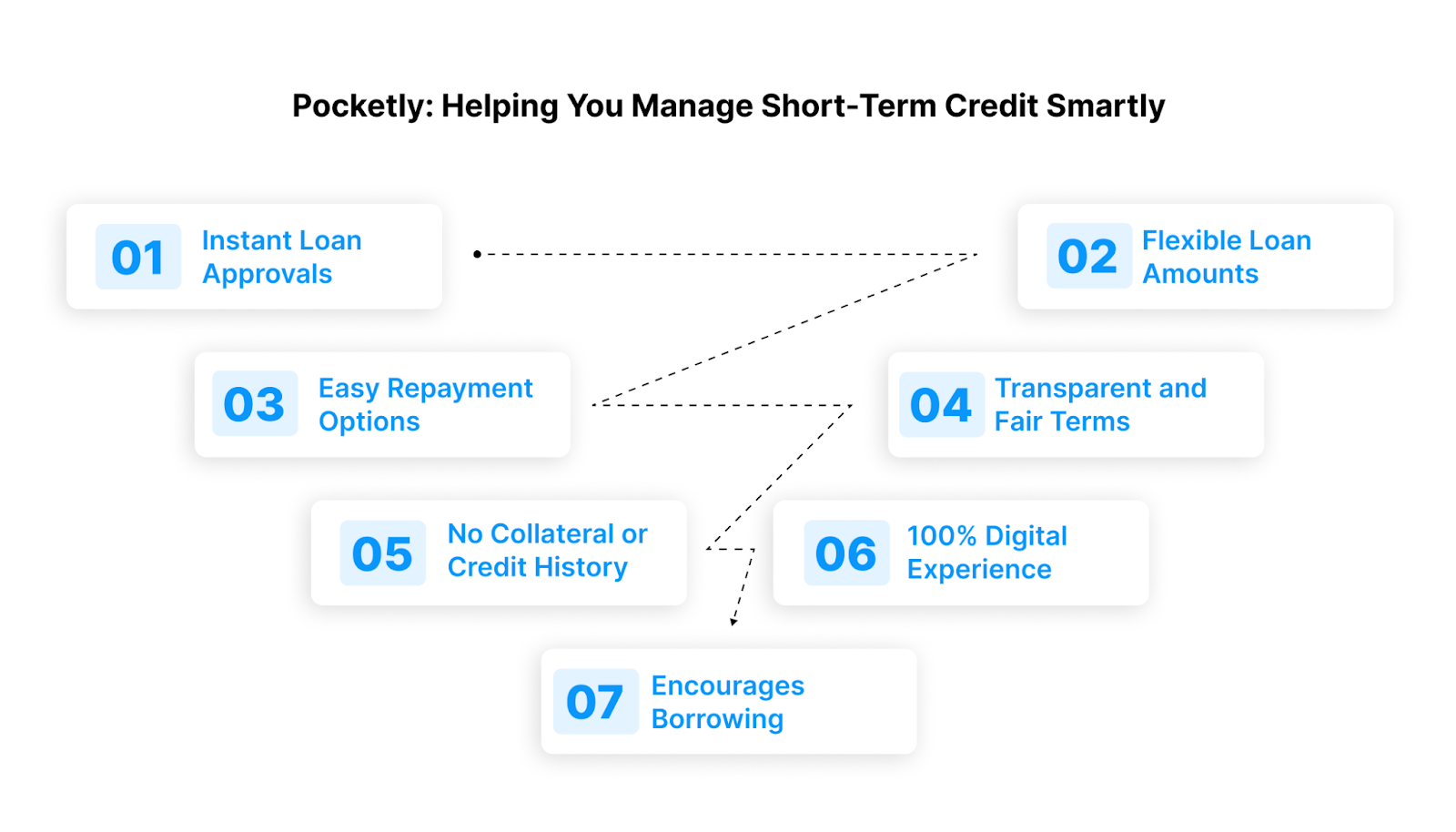

Pocketly: Helping You Manage Short-Term Credit Smartly

When you have the correct money tools, it's much easier to pay off loans quickly. One platform like this is Pocketly, which makes short-term loans easy, straightforward, and manageable, especially for students, young professionals, and people who are borrowing money for the first time.

Here’s how Pocketly helps you manage short-term credit smartly:

- Instant Loan Approvals: Pocketly makes it easy and quick to borrow money. You can apply online and get a response right away; there's no need to fill out long forms or go to a physical location. The funds are directly transferred to your bank account so that you can manage urgent expenses right away.

- Flexible Loan Amounts: Borrow only what you need. Pocketly allows you to take loans starting from ₹1,000 up to ₹25,000, depending on your requirement and eligibility. This flexibility ensures you never over-borrow or pay unnecessary interest.

- Easy Repayment Options: You can make payments on your loan over 2 to 6 months that are easy to handle. You can plan your finances freely with this flexibility, and you can keep up a good repayment history.

- Transparent and Fair Terms: There are no surprises or hidden fees. Pocketly shows you its interest rates and processing fees right away, so you always know how much you're paying. Being honest about your finances helps you make better plans and keep your cool.

- No Collateral or Credit History Required: Pocketly makes it easy to borrow money, even if you have bad credit. It's great for students and first-time borrowers who want to build their credit because they don't have to put up any collateral or have a long credit history.

- 100% Digital and Secure Experience: Everything from application to repayment happens through the Pocketly app, available 24/7. The whole process is safe, easy, and doesn't require any paper. It's made to fit your modern life.

- Encourages Responsible Borrowing: Pocketly's goal is not only to give loans, but also to teach people how to manage their money well. By offering small, manageable loans and encouraging timely repayments, it helps users build a positive credit history and develop smart borrowing habits early in life.

Pocketly bridges the gap between financial need and responsible borrowing. Whether you’re managing short-term expenses or looking to improve your financial health, Pocketly empowers you to do it with ease, clarity, and confidence.

Must Read: Applying for Instant Cash Loans Online for Quick Financial Support

Conclusion

You won't be debt-free overnight, but every small step you take, like making extra payments or cutting costs you don't need, brings you closer to being financially free. Staying disciplined, motivated, and organized can make the process smoother and more rewarding.

If you’re looking for a more innovative way to manage short-term financial needs while maintaining responsible borrowing habits, Pocketly can help. With flexible loans, transparent terms, and quick access to funds, Pocketly gives you the tools to stay in control of your finances without adding unnecessary stress.

Start your journey toward financial freedom today. Download the Pocketly app on iOS or Android and experience simple, secure, and responsible short-term credit designed for your goals.

FAQs

1. How can I clear my loan fast?

You can clear your loan faster by making extra payments, increasing your EMI amount whenever your income rises, and prioritizing high-interest loans first. Creating a solid repayment plan and cutting unnecessary expenses also helps speed up the process.

2. Does paying off a loan early improve my credit score?

Yes, making regular on-time payments and closing loans early can positively impact your credit score. It shows financial discipline and reduces your credit utilization ratio, both of which lenders view favorably.

3. Is it better to prepay or increase my EMI?

Both strategies are effective. Prepaying reduces your principal directly, saving interest over time. Increasing EMIs helps you clear the loan faster without needing lump-sum payments. Choose what best fits your financial situation.

4. Should I consolidate my loans to pay them off faster?

If you’re managing multiple loans with high interest rates, loan consolidation can simplify repayments and reduce interest costs. However, always compare rates and terms carefully before making the switch.

5. What should I avoid when trying to pay off loans faster?

Avoid taking new loans, missing payments, or making only the minimum EMI. These actions can increase your debt burden and extend your repayment period. Stay disciplined and focused on your goal.