Ever feel like your loans are multiplying faster than you can manage? Multiple credit cards, personal loans, or even small borrowings can pile up, leaving you juggling several due dates every month. The stress of tracking EMIs and high interest rates can make it hard to breathe financially.

What if we told you there’s a way to simplify all these debts into one manageable payment? Yes, you read that right! Debt consolidation loans could be the solution to all these problems, helping you combine multiple debts and reduce your monthly burden.

In this blog, we’ll explore what a debt consolidation loan is, how it works, and the benefits it can bring. Don’t miss the end, where we reveal the common mistakes to watch out for when consolidating your debt.

Quick Overview:

- Debt consolidation loans merge several debts into a single, easier-to-manage monthly payment.

- Personal loans, balance transfer cards, and home equity loans are common consolidation options.

- Consolidation can reduce interest costs, simplify repayments, and improve financial control.

- Choosing the right loan, budgeting carefully, and avoiding new debt are crucial.

- Avoid common mistakes like ignoring total costs or choosing an unrealistic EMI to maximise benefits.

What Is A Debt Consolidation Loan?

Handling multiple EMIs every month can be frustrating, especially when each comes with its own interest rate and deadline. A debt consolidation loan helps you roll all these payments into a single loan with just one EMI, often at a lower interest rate. Many debt consolidation loan providers in India even let you apply online, so the process is quick and stress-free. Let’s give you an example to make things simple.

Consolidation Loan Example

Here’s a quick scenario to show how it makes life simpler:

- Card 1: Rs 50,000 balance at 20% interest

- Card 2: Rs 20,000 balance at 25% interest

- Card 3: Rs 10,000 balance at 16% interest

If you pay these debts over 12 months, the interest adds up to around Rs 9,270. But let’s say you choose a 12-month loan consolidation India option for the total Rs 80,000 at just 10% interest. Your interest drops to about Rs 4,400. That’s almost half your cost, and now you only track one EMI.

Pretty straightforward, right? One loan replaces many, and you end up paying less. Still, many people confuse debt consolidation with debt settlement, so let’s clear that up.

Debt Consolidation vs Debt Settlement

| Feature | Debt Consolidation | Debt Settlement |

| Meaning | Merge multiple debts into one loan | Negotiate to reduce the total owed |

| Process | Take a new loan to repay existing ones | Creditors forgive part of the debt |

| EMI | One fixed monthly repayment | Payments vary and may stop temporarily |

| Credit Score | Stable or improves with timely payments | Often negatively impacted |

| Best For | Those who can repay steadily | Those unable to repay in full |

If you’re still not convinced what’s in it for you, keep reading to see how a consolidation loan can make debt much easier and more manageable.

Also Read: Understanding the Debt Restructuring Process and Its Importance

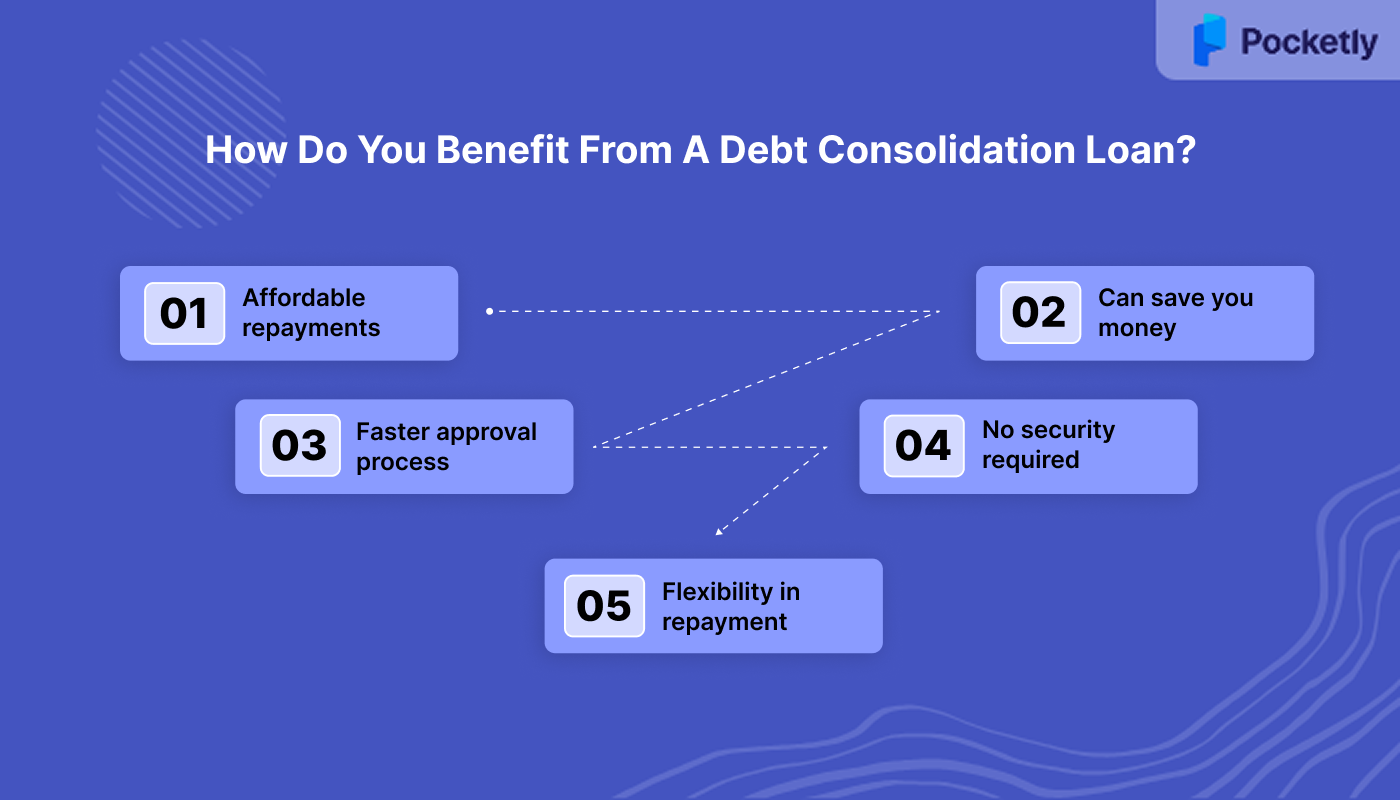

How Do You Benefit From A Debt Consolidation Loan?

- Affordable repayments: Instead of tracking multiple EMIs, you only manage one fixed repayment.

- Can save you money: A lower interest rate means you spend less on debt overall.

- Faster approval process: Many lenders offer online options with instant disbursal once approved.

- No security required: Most loans don’t need collateral, making them accessible to students and young professionals.

- Flexibility in repayment: Choose tenures that fit your income and repayment ability.

Whether you’re exploring debt consolidation loans with bad credit or simply want an easier way to handle bills, these benefits make it worth considering. Let’s now walk through how the process actually works, from application to debt clearance.

Also Read: Understanding the Loan Restructuring Process and Guidelines

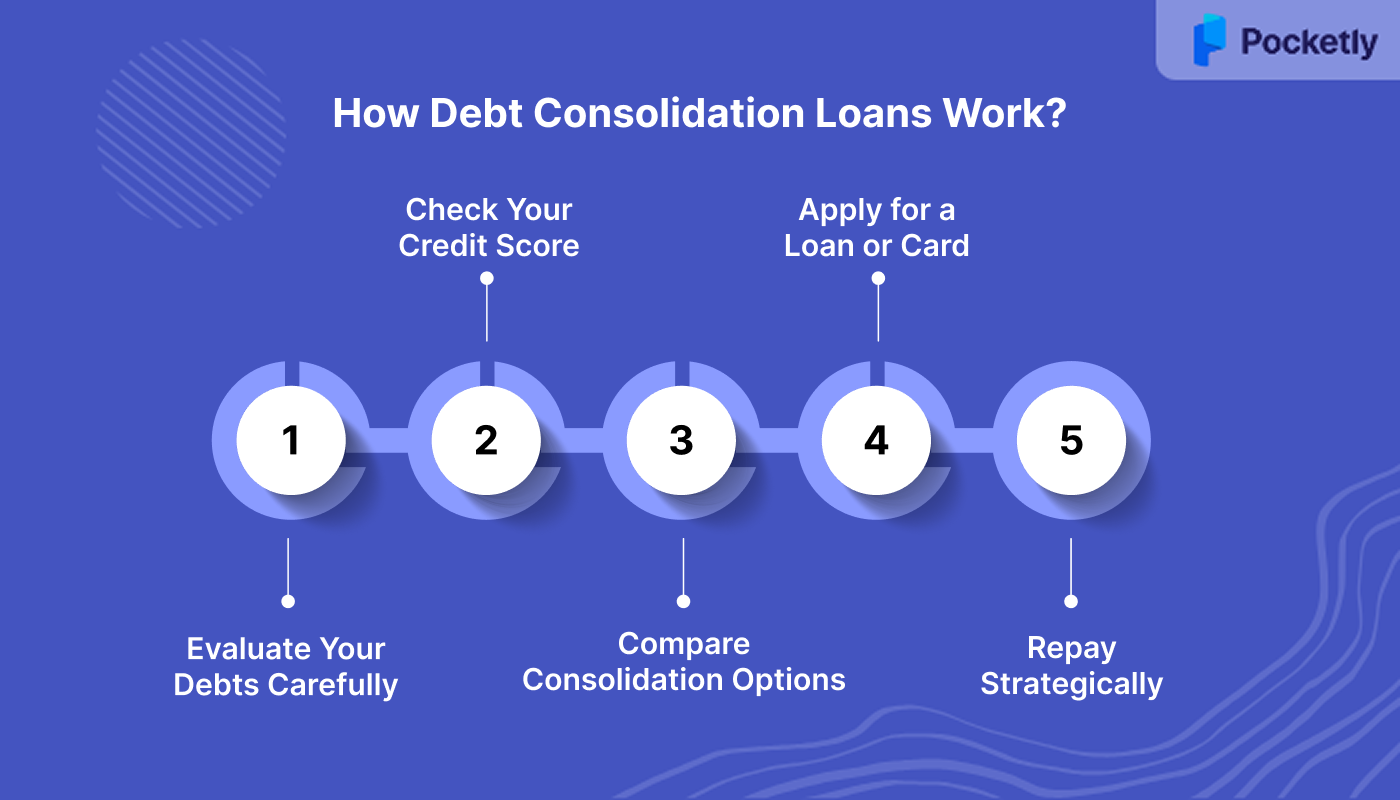

How Debt Consolidation Loans Work?

Step 1: Evaluate Your Debts Carefully

Start by listing down everything you owe- credit card balances, personal loans, or even small medical bills. Note the interest rates, EMIs, and repayment timelines. This helps you understand the total amount to consolidate and where your money is going. Pay utmost attention here, as without it, choosing the right plan becomes tricky.

Step 2: Check Your Credit Score

Before applying, review your credit score to check your debt consolidation loan eligibility. A higher score often helps you get lower interest rates and better loan terms. Pay off small pending bills, avoid new borrowings, keep credit card usage under 30%, and check your credit report for errors before taking this step.

Step 3: Compare Consolidation Options

Different people need different solutions. Some go for a personal loan for debt consolidation, while others may prefer balance transfer credit cards or even home equity loans. Take your time to carefully review interest rates, charges, and repayment terms.

Step 4: Apply for a Loan or Card

Once you’ve chosen the right option, it’s time to apply. With most debt consolidation loan providers, applications are online and fairly quick. Submit your documents, wait for approval, and get ready to simplify your repayments.

Step 5: Repay Strategically

When the loan is approved, use the funds to clear your existing debts. Now, you’ll only have to worry about one EMI. Create a budget and try automating payments so you never miss a due date. This way, your consolidation loans will work in your favour.

Whether you’re using a personal loan or a balance transfer card, knowing your options can make or break your debt plan.

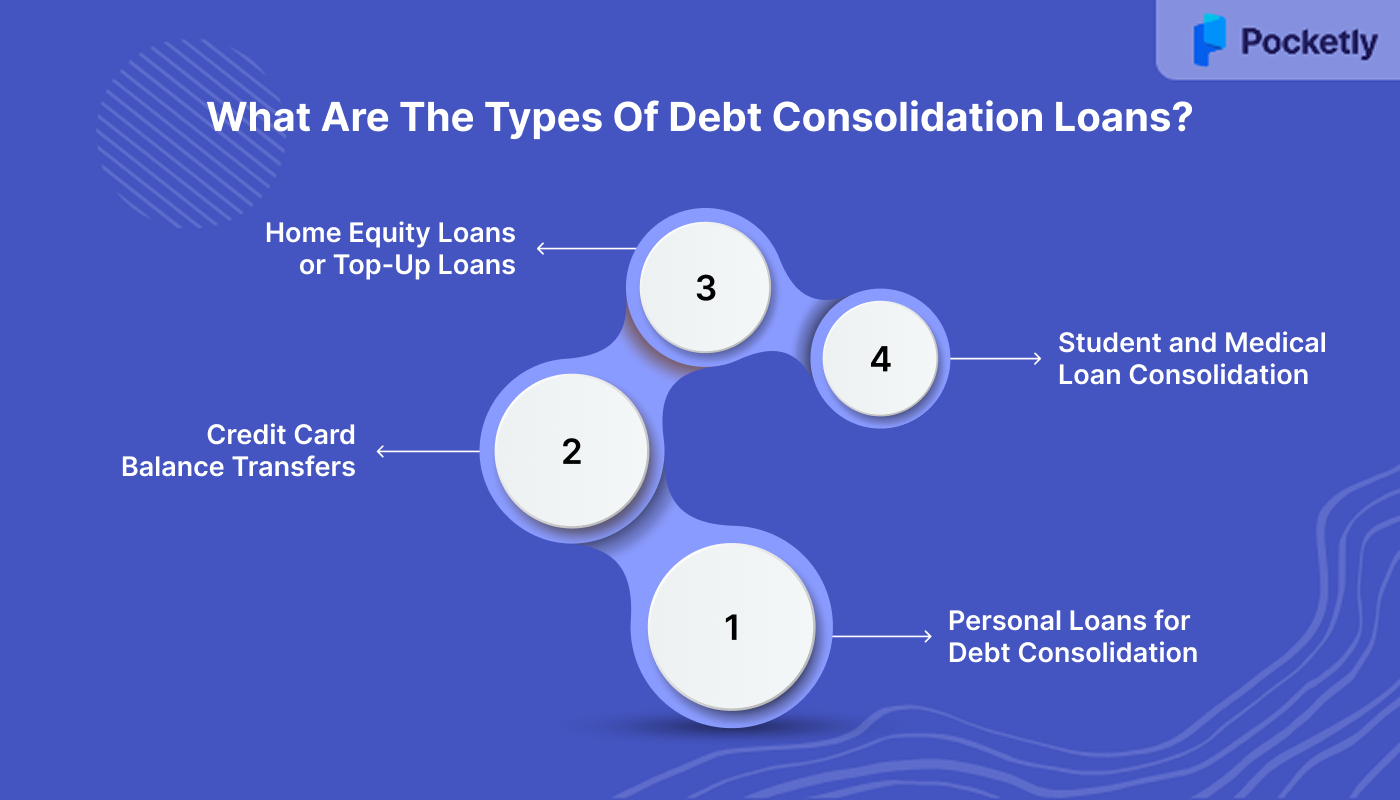

What Are The Types Of Debt Consolidation Loans?

1. Personal Loans for Debt Consolidation

A personal loan is often the most popular choice. It’s unsecured, requires no collateral, and comes with fixed EMIs. Interest rates are mostly lower than credit cards, making it a smart option for combining multiple dues into one.

2. Credit Card Balance Transfers

If most of your debt is on credit cards, this option can save you money. Many banks offer a 0% introductory interest period when you transfer your balances to a new card. But be careful, these offers are temporary, so you’ll need to repay quickly before the rates increase.

3. Home Equity Loans or Top-Up Loans

If you or your family owns a house, you can use home equity as collateral. These secured loans generally have lower rates, but they put your property at stake if you can’t repay. So, it’s best only if you’re confident about repayment.

4. Student and Medical Loan Consolidation

If you have multiple student or medical loans, these can be merged into one manageable repayment structure. This makes it easier to track dues without stressing over multiple EMIs.

Whether you go for unsecured or secured loans, always match the option with your repayment ability and financial comfort. But before you finalise things, you'll want to know how it could impact your credit score- for better or worse.

Also Read: What is Debt Trap and How to Avoid It?

Does Debt Consolidation Affect Your Credit Score?

A credit score is one of the biggest concerns when it comes to taking out a new loan. While it can dip initially, the impact isn’t always negative, as it majorly depends on how you manage things. Here’s how it plays out:

- Initial hard inquiry: Applying for a loan triggers a credit check, which could slightly lower your score.

- New account effect: Opening a new loan lowers the average age of your credit history temporarily.

- Lower utilisation helps: With more available credit and one structured EMI, your usage ratio goes down, which is positive.

Overall, consolidation can eventually strengthen your score if you remain consistent. Even people looking for debt consolidation loans for bad credit in India can benefit by showing lenders improved repayment behaviour.

Thinking about applying? Let’s see if you meet the criteria to qualify for a debt consolidation loan.

Also Read: Consequences Of Not Paying Unsecured Loans In India

How To Qualify For A Debt Consolidation Loan?

The requirements vary by lender, but most providers in India look for similar basics. Fulfilling these can improve your chances of approval and better loan terms.

Here’s a general checklist:

- Age: You should be at least 21 years old.

- Stable Income: Proof of steady salary or business income shows you can repay the loan.

- Manageable Debt: Your existing debt shouldn’t outweigh your monthly earnings.

- Credit History: A score of 650 or higher is often preferred to secure favourable terms.

- Employment History: Lenders like to see stable work or business continuity.

Once you know you meet the debt consolidation loans eligibility criteria, applying is straightforward. Begin by filling out the application form online or at the lender’s branch, then submit the required documents. After verification, the lender approves your loan, and the funds are sent directly to pay off your debts.

Also Read: Features and Types of Long-Term Personal Loans

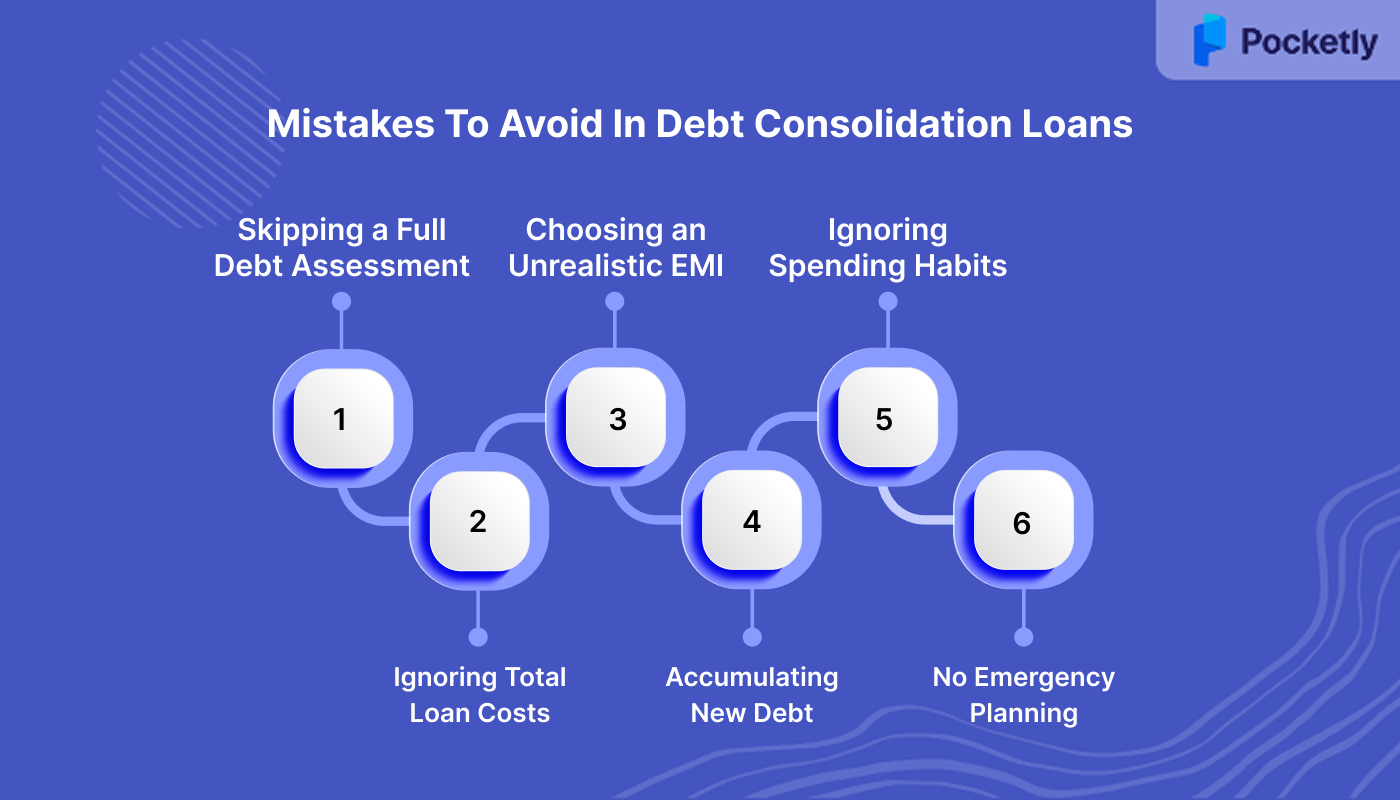

Mistakes To Avoid In Debt Consolidation Loans

Skipping a Full Debt Assessment

A common error is not including all your loans during consolidation. Leaving out a credit card or a small personal loan creates confusion later. Always assess your debts thoroughly before applying.

Ignoring Total Loan Costs

Focusing only on EMI reduction without checking processing fees, prepayment charges, or hidden costs is risky. Sometimes, the overall expense may outweigh the savings. Always compare total repayment amounts, not just monthly instalments.

Choosing an Unrealistic EMI

Lower EMIs may look attractive, but stretching the tenure unnecessarily increases your total interest. Pick an EMI that fits your budget without putting pressure on future finances.

Accumulating New Debt

Clearing your cards with consolidation often tempts you to swipe them again. This leads to fresh debt on top of your new EMI. Discipline is key; avoid using credit for non-essentials.

Ignoring Spending Habits

Debt consolidation is only effective if you fix the habits that caused the debt in the first place. Track your expenses, cut down unnecessary spending, and set realistic financial goals.

No Emergency Planning

Not keeping an emergency fund means you might fall back on loans during unexpected expenses. Always redirect some savings towards building a financial cushion.

Simplify Your Debt Repayments With Pocketly Loans

Managing multiple debts or sudden expenses can be stressful, but Pocketly makes it simpler. With flexible personal loans from ₹1,000 to ₹25,000, you can cover short-term cash shortages without collateral. Interest rates start from just 2% per month, and processing fees range from 1 to 8% depending on the loan amount.

The application process is completely online, simple, and fast:

- Sign Up: Quick 2-click registration using your mobile number.

- Upload Documents: Aadhaar, PAN, and bank details—fully online.

- Verify & Apply: Complete KYC, select loan amount and tenure.

- Get Funds Instantly: The Loan is disbursed directly into your account.

As a digital lending platform, Pocketly offers 24/7 support, fast disbursal, and flexible EMIs to simplify managing short-term debt efficiently. Enjoy access to funds quickly and handle urgent expenses without hassle, all through a fully online process.

Final Thoughts

A debt consolidation loan stands as an effective way to handle multiple debts by combining them into a single, manageable repayment plan. It can help reduce stress, lower interest costs, and improve your financial organisation. Remember, choosing the right consolidation method depends on your personal financial situation, so always assess your debts, interest rates, and repayment ability carefully.

While consolidation helps with long-term planning, short-term cash crunches can still pop up unexpectedly. This is where Pocketly comes in, helping you manage urgent needs without collateral or lengthy paperwork. Get flexible personal loans from ₹1,000 to ₹25,000, simple online KYC, and instant fund transfers.

Download Pocketly today on iOS or Android to streamline your finances and handle emergencies with ease.

FAQ’s

How do I get a debt consolidation loan?

To get a debt consolidation loan, start by reviewing your debts, then check eligibility, and apply for a suitable loan. For small, urgent needs, Pocketly offers quick, digital personal loans with minimal KYC, helping you manage multiple debts easily.

Can I use a debt consolidation loan for anything?

You can use a debt consolidation loan to pay off existing debts such as personal loans, credit card balances, or medical bills. Essentially, it helps you merge multiple payments into one manageable EMI.

How much debt consolidation loan can I get?

The loan amount depends on various factors like your income, credit score, and the lender’s policies. It can range from a few thousand to several lakhs for larger personal loans.

Which debt consolidation loan is best?

The choice for the best debt consolidation loan depends on your debt type and financial goals. While secured loans offer a lower interest rate, they also require collateral. On the other hand, unsecured personal loans provide more flexibility.