Ever taken a loan thinking you’ll easily repay it, only to find yourself struggling? Maybe it’s a job loss, a medical emergency, or rising expenses eating into your monthly budget. Suddenly, that once-manageable EMI feels impossible. But do you know exactly what happens if an unsecured loan is not paid?

The truth is, defaulting can trigger more than just reminder calls from your lender. Missed payments can quickly pile up, leading to higher interest, a lower credit score, and even legal action. And while the consequences can feel overwhelming, they’re not always irreversible if you act quickly and know your options.

In this guide, we’ll break down the possible outcomes of non-payment and share practical steps to manage your debt. So, if you’re on the edge of missing an EMI, or already have, keep reading to reduce the impact and get back on track.

Key Takeaways:

- Missing unsecured loan payments can lead to late fees, higher interest rates, and credit damage.

- Persistent default may result in legal action, wage garnishment, or asset seizure.

- As a borrower, you have rights to fair debt collection practices and the option to negotiate terms.

- Communicating with your lender early can help restructure payments and avoid severe penalties.

- Choosing a transparent, flexible lending partner reduces risks and makes repayment easier.

What Are Unsecured Loans?

Before knowing what happens if an unsecured loan is not paid, it’s important to understand what these loans are. Unlike loans backed by property or assets, unsecured loans don’t have collateral. This means the lender cannot directly seize your belongings if you fail to pay.

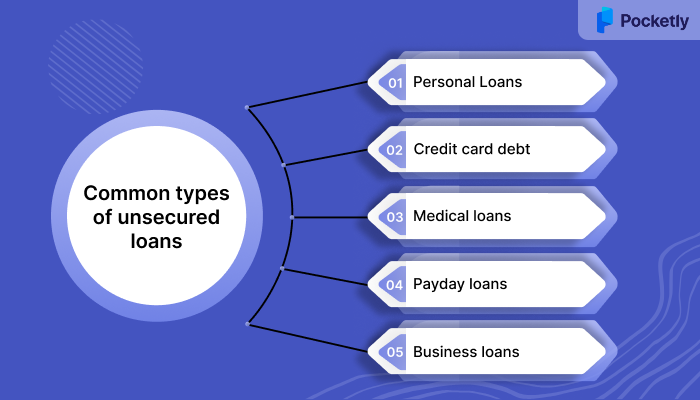

Common types of unsecured loans include:

- Personal loans: Borrowed for emergencies, tuition, or daily expenses without offering any assets as security.

- Credit card debt: Allows short-term borrowing for shopping, travel, or cash withdrawals, repayable monthly.

- Medical loans: Used to cover hospital bills or health emergencies without collateral.

- Payday loans: Small, short-term loans that need repayment within weeks.

- Business loans: For small ventures or startups that don’t require collateral.

Understanding these basics helps you see why non-repayment can quickly escalate into bigger problems.

Learn More: Difference Between Secured and Unsecured Loans

What Happens If You Don't Repay An Unsecured Loan?

If you miss payments on an unsecured loan, things can get complicated. Initially, you may receive reminders and warnings, but long-term non-payment can lead to severe consequences. Here’s what typically happens if an unsecured loan is not paid:

- Late payment fees: If you don’t pay within 7-10 days of the due date, lenders may charge small fees starting from your first missed EMI.

- Loss of grace period: Any extra time to pay without penalty is usually lost if your payment is overdue for more than 15 days.

- Increased interest rates: Prolonged non-payment beyond 30 days can trigger higher interest rates, making your repayment much harder.

- Impact on credit record: If you fail to pay for 30 days or more, your missed payment may be reported. This can drop your credit score by 50-70 points with every default, affecting future loans or credit approvals.

These initial consequences may seem manageable, but continued non-payment can worsen significantly. Here’s what follows.

What Are The Consequences Of Unsecured Loan Default?

When you fail to pay for several months, your unsecured loan may move into default. This impact extends beyond just missing payments. The longer you delay, the more serious the consequences:

Loan Default

When your loan goes into default, you are breaking the terms of your agreement. Your lender will likely take stronger steps to recover the debt, including repeated reminders and escalation to higher authorities. Defaulting can also make it harder for you to get loans in the future.

Classified as a Non-Performing Asset (NPA)

After prolonged missed payments, usually around 90 days or more, your loan may be classified as an NPA. This means it is considered risky for the lender, who may then take legal action to recover the money.

Debt Charge-Off

If your loan remains unpaid for several months, the lender may write it off as uncollectible. Known as a charge-off, this will appear on your credit record and can seriously damage your creditworthiness. The lender may also sell the debt to a collection agency.

Legal Actions

When a debt is sold to a collection agency, legal action may follow. This could include suing you or garnishing your wages. Court proceedings can also add extra costs, like legal fees, making repayment more difficult.

Harassment from Debt Collectors

Collection agencies may contact you repeatedly by phone or letter. They might threaten legal action, causing emotional stress and pressure. Persistent reminders and follow-ups can even affect your personal reputation.

Before things get too difficult, understanding your legal rights makes it easier to manage the situation better.

Learn More: Understanding Different Modes of Loan Repayment

What Are Your Rights As A Borrower?

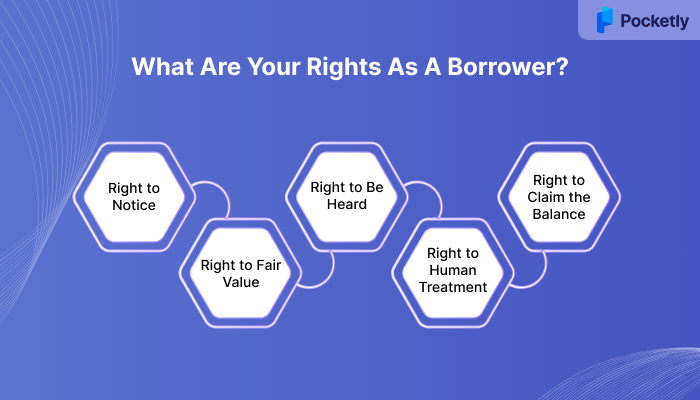

Even during loan recovery, you are legally protected. Knowing these rights can help you respond wisely if you’re struggling to pay:

- Right to Notice: You must be given at least 60 days’ notice if a lender plans to sell your asset.

- Right to Fair Value: The lender must be transparent about the asset’s value during recovery.

- Right to Be Heard: You can raise objections during the notice period and regain possession by paying the due amount.

- Right to Human Treatment: Lenders must respect your dignity and cannot pressure or harass you.

- Right to Claim the Balance: If the asset sells for more than your debt, the leftover amount legally belongs to you.

While these rights protect you, it’s always better to maintain timely payments and avoid legal action. That said, if repayments have already become unmanageable, there are ways to handle the situation.

How To Settle An Unsecured Loan If You Can’t Pay?

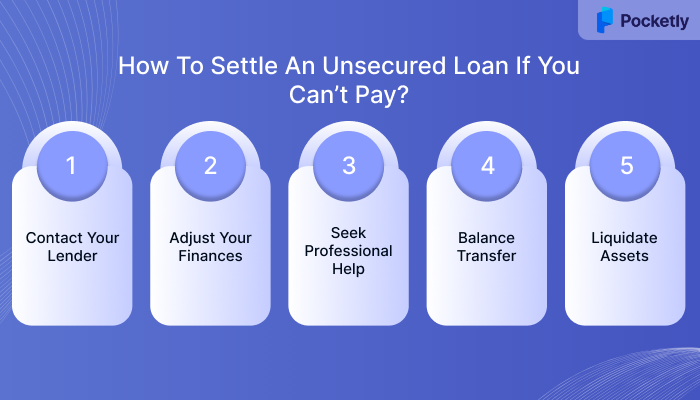

Struggling to repay your unsecured loan is stressful, but acting quickly can stop things from escalating further. Here’s how you can take back control:

Contact Your Lender

The first step is always communication, so be honest about your financial difficulties. Many lenders can restructure your loan, offer temporary relief, or create a new repayment plan. You may need to provide proof of hardship.

Adjust Your Finances

Look for ways to free up money. This could be cutting unnecessary expenses, taking up extra work, or borrowing temporarily from friends or family. Emergency savings can also help you avoid default.

Seek Professional Help

If you're overwhelmed, a credit counselor might help you create a feasible repayment plan. They may advise a debt management plan (DMP) to streamline payments, though it's essential to weigh the pros and cons.

Consider Debt Consolidation or Balance Transfer

If you have multiple loans or high monthly payments, consolidating debts or transferring balances to a lower-interest lender can ease your repayment burden. Always check associated fees before proceeding.

Liquidate Assets (Last Resort)

Only if necessary, you may consider selling investments or other assets to clear the loan. Make sure this doesn’t compromise your other financial goals.

How Pocketly Supports You In Financial Emergencies

Falling behind on a loan can have serious consequences, from damaged credit scores to legal action. But with the right lending partner, borrowing doesn’t have to be risky or stressful.

At Pocketly, we focus on giving young Indians access to short-term loans, from ₹1,000 to ₹25,000, in a way that’s fast, fair, and transparent. Our goal is to make borrowing flexible, affordable, and simple, so you can stay in control of your finances.

Why Pocketly works for you:

- No Collateral Required: Borrow without needing to pledge any assets.

- Fast Approval & Quick Disbursement: Get your loan approved and money transferred directly to your bank account within minutes.

- Flexible Loan Amounts: Choose loans ranging from ₹1,000 to ₹25,000 based on your needs.

- Affordable Rates: Interest rates start as low as 2% per month, with processing fees ranging from 1-8%.

- Simple Loan Application: Apply online, complete a quick KYC verification, choose a loan amount, and get approval for quick disbursal.

- 24/7 Support: Our team is available to assist you whenever you need help.

Note: Pocketly is a digital lending platform (not an NBFC), partnering with trusted lenders to make borrowing quick, safe, and transparent.

In Summary

Understanding what happens if an unsecured loan is not paid is crucial for anyone considering borrowing. Missed repayments can lead to mounting interest, late fees, a lower credit score, and even legal action. Financial stress often grows quietly, so it’s wise to plan repayments early, borrow wisely, and speak to your lender if you’re struggling.

One of the best ways to avoid these pitfalls is to choose a lending partner that’s transparent, flexible, and supportive. That’s where Pocketly steps up. With no collateral required, fast approval, affordable rates, and instant bank transfers, borrowing stays simple and safe.

Don’t let missed payments hurt your future. Turn to Pocketly for help. Download Pocketly on Android or iOS for quick, reliable financial support when you need it most.

FAQ’s

1. Can defaulters get loans after 7 years in India?

Typically, negative records are removed from your credit history after about seven years, but past defaults may still raise concerns for lenders. To boost your chances of approval, focus on rebuilding your credit profile and demonstrating responsible repayment habits during this period.

2. Can unsecured loans be written off?

In most situations, unsecured loans remain payable until cleared in full. That said, if a lender concludes that recovery is no longer possible, they may write off the amount for accounting purposes. However, the borrower’s obligation to repay can still remain.

3. What happens when an unsecured loan becomes NPA?

When an unsecured loan becomes a Non-Performing Asset (NPA), it means the borrower hasn’t paid EMIs for over 90 days. The lender may initiate recovery action, report the default to credit bureaus, and, in some cases, take legal steps.

4. What is the punishment for loan defaulters?

Defaulting on a loan in India can lead to civil legal action, where the lender files a case to recover the outstanding amount. Depending on the court’s ruling, this could result in measures like asset seizure or deduction of wages to settle the debt.