For many, the need for quick financial help arises at unexpected times—whether it’s covering medical expenses, dealing with emergency repairs, or handling sudden travel costs. The idea of offering up a valuable asset like a home or car as collateral can make securing a loan feel like a heavy burden. This is where unsecured loans come in, offering an alternative that allows you to borrow money without the risk of losing your property. While they might come with higher interest rates, unsecured loans provide quick access to funds.

In this blog, we’ll take a closer look at what is an unsecured loans, their benefits, and how to manage unexpected financial needs without putting your assets at risk.

Key Takeaways

- Higher Interest Rates for Risk: Unsecured loans come with a higher rate of interest due to the lack of collateral, making them more expensive than secured loans.

- Quick Access to Funds: These loans offer fast approval and disbursement, often within 24-48 hours, making them ideal for urgent financial needs.

- Flexible Loan Usage: Borrowers have complete freedom to use the funds for various purposes, medical emergencies, travel, home renovations, or debt consolidation, without any restrictions.

- Minimal Documentation and Easy Application: With basic documents and a quick online application, unsecured loans are accessible to a wider range of borrowers, even those without assets.

- Risk of Debt Accumulation: Without careful planning, multiple unsecured loans can lead to a debt cycle, so it's important to manage repayment schedules and avoid over-borrowing.

What is an Unsecured Loan?

This loan is a type of borrowing where you don’t have to pledge any property or assets as security with the bank or NBFC. The lender approves the loan, which is based on factors like your creditworthiness, income, and repayment history.

Unsecured loans have higher interest rates because there’s no collateral to reduce the lender’s risk. These loans are used for covering personal expenses, handling emergencies, or consolidating debt.

What are the Different Types of Unsecured Loans?

The different types of unsecured loans cater to varied financial needs, and each has its unique features. Understanding how they matter can help borrowers choose the right loan type based on their specific situation. Since unsecured loans don’t require collateral, the terms and conditions are based on the borrower’s creditworthiness and ability to repay. Here are the different types and why it is important to know them:

1. Personal Loans

Personal loans are a type of unsecured loan, where individuals borrow money for personal use without the need to provide collateral. The loan amount is used for purposes, like covering medical expenses, or home renovations.

Key Features:

- Loan Amount: Varies from ₹50,000 to ₹55 lakhs

- Interest Rates: Ranges from 9.00% to 36%.

- Repayment Tenure: 12 months to 96 months.

- Processing Time: 24 to 48 hours

- Documentation: Minimal paperwork with basic identification and proof of income.

2. Student Loans

Student loans are designed specifically to help students pay for their higher education expenses, such as tuition fees, textbooks, and living costs. Applying for a student loan in India offers beneficial terms, such as a lower rate of interest and deferred repayment options, to ease the financial burden on students and graduates.

Key Features:

- Interest Rates: The rates will be either fixed or variable. In many cases, government-backed loans offer subsidized interest rates.

- Repayment Period: Begins after course completion, extending up to 15 years.

- Grace Period: Moratorium period of 6 months to 1 year after graduation.

Pocketly offers short-term, unsecured loans ranging from ₹1,000 to ₹25,000, perfect for unforeseen expenses. With minimal documentation and quick KYC approval, you can get funds within hours. It offers an affordable interest rate starting from 2% per month.

3. Credit Cards

Credit cards offer a revolving line of unsecured credit, allowing cardholders to borrow money for purchases up to a predetermined limit. The borrower can carry a balance and pay it off over time, with interest charges applied to any unpaid balance. Credit cards are commonly used for everyday expenses and as a short-term financing tool.

Key Features:

- Credit Limit: Range from ₹10,000 to ₹10 lakhs

- Interest Rates: Range from 12% to 45% per annum.

- Repayment: Credit cards are a form of revolving credit, meaning borrowers can carry an outstanding balance from month to month.

- Grace Period: 20 to 50 days.

4. Lines of Credit

A line of credit is an unsecured loan that provides borrowers with access to a pre-approved amount of credit. Unlike a lump-sum loan, borrowers can withdraw funds as needed, up to the credit limit, and are only charged interest on the amount they use.

Key Features:

- Credit Limit: ₹1 lakh to ₹50 lakhs.

- Interest: Interest is charged only on the amount that the borrower withdraws.

- Repayment: Borrowers have the flexibility to repay the borrowed amount and then re-borrow as needed.

- Types: There are personal lines of credit, which are unsecured, and home equity lines of credit (HELOCs), which are secured by the borrower’s home.

5. Peer-to-Peer (P2P) Loans

Peer-to-peer (P2P) loans are a form of online lending where individual borrowers are matched with investors via digital platforms. These loans skip traditional banks, providing a more direct lending process that can lead to lower interest for borrowers and better returns for investors.

Key Features:

- Interest Rates: Around 11.49%

- Loan Amount: Range is ₹50,000 to ₹40 lakhs

- Processing: Applications are processed digitally, and borrowers need to provide minimal documentation.

Also Read: Best Spot Loan and Instant Cash Apps in India

While understanding the various types of unsecured loans helps you choose the right product, grasping how these loans function can further help you make appropriate borrowing decisions.

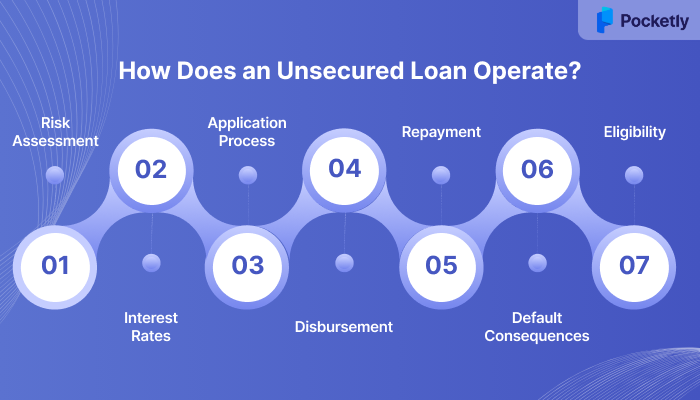

How Does an Unsecured Loan Operate?

Unsecured loans are offered without collateral, with approval based on your creditworthiness rather than assets. Here is a breakdown of how it works:

- Risk Assessment: Approval based on credit score, income, and employment history, not collateral.

- Interest Rates: Higher rates (9.99% to 36%) due to increased lender risk.

- Application Process: Apply online with minimal documentation (ID, address, income proof). Lenders verify details and provide approval within 24-72 hours.

- Disbursement: The funds are transferred to your bank account within 24-48 hours after approval.

- Repayment: Fixed EMIs, flexible tenures (12 to 96 months), with auto-debit for easy payments.

- Default Consequences: No asset seizure; lenders may use collection agencies or legal action to recover debt.

- Eligibility:

- Age: 21-80 years.

- Income: ₹15,000 to ₹30,000/month (varies by lender).

- Credit Score: 650+ (higher score improves terms).

- Technology: Digital application, approval, and account management via mobile apps.

These operational improvements enhance the borrowing process, overcoming many of the typical challenges faced when seeking financial help, and provide access to opportunities that may have been out of reach otherwise.

What are the Benefits of an Unsecured Loan?

These benefits make unsecured loans an attractive financing option for individuals seeking quick access to funds without risking their assets, though borrowers should carefully consider the interest rates and adequate time for repayment before applying.

Let’s take a look at the benefits of Unsecured Loans

- No Collateral: Unsecured loans do not require assets, like a car or valuables, to be pledged as security.

- Quick Approval and Disbursal: Funds are disbursed within 24-48 hours of loan approval, with some lenders offering instant disbursal within minutes.

- Minimal Documentation: The application process requires only basic documents like proof of Identity and address) In scanned form.

- Hassle-Free Processing: The entire process is digital and can be completed online. No visiting bank branches or standing in long queues.

- Flexible Repayment Terms: There are different modes of loan repayments, and you may also choose a term that aligns with your financial capacity.

- Builds Credit Score: Timely repayment of your unsecured loan EMIs can help improve your credit score, showcasing responsible borrowing behavior.

- Interest Rates: Unsecured loans' interest is competitive, especially for borrowers with a good credit score. They are lower than credit card rates.

- Higher Loan Amounts Available: Unsecured loans offer the possibility of borrowing amounts up to ₹55 lakhs, based on your income and creditworthiness.

- Tax Benefits: In certain cases, unsecured loans may offer tax benefits. For example, home renovation or education loans may qualify for tax deductions.

- Other Features: Some lenders provide flexi-hybrid loan options, which allow partial withdrawals and repayments. Some lenders offer interest-only EMIs.

Like any financial product, unsecured loans come with their own set of challenges that potential borrowers must weigh carefully as per their goals and circumstances.

What are the Drawbacks of an Unsecured Loan?

Unsecured loans offer easy access to funds, but they come with certain drawbacks that should be carefully considered before borrowing. Here's a brief overview:

- Higher Interest Rates: Unsecured loans typically carry higher interest rates due to the increased risk for lenders, as there is no collateral to reclaim in case of default.

- Debt Accumulation: Without proper financial planning, borrowers may take on multiple unsecured loans, which can quickly lead to a debt cycle that will be difficult to break.

- Lower Loan Amounts: Since unsecured loans don't require collateral, lenders may offer smaller loan amounts, which may not be sufficient for larger expenses.

- Limited Negotiation: Borrowers have less room to negotiate the interest rates and repayment terms on unsecured loans, as the lender's risk is higher.

These advantages and disadvantages naturally lead to a fundamental question that many borrowers grapple with: Should you choose the security of collateral-backed financing or the flexibility of unsecured borrowing?

Secured or Unsecured Loans: Which is Better?

A secured loan backed by collateral usually has a lower interest rate since it is less risky for lenders. This makes them ideal for larger loan amounts, such as mortgages or car loans. However, the risk of losing the collateral in case of non-payment is a significant downside.

On the other hand, unsecured loans, though they carry higher interest rates, offer the benefit of not requiring any collateral, making them a safer option if you don't want to put your assets at risk. They are more accessible and quicker to obtain, but due to higher rates and more stringent credit checks, they may not always be the most cost-effective option for large sums.

If you’re confident in your ability to repay and need more flexibility, an unsecured loan could be the right option. However, for larger loan amounts with lower interest rates, a secured loan might be more beneficial.

If you've decided that an unsecured loan fits your needs, the next step is finding the right platform to secure your financing.

How to Apply for an Unsecured Loan with Pocketly

Pocketly is a digital lending platform to assist young professionals and students in India who face financial challenges, especially during the month-end cash crunch. Pocketly prioritizes data security, being ISO 27001 certified, ensuring your personal information is protected. Here’s how it works:

Step 1: Download the Pocketly App: Available on Google Play and the Apple App Store.

Step 2: Complete Registration & KYC

- Register with your mobile number.

- Upload required documents: Aadhaar, PAN card, selfie video, bank details, and email address.

Step 3: Choose Loan Amount & Tenure: Select loan amount (₹1000 to ₹25,000) and repayment tenure (2 to 6 months).

Step 4: Loan Approval & Agreement

- Pocketly assesses your application.

- Review and accept the loan terms, interest rate, processing fee (1%-8% of the loan amount), and repayment schedule.

Step 5: Disbursement of Funds: The approved amount is transferred to your bank account within minutes.

Step 6: Loan Repayment: Repay via the Pocketly app, with options for automatic deductions or a manual repayment plan.

Conclusion

Unsecured loans provide a quick and accessible way to secure funds for urgent needs without putting your assets at risk. While they may come with higher interest rates, their flexibility, minimal documentation requirements, and fast processing make them an attractive option for many borrowers. Whether you need money for medical emergencies, personal expenses, or any other unexpected costs, unsecured loans offer an efficient solution.

If you're a student, salaried professional, or self-employed individual, Pocketly offers unsecured personal loans with flexible repayment terms, ranging from ₹1,000 to ₹25,000. With quick approval and disbursal, Pocketly makes it easy to manage your finances when you need it most.

Download Pocketly now and get the funds you need without the hassle!

FAQs

1. What if an unsecured loan is not paid?

If you don't pay the loan, the lender will report your missed payments to credit bureaus, further harming your credit score. If there is a debt, the lender may escalate the issue by using collection agencies or taking legal action, which could result in wage garnishment or other legal measures to recover the owed amount.

2. How long does an unsecured loan last?

The duration of an unsecured loan generally depends on the lender and the loan type. For most personal loans, the repayment period typically ranges from 12 to 96 months, providing borrowers with flexibility to choose a term that suits their financial situation.

3. How do you know if a loan is unsecured?

An unsecured loan does not require collateral, such as property or assets, to be pledged. The unsecured loan is granted based on the borrower's creditworthiness, income, and employment history.

4. Is it compulsory to pay interest on an unsecured loan?

Yes, paying interest on an unsecured loan is a requirement. Since there is no collateral, lenders charge interest rates that are generally higher than those for secured loans to compensate for the added risk. Borrowers are obligated to repay both the principal and the interest according to the terms of the loan agreement.

5. Is TDS deducted on unsecured loans?

Yes, interest paid on unsecured loans is subject to TDS under Section 194A of the Income Tax Act. A standard TDS rate of 10% applies if the borrower provides a valid PAN. If no PAN is provided, the TDS rate increases to 20%.

6. Are unsecured loans part of assets or liabilities?

For the borrower, an unsecured loan is considered a liability since it represents an amount that must be repaid. For the lender, the loan is classified as an asset because it is a receivable amount that the lender expects to be paid back over time.