Introduction

Ever been caught off guard by an unexpected cost, like a medical bill, home repair, or a chance you didn't want to miss and wished you had extra cash on hand right away?

That's when loans come in handy. But not every loan is the same.

Some are for immediate, short-term needs, like paying rent or buying necessities before your next paycheck, while others help you reach long-term goals, like buying a house or paying for college. It's hard to decide between short-term and long-term loans because they each have their own pros and cons.

This blog will explain short-term vs long-term loans, how they work, and which is best for your financial goals.

What is a Short-Term Loan?

Short-term loans cover immediate financial needs. It's ideal for quickly accessing cash for urgent bills, unexpected expenses, or cash flow gaps.

Short-term loans typically have smaller loan amounts (₹1,000-₹1,000,000) and shorter repayment periods (weeks to 12 months). Students, young professionals, and small business owners who need immediate financial support like them because of the quick approval process and minimal paperwork.

Short-term loans are unsecured, unlike bank loans, which require extensive paperwork and collateral. But the ease of quick approval often comes with slightly higher interest rates than with long-term loans.

Once you know what a short-term loan is, you can decide if it's right for you. But before you choose, let's look at the pros and cons to see how it fits into your overall budget.

Must Read: Applying for Urgent Personal Loans with a Low Credit Score

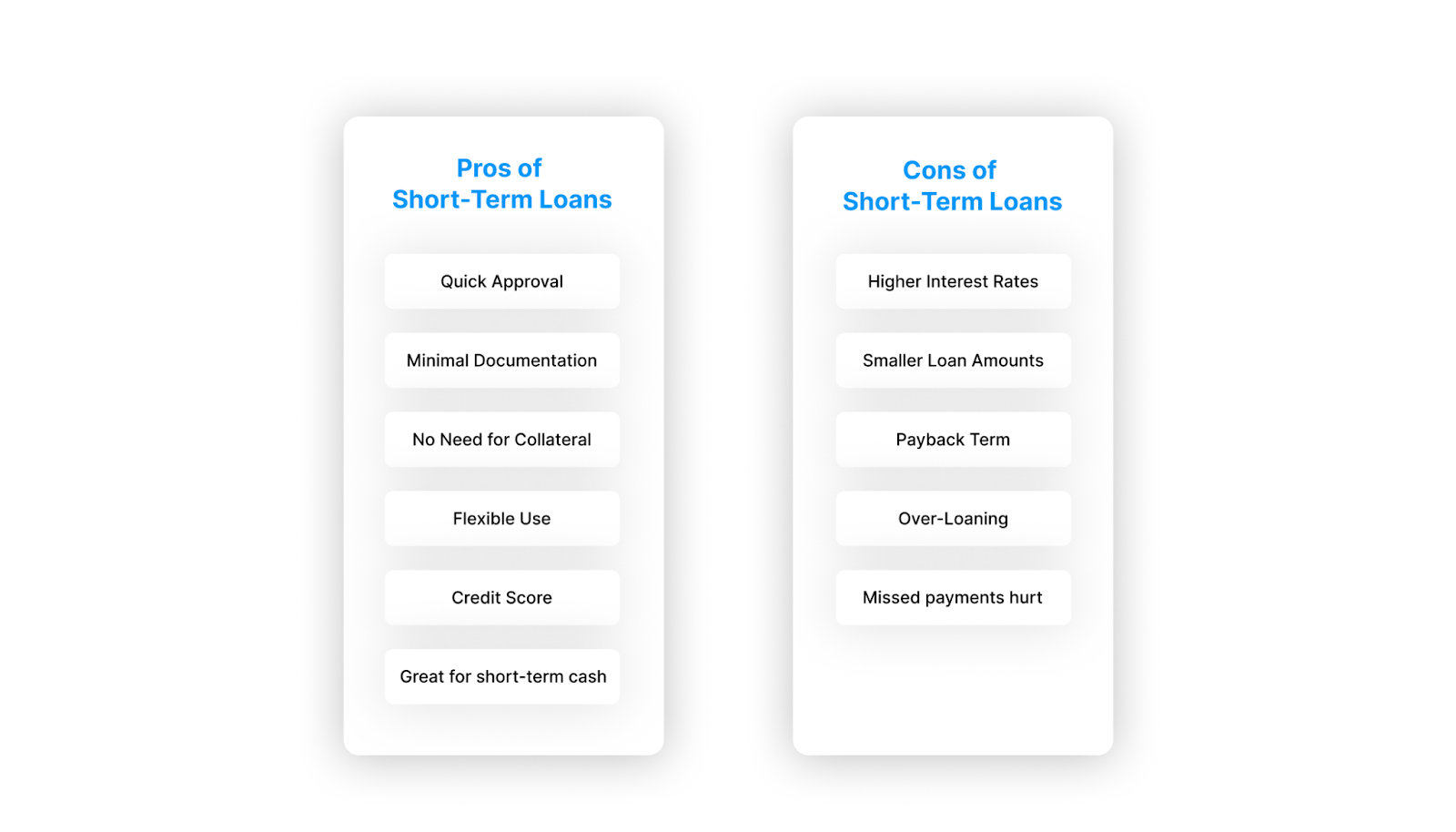

Pros of Short-Term Loans

- Quick Approval and Payment: Short-term loans are meant to help you out in an emergency. The approval process is fast, and the money is usually sent within hours or a day, which makes them great for when you need cash quickly.

- Minimal Documentation: Unlike traditional bank loans, these only need basic Know Your Customer (KYC) documents. This makes the process easier and cuts down on the time you have to wait.

- No Need for Collateral: Since most short-term loans are unsecured, you don't have to put up anything as collateral, like jewellery or property.

- Flexible Use: The money can be used for a lot of different things, from paying bills and medical costs to dealing with personal or business emergencies.

- Credit Score: If you pay back your short-term loan on time, it can help you build or improve your credit history. This is especially true if this is your first time borrowing money.

- Ideal for Short-Term Cash Flow Problems: This loan is perfect for short-term cash flow problems without taking out long-term debt.

Cons of Short-Term Loans

- Higher Interest Rates: Because they're unsecured and quickly approved, short-term loans often come with higher interest rates compared to long-term loans.

- Smaller Loan Amounts: The approved amount is usually small, between ₹1,000 and ₹1,000,000, which might not be enough to cover bigger costs.

- Payback Term: You only have a few months to pay back the loan, which can be hard if your income or cash flow isn't steady.

- Over-Loaning: People who can get credit quickly may be tempted to take out more loans than they need, which can lead to debt cycles.

- Impact on Credit Score if Missed: Missing payments or defaulting can hurt your credit score and make future borrowing more difficult.

Must Read: Instant Payday Loans for Salaried Employees in Bangalore

What is a Long-Term Loan?

Long-term loans are a type of credit that is paid back over a long period of time, usually between 3 and 30 years, but this depends on the type of loan and its purpose. For big financial goals like buying a house, paying for college, or growing a business that needs a lot of money but can't pay it back all at once, these loans are perfect.

Long-term loans usually have lower interest rates, bigger borrowing limits, and structured monthly payments (EMIs) that are spread out over a number of years. As a result, the monthly payment is lower, which makes it easier to handle with other financial obligations.

Most long-term loans are secured, which means you may have to put up property, a car, or something else of value as collateral. There are, however, unsecured options as well, such as personal or education loans, which depend on your income and credit score.

Now that you have a general idea of how long-term loans work, let's look at the pros and cons of them to understand their effects fully.

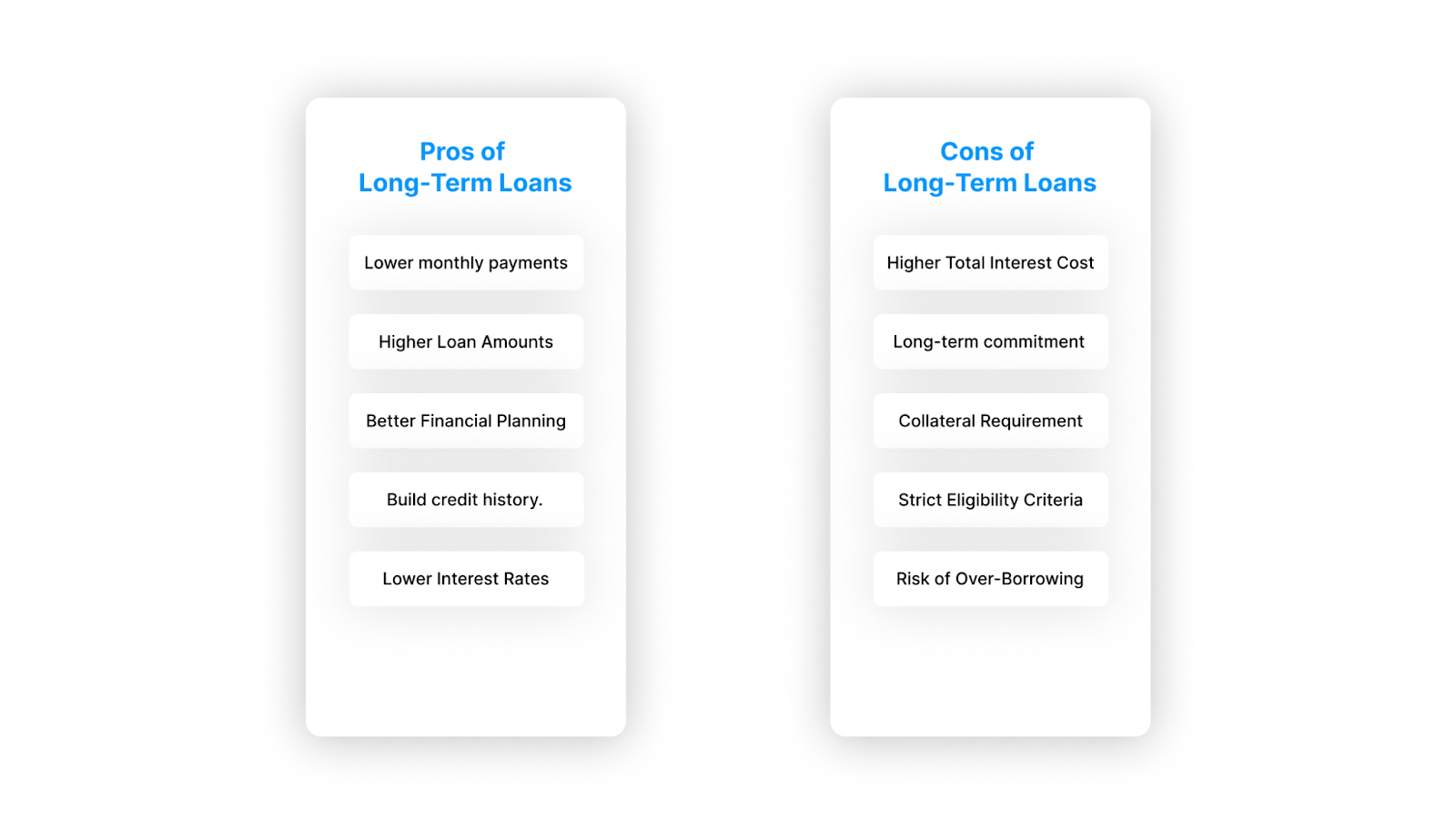

Pros of Long-Term Loans

- Lower monthly payments: The EMI amounts are much smaller than with short-term loans because the costs are spread out over a number of years. This helps you stick to your monthly budget without worrying about money.

- Higher Loan Amounts: Long-term loans let you borrow more money, which makes them perfect for big financial goals like buying a house, paying for school, or growing your business.

- Better Financial Planning: You can make better financial plans when you know what your EMIs will be and how long the loan will last. If you know exactly how much you owe every month, you can keep your cash flow steady.

- Opportunity to Build Credit History: If you make your payments on time every month for a few years, your credit score will go up a lot, and you'll build a strong credit history, which will help you when you need to borrow money in the future.

- Lower Interest Rates: Generally, the interest rates on long-term loans are lower than those on short-term loans. This is especially true for secured loans. This reduces the overall cost of borrowing in the long run.

Cons of Long-Term Loans

- Higher Total Interest Cost: Even with lower rates, paying over several years means you end up paying more interest overall compared to a short-term loan.

- Commitment Over Many Years: A long-term loan locks you into a financial obligation that can last a decade or more. This can limit flexibility if your financial situation or goals change.

- Collateral Requirement: Many long-term loans are secured, meaning you must pledge an asset such as a house or car. Failure to repay can result in losing that asset.

- Strict Eligibility Criteria: Lenders typically assess your income, employment stability, and credit score more rigorously before approving large loan amounts.

- Risk of Over-Borrowing: Because higher amounts are available, borrowers may take on more debt than necessary, leading to repayment difficulties in the future.

Difference Between Short-Term Loans and Long-Term Loans

Let us look at the difference between short-term loans and long-term loans:

| Criteria | Short-Term Loans | Long-Term Loans |

| Loan Tenure | Usually ranges from a few months up to 2 years. | Typically lasts from 3 years to 30 years, depending on the type of loan. |

| Loan Amount | Ideal for smaller financial needs (₹1,000 to ₹5 lakhs). | Suitable for large financial goals (₹5 lakhs to ₹1 crore or more). |

| Approval and Disbursal | Quick approval and instant disbursal, often within hours or days. | Approval takes longer due to more documentation and eligibility checks. |

| Interest Rate | Usually higher because of the short repayment period and unsecured nature. | Generally lower, especially for secured loans like home or car loans. |

| Collateral Requirement | Usually unsecured. No collateral or security needed. | Often secured. Requires an asset like property or a vehicle as collateral. |

| Repayment Schedule | Frequent and shorter repayment cycles (monthly or fortnightly). | Extended repayment periods with smaller EMIs. |

| Total Interest Paid | Less overall interest due to shorter tenure. | More overall interest because of longer tenure, even with lower rates. |

| Purpose | Best for emergency expenses, cash flow gaps, or short-term needs. | Best for long-term investments like buying a house, higher education, or business expansion. |

| Eligibility Criteria | Easier to qualify for; minimal documentation required. | Stricter eligibility and documentation process. |

| Credit Score Impact | Quick repayment helps improve your credit score faster. | Builds long-term credit history if EMIs are paid consistently. |

Short-term loans are perfect for quick, urgent financial needs that you can repay soon, while long-term loans are better suited for major financial goals that require larger sums and longer repayment timelines.

You know the main differences between them now. The next question is how to choose the one that best fits your financial goals. The following tips will help you pick the best type of loan for your needs.

Must Read: Understanding How Student Loans Work

How to Choose Between Short-Term and Long-Term Loans?

Here’s what you need to keep in mind when choosing between short-term and long-term loans:

- Start by identifying why you need the loan. If it’s for quick or temporary needs like paying bills, handling an emergency, or managing short-term business costs, a short-term loan is ideal. For larger, long-term goals such as buying a home, funding higher education, or expanding a business, a long-term loan makes more sense.

- Consider the loan amount you require. Short-term loans work best for smaller sums, usually between ₹1,000 and ₹5 lakhs, while long-term loans are better for higher amounts that need structured EMIs over several years.

- Evaluate your repayment capacity. Short-term loans have higher EMIs because they’re repaid quickly, so only choose them if your income allows comfortable repayments. Long-term loans, while easier on monthly budgets, accumulate more interest over time.

- Compare the total cost of borrowing, not just the interest rate. Short-term loans may have higher monthly rates, but you end up paying less interest overall. Long-term loans seem cheaper initially but cost more due to longer tenures.

- Think about the paperwork and collateral. Short-term loans usually don't need a lot of paperwork or security. This is especially true for digital options like Pocketly, which offer instant approval with little to no Know Your Customer (KYC) checks. Long-term loans often require assets as collateral and involve a longer approval process.

- Keep your credit goals in mind. Short-term loans are great if you want to build or improve your credit score quickly through timely repayments. Long-term loans help maintain a consistent credit history over time.

- Consider the urgency of your need. If you require money immediately, short-term loans are faster and can be approved within hours. Long-term loans take more time due to detailed verification and documentation.

Should you want to handle your short-term money needs better, Pocketly is a platform that makes the process easier. Let's look at how it helps young professionals and salaried workers handle short-term loans wisely.

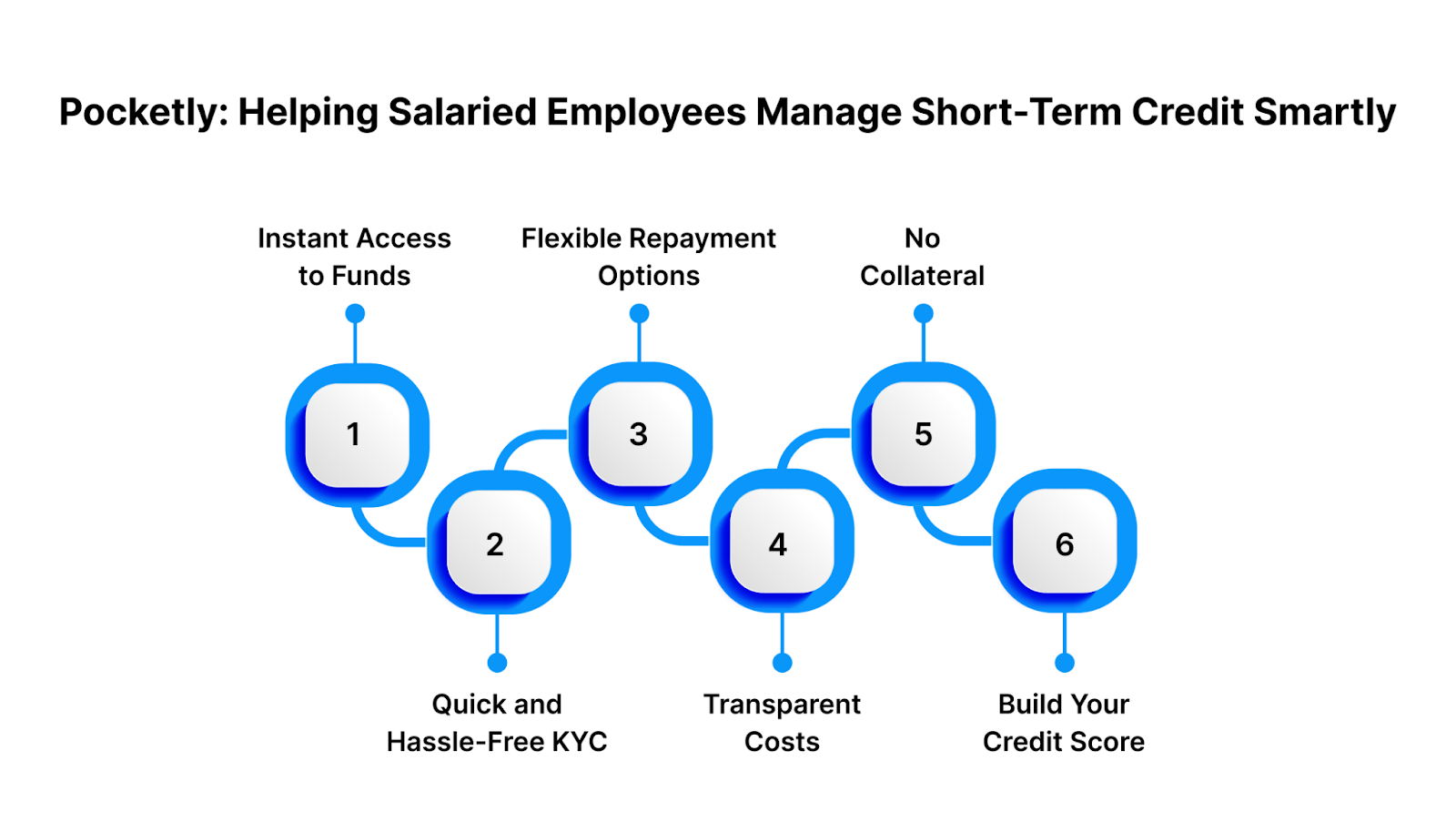

Pocketly: Helping Salaried Employees Manage Short-Term Credit Smartly

Unexpected costs can happen even if you plan your money well. These could be a sudden medical bill, a car repair, or a shortfall at the end of the month before you get paid. Pocketly makes it easy and responsible to handle your short-term money needs.

Here’s how Pocketly makes borrowing simple, fast, and stress-free:

- Instant Access to Funds: Borrow small amounts starting from ₹1,000 up to ₹25,000 based on your needs. It's all done online, and it only takes a few minutes. This makes it perfect for handling emergencies or important bills right away.

- Quick and Hassle-Free KYC: No lengthy paperwork or physical verification. Complete a simple online KYC process, and receive the approved amount directly in your bank account.

- Flexible Repayment Options: Repay conveniently over 2 to 6 months. You can plan your EMIs according to your budget, making it easy to stay financially balanced.

- Transparent Costs: Pocketly shows all charges upfront before you confirm your loan. Interest rates start at just 2% per month, with a small processing fee (1–8%), ensuring there are no hidden surprises.

- No Collateral or Credit History Required: Even if you’re new to credit or have no prior borrowing record, you can still get approved. Pocketly uses modern data-based evaluation instead of traditional credit scores.

- Build Your Credit Score: Making repayments on time helps you establish a positive credit history, giving you a head start for future loans or credit cards.

Conclusion

Choose a short-term or long-term loan based on your needs, repayment capacity, and financial goals. You should use short-term loans for urgent expenses and be able to repay them quickly. But long-term loans are better for bigger financial goals like buying a home, funding college, or expanding a business, which require more time and flexibility.

Whatever you choose, borrow responsibly and understand the repayment terms before committing. An informed loan choice can support your goals, but an uninformed choice can cause financial stress.

That’s where Pocketly steps in. Whether it’s an unexpected expense or a small cash crunch, Pocketly lets you access instant credit from ₹1,000 to ₹25,000 with full transparency, no collateral, and flexible repayment options.

Smart borrowing lets you manage your finances. Download the Pocketly app on Android or iOS today to get instant short-term credit to simplify your finances.

FAQs

1. What is the main difference between short-term and long-term loans?

The main difference lies in the repayment period. Short-term loans are typically repaid within a few months to a year, while long-term loans can extend for several years, depending on the loan type and amount.

2. Which loan type is better for emergencies?

Short-term loans are better for emergencies like medical bills, travel expenses, or sudden repairs since they offer quick approval and smaller loan amounts.

3. Do short-term loans have higher interest rates than long-term loans?

Yes, short-term loans often come with higher interest rates due to their quick approval and shorter repayment periods. However, since they’re repaid faster, the total interest paid may still be lower than on long-term loans.

4. Can I take both short-term and long-term loans at the same time?

Yes, it’s possible if your income and creditworthiness support multiple loans. However, always ensure you can manage repayments comfortably to avoid financial strain.

5. What happens if I fail to repay a short-term loan on time?

Late or missed payments can lead to penalties, higher interest rates, and a negative impact on your credit score. Always plan your repayment before borrowing.