Introduction

Pocket money might seem like a small thing, but it’s actually your first real step toward financial independence. Whether it’s money from your parents, a part-time job, or something you earn on your own, the way you handle it shapes your future money habits.

If you often wonder where all your money goes by the end of the month, you’re not alone. Many students spend without a plan, and that’s okay, but learning to manage your pocket money is what helps you take control. It’s not about limiting yourself; it’s about gaining freedom. The freedom to save, spend wisely, and make smart financial choices.

In this blog, we’ll share practical ways to manage your pocket money, save more, and even grow your savings. These simple strategies will help you build strong financial habits and feel more confident about your money.

At a Glance

- Students can learn money management skills from pocket money.

- Creating a simple budget helps track expenses, avoid overspending, and ensures that saving becomes a consistent habit.

- Following smart saving strategies, like the 50-30-20 rule or using cashback apps, can make every rupee go further.

- Learning to differentiate between wants and needs helps students spend wisely and avoid unnecessary financial stress.

- Better financial discipline comes from avoiding impulse spending, frequent borrowing, and ignoring small expenses.Learning to manage pocket money is one of the most valuable life skills you can develop early on. It's about responsibility, money value, and lifelong financial decisions, not just saving a few rupees.

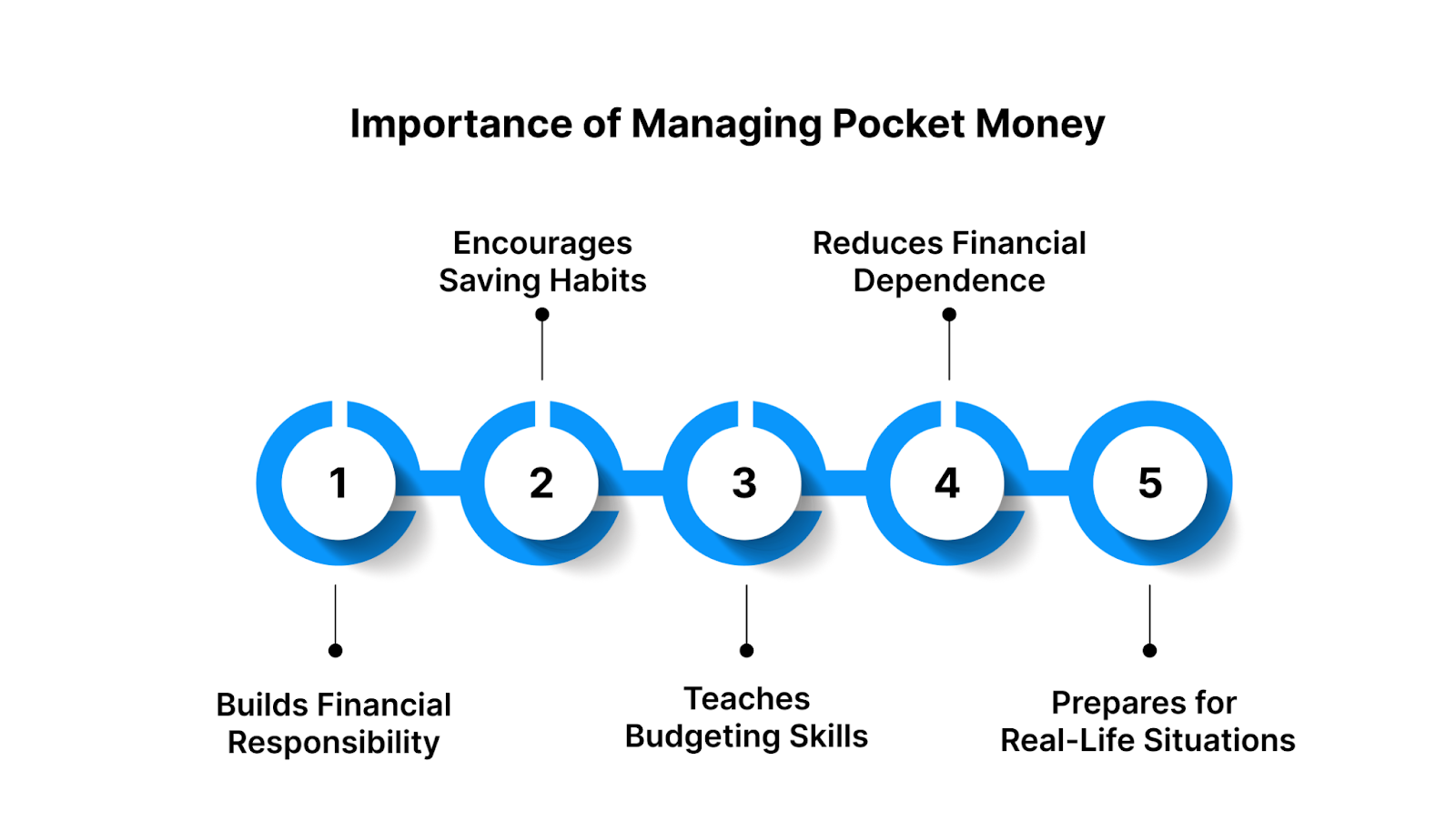

Importance of Managing Pocket Money

Learning to manage pocket money is one of the most valuable life skills you can develop early on. It's about responsibility, money value, and lifelong financial decisions, not just saving a few rupees.

Here’s why managing pocket money is so important for students:

1. Builds Financial Responsibility

When you plan how to use your pocket money, you start taking charge of your own financial decisions. You learn that money isn’t endless. It needs to be spent wisely to cover what you truly need.

2. Encourages Saving Habits

Even if you save a small amount each month, it adds up over time. Saving teaches you patience and helps you prepare for bigger goals, like buying something meaningful or handling unexpected expenses later.

3. Teaches Budgeting Skills

Managing your pocket money helps you understand the difference between what you want and what you need. It makes you think before you spend and enables you to make smarter choices, skills that will help you throughout life.

4. Reduces Financial Dependence

When you know how to manage your money, you don’t have to ask your parents for every small thing. It gives you confidence and a sense of independence that feels really good.

5. Prepares for Real-Life Situations

By handling your pocket money, you learn to balance income and expenses, save for the future, and deal with small emergencies, just like you’ll do as an adult.

In short, managing your pocket money now sets you up for lifelong financial confidence. Once you understand why it matters, the next step is learning how to organise it, and that starts with creating a simple student budget.

Learning the importance of managing pocket money is only the beginning. The next step is organising it, starting with a simple student budget.

Must Read: Understanding the Importance of Financial Education

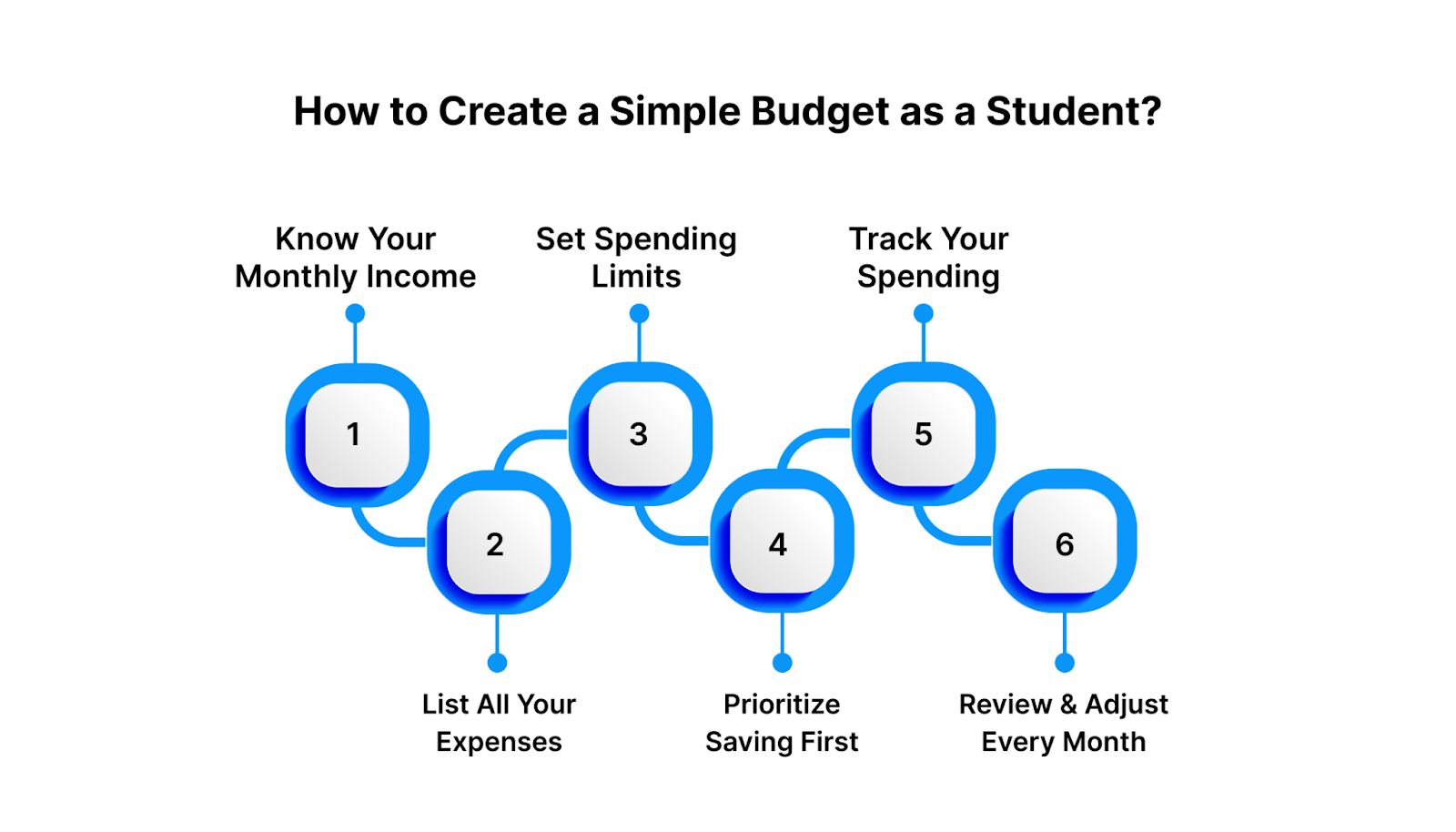

How to Create a Simple Budget as a Student?

Creating a budget is one of the smartest ways to take control of your pocket money. It helps you see exactly where your money goes, stops you from overspending, and ensures you always have something saved for what truly matters to you.

Here’s a simple step-by-step guide to creating a simple budget that works for you.

1. Know Your Monthly Income

Start by listing how much pocket money or allowance you receive each month. If you also earn money from part-time jobs, freelancing, or tutoring, include that amount as well. Knowing your total income helps you set spending limits wisely.

2. List All Your Expenses

Next, write down your regular expenses, such as food, transportation, mobile recharge, books, or social activities with friends. Divide them into two categories:

- Needs (essentials like food, stationery, travel)

- Wants (non-essentials like outings, online shopping, or entertainment)

3. Set Spending Limits for Each Category

Once you know your expenses, allocate specific amounts for each category. For example, decide how much you’ll spend on food and travel every week and how much you’ll save. This keeps you from spending all your pocket money at once.

4. Prioritise Saving First

Before spending, make saving a fixed part of your budget. Even if it’s just ₹100 or ₹200 each month, set it aside for emergencies or future goals. Treat savings like a mandatory expense.

5. Track Your Spending Regularly

Use a notebook or a simple budgeting app to track where your money goes. At the end of each week, check if you’ve stayed within your limits or need to adjust your spending for the next week.

6. Review and Adjust Every Month

Your expenses may change, so review your budget regularly. If you’re saving more or spending too much in one area, update your plan accordingly.

A consistent budget doesn't need to be complicated. Students can maximise their pocket money, avoid last-minute financial stress, and develop good financial habits by following this simple method.

Once you have a clear budget in place, the next challenge is learning how to save smartly. Let’s explore some creative and practical saving strategies that can make a significant difference, even with limited pocket money.

Start tracking your expenses today and see how much you can actually save this month with Pocketly!

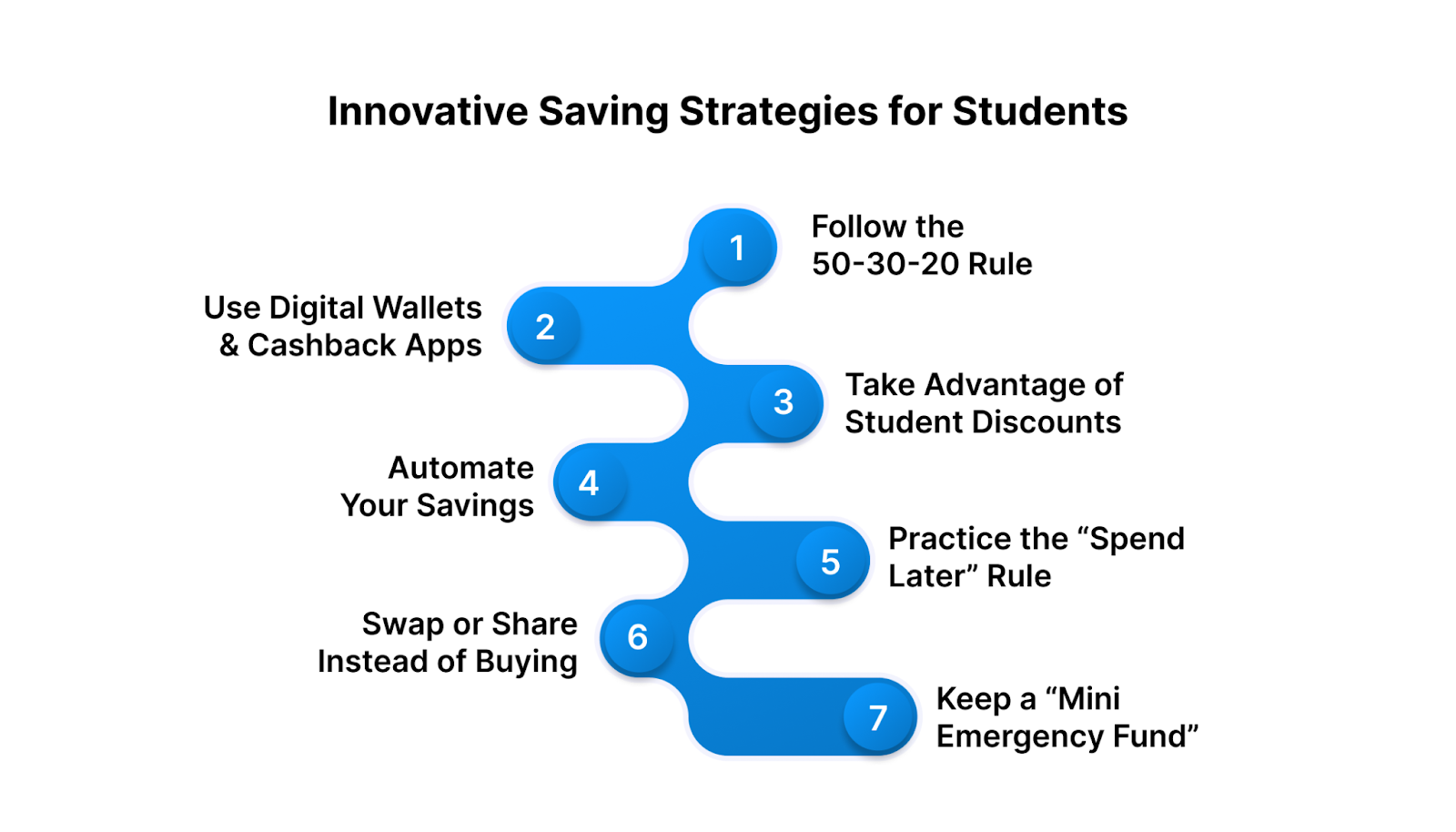

Innovative Saving Strategies

Saving money as a student may seem harsh, especially when your student budget is limited. But with the right approach and a little creativity, you can make every rupee count.

Here are some innovative and practical ways to save money smartly while still enjoying your student life:

1. Follow the 50-30-20 Rule

This classic budgeting method is simple and effective.

- 50% of your money goes to essentials like food, transport, and stationery.

- 30% is spent on entertainment, snacks, and socialising.

- 20% should always be saved.

Even if your pocket money is small, saving a portion regularly helps you build a habit of financial discipline.

2. Use Digital Wallets and Cashback Apps

Digital payment apps often offer discounts, cashback, or reward points on transactions. Use them for small purchases, such as food orders or mobile recharges. Over time, these savings add up.

3. Take Advantage of Student Discounts

Many brands, movie theatres, online learning platforms, and even cafes offer student discounts. Before making a purchase, always inquire about any student offers. You'll be shocked at how much you can save each month.

4. Automate Your Savings

If you receive your pocket money in a bank account, try setting up an automatic transfer of a small amount to your savings account every month. It’s an easy way to save without thinking about it.

5. Practice the “Spend Later” Rule

Whenever you want to buy something non-essential, wait at least 24 hours before making a purchase. This delay helps you decide if you really need it or if it’s just an impulse buy. Most of the time, you’ll end up saving that money.

6. Swap or Share Instead of Buying

Exchange books, notes, or even accessories with friends instead of buying new ones every time. It’s sustainable, cost-effective, and a great way to save your pocket money for bigger goals.

7. Keep a “Mini Emergency Fund”

Save a small amount each month for unexpected expenses, such as sudden trips or health-related costs. Having this backup prevents you from needing to borrow money later.

By applying these simple yet innovative strategies, students can save effectively, reduce unnecessary spending, and manage their pocket money with confidence. Smart saving today lays the foundation for financial independence tomorrow.

Saving money is one part of the journey. However, to truly make the most of your pocket money, you need to strike a balance between spending, saving, and planning. Here’s how you can make every rupee count.

Must Read: 7 Smart Tips to Increase Your CIBIL Score Immediately

How to Make the Most of Your Pocket Money?

Giving students pocket money is the first step toward teaching them financial responsibility; it's more than just giving them money to spend. Making the most of it means managing, saving, and spending wisely so that you can enjoy today while preparing for tomorrow.

Here’s how you can stretch your pocket money and make it truly count:

- Prioritise essentials: Always start with necessary expenses like food, transportation, and study materials. Once those are covered, you can use the remaining money for fun or personal treats without guilt.

- Track your spending: Write down every expense in a notebook or use a free budgeting app. Seeing where your money goes helps you control spending and avoid surprises at the end of the month.

- Set clear goals: Give your money a purpose. Save for a specific goal like a new phone, concert ticket, or trip. This keeps you focused and prevents impulsive purchases.

- Use smart tools: Try using student-friendly payment apps or prepaid cards that send spending alerts. These tools make it easier to stick to your budget and avoid overspending.

- Avoid borrowing: Borrowing from friends or using credit for small things can build bad money habits. Learn to live within your means and plan for future expenses.

- Spend smartly: Look for student discounts, cashback offers, and free campus activities. This way, you can still enjoy social outings without emptying your wallet.

- Save first: As soon as you get your pocket money, put aside 10–20% in savings. It may seem small, but over time it adds up and helps you feel financially secure.

Learning to make the most of your pocket money as a student helps you build strong financial habits early. When you learn to manage small amounts wisely, you prepare yourself to handle larger financial responsibilities with confidence in the future.

Even with the best intentions, students sometimes make small financial mistakes that lead to big problems later. Let’s take a look at some common pitfalls and how to avoid them.

Ready to take charge of your pocket money? Create your first budget now and stick to it for 30 days.

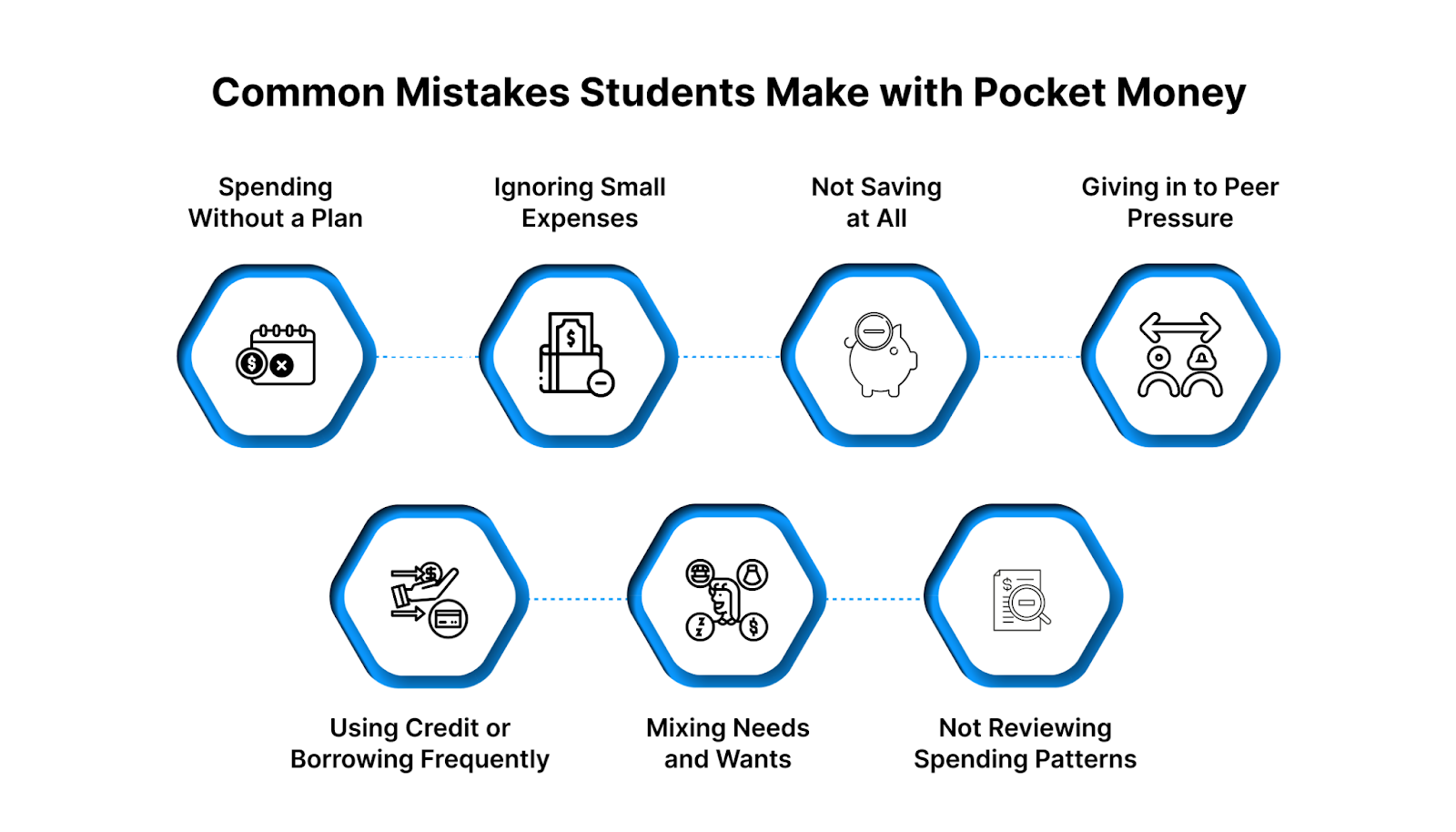

Common Mistakes Students Make with Pocket Money

Receiving pocket money is exciting. But managing it wisely takes practice. Many students fall into common traps that leave them short of cash by the end of the month.

Here are the most frequent mistakes to watch out for and avoid:

Understanding these mistakes early can help you build better financial habits.

- Spending without a plan: When you don’t set a basic budget, it’s easy to spend impulsively on snacks, outings, or online shopping. Without planning, you might find yourself broke when an important expense comes up.

- Ignoring small expenses: A few rupees spent daily may not seem like much, but frequent small purchases like coffee or food deliveries can quickly add up and drain your funds.

- Not saving at all: Waiting to start saving “later” is a mistake. Saving even ₹100–₹200 from your pocket money builds discipline and prepares you for managing bigger finances in the future.

- Giving in to peer pressure: Trying to match your friends’ lifestyle, from shopping to dining out, can lead to overspending. Remember, your goals and budget are unique, and it’s okay to say no.

- Relying on credit or borrowing often: Borrowing money or using credit for minor expenses can create dependency and reduce your sense of financial control. It’s better to adjust your spending instead.

- Mixing needs and wants: When you don’t distinguish between essentials (books, transport) and luxuries (gadgets, extra outings), you risk overspending on unnecessary items. Prioritising needs can help you be on track.

- Not reviewing spending habits: If you never check where your money goes, you can’t improve your financial habits. Reviewing your spending regularly helps you spot patterns and plan smarter.

Avoiding these mistakes helps you stay in control of your pocket money, reduce financial stress, and develop lasting money management skills. When handled wisely, even small allowances can teach powerful lessons in independence and responsibility.

While prudent pocket money management is essential, having access to responsible short-term credit can be just as useful in times of need. This is where Pocketly, a cutting-edge tool made specifically for students, comes in.

Must Read: Financial Planning Tips for Young Adults

Pocketly: Helping Students Manage Short-Term Credit Responsibly

With Pocketly, you can easily handle those unexpected expenses. Whether it's last-minute project materials, travel, or college supplies, without having to rely on friends, family, or expensive credit cards.

It’s all about helping you develop smart borrowing habits and a solid repayment plan right from the start, so you’re set up for financial success down the road.

Here’s how Pocketly makes managing short-term credit responsible and straightforward:

- Quick access to funds: You can borrow small amounts, from ₹1,000 to ₹25,000, whenever you need them. The entire process is digital, with instant approval and fast transfers directly to your bank account.

- Flexible repayment options: Choose a repayment period that fits your budget, usually between 2 to 6 months. This makes paying back easy and stress-free.

- Transparent and fair terms: Pocketly shows you all costs upfront. No hidden charges or complicated interest rates. So you can plan your repayments confidently.

- No collateral or credit history needed: Even if you’ve never borrowed before, you can still use Pocketly. It uses alternative credit checks, making it student-friendly and accessible.

- Builds good financial habits: Every time you borrow responsibly and repay on time, you make a positive credit history. This helps you become financially independent and ready for future opportunities.

Students can fill short-term financial gaps with Pocketly without wasting their pocket money or developing bad borrowing habits. Gaining credit quickly isn't enough; you also need to learn how to handle it sensibly for a stable financial future.

Conclusion

Students who learn how to manage their pocket money are laying the groundwork for lifelong financial responsibility, which goes beyond simply saving pennies. When students create budgets, save consistently, and avoid impulsive spending, they gain control over their finances and learn to make more informed choices. In addition to being beneficial outside of the classroom, early financial management fosters confidence, self-reliance, and self-control.

Download the Pocketly app today on iOS or Android to experience quick, flexible, and responsible short-term credit designed to support students’ real financial needs. Start managing your pocket money the smart way!

FAQs

1. Why is managing pocket money necessary for students?

Managing pocket money teaches students financial discipline, helps them understand budgeting, and builds early habits of saving and spending wisely. It also prepares them to handle larger financial responsibilites in the future.

2. How much pocket money should a student get?

The amount of pocket money allocated to students varies depending on their age, individual needs, and family income. It should be enough to cover basic personal expenses and occasional treats without encouraging overspending.

3. What’s the best way for students to save pocket money?

Students can save by setting aside a small percentage of their pocket money regularly, using savings jars or digital wallets, and avoiding impulse purchases. Over time, these small savings can grow significantly.

4. Can students use digital apps to manage their pocket money?

Yes, several apps help students track spending, set saving goals, and even access short-term funds responsibly. Tools like Pocketly offer financial support while promoting good repayment habits.

5. What common mistakes should students avoid with pocket money?

Students should avoid borrowing excessively, ignoring budgets, spending on unnecessary items, and failing to track their spending. Awareness and planning are key to avoiding debt and overspending.