Introduction

Managing money during college can feel overwhelming. Between tuition fees, rent, daily expenses, and the occasional night out, it’s easy to run short of cash before the month ends.

The good news is that following healthy financial habits early on can simplify life now and set you up for long-term success. By following practical money strategies, you can avoid unnecessary debt, make your allowance or income last longer, and gain confidence in handling your finances.

In this blog, we have listed down some of the most effective personal finance tips for students, each explained with simple examples you can relate to.

At a Glance

- College life often involves limited income and high expenses, making financial planning a crucial aspect of student life.

- Managing money well builds independence, confidence, and prepares you for future responsibilities.

- Key habits include budgeting, saving regularly, separating spending from savings, and reviewing expenses every week.

- Students should build an emergency fund, avoid unnecessary debt, and use credit cards responsibly.

- Discounts, second-hand books, and cooking at home can significantly reduce costs.

- Digital payments are convenient, but must be used safely to prevent fraud.

- Part-time work or freelancing can boost income and reduce dependence on parents.

Why Personal Finance Matters for Students?

Personal finance goes beyond saving money; it helps students gain independence, build confidence, and prepare for the future. For those managing their own finances for the first time, financial awareness can mean the difference between constant stress and steady control.

1. Managing Limited Income

Most students live on a fixed allowance, part-time job earnings, or stipends. With money already tight, it becomes essential to plan every rupee carefully. Without basic financial skills, it’s easy to overspend on wants like eating out or online shopping, leaving little left for essentials.

Example: If you receive ₹8,000 per month, spending ₹4,000 on entertainment in the first two weeks could leave you struggling to cover rent or transport at the end of the month.

2. Building Independence and Responsibility

College life often marks the transition from dependence on parents to managing your own affairs. Learning personal finance helps students take responsibility for their spending choices and fosters accountability.

Example: Instead of relying on parents to bail you out at the end of every month, budgeting ensures you can cover your own expenses with confidence.

3. Preparing for Emergencies

Unexpected situations, such as medical bills, urgent travel, or laptop repairs, can arise at any time. Without savings or a backup plan, students may resort to borrowing or using high-interest credit. Having even a small emergency fund provides peace of mind and financial stability.

Example: Saving just ₹500 a month creates a ₹6,000 buffer over the course of a year. This amount is sufficient to handle most minor emergencies without undue stress.

4. Avoiding Debt Traps Early

Poor money management can lead to borrowing more than you can repay, creating a cycle of debt even before starting your career. By understanding personal finance, students learn to distinguish between healthy borrowing (for genuine needs) and risky spending (on luxuries or impulse buys).

Example: Using a loan for exam fees is responsible; using it for the latest smartphone when you already own one is not.

5. Building Credit for the Future

College is the ideal time to establish a solid financial foundation. Paying bills on time, using small loans wisely, or managing a student credit card responsibly helps establish a good credit history. This will be important later when applying for car loans, home loans, or business financing.

Example: Paying off a ₹2,000 student credit card bill in full every month can create a positive credit score that benefits you years later.

6. Gaining Confidence and Reducing Stress

Money problems are one of the most significant sources of stress for students. Constantly worrying about whether you have enough can distract from studies and personal growth. Financial literacy helps you take control, reducing anxiety and allowing you to focus on your goals.

Example: A student who tracks expenses and saves regularly feels secure, while one who spends without planning often scrambles to borrow at the month’s end.

7. Laying the Foundation for Long-Term Success

The habits students develop in college often carry into adulthood. Whether it’s budgeting, saving, or responsible borrowing, these practices set the stage for long-term financial health. The earlier you start, the stronger your financial foundation will be.

Example: A student who saves ₹1,000 every month during college graduates with the discipline and confidence to manage a salary wisely.

Once you understand how personal finance affects your independence and stability, the next step is to apply these lessons in practice through simple, actionable tips.

Must Read: 11 Successful Tips On How To Save Money While In College

15 Personal Finance Tips for Students

Handling money wisely during college can feel challenging, but it’s also the best time to build strong financial habits. By adopting a few simple strategies, students can stretch their budgets, avoid unnecessary debt, and feel more confident about their financial future.

Here are 15 practical personal finance tips every student should know.

1. Know Your Money Situation

Before you can manage money, you need to know where it goes. Start by listing your sources of income (allowance, part-time work, scholarships) and your regular expenses (rent, food, travel, subscriptions). This “money snapshot” shows whether you are living within your means or spending beyond them.

Example: If you earn ₹8,000 a month from part-time work and allowance, but spend ₹9,500, you instantly know where the problem lies and can cut back.

2. Create and Stick to a Budget

A budget is simply a plan for your money. Divide your income into three categories: needs (essentials such as food, rent, and transportation), wants (activities like going to the movies and eating out), and savings. Tracking expenses through apps or a simple spreadsheet helps avoid surprises. The key is not just to make a budget, but to stick to it.

Example: Out of ₹6,000 allowance, you decide ₹3,000 goes to rent/food, ₹2,000 to personal expenses, and ₹1,000 to savings.

3. Separate Spending and Savings Accounts

Having two bank accounts makes managing money easier. Keep one for day-to-day use (such as UPI, cards, and withdrawals) and another strictly for savings. This separation reduces the temptation to spend money meant for future needs.

Example: When your stipend comes in, transfer ₹1,500 straight into savings so you don’t “accidentally” spend it on weekend outings.

4. Save Automatically

Discipline is easier when it’s automatic. Set up a recurring transfer from your main account to savings or a digital wallet every month. Treat savings like a fixed expense. Think of it like rent or phone bills.

Example: If you earn ₹10,000, schedule an auto-transfer of ₹1,000 into savings on the first of every month.

5. Build a Small Emergency Fund

Life is unpredictable. A sudden illness, a laptop repair, or a trip home can throw your budget off track. An emergency fund (even a small one) prevents you from borrowing unnecessarily. Aim to save at least 1–2 months of expenses over time.

Example: Saving ₹500 every month accumulates to ₹6,000 in a year, enough to cover most student-level emergencies.

Must Read: Consequences Of Not Paying Unsecured Loans In India

6. Borrow Only When Necessary

Loans and credit can be helpful but dangerous if misused. Avoid borrowing for luxuries or impulse purchases. Debt should be your last resort, not your first option.

Example: Using a loan for exam fees is sensible. Taking one for the latest phone model when you already have a working device isn’t.

7. Use Credit Cards Responsibly

Credit cards help you build a financial history, but only if used wisely. Spend only what you can repay in full, and never miss a due date to avoid interest and penalties.

Example: If your card has a ₹15,000 limit, keep monthly spending within ₹4,000–₹5,000 and pay it off entirely before the bill is due.

8. Take Advantage of Student Discounts

Students often have access to special rates on software, travel, events, or food. These discounts can significantly reduce costs if you actively utilize them.

Example: A student email ID can get you cheaper access to Microsoft Office, Spotify, or discounted bus/metro passes.

9. Cut Down on Textbook and Material Costs

Academic expenses are high, but there are more innovative ways to handle them. Look for used books, rentals, digital versions, or sharing with classmates instead of buying everything new.

Example: Instead of paying ₹2,000 for a brand-new textbook, buy a secondhand copy for ₹500 or borrow it from the library.

10. Cook More, Order Less

Food is one of the biggest drains on a student’s budget. Cooking your own meals or sharing groceries with roommates can save money and promote healthier eating habits.

Example: Spending ₹1,000 on groceries covers meals for a week. That same amount barely covers three or four food delivery orders.

11. Budget Conservatively

Plan your budget as if your income is a little less and your expenses a little more. This creates a buffer and prevents overspending.

Example: If you expect ₹8,000 from part-time work, plan your budget as though it’s ₹7,000. This way, any extra income feels like a bonus.

12. Review Your Spending Weekly

Don’t wait until the end of the month to realise you have overspent. A weekly check-in helps you make adjustments before it’s too late.

Example: If you see you have already spent ₹1,800 on food by mid-month when your budget was ₹2,500, you know to cut back for the next two weeks.

13. Learn the Basics of Investing Early

You don’t need to dive into risky trading, but understanding safe investments builds long-term habits. Explore recurring deposits, mutual fund SIPs, or fixed deposits.

Example: Saving ₹500 a month in a SIP during college could grow into a substantial amount by the time you graduate.

14. Use Digital Payments Safely

Digital tools like UPI, wallets, and cards are convenient but require caution. Always double-check details, use secure apps, and never share OTPs or PINs.

Example: Before transferring ₹1,000 via UPI, confirm the name linked to the account to avoid sending money to the wrong person.

15. Earn Extra Income Through Part-Time Work or Freelancing

Earning while studying eases financial pressure and builds independence, as well as valuable skills. Look for part-time jobs, internships, or online gigs.

Example: Freelancing in writing, tutoring, or design can earn you an extra ₹3,000–₹5,000 per month, which can go into savings or paying bills.

While these strategies can help you take control of your money, sometimes unexpected expenses still arise, and that's when having the right support matters.

Must Read: Understanding Financial Literacy: Importance And Benefits

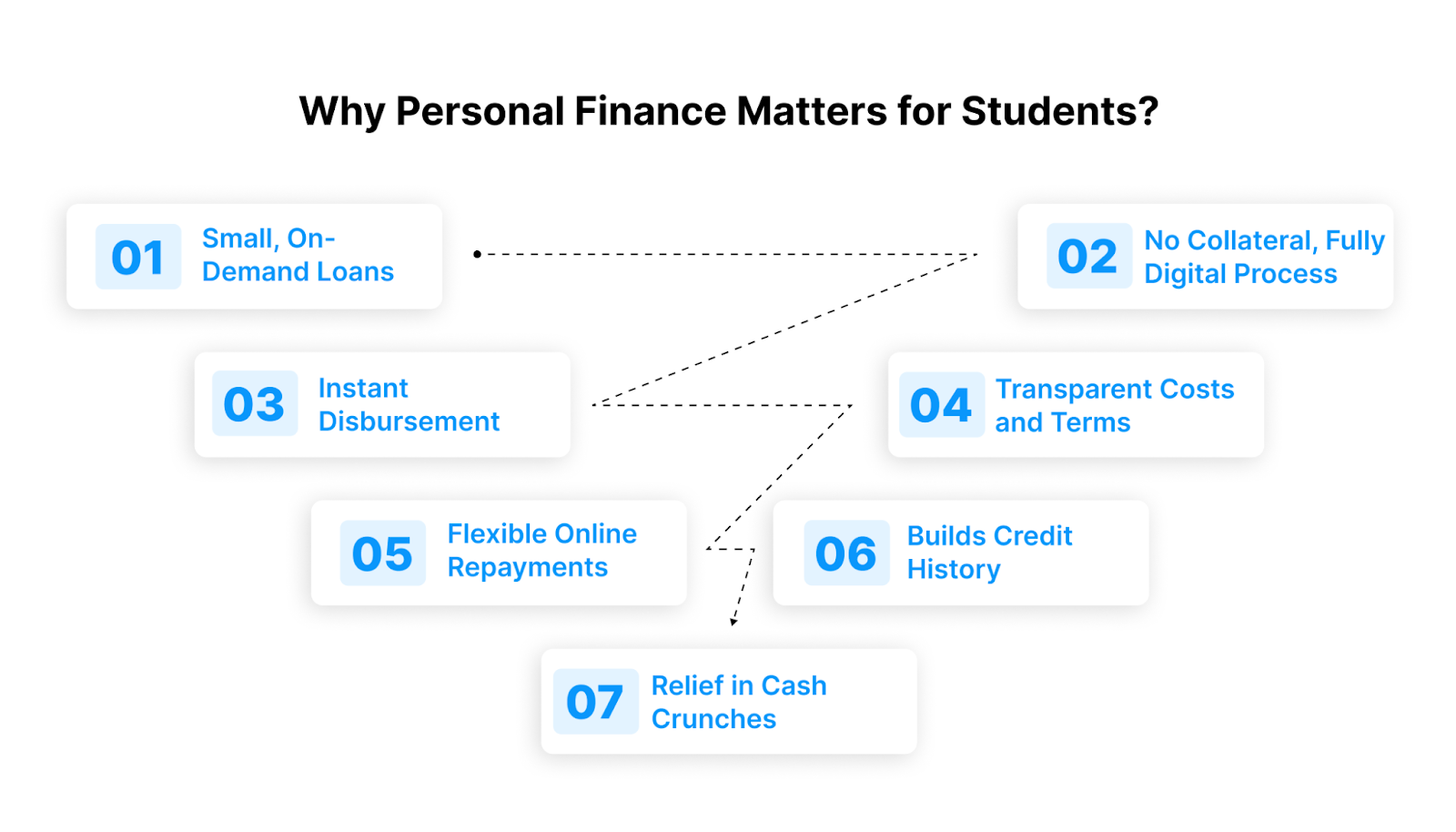

How Pocketly Can Help Students Manage Finances?

When every rupee counts, students need not just tips but real, reliable support. Pocketly bridges the gap during financial crunches while helping you build good credit habits.

Here's how:

1. Small, On-Demand Loans for Emergencies

Pocketly offers short-term personal loans ranging from ₹1,000 to ₹25,000. This is ideal for covering exam fees, travel expenses, medical bills, or unexpected costs when you don't want to borrow from friends or family.

2. No Collateral, Fully Digital Process

The loan application is entirely online. You don't need to pledge property or submit physical documents. With quick KYC verification, approvals are swift, and convenience is high.

3. Instant Disbursement to Bank Account

Once approved, the loan amount is transferred directly to your bank account. You can use UPI, net banking, or other digital payment methods immediately without delay.

4. Transparent Costs and Terms

Pocketly makes sure you always know what you're signing up for. Interest rates starting at 2% per month, processing fees ranging from 1% to 8%, and no hidden charges.

5. Flexible Online Repayments

You can repay your loan digitally via UPI, net banking, or other payment options. The flexibility ensures you're not scrambling for cash physically to clear dues.

6. Builds Credit History

Regular, timely repayments via Pocketly are recorded in credit bureaus. For students, this means laying the foundation for a strong credit profile early, which can help with future loans, such as those for a car or a home.

7. Peace of Mind During Cash Crunches

Instead of stressing over how to source cash at the last moment, Pocketly acts as a safety net. This gives you space to focus on studies, projects, or life, without constant financial worry.

Pocketly makes handling sudden financial gaps easier, but good money management is still about the daily choices you make. Let's take a step back to consider the bigger picture.

Conclusion

Managing money as a student may feel overwhelming at first, but building smart financial habits early lays the foundation for long-term stability and independence. From budgeting and saving to avoiding unnecessary debt, every small step you take today makes your future financial life easier. With the right approach, you can enjoy college life without the constant stress of money worries.

And when unexpected expenses come up, Pocketly can be your reliable partner. With instant, collateral-free loans between ₹1,000 and ₹25,000, quick approvals, and flexible digital repayments, Pocketly gives you the support you need while helping you build healthy credit habits.

Download the Pocketly app today on iOS or Android and take control of your finances with confidence.

FAQs

Q1. Why is personal finance important for students?

Personal finance helps students manage limited income wisely, avoid debt, and build habits that prepare them for financial independence after graduation.

Q2. What are the best personal finance tips for students?

Some of the most valuable tips include creating a budget, saving regularly, using digital payments safely, taking advantage of student discounts, and avoiding unnecessary loans.

Q3. How much should a college student save each month?

Even saving a small amount, such as ₹500–₹1,000 per month, can make a significant difference. Over time, it builds an emergency fund and teaches consistent saving habits.

Q4. Can students build a credit score while in college?

Yes. Using a student credit card responsibly or repaying small, short-term loans on time helps students establish a positive credit history early.

Q5. What mistakes should students avoid in personal finance?

Common mistakes include overspending on non-essential items, relying on friends or parents for constant financial support, misusing credit cards, and failing to save for emergencies.

Q6. How can Pocketly help students with money management?

Pocketly offers quick, collateral-free loans ranging from ₹1,000 to ₹25,000 with transparent costs and flexible repayment options, helping students manage emergencies without financial stress.