Ever wondered why some people always seem to have their finances under control, while others struggle to make ends meet? The difference often comes down to financial literacy.

Understanding how to budget, save, and plan your money isn’t just for experts. It’s a skill that can simplify your daily life and secure your future. Well, the good news is, it’s never too late to start.

Whether you’re just beginning to budget or already thinking about long-term goals, the right knowledge can help you stay in control. This blog breaks down the essentials of financial literacy, giving you practical tips to manage your money and make smarter financial choices.

Key Highlights:

- Financial literacy allows you to make educated decisions about budgeting, saving, and investing wisely.

- Key components include budgeting, saving, investing, borrowing, insurance, debt management, and taxes.

- Being financially literate boosts savings, lowers debt, and strengthens your overall money management.

- You can build these skills by tracking expenses, managing credit, and starting small investments.

- Practicing these skills gradually builds financial independence and confidence in handling everyday and emergency finances.

What Is Financial Literacy?

If you’ve ever wondered what financial literacy is, think of it as the skill to manage money wisely. The financial literacy meaning involves knowing where your money comes from, how it is spent, and how to save it wisely.

It covers core concepts like budgeting, saving, borrowing, investing, and managing risks. In short, financial literacy helps you make informed decisions about money both in the present and for the future.

Many youngsters in India grow up without this essential knowledge. Lack of financial literacy often leads to poor money habits such as overspending, depending heavily on credit cards, or not having an emergency fund. For students, financial illiteracy may cause loan struggles, while young professionals face debts, delayed goals, and paycheque-to-paycheque living.

Also Read: Financial Planning Tips for Young Adults

Why Is Financial Literacy Important?

Understanding the importance of financial literacy helps you control your money instead of letting it control you.

When you are financially literate, you can:

- Create and follow a budget with confidence.

- Save money for unexpected situations.

- Use credit sensibly and avoid debt traps.

- Plan for short-term needs and long-term goals like higher education or retirement.

- Feel less stressed about money matters.

For example, imagine you have ₹500 for the week to split between food, travel, savings, and leisure. Now, if you spend most of it on eating out or online shopping, you may fall short when an urgent need arises. Being financially literate helps you balance these expenses wisely so you are never caught off guard.

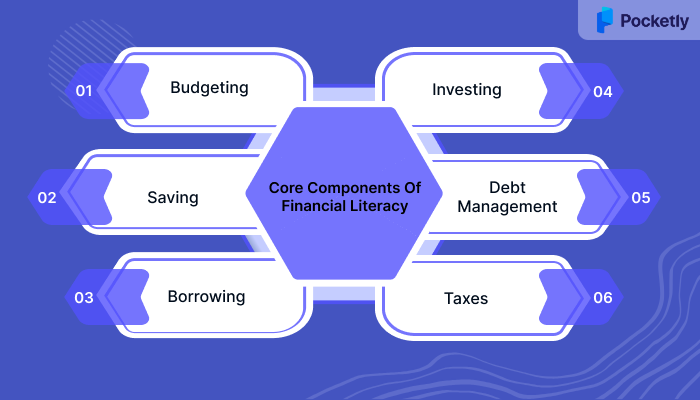

Core Components Of Financial Literacy

Financial literacy is built on certain core elements that guide how you earn, spend, save, and grow your money. Here are the essentials you should know.

Budgeting

Budgeting means planning your income and expenses so you can live within your means. It ensures your money is used wisely.

- Monitor monthly income and expenses to see spending patterns.

- Setting aside funds for essential and non-essential categories.

- Ensuring savings are included in the plan.

Saving

Saving involves putting aside part of your earnings to secure your future and prepare for emergencies. Even small amounts add up over time.

- Building an emergency fund for unexpected needs.

- Developing the habit of putting away money regularly.

- Choosing safe options such as savings accounts or digital deposits.

Borrowing

Borrowing allows you to access money through personal loans or credit, but it must be managed carefully to avoid long-term financial stress.

- Understanding loan terms like EMIs and repayment periods.

- Recognising the risks of overusing credit cards.

- Maintaining good credit by repaying on schedule.

Investing

Investing allows your money to grow over time by putting it into financial instruments that earn returns. It builds wealth beyond regular savings.

- Exploring options such as mutual funds, SIPs, or fixed deposits.

- Balancing risk and return through diversification.

- Understanding compound interest and how it increases value.

Insurance And Debt Management

Insurance covers you from unexpected events that can harm your finances, such as medical emergencies or accidents. It reduces financial stress in critical times.

- Choosing health, life, or other insurance policies suited to your needs.

- Understanding coverage, premiums, and exclusions clearly.

- Using insurance as a financial safety net in emergencies.

Taxes

Taxes are a part of every income, and understanding them helps you plan your finances better. Being aware of deductions can also save money.

- Learning how different income tax slabs apply in India.

- Identifying deductions and exemptions that reduce taxable income.

- Filing returns on time to remain compliant and avoid penalties.

Also Read: Understanding Personal Finance and Budgeting for Financial Needs

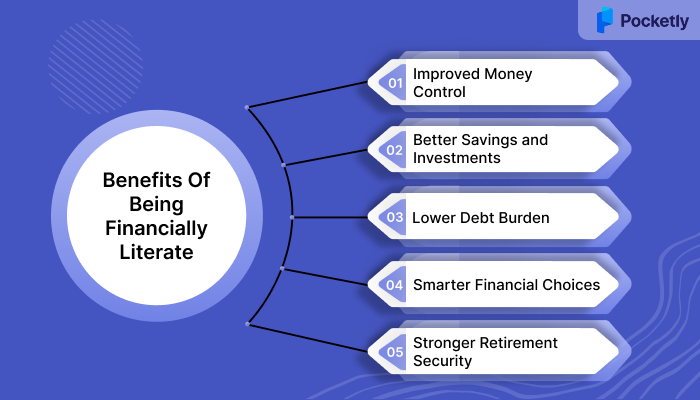

Benefits Of Being Financially Literate

Being financially literate can completely change how you handle money. Let’s look at the key benefits it brings to your life.

- Improved Money Control

- You understand where your money goes and how to plan it better. Tracking expenses and budgeting wisely means fewer surprises and more financial stability every month.

- Better Savings and Investments

- Instead of letting money sit idle, you learn how to save and invest it smartly. This helps your wealth grow steadily and supports long-term goals like education or travel.

- Lower Debt Burden

- With financial literacy, you know how loans, EMIs, and interest work. This helps you borrow carefully, repay on time, and avoid the stress of mounting debt.

- Smarter Financial Choices

- You can confidently compare options before spending or investing. Whether it’s picking an insurance plan or a mutual fund, you make decisions that truly fit your needs.

- Stronger Retirement Security

- Planning early ensures you don’t rely only on others later. With the right savings and investments, you build a comfortable, independent retirement lifestyle for yourself.

How To Gain Financial Literacy?

If you’ve ever wondered how to handle your finances better, the answer is simple- start small. Below are practical ways to build financial literacy step by step.

Start With A Budget

A budget is the foundation of financial literacy. Tracking income and expenses helps you see where your money goes and whether you’re overspending.

Use simple tools like apps, spreadsheets, or even a notebook to record fixed expenses, daily expenses, and savings. This habit gives you clarity and control over your money.

Stay On Top Of Bills

Late payments hurt both your finances and your credit history. Missed deadlines mean penalties, higher interest, and unnecessary stress.

Automating payments or setting reminders ensures you never slip up. It’s a small habit that keeps your financial record clean and trustworthy.

Manage Debt Smartly

Loans and credit cards aren’t bad by themselves. It’s unmanaged debt that becomes a problem. Begin by listing your debts, their interest rates, and repayment timelines.

Try clearing high-interest loans first to reduce overall costs. If repayment feels overwhelming, explore restructuring, consolidation, or professional advice to ease the pressure.

Learn The Basics Of Investing

Savings alone won’t outpace inflation, so investing helps your money grow. Financial literacy for students includes exploring safer options like mutual funds, SIPs, or fixed deposits.

The key is consistency. Even small investments over time build wealth and move you closer to long-term goals like buying a home or retiring comfortably.

Track Your Credit Score

Think of your credit score as your financial report card. Lenders check it before approving loans or credit cards, and a good score gets you better rates.

You can access free reports from official bureaus and dispute any errors. Paying bills on time and maintaining outstanding amounts are one of the easiest ways to maintain a healthy score.

Prioritise Saving

Instead of saving what’s left after spending, flip the process and pay yourself first. Set aside a fixed amount for savings as soon as you get your income.

Even a small, regular contribution adds up. Keeping it in a savings account not only keeps money safe but also earns interest and builds financial discipline.

Plan For The Future

Financial literacy isn’t just about today, but about tomorrow, too. Building a retirement plan early ensures you won’t depend on others later in life.

Start with employer-backed schemes, pension funds, or IRAs. The earlier you begin, the more time your money has to grow, making your future more secure.

Protect Yourself With Risk Management

Life’s uncertainties can drain savings in one blow. That’s why insurance and an emergency fund are essential parts of financial literacy.

Health cover, life insurance, and a buffer fund ensure unexpected crises do not derail you. It’s about preparing smartly, not living in fear.

How Pocketly Helps You Manage Finances Responsibly

Financial literacy isn’t just about managing money; it’s also about handling emergencies without derailing your budget. Pocketly bridges sudden cash flow gaps responsibly, letting you apply your financial knowledge in real situations.

Pocketly provides flexible, short-term personal loans ranging from ₹1,000 to ₹25,000, specifically designed for young Indians. With no collateral required, the platform offers a simple and fast loan application process. Approval is quick, and funds are transferred directly to your bank account in just a few minutes.

- Flexible Loan Amounts: Pocketly offers loans from ₹1,000 to ₹25,000 to cover a variety of financial needs.

- No Collateral: Unlike traditional loans, you don't need to pledge any assets, making it easier for students and young professionals to access funds.

- Quick Approval & Disbursal: The loan process is fast, approval is swift, and money is transferred within minutes.

- Transparent Fees: Pocketly’s interest rate starts at just 2% per month, with processing fees ranging from 1-8%, depending on the loan amount.

- Simple KYC & Application: No complicated paperwork. Just upload basic documents like Aadhaar and PAN, and you’re ready to go.

- 24/7 Support: Pocketly provides round-the-clock assistance to help you at any stage of the loan process.

Pocketly is a digital lending platform, helping you manage cash flow without compromising long-term financial goals.

Wrapping Up

Becoming financially literate is truly the best investment you can make in your future. The ability to manage money effectively, plan for emergencies, and achieve long-term goals empowers you to take control of your financial journey. Financial literacy puts you in the driver’s seat of your own financial independence.

For times when you need a little extra help, Pocketly is ready to assist with fast, easy loans. With no collateral required and simple repayment terms, you can manage your cash flow easily.

Download Pocketly now on iOS or Android and take the first step toward financial stability.

FAQ’s

1. What is the basic understanding of financial literacy?

Financial literacy means understanding and managing your money effectively. It includes knowing how to earn, spend, save, invest, and borrow responsibly to achieve financial stability.

2. What are the 5 principles of financial literacy?

The five key principles of financial literacy are: earn, save and invest, protect, spend wisely, and borrow or manage debt. Following these principles helps you make informed money decisions.

3. What is the 50/30/20 rule?

The 50/30/20 technique is a simple budgeting approach that allocates 50% of income to needs, 30% to wants, and 20% to savings. It’s an easy way to practice financial literacy for students and young professionals.

4. What is the main goal of financial literacy?

The major goal of financial literacy is to build confidence in managing money. It helps you budget effectively, save for the future, and make smarter financial decisions.