A 780 credit score gives you confidence, but not certainty. You still hesitate before hitting apply. Will the lender treat you like gold or make you wait like everyone else? Will the interest rate drop enough to feel it or just enough to impress you on paper? And once the loan hits your report, what stops that 780 from quietly sliding down?

Digital lenders now approve loans in as little as 10 minutes, while banks still take 3 to 7 days. Borrowers with stronger credit files are being fast-tracked more often than those in mid-score bands.

This article breaks down what a 780 score truly buys you and what can silently chip away at it after approval.

If You Only Need the Short Version

- A 780 credit score signals low lending risk, but lenders still verify income strength, FOIR, and KYC before approving.

- High scores often lead to faster decisions and better pricing only when the broader credit file is consistent and traceable.

- Thin-file or first-time borrowers can still reach 780 using small, well-managed credit lines and disciplined usage habits.

- A 780 score can slip through fraud entries, clustered inquiries, or co-signed liabilities even without a missed EMI.

- Growth beyond 780 is possible when you extend clean behaviour across time, not by adding new credit just to move the number.

Is a 780 Credit Score Good or Bad?

Credit bureaus in India classify scores from 300 to 900. A 780 credit score falls in the very good to excellent band, which signals that you repay on time, keep credit use under control, and have a stable repayment pattern. Lenders read this score as low-risk behaviour and treat you as someone who is likely to honour debt commitments without intervention.

Can You Get a Loan with 780 Credit Score?

You can usually get a loan with a 780 credit score, but lenders still look at your income stability, FOIR (Fixed Obligation to Income Ratio), and completed KYC before approving or pricing the loan. The score does not override these checks. A weak income file or a high EMI burden can still limit approval or reduce the sanctioned amount even with a 780.

According to TransUnion CIBIL’s Credit Market Indicator Report (December 2024), 55 percent of retail borrowers in India now fall into the “prime and above” tier (scores above 731), which shows lender preference for high-score segments and stronger approval likelihood for borrowers who maintain scores near 780.

To place a 780 score in the tier system, see the bands below:

| CIBIL Score Range | Category Name | Typical Lender View |

| 300–549 | Poor | High default risk |

| 550–649 | Sub-prime | Cautious approvals, steep pricing |

| 650–699 | Fair | Conditional approvals |

| 700–749 | Good | Wider access with moderate pricing |

| 750–900 | Very Good to Excellent | High approval probability and score-based advantages |

You stand in the second strongest tier, which puts you in a favourable bracket for approval and for negotiation of better terms when your income and current obligations support the request.

Need quick cash without paperwork delays? Get a personal loan from ₹1,000 to ₹25,000 with a simple, flexible repayment plan. Apply in minutes and get funds when you actually need them.

You do not need years of borrowing history to reach that bracket because the bureau scores consistency, not seniority or age in credit.

Can First-Time or Young Borrowers Reach and Use a 780 Credit Score?

You can build a 780 credit score even if you are a first-time borrower or still early in your career. Credit scores measure consistency more than age or income size, so a thin-file borrower can reach a high score through controlled and traceable credit behaviour. The key is to create small, observable proof that you can borrow and repay without friction.

If you are starting from zero, the following inputs build the initial profile:

- Use small-ticket credit first such as student credit lines or short-term personal loans through regulated digital lending platforms

- Repay EMIs and bills on or before the due date so the bureau records punctual behaviour from month one

- Keep card or credit use low relative to the limit so the report shows stability, not pressure on credit

Banks often reject first-time applicants without bureau history even if income exists, while digital lenders accept thin-file users when KYC and repayment capacity are clear. You typically need PAN, Aadhaar, bank statements, and proof of income. Once early trades build a visible repayment history, the score can climb toward 780 and stay defensible for future large-ticket credit.

Also Read: How to Pay Off Loans Quickly and Easily?

Once that early profile matures into a stable 780, the conversation shifts from eligibility to the terms you are offered for that credit.

Impact of a 780 Credit Score on Interest Rates and Approval Terms

A 780 credit score places you in a low-risk band for lenders, which often improves pricing and speeds up credit decisions. You are treated as someone who is less likely to default or roll over dues. That risk reduction creates room for better terms when your income file supports it.

Why Lenders May Offer Better Pricing to 780 Credit Score Borrowers

Lenders use risk-based pricing. When your past behaviour shows low risk, the lender does not need to cover themselves with a high rate. This gives you the position to negotiate better terms, especially on longer tenures where interest cost compounds. The exact rate still depends on the class of lender you apply to.

Common lender classes:

| Lender Type | Typical Approach With High Score Borrowers |

| Banks | Prefer high scores for term loans and premium cards |

| NBFCs | Balance score with income strength and FOIR |

| Digital lenders | Move faster when the score is strong and KYC is complete |

Also Read: Difference Between Credit Score and CIBIL Score: A Comparison

When a 780 Credit Score Still Will Not Secure the Lowest Rate

A high score does not override a weak file. Lenders check income continuity, EMI burden, and recent behaviour in your credit report. You can still be priced high or approved for a lower amount if other risk flags exist.

Situations that can weaken pricing even with a 780:

- Unstable income or frequent job changes reduce trust in future repayment

- High FOIR showing that a large part of your income is already tied to EMIs

- Recent delinquency or settlement on any account signaling recent stress in cash flow

- Heavy unsecured mix which increases volatility even when payments are on time

On a fixed salary and need a quick buffer? Get up to ₹25,000 instantly with minimal checks and zero hassle, whether it's bills, a gap week, or a small splurge. Apply now and get funded fast!

Lender policies differ, and internal scorecards often weigh income and obligations more heavily than the credit number when pricing long-tenure debt. That benefit holds only when the score is backed by a history that proves the behaviour can survive new debt, not just past cycles.

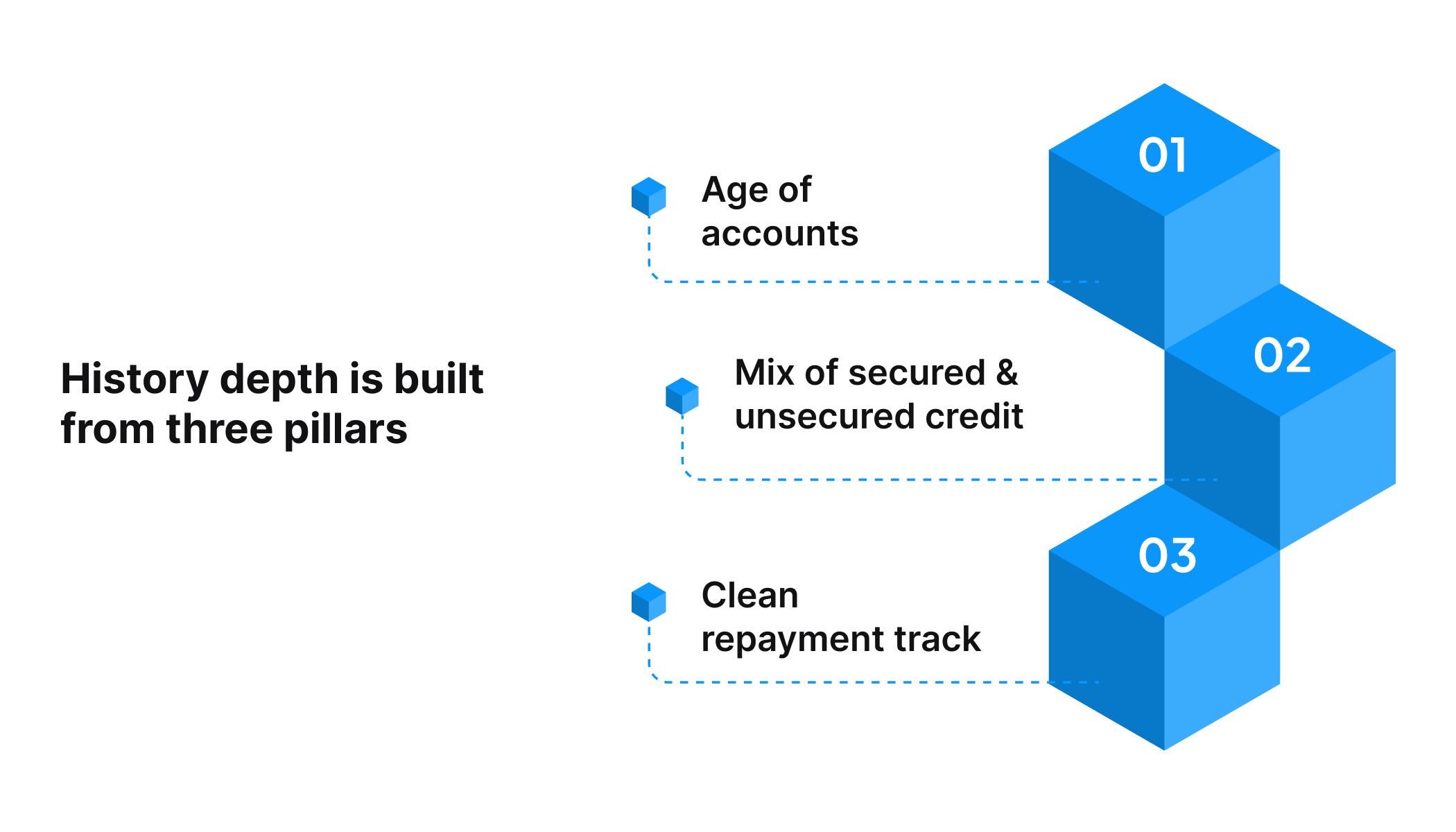

Importance of Strong Credit History Behind a 780 Credit Score

A 780 credit score carries weight only when the file behind it shows that the behaviour is stable and repeatable. Lenders do not approve or price on the number alone. They scan the structure beneath that number to judge if it can hold under the new debt.

The depth of history is built on three pillars:

- Age of accounts: Longer active lines prove that you can handle credit over multiple cycles without slipping

- Mix of secured and unsecured credit: A balanced mix shows that you can handle both collateral-backed products and free-credit products without stress

- Clean repayment track: Absence of delays, settlements, or write-offs signals that repayment is a habit, not a one-time phase

When your credit history shows these traits over time, lenders read you as a low-risk borrower with predictable repayment behaviour, which supports both approval and term flexibility.

Also Read: Understanding Different Credit Score Ranges in India

Even if repayment stays clean, the score can still fall when the file is altered or misused without your knowledge, which is why protection matters.

How to Protect a 780 Credit Score From Fraud and Credit Misuse

A 780 credit score is valuable only if it is guarded against misuse. Fraud and silent reporting errors can push the score down even when your repayment behaviour is clean. You need to monitor the record and block abuse before it appears in the bureau file.

Some actions lower the score without any theft or late payment. These are behaviour choices that add risk signals in the report, even when the EMI stream is clean.

- Co-signing or acting as a guarantor for someone with weak repayment discipline, which ties their future defaults to your bureau

- Ignoring bureau disputes when wrong entries appear, allowing errors to age and be scored as factual data

- Using unverified lending apps that may report inconsistently or mishandle your KYC, creating negative entries or soft flags during audits

- Allowing excess auto-debits without reconciling bank balances, which can create accidental bounces that get reported

- Applying for credit across multiple lenders within a short interval, which signals credit hunger even if you do not accept the loan

Running your own income and need a short cash cushion? Get up to ₹25,000 instantly with simple checks and no collateral. Whether it is business needs or personal spend: apply and get funds when you need them!

Once the file is protected against external and silent threats, you can shift focus from defending the score to carefully compounding it.

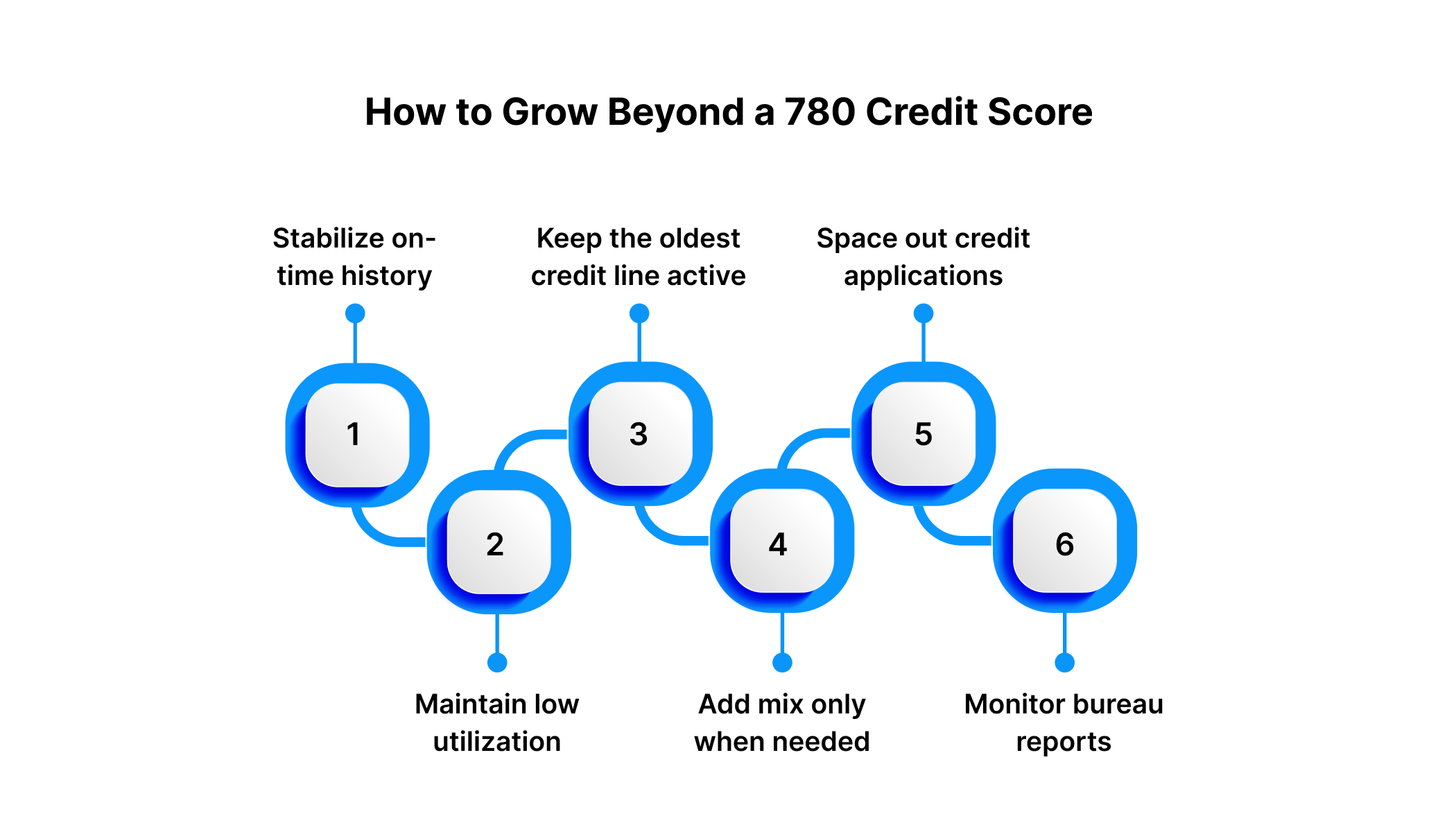

How to Grow Beyond a 780 Credit Score: Step-by-Step

Even a 780 credit score can continue to rise when the underlying file shows deeper maturity over time. Growth at this stage is slow because you are already in a high bracket, so the only way up is to extend the same discipline across more cycles without adding risk signals.

Follow these steps in sequence:

Follow these steps in sequence:

1. Stabilize on-time history for the next 6–12 months

Continue punctual payments without gaps so the bureau records longer consistency rather than a short, clean burst

2. Maintain low utilization and request limit increases instead of spending spikes

Use the extra limit to improve the utilization ratio instead of adding pressure through higher spending

3. Keep the oldest credit line active

Do not close aged cards or loans that contribute to credit-age depth

4. Add mix only when needed

Introduce a secured product, such as a small deposit-backed card, only when your file lacks mix, not as a cosmetic move

5. Space out credit applications

Avoid clustered hard inquiries to prevent the file from showing credit hunger

6. Monitor bureau reports and correct errors quickly.

Use bureau portals to dispute wrong entries early so they do not age into a permanent score impact.

Also Read: How a Savings Account Can Build Your Credit Score

Conclusion

A 780 credit score is already loan-ready, but it stays there only when your behaviour supports it month after month. Paying on time, keeping utilization low, and watching for fraud keep the number from sliding when a new loan enters your file.

When short-term gaps appear and you do not want to disrupt your score with risky borrowing, you can use a regulated digital option like Pocketly to handle small needs without collateral or long processing.

Pocketly gives you:

- ₹1,000 to ₹25,000 short-term credit

- 100% digital KYC with fast approval

- Transparent terms without hidden conditions

Use credit with intention, protect the score you built, and act only when the maths supports it. You can download Pocketly on Android or iOS to manage short term needs without disturbing your credit health.

FAQs

Q: Can a 780 credit score improve loan terms if I apply jointly with someone who has a lower score?

A: Yes, but the weaker profile can dilute the benefit. Lenders re-evaluate risk on the combined file instead of the stronger file alone.

Q: If I shift my salary account to another bank, can that affect my ability to get a loan with a 780 score?

A: It can pause instant approval features tied to the old bank. Lenders may request fresh statements before issuing a new sanction.

Q: Will a 780 credit score help when requesting restructuring of an existing loan agreement with a bank?

A: It can strengthen the negotiation because banks view compliant borrowers as lower litigation risk. Restructuring still depends on income proof.

Q: Can a 780 credit score help me get pre-approved offers without submitting fresh financial documents?

A: Many lenders trigger pre-approved offers based on bureau pulls. They still verify identity and banking before the release of funds.

Q: If I refinance my current loan with another institution, does a 780 score improve the transfer experience?

A: It can reduce friction during onboarding since the new lender sees low default probability. Transfer eligibility still depends on open balances.

Q: Does a 780 credit score influence eligibility for rent-security waiver products from fintech companies?

A: Yes, firms offering deposit-free housing evaluate bureau health to price risk. Strong scores reduce the collateral substitute they demand.