A savings account alone won’t build your credit score directly. Credit scores are all about how you borrow and repay money. Since savings accounts aren’t credit products, they don’t get reported to credit bureaus.

But keeping a healthy savings account can make life smoother. It’s a safety net. Having enough saved up means it’s easier to pay bills and EMIs on time, even if there’s a surprise expense or a dip in income. This helps you avoid missed payments, keeps your debts low, and reduces the risk of hurting your credit score.

In fact, a recent report found that people with steady savings habits are much less likely to miss loan or credit card payments in tough times, a key factor for maintaining an excellent credit score in 2025.

So, while a savings account doesn’t directly show up on your credit report, it supports good habits that help your credit score grow. It’s a simple step that sets you up for financial confidence.

In this blog, you will learn how a savings account sets the stage for credit-building, even if it doesn't boost your score directly.

At a glance

- Savings accounts don't directly impact credit scores since they aren't reported to credit bureaus, but they provide crucial indirect benefits for credit building.

- Financial stability from savings helps you avoid missed payments on loans and credit cards, which is essential for maintaining and improving your credit score.

- Regular saving demonstrates financial responsibility to lenders, making you more attractive for future credit products, even without an existing credit history.

- Emergency fund protection prevents you from relying on high-interest loans during unexpected expenses, keeping your overall financial health intact.

- Combining savings habits with responsible borrowing from platforms like Pocketly creates a foundation for building strong credit over time.

What is Your Credit Score?

A credit score is a simple three-digit number showing how good someone is at managing borrowed money. The score usually goes from 300 to 900 in India; higher means better. Lenders check this number to decide if they should give a loan, and what interest rate to offer.

If the score is above 750, it’s seen as strong and helps with faster loan approvals and better rates in 2025. This number is based on your borrowing history, how you repay, the types of loans you have, and how much credit you use. Checking your score regularly is smart, so you always know where you stand before applying for credit.

So, how exactly can your savings account influence this important number?

How a Savings Account Affects Your Credit Score: Direct vs. Indirect Impact

A savings account doesn’t directly affect your credit score. It’s not reported to credit bureaus, so it doesn’t show up on your credit report. But that doesn’t mean it’s not helpful.

Let’s break down the direct vs. indirect impact of a savings account on your credit score:

Direct Impact

- No Direct Effect: Your savings account doesn’t impact your credit score because it’s not part of your credit report. Savings accounts, whether basic or specialised, are not reported to credit bureaus like CIBIL, Experian, or Equifax.

- Doesn’t Factor into Your Credit Score: Credit scores are based on things like your payment history, amount owed, length of credit history, types of credit used, and recent credit inquiries. A savings account doesn’t fall under any of these categories, so it won’t increase or decrease your score directly.

Indirect Impact

While it won’t raise or lower your score directly, a savings account can help you build good habits that improve your credit over time:

- Building Good Financial Habits: Saving regularly shows that you’re financially responsible, which helps you manage credit better.

- Financial Stability: A savings account helps you avoid missed payments, showing lenders you can handle money well.

- Trust with Lenders: A steady savings history makes it easier to qualify for loans in the future. Lenders like seeing that you can manage your finances.

- Timely Loan Repayments: Savings give you a cushion, helping you pay off loans on time, which is key to building your credit score.

In India, a savings account is a simple first step in building a strong financial future. While it won’t impact your credit score right away, it sets you up for success down the road. Pairing a savings account with smart lending platforms like Pocketly can help you establish a solid credit history.

Understanding these impacts is just the beginning. The real question is: how can you leverage your savings account to become more attractive to lenders?

Read More: Minimum Credit Score Required for Personal Loan

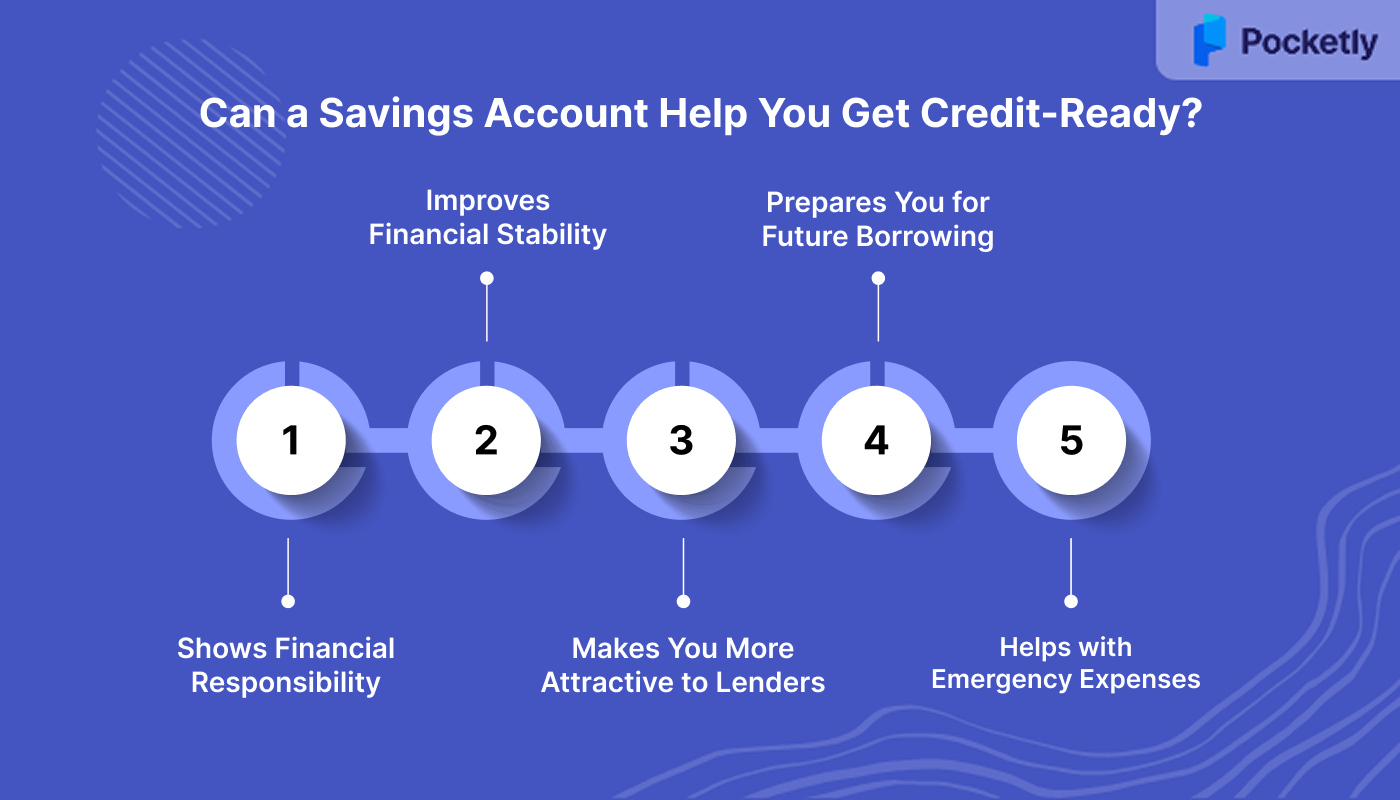

Can a Savings Account Help You Get Credit-Ready?

A savings account can play an important role in getting you credit-ready, even though it doesn’t directly affect your credit score. Here's how:

1. Shows Financial Responsibility

Having a savings account shows you’re capable of managing money. Regularly saving helps build a stable financial history, which is a good sign to lenders when you apply for loans or credit.

2. Improves Financial Stability

A savings account helps you avoid financial stress and late payments, which are key to maintaining a healthy credit score. When you have savings, you're less likely to miss loan repayments or credit card bills.

3. Makes You More Attractive to Lenders

Lenders like to see that you’re financially responsible. A savings account provides evidence that you manage your finances well, which can increase your chances of qualifying for credit products like personal loans from Pocketly.

4. Prepares You for Future Borrowing

Even though a savings account doesn’t directly impact your credit score, it helps you manage finances better, which is essential for making timely payments on any future loans. This is important for building your credit profile.

5. Helps with Emergency Expenses

Life is unpredictable. A savings account can act as a safety net for unexpected costs. This ensures you won’t need to rely on high-interest loans, keeping your financial health in check.

A savings account doesn’t give you an immediate credit boost, but it’s essential for getting credit-ready. For young Indians looking to build credit, pairing good savings habits with platforms like Pocketly can pave the way to financial independence and a stronger credit profile.

Now that you know why savings accounts matter for credit readiness, let's get into the practical steps you can take to make the most of your savings account.

Also Read: Understanding the Process and Meaning of Credit Control

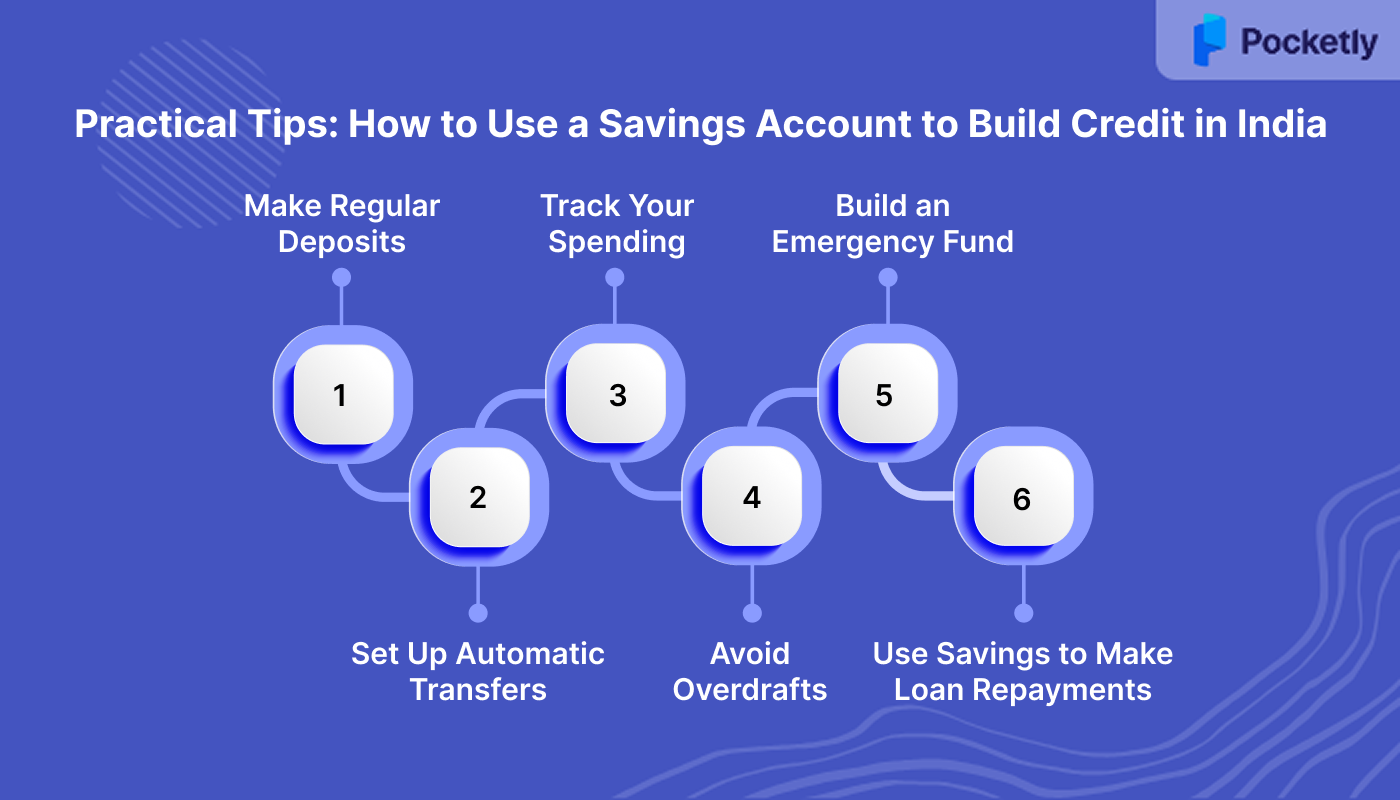

Practical Tips: How to Use a Savings Account to Build Credit in India

Building credit in India doesn’t have to be hard. A savings account can help you get started, even though it doesn’t directly affect your credit score. Here are some easy tips to make the most of it.

1. Make Regular Deposits

Consistency is key. By regularly depositing money into your savings account, you show financial responsibility. This helps build a strong foundation for your credit profile, making it easier to access credit in the future.

2. Set Up Automatic Transfers

Set up automatic transfers from your salary or income to your savings account. This way, you’re saving without having to think about it. It’s an easy way to stay disciplined and avoid missing any payments later on.

3. Track Your Spending

Keep an eye on your spending by reviewing your savings account regularly. This helps you stay within your budget and avoid overspending, which can lead to financial stress and missed payments.

4. Avoid Overdrafts or Unnecessary Withdrawals

Try not to withdraw more money than you have in your account. Keeping a healthy balance shows that you’re in control of your finances. This can help you when applying for credit in the future.

5. Build an Emergency Fund

Set aside money in your savings for emergencies. This gives you a cushion when unexpected expenses arise, so you don’t have to rely on loans or credit cards. It helps you manage your finances better and shows you’re financially stable.

6. Use Savings to Make Loan Repayments

If you have loans or bills, use your savings account to ensure timely payments. Missing payments can hurt your credit score. Having savings set aside makes it easier to pay on time.

While these savings strategies are helpful, there are also other ways to build credit that work alongside your savings efforts.

Read More: How to Build and Improve Your Credit Score

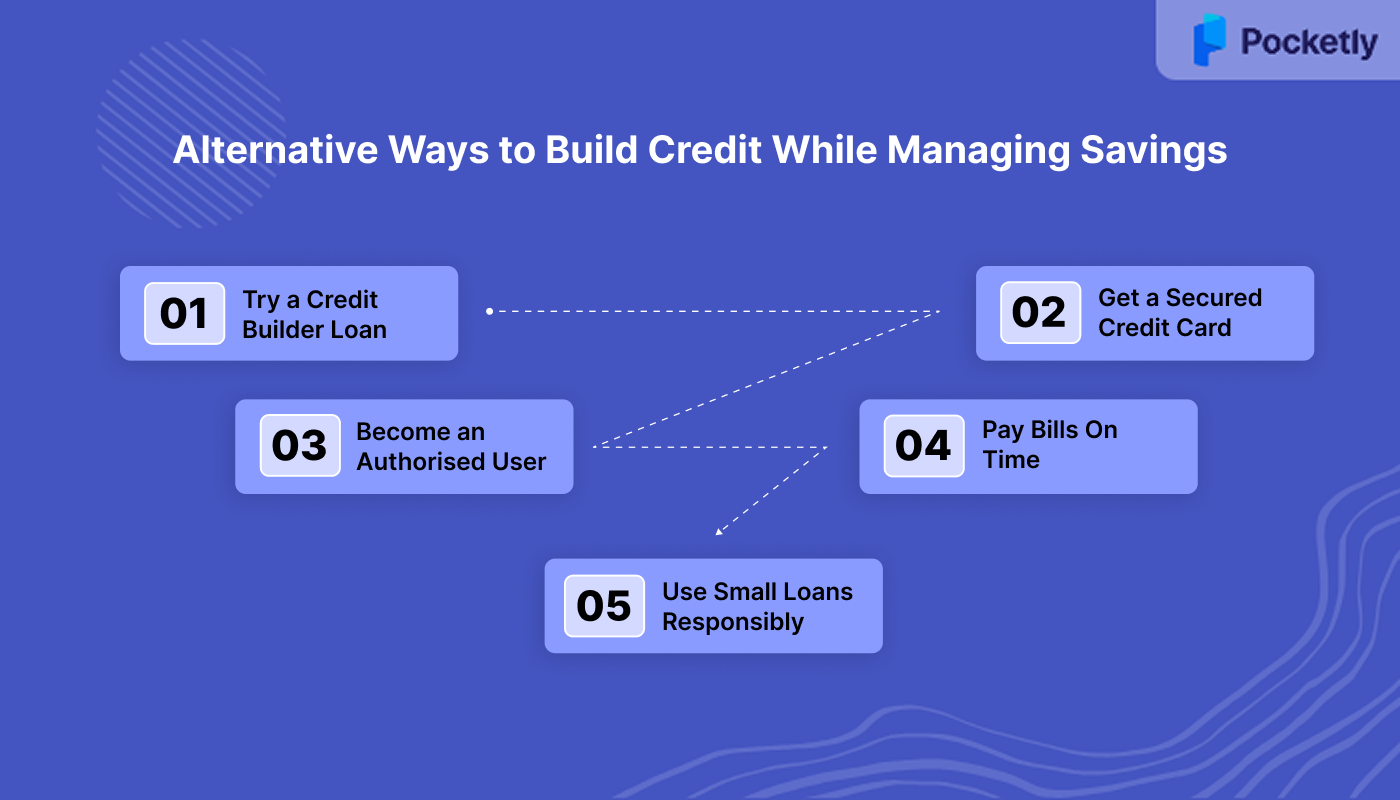

Alternative Ways to Build Credit While Managing Savings

1. Try a Credit Builder Loan

A credit builder loan is a small loan that helps you build credit. You don’t get the money up front. Instead, it’s saved for you until you finish repaying. This helps show that you can handle credit without touching your savings.

2. Get a Secured Credit Card

A secured credit card works like a regular credit card, but you need to deposit money first. That deposit becomes your credit limit. Use it, and make sure to pay off the balance each month. It’s a safe way to build credit without affecting your savings.

3. Become an Authorised User

Ask a family member or friend with good credit if you can be added as an authorised user on their card. You don’t need to use the card, but their good credit history will help boost your score.

4. Pay Bills On Time

Some of your bills, like phone or utility bills, can help your credit score. If these companies report your payments, paying on time can work in your favour. It’s an easy way to build credit while staying on top of your finances.

5. Use Small Loans Responsibly

If you need some extra help, small loans from platforms like Pocketly can also boost your credit. Just borrow what you need and make sure to repay it on time. It’s a simple way to build credit, without putting your savings at risk.

Building credit doesn’t mean you have to take on big debt or sacrifice your savings. The key is to stay responsible with both your savings and your borrowing, and over time, you’ll see your credit score grow.

Speaking of responsible borrowing, let's look at how platforms like Pocketly can help you build credit without requiring collateral or affecting your savings.

Also Read: Can Paying Bills Help Build a Credit Score?

How Pocketly Can Help Build Credit Without Collateral

Pocketly is designed to help young Indians access credit without the need for collateral. Here’s how it works and how the features can help you build your credit, step by step:

Key Features of Pocketly

- Loan Amounts from ₹1,000 to ₹25,000: Flexible loan amounts that fit your needs, whether it’s a small emergency or a larger expense. This flexibility helps you avoid financial strain and ensures you can repay on time, which is key to building credit.

- Flexible Repayment Options: Repay loans in easy instalments, within 2 to 6 months. You can show lenders that you can handle credit, which is essential for boosting your credit score.

- Quick, Instant Loan Disbursal: Having the flexibility to address urgent expenses without delays can prevent missed payments on other financial commitments, keeping your credit score intact.

- Minimal Documentation: Only basic KYC details are required to get started, making the process quick and easy.

- Transparent Terms: No hidden charges, and clear loan terms from the start. Knowing exactly what you’re agreeing to helps you manage your repayment plan, ensuring you can meet deadlines and maintain a positive credit history.

- Easy Online Process: Everything is done digitally. Apply, get approved, and receive funds without any hassle.

With Pocketly, you just borrow responsibly, repay on time, and watch your credit score grow over time. Whether you need a small loan for an emergency or just want to start building credit, Pocketly makes it simple and stress-free.

Final Words!

Building credit doesn’t have to be difficult or require collateral. By borrowing responsibly and repaying on time, you can start creating a strong credit history that opens doors to future financial opportunities.

Pocketly offers an easy and flexible way for young Indians to start building their credit without the need for assets. With loans ranging from ₹1,000 to ₹25,000, flexible repayment options, and a simple application process, Pocketly makes credit-building accessible for everyone.

Ready to take control of your credit? Download the Pocketly app now on iOS and Android and start your journey to financial independence today!

FAQs

1. How can a savings account help me get a loan?

Having a savings account shows potential lenders that you are financially responsible, making it easier to qualify for loans. A consistent savings history can enhance your chances of securing loans from platforms like Pocketly, even if you’re just starting to build your credit.

2. How can I check my credit score in India?

You can check your CIBIL score for free once a year through CIBIL’s official website or through other platforms offering free credit score reports. This helps you track your progress and ensure that your credit-building efforts are paying off.

3. What are some easy ways to start building credit as a young Indian?

Start by opening a savings account, making regular deposits, and using financial products like Pocketly loans. Building a positive repayment history through timely loan repayments is a great way to boost your credit score without needing traditional credit cards or collateral.

4. Does having a savings account increase my CIBIL score in India?

A savings account alone does not directly impact your CIBIL score, but it helps establish a history of financial activity. Over time, it can provide a foundation for demonstrating responsible financial behaviour when applying for credit.