Understanding the distinction between a credit score and a CIBIL score is essential for anyone dealing with the financial ecosystem. While both are used to assess creditworthiness, they are not interchangeable. The CIBIL score is a key metric used by most lenders in India to evaluate a borrower’s credit history.

As of March 2024, over 119 million Indians monitored their CIBIL scores, reflecting a 51% year-on-year growth in credit self-monitoring. This blog will explore the differences between credit scores and CIBIL scores, explaining what each score reflects and how they impact your financial decisions.

Key Takeaways

- While both assess creditworthiness, the CIBIL score is specific to India and provided by TransUnion CIBIL, whereas credit scores are used globally by different bureaus like Experian, Equifax, and CRIF High Mark.

- Your CIBIL score is calculated based on payment history, credit utilization, credit mix, credit history length, and recent inquiries, with payment history carrying the most weight (35%).

- Maintaining a good credit or CIBIL score (750) can significantly lower interest rates, improve loan eligibility, and provide access to higher loan amounts and credit limits.

- Timely bill payments, reducing credit utilization, and maintaining a healthy mix of credit types are key strategies to improve your score.

- Regularly checking your credit score helps you stay on top of your financial health, identify errors, and take corrective actions before they impact loan eligibility.

What is a Credit Score?

A credit score is a three-digit number that represents an individual’s creditworthiness, ranging from 300 to 850. It is calculated by credit bureaus such as CIBIL, Equifax, Experian, and CRIF High Mark based on your credit history, including how well you manage debt, your repayment behavior, and your credit utilisation.

Lenders use this score to assess the risk of lending to you and to determine loan approvals, credit card issuances, and interest rates. A higher score means good credit habits, while a lower score signals higher risk for lenders.

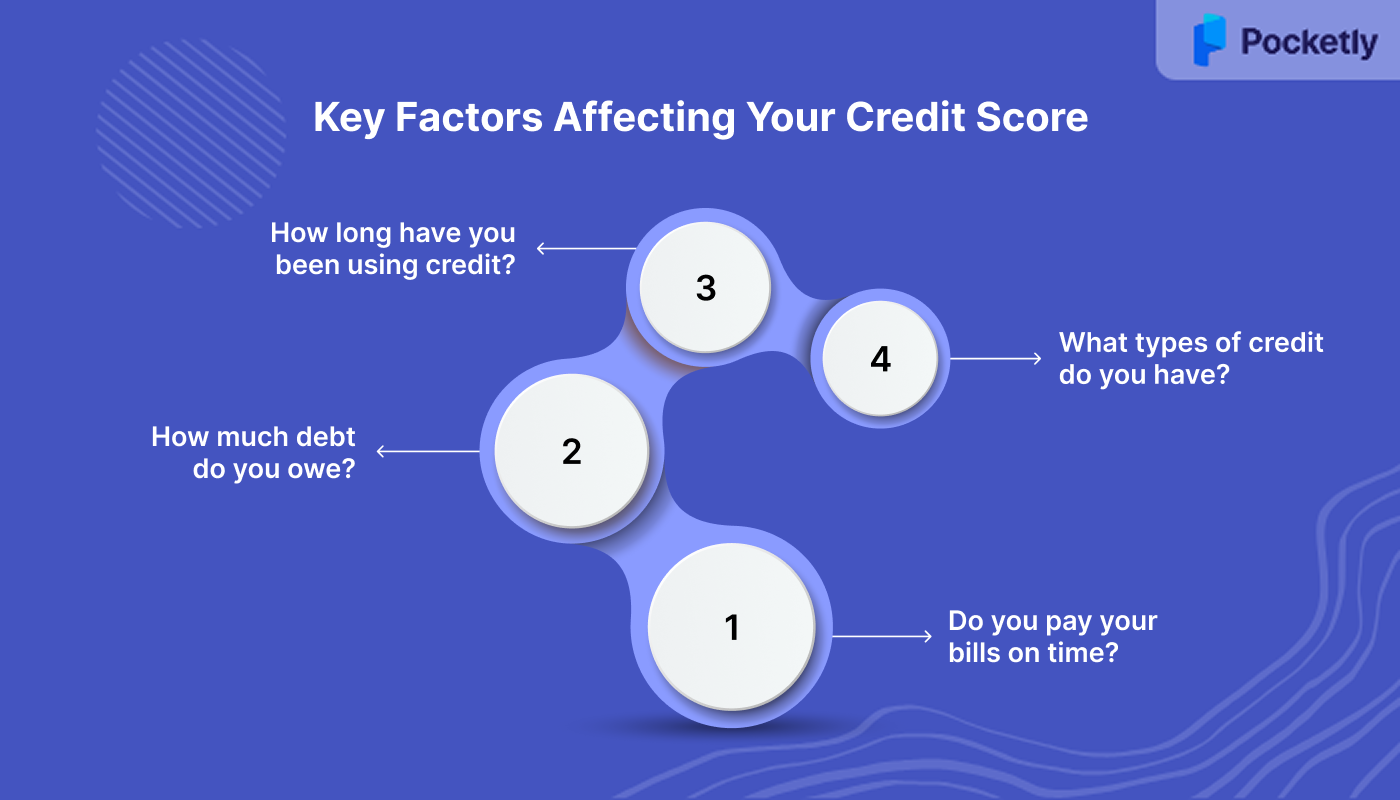

Key Factors Affecting Your Credit Score

1. Do you pay your bills on time?

Payment history accounts for the largest portion of your score. Timely payments increase your score, while late payments and defaults decrease it.

2. How much debt do you owe?

The amount of outstanding debt relative to your credit limit impacts your score. High balances or maxed-out cards can lower your score.

3. How long have you been using credit?

A longer credit history is beneficial, as it provides more data on your borrowing and repayment behavior.

4. What types of credit do you have?

Having a variety of credit accounts (credit cards, loans, etc.) shows lenders you can manage different types of debt responsibly, positively impacting your score.

What is a CIBIL Score?

A CIBIL score is a type of credit score provided by TransUnion CIBIL, one of the major credit bureaus in India, and is authorized by the Reserve Bank of India (RBI). It ranges from 300 to 900 and represents an individual’s creditworthiness based on their credit history.

Lenders use the CIBIL score to evaluate the risk associated with lending money and determine eligibility for loans, credit cards, and mortgages. The higher the CIBIL score, the more favorable the terms you’re likely to receive.

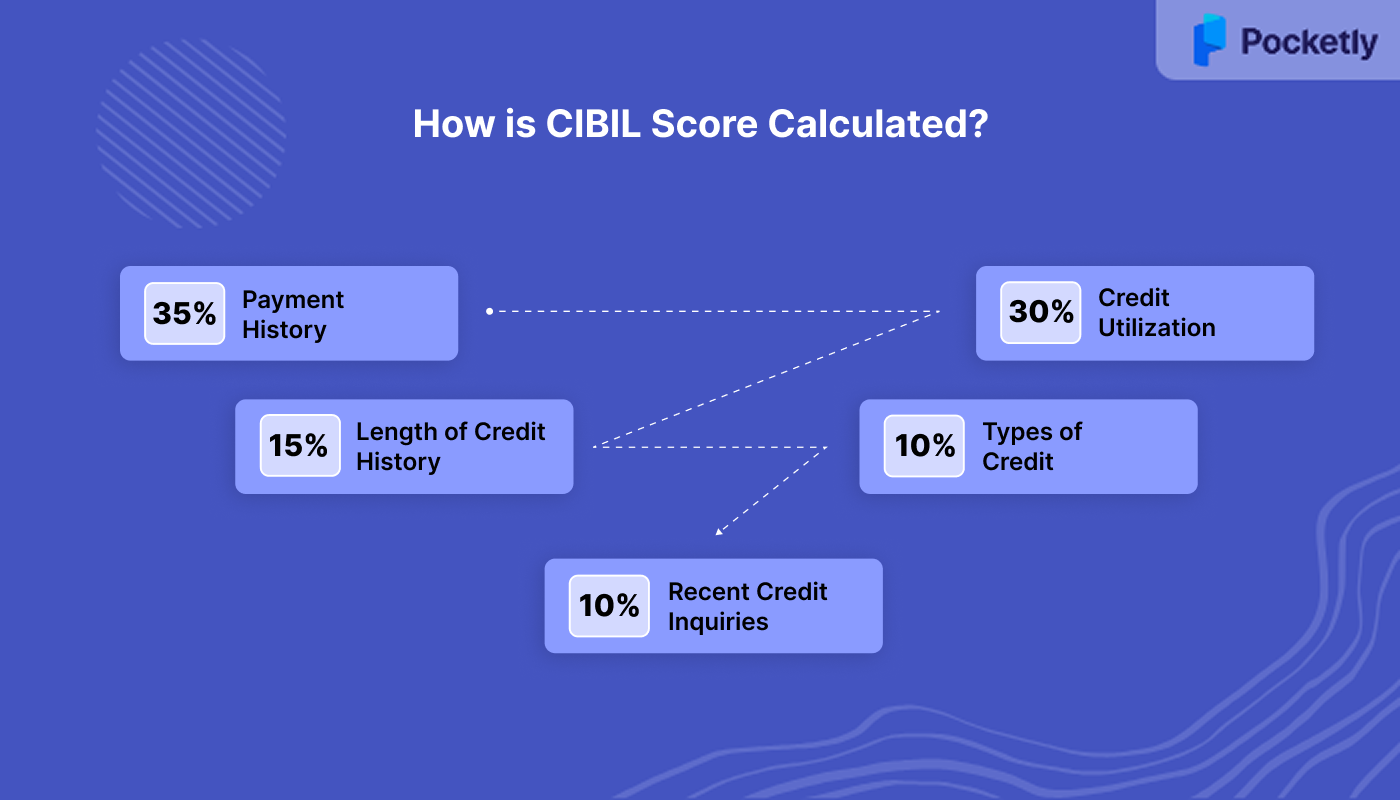

How is CIBIL Score Calculated?

- Payment History (35%): Timely payments improve your score, while missed payments and defaults hurt it.

- Credit Utilization (30%): High credit usage relative to your limit can lower your score. Maintaining a low balance is better.

- Length of Credit History (15%): A longer credit history demonstrates your ability to manage debt responsibly, improving your score.

- Types of Credit (10%): A mix of credit types (credit cards, loans, etc.) shows you can manage different debt forms.

- Recent Credit Inquiries (10%): Frequent credit inquiries can indicate financial strain and slightly lower your score.

Also Read: Getting Personal Loan with Low CIBIL Score

With both scoring systems following similar principles but operating under different frameworks, it becomes crucial to distinguish between them. Several aspects set these scoring methods apart, affecting how lenders evaluate your creditworthiness.

Key Differences Between Credit Score and CIBIL Score

While both CIBIL score and credit score refer to the same concept of assessing creditworthiness, there are some key differences based on their origin, usage, and the bureaus that calculate them.

| Aspect | CIBIL Score | Credit Score |

| Provider | Provided by TransUnion CIBIL, an RBI-authorized bureau in India. | Provided by multiple bureaus like Experian, Equifax, and CRIF High Mark. |

| Range | Ranges from 300 to 900. | Varies from 300 to 850, depending on the bureau. |

| Usage | Primarily used by Indian lenders for loan and credit card approvals. | Used globally by various lenders and financial institutions. |

| Focus | Reflects credit history specifically for India. | Reflects credit history, with models varying by country and bureau. |

| Impact on Financial Products | Directly influences loan eligibility, interest rates, and credit card approvals in India. | Impacts loan eligibility and terms, but criteria differ across countries and bureaus. |

While the table provides a quick overview, here’s a more detailed explanation of the key differences between the CIBIL score and a general credit score, which will help you better understand how they influence lending decisions and your financial health.

Score Calculation

CIBIL calculates its score based on your credit history, repayment behavior, credit mix, and other factors. While it is a type of credit score, the formula may vary from other bureaus, leading to slight differences. These variations can influence lending decisions, especially if your score is near a cutoff.

Usage in Lending Decisions

In India, CIBIL scores often carry more weight than other credit scores when applying for loans. For instance, many banks require a CIBIL score of 750 or above for approval of personal and home loans. A strong CIBIL score increases your chances with most lenders, highlighting its importance in India’s lending ecosystem.

Accessing and Monitoring the Scores

CIBIL scores are commonly checked due to their acceptance in the financial sector. TransUnion CIBIL offers free annual credit reports, and you can subscribe for regular updates. Other bureaus may charge fees, but regular monitoring of your CIBIL score helps track your credit health and improve it over time.

The varying acceptance and usage patterns of these scores highlight another crucial dimension of the credit scoring system. The level of trust and recognition that different bureaus command can influence your financial prospects.

Recognition and Reliability of CIBIL Score vs Credit Score

CIBIL's longstanding presence in India's financial sector has cemented its reputation as a trusted credit bureau. Its credibility is reflected in:

- Widespread Acceptance: Most Indian lenders predominantly rely on CIBIL scores for evaluating credit applications.

- Regulatory Endorsement: As an RBI-authorized credit bureau, CIBIL's operations and methodologies are recognized and regulated by the Reserve Bank of India.

- Comprehensive Data Integration: CIBIL aggregates data from a vast network of financial institutions, ensuring a holistic view of an individual's credit history.

This established trust makes the CIBIL score a standard reference point in India's credit assessment processes.

In contrast, credit scores provided by other bureaus like Experian, Equifax, and CRIF High Mark, though valuable, may not hold the same weight in India. These scores are often used in different contexts and may not be as widely accepted by Indian lenders.

The variation in scoring models and criteria across different bureaus can lead to discrepancies in scores, further emphasizing the unique position of the CIBIL score within India.

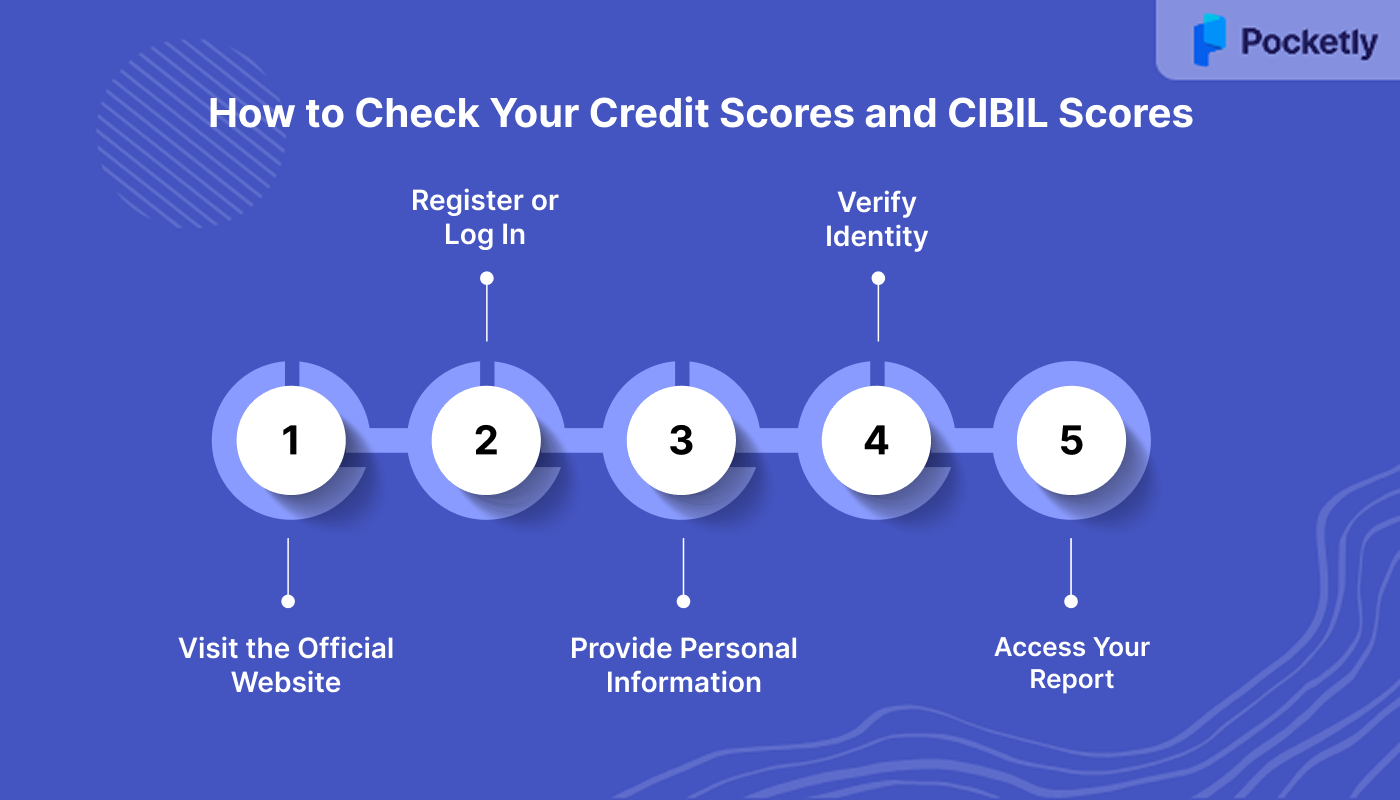

How to Check Your Credit Scores and CIBIL Scores

Steps to Check Your Credit Score

- Visit the Official Website: Navigate to the official website of the credit bureau from which you wish to obtain your score.

- Register or Log In: Create a new account or log in if you already have one.

- Provide Personal Information: Enter details such as your name, date of birth, PAN number, and address.

- Verify Identity: Complete the identity verification process, which may involve answering security questions or receiving an OTP on your registered mobile number.

- Access Your Report: Once verified, you can view and download your credit score and report.

You are entitled to one free credit report per year from each bureau. Additional reports may require a subscription. It's advisable to check your credit score regularly to stay informed about your credit health and to identify any discrepancies early.

How to Improve Credit Scores and CIBIL Scores

Building and Improving your credit score or CIBIL score requires consistent financial habits and proactive measures. Here’s a brief guide on how to improve both:

- Pay Your Bills On Time: Timely payments are the most significant factor in improving your score. Always pay your credit card bills, loan EMIs, and utility bills on time to build a positive payment history.

- Reduce Credit Utilization: Aim to keep your credit utilization ratio below 30%. High balances relative to your credit limits can lower your score, so try to pay down outstanding balances.

- Avoid Opening Multiple Credit Accounts: Applying for too many credit cards or loans in a short period can negatively affect your score. Each application results in a hard inquiry, which can reduce your score temporarily.

- Maintain a Healthy Credit Mix: A combination of revolving credit (credit cards) and installment loans (personal loans, car loans, etc.) shows lenders that you can manage different types of credit responsibly.

- Check Your Credit Report Regularly: Regularly check your CIBIL report for any inaccuracies or errors, such as missed payments that were actually made. Dispute any discrepancies with the credit bureau to ensure your score reflects your true creditworthiness.

- Keep Older Accounts Open: The length of your credit history matters. Keeping older credit accounts open, even if they’re not used frequently, can positively affect your score by showing a longer credit history.

By following these steps, you can steadily improve your credit score and CIBIL score, leading to better financial opportunities and lower interest rates on loans and credit cards.

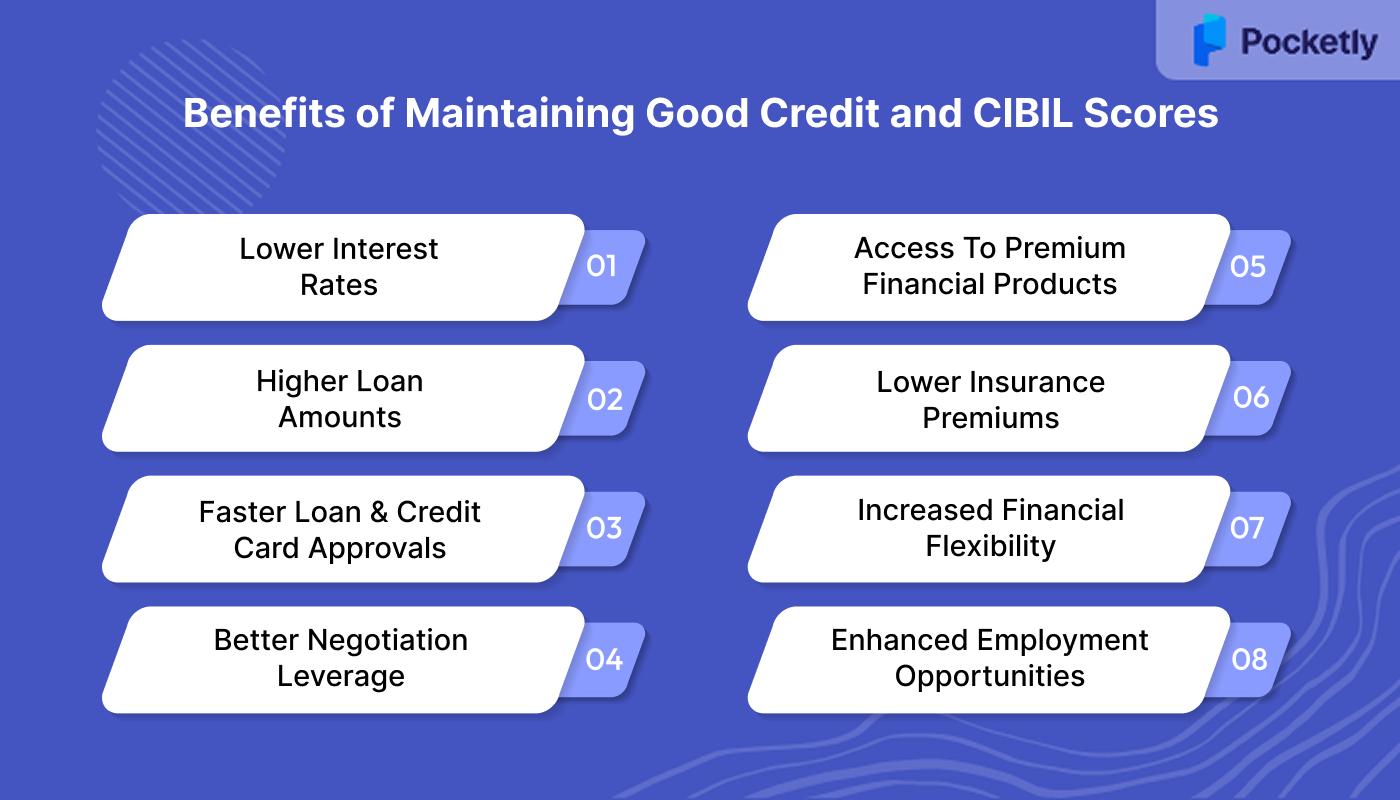

Benefits of Maintaining Good Credit and CIBIL Scores

- Lower Interest Rates on Loans and Credit Cards: Individuals with a CIBIL score above 750 are often eligible for personal loan interest rates starting at approximately 10.5% to 12% per annum. In contrast, those with scores below 650 may face rates ranging from 18% to 24% or higher. This difference can result in substantial savings over the loan tenure.

- Higher Loan Amounts and Credit Limits: A good credit score increases your chances of securing larger loan amounts and higher credit limits. Lenders are more confident in offering substantial sums to borrowers with proven creditworthiness

- Faster Loan and Credit Card Approvals: Applicants with high credit scores often experience quicker loan and credit card approval processes. For instance, a score above 700 can lead to expedited approvals with minimal documentation, as lenders perceive these applicants as low-risk.

- Better Negotiation Leverage: A strong credit score provides leverage to negotiate better terms with lenders, such as lower interest rates, reduced processing fees, and more flexible repayment schedules.

- Access to Premium Financial Products: Individuals with excellent credit scores are more likely to qualify for premium credit cards and financial products that offer benefits like cashback, rewards, and exclusive offers.

- Lower Insurance Premiums: Some insurers consider credit scores when determining premiums. A good credit score may result in lower premiums for products such as home, auto, or life insurance, reflecting a lower risk profile.

- Increased Financial Flexibility: Maintaining a good credit score provides greater access to credit when needed, offering financial flexibility in emergencies or for planned expenses. This can prevent the need for high-interest borrowing options.

- Enhanced Employment Opportunities: Certain employers, especially in finance-related sectors, may review credit scores as part of the hiring process. A good credit score can enhance your employability by demonstrating financial responsibility.

While building and maintaining excellent credit scores is a long-term strategy, immediate financial needs often arise regardless of your current credit standing. Modern digital lending solutions have emerged to bridge this gap, offering instant financial support.

Pocketly: A Smart Digital Lending Solution for Today’s Financial Needs

Pocketly is a digital lending platform that provides quick and easy access to loans for salaried, and loans for self-employed individuals. With a focus on transparency and simplicity, Pocketly offers a seamless borrowing experience. Whether you're looking to manage an emergency expense or fund a planned purchase, Pocketly ensures that you have the financial flexibility you need.

Key Features of Pocketly:

- Loan Amounts: Borrow from ₹1,000 to ₹25,000 based on your needs and eligibility.

- Flexible Repayment: Choose flexible EMI options, with tenure ranging from 2 to 6 months.

- Affordable Interest Rate: Enjoy an interest rate as low as 2% per month.

- Transparent Processing Fees: Processing fees ranging from 1% to 8%, depending on the loan amount and tenure.

- Fast and Simple Application: No physical documentation required; apply and get approval within minutes.

- Quick Disbursement: Get funds directly in your bank account within hours, ensuring you can manage your expenses without delay.

Conclusion

Understanding the differences between a CIBIL score and a credit score is essential for making informed financial decisions. Both scores serve to evaluate your creditworthiness, but with distinct factors and scoring models.

By regularly checking and maintaining a good CIBIL score, you can enjoy numerous financial benefits such as lower interest rates, higher loan amounts, faster approvals, and better terms from lenders. It also opens doors to premium financial products and insurance benefits.

Pocketly is an excellent option for those seeking immediate financial support. Whether it's for an emergency or a planned purchase, it offers a personal loan with minimal documentation. Download Pocketly Now on iOS or Android.

FAQs

1. Does a 750 vs 800 credit score matter?

While both scores are considered excellent, an 800+ score might give you slightly better terms, such as lower interest rates, compared to a 750 score. However, both are well above the threshold for favorable loan approvals.

2. How much does the CIBIL score increase per month?

Your CIBIL score can increase by a few points each month, depending on your financial behavior, such as timely payments and reduced credit utilization. The rate of improvement varies based on individual credit activities.

3. At what age can you start building credit?

In India, you can start building credit as early as 18 years old. This typically involves getting a credit card or small loan, and ensuring timely repayments to establish a solid credit history.

4. Which is more important, credit score or credit history?

Both are crucial, but credit history often holds more weight. A strong credit history with timely payments and responsible credit usage will naturally lead to a higher credit score, which is then used for lending decisions.

5. Why is my credit score going down when I pay on time?

Your credit score may drop due to factors like high credit utilization, multiple recent credit inquiries, or a change in your credit mix. It's important to monitor all aspects of your credit, not just timely payments, to maintain a healthy score.