For many Indians, affordable loans can be a lifeline. But a single three-digit number, your credit score, determines whether you’ll get approved, how quickly, and at what cost.

In India, most personal loan applications with a score below 700 are rejected by banks and NBFCs, or they face higher costs or outright denials each month. Shockingly, around 451 million Indians don’t have access to formal credit or have very limited options.

This gap is a key pain point. Not understanding credit score ranges can delay financial independence or force young professionals to opt for pricier loan options.

In this guide, you’ll learn what these ranges mean, why they’re crucial when applying for loans or credit cards, and actionable steps to build a solid credit foundation from your very first paycheque or EMI.

At a glance:

- In India, scores range from 300 to 900, with scores between 650 to 900 ideal for loan approval.

- A higher credit score results in lower interest rates and better loan terms.

- Pay bills on time, keep credit utilisation low, and avoid closing old accounts to boost your score.

- Alternative loan options include NBFCs, joint loans, and fintech platforms like Pocketly.

What is a Credit Score?

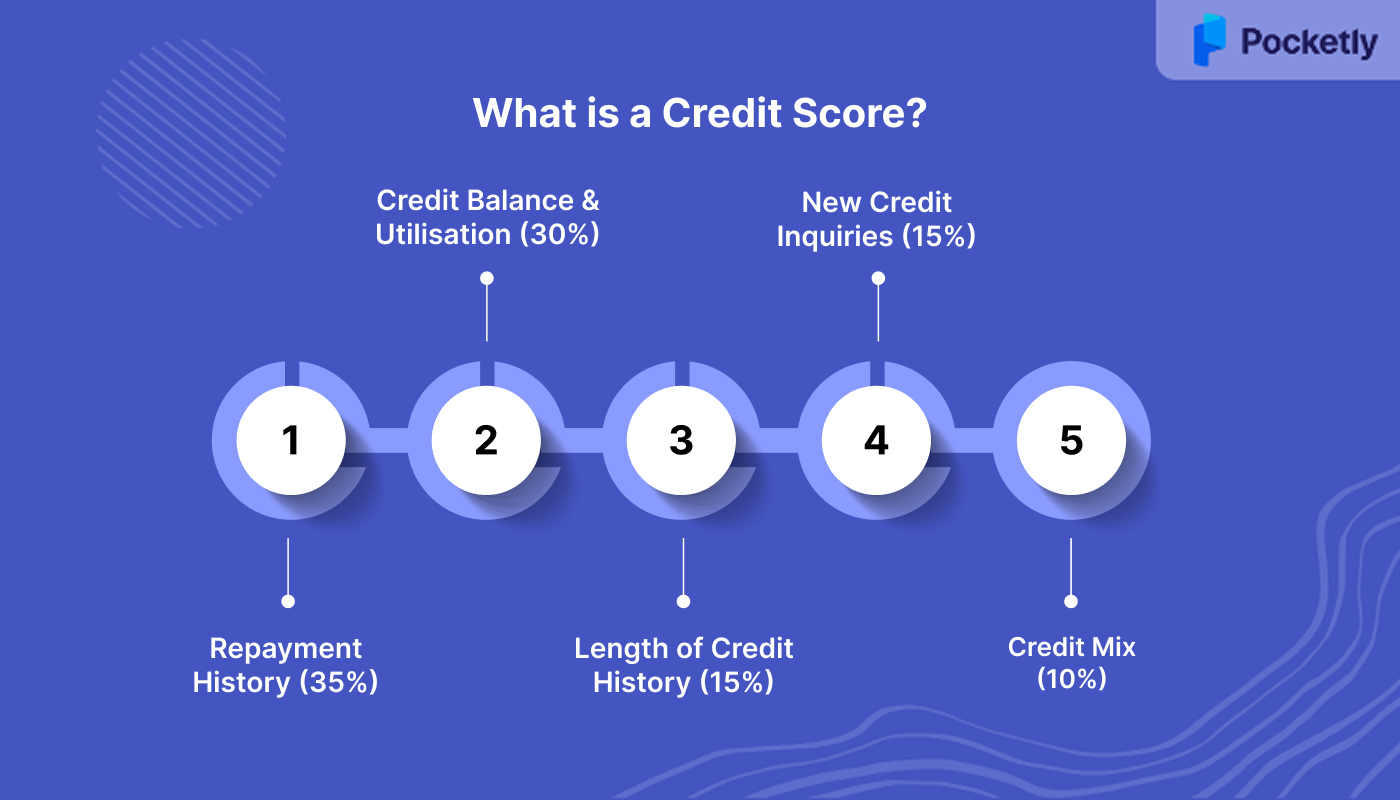

Your credit score is composed of several elements, such as:

- Repayment History (35%): The most significant factor. Timely payments boost your score.

- Credit Balance & Utilisation (30%): How much of your available credit you use. Keep usage below 30% for an optimal score.

- Length of Credit History (15%): A long, positive credit history improves your score.

- New Credit Inquiries (15%): Frequent requests for new credit within a short time can lower your score.

- Credit Mix (10%): Managing different types of credit (e.g., secured loans, credit cards) can enhance your score.

These factors collectively influence your credit score, which is crucial for loan approvals, credit card offers, and even some job checks in the financial sector.

In India, we have some common credit score ranges.

What Are the Common Credit Score Ranges in India and What Do They Mean?

Here's a breakdown of the common credit score ranges and what they mean for you.

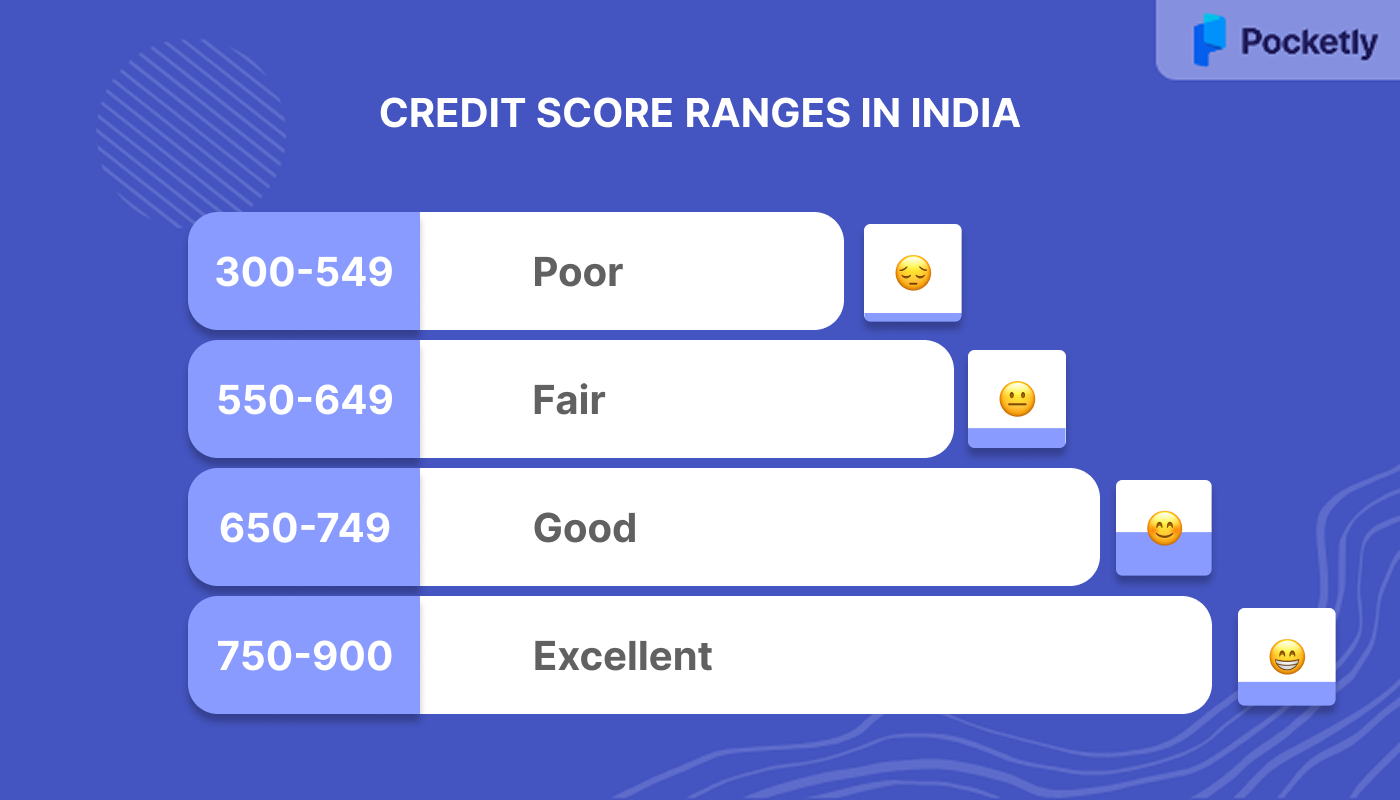

300-549: Poor

A score in this range usually signals missed payments or defaults. Lenders see you as a high-risk borrower, so getting approved for credit is tough. Even if you do get approved, expect high interest rates and stricter terms.

550-649: Fair

This range shows you're making progress, but still face some financial challenges. While you might be eligible for loans or credit cards, the terms are generally less favourable, with higher interest rates. It's a good idea to work on improving your score.

650-749: Good

A good score means you've shown responsible credit habits. You're likely to be approved for loans with standard terms, though the interest rates might still be higher than those for borrowers with excellent scores.

750-900: Excellent

This is the gold standard. With a score in this range, you're seen as a low-risk borrower. You'll enjoy the best loan terms, including lower interest rates, higher loan amounts, and additional perks like fee waivers.

How These Ranges Affect Your Borrowing Experience

The way lenders view these ranges varies. Banks tend to favour borrowers with scores in the "Good" or "Excellent" categories. However, platforms like Pocketly, which partner with NBFCs and fintech startups, might offer more flexibility. They may still extend credit to those in the "Fair" range, though at higher costs and stricter terms.

While these ranges are generally standardised, different credit agencies may interpret them slightly differently. So what is an ideal credit score range?

Also Read: Minimum Credit Score Required for Personal Loan

What is the Ideal Credit Score Range for Loan Approval in India?

When applying for a loan in India, your credit score is one of the first things lenders check. It helps them decide if you’re a reliable borrower. So, what’s the ideal credit score range for getting approved?

650 to 900: The Sweet Spot

In India, the ideal credit score range for loan approval is between 650 and 900. Here's what it means:

- 650–749 (Good): This range shows you’re managing your credit well. Lenders are likely to approve your loan, though you might still face higher interest rates compared to those with excellent scores.

- 750–900 (Excellent): This is the top range. With a score here, you’re seen as low risk. You’ll likely get approved quickly, enjoy lower interest rates, and may even get additional perks like fee waivers.

A higher score signals that you’ve been responsible with your credit, paying bills on time and keeping debt in check. This reassures lenders that you can handle a loan.

What If Your Score Is Below 650?

- 550–649 (Fair): You can still get a loan, but expect higher interest rates and tougher terms. Some fintech platforms, like Pocketly, may offer loans here, but with some minimal and negotiable conditions.

- 300–549 (Poor): Getting approved for a loan in this range is tough. Lenders see you as high risk, and you might face rejection or very high interest rates. Focus on improving your score to increase your chances.

While a score between 650 and 900 is ideal for loan approval in India, fintech platforms like Pocketly may still approve loans for those with lower scores. It’s always a good idea to work on improving your score to get better loan offers and terms.

In India, a higher credit score means better loan terms, like lower interest rates and favourable repayment conditions. Lenders offer the best rates to low-risk borrowers. For example, a borrower with a score of 780 may get an 8.4% interest rate on a home loan, while one with a 660 score might face 9.5%. That extra 1.1% adds up over time.

So how can you improve your credit score? Find some tips below.

Tips to Improve Your Credit Score for Better Loan Eligibility?

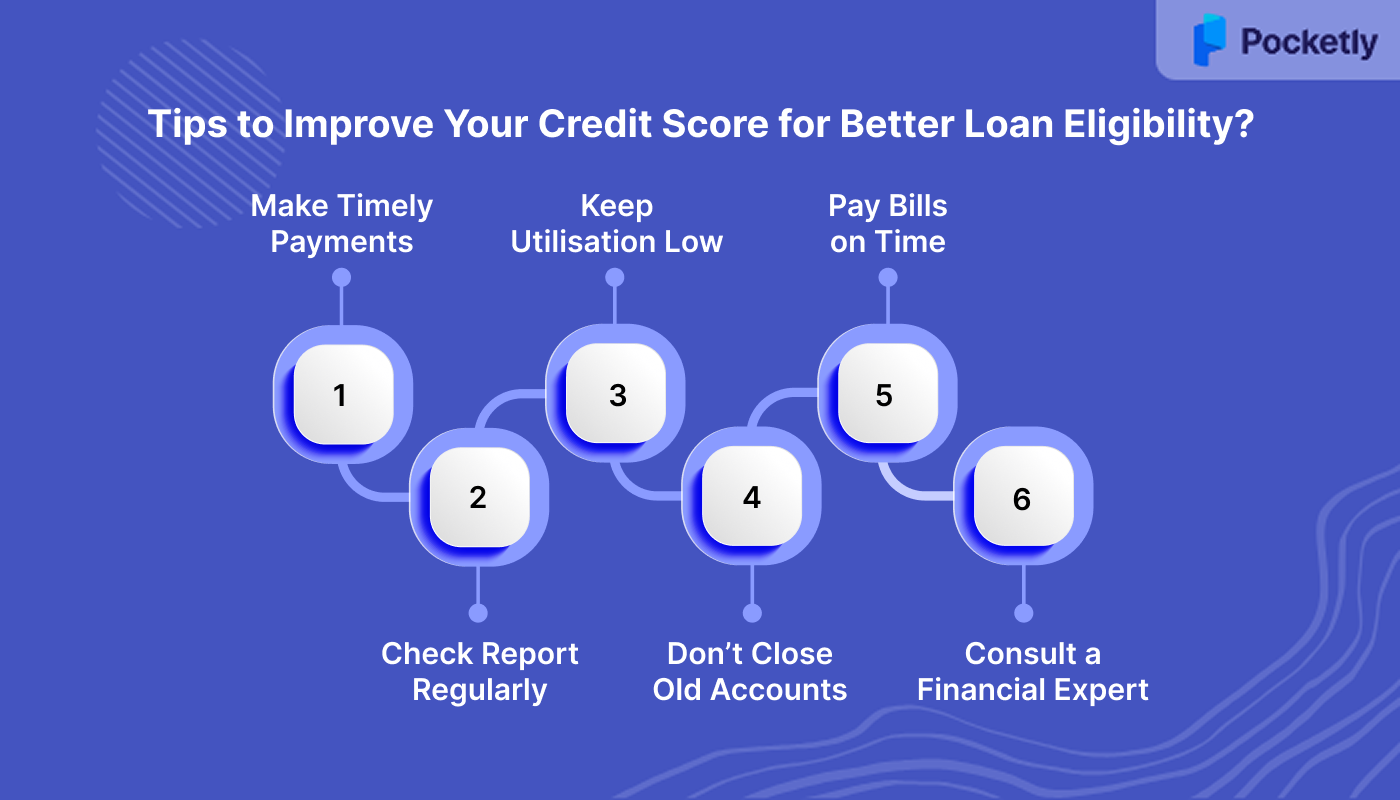

- Make Timely Payments: Paying your bills on time is the most important factor for building a strong credit profile. Even one missed payment can negatively impact your score quickly. Stay on top of your EMIs and credit card bills!

- Check Your Credit Report Regularly: Review your credit reports for accuracy. If you find any mistakes, report them right away; credit bureaus must address errors within 30 days. Take advantage of free annual checks to stay on top of things.

- Keep Your Credit Utilisation Low: Aim to use less than 30% of your available credit. This shows lenders you’re managing your finances responsibly and helps keep your score healthy.

- Don’t Close Old Accounts: Keep older accounts open to maintain a longer credit history. Closing them can shorten your credit history, which lenders see as a sign of instability. Similarly, avoid applying for too much new credit at once, as each application can temporarily lower your score.

- Pay Utility and Telecom Bills on Time: Small bills like utilities and telecom payments now show up on your credit report. Prepaying these bills can boost your credit score quickly, especially under the new RBI reporting rules.

- Consult a Financial Expert if Needed: If you’re struggling to improve your score, a financial expert can offer tailored advice to help you take the right steps.

Improving your credit score takes time, but by staying consistent with these simple habits, you’ll be well on your way to achieving and maintaining a great credit score! Keep it up, and be patient!

Now you must be thinking, "I can’t get a loan without a perfect credit score." That’s not true at all!.

Also Read: Getting a Personal Loan with a Low CIBIL Score

What Are the Best Loan Options for Young Indians with a Low Credit Score?

For individuals in India with lower credit scores, traditional bank loans can be challenging to secure, but there are several alternative avenues to consider.

Here are some loan options for you if you have a low credit score:

- Loans from NBFCs (Non-Banking Financial Companies): NBFCs may be more flexible in their lending criteria compared to traditional banks. They often consider factors beyond your credit score, such as income and employment stability.

- Joint Loans with a Co-Applicant: Applying for a loan with a co-applicant who has a better credit score can increase your chances of approval. Lenders will consider both credit profiles when assessing the application.

- Secured Loans: Offering collateral, such as a fixed deposit or property, can make lenders more inclined to approve your loan application, even with a low credit score.

- Government Schemes for Students: If you're a student, certain government schemes offer loans without the need for a credit score. For example, the PM Vidya Lakshmi Scheme provides education loans up to ₹10 lakh without considering the applicant's credit score.

- Microfinance and Peer-to-Peer Lending: Platforms that connect borrowers with individual lenders can be an alternative for those with low credit scores.

- Minimal Credit-Check Personal Loans: Some digital lenders like Pocketly provide personal loans with lower credit scores as well. These loans often focus on your income and employment status instead.

While these options are available, it's important to be cautious of high-interest rates and fees associated with loans for individuals with low credit scores. Always read the terms and conditions carefully before proceeding.

Also Read: Differences and Advantages of Instalment Credit

How Can Pocketly Help You Build Your Credit Score?

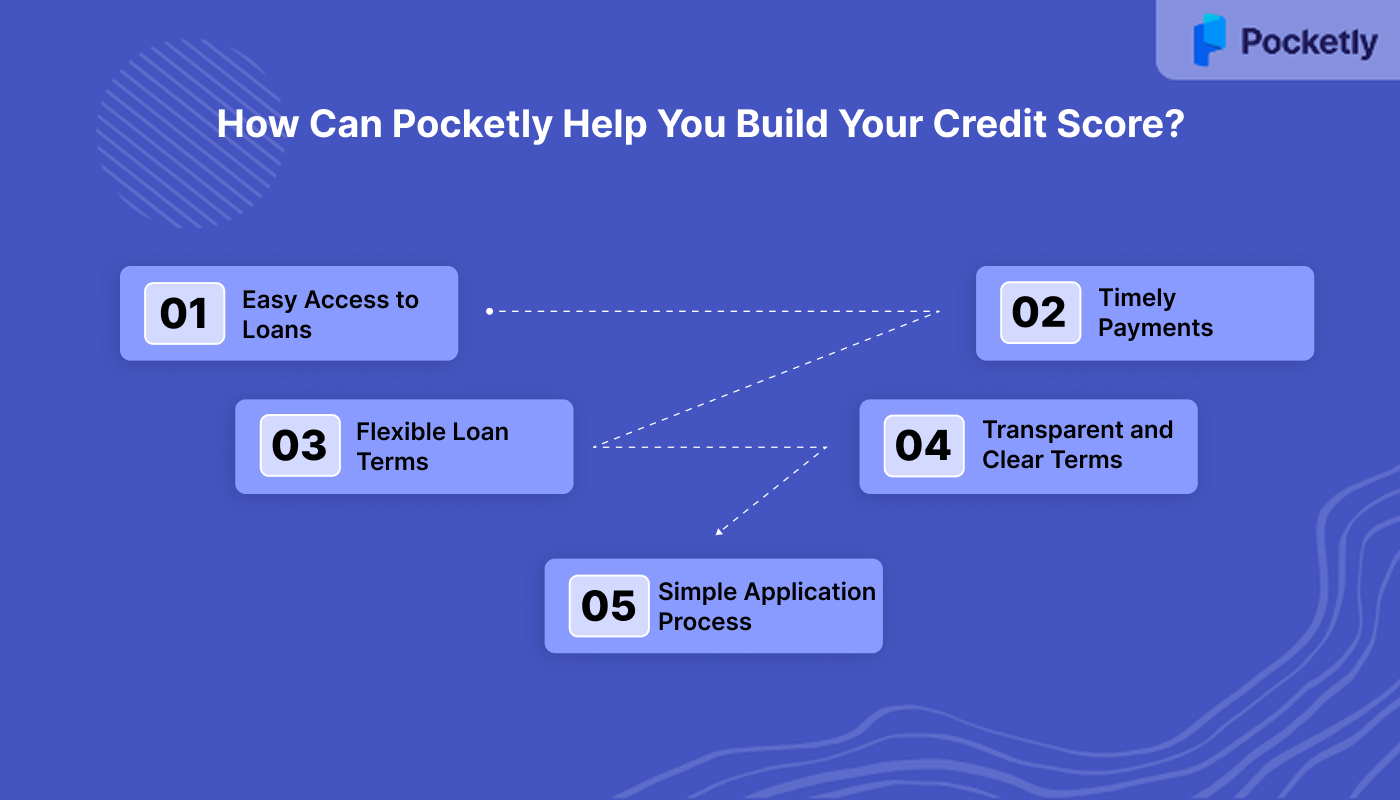

- Easy Access to Loans: Pocketly offers quick, short-term loans starting from ₹1,000 to ₹25,000. No collateral is needed, and the process is simple.

- Timely Payments Boost Your Score: Your repayment history is key to improving your credit score. Pocketly offers repayment tenure of 2 to 6 months, helping to improve your score over time.

- Flexible Loan Terms: Pocketly’s rate of interest starts from 2% per month, and repayment terms are flexible, which fit your budget. This flexibility helps you make payments on time.

- Transparent and Clear Terms: Pocketly is committed to transparency. No hidden fees, no surprises. You’ll know exactly what to expect, making it easier to manage your loan and maintain a positive payment record.

- Simple Application Process: There’s no need for collateral or complex paperwork. Pocketly makes applying for loans easy, even if you’re new to borrowing or have a low credit score.

With Pocketly, you can access quick loans and build your credit score with ease.

Final Words!

In conclusion, understanding credit score ranges is crucial for managing your financial health and securing favourable loan terms. In India, a score between 650 and 900 is ideal for loan approval, but platforms like Pocketly offer flexible options even for those with lower scores.

With a minimum interest rate starting from 2% per month, Pocketly offers flexible loan amounts starting from ₹1,000 to ₹25,000. We are fully digital and don't need any physical documents.

Download the Pocketly app on iOS or Android to start your journey toward better credit today!

FAQs

1. How long does it take to improve a credit score?

Improving your credit score can take anywhere from a few months to a few years, depending on factors like your payment history, credit utilisation, and overall credit habits. Consistently paying bills on time, reducing debt, and avoiding unnecessary credit inquiries can accelerate the process.

2. What is a credit report, and how do I check it?

A credit report is a detailed record of your credit history, including loans, credit cards, repayment behaviour, and outstanding debts. You can check your credit report for free once a year through credit bureaus like CIBIL, Equifax, or Experian to monitor your financial health and spot any inaccuracies.

3. What are the common mistakes that negatively impact my credit score?

Common mistakes that can negatively impact your credit score include missing payments, maxing out credit cards, applying for too much new credit in a short time, and closing old accounts. Regularly reviewing your credit report and maintaining good financial habits can help prevent these errors.

4. How does a co-applicant affect my loan application?

A co-applicant with a higher credit score can improve your chances of loan approval, as the lender will consider both applicants' credit profiles. This can be particularly helpful when applying for a larger loan or when your credit score is on the lower end.