Managing your finances is crucial, especially when it comes to making larger purchases or incurring unexpected expenses. One way many people approach financing is through installment credit. This type of credit allows you to break down a larger payment into smaller, more manageable amounts over a set period.

But what exactly is installment credit, and why is it such a popular option for many? By understanding the advantages of installment credit, you can see how it differs from other credit types and why it might be a helpful solution for you when making significant purchases or handling ongoing payments.

In this article, we'll explore what installment credit is, how it works, and how it can offer more stability in your financial planning.

TL;DR (Key Takeaways):

- Installment Credit Definition: A loan where you pay in fixed monthly installments, helping you manage big purchases and build credit.

- Benefits: Provides financial flexibility for big purchases and builds a positive credit history with a good mix of credit types.

- Risks: Missed or late payments and high credit balances negatively affect your credit score.

- Using Credit Responsibly: Always stay within your limit, make on-time payments, and monitor your debt-to-income ratio to maintain a healthy credit score.

What is Installment Credit?

Installment credit is a type of loan or credit that allows you to borrow a specific amount of money and repay it in equal monthly payments (installments) over a predetermined period. Unlike revolving credit, which allows continuous borrowing and repayment, installment credit features a fixed loan term and payment schedule. This structure helps borrowers manage their debt more predictably.

In an installment credit agreement, the amount you borrow is typically paid off in equal installments that include both principal and interest. Once the loan term is completed, the debt is considered fully paid off.

Examples of Installment Credit

Here are some common examples of installment credit:

- Personal Loans: These are loans offered by banks, credit unions, or online lenders that come with fixed loan amounts, repayment terms, and interest rates.

- Car Loans: These loans help you purchase a car, with the loan amount typically divided into fixed monthly payments over the life of the loan (often 36 to 72 months).

- Mortgages: Home loans are a well-known example of installment credit, where you borrow a large sum to buy property and pay it off in fixed payments over a long period (typically 15 to 30 years).

These examples highlight how installment credit is used for significant purchases or investments, with predictable repayment terms to help individuals plan their finances effectively.

When it comes to managing debt, it's essential to understand the distinction between installment credit and revolving credit. Both serve different purposes and are structured in unique ways. Here’s a clear comparison to help you understand which one better suits your financial goals.

Differences Between Installment Credit and Revolving Credit

Installment credit and revolving credit serve different financial needs, each with its own set of benefits and drawbacks. In this section, we’ll focus on the advantages of installment credit, helping you understand how it can work to your benefit when used wisely:

| Feature | Installment Credit | Revolving Credit |

|---|---|---|

| Credit Type | Fixed loan amount | Credit limit that can be borrowed again after repayment |

| Repayment Structure | Fixed monthly payments (principal + interest) | Flexible payments, minimum due amount |

| Term | Fixed term (e.g., 12, 36, or 60 months) | No fixed term, ongoing borrowing and repayment |

| Interest Rates | Generally fixed for the term | Varies depending on the balance and usage |

| Credit Limit | Fixed amount, set at the beginning of the loan | Flexible credit limit (e.g., credit cards) |

| Example | Personal loans, auto loans, mortgages | Credit cards, home equity lines of credit (HELOC) |

| Impact on Credit | Helps build credit with consistent payments | Can build credit if managed responsibly, but high balances may hurt credit score |

| Pros | Predictable payments, helps with long-term goals | Flexibility, immediate access to funds |

| Cons | Less flexibility, fixed commitment | Higher risk of debt if payments aren’t managed properly |

Building upon the differences discussed earlier, let's now explore how installment credit can specifically benefit you.

Curious about loan types? Read [Differences between Personal Loan and Car Loan: What to Choose?] to better understand which loan fits your needs.

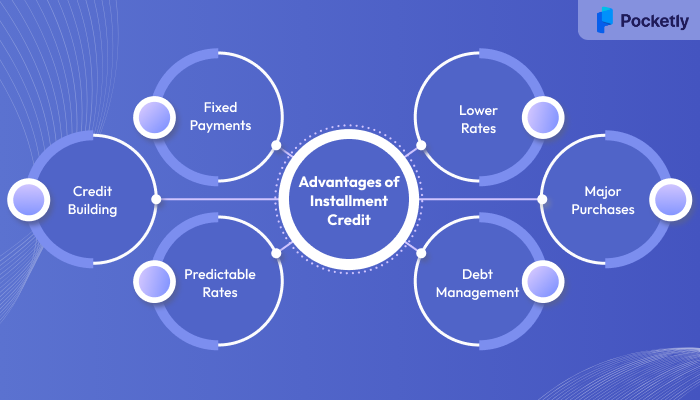

Advantages of Installment Credit

With its structured repayment process, installment credit is designed to offer stability and predictability in managing financial commitments. Here are some of the key advantages of choosing this type of credit:

- Fixed Payment Schedules: Installment credit offers fixed monthly payments, which makes it easier to plan and budget your finances. This predictability is beneficial for long-term financial management, helping you avoid surprises in your payment obligations.

- Building Positive Credit History: Regular and timely payments made on installment loans are reported to credit bureaus, contributing to the development of a positive credit history. This can help improve your credit score over time, opening the door to better loan terms in the future.

- Predictable Interest Rates: Most installment credit agreements come with fixed interest rates. This means that you can plan your finances more effectively, knowing exactly how much you’ll be paying in interest each month.

- Lower Interest Rates: When compared to some other types of credit, such as credit cards or payday loans, installment credit typically offers lower interest rates, which can save you money in the long run.

- Financing Large Purchases: Installment credit is ideal for financing major purchases like homes, cars, or even educational expenses. These large-ticket items may be more difficult to finance through other means, but with installment credit, you can spread the cost over a manageable period.

- Helps in Managing Debt Effectively: The structured nature of installment credit can make it easier to stay on top of debt. By making consistent payments, you can gradually reduce the balance, helping you manage debt more effectively and reducing the risk of falling into unmanageable debt.

These advantages make installment credit a powerful tool for managing large financial commitments, providing clarity and control in your financial journey. With these advantages in mind, you may wonder how to identify situations where installment credit is best suited. Let's look into the scenarios where it’s most beneficial.

If you're looking to make the most of installment loans, learn how to manage them effectively with "Understanding Different Modes of Loan Repayment"

When is Installment Credit the Right Option?

While installment credit can offer stability and predictability, it's not always the ideal solution in every situation. Let’s take a look at when opting for installment credit would be the best choice for you:

- For Large Purchases

- If you're planning to make a large purchase, such as a car, home, or educational expenses, installment credit allows you to break down the cost into manageable monthly payments, making it easier to afford these substantial investments.

- When Predictable Payments Matter

- If you prefer knowing exactly how much you need to pay each month, installment credit is ideal. Fixed payments make budgeting easier and prevent the surprise of fluctuating payment amounts, helping you maintain better control over your finances.

- When Building Credit is a Goal

- Installment credit can be an excellent option if you’re working on building or improving your credit score. Timely payments on an installment loan can have a positive effect on your credit history, demonstrating your reliability to lenders.

- If You’re Looking to Save on Interest

- Compared to other types of credit, such as credit cards, installment loans often come with lower interest rates. This makes them a good choice for individuals who want to minimize the amount of interest paid over time.

- For Structured Repayment Plans

- If you prefer a more organized approach to managing debt, installment credit can be a great way to pay off a loan over time without the uncertainty of revolving credit. The structured nature of the loan helps you stick to a plan and avoid going into debt indefinitely.

While installment credit can provide great benefits, it’s equally important to weigh the potential drawbacks before you commit to any long-term financial arrangements. Let’s look into the disadvantages of installment credit and what to consider before making a decision.

Disadvantages of Installment Credit

As with any financial product, installment credit has its downsides. Before proceeding, it's essential to understand the potential pitfalls that could impact your finances.

1. Potential for Long-Term Debt

One of the primary disadvantages of installment credit is the risk of long-term debt. When you take out an installment loan, you commit to paying it off over a set period. If the loan has a long repayment schedule, you could be tied to it for a significant amount of time, leading to financial strain in the future.

2. Late Fees and Impact on Credit Score

If you miss payments on your installment loan, not only do you risk incurring late fees, but your credit score can also be affected. A lower credit score could make it harder to qualify for other credit products or result in higher interest rates in the future.

3. Inflexibility Compared to Revolving Credit

Unlike revolving credit, which offers flexible borrowing and repayment options, installment credit has fixed repayment schedules. This lack of flexibility can be a disadvantage if your financial situation changes and you need to adjust the amount or timing of your payments.

Before looking into the impact of installment credit on your credit score, it's important to note that the way you handle any form of credit has a direct effect on your financial health. Understanding this will help you make more informed decisions when managing installment credit.

If you're facing financial strain due to installment credit or other obligations, it’s essential to have quick and flexible solutions to manage your expenses. Pocketly provides a seamless and convenient way to bridge financial gaps, enabling you to stay on top of your finances without the complexities of traditional credit products. Get started with Pocketly today and experience quick access to funds when you need them the most!

How Installment Credit Affects Your Credit Score

Installment credit affects your credit score in multiple ways. Responsible use of installment loans, such as paying on time and keeping balances manageable, can improve your credit score. Conversely, missed payments and high debt levels can damage it. Here's how it works:

| Positive Effects | Negative Effects |

|---|---|

| Improved Payment History: Consistently making on-time payments is one of the best ways to improve your credit score. | Missed or Late Payments: Any delay or missed payment will result in a negative impact on your credit score. |

| Diversified Credit Profile: A good mix of credit types, including installment loans, helps build a strong credit history. | High Credit Balances: Carrying a high balance on your installment loan relative to your credit limit can hurt your credit score. |

| Longer Credit History: The longer you maintain an installment loan, the better it reflects on your credit score. | Frequent Loan Applications: Multiple hard inquiries from frequent loan applications can temporarily reduce your score. |

To ensure that installment credit works to your advantage and doesn’t negatively impact your credit score, it’s crucial to use it responsibly.

Tips to Use Installment Credit Responsibly

To maintain a healthy credit score and ensure that your use of installment credit is beneficial, it’s essential to approach it with careful planning and responsibility. Here are some tips to help you use installment credit wisely and avoid common pitfalls that can affect your financial health:

1. Stick to Your Payment Schedule: Consistent and timely payments are key to building and maintaining a good credit score. Missing or late payments can quickly hurt your credit, so set reminders or automate your payments to stay on track.

2. Only Borrow What You Can Afford to Repay: Before taking on a loan, make sure you can comfortably afford the monthly payments. Borrowing more than you can handle can lead to financial stress and missed payments, which can damage your credit score.

3. Avoid Taking Out Too Many Loans at Once: Multiple loans can stretch your budget and increase your debt-to-income ratio, which may impact your credit score. Be cautious about taking on additional loans unless absolutely necessary, and ensure you can manage the repayments effectively.

4. Keep Your Credit Utilization Low: For installment loans with revolving credit options, try to keep your balance below 30% of your credit limit. This helps maintain a positive impact on your credit score and signals to lenders that you can manage your credit well.

5. Monitor Your Credit Regularly: Keeping an eye on your credit score and report helps you track your progress and identify any issues early on. You can use free tools to monitor your credit regularly, ensuring you catch any discrepancies or potential issues before they become bigger problems.

By following these tips, you can maximize the benefits of installment credit and manage it in a way that enhances your financial well-being rather than hindering it.

If you're looking for a simple and flexible way to manage your finances and improve your credit health, Pocketly offers an efficient solution that can help you bridge gaps during challenging times.

For more tips on managing your credit wisely, check out [Ways to Improve CIBIL Score from 600 to 750] to ensure your credit is always in good standing.

Pocketly: A Smart Financial Solution for Managing Credit

Pocketly is a user-friendly, fast financial solution that simplifies the lending process. Whether you're facing salary delays, covering an emergency expense, or handling unexpected costs, Pocketly ensures a smooth, transparent borrowing experience with quick approvals and flexible terms.

Here’s how Pocketly works:

- Loan Amounts: Borrow between ₹1,000 and ₹25,000 based on your needs.

- Interest Rate: Starting from just 2% per month, allowing you to manage your repayment more easily.

- Processing Fees: The processing fee ranges from 1% to 8%, depending on the loan amount and type.

- Minimal Documentation: Pocketly offers a quick, hassle-free application process with minimal paperwork.

- Flexible Repayment: Choose repayment terms that work with your financial situation.

When you need quick funds, Pocketly offers an alternative to complex and long-term credit products. With its fast disbursement and easy-to-understand terms, Pocketly helps you handle unexpected expenses efficiently and stress-free.

Contact us today and experience the flexibility and transparency of fast, personal loans.

Conclusion

Managing installment credit can provide numerous benefits when used correctly, but it requires mindful management. By understanding how it impacts your credit score and employing strategies to use it responsibly, you can optimize its benefits to achieve your financial goals. Whether you're looking to establish or improve your credit profile, maintaining consistent payments and keeping your credit utilization in check are key steps toward financial success.

However, even with the best financial planning, life can throw unexpected challenges your way. If you find yourself in a financial crunch or facing unplanned expenses, Pocketly is here to offer a flexible, quick, and transparent lending solution. With minimal paperwork, a range of loan amounts, and flexible repayment terms, Pocketly makes it easy to manage financial obligations without unnecessary stress.

Download Pocketly today on Android or iOS and take control of your finances with ease.

FAQs

- How can installment credit improve my credit score?

- Installment credit can boost your credit score by creating a positive payment history and diversifying your credit profile.

- What are the risks of using installment credit?

- If payments are missed or your balance exceeds your credit limit, your credit score may be negatively impacted.

- Can I use installment credit to build my credit history?

- Yes, maintaining an installment loan responsibly can help build your credit history, which is beneficial for future credit applications.

- What is the interest rate on installment credit?

- The interest rate varies by lender but is typically lower than that of revolving credit options, such as credit cards.

- How does Pocketly help with managing finances?

- Pocketly provides quick loans with flexible terms, helping you bridge financial gaps without the complexities of traditional loans.