Think of getting your loan approved, but the funds just don’t arrive when you need them most. For students, salaried professionals, and self-employed individuals, that wait can feel stressful, especially when the money is meant for urgent needs. Thankfully, digital lending platforms in India have made borrowing simpler and faster. In fact, loan disbursements touched ₹1.46 trillion in the financial year 2024, showing how quickly access to funds is growing.

Still, even with faster systems, the loan process isn’t always as simple as it seems. Small oversights or missing details can easily cause delays or confusion during disbursement. That’s why understanding what really affects loan disbursement can help you get your money on time and avoid unnecessary stress.

In this blog, you’ll explore the loan disbursement process, clear up common misconceptions, and share simple tips to help you avoid unnecessary delays.

Key Takeaways:

- Loan disbursement is the stage when your approved funds are finally transferred to your account, marking the last and most-awaited step in your borrowing journey.

- Digital lending has completely changed the loan disbursement process, allowing funds to reach your account within minutes without visiting a branch.

- The speed of disbursement depends on factors such as your credit profile, eligibility, and the accuracy of your documents.

- Many old beliefs about loan disbursement are outdated, as you no longer need a perfect credit score or weeks of waiting to get your funds credited.

- Technology has transformed the lending space, using automation, digital KYC, and AI-powered systems to make borrowing faster, safer, and more convenient.

What is Loan Disbursement?

Loan disbursement is the final and most exciting step in getting a loan. It’s when the lender actually sends the approved money to your account. Once your loan application is approved and all your documents are verified, the disbursement process begins.

That’s when you finally receive the funds, whether you need them for personal expenses, an emergency, or to improve your business. Most lenders transfer the money straight to your bank account, and it usually happens within a few hours or a couple of days. This step marks a big moment in the process. It means the loan is officially yours, and you can now use it for the purpose you planned.

Once you understand what loan disbursement actually involves, it’s much easier to tell the real facts from the common myths surrounding it.

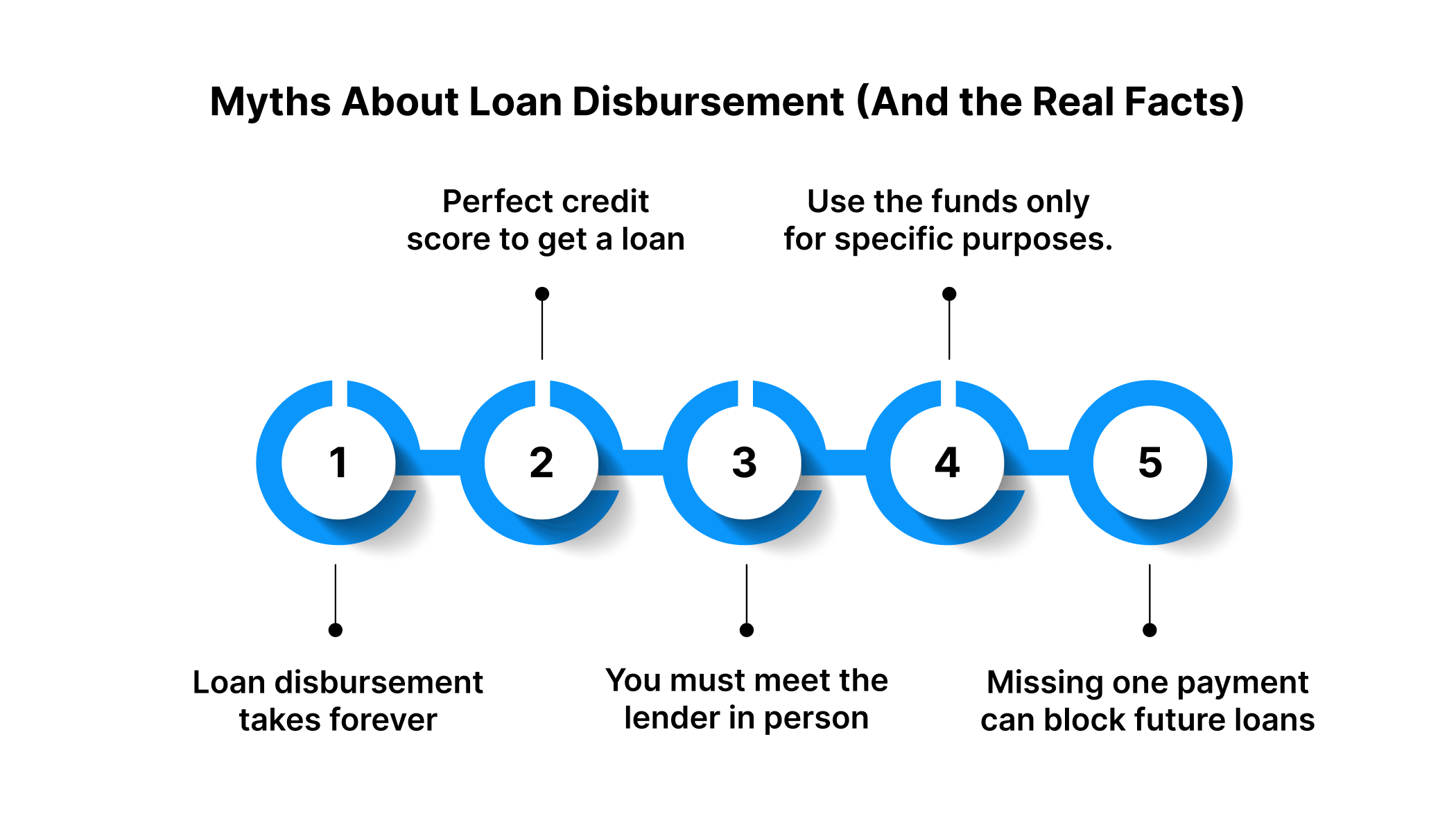

Myths About Loan Disbursement (And the Real Facts)

There are several myths circulating about how loan disbursement actually works, which often lead people to second-guess applying for a loan. So, let’s set the record straight and see what’s true and what’s not:

Myth 1: Loan disbursement takes forever

Many assume getting the money will take days or even weeks, but that’s no longer the case. With digital lending, most loans are disbursed within hours, and sometimes even within minutes, after approval. The usage of online platforms and automated systems has made the process faster and smoother than ever before.

Myth 2: You require a perfect credit score to get a loan

While your credit score does matter, it’s not the only thing lenders look at. Pocketly offers loans to individuals with varying credit scores, and even those with lower scores can qualify, though the terms might vary. The platform also considers your income and job stability, making it easier for individuals with limited or no credit history to access funds.

Myth 3: You have to meet the lender in person to get your loan

Not anymore! With digital lending platforms, you can apply, upload your documents, complete your KYC, and receive your funds, all online. There’s no need to visit a branch or meet anyone face-to-face. The entire process is quick, secure, and super convenient.

Myth 4: You can only use the disbursed money for specific things

That’s only true for certain types of loans, like home or car loans. Personal loans, on the other hand, give you full flexibility. You can utilise the funds to cover medical expenses, pay tuition fees, plan a vacation, or even manage business needs; it’s entirely up to you.

Myth 5: Missing one payment ruins your chances of getting another loan

Missing a payment can lower your credit score, leading to late fees, but it doesn’t mean you’ll never get approved again. Lenders look at your overall repayment behaviour. If you make up for missed payments and maintain a steady record afterwards, your chances of future approval remain strong.

Now that the common myths are cleared up, it’s easier to focus on the actual steps involved in completing your loan disbursement application.

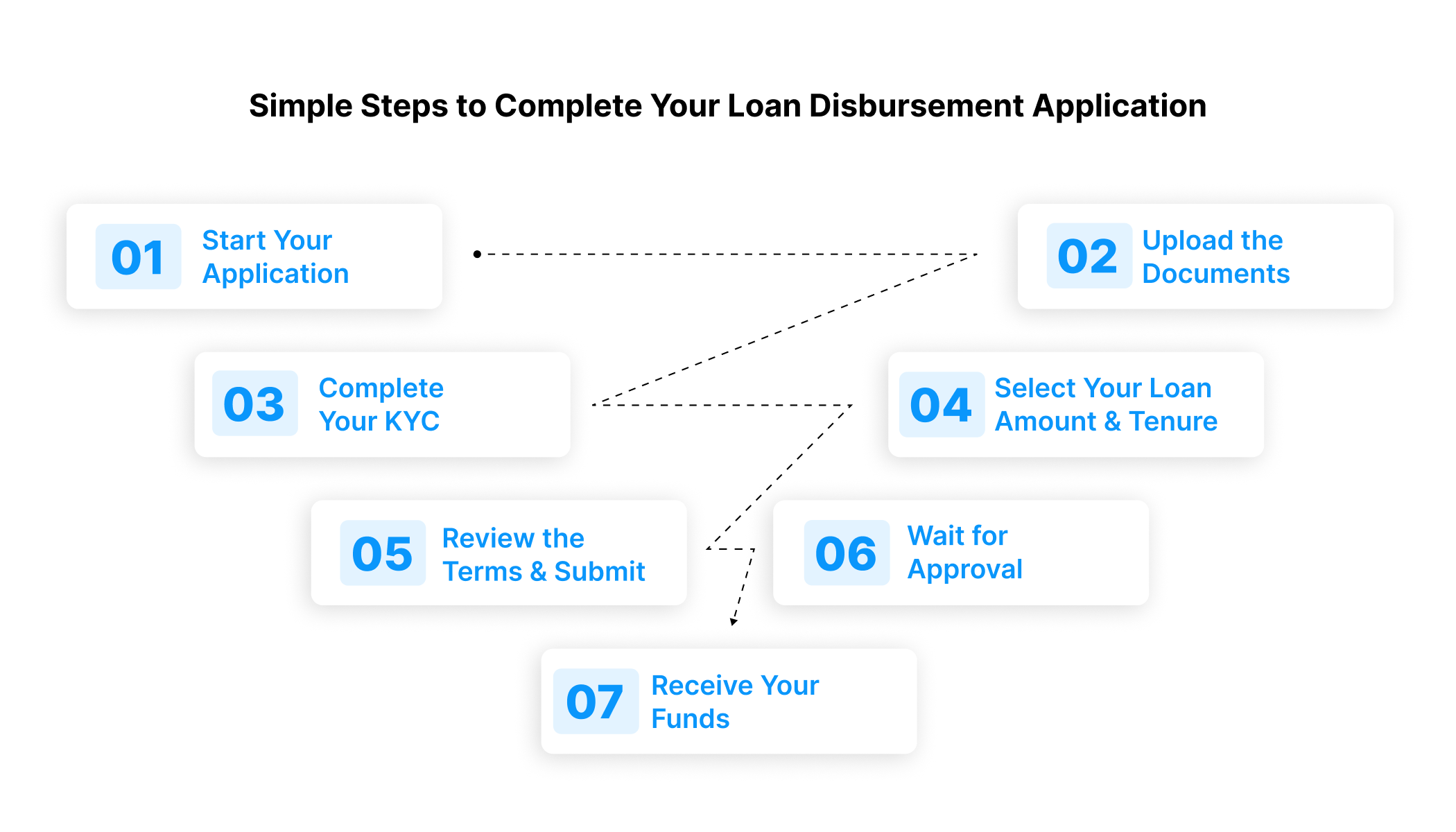

Simple Steps to Complete Your Loan Disbursement Application

Applying for a loan disbursement might sound complicated at first, but it’s actually pretty straightforward. Once you know the steps, the whole process feels smooth and easy. Here’s how it works:

Step 1: Start Your Application

Head over to your lender’s website or download their mobile app. Create an account by entering your basic details, such as your name, phone number, and email address. This sets up your profile and gets your application started in just a few minutes.

Step 2: Upload the Required Documents

Next, you’ll need to share a few documents to verify your identity and show your financial stability. Usually, you’ll be asked for:

- Aadhaar card (for ID and address proof)

- PAN card (for tax verification)

- Bank account details (for transferring the funds)

- Proof of income (like salary slips or bank statements)

Some lenders may request additional documents depending on the loan type, but most of the process is conducted online. You can easily upload scanned copies or clear photos, with no paperwork hassles.

Step 3: Complete Your KYC

The Know Your Customer (KYC) step helps lenders confirm your identity and prevent fraud. It’s quick and mostly digital, done either through a short video call or by submitting images of your ID documents. Once completed, you’re ready to move forward.

Step 4: Select Your Loan Amount and Tenure

After your documents and KYC are verified, you can decide how much money you need and how long you’d like to repay it. Loan amounts often range from ₹1,000 to ₹25,000, and repayment periods vary from a few weeks to a few months. Pick what suits your financial comfort.

Step 5: Review the Terms and Submit

Before you hit submit, take a moment to go over the loan details. Check the interest rate, any processing fees, and the repayment schedule. Once everything looks good, submit your application.

Step 6: Wait for Approval

Now the lender reviews your application. It usually doesn’t take long. Digital lenders often use automated systems to speed things up. You may be asked for a quick clarification, but approvals typically occur quickly.

Step 7: Receive Your Funds

Once your loan is approved, it’s payout time! The lender will transfer the approved amount straight to your bank account, often within minutes. You’ll receive a confirmation via email or SMS once the money is received.

By following these simple steps, you can complete your loan disbursement process quickly and without any stress. After you’ve completed your loan disbursement application, it’s essential to understand the factors that can affect how soon your funds are released.

Suggested Read: Understanding the Loan Restructuring Process and Guidelines

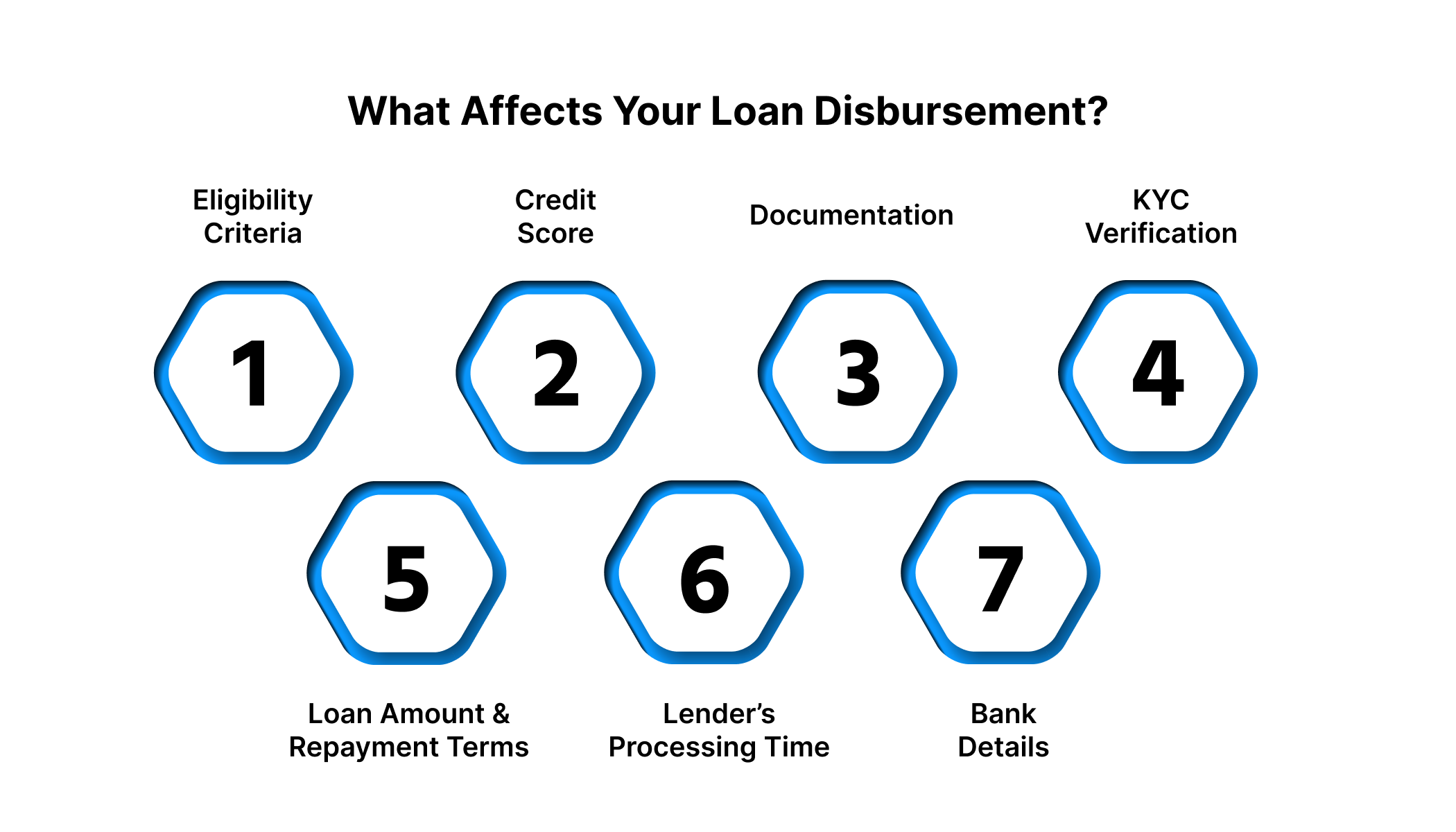

What Affects Your Loan Disbursement?

Several factors can affect how fast and smoothly your loan gets disbursed. Even though most digital lending platforms work hard to keep the process quick and simple, a few things can still impact the speed and approval of your loan.

Here are the main factors that can make a difference:

1. Eligibility Criteria

Your eligibility decides whether you qualify for a loan. Lenders consider factors such as your income, age, and employment status before approving your application.

- Income: Lenders usually set a minimum income requirement to make sure you can repay the loan comfortably. If your income is below the set limit, your application might get delayed or even rejected.

- Age: Most lenders prefer borrowers aged 18 to 60. This helps ensure you can complete repayment within your earning years.

- Employment Status: Having a stable job or a steady business income gives lenders confidence that you can repay on time. Borrowers with regular income sources are often seen as low-risk applicants.

2. Credit Score

Your credit score significantly impacts how quickly your loan is approved and the funds are released. A higher score improves your approval chances and ensures quicker disbursement. If your score is lower than expected, try paying any outstanding debts and correcting any errors on your credit report before applying. These small steps can strengthen your profile.

3. Documentation

Submitting the right documents accurately and on time makes a big difference in how quickly your loan is processed.

- Completeness: Any missing or incorrect information can hold up approval. Make sure your Aadhaar, PAN, income proof, and other details are accurate and up to date.

- Digital Documents: Most lenders now accept online uploads, so ensure your documents are clear and easy to read. Blurry or incomplete files can cause unnecessary delays.

4. KYC (Know Your Customer) Verification

KYC is a standard process that helps lenders verify your identity. Completing it quickly helps move your loan along faster.

- Verification Process: Submitting your ID proofs or completing verification on time helps avoid setbacks.

- Online KYC: Most lenders now make it extremely easy with online options, such as video calls or document uploads. A stable internet connection and clear images keep the process smoother.

5. Loan Amount and Repayment Terms

The amount you apply for and how long you plan to repay it can both affect how quickly your loan is approved.

- Loan Amount: Larger loan amounts may take longer to approve, as lenders often conduct additional checks to assess repayment capacity.

- Repayment Terms: Choosing longer repayment periods can also require additional verification steps, which may slightly delay disbursement.

6. Lender’s Processing Time

Every lender has its own pace and process, which directly impacts how soon you get your money.

- Internal Processes: Some lenders release funds instantly upon approval, while others may take a little longer due to internal checks.

- Peak Application Times: Applying at the end of the month or during festive seasons can slow down the process slightly, as lenders tend to handle more applications during these periods.

7. Bank Details

Accurate bank details are crucial for prompt, error-free disbursements.

- Accuracy: Even a small mistake, such as an incorrect account number or IFSC code, can delay your fund transfer. Always double-check before submitting.

- Bank Processing Time: Most lenders transfer funds right away, but the time it takes for the amount to reflect in your account can depend on your bank’s processing speed.

While loan disbursement can be affected by various reasons, technology is now helping lenders and borrowers overcome many of these challenges and speed up the disbursement process.

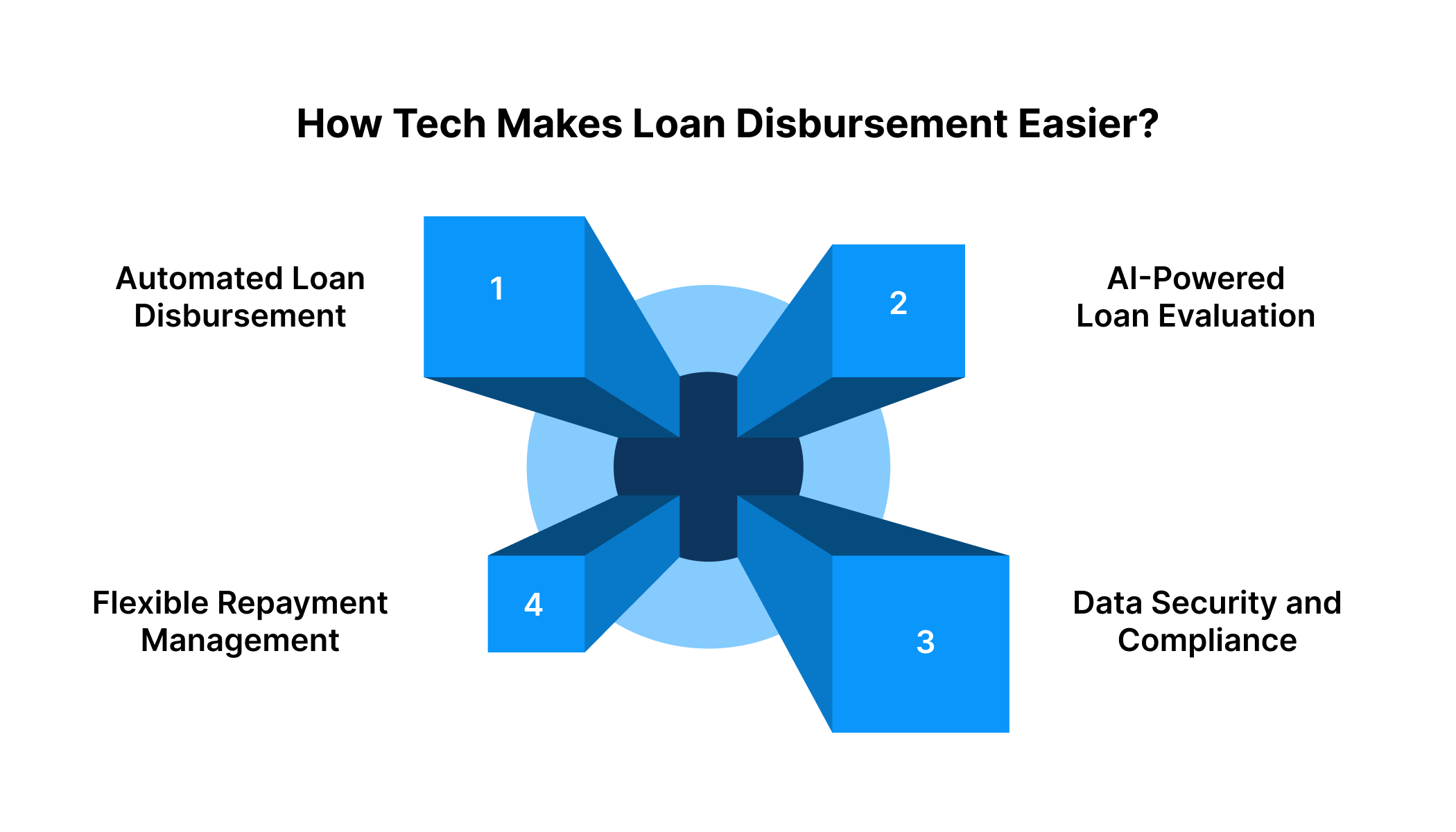

How Tech Makes Loan Disbursement Easier?

Technology has completely changed how loans are disbursed, making the process faster, smoother, and easier for everyone. Gone are the days of waiting for weeks or dealing with endless paperwork; digital lending has made getting a loan as simple as a few clicks. Here’s how technology is reshaping the loan disbursement process:

1. Automated Loan Disbursement

Once your loan is approved, technology takes over to transfer the money straight into your bank account, sometimes within minutes. Automated disbursements eliminate manual errors and speed up the process, so you can access your funds right when you need them.

2. AI-Powered Loan Evaluation

Artificial intelligence and machine learning now help lenders make smarter and fairer decisions. These systems consider factors such as your income, spending habits, and credit score to quickly and accurately evaluate your eligibility.

3. Data Security and Compliance

With advanced encryption and secure digital systems, your personal and financial information stays protected. These platforms comply with all applicable regulations, ensuring your data is handled safely and responsibly throughout the disbursement process.

4. Flexible Repayment Management

Technology also makes managing repayments simple. You can track your EMIs, make payments, or even clear your loan early, all through your lender’s app or website. This convenience helps borrowers stay on top of their finances and avoid missed payments.

Platforms like Pocketly make the loan disbursement process quick and hassle-free with the help of smart technology. Automated approvals, digital KYC, and intelligent evaluations work together to make the entire process fast, smooth, and secure.

As technology continues to simplify the process, it’s a good idea to focus on strengthening your credit profile to make future loan approvals even easier.

Also Read: Getting Personal Loans with a 650 Credit Score

How to Build a Solid Credit Profile for Future Loans?

A strong credit profile can help you secure better loan offers, lower interest rates, and quicker approvals in the future. If you’re just starting your financial journey or looking to improve your existing credit standing, some smart habits can make a big difference. Here’s how you can strengthen your credit profile for future loans:

1. Check Your Credit Report Regularly

Make it a habit to review your credit report every few months. It helps you stay updated on your score and identify any errors that could harm your profile. If you find mistakes, raise a dispute immediately to get them corrected.

2. Maintain a Healthy Mix of Credit

Lenders prefer borrowers who can manage various types of credit, including credit cards, personal loans, and car loans. Having a healthy mix shows that you handle credit wisely and responsibly.

3. Keep Old Accounts Open

Your credit history length matters. Older accounts add depth and stability to your profile. Even if you don’t use them much, keeping them active can help improve your credit score over time.

4. Try a Secured Credit Card

If you’re new to credit or trying to rebuild, a secured credit card is a great place to start. You’ll need to make a small deposit that serves as your credit limit. Responsible use and timely payments can gradually enhance your score.

5. Manage Debt Smartly

High outstanding debt can weigh down your credit score and future loan eligibility. Focus on paying down existing balances before taking on new ones, and aim to stay within your repayment capacity.

By building these habits, you’ll strengthen your credit profile and become a more trustworthy borrower.

Must Read: Top 30 Instant Loan Apps Without Income Proof in India

How Pocketly Makes Loan Disbursement Fast and Clear?

If you're looking to improve your credit score and secure better loan terms, Pocketly can help you on that journey. Here’s how:

- Easy Access to Loans: Pocketly offers quick, short-term loans ranging from ₹1,000 to ₹25,000. With no collateral required, it’s a hassle-free way to access the funds you need while you work on building your credit.

- Timely Payments Improve Your Score: One of the most crucial factors in enhancing your credit score is making timely payments. Pocketly offers flexible repayment tenures from 2 to 6 months, helping you establish a positive repayment history, which is crucial for boosting your credit score.

- Flexible Loan Terms: Pocketly’s interest rates start from 2% per month, with repayment options designed to fit your budget. This flexibility makes it easier to stay on track with your repayments and gradually improve your credit score.

- Transparent and Clear Terms: Pocketly is committed to transparency, with no hidden fees or surprises. You’ll always know exactly what to expect, making it easier to manage your loan, stay consistent with payments, and maintain a positive payment record.

- Simple Application Process: Applying for a loan is simple and doesn’t require complex paperwork or collateral. Whether you’re new to borrowing or have a lower credit score, Pocketly ensures a smooth and accessible borrowing process.

With Pocketly, you can access quick loans, build a solid credit history, and improve your score over time, making you more eligible for favourable loans in the future.

Final Thoughts

Understanding how loan disbursement works is the first step to ensuring your funds reach you quickly and without issues. By following the right steps, submitting accurate documents, and avoiding common mistakes, you can save time and prevent unexpected delays.

Platforms like Pocketly use smart technology to make the loan disbursement process faster, simpler, and more efficient. With quick approvals and instant digital transfers, your funds are transferred straight to your bank account, often within minutes of approval. With Pocketly, you can handle your loan application and disbursement smoothly and confidently.

Download the Pocketly app on iOS or Android today to experience quick and hassle-free loan disbursement!

FAQs

Q1. Can I change my loan amount after applying?

A1. Usually, once you’ve submitted your loan application, the loan amount is locked in. However, some lenders may allow you to cancel your application and reapply for a new amount, depending on their internal policies.

Q2. What happens if I miss a loan payment?

A2. Missing a payment leads to late fees and may hurt your credit score. If you think you might miss a payment, reach out to your lender as soon as possible. Many lenders are willing to help you reschedule your payment or adjust your terms to avoid penalties.

Q3. How does my loan disbursement affect my credit score?

A3. The disbursement itself doesn’t impact your credit score, but your repayment habits do. Paying your EMIs on time helps build a strong credit history, while missed or delayed payments can lower your score.

Q4. Can I apply for multiple loans at once?

A4. You can apply for multiple loans, but it’s not always the best move. Each application adds a hard inquiry to your credit report, which can reduce your score if done too often. It’s smarter to apply only when you really need to keep your credit profile in good shape.

Q5. Is it possible to get a loan without a credit history?

A5. Yes, it’s possible. Some lenders offer loans to people with little or no credit history by evaluating factors such as your income, job stability, and KYC details. Just keep in mind that such loans may come with higher interest rates since lenders consider them riskier.