When considering loans, one of the first numbers you’ll check is the interest rate, but do you know how much of that rate is actually legal? In India, the personal loan interest rates at major banks begin from around 10% per annum for top credit profiles. These rates are shaped not just by the market but also by what regulators permit under law, state‑level caps, and court decisions.

For young professionals who increasingly rely on digital loan apps for quick access to funds, understanding the “legal interest rate” not only helps you compare offers; it can protect you from high and potentially unfair costs.

This blog will unpack what a legal interest rate means in the Indian context, how it applies to instant‑loan apps, and what smart borrowers should watch out for before they hit “apply.”

Key Takeaways

- Legal interest rates in India are shaped by state-level regulations and RBI guidelines, which aim to protect borrowers from excessive lending rates.

- States like Karnataka, Maharashtra, and Punjab have specific interest rate caps to prevent predatory lending practices, with rates typically ranging from 18% to 24% annually.

- The RBI does not set a national interest rate cap but provides guidelines for how banks and NBFCs should determine rates, based on market conditions and risk profiles.

- Borrowers must ensure that digital lending apps disclose all fees and clearly explain the interest rate structure, as transparency is key to avoiding hidden charges and unfair practices.

- Pocketly stands out by offering transparent loan terms with clear interest rates, no hidden fees, and flexible repayment options, making it a reliable and safe option for quick loans.

Overview of Legal Interest Rates in India

The legal interest rate refers to the maximum interest rate that can be charged on loans, as defined by Indian law. It ensures that lending practices remain fair and transparent, preventing predatory lending. While the Reserve Bank of India (RBI) doesn’t directly set interest rates for personal loans, it provides guidelines to banks and financial institutions on how rates should be structured.

In India, the State Government plays a role in regulating interest rates for certain types of loans, such as microloans or loans given by non‑banking financial companies (NBFCs).

For example, some states have set caps on the interest rates that can be charged on personal loans, generally ranging between 18% to 24% annually, depending on the state’s regulations. The Indian Contract Act, 1872, and the Reserve Bank of India (RBI) Act, 1934, also impose restrictions so that the interest charged is “just and reasonable.”

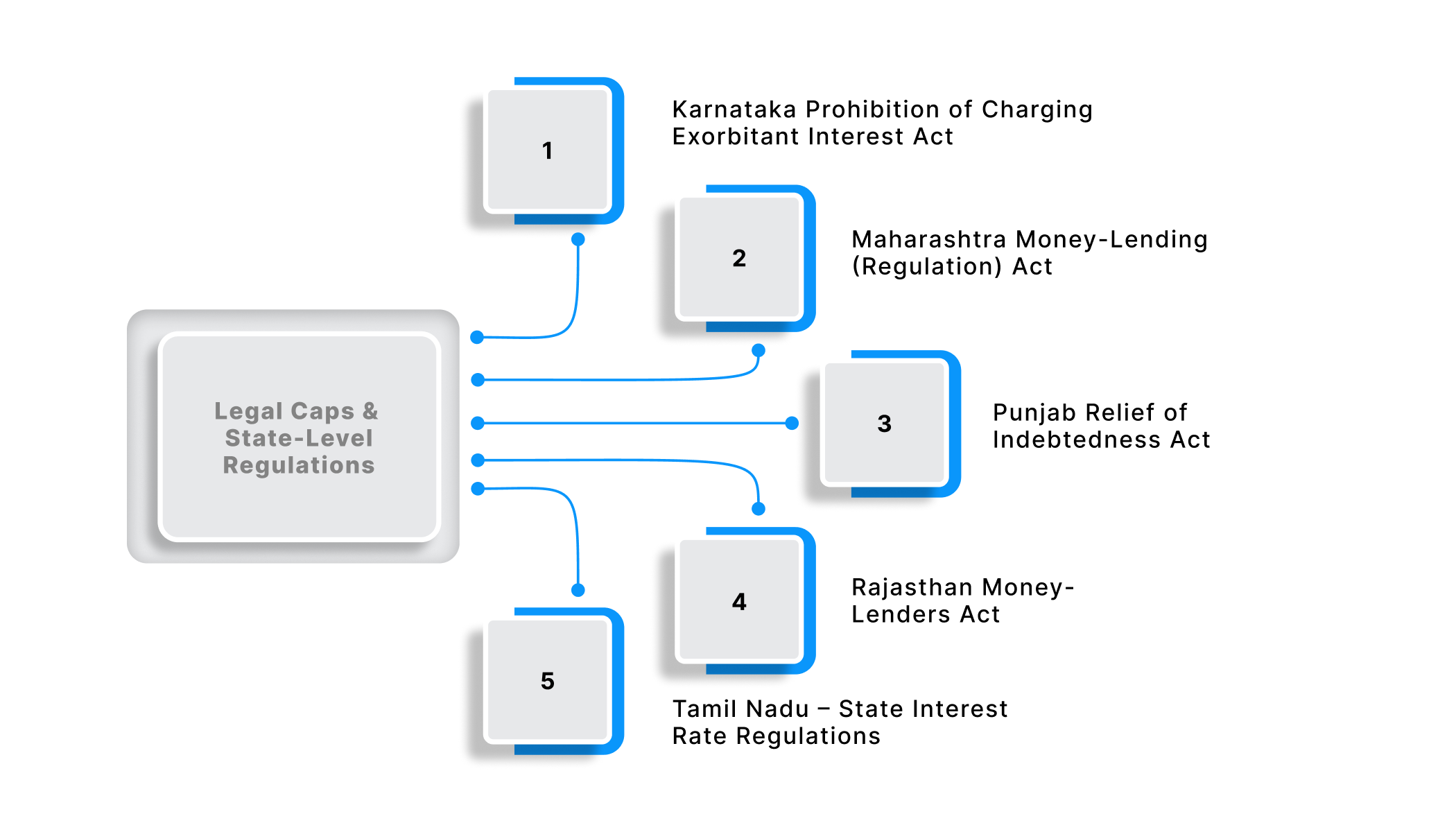

Legal Caps & State-Level Regulations You Must Know

In India, the legal interest rate for loans is not just defined by national guidelines but can also vary at the state level. State governments have enacted their own interest rate regulations to protect borrowers from predatory lending practices, especially from private money lenders.

Understanding these state-level caps is crucial for anyone considering borrowing money, as each state may impose different limits on the interest rate that can be charged.

Let’s take a look at how various states in India regulate interest rates:

1. Karnataka Prohibition of Charging Exorbitant Interest Act

Karnataka’s Prohibition of Charging Exorbitant Interest Act, 1976, sets a maximum interest rate of 18% per annum for private money lenders. This regulation was introduced to curb the predatory practices of money lenders who were charging excessively high interest rates, often leading borrowers into a cycle of debt. Private lenders in Karnataka are required to be licensed and must adhere to these caps.

2. Maharashtra Money-Lending (Regulation) Act

In Maharashtra, the Money-Lending (Regulation) Act, 2014, caps interest rates depending on the type of loan:

- Agricultural loans: Capped at 9% p.a. for secured loans, and 12% p.a. for unsecured loans.

- Non-agricultural loans: Capped at 15% p.a. for secured loans, and 18% p.a. for unsecured loans.

This regulation protects borrowers from overcharging and promotes fair practices in money lending.

3. Punjab Relief of Indebtedness Act

Punjab’s Relief of Indebtedness Act, 1934, is another example of a state‑specific regulation designed to protect borrowers. According to this Act:

- Interest on secured loans cannot exceed 7.5% p.a.

- Interest on unsecured loans is capped at 12.5% p.a.

This legislation aims to protect borrowers from the burden of excessively high-interest rates, and it empowers courts to review and intervene if the interest charged is found to be unfair.

4. Rajasthan Money-Lenders Act

Under the Rajasthan Money-Lenders Act, 1963, private money lenders are required to follow regulations that ensure the interest rates charged are fair and not exploitative. This Act empowers courts to intervene in cases of exorbitant interest rates. While the Act does not specify a fixed cap, it gives judicial bodies the authority to regulate unfair interest practices based on loan type and circumstances.

5. Tamil Nadu – State Interest Rate Regulations

In Tamil Nadu, the legal framework for interest rates on loans is shaped by two key pieces of legislation , the Tamil Nadu Money‑Lenders Act, 1957, and the Tamil Nadu Prohibition of Charging Exorbitant Interest Act, 2003.

Under Rule 15 of the 1959 Rules (to the Money‑Lenders Act), government notifications limit interest rates for money‑lenders to up to 9% per annum for secured loans, and up to 12% per annum for unsecured loans.

Also Read: Simple Interest Formula Calculation and EMI Examples

These state-level caps reveal how diverse India's lending system is. But beyond these regional boundaries, there's a national framework that shapes how every bank and NBFC in the country approaches interest rates, and that's where the RBI's influence becomes critical.

Role of RBI in Setting Interest Rate Frameworks

India’s interest rate regulation system is nuanced and based on principles of market-driven transparency rather than a unified statutory cap. While India does not have a central law that sets a maximum interest rate across all types of loans, the Reserve Bank of India (RBI) plays a crucial role in setting the framework that banks and non-banking financial companies (NBFCs) must adhere to when determining interest rates.

Here’s how RBI's framework works:

1. RBI and Interest Rate Frameworks for Banks and NBFCs

- Market-Determined Rates: The RBI does not impose a central statutory cap on interest rates across all loan types. Instead, it allows financial institutions to determine rates based on market conditions and internal factors like cost of funds, operational costs, and risk profiles.

- RBI’s Benchmarks: Banks and NBFCs are required to base their interest rates on benchmarks like the Marginal Cost of Funds-based Lending Rate (MCLR) or the External Benchmark-based Lending Rate (EBLR). These frameworks are transparent about how rates are set.

- Cost of Funds and Risk Premium: Banks and NBFCs must consider factors like the cost of funds, operational costs, and the credit risk premium when setting interest rates. RBI guidelines mandate that these rates must not be arbitrary but should be reflective of market conditions.

Also Read: A Guide to Digital Transactions as Per RBI Regulations

2. The Lack of a Statutory Cap on Interest Rates

Unlike some other countries, India does not impose a strict cap on interest rates, which means financial institutions can set interest rates based on their individual risk profiles and cost structures. However, this freedom comes with guidelines and checks so that the rates remain competitive and fair:

- RBI's Market Conduct Regulation: The RBI has guidelines in place to prevent banks and NBFCs from charging excessively high rates that would be considered exploitative. For example, banks are expected to set interest rates based on market benchmarks and disclose how rates are calculated.

- Fair Lending: While rates aren’t capped, the RBI has built-in safeguards to protect borrowers from usurious lending practices. In 2019, the RBI issued guidelines that prohibited banks and NBFCs from charging rates that are disproportionately high or exploitative, even if they’re not subject to a statutory cap.

3. RBI's Role in Digital Lending

While the RBI doesn’t directly set the maximum interest rates for digital loan apps, it regulates digital lenders through its guidelines for NBFCs and banks offering digital products.

- Interest rates are disclosed and are fair and transparent.

- No hidden charges are imposed, and processing fees are clearly outlined.

- The digital lending platforms comply with the fair lending practices under the Consumer Protection Act.

Pocketly stands out as a leading digital lending platform, offering fast, hassle-free loans with clear, transparent interest rates and no hidden fees. Pocketly’s instant personal loan, requiring minimal documentation, makes it a great choice for young professionals.

The RBI's framework establishes the rules, but enforcement and consumer protection require another layer of oversight. When borrowers face exploitation despite existing regulations, the courts step in as the final safeguard against unfair lending.

Judiciary's Role in Fair Lending Practices

In India, the judiciary plays a crucial role in upholding fair lending practices so that the borrowers are protected from excessive interest rates and unfair loan terms. Courts are empowered to intervene in lending disputes, examine the legality of interest rates charged by lenders, and make judgments to safeguard the rights of consumers.

For example, the Rajasthan Money-Lenders Act prohibits charging interest rates that are excessive or usurious, and courts can intervene if the terms are found to be unfair. The judiciary enforces laws, thereby protecting borrowers from exploitation by moneylenders.

Here's how the judiciary helps in protecting fair lending practices:

- Court Rulings on Excessive Lending Rates: The courts intervene when lenders violate interest rate caps or charge exorbitant fees, as seen in key rulings such as the RBI v. M/s. Vikram Financial Services case, where a digital lender was ordered to lower its rates.

- RBI’s Role in Judicial Oversight: The RBI works closely with the judiciary on fair lending practices. It monitors digital lending apps and monitors if they comply with interest rate regulations and transparency standards.

- State-Level Caps: Many states have set interest rate caps (e.g., Karnataka’s 18% per annum) for private lenders, and courts can take action if these caps are violated.

- Access to Fair Terms: The judiciary protects borrowers from being charged hidden fees or unfair rates, creating a more transparent borrowing environment.

Understanding the regulatory system is one thing; applying that knowledge when you're actually evaluating a loan offer is another. With RBI guidelines and judicial protections, you can now assess whether a digital lending app is playing by the rules.

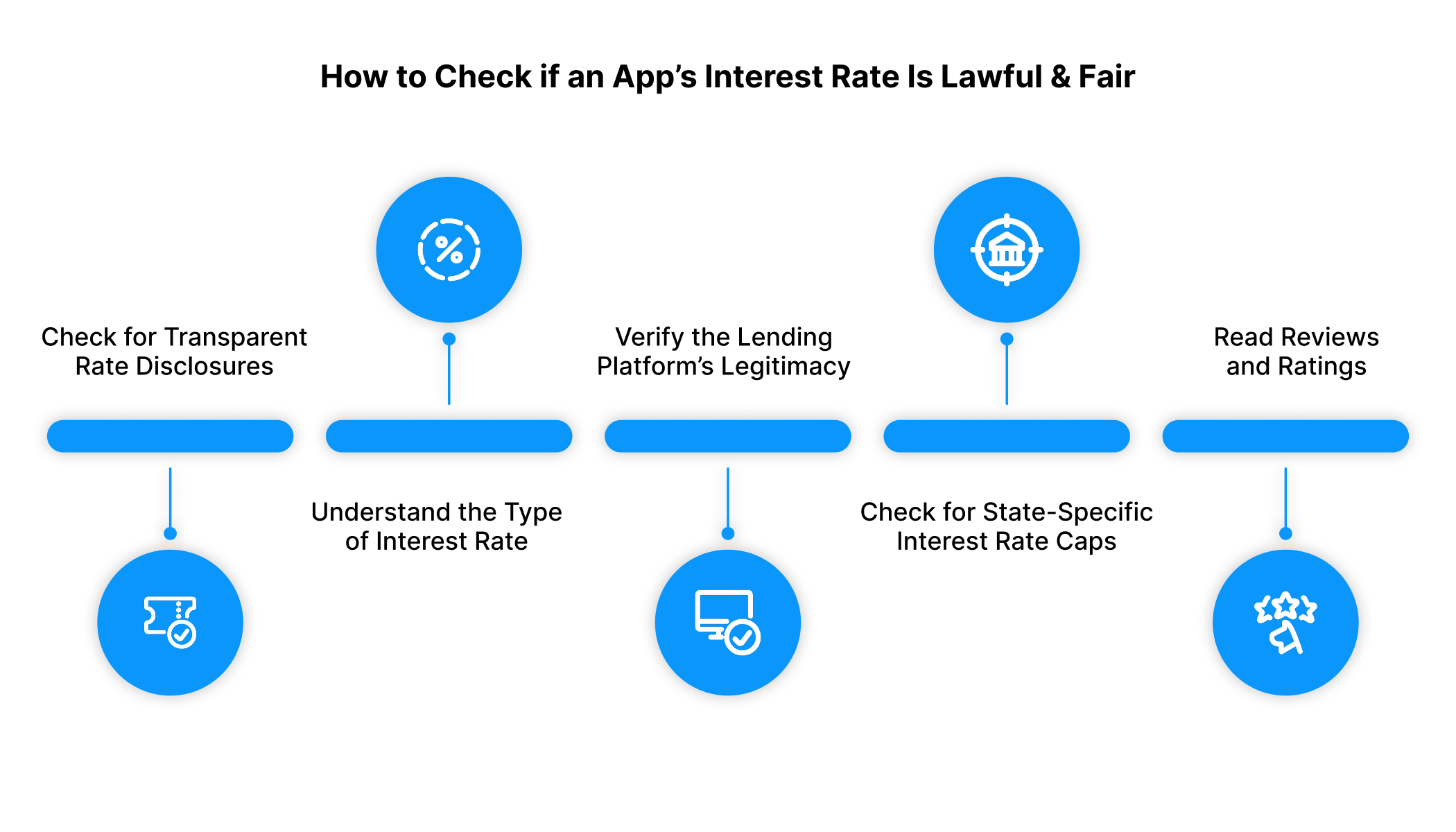

How to Check if an App’s Interest Rate Is Lawful and Fair

When borrowing from a digital lending app, it’s essential to make sure the interest rate, fees, and loan terms are lawful and fair. With the rise of quick-access loans, borrowers must be cautious of hidden costs and high rates. Here’s how to evaluate an app’s loan offer:

- Check for Transparent Rate Disclosures: A legitimate loan app will clearly show its interest rates, processing fees, and the total cost of the loan. The annual percentage rate (APR) should be listed, covering all costs like fees and penalties.

- Understand the Type of Interest Rate: Interest rates can be calculated in two ways, Flat-rate, where the Interest is charged on the full loan amount for the entire duration. Reducing balance, interest is charged only on the outstanding balance as the loan is repaid. Make sure you understand the method used to calculate interest and how it affects the total loan repayment.

- Verify the Lending Platform’s Legitimacy: Before applying for a loan, check if the app is registered with the RBI or adheres to state regulations. A legitimate app will be listed in the RBI’s directory of regulated lenders.

- Check for State-Specific Interest Rate Caps: Interest rate regulations can differ from state to state. Be aware of state-level caps (e.g., Karnataka’s 18% p.a. cap on private lenders). If an app’s interest rate exceeds these caps, it may not comply with local regulations.

- Read Reviews and Ratings: Check user reviews on trusted platforms to see if the app is transparent about its pricing.

These verification steps might seem tedious, but they're your defense against predatory lending. For borrowers who want these checks already built into their lending experience, platforms that prioritize compliance and transparency offer a simpler path forward.

Why Pocketly Stands Out in Transparency and Legal Compliance

Pocketly is a leading digital lending platform and not an NBFC; however, it provides full compliance with Indian regulations by offering transparent interest rates and clear loan repayment modes and terms. The App is designed to offer affordable loans and flexible EMI options for self-employed and salaried individuals seeking short-term financial relief.

Here are some key features of Pocketly:

- Loan Amount Range: ₹1,000 to ₹25,000

- Interest Rate: Starting from 2% per month

- Processing Fees: 1% to 8% of the loan amount

- Eligibility Criteria: Age 18+, Indian residents; minimal income proof required

- 100% Online Process: Apply, submit KYC, and receive funds without any paperwork.

- Two‑Click Sign-Up: Simple and quick registration.

Conclusion

Understanding legal interest rates in India is vital for anyone seeking loans, especially with the rise of digital lending apps. While India doesn’t have a central cap on interest rates, RBI guidelines, state-level regulations, and judicial oversight play crucial roles in ensuring that lending practices are fair and transparent.

State-specific interest rate caps, such as those in Karnataka, Maharashtra, and Punjab, set limits to prevent excessive charges by private lenders. In addition, the judiciary’s role in safeguarding consumers helps maintain fair lending by holding lenders accountable for unjust rates.

When borrowing from digital platforms, it's essential to check if the loan app complies with these regulations. Pocketly offers a transparent borrowing experience, with no hidden fees. Download the Pocketly app today on iOS or Android.

FAQs

1. Is 30 percent interest legal?

In India, 30% interest is generally considered excessive and may fall outside the legal framework unless specified by specific state regulations or contracts. Most states set caps on interest rates for money lenders to prevent usurious lending practices.

2. What is the highest legal interest?

The highest legal interest rate varies by state, with many states in India capping interest rates on loans at 18% to 24% per annum. States like Karnataka and Punjab impose strict interest rate caps for personal loans to protect consumers.

3. What is the new interest rate announced by the RBI in 2025?

As of 2025, the RBI’s monetary policy may influence interest rates, but it does not directly set maximum loan interest rates. Banks and lenders typically set rates based on RBI benchmarks, such as MCLR or EBLR.

4. Is the RBI going to cut interest rates?

The RBI may cut interest rates depending on economic conditions, inflation rates, and monetary policy decisions. Rate cuts are usually used to boost growth or stimulate demand in the economy.

5. Will interest rates fall in the next 5 years?

While it's difficult to predict exact rates, interest rates in India could decline over the next 5 years if economic conditions improve, inflation is controlled, and the RBI takes steps to support growth.