Still relying on traditional loan methods to get approval? Long waiting times, endless paperwork, and strict eligibility rules can feel like a roadblock when you need money quickly.

Today, digital lending is rewriting the borrowing experience in India. With 52% of the indian population already digitally active with fintech, the lending market is shifting towards faster, simpler, and more accessible solutions.

In this blog, we’ll look at what’s driving this shift, the latest trends shaping the industry, and predictions for its future. By the end, you’ll see how digital lending can change the way you manage your finances.

Key Highlights

- Digital lending in India is expanding fast, driven by rising fintech adoption, projected to reach $515 billion by 2030.

- Aadhaar, UPI, and e-KYC are driving easier access to loans across income groups.

- Key trends include AI-driven credit scoring, blockchain contracts, and embedded lending options.

- RBI guidelines ensure borrower protection, transparent loan terms, and secure digital lending practices.

What Is Digital Lending In India?

When you think about taking a loan, the first image is usually endless paperwork, multiple bank visits, and long waiting periods. Digital lending changes that completely.

At its core, digital lending means getting credit through online platforms rather than walking into a physical branch. Everything from filling out your application to receiving money happens on your phone or laptop. Instead of waiting weeks for approvals, digital platforms let you apply in minutes and get funds almost instantly.

Now, when we talk about digital lending in India, the growth has been nothing short of impressive. Here’s why it’s gaining popularity in India:

- Faster approvals: Online processes reduce waiting times from weeks to just hours.

- Paperless systems: Aadhaar-based eKYC makes borrowing quick and stress-free.

- Wider access: Even without a strong credit history, you can still access small-ticket loans.

Thanks to these changes, the digital lending industry in India is projected to reach $515 billion by 2030. That means more opportunities, easier access, and faster solutions for students, professionals, and small businesses alike.

But why has digital lending in India grown so quickly? The answer lies in a few strong driving factors.

Also Read: Understanding Lending In Banking: Types and Importance

Key Drivers Behind India’s Digital Lending Boom

Digital lending in India is expanding fast, and three main factors are pushing this change. Here’s how each one is reshaping access to credit:

- Rising Demand for Easy Credit

- Traditional banks often overlook small-ticket loans, leaving a gap for small businesses. Digital lenders bridged this gap, with micro and small enterprises’ credit access rising from 14% to 20% between 2020 and 2024.

- Government-Led Digital Push

- Initiatives like Aadhaar-based eKYC and UPI made borrowing quicker and paperless. Aadhaar authentications crossed 150 billion, while UPI grew from 131 billion (2023-24) to a projected 439 billion transactions by 2028-29.

- FinTech-Powered Innovation

- AI and big data help lenders assess creditworthiness using alternative data. By analysing spending patterns, mobile use, and bill payments, lenders now extend credit to borrowers previously left outside formal systems.

With these drivers shaping the market, let’s look at the exciting new trends taking centre stage.

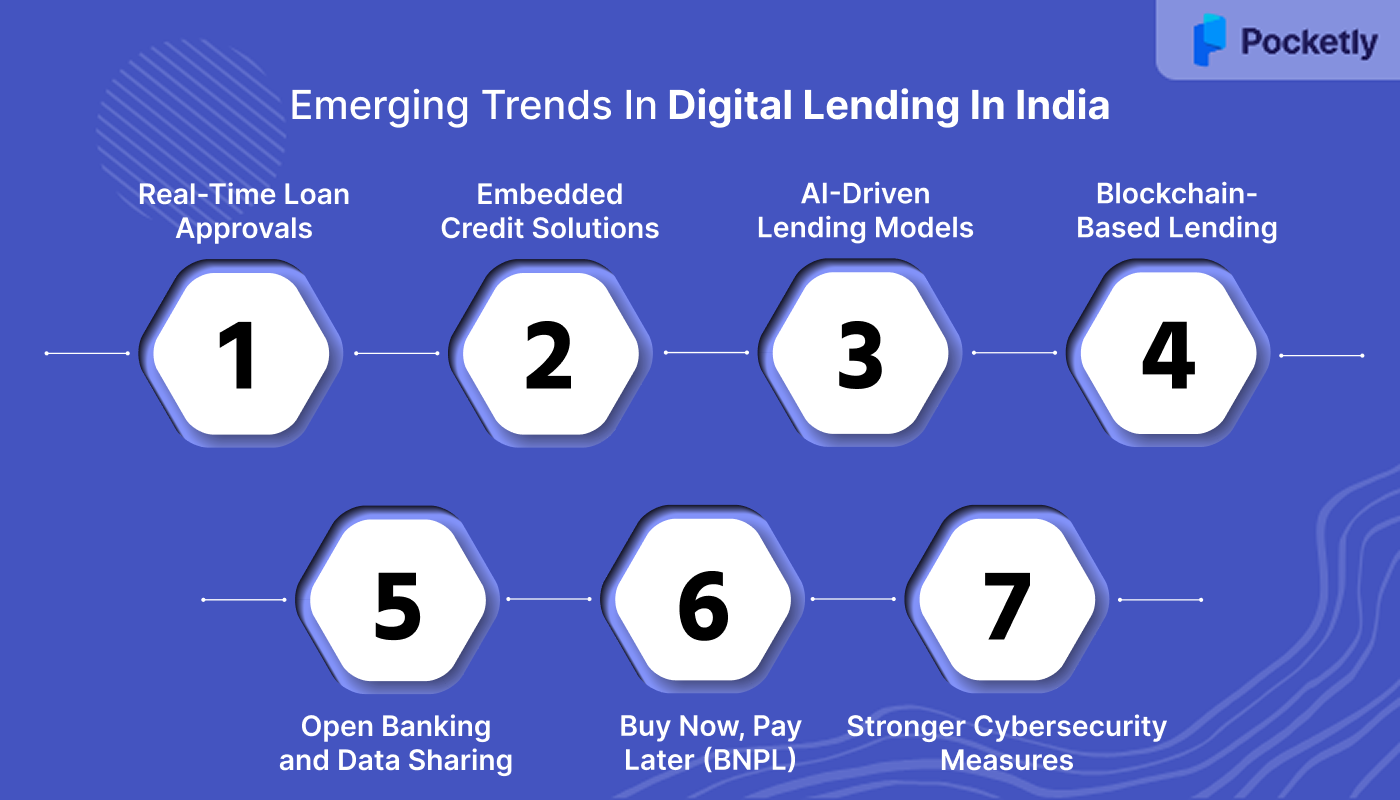

Emerging Trends In Digital Lending In India

Digital lending in India isn’t standing still. New technologies and models are changing how you access credit and how lenders manage risks. Let’s explore the major trends leading this shift:

Real-Time Loan Approvals

One of the biggest shifts in lending is speed. With AI and automation, approvals that once took days now happen instantly. This real-time approach is particularly effective for small-ticket loans, where you get quick turnaround.

The process starts right from loan origination and extends to servicing. Automated checks, digital verification, and AI-powered scoring allow lenders to deliver funds almost immediately, making access to credit faster than ever before.

Embedded Credit Solutions

Embedded lending goes beyond banks by integrating credit options directly into platforms you already use. For example, food delivery apps offering credit at checkout or edtech platforms providing pay-later options.

This approach makes borrowing seamless and less intimidating. For businesses, it creates more engagement and higher sales, while for borrowers, it ensures access to finance without visiting a separate financial institution.

AI-Driven Lending Models

Artificial intelligence and machine learning are transforming how loans are evaluated. These systems can scan massive datasets in seconds, giving lenders a sharper view of a borrower’s repayment ability.

Machine learning also helps improve fraud detection and risk prediction. By continuously learning from patterns, these models reduce defaults and make lending more inclusive, especially for those lacking a strong credit history.

Blockchain-Based Lending

Blockchain technology is bringing transparency and security into digital lending. Transactions recorded on blockchain are immutable, reducing the chances of tampering or fraud.

Smart contracts built on blockchain automatically enforce lending terms without human intervention. This cuts operational costs, eliminates delays, and builds stronger trust between lenders and borrowers.

Open Banking and Data Sharing

Open banking allows secure sharing of your financial data across institutions. With this, lenders can design offers that are more tailored to your needs and spending habits.

Combined with data sharing, it gives lenders a wider picture of your financial behaviour. This especially benefits new borrowers who may lack a traditional credit history.

Buy Now, Pay Later (BNPL)

BNPL has quickly become one of the most popular lending models. It allows you to split payments into smaller instalments, making bigger purchases more accessible.

For businesses, BNPL ensures smoother cash flow without burdening customers. For borrowers, it provides flexibility without entering a traditional loan agreement, blending affordability with convenience.

Stronger Cybersecurity Measures

With rapid digitisation comes the need for tighter security. Lenders are adopting advanced fraud detection systems powered by generative AI, as well as biometric verification and multi-layer authentication.

Generative AI is also being applied to detect new fraud patterns in real time. This ensures your data and money stay safe as digital lending platforms expand.

Also Read: Best Instant Personal Loan Apps in India 2024

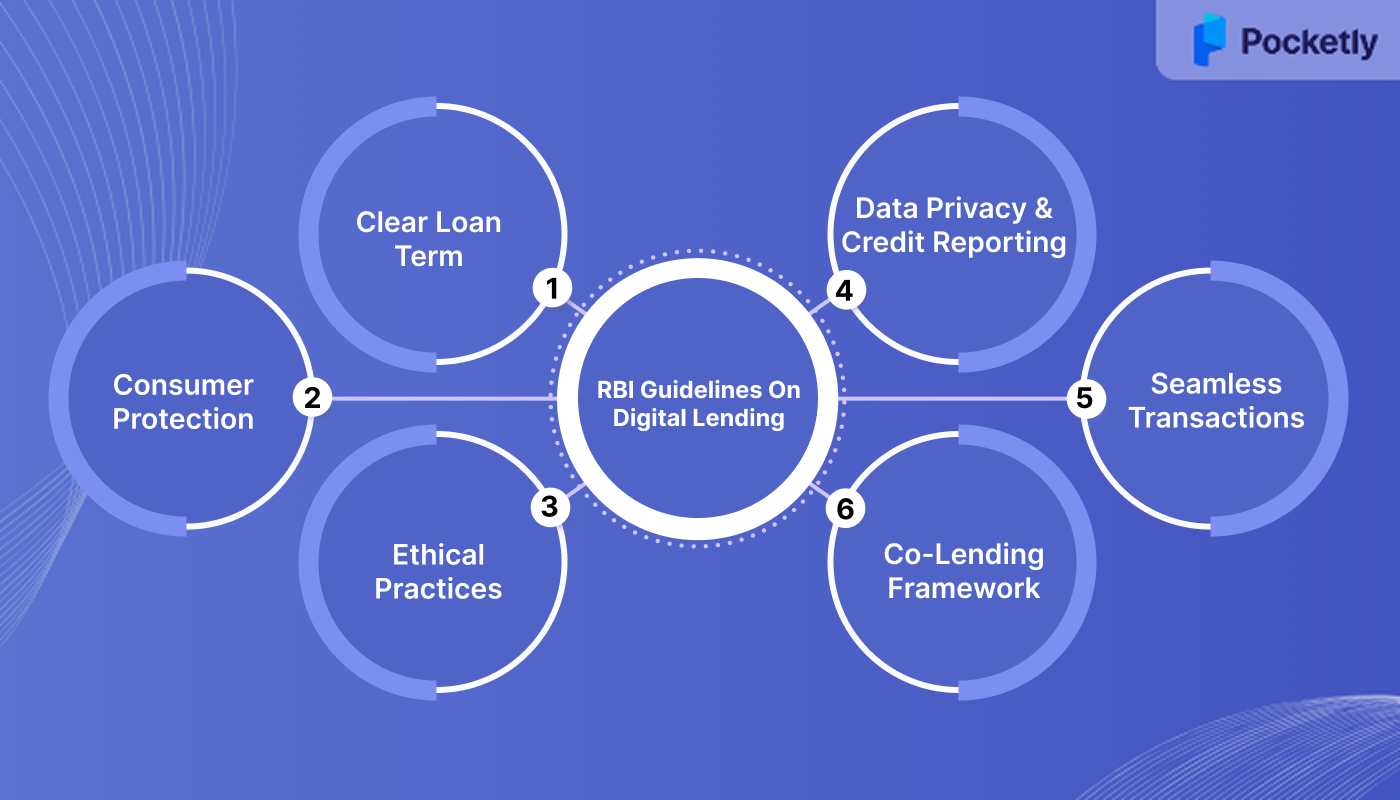

RBI Guidelines On Digital Lending

To make digital lending in India safer and more transparent, the RBI rolled out its Digital Lending Guidelines in 2021. These rules aim to regulate platforms, protect borrowers, and enforce fair practices.

- Clear Loan Terms: The RBI requires lenders to clearly disclose interest rates, processing fees, and APR upfront. Even changes in floating interest rates must be communicated in advance, helping borrowers avoid hidden charges and understand repayment responsibilities better.

- Consumer Protection: Every platform must appoint a grievance redressal officer to handle complaints. Also, third-party apps cannot control the flow of funds between banks and borrowers, reducing misuse of money and ensuring borrowers’ interests remain protected.

- Ethical Practices: RBI rules ban unfair recovery practices, excessive penalties, or outsourcing repayments to aggressive agents. These measures promote transparency, prevent harassment, and ensure borrowers are treated fairly throughout the loan cycle, without falling into unmanageable debt traps.

- Data Privacy & Credit Reporting: Digital lenders must protect borrower data, ensuring sensitive details aren’t misused or shared without consent. Additionally, all loans must be reported to credit bureaus, which builds borrowers’ credit history and supports greater financial inclusion in the long term.

- Seamless Transactions: The guidelines mandate that all disbursals and repayments flow directly between the bank accounts of the lender and borrower. This eliminates cash handling, improves transparency, and makes the entire loan process safe and traceable.

- Co-Lending Framework: For loans disbursed jointly by banks and NBFCs, the RBI requires money to flow directly between lenders. This reduces operational risks, ensures accountability, and encourages collaboration, allowing both traditional and new players to serve borrowers better.

While these regulations bring structure to the industry, digital lending in India still faces several roadblocks.

Also Read: RBI Guidelines for Personal Loan Recovery Process and Rights

Major Challenges In Digital Lending

While digital lending in India is making borrowing faster, it’s not always risk-free. Here are some major challenges today:

- Fraud & Cybersecurity Risks: Digital lending platforms face constant threats from online fraud, data theft, and cyber-attacks.

- Unclear Risk Models: Using social and mobile data can misjudge borrower creditworthiness, increasing the chances of loan defaults.

- Changing Rules: With rapidly changing RBI rules, lenders must invest heavily in staying compliant and avoiding penalties.

- Low Awareness: Many borrowers lack knowledge of digital lending processes, leading to poor decisions and avoidable risks.

Digital Lending In India: 2030 Predictions

By 2030, the landscape of digital lending in India is expected to transform dramatically.

1. FinTechs Competing in High-Value Lending

Fintechs will move beyond small-ticket unsecured loans and expand into asset-backed lending, breaking traditional banks’ dominance. This will level the playing field and give borrowers more options.

2. Co-Lending as the New Normal

Partnerships between banks and fintechs will mature, with co-lending becoming the standard model. Both sides share risk and expertise, giving borrowers better rates and smoother access to credit.

3. Open Data & AI-Driven Lending

With open data gaining ground, fintechs will access AI and analytics to design better products. Big tech firms will also enter the credit market, reshaping competition and customer experience.

How Pocketly Makes Digital Lending Simple

Emergencies rarely come with a warning, and that’s where digital lending shines. Pocketly brings this convenience to life by offering short-term, collateral-free loans designed for young Indians. Whether it’s an unexpected medical bill, project expense, or mid-month cash crunch, you can borrow anywhere between ₹1,000 and ₹25,000.

Pocketly keeps it transparent, with interest rates starting at 2% per month and processing fees of 1-8% depending on the loan amount. There are no hidden costs, annual charges, or complicated paperwork.

Loan Process (100% Online):

1. Sign up in just 2 clicks

2. Upload minimal KYC documents & verify profile

3. Provide bank account details

4. Select loan amount & tenure

5. Get funds disbursed instantly

With flexible EMIs, perks for timely repayments, and 24/7 support, Pocketly ensures you never feel stuck during financial gaps.

Bottom Line

The rise of digital lending in India shows how borrowing is no longer tied to paperwork, delays, or collateral. From AI-powered credit decisions to instant approvals and flexible repayment options, it is growing rapidly.

With increasing adoption, strong RBI guidelines, and new trends like open banking, the industry is only expected to grow stronger. For borrowers, this means better access to safe, transparent, and flexible borrowing options.

Pocketly makes this experience even smoother with instant approvals, transparent rates, and flexible short-term loans. Download the Pocketly app on iOS or Android and manage your money smarter, anytime.

FAQ’s

1. Who regulates digital lending in India?

Digital lending in India is regulated by the Reserve Bank of India (RBI). The RBI sets clear guidelines to ensure borrower protection, fair practices, and transparency in all digital loan processes.

2. How do digital loans work?

Digital loans are processed completely online. Borrowers apply through an app or website, complete KYC, and once approved, the loan amount is disbursed directly into their bank account within minutes.

3. What is the cooling-off period for digital lending?

The RBI mandates that borrowers must get a cooling-off period of at least 1 day. During this time, they can exit the loan by repaying the principal and annual percentage rate (APR) without penalties.

4. What is the difference between traditional lending and digital lending?

Traditional lending often requires physical paperwork, longer approval times, and collateral. In contrast, digital lending offers faster approvals, no physical documents, and easy access to short-term loans through online platforms.