Buy Now, Pay Later has gained traction as a game-changer in the consumer finance space, offering a fresh and flexible way to manage purchases. Imagine getting that gadget or outfit you've been eyeing without paying for it all at once—sounds appealing, right? Many of us have experienced tight budgets, especially when unexpected expenses pop up.

This blog will walk you through everything you need to know about BNPL, what it is, how it works, and the benefits and challenges it brings. We'll also dive deep into how BNPL operates, uncover the details hidden in the fine print, and examine its impact on your finances.

Key Takeaways

- BNPL provides flexibility in payments, allowing consumers to spread out costs without immediate upfront payment, making it ideal for larger purchases.

- Interest-free periods are a major benefit, but missed payments can incur late fees and affect your credit score, so it's crucial to stay on top of payments.

- BNPL services do not always impact credit scores positively unless payments are missed, but defaults can severely damage your credit profile.

- BNPL approval typically involves a soft credit check and is accessible even to those with limited credit history, but creditworthiness and income play a role in approval.

- Choosing the right BNPL provider involves evaluating factors like interest-free periods, fees, repayment flexibility, and the provider's merchant partnerships for a smooth shopping experience.

What is Buy Now, Pay Later (BNPL)?

BNPL is a short-term financing option where consumers can make purchases and pay in installments over a set period. It offers interest-free payments, provided the balance is paid off within the agreed timeframe. BNPL often comes with minimal or no fees, making it an attractive choice for those looking to manage large purchases without immediate upfront payments.

BNPL providers like Klarna, Afterpay, and LazyPay offer plans that range from 3 to 6 months, and some allow zero-interest payments. However, missed payments can lead to late fees and potential damage to your credit score.

Example:

If you buy a pair of shoes worth ₹5,000 using LazyPay, you might have the option to pay ₹1,000 per month for 5 months. If you pay on time, no interest is charged.

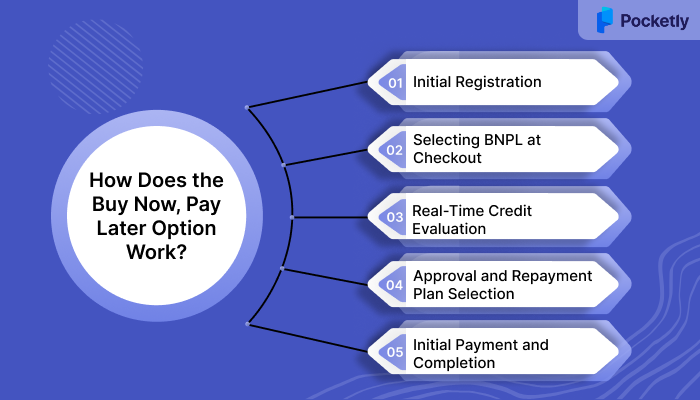

How Does the Buy Now, Pay Later Option Work?

Buy Now, Pay Later (BNPL) has transformed the purchasing experience by providing a flexible option beyond conventional payment methods. Grasping how this system works is crucial for both consumers and merchants aiming to make the most of this popular financial service.

1. Initial Registration: Consumers create an account with a BNPL provider, entering minimal personal details and linking a payment method (debit or credit card, bank account). This process is quick and requires no extensive paperwork.

2. Selecting BNPL at Checkout: While shopping at participating merchants, customers opt for BNPL as their payment method during checkout, which is seamlessly integrated into the merchant’s payment system.

3. Real-Time Credit Evaluation: The BNPL provider conducts a quick soft credit check (or alternative evaluation) to assess eligibility, taking factors like prior payment history and current balances into account. This usually takes just a few seconds.

4. Approval and Repayment Plan Selection: Once approved, customers receive their credit limit and can choose from repayment options like pay-in-4 (interest-free), extended plans (up to 36 months with interest), or a full payment due within 30 days.

5. Initial Payment and Completion: The customer makes an initial payment (if required), finalizing the purchase. They then begin the installment payments as per the chosen plan.

The BNPL has gained widespread adoption, the streamlined process addresses many pain points of traditional financing, creating compelling advantages for modern consumers.

What are the Benefits of Buy Now, Pay Later?

Buy Now, Pay Later (BNPL) services offer several benefits, making them an attractive payment option for consumers, particularly when managing large purchases. Below are the key benefits that BNPL offers:

- Flexibility in Payments: BNPL allows customers to split the cost of purchases over time, making large purchases easier to manage, especially for those who experience sticker shock from high upfront costs.

- Interest-Free Options: Many BNPL services offer interest-free payment plans if paid on time, saving customers extra costs.

- No Need for Credit Cards: BNPL enables purchases without using a credit card, providing an option for those who don’t have or prefer not to use one.

- Quick and Easy Approval: The approval process for BNPL is typically fast and straightforward, requiring minimal documentation.

- Improves Cash Flow Management: BNPL helps customers manage their cash flow by spreading the cost of purchases into smaller installments.

- Accessibility for Limited Credit History: BNPL offers an alternative for individuals with limited or no credit history, making financing accessible to more people.

- Instant Gratification: Customers can receive their products right away while paying for them in installments.

- Reach More Customers: BNPL attracts younger shoppers, including millennials and Gen Z, who often don’t have credit cards. BNPL services also provide marketing channels, such as directories and email marketing, to help merchants reach more customers.

Pocketly is a great personal loan option for students and professionals looking for quick financial assistance. Offering loans ranging from ₹1,000 to ₹25,000, Pocketly provides instant approval with minimal documentation and competitive interest rates, helping you manage unexpected expenses easily.

What are the Risks of Buy Now, Pay Later?

While Buy Now, Pay Later (BNPL) services offer convenience, there are many risks associated with their use, such as the accumulation of debt. Because BNPL allows you to make purchases and pay in installments, it can be tempting to buy more than you can afford, which can lead to multiple outstanding payments.

Missed or late payments also result in hefty late fees. For example, if you miss a payment, providers may impose daily penalties, which quickly add up, making the total cost higher than expected.

Another risk is the adverse effect on your credit score. Unlike traditional loans, BNPL defaults are often reported to credit bureaus, and even a small missed payment can damage your credit score more than a delayed EMI on a larger loan. This can affect your ability to access future credit or loans.

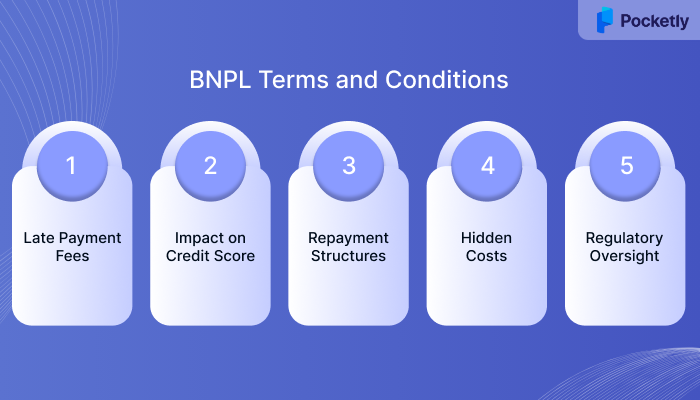

What are the Terms and Conditions of Buy Now, Pay Later?

When using BNPL services, you have to understand the terms and conditions associated with the payment structure and penalties. While BNPL provides a convenient way to break up payments, failing to meet deadlines can result in fees and damage your credit score. Below are the key factors to consider:

1. Late Payment Fees: Missed BNPL payments in India can attract late fees of ₹300 or more, equivalent to an annual interest rate of around 30%. Some providers also charge daily penalties (e.g., ₹15/day) for delayed payments, making the total amount due higher than the original cost.

2. Impact on Credit Score: Even small defaults, like missing a ₹1,000 payment, can damage your credit score more significantly than larger loan payment delays. BNPL defaults are often reported to credit bureaus, which can affect your ability to secure future credit.

3. Repayment Structures: BNPL agreements split your purchase into installments (e.g., "pay-in-four" model with four equal payments due every two weeks). Some plans offer deferred payments or extended plans with adjustable schedules at checkout.

4. Hidden Costs: Besides late fees, BNPL agreements may have other hidden charges like subscription fees, activation fees, or NSF charges for insufficient funds. These extra costs can quickly add up.

5. Regulatory Oversight: BNPL services in India act as intermediaries between lenders and borrowers, and are regulated under the RBI Act, 1934. The RBI has issued guidelines, including mandatory credit checks, restricting credit for those with poor credit histories, and limiting available credit to transparent terms and conditions.

The terms and conditions directly influence one of the most important aspects of any financial product, its effect on your creditworthiness. BNPL's relationship with credit scoring is particularly nuanced, creating both opportunities and risks that many consumers don't fully grasp until it's too late.

Credit Impact of BNPL

Buy Now, Pay Later (BNPL) services can affect your credit score, particularly if you miss payments. Typically, BNPL providers do not report positive payment history to credit bureaus, which means making payments on time doesn’t directly build your credit.

However, missed payments are reported and can lower your credit score, making it difficult to get other forms of credit in the future. Even a small delay, like missing a ₹1,000 bill, can result in a drop in your credit score.

It’s important to note that since BNPL services often don’t report timely payments, their main impact on your credit score comes from defaults or overdue payments. These can remain on your credit report for years, which is why it is important to stay on top of your payments to avoid damage.

Note: In the US, the landscape is changing as major credit bureaus like FICO and Experian will begin to incorporate BNPL data in their credit scoring models. This means that while responsible BNPL usage could enhance your credit profile, defaults or missed payments will be reflected, lowering your credit score.

Approval Criteria of BNPL

When applying for BNPL, the approval process does not involve a hard credit check. Instead, most BNPL providers perform a soft credit check or simply evaluate the information you provide to assess your eligibility. Some providers may also check your payment history with other BNPL services or assess your general financial situation.

The key factors that influence your approval decision include:

- Creditworthiness: Although BNPL companies may not conduct a hard credit check, they still look at your previous payment behavior and overall financial standing.

- Income & Affordability: Providers often ask for basic information regarding your income to ensure you can manage the repayments.

- Outstanding Credit: The number of existing debts you have will be considered to determine if you’re over-leveraged and if you can afford new credit.

- Purchase Amount & Merchant: The value of your purchase and the merchant’s reputation may also play a role in the approval process.

Understanding these approval factors puts you in a stronger position to not only get approved but to choose the right provider for your specific needs.

How to Choose the Right BNPL Provider?

When making significant purchases using Buy Now, Pay Later (BNPL), selecting the right provider is crucial for a smooth and financially beneficial experience. Here are some pointers to guide your decision-making:

1. Evaluate Interest-Free Periods: Look for providers offering the longest interest-free periods for your purchase. Some BNPL services allow up to 12 months with no interest. The longer the interest-free period, the more time you have to pay off the amount without incurring additional charges.

2. Check for Hidden Fees: Many BNPL providers charge late fees or set up costs if you miss a payment or exceed your limit. Make sure to opt for a provider with minimal or no hidden fees.

3. Understand Repayment Flexibility: Some providers offer weekly, bi-weekly, or monthly installment plans, so pick the one which aligns with your cash flow and repayment ability.

4. Know the Approval Criteria: Providers have different approval standards. Some may not require a credit check, while others might assess your creditworthiness.

5. Check Merchant Partnerships: Make sure the provider partners with the retailers or marketplaces where you plan to shop. This will make your purchase process smoother.

6. Customer Support: Choose a provider who offers responsive customer support. You may need assistance for various issues like repayments, disputes, or extending payment terms, so having good customer service can be a lifesaver.

While BNPL offers one approach to managing your finances, it's worth considering alternative solutions that might better suit your specific financial situation.

How Pocketly Can Help You Manage Your Finances

Pocketly can be an excellent alternative to BNPL services, offering flexible personal loans with easy access and transparent terms. Unlike BNPL, which often requires making purchases through specific merchants, Pocketly gives you the freedom to use the loan for any financial need, with a quick and simple application process.

Key Features of Pocketly:

- Flexible Loan Amounts: Borrow between ₹1,000 to ₹25,000 based on your needs.

- Competitive Interest Rates: Enjoy affordable rates starting at just 2% per month.

- Minimal Documentation: Simple KYC process with basic documents like PAN and Aadhaar card.

- Transparent Processing Fees: Range from 1% to 8% of the loan amount, with no hidden charges.

- Quick Disbursal: Funds are transferred directly to your account within minutes after approval.

- Instant Access: Apply and get approved for a loan in minutes, with no need for physical paperwork.

Conclusion

In conclusion, Buy Now, Pay Later (BNPL) has reshaped how consumers manage their finances by offering flexibility and ease of payment for their purchases. However, it’s important to understand its structure, potential risks, and costs involved before committing. By carefully evaluating your payment plan and ensuring timely repayments, you can make BNPL a valuable tool for managing larger purchases without overextending yourself financially.

If you’re looking for an alternative to BNPL for managing urgent expenses or making purchases, consider Pocketly, a digital lending platform that offers quick, hassle-free personal loans. Download the app for iOS or Android.

FAQs

1. What is the contract period of BNPL?

The contract period for BNPL typically ranges from 3 to 12 months, depending on the provider and purchase amount. Some providers also offer flexible terms with shorter or extended repayment options.

2. What is the return policy for BNPL?

The return policy for BNPL purchases generally follows the merchant's standard return policy. However, if you return an item, the BNPL provider may adjust the payments accordingly or require you to continue paying until the return is processed.

3. What happens if you don't pay back buy now pay later?

If you fail to repay a BNPL balance, you may incur late fees, interest charges, and your account could be sent to collections. This can further impact your credit score if missed payments are reported to credit bureaus.

4. What is the interest rate for BNPL?

BNPL services often offer 0% interest if paid within the agreed period. However, if you miss payments or opt for longer repayment terms, interest rates can range from 10% - 30% or more, depending on the provider.

5. What is the difference between installment and BNPL?

The key difference is that installment loans generally involve larger, long-term loans with set repayment periods, while BNPL services offer short-term, interest-free payment plans for smaller purchases, often with flexible repayment options.