As digital lending platforms in India expand rapidly, so do the challenges of ensuring transparency, fairness, and consumer protection. Many borrowers face issues like hidden fees, unclear repayment terms, and misuse of personal data, while lenders struggle to maneuver the complex regulatory environment.

The Reserve Bank of India (RBI) has introduced guidelines to address these concerns, but the implementation and understanding of these rules remain a challenge for both consumers and financial institutions.

This blog will break down the RBI’s digital lending regulations, offering insights into the disbursement practices, interest rates, and data security, and provide solutions on how these regulations aim to safeguard borrowers and promote responsible lending in India.

Key Takeaways

- Transparent Transactions: Loans must be disbursed directly to borrowers' accounts, ensuring traceability and preventing third-party interference.

- Grievance Redressal: A centralized complaint system, including the RB-IOS 2021, ensures efficient resolution of digital transaction issues.

- Data Security: All digital transaction data must be stored in India, with strong encryption and regular security audits to protect customer information.

- Consumer Protection: The RBI mandates compensation for failed transactions and safeguards against unauthorized transactions with clear timelines.

- Future of Fintech: Initiatives like the ‘On Tap’ Regulatory Sandbox and FREE-AI framework drive innovation while ensuring ethical and transparent fintech practices.

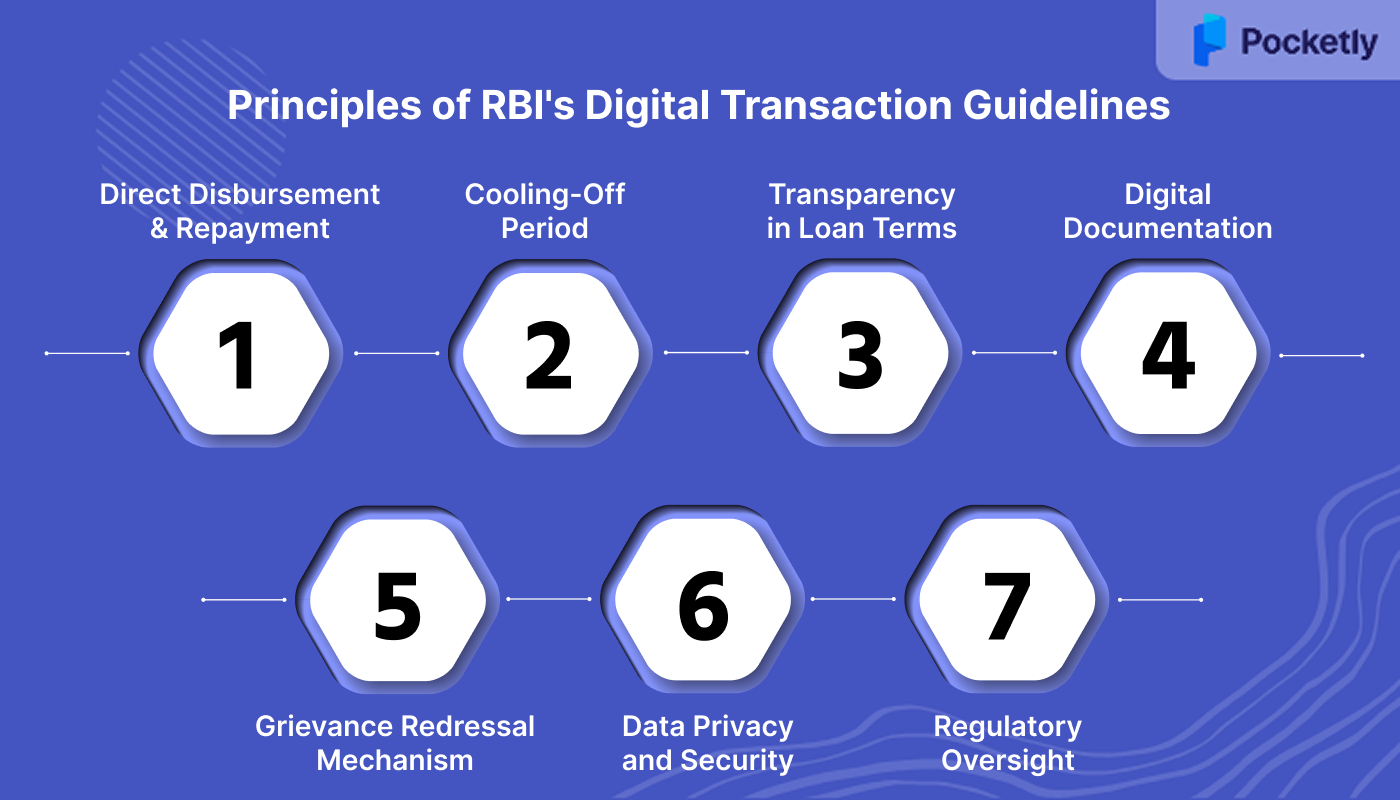

Core Principles of RBI's Digital Transaction Guidelines

The Reserve Bank of India (RBI) has established comprehensive guidelines to regulate digital transactions in India. The core principles of these guidelines are as follows:

1. Direct Disbursement and Repayment

To maintain transparency and accountability, loans must be disbursed directly into the borrower's bank account, and repayments should be made directly to the Regulated Entity's (RE's) account. This practice ensures that the flow of funds is traceable and not influenced by third-party entities, including Lending Service Providers (LSPs).

2. Cooling-Off Period

Borrowers are entitled to a cooling-off period during which they can exit the loan agreement by repaying the principal and applicable Annual Percentage Rate (APR) without incurring any penalty. This provision allows borrowers to reconsider their decision without financial repercussions.

3. Transparency in Loan Terms

REs are required to provide clear and concise information about loan terms, including the APR, processing fees, and other charges. This information must be disclosed upfront and in a manner that is easily understandable to the borrower.

4. Digital Documentation

All loan-related documents, including the Key Fact Statement (KFS), sanction letter, terms and conditions, and privacy policies, must be digitally signed and sent to the borrower's registered email or mobile number post-execution of the loan contract.

5. Grievance Redressal Mechanism

REs are mandated to establish a robust grievance redressal mechanism to address borrower complaints. This includes the appointment of a Grievance Redressal Officer and the establishment of a centralised complaint management system to ensure timely and effective resolution of issues.

6. Data Privacy and Security

REs and their LSPs must adhere to strict data privacy norms, ensuring the protection of borrower information and compliance with applicable data protection laws. This includes implementing measures to prevent unauthorized access and misuse of personal data.

7. Regulatory Oversight

The RBI mandates the creation of a public directory of Digital Lending Apps (DLAs) to facilitate transparency and enable borrowers to identify authorized lending platforms. This directory is accessible to the public and serves as a tool for borrowers to verify the legitimacy of digital lending platforms.

While these principles establish the foundation for fair lending practices, the RBI has implemented specific mandates that extend beyond basic consumer protection to encompass broader systemic stability.

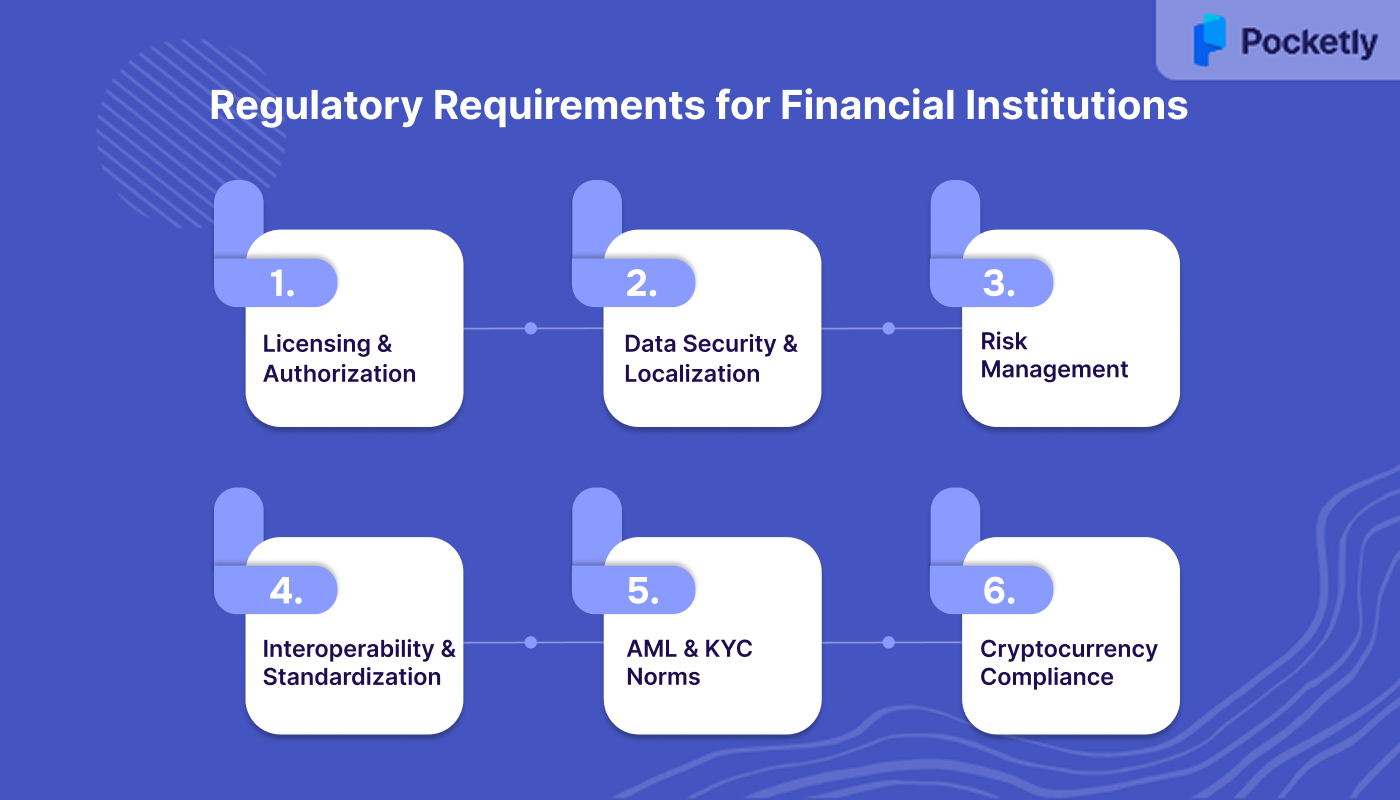

Regulatory Requirements for Financial Institutions

The Reserve Bank of India (RBI) has outlined specific regulations for financial institutions engaged in digital transactions. These regulations focus on transparency, consumer protection, data security, and ensuring that digital lending and payment services are ethical and secure. Here’s an overview of the key regulatory requirements:

1. Licensing & Authorization

Financial institutions, including fintech companies and payment service operators, must obtain authorization from the RBI before offering digital payment services. This ensures that only regulated entities can operate in the digital space, maintaining compliance with legal and ethical standards. Non-compliance with this requirement can result in penalties or the revocation of operating licenses.

2. Data Security & Localization

The RBI mandates strict data localization norms to protect consumer information. All digital transaction data must be stored on servers within India. If any data is processed abroad, it must be repatriated and stored locally within 24 hours. Institutions must also conduct regular security audits and implement strong encryption protocols to safeguard data from unauthorized access.

3. Risk Management & Fraud Prevention

Financial institutions are required to implement robust risk management frameworks, including fraud detection tools, to monitor abnormal transaction patterns. They must also employ multi-factor authentication (MFA), tokenization, and real-time transaction alerts to ensure customer account protection.

4. Interoperability & Standardization

To ensure seamless integration across various digital platforms, the RBI requires that all digital payment systems must support interoperability. Financial institutions must align with the prescribed security standards and ensure that their systems can integrate with other regulated networks like UPI, NEFT, and RTGS.

5. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms

Financial institutions must adhere to stringent KYC and AML regulations to combat fraud and money laundering. This includes verifying the identity of customers using official documents and applying due diligence for high-risk individuals or transactions. Institutions must also monitor transactions for suspicious activity and report it to the Financial Intelligence Unit (FIU-IND).

6. Digital Asset and Cryptocurrency Compliance

The RBI has extended its AML and KYC regulations to Virtual Digital Asset (VDA) service providers, including cryptocurrency exchanges. These entities must comply with the same AML/KYC standards as traditional financial institutions, ensuring that they operate transparently and securely.

Beyond the regulatory framework lies the practical implementation of these standards through day-to-day operations. The RBI has developed detailed operational guidelines that translate regulatory intent into actionable procedures.

What are the Operational Guidelines for Digital Transactions by RBI

The RBI’s operational guidelines for digital transactions include strong authentication for mobile apps, restrictions on storing sensitive data, clear customer consent for services, and transaction alerts. Additionally, the guidelines enforce robust cybersecurity and compliance with the Payment and Settlement Systems Act (PSS Act) 2007 for settlement finality and dispute resolution.

1. Mobile Banking Transactions: The RBI's Master Circular on Mobile Banking Transactions provides a consolidated framework for banks to offer mobile banking services. It outlines requirements for customer registration, security standards, and operational procedures to ensure safe and efficient mobile banking.

2. Prepaid Payment Instruments (PPIs): The RBI's Master Circular on the Issuance and Operation of Prepaid Payment Instruments in India sets forth guidelines for the issuance and operation of PPIs. It includes provisions on eligibility criteria, capital requirements, transaction limits, and customer protection measures to regulate the PPI sector..

3. Risk Management and Inter-Bank Dealings: The Master Circular on Risk Management and Inter-Bank Dealings consolidates existing instructions on risk management practices and inter-bank transactions. It provides guidelines on managing risks associated with electronic banking transactions and inter-bank dealings to maintain financial stability.

4. Storage of Payment System Data: The RBI's guidelines on the Storage of Payment System Data mandate that all payment system data be stored within India. This includes end-to-end transaction details, customer data, and payment credentials.

5. Online Dispute Resolution (ODR) System: The RBI has introduced an Online Dispute Resolution (ODR) system for digital payments to address customer grievances related to failed transactions. The system is designed to be transparent, rule-based, and system-driven, with minimal manual intervention.

Operational excellence means little without strong mechanisms to protect the end consumer when things go wrong. The RBI has established consumer protection measures that go beyond prevention to include active resolution of disputes.

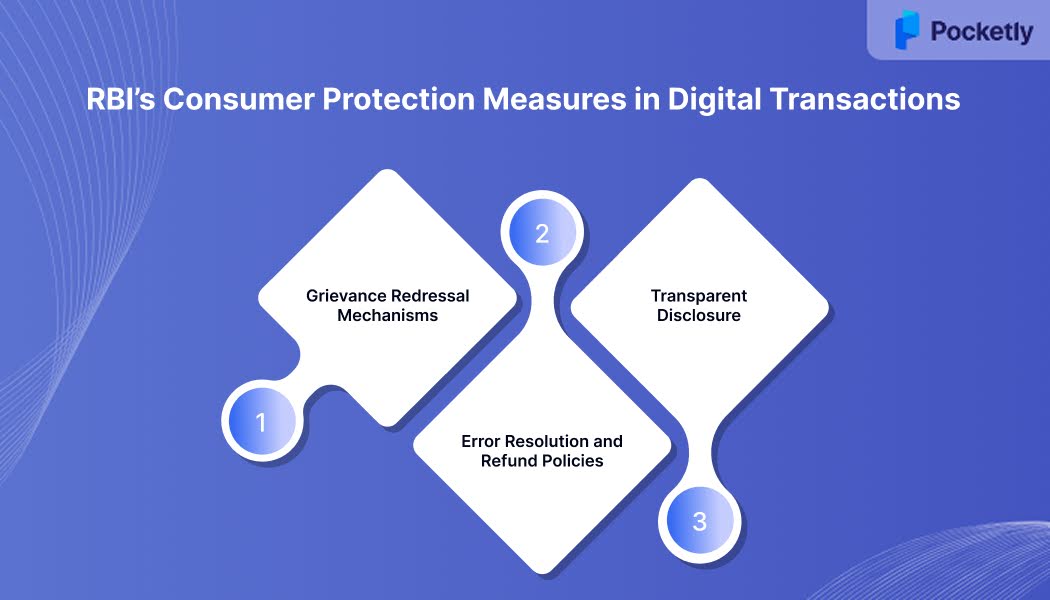

RBI’s Consumer Protection Measures in Digital Transactions

The Reserve Bank of India (RBI) has implemented consumer protection measures and clear grievance redressal mechanisms, structured procedures for error resolution and refunds, and transparent disclosure of fees and charges. Collectively, they reflect the RBI's commitment to safeguarding consumer interests in the digital financial ecosystem.

Let’s take a look at them in detail:

1. Grievance Redressal Mechanisms

The RBI has established the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS 2021) to address consumer complaints related to digital transactions. This scheme provides a cost-free and expeditious mechanism for resolving grievances against system participants, including non-bank entities regulated by the RBI. For complaints involving banks, the traditional Banking Ombudsman Scheme continues to apply. Consumers can escalate unresolved issues to the Ombudsman after a specified period.

2. Error Resolution and Refund Policies

In cases of failed digital transactions, the RBI mandates a Harmonisation of turnaround time (TAT) and a Customer Compensation framework. This framework sets clear timelines for resolving failed transactions and ensures that affected customers receive compensation without the need for filing a complaint. For instance, if a transaction is not credited or returned within the prescribed time, banks are required to pay penal interest to the affected customer.

Additionally, under the Limiting Liability of Customers in Unauthorised Electronic Banking Transactions guidelines, customers are protected against losses arising from unauthorized transactions, provided they report such incidents promptly.

3. Transparent Disclosure of Fees, Charges, and Transaction Terms

To promote transparency, the RBI requires financial institutions to disclose all applicable fees and charges associated with digital transactions. This includes providing clear information on interest rates, processing fees, and any other charges at the time of loan processing and on the institution's website.

India's ambitious digital economy goals require forward-thinking regulatory frameworks that balance innovation with stability. The RBI's future-focused initiatives demonstrate how regulation can enable rather than restrict technological advancement.

Future Directions and Innovations in RBI's Digital Transaction System

India is poised to become a $1 trillion digital economy by 2028, driven by advancements in 4G, 5G, and digitalization. This growth is expected to transform the digital transactions space, presenting both opportunities and challenges.

To support this digital revolution, the RBI is implementing forward-thinking initiatives, including regulatory frameworks for fintech, AI, and data security.

- Self-Regulatory Organisation (SRO) Framework: In May 2024, the RBI introduced a framework for fintech Self-Regulatory Organisations (SROs), aiming to promote ethical conduct, transparency, and accountability within the sector. The Fintech Association for Consumer Empowerment (FACE) was recognized as the first SRO under this framework.

- 'On Tap' Regulatory Sandbox: The RBI launched a 'theme-neutral' regulatory sandbox in August 2024, allowing fintech startups to test innovative products and services in a controlled environment. This initiative encourages experimentation while ensuring compliance with regulatory standards.

- Framework for Responsible and Ethical Enablement of AI (FREE-AI): In August 2025, the RBI unveiled the FREE-AI framework, outlining seven foundational principles and 26 actionable recommendations to guide the ethical adoption of artificial intelligence in the financial sector. This framework emphasizes fairness, transparency, and accountability in AI systems.

With a clear understanding of the regulatory landscape and future trajectory of digital transactions in India, choosing the right platform becomes crucial for borrowers. The complexity of compliance and consumer protection measures highlights the importance of working with regulated entities that prioritize transparency.

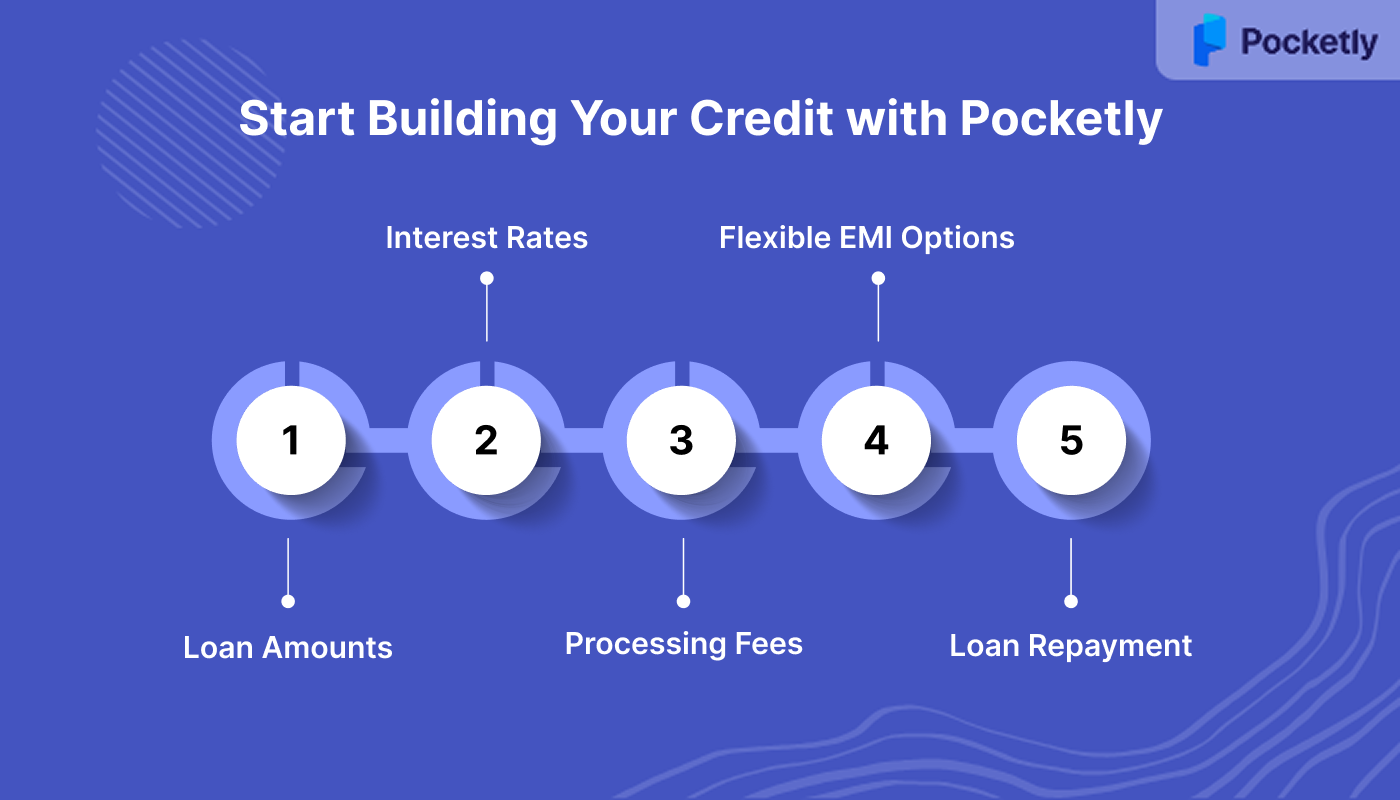

Start Building Your Credit with Pocketly

As digital lending platforms grow and evolve, it's essential to choose the right financial tools that align with both your needs and regulatory guidelines. Pocketly, an innovative digital lending platform, adheres to RBI's regulations while offering a seamless borrowing experience for your instant personal loan needs.

- Loan Amounts: Borrow anywhere between ₹1,000 and ₹25,000, designed to meet various financial needs.

- Interest Rates: Competitive interest rates starting at 2% per month, ensuring affordable repayment terms.

- Processing Fees: One-time processing fee ranging from 1% to 8% of the loan amount, with full transparency.

- Flexible EMI Options: Pocketly provides flexible EMI plans tailored to your financial situation.

- Loan Repayment: Simplified repayment terms, making it easier to pay back the loan as per your convenience.

Conclusion

The Reserve Bank of India’s digital lending and transaction guidelines aim to create a transparent, fair, and secure financial ecosystem. By mandating practices such as direct loan disbursement and repayment, transparent interest rate disclosures, and strong grievance redressal mechanisms, the RBI ensures that both consumers and lenders can engage in digital transactions with confidence.

These measures address critical issues like data privacy, fraud prevention, and consumer protection, setting clear expectations for regulated entities and digital platforms.

For individuals looking to navigate the digital lending system, Pocketly offers a reliable and compliant option. With personal loans ranging from ₹1,000 to ₹25,000, Pocketly ensures low interest rates, flexible EMIs, and transparent fees. Download now on iOS or Android.

FAQs

1. What are the new RBI guidelines for UPI transactions?

The RBI's new guidelines, effective August 2025, limit transaction retries, implement peak-hour restrictions, and mandate direct disbursements into borrowers' accounts. It also introduces a cooling-off period and transaction status check limits for enhanced transparency and security.

2. What are the rules for digital safety in RBI?

RBI's digital safety rules include mandatory two-factor authentication (2FA), strong encryption protocols, regular security audits, and consumer education on protecting sensitive information, such as OTPs and passwords, particularly when using public Wi-Fi.

3. What is the difference between electronic payment and digital payment?

Electronic payments cover all non-cash transactions, including card payments and bank transfers. Digital payments, however, specifically refer to online transactions like UPI or mobile wallets that occur entirely on digital platforms.

4. What is the difference between EFT and RTGS?

EFT (Electronic Funds Transfer) processes transactions in batches, often taking hours, while RTGS (Real-Time Gross Settlement) settles transactions individually and instantly, making it ideal for high-value, urgent transfers.

5. What are the three digital payment systems?

India’s three main digital payment systems are UPI (for real-time peer-to-peer transfers), NEFT (for batch-based transfers), and IMPS (for round-the-clock real-time payments). Each serves different transaction needs.