Introduction

Fintech loans are changing the way people borrow money. Unlike traditional banks that ask for long paperwork, collateral, and waiting times, fintech platforms make borrowing fast, flexible, and hassle-free.

For students, young professionals, and self-employed individuals, getting small, quick loans from banks has always been a challenge. Fintech lenders solve this problem by offering instant approvals, digital KYC, and short-term loans that fit real needs.

In this blog, we’ll explain what fintech loans are, why they are becoming popular, the benefits they offer, and what challenges you should know about. By the end, you’ll see how fintech loans are making credit more accessible and convenient for everyday users.

At a Glance

- Fintech loans are small, short-term loans offered via apps/websites. Apply online, complete digital KYC, get money in your bank, often in minutes.

- Fully digital, faster approvals, minimal paperwork, small ticket sizes, flexible EMIs, and usually no collateral.

- Instant disbursal, ₹1,000–₹25,000 flexibility, transparent pricing, 24/7 access, and clear repayment options.

- Lower operating costs, faster processing, wider reach, smarter risk models, and better collections with automation.

- Fast, transparent, small-ticket credit (₹1,000–₹25,000) with minimal docs and flexible EMIs, useful for urgent needs and building a positive credit history.

What is Fintech Lending?

Fintech lending means borrowing money through digital platforms instead of going to a traditional bank. These platforms use technology to make the entire process faster, easier, and more flexible.

Unlike banks that usually ask for heavy paperwork, long approval times, and sometimes collateral, fintech lenders focus on a smooth online experience. You can apply online. You can also use an app. The basic Know Your Customer (KYC) checks are done online. You will get the money in your bank account right away. It usually takes just a few minutes.

Fintech loans are usually small-ticket and short-term, designed for young professionals, students, and self-employed individuals who need quick access to funds. The idea is simple: provide credit without the usual barriers, making borrowing more accessible to people who may not qualify for traditional loans.

With the basics clear, the next step is to see how fintech lending actually works in practice.

Must Read: Understanding Financial Literacy: Importance And Benefits

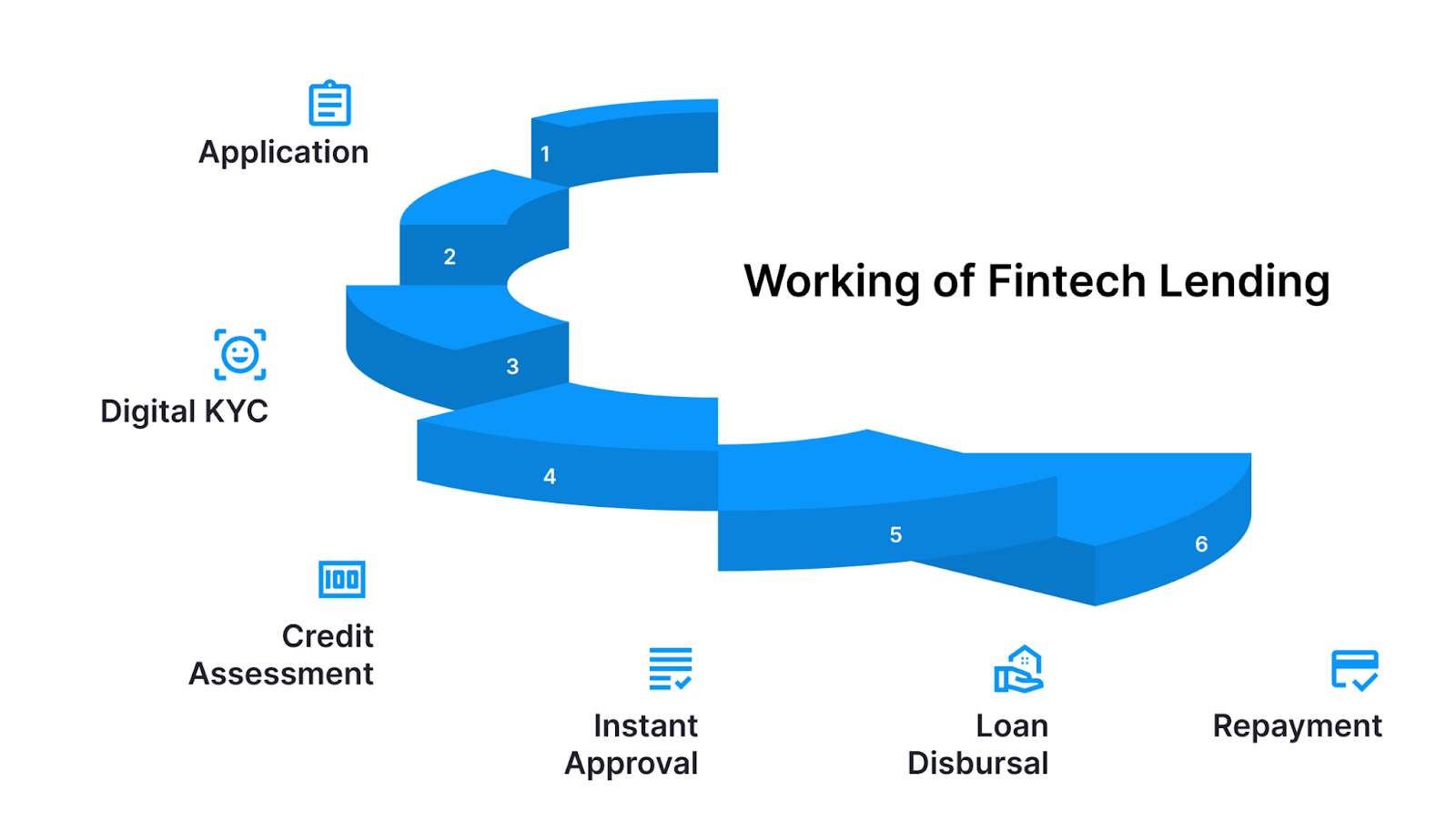

Working of Fintech Lending

Fintech lending works by using technology to simplify every step of the borrowing process. Instead of visiting a bank branch, everything happens online—through mobile apps or websites.

Here’s how it usually works:

1. Application

You start by downloading the fintech app or visiting the website. You choose the loan amount and repayment period that suits your needs.

2. Digital KYC

Basic details like your ID, address proof, and sometimes income proof are uploaded digitally. There is no heavy paperwork or in-person verification.

3. Credit Assessment

Instead of just relying on credit scores, fintech lenders use technology, AI, and alternative data (like digital transactions or bank statements) to check your repayment ability. This helps people with little or no credit history get access to loans.

4. Instant Approval

Once your details are verified, the platform approves your loan in minutes. This is much faster than traditional banks, which can take days.

5. Loan Disbursal

The approved loan amount is transferred directly to your bank account, ready for use.

6. Repayment

You repay through digital methods like UPI, net banking, or auto-debit. Flexible EMIs make it easier to manage repayments without stress.

Once you understand the process, it becomes easier to see what makes fintech loans unique compared to traditional lending.

Must Read: https://pocketly.in/article/financial-advice-for-young-adults-planning-tips

Key Features of Fintech Loans

Fintech loans stand out from traditional borrowing because they are designed to be faster, easier, and more flexible.

Here are the main features that make them different:

1. Instant Approvals and Disbursals

Most fintech platforms approve and transfer loans within minutes, helping you manage emergencies without long waiting times.

2. Small and Flexible Loan Amounts

You can borrow small amounts, starting at ₹1,000, to higher amounts based on your needs. This flexibility makes fintech loans useful for both minor expenses and bigger short-term requirements.

3. Minimal Documentation

Only basic KYC details are needed. There’s no heavy paperwork or repeated bank visits, making the process hassle-free.

4. A fully Digital Process

From application to repayment, everything happens online through an app or website. You don’t need to visit a branch or deal with manual forms.

5. Flexible Repayment Options

Fintech loans usually allow repayment in easy EMIs with options to prepay or close the loan early, giving borrowers more control.

6. Transparent Terms

Interest rates, processing fees, and repayment timelines are shown upfront. There are no hidden charges, so you always know what to expect.

7. 24/7 Availability

Unlike traditional banks that work within fixed hours, fintech lending platforms are available anytime, making them convenient for urgent needs.

These features highlight the strength of fintech loans, but to truly understand them, let’s compare them directly with traditional lending.

Must Read: Top Financial Skills Employers Look for in Candidates

What is the Difference Between Fintech Lending and Traditional Lending?

Fintech lending and traditional lending both serve the same purpose. They provide people with access to credit. However, they operate in very different ways. The differences mainly come from the use of technology, speed of service, and accessibility.

Here’s a detailed look:

1. Application Process

- Traditional Lending: To borrow from banks or NBFCs, you usually need to visit a branch, fill out detailed forms, and provide multiple physical documents. This process can feel lengthy and tiring.

- Fintech Lending: With fintech lenders, everything happens online. You apply through an app or website. You complete KYC digitally. You choose your loan terms. All of this can be done without leaving home.

2. Speed of Approval and Disbursal

- Traditional Lending: Loan approvals may take several days or even weeks. Banks perform multiple manual checks before approving funds, which can delay urgent needs.

- Fintech Lending: Approvals are much faster. Many fintech platforms verify your details in minutes and transfer money to your bank account instantly.

3. Documentation and Collateral

- Traditional Lending: Requires a stack of documents such as income proofs, address proofs, employment letters, and sometimes collateral or guarantors. This makes it harder for students or first-time borrowers.

- Fintech Lending: Needs only minimal documents like ID and bank details. Most fintech loans are collateral-free, which makes borrowing more accessible to young people.

4. Loan Amounts and Purpose

- Traditional Lending: Banks generally focus on larger loans such as car loans, home loans, or long-term business loans. They are best suited for big-ticket borrowing.

- Fintech Lending: Fintech platforms specialise in small-ticket, short-term loans ranging from ₹1,000 to ₹25,000 or more. These loans are designed for everyday needs like paying bills, covering month-end shortages, or handling emergencies.

5. Repayment Options

- Traditional Lending: Repayments usually follow fixed EMI schedules with little flexibility. Early closures may attract penalties or extra charges.

- Fintech Lending: Offers more flexibility. Borrowers can repay in short instalments, prepay anytime, or even close the loan early without heavy penalties.

6. Eligibility and Accessibility

- Traditional Lending: Often limited to individuals with strong credit scores, stable jobs, or established businesses. New borrowers with no credit history may struggle to qualify.

- Fintech Lending: Uses modern credit assessment tools, including alternative data such as transaction history, bank statements, and even spending patterns. This makes it easier for students, freelancers, and first-time borrowers to access credit.

7. Customer Experience

- Traditional Lending: Involves more face-to-face interactions, longer waiting times, and fixed working hours.

- Fintech Lending: Focuses on speed, convenience, and user experience. Borrowers can apply, track, and repay loans 24/7 through an app.

This comparison shows why fintech lending is so appealing to modern borrowers. Now, let’s focus on the specific benefits it brings to borrowers.

Must Read: Determining Personal Loan Amount with a Rs. 40000 Salary

Benefits of Fintech Lending for Borrowers

Fintech lending is becoming popular because it solves many of the problems borrowers face with traditional loans.

Here are the main benefits:

1. Fast and Hassle-Free Access to Credit

Borrowers no longer need to stand in long bank queues or wait weeks for approval. With fintech platforms, you can apply online and get funds disbursed within minutes. This speed is especially useful in emergencies.

2. Small, Flexible Loan Amounts

Fintech loans are designed for everyday needs. You can borrow as little as ₹1,000 for a quick recharge or ₹25,000 for larger expenses. This flexibility ensures you borrow only what you need and avoid unnecessary debt.

3. Minimal Documentation

Gone are the days of carrying files full of paperwork. Most fintech lenders require only basic KYC documents like ID proof and bank details. This makes loans accessible even to students and first-time borrowers.

4. No Collateral Needed

Traditional loans often demand security like property or guarantors. Fintech loans are usually collateral-free, making them easier to access for young professionals, freelancers, and students who may not have assets to pledge.

5. Flexible Repayment Options

Borrowers can repay in short EMIs, prepay early, or close the loan without heavy penalties. This freedom reduces stress and makes managing loans more comfortable.

6. Digital Convenience

Everything is handled online. This includes the application process. It also covers approval and repayment. Borrowers can handle their loans anytime, anywhere through a smartphone.

7. Financial Inclusion

Fintech lenders use alternative ways to assess creditworthiness, such as transaction history or digital spending patterns. This allows people with little or no credit history to still access loans and begin building their financial track record.

8. Transparency and Trust

Interest rates, fees, and repayment timelines are shown upfront. With no hidden charges, borrowers can plan better and avoid unpleasant surprises.

Borrowers clearly benefit from fintech loans, but lenders also gain important advantages by adopting this model.

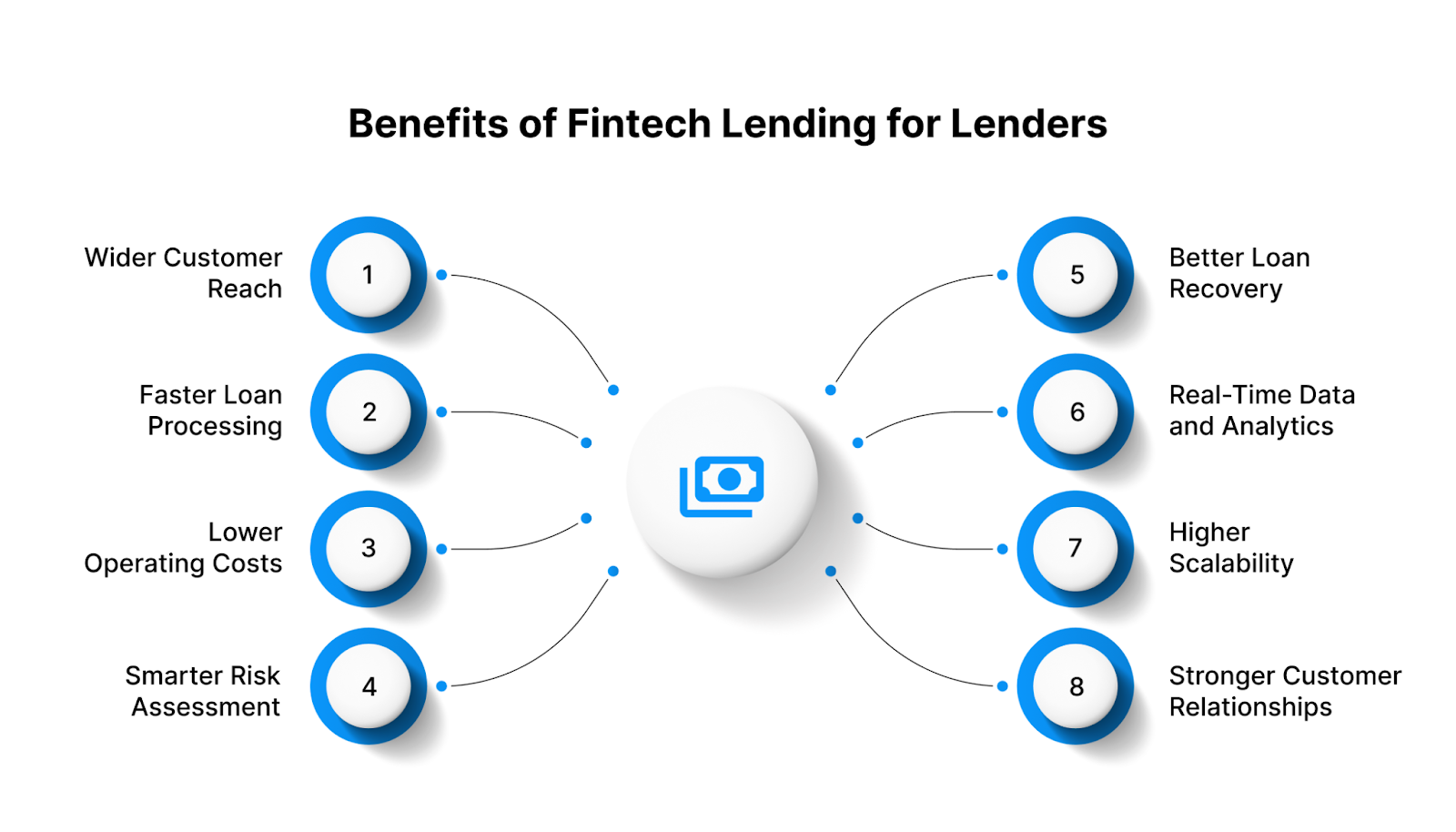

Benefits of Fintech Lending for Lenders

Fintech lending benefits borrowers. It also creates strong advantages for lenders. By using technology, data, and automation, fintech platforms can operate more efficiently and serve more customers than traditional banks.

1. Wider Customer Reach

People who were not well served by traditional banks can now use fintech platforms. This includes students, freelancers, and people who are borrowing money for the first time. This makes it possible for more people to borrow money and attracts new types of customers.

2. Faster Loan Processing

With digital applications, automated KYC, and instant approvals, lenders can process a higher number of loans in less time. This efficiency reduces costs and increases overall profitability.

3. Lower Operating Costs

Unlike traditional banks that depend on branches, staff, and paperwork, fintech lenders run mostly online. This reduces overhead costs significantly while still allowing them to scale quickly.

4. Smarter Risk Assessment

Fintech platforms use advanced technologies such as AI, machine learning, and alternative data (like spending behaviour, digital transactions, and bank history) to evaluate borrowers. This improves risk management and reduces the chances of default.

5. Better Loan Recovery

Automated reminders, digital repayment options, and flexible EMIs improve the chances of timely repayments. Lenders benefit from higher collection rates with less manual follow-up.

6. Real-Time Data and Analytics

Fintech lenders have access to real-time borrower data. This helps in tracking repayment behaviour, predicting defaults, and making quick adjustments to lending strategies.

7. Higher Scalability

Since everything runs digitally, fintech lenders can serve thousands of customers simultaneously across geographies, without the limitations of physical branches.

8. Stronger Customer Relationships

By offering fast approvals, transparent terms, and user-friendly apps, fintech platforms build trust and long-term relationships with borrowers. This loyalty often translates into repeat business.

While there are many advantages, it’s also important to be aware of the challenges in fintech lending.

Must Read: Getting Personal Loan with Low CIBIL Score

Challenges in Fintech Lending

While fintech lending is growing quickly and offers many advantages, it also comes with challenges that both borrowers and lenders need to be aware of.

1. Higher Interest Rates

Fintech loans are often small and short-term, which means they may come with higher interest rates compared to traditional bank loans. If borrowers are not careful, this can lead to higher repayment burdens.

2. Risk of Over-Borrowing

Some users may take out multiple loans at once without planning ahead because fintech loans are easy to get. This can create a debt trap, especially for students and young professionals.

3. Data Privacy and Security

Fintech platforms collect sensitive personal and financial data. Protecting this data from breaches, hacking, or misuse is a major challenge, and any failure can affect customer trust.

4. Regulatory Uncertainty

The fintech sector is still evolving, and regulations keep changing. Companies must constantly adapt to RBI guidelines and compliance requirements. For smaller fintech firms, this can be costly and complex.

5. Credit Risk for Lenders

Many borrowers using fintech loans are first-time borrowers with little or no credit history. While technology helps assess risk, defaults are still possible, which can impact lenders’ profitability.

6. Lack of Awareness Among Users

Not all borrowers fully understand loan terms, repayment schedules, or hidden costs. This lack of awareness can lead to confusion, missed payments, and disputes.

7. Dependence on Technology

Technical problems, like app downtime, payment gateway failures, or slow internet access, can stop fintech lending services and make users angry.

To overcome these challenges, many trusted fintech platforms like Pocketly are setting an example with transparent, reliable lending practices.

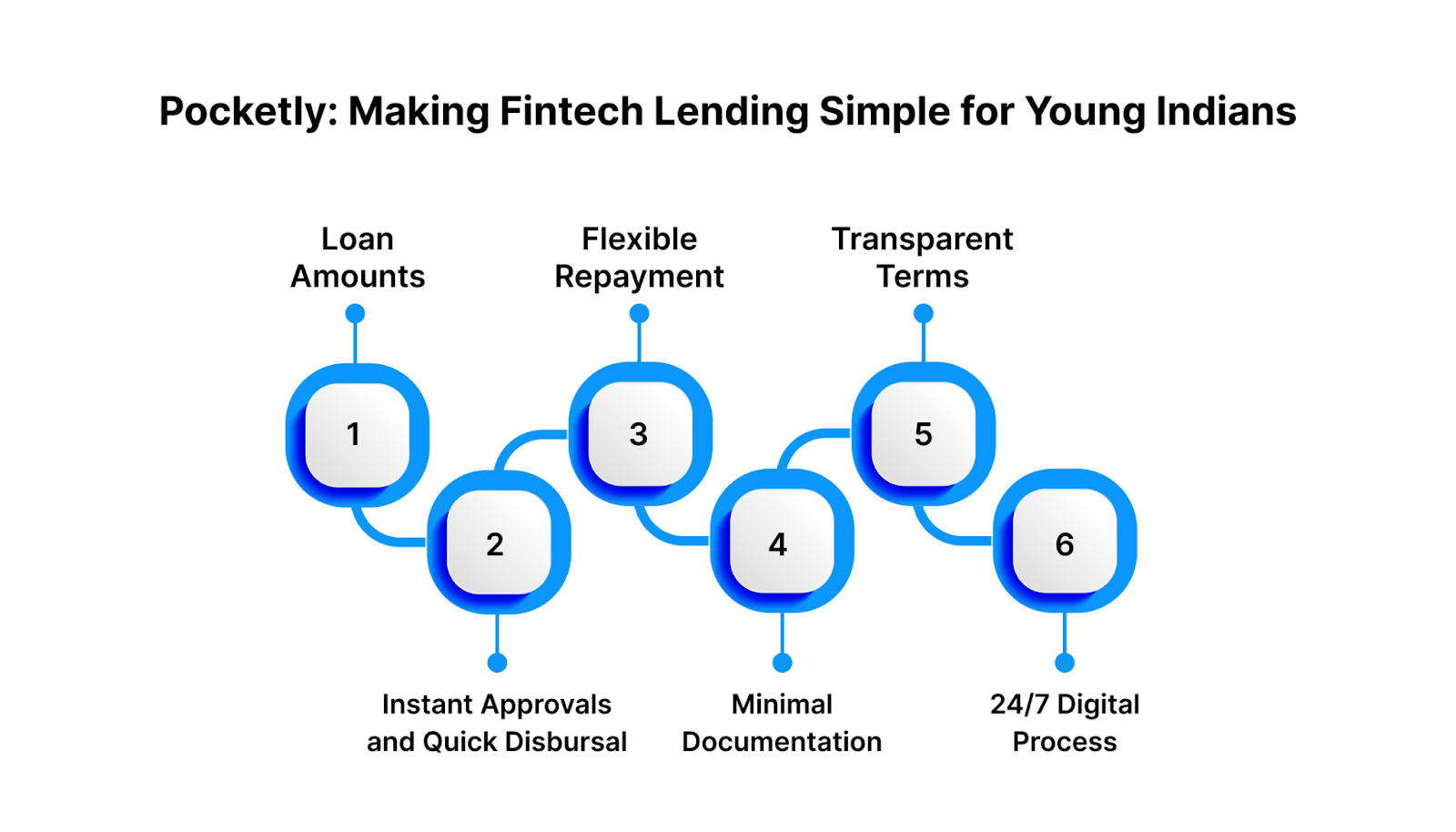

Pocketly: Making Fintech Lending Simple for Young Indians

Pocketly is one of India’s leading fintech platforms designed to give young people easy access to credit without the stress of traditional loans. It focuses on short-term, small-ticket loans that are quick, transparent, and fully digital—making it perfect for students, salaried professionals, and self-employed individuals.

Here are some of the highlights:

Loan Amounts from ₹1,000 to ₹25,000

Borrow only what you need, whether it’s for a small emergency or a bigger expense. This flexibility prevents unnecessary debt and keeps repayment manageable.

Instant Approvals and Quick Disbursal

You don't have to wait long to get approved. You'll get the money in minutes, and it will be ready for digital payments in your bank account.

Flexible Repayment Options

Repay your loan in 2–6 months with EMIs that suit your budget. You can also prepay or close the loan early without hidden charges.

Minimal Documentation

Just upload basic KYC details. No collateral, guarantors, or piles of paperwork are needed.

Transparent Terms

Interest rates start at 2% per month, and processing fees are upfront (1–8%). No hidden costs, so you know exactly what you’re paying.

24/7 Digital Process

From application to repayment, everything is done through the Pocketly app, available anytime you need it.

With Pocketly, young borrowers get a safe and reliable entry point into digital credit. By borrowing responsibly and repaying on time, users can also start building their credit history, which strengthens their financial future.

Conclusion

Fintech loans are transforming the way people access credit. They make borrowing faster. They make it simpler. They make it more flexible. This approach solves many problems. Traditional lending often has long approval times. It involves heavy paperwork. It also lacks access for first-time borrowers.

For students, young professionals, and self-employed individuals, fintech lending offers an easy way to manage short-term needs while beginning their credit journey. At the same time, lenders benefit from wider reach, lower costs, and smarter risk assessment through technology.

Fintech loans are not just a trend. They represent the future of lending. This future is in a digital-first world. It makes credit more accessible. It is also more inclusive and convenient for everyone.

Ready to experience hassle-free fintech lending? Download the Pocketly app today and get instant access to short-term loans that are safe, flexible, and 100% digital.

FAQs

1. What are fintech loans in simple words?

Fintech loans are provided through digital platforms. You apply online, complete KYC digitally, and get funds in your bank account without visiting a bank.

2. Who can apply for fintech loans?

Students, young professionals, self-employed individuals, and even first-time borrowers can apply. Eligibility usually depends on basic KYC and repayment ability, not just credit history.

3. Are fintech loans safe?

Yes. Most fintech platforms follow RBI guidelines and use encryption to protect your data. Always use trusted apps to stay secure.

4. Do fintech loans require collateral?

No. Most fintech loans are unsecured, meaning you don’t need to provide property or guarantors as collateral.

5. What is the typical loan amount I can get through fintech platforms?

Loan amounts usually range from ₹1,000 to ₹25,000 or more, depending on the platform and your repayment capacity.

6. How fast can I get a fintech loan?

Most fintech platforms approve and disburse loans within minutes, making them much faster than traditional banks.

7. What are the risks of fintech loans?

The main risks include higher interest rates, the chance of over-borrowing, and data security concerns. Borrowing responsibly and using trusted platforms helps reduce these risks.

8. Can fintech loans help build my credit score?

Yes. By borrowing responsibly and repaying on time, you can create a positive credit history, which helps in future borrowing.