Trying to make one month’s money cover a lifestyle that keeps getting more expensive is a reality most young Indians face today.

Rent rises, commute costs jump, food prices fluctuate, social plans aren’t cheap, and even the “small things”- skincare, data packs, weekend plans, birthdays, gifts- somehow squeeze themselves into your monthly spending.

Life isn’t slowing down, and your expenses aren’t either.

That’s why even people who earn decently often feel broke before the month ends. Not because they’re careless, but because their money isn’t structured to support the pace of their life.

Traditional budgeting doesn’t help much; it feels restrictive, rigid, and unrealistic for how young people actually spend.

Budget optimisation is different. It’s about making your money work smarter, not smaller, so you can afford the life you want without constantly feeling like you’re catching up.

Key Takeaways

- Budget optimisation helps you stretch your income by spending smarter, not cutting your lifestyle.

- The “minimum viable budget” framework keeps essentials secure while allowing flexible and emotional expenses.

- Smart allocation methods like 70/20/10, 60/20/20, goal-first budgeting, and reverse budgeting make monthly planning easier.

- Digital India tools, discounts, cashbacks, reminders, price trackers, and wallets simplify optimisation without extra effort.

- When unavoidable expenses hit, short-term support like Pocketly can help bridge genuine gaps responsibly.

What do you mean by Budget Optimisation?

Budget ≠ Optimisation

A budget simply tells you where your money should go.

Budget optimisation tells you how to make that money work better for you.

Traditional budgets focus on limits; optimisation focuses on strategy.

You’re not just dividing money into categories; you’re actively improving the way you use every rupee so your lifestyle, priorities, and comfort don’t suffer.

Optimisation = Efficiency, Not Restriction

Optimising your budget doesn’t mean cutting everything you enjoy.

It means finding smarter, more efficient ways to spend so you get the same (or better) value for less money.

It’s choosing timing, alternatives, combinations, and structures that reduce cost without reducing quality.

Think: less pressure, more freedom, and no guilt about spending on things you love.

Making Your Money Work Harder for You

When your income is limited, efficiency matters more than quantity. Optimisation helps you stretch your money by:

- spending intentionally instead of reactively

- removing costs that don’t add value

- redirecting money toward what matters most

- planning for expenses before they hit

- avoiding financial friction throughout the month

Your money starts doing more than just covering expenses; it supports your goals, comforts, and choices.

Why Students & Young Earners Need Optimisation More Than Planning

Most young people don’t have predictable expenses or stable routines.

One month may include a project fee, the next a birthday gift, then a sudden travel cost. Rigid budgeting collapses under that kind of unpredictability.

Optimisation works because it adapts; it helps you handle lifestyle changes, social spending, pop-up expenses, and irregular income without losing control.

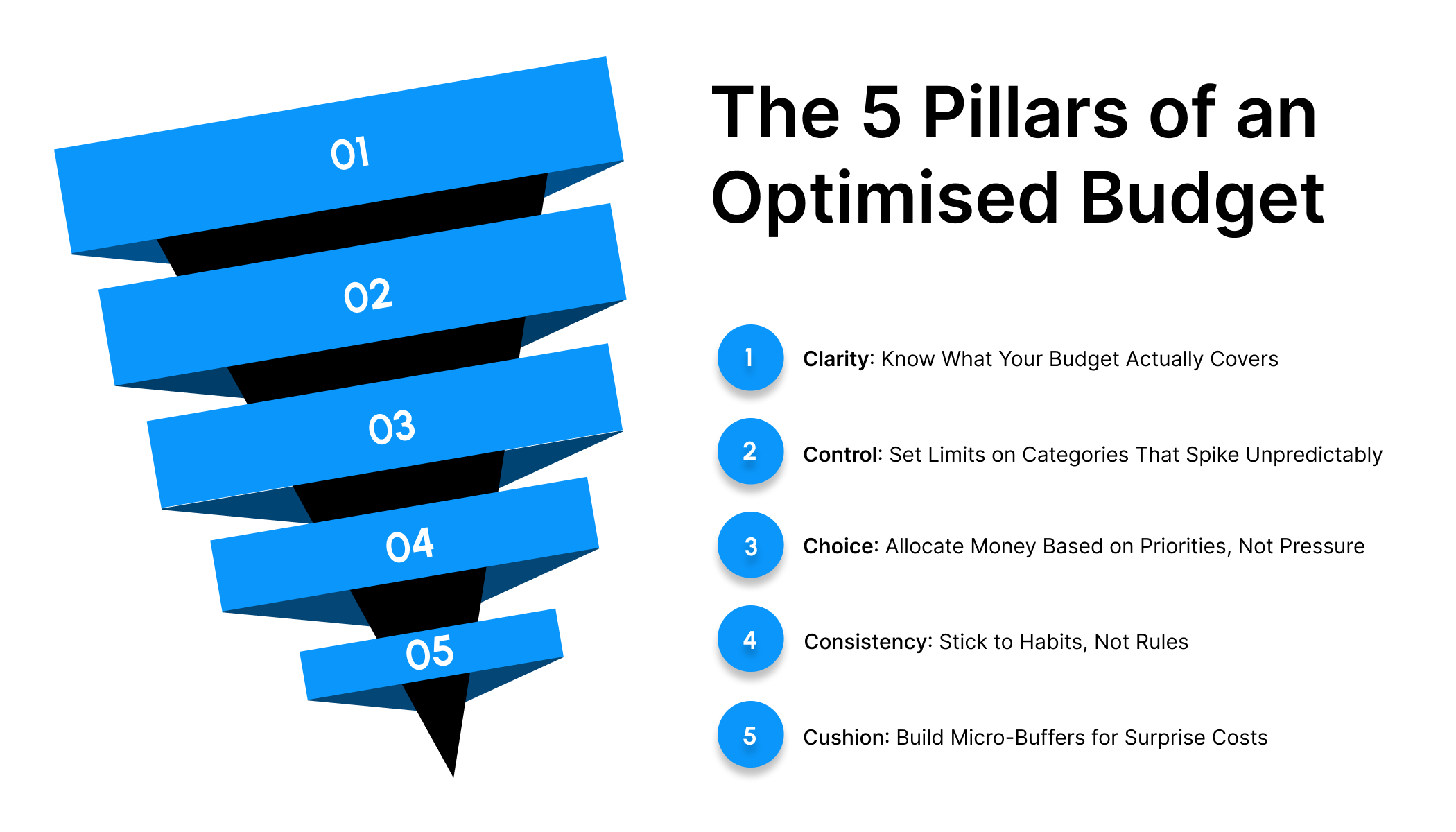

The 5 Pillars of an Optimised Budget

Think of these five pillars as the structure that keeps your budget steady, no matter how unpredictable life gets.

1. Clarity: Know What Your Budget Actually Covers

Most people think they know their monthly expenses, but when they list everything out, the total is usually higher than expected.

Clarity means knowing exactly what your money needs to cover, not roughly guessing.

When you understand your essentials, optional spending, and recurring commitments, you stop budgeting blindly and start allocating with intention.

2. Control: Set Limits on Categories That Spike Unpredictably

Your biggest budget problems usually come from categories that feel “small” but jump suddenly, food delivery, weekend plans, travel, and personal shopping.

When you control the categories that swing wildly, your entire month becomes more stable.

3. Choice: Allocate Money Based on Priorities, Not Pressure

Your money should reflect your values, not what your friends are doing or what social media makes look normal.

Optimisation means choosing where you want your money to go: skills, travel, health, experiences, instead of reacting to invitations, trends, or impulse moods.

Prioritising consciously prevents regret spending and frees up money for things you actually care about.

4. Consistency: Stick to Habits, Not Rules

Strict rules fail; small, consistent habits don’t.

A weekly check-in, a simple spend limit, or a routine like planning weekend expenses in advance can improve your financial flow more than any big restriction.

Consistency builds financial stability quietly in the background without making your life feel controlled.

5. Cushion: Build Micro-Buffers for Surprise Costs

A micro-buffer for all the unpredictable situations (even ₹200–₹500 a week) gives your budget room to absorb surprises without collapsing your entire month.

This tiny safety net is what turns an unpredictable month into a manageable one.

How to Optimise Your Budget Without Cutting Your Lifestyle

Most people assume “optimising your budget” means cutting back on everything fun. In reality, it’s the opposite.

It’s about getting the same comfort, convenience, and lifestyle you already enjoy, just without the unnecessary extra cost attached to it.

When you learn to make small, smarter switches, you start realising your money can go much further than you thought, without your life feeling restricted or boring.

Smart Substitutions

Lifestyle doesn’t have to suffer when you adjust how you spend instead of what you spend on.

For example:

- choosing local cafés over premium chains,

- using public transport or shared rides on weekdays,

- buying store-brand essentials instead of premium labels,

- switching from daily food delivery to weekly meal prep.

The goal is simple: get the same experience, comfort, or convenience for less money.

Value-per-Use Calculation

Instead of asking “Is this cheap or expensive?”, ask “How many times will I actually use this?”

A ₹2,000 backpack used 250 times has better value than a ₹700 shirt worn twice.

This mindset helps you spend on things that last, not things that look good in the moment.

Value-per-use prevents impulsive lifestyle purchases and directs money toward long-term comfort.

Timing Hacks

Prices fluctuate more than people realise. Optimising timing can save a surprising amount:

- Buy essentials during monthly discount cycles.

- Order online early in the week when demand is lower.

- Travel during non-peak hours.

- Do weekend planning mid-week (when costs are clearer).

You don’t need to change your lifestyle, just the timing of when you spend.

Batch Spending vs Scattered Spending

Scattered spending feels small but usually costs more. Batch spending helps you stay organised and reduces “oh, I forgot I needed this” purchases throughout the month.

Examples:

- Weekly grocery runs instead of daily top-ups

- Buying toiletries together for the month

- Planning all social outings for the week

- Doing one combined shopping order instead of multiple impulse ones

Batching reduces delivery fees, travel costs, and impulse buys, while keeping your routine the same.

Forecasting Small Predictable Expenses

Most budgets break not because of big expenses, but because of small, predictable ones that catch you off guard, birthday gifts, monthly data boosts, grooming, project materials, travel, and festivals.

Forecasting means listing the small things that always come up but never get planned for.

When you account for them early, they no longer become “surprises” that disrupt your lifestyle or force last-minute compromises.

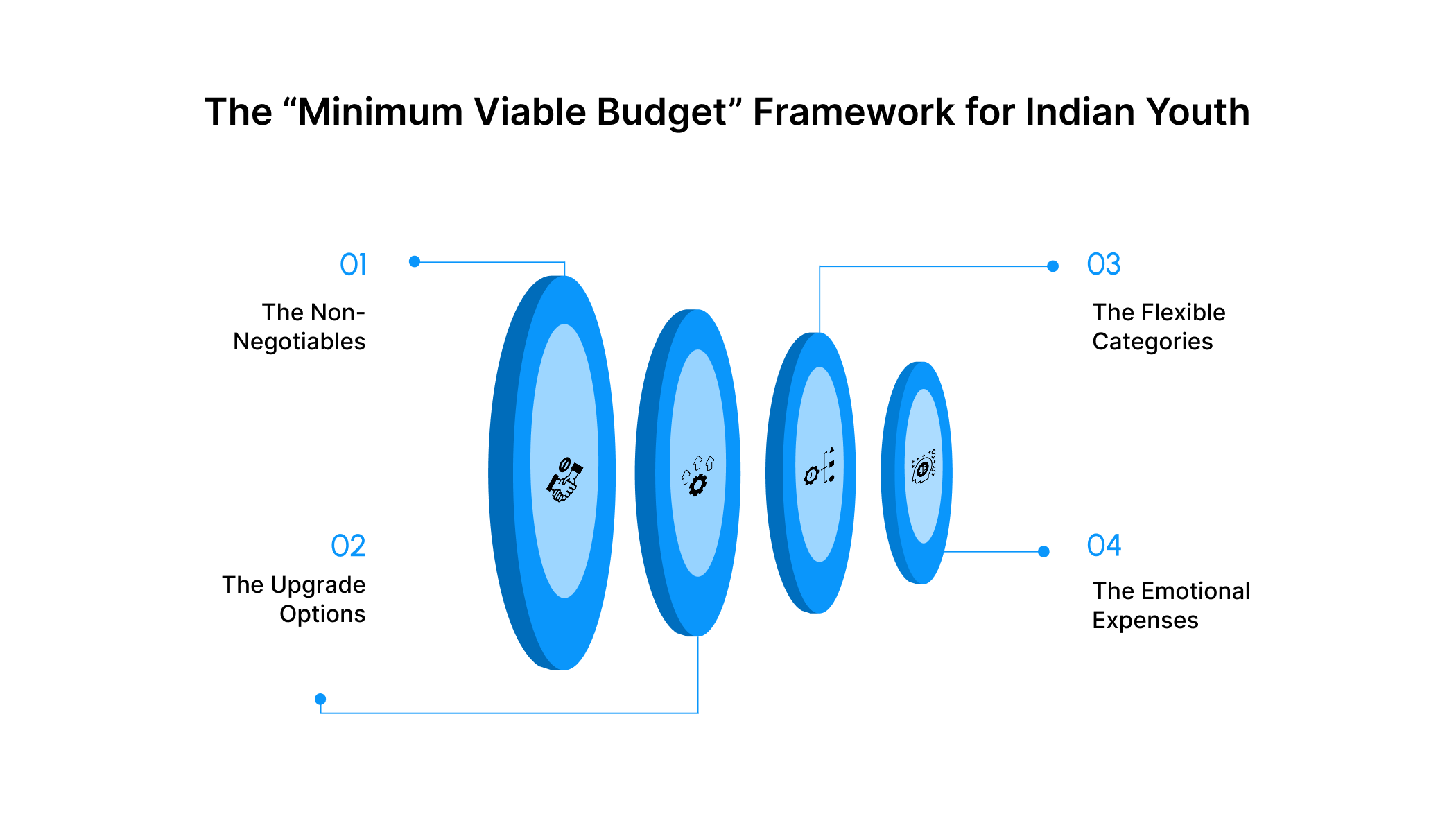

The “Minimum Viable Budget” Framework for Indian Youth

A minimum viable budget is about designing a budget that can survive real-world unpredictability while still supporting the lifestyle you want.

The Non-Negotiables

These are the expenses you cannot skip, delay, or downgrade without risking your safety, health, or essential functioning.

Examples include: rent, groceries, college or work travel, mobile/data, basic healthcare, essential bills, and mandatory fees.

An optimised budget starts by protecting these first; everything else fits in only after the essentials are fully covered.

The Upgrade Options

Upgrade options are the things that make life more comfortable, but you can switch between versions without losing quality of life.

Think: choosing a different café, switching brands, opting for weekday outings instead of weekends, or choosing a flexible gym pass over an expensive membership.

These aren’t sacrifices; they’re smarter alternatives that save money without reducing your experience.

The Flexible Categories

These are expenses that adjust easily to your budget: shopping, ordering food, entertainment, hobbies, gifts, and social plans.

They don’t require strict limits, but they do benefit from boundaries.

Some months you’ll spend more here, some less, which is perfectly normal.

Flexibility prevents your budget from feeling restrictive and allows room for personal expression.

The Emotional Expenses

Every young person has emotional spending triggers, stress ordering food, retail therapy after a bad week, celebrating small wins, or spontaneous plans with friends.

Instead of pretending these don’t exist, this framework makes room for them.

A small emotional-spend allowance (even ₹300–₹500/week) keeps your budget realistic and reduces guilt or rebound overspending.

Building a Budget protects essentials, allows upgrades when possible, keeps flexible spending controlled, and gives emotional expenses a safe space, so your month feels balanced, not stressful.

How to Allocate Your Budget for Maximum Impact

Once you know your essentials, lifestyle priorities, and flexible categories, the next step is deciding how to divide your monthly income in a way that actually supports your goals.

The 70/20/10 Method (For Limited or Beginner Income)

This structure works perfectly for students, interns, freshers, and anyone working with tight monthly funds.

- 70% Essentials: rent, travel, food, data, bills

- 20% Personal/Lifestyle: outings, hobbies, ordering-in, shopping

- 10% Safety/Growth: savings, skill courses, emergency buffer

It’s simple, realistic, and flexible enough for irregular costs while still building small financial discipline.

The 60/20/20 Method (For Stable Salaried Income)

This version gives more room for long-term security and planned expenses.

- 60% Essentials

- 20% Lifestyle + Leisure

- 20% Savings + Future Goals

This is ideal for young professionals who want comfort and long-term progress, without sacrificing their daily life.

The Goal-First Allocation Method

Instead of allocating money and then trying to squeeze goals in, this method flips the process:

- Pick 1–2 short-term priorities (e.g., laptop upgrade, travel, course fee).

- Assign a fixed amount to these goals first.

- Divide the remaining money across essentials and lifestyle.

This method works because goals get funded intentionally, not accidentally. It keeps you motivated and prevents last-minute scrambles.

Reverse Budgeting: Pay Goals First, Live on the Rest

Reverse budgeting is built for people who hate traditional budgeting.

Here’s how it works:

- Fund your top priorities the moment you receive money — savings, EMIs, skill development, emergency buffer, and important purchases.

- Whatever remains becomes your “live freely” money.

It removes guilt, reduces overspending, and ensures progress even if you’re not tracking every category.

Perfect for young earners who want structure without strict rules.

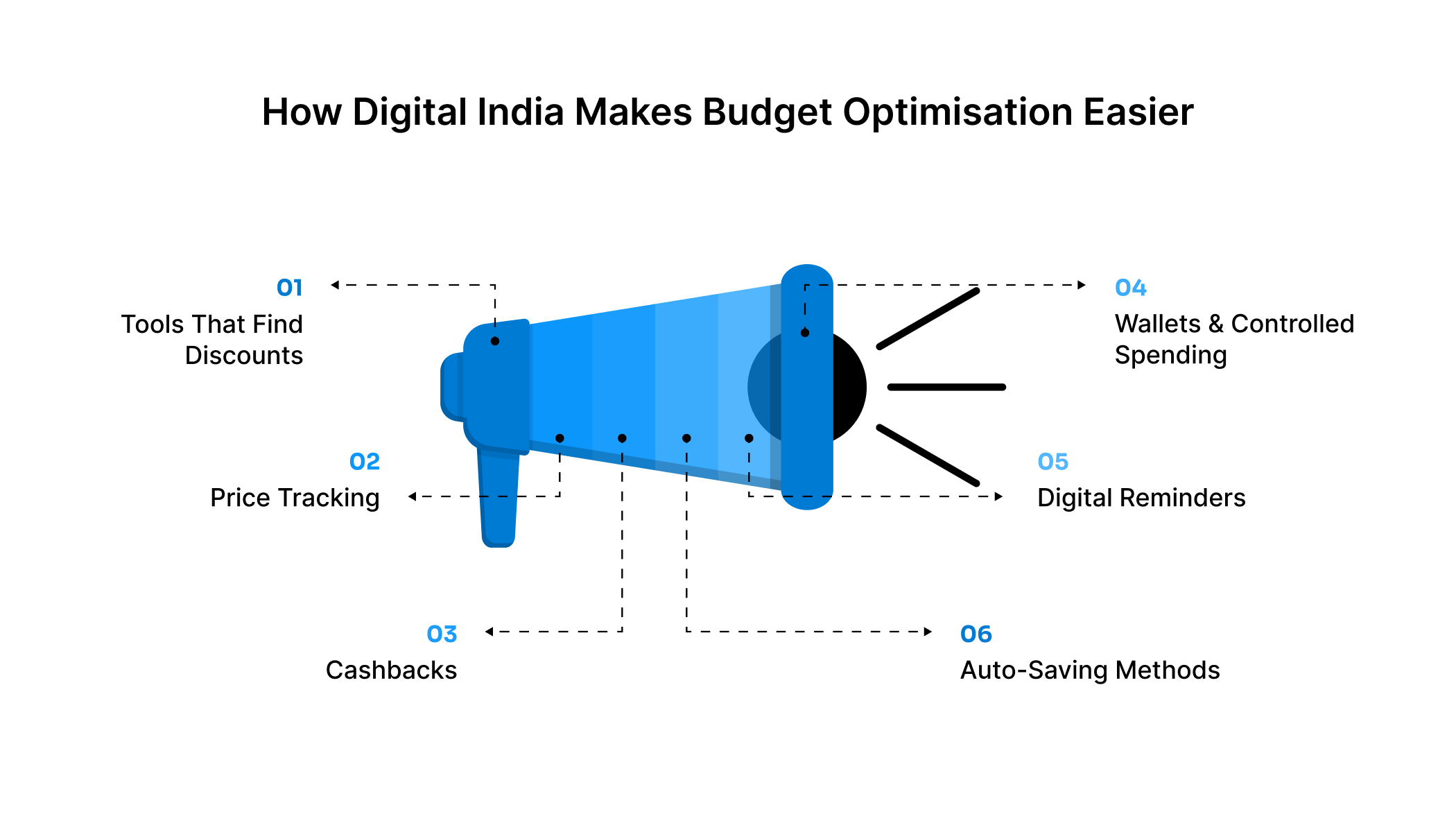

How Digital India Makes Budget Optimisation Easier

If you use your phone for everything, payments, shopping, travel, and subscriptions, you already have powerful tools that can help you optimise your budget without doing any extra work.

1. Tools That Find Discounts: Many apps automatically surface the best deals without you hunting for them.

Whether it’s grocery apps showing bundle offers, travel apps comparing fares, or food delivery apps listing nearby discounts, these tools help you get the same things for lower prices.

Small automated savings across the month add up fast.

2. Price Tracking: E-commerce platforms and browser tools can notify you when prices drop on items you’ve been eyeing, gadgets, skincare, books, accessories, and even everyday essentials.

Instead of buying something the moment you want it, price tracking helps you buy it at the right moment.

This alone can reduce impulse spending and save hundreds or thousands monthly.

3. Cashbacks: UPI apps, wallets, and payment gateways frequently offer cashbacks on recharges, bill payments, and purchases.

While each cashback seems small, using the right platform at the right time turns them into meaningful savings across the month, especially for recurring spends like food orders, rides, or mobile top-ups.

4. Wallets & Controlled Spending: Digital wallets (like dedicated prepaid balances) act as natural spending boundaries.

Loading a fixed amount into a wallet for food delivery, travel, or outings helps you stay within limits without feeling restricted.

It’s budgeting without the mental load; once the wallet is empty, you automatically pause.

5. Digital Reminders: Calendar reminders, SMS alerts, bank notifications, and even UPI app summaries act like mini financial nudges.

They help you remember bill due dates, subscription renewals, loan repayments, and recurring fees, preventing late charges or accidental renewals.

This simple habit reduces the “unexpected expense” stress dramatically.

6. Auto-Saving Methods: Some digital banking tools allow automatic transfers into a savings pocket each time money comes in or when you make a transaction.

This builds a small safety cushion in the background without you thinking about it.

A few rupees saved per transaction or a weekly auto-transfer can grow into a reliable emergency buffer.

Digital India makes money management easier than ever. From automatic reminders to price alerts and cashback offers, your phone can take care of half your budgeting work.

All you need is the awareness to use these tools intentionally.

But When Budget Optimisation Still Isn’t Enough?

Even the best-planned budget can’t predict everything.

Life has a way of throwing sudden costs at you, a cracked phone screen right before exams, a last-minute trip home, medical expenses, a project fee, a repair, or an essential bill you didn’t expect.

These aren’t lifestyle choices; they’re unavoidable expenses that push your budget beyond what you prepared for.

This is where short-term, responsible support becomes useful.

Pocketly helps bridge temporary financial gaps by offering small, quick loans designed specifically for students, young professionals, and early earners.

You can borrow between ₹1,000 and ₹25,000, depending on your need, with interest rates starting at 2% per month and processing fees between 1–8%.

There’s no collateral required, and the process is simple:

- Complete a quick digital KYC

- Choose your loan amount

- Receive funds instantly once approved.

It’s built for moments when timing matters more than anything else.

Note: Pocketly operates as a digital lending platform, not an NBFC. It partners with registered NBFCs to facilitate credit safely and transparently.

If you ever need short-term financial help, you can download Pocketly and see how it works for you.

Conclusion

Budget optimisation isn’t about strict rules or cutting back on everything you enjoy; it’s about designing a money system that fits your life.

When you understand your priorities, anticipate real expenses, and use smart strategies to stretch your income, your month becomes easier to manage and far less stressful. With a flexible budget that adapts to real-world needs, you stay in control even when life gets unpredictable.

Small shifts in how you plan and spend can completely change how confident you feel about your money.

FAQs

1. What is budget optimisation in simple terms?

It means using your money in the most efficient way possible — not by cutting everything, but by spending smarter, reducing waste, and aligning your budget with your real priorities.

2. How can I optimise my budget without cutting everything?

Focus on better timing, smarter substitutions, batch planning, and understanding what gives you real value. These small changes let you keep the same lifestyle at a lower monthly cost.

3. How can young adults manage a limited income better?

Use simple frameworks like 70/20/10, plan for predictable expenses, and build a small buffer for surprises. This keeps your budget stable even when income is tight.

4. What is the best way to allocate a monthly budget?

Choose a method that matches your income and goals — like 60/20/20 or goal-first budgeting. The key is allocating money to priorities first, then adjusting lifestyle spending around them.

5. When is short-term support helpful?

Short-term support makes sense when you face urgent, unavoidable expenses that your budget didn’t plan for, such as medical needs, repairs, or essential travel and you can repay on time.