Introduction

Have you wondered why some companies pay salaries on time, manage expenses well, and still have money to invest, while others struggle with cash flow?

Often, the answer lies in a simple budgeting tool: cash.

Cash budgets are roadmaps that show where your money is coming from, where it's going, and how much you'll have left at the end of a period. It helps you budget, avoid financial stress, and make confident business decisions.

This blog will explain what a cash budget is, the importance of cash budget, and how it helps businesses succeed financially.

At a Glance

- A cash budget gives full visibility and control over your money.

- It focuses on liquidity, helping you determine if you’ll have actual cash available to pay expenses on time.

- Early identification of surpluses and shortfalls allows proactive decisions such as reinvesting excess funds or arranging financing before a shortage occurs.

- Regularly reviewing actual performance against budgeted figures keeps estimates accurate and encourages financial discipline.

- Distinguishing between fixed and variable costs helps control expenses and maintain flexibility during low-revenue periods.

- Maintaining an emergency cash reserve and accounting for seasonal or market fluctuations safeguards the business from unexpected financial stress.

What is a Cash Budget?

A cash budget is a financial plan that shows how much money a business expects to bring in and spend over a certain time period, usually once a month, three times a year, or yearly. It's one of the most useful ways to keep track of cash flow and make sure your business never runs out of cash to pay its bills.

A cash budget helps a business do the following:

- Identify periods of surplus or shortage in advance.

- Plan financing needs or short-term investments accordingly.

- Ensure smooth operations without cash flow interruptions.

Definitions are helpful, but numbers make it real. Here's a simple example to show how a cash budget looks and works in practice.

Must Read: Getting Instant Small Personal Loans Online With Loan Apps in India

Example of a Cash Budget

Let’s understand how a cash budget works with a simple example.

Let's say Riya owns a small business and runs a boutique. She wants to make a cash budget for April to make sure she can handle all of her upcoming bills.

Here’s how her cash budget might look:

| Particulars | Amount |

| Opening Cash Balance (as on April 1) | 50,000 |

| Expected Cash Inflows: | |

| Cash Sales | 1,20,000 |

| Receipts from Credit Customers | 80,000 |

| Loan Received | 50,000 |

| Total Inflows | 2,50,000 |

| Expected Cash Outflows: | |

| Purchase of Raw Materials | 70,000 |

| Rent and Utilities | 25,000 |

| Salaries | 40,000 |

| Marketing and Miscellaneous | 15,000 |

| Loan Repayment | 20,000 |

| Total Outflows | 1,70,000 |

| Closing Cash Balance (as on April 30) | 1,30,000 |

Now, here’s what this shows:

- Riya starts April with ₹50,000 in hand.

- During the month, she expects to receive ₹2,50,000 and spend ₹1,70,000.

- This leaves her with a closing balance of ₹1,30,000, meaning she’ll have enough liquidity to cover any unexpected expenses or plan small business investments for May.

After reviewing the format, let's examine how inflows and outflows become actionable decisions.

How Does a Cash Budget Work?

A cash budget helps you plan, track, and manage your business's cash flow by giving you a way to estimate what will happen.

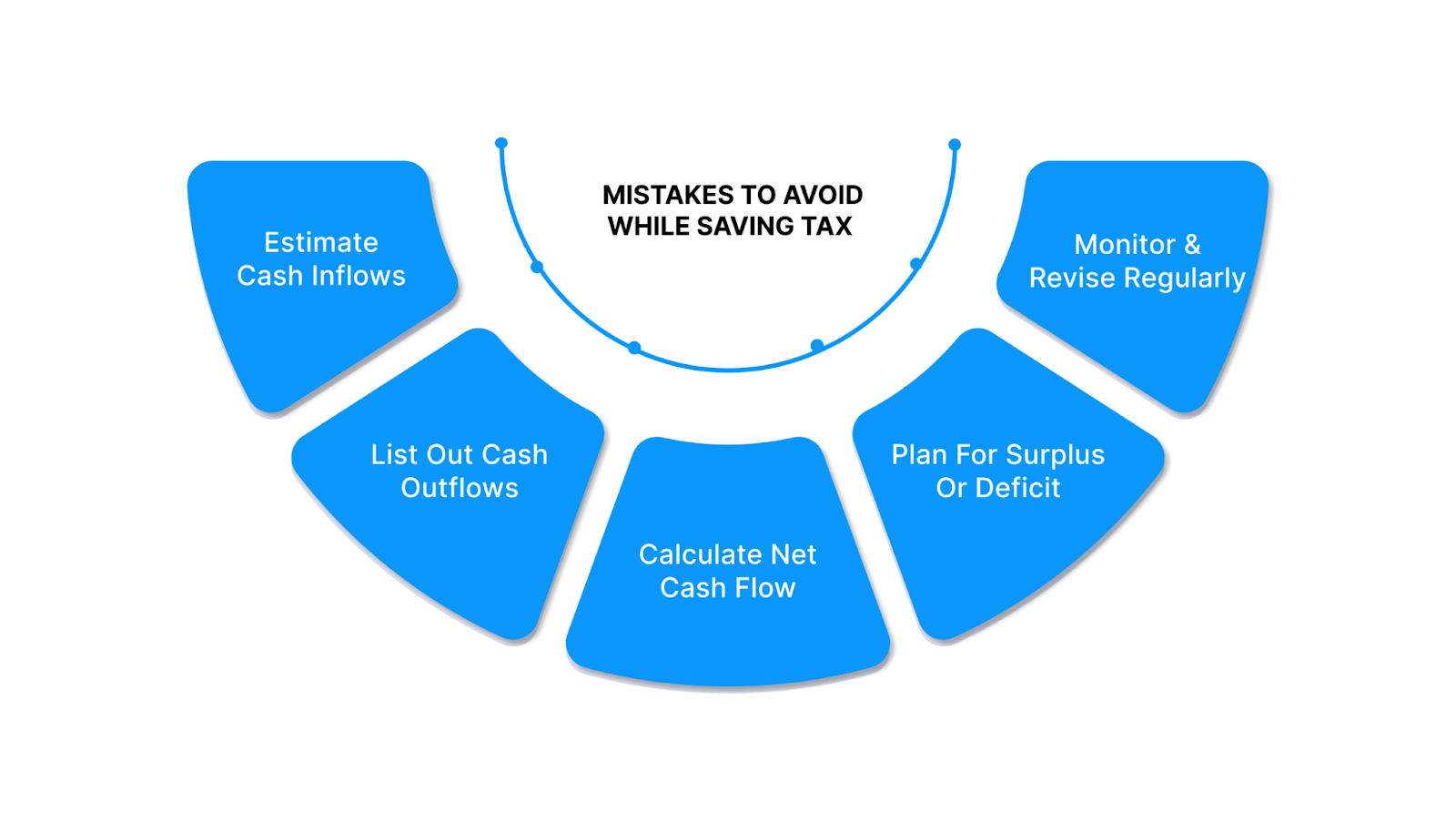

Here’s a simple breakdown of how it works:

1. Estimate Cash Inflows

The first step is to make a list of all the cash you expect to get during the span of time. This could be money from sales (cash and credit), loan payments, rent, or returns on investments. Foresight is very important; guessing too high on the money coming in can lead to unrealistic expectations.

Example: A café might expect ₹3,00,000 in cash sales and ₹50,000 in payments from customers on credit during a month.

2. List Out Cash Outflows

Next, make a list of all the cash payments you expect to make, like rent, salaries, raw materials, marketing, loan payments, utilities, and so on. This gives you a clear picture of where your money is going.

Example: The same café expects to spend ₹1,00,000 on supplies, ₹50,000 on salaries, and ₹20,000 on rent.

3. Calculate Net Cash Flow

Subtract total outflows from total inflows to find your net cash position.

- If inflows > outflows → you have a surplus (extra funds you can save or invest).

- If outflows > inflows → you have a deficit (you'll need to plan for additional funds).

Example: If inflows = ₹3,50,000 and outflows = ₹2,00,000, the business has a cash surplus of ₹1,50,000.

4. Plan for Surplus or Deficit

- In case of a surplus, businesses can invest excess cash in short-term deposits or expansion projects.

- In case of a deficit, businesses can plan to arrange short-term financing, delay non-essential expenses, or improve collections.

5. Monitor and Revise Regularly

Since sales, expenses, and market conditions can change at any time, a cash budget needs to be looked at on a regular basis. Comparing actual results with your projections helps improve accuracy and financial control over time.

First, learn the workflow, then see the tangible benefits of a cash budget.

Must Read: 10 Minute Instant Personal Loan Online

Benefits of a Cash Budget

You can use a cash budget to plan and keep track of your money, whether you're in charge of a small business, a big company, or your own personal finances. Not only does it help you plan your cash flow, but it also makes you more responsible with your money in general.

Let us take a closer look at the importance of a cash budget:

1. Ensures Liquidity and Business Continuity

With a cash budget, you can be sure that your business always has enough cash on hand to pay its bills, like rent, salaries, and supplier dues. By forecasting upcoming cash requirements, you can avoid liquidity crises and ensure smooth operations even during low-revenue periods.

2. Helps Identify Cash Surpluses and Shortages Early

One of the biggest advantages of a cash budget is foresight. It clearly shows when your business might face a cash shortage or enjoy a surplus. This early warning system lets you make plans, like getting short-term loans if you need to or investing extra money wisely so it doesn't just sit there.

3. Improves Financial Planning and Decision-Making

A well-prepared cash budget acts as a financial roadmap. It helps business owners decide when to make major purchases, schedule marketing campaigns, or plan expansion activities. You can confidently make informed decisions knowing how each move will impact cash flow.

4. Encourages Better Control Over Expenses

By regularly monitoring and comparing actual expenses with budgeted figures, businesses can detect unnecessary spending and reduce waste. This continuous review process encourages cost control and helps develop a culture of accountability within the organisation.

5. Facilitates Loan Management and Creditworthiness

Banks and investors often look at a company’s cash budget before extending credit. A strong cash management record shows that the business can handle debt responsibly. With a clear cash flow plan, you can time your loan repayments efficiently and maintain a positive credit profile.

6. Supports Strategic Growth and Expansion

Cash budgets allow you to plan long-term growth confidently. You can plan for growth, equipment purchases, or new product launches without putting too much strain on your finances if you know your cash flow cycles, or when money comes in and goes out.

7. Reduces Financial Stress

Unplanned cash shortages often lead to panic decisions, such as taking costly short-term loans or delaying supplier payments. With a cash budget in place, you can anticipate financial pressures early and handle them calmly, reducing overall business stress.

8. Builds Investor and Stakeholder Confidence

A business that maintains clear financial planning practices, including a cash budget, signals reliability and professionalism. Stakeholders, investors, and partners gain confidence in your management, knowing that financial risks are being monitored proactively.

It's not just paperwork to keep track of money; a cash budget is a safety net for your money. It helps you stay in control, make smarter financial choices, and achieve steady, sustainable growth without running into liquidity troubles.

Even strong tools have blind spots. Before you implement, consider the limitations so you can plan around them.

Must Read: Top Financial Skills Employers Look for in Candidates

Limitations of a Cash Budget

While a cash budget is an essential tool for managing finances, it’s not without its drawbacks. Like any forecast-based system, its accuracy depends on assumptions, data reliability, and external factors. Understanding its limitations helps you use it more effectively and avoid over-reliance on projections.

1. Based on Estimates, Not Certainty

A cash budget relies on projected figures for income and expenses. If your estimates are wrong, like if sales are lower than expected or costs go up without warning, your whole budget can be wrong. This makes forecasting both an art and a science that requires continuous refinement.

2. Cannot Predict Sudden Economic Changes

External factors like inflation, interest rate hikes, supply chain disruptions, or policy changes can drastically alter cash flow. Since a cash budget is usually prepared in advance, it may not account for such unforeseen circumstances, leading to gaps in financial planning.

3. Time-Consuming to Prepare and Update

Preparing a detailed cash budget takes time and effort, especially for growing businesses with multiple income streams and expenses. It also needs to be updated often to stay useful, which can be hard for small business owners who are busy with day-to-day tasks.

4. Limited Long-Term Perspective

A cash budget mainly focuses on short-term liquidity management, typically over a few weeks or months. While it helps with immediate financial planning, it doesn’t always provide a comprehensive view of long-term profitability, capital structure, or strategic investments.

5. Doesn’t Account for Non-Cash Items

Since a cash budget tracks only cash inflows and outflows, it ignores important non-cash elements like depreciation, accrued expenses, or credit sales. This means it may not reflect the true financial performance or profitability of a business.

6. Can Create a False Sense of Security

Businesses sometimes assume that having a positive cash flow in the budget means everything is under control. Ignoring other financial indicators, like profit margins or working capital ratios, on the other hand, can make you lazy and lead to bad decisions.

7. Difficulty in Large Organisations

For large companies with complex structures, multiple departments, and varied payment cycles, consolidating accurate cash data can be challenging. Small errors in one department’s forecast can distort the company’s overall cash position.

8. Requires Skilled Financial Oversight

Creating and interpreting a cash budget effectively demands a good understanding of finance and accounting. Without proper expertise, there’s a risk of misclassification, incorrect assumptions, or misinterpretation of cash flow data.

In short, a cash budget can help you, but it can't always tell you what will happen. It should be used with other financial tools, like income statements and balance sheets, to get a full picture of the economic health of your business.

Aware of the caveats? Great! Now you have a clear, step-by-step plan for making a cash budget that works.

Turn your budgeting process digital with Pocketly and get instant clarity on your spending patterns.

How to Create a Cash Budget?

Creating a cash budget is a straightforward yet strategic process that helps you forecast your business’s financial position and maintain healthy cash flow. Whether you’re a small business owner, freelancer, or manager of a growing enterprise, here’s a step-by-step guide to building an effective cash budget:

1. Determine the Budgeting Period

The first step is to decide the time frame for your cash budget.

You can prepare it for:

- Short-term: Weekly or monthly (best for small businesses or startups).

- Long-term: Quarterly or annually (suitable for established businesses).

Choosing the right period depends on your cash flow frequency and business needs. For example, a retail store with daily transactions may need a weekly cash budget, while a manufacturer might use a monthly one.

2. Estimate Cash Inflows

List all sources of cash expected during the period. This includes:

- Sales revenue (both cash and credit collections)

- Accounts receivable from past sales

- Investment income (interest, dividends, etc.)

- Loans or credit lines

- Asset sales or other receipts

Estimate realistic inflows based on past data; overestimating can give you false confidence in liquidity.

Example: If your business expects ₹5,00,000 in sales and ₹1,00,000 in pending customer payments, total inflows will be ₹6,00,000.

3. Estimate Cash Outflows

Next, list all projected cash payments for the period. Typical outflows include:

- Operating expenses: Rent, salaries, utilities, marketing, etc.

- Purchase of inventory or raw materials

- Loan repayments and interest

- Taxes and insurance premiums

- Capital expenditures (CapEx): Machinery, equipment, etc.

Many costs can add up, even small ones that you have to pay over and over again, like internet bills or office supplies.

4. Calculate Net Cash Flow

Once you’ve listed inflows and outflows, calculate your net cash flow using this formula:

Net Cash Flow = Total Inflows – Total Outflows

- If the result is positive, you have a surplus.

- If the result is negative, you have a deficit and need to arrange funds to bridge the gap.

This simple calculation helps you identify whether your business can cover expenses comfortably or needs additional support.

5. Plan for Surplus or Deficit

Use the net cash position to make smart financial decisions:

- If there’s a surplus: Consider investing excess funds in short-term deposits, paying off debt early, or reinvesting in business expansion.

- If there’s a deficit: Explore cost-cutting measures, renegotiate credit terms with suppliers, or arrange short-term financing to maintain operations.

6. Monitor, Compare, and Revise Regularly

A cash budget is only effective if it’s reviewed regularly. At the end of each period, compare actual results vs. budgeted figures to understand any deviations. Adjust your future forecasts based on these insights.

Consistent monitoring helps improve accuracy over time and keeps your business agile against changing market conditions.

7. Use Tools or Software for Efficiency

Manual budgeting can be time-consuming and prone to errors. You can use Excel templates or accounting software like Tally, QuickBooks, or Zoho Books to automate calculations, track expenses, and generate visual cash flow reports.

Once you’ve set it up, the question becomes application. Here’s how businesses use cash budgets to run smarter every day.

Must Read: Top Financial Skills Employers Look for in Candidates

How Businesses Use a Cash Budget?

Businesses of all sizes use cash budgets to forecast, monitor, and control their financial health.

Here’s how they do it effectively:

1. Managing Daily Cash Flow

Businesses rely on a cash budget to ensure they have enough liquidity to meet daily obligations like salaries, utility bills, supplier payments, and rent. By tracking expected inflows and outflows, they can schedule payments strategically to avoid overdrafts or unnecessary borrowing.

Example: A store could use the cash budget to plan when to pay its suppliers, making sure that payments only go out after big sales over the weekend have brought in enough cash.

2. Planning for Seasonal Fluctuations

A lot of businesses have changes in their cash flow throughout the year. For example, sales might go up during festivals or down during the off-season. A cash budget helps anticipate these fluctuations and maintain balance by saving during high-revenue months and preparing reserves for lean periods.

Example: An ice cream manufacturer can use cash budgeting to prepare for slower winter months by maintaining surplus cash from summer sales.

3. Controlling Costs and Avoiding Overspending

By comparing actual expenses with the budgeted figures, businesses can identify areas where spending exceeds expectations. This helps control unnecessary costs, allocate resources wisely, and improve overall efficiency.

Example: A company may notice it’s overspending on marketing compared to the budget and can reallocate that amount toward inventory or debt repayment.

4. Making Investment and Financing Decisions

A cash budget allows management to determine when it’s the right time to invest in new assets, launch a new product, or take a loan. It shows whether sufficient cash reserves are available or if external financing is needed.

Example: A manufacturing firm can use its cash budget to decide whether to purchase new equipment outright or lease it, based on the projected cash position.

5. Managing Credit and Collections

Businesses use cash budgets to predict when they will receive customer payments and when supplier payments are due. This insight enables better credit control and timely follow-ups on receivables to prevent cash shortages.

Example: A wholesaler can adjust payment terms for certain customers if the cash budget shows a potential shortfall in upcoming months.

6. Supporting Borrowing and Loan Repayments

Lenders often require businesses to present a cash budget when applying for loans. It demonstrates repayment capability and overall financial discipline. Businesses also use cash budgets to plan loan repayments, ensuring they don’t default or face penalties.

Example: A cash budget shows expected cash flows, planned expenses, and repayment schedules, giving lenders more confidence in a startup seeking working capital.

7. Aiding Long-Term Strategic Planning

Beyond day-to-day management, cash budgets support broader financial strategies like expansion, mergers, or acquisitions. They help evaluate whether future plans are financially feasible and sustainable.

Example: Before opening a new branch, a business might use its cash budget to estimate setup costs, expected revenue, and breakeven timelines.

8. Enhancing Financial Transparency and Accountability

Regular cash budgeting promotes financial literacy in an organisation. Accountability and data-driven decision-making are improved when department heads track spending against budgets.

Cash budgets help businesses avoid cash shortages and make financial decisions. Every rupee is used efficiently, assisting businesses to grow confidently and steadily.

To get consistent results, process matters. These best practices will help you keep your budget accurate, useful, and actionable.

Pocketly makes it easy to understand where your money goes. Download the app and take charge of your cash today.

Best Practices for Effective Cash Budgeting

The cash budget should be reviewed, refined, and used for financial decisions. Organisation and discipline are essential for business success.

The following best practices will help your cash budget grow and stabilise.

1. Use Realistic and Data-Driven Estimates

Avoid assumptions when creating a cash budget. Base your projections on actual historical data such as past sales, expense reports, and payment cycles. This ensures that your forecasts reflect real financial patterns and help prevent overestimations or shortfalls.

Example: If your average monthly sales for the last quarter were ₹10 lakh, use that as a benchmark instead of an optimistic projection of ₹15 lakh.

2. Review and Update the Budget Regularly

A cash budget should change with your business. Monthly or quarterly reviews reveal inflow and outflow trends. Adjust your projections as needed to keep your budget relevant and responsive to market conditions.

Example: If material costs rise by 5% mid-year, revising your budget ensures your expense forecasts stay accurate.

3. Distinguish Between Fixed and Variable Expenses

Separating fixed (rent, salaries, insurance) and variable (marketing, inventory, utilities) expenses helps manage costs better. During low-revenue months, businesses can adjust or postpone variable expenses without affecting essential operations.

Example: Reducing advertising costs temporarily while continuing to pay rent and salaries keeps operations running smoothly.

4. Maintain an Emergency Cash Reserve

Always set aside a portion of funds for unforeseen circumstances like sudden repairs, delayed payments, or unexpected expenses. This financial cushion ensures business continuity during tough times.

Example: Keeping a reserve equal to three months of operating expenses helps maintain stability even when sales dip unexpectedly.

5. Monitor Accounts Receivable Closely

Delayed customer payments can disrupt your entire cash flow. Track receivables actively, follow up on overdue invoices, and offer incentives for early payments to maintain consistent liquidity.

Example: Sending payment reminders at regular intervals can reduce outstanding dues and ensure steady inflows.

6. Align the Budget with Business Goals

The cash budget should support your strategic goals, such as expansion, hiring, or production. Plan cash inflows and outflows in sync with these goals to maintain focus and direction.

Example: If you plan to open a new branch next quarter, your budget should account for setup costs and expected revenue timelines.

7. Use Technology for Accuracy and Efficiency

Manual spreadsheets are prone to human error and take time to update. Using digital accounting and budgeting software helps automate calculations, monitor performance, and generate real-time insights for better decision-making.

Example: Tools like QuickBooks or Zoho Books can automatically generate monthly variance reports and highlight cash flow trends.

8. Collaborate Across Departments

Consider sales, procurement, and operations when creating the budget. Their input provides a clearer view of upcoming revenues and expenses, improving accuracy and accountability.

Example: The sales team’s forecasts can help predict inflows, while procurement can estimate raw material costs more precisely.

9. Analyse Variances and Take Corrective Action

Compare actual results with budgeted figures to spot discrepancies early. Understanding the reasons behind these variances allows you to adjust spending, renegotiate contracts, or improve forecasting for future periods.

Example: If actual travel expenses exceed the budget consistently, consider introducing approval limits or revising travel policies.

10. Keep a Long-Term Perspective

Even though a cash budget focuses on short-term liquidity, it should also align with long-term financial goals. Regular analysis helps you balance immediate operational needs with future investments and growth.

Example: A surplus in current months can be reinvested into expansion or technology upgrades to support long-term strategy.

11. Account for Seasonality and Market Fluctuations

Businesses with cyclical or seasonal sales patterns should plan accordingly. Allocate resources during peak periods and set aside reserves for slower months to maintain cash flow consistency.

Example: A clothing retailer can save surplus from festive-season sales to cover inventory and rent during the off-season.

12. Promote Financial Awareness Across Teams

Encourage every department to understand how their decisions impact cash flow. When employees are financially aware, they make smarter spending choices that contribute to overall stability.

Example: A marketing team that understands cash flow constraints will plan campaigns within budget limits and prioritise ROI.

Best practices stick better with the right tools. Here’s how Pocketly can simplify tracking and strengthen your cash discipline.

Must Read: 11 Successful Tips On How To Save Money While In College

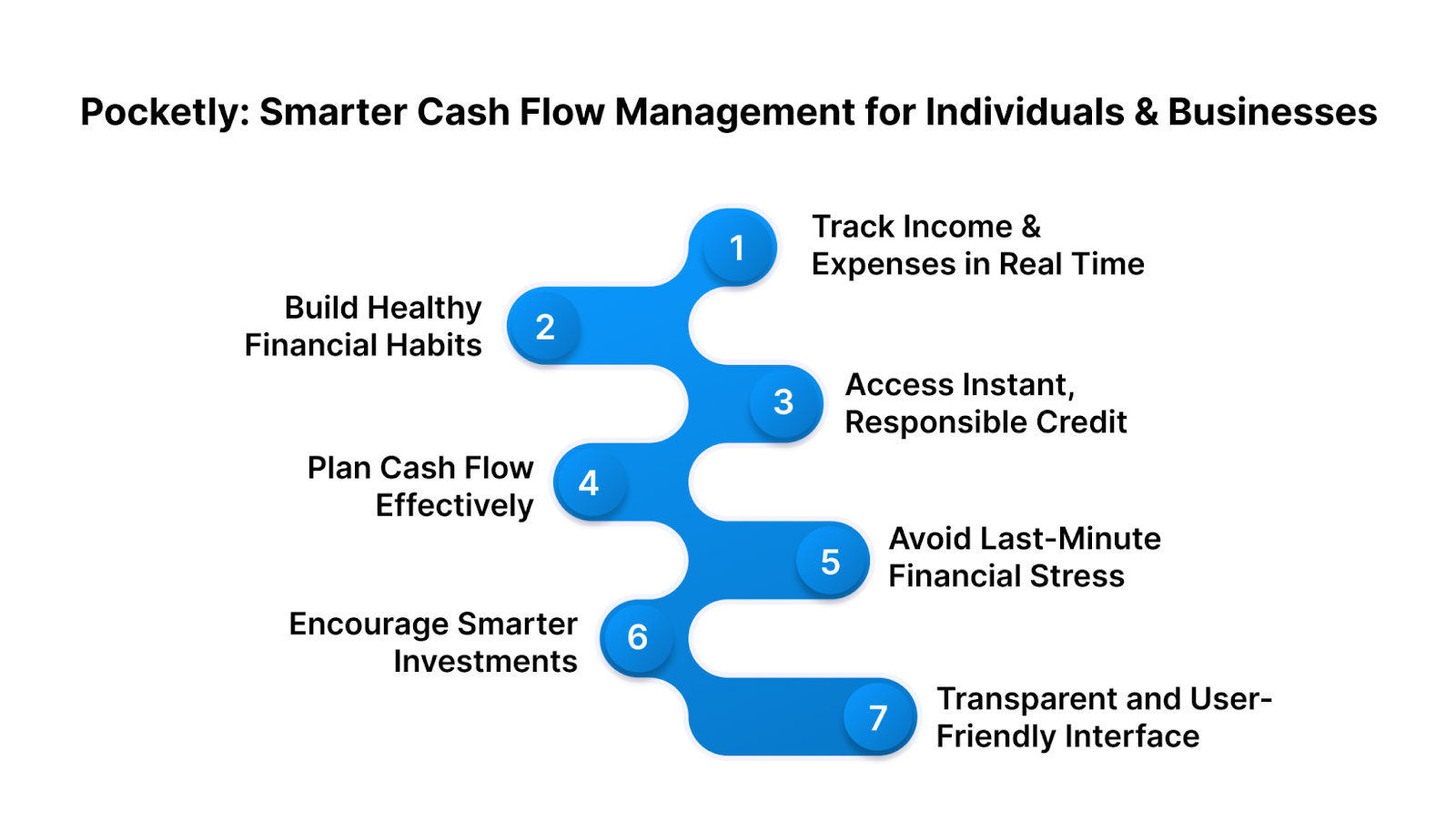

Pocketly: Smarter Cash Flow Management for Individuals and Businesses

Individuals and small business owners managing daily finances need effective cash budgeting, too. Pocketly streamlines cash management, expense tracking, and financial discipline.

Here’s how Pocketly can make your cash flow management smarter and more efficient:

- Track Income and Expenses in Real Time: Pocketly helps you monitor where your money is going. Categorising expenses and visualising spending patterns enables better budgeting decisions and prevents unnecessary outflows.

- Build Healthy Financial Habits: Pocketly encourages consistent money management by reminding, informing, and summarising spending.

- Access Instant, Responsible Credit: In times of short-term cash shortages, Pocketly offers quick and transparent access to small credit amounts, helping you maintain liquidity without resorting to high-interest loans.

- Plan Cash Flow Effectively: The app forecasts income and expenses like a cash budget. It helps you allocate funds for essentials, savings, and emergencies efficiently.

- Avoid Last-Minute Financial Stress: Pocketly keeps your finances organised, so you always know what's due, what's saved, and what's available, preventing month-end surprises.

- Encourage Smarter Investments: By helping you control short-term spending and maintain liquidity, Pocketly allows you to redirect funds toward long-term investments like ELSS, NPS, or fixed deposits.

- Transparent and User-Friendly Interface: The app is designed to be intuitive and simple, providing complete visibility into your transactions, repayment timelines, and interest rates without hidden charges.

Conclusion

A cash budget is a roadmap that keeps businesses and individuals liquid, prepared, and in control of their money.

By forecasting income and expenses, you gain the power to anticipate challenges, make informed decisions, and avoid last-minute financial stress. Whether you’re running a small business or managing personal finances, a well-maintained cash budget ensures stability and sustainability in the long run.

Consistently reviewing, updating, and aligning your budget with real-world changes is key. Combine this with modern tools like Pocketly to simplify tracking, access insights instantly, and strengthen your overall financial planning.

Ready to take control of your cash flow and plan smarter? Download Pocketly on Android or iOS to track expenses, forecast budgets, and stay financially confident with smart decisions.

FAQs

1. Why is a cash budget important for businesses?

Businesses need a cash budget to maintain liquidity, predict cash shortages or surpluses, and plan for financial needs. It prevents overdrafts and ensures timely employee and supplier payments.

2. How often should a cash budget be prepared?

Business type and cash flow determine frequency. Small businesses and startups create monthly or weekly cash budgets, while larger companies use quarterly or annual plans with monthly reviews.

3. What are the key components of a cash budget?

Cash budgets include sales, loan receipts, investments, expenses, salaries, purchases, and loan repayments. A business's surplus or deficit depends on its net cash flow.

4. Can individuals also use a cash budget?

Absolutely. Cash budgets help people manage monthly income, expenses, and savings. Just as businesses use it to manage cash, it helps track spending, avoid debt, and plan for emergencies and big purchases.

5. How does technology improve cash budgeting?

Pocketly, QuickBooks, and Zoho Books automate calculations, track inflows and outflows, and provide real-time insights to simplify budgeting. They reduce manual errors and speed up data-driven financial decisions.