Introduction

If you’ve ever found yourself wondering where your salary disappeared before the month even ended, you’re not alone. Between bills, rent, EMIs, groceries, and a few well-deserved treats, managing monthly income can sometimes feel like juggling too many balls at once.

That's where good money sense comes in handy. Anyone who makes a steady income and wants to stretch their money further can do financial planning. It's not just for investors or economic experts. It means taking charge of your money, your spending, your savings, and your plans for the future so that you can live well today and be sure of tomorrow.

This blog post will teach you simple, doable steps that can help with financial planning for salaried employees.

Key Takeaways

- Financial planning helps you stay in control of your income, expenses, and future goals.

- A monthly budget is the foundation of every successful financial plan.

- Building an emergency fund protects you from unexpected expenses.

- Prioritise clearing high-interest debts before increasing investments.

- Start investing early in options like SIPs, PPF, and NPS to grow your wealth steadily.

- Don’t forget tax planning. Use deductions under Sections 80C, 80D, and 80CCD to save more.

- Regularly review your plan to adjust for income changes or new life goals.

- Avoid common mistakes like overspending, ignoring insurance, or delaying savings.

- Use smart financial tools like Pocketly for short-term liquidity instead of relying on credit cards or informal borrowing.

- Consistent planning and discipline today can lead to long-term financial confidence and independence.

What is Financial Planning and Why Does It Matter?

When you plan your finances, you make sure you have enough money to meet your short-term and long-term needs without stress. You should know how much money you make, how much you spend, and how much you can save or put away to build the life you want.

This is like a map for your money. You wouldn't go on a road trip without first checking the directions. Similarly, planning your finances helps you understand where your money should go, whether it's for paying bills, building an emergency fund, investing for retirement, or giving yourself a guilt-free treat now and then.

For salaried workers, budgeting is important because while your income stays the same, your costs can change. It's simple to get off track and run out of money before your next paycheck if you don't have a plan. You should always have enough money to cover the basics, save regularly, and be ready for life's surprises if you have a good plan.

You're not just managing your salary when you plan your finances well; you're also taking charge of your future. It gives you peace of mind, keeps you out of debt traps, and gives you the money to make your own decisions.

Must Read: Financial Planning Tips for Young Adults

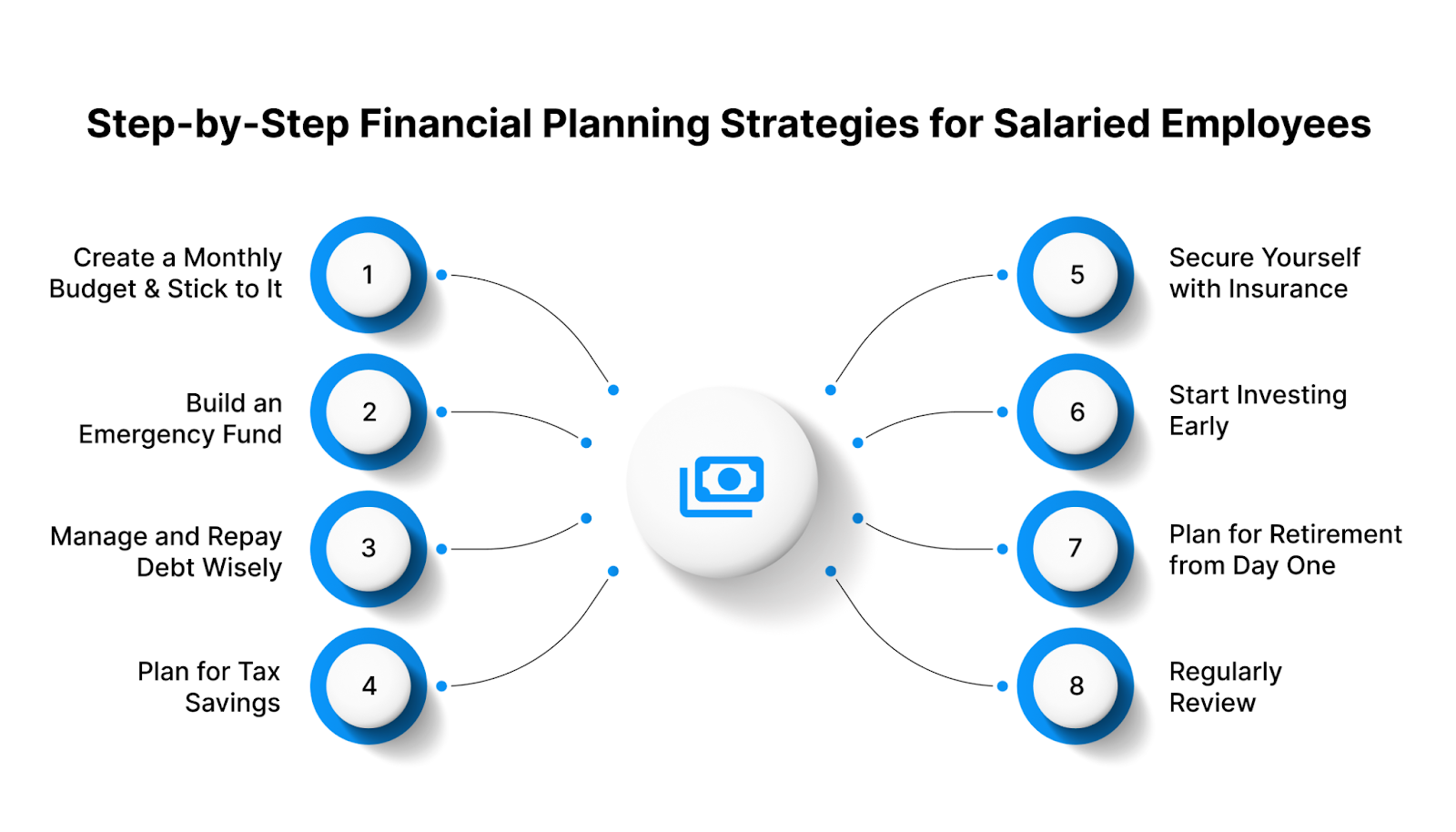

Step-by-Step Financial Planning Strategies for Salaried Employees

A little planning goes a long way when it comes to your salary. Planning your money doesn't just mean saving; it also means balancing your needs now with your goals for tomorrow.

Alt text:Step-by-Step Financial Planning Strategies for Salaried Employees

Here are the steps to strong financial planning for salaried employees:

1. Create a Monthly Budget and Stick to It

Start by writing down all of your monthly costs, such as rent, groceries, travel, utility bills, and fun things to do. To find out where your money is going, sort them into "needs" and "wants."

Once you know this, set limits on how much you can spend in each area, and make sure that savings are a fixed cost. At first, sticking to your budget might seem hard, but if you do it often, it will become a habit. You can keep track of your progress and avoid stress at the end of the month with budgeting apps or simple spreadsheets.

2. Build an Emergency Fund

If you're not ready, unplanned costs like a medical emergency or losing your job can mess up your finances. In these situations, an emergency fund is like a safety net.

Try to set aside enough money in a separate account to cover your basic needs for three to six months. It doesn't have to be built in one day; start small and keep at it. This fund gives you peace of mind and keeps you from borrowing money you don't need to.

3. Manage and Repay Debt Wisely

Not all debt is bad, but if you don't handle it, it can become a big problem. Pay back your loans and credit card bills on time to avoid fees and interest that add up.

Pay off loans with high interest rates first, like credit card bills, and then move on to other loans. Don't take out any new loans unless you have to. If you're having trouble making your payments, you might want to consolidate your debt or set up automatic EMI payments to help you stay on track.

4. Plan for Tax Savings

Tax planning isn't just something you do at the end of the year; it should be a part of your all-year financial plan.

Under Section 80C, you can deduct investments like PPF and ELSS, as well as life insurance premiums and home loan principal payments. You can deduct the cost of your health insurance premiums for you and your family under Section 80D.

If you plan your taxes well, you won't pay too much and can use the money you save for future goals.

5. Secure Yourself with Insurance

A good financial plan is built around insurance. Life insurance protects your family financially if you die, and health insurance keeps you from having to pay huge medical bills.

As a salaried professional, choose a term life insurance plan for affordable, high coverage and a comprehensive health insurance policy that covers hospitalisation, medicines, and critical illnesses. The earlier you start, the lower your premiums will be.

6. Start Investing Early

You can't just save money; it needs to grow, too. Do something about it right away, even if it's just a little bit.

Depending on your goals and risk tolerance, look into different ways to invest, such as mutual funds, SIPs, PPF, and NPS. When you start investing early, you can take advantage of compounding, which means that your returns earn more returns over time. This makes it easy to build wealth over the long term.

7. Plan for Retirement from Day One

It may seem like a long time away, but planning for retirement now will make it easier in the future. You can build a safe nest egg for life after work by putting some of your monthly income into a retirement fund, such as an EPF, NPS, or pension plan.

When you start saving early, you'll need to put away less each month, and your savings will grow faster over time because the interest will add up.

8. Regularly Review and Adjust Your Financial Plan

The things that matter to you financially can change over time, like getting a new job, getting married, or taking out a home loan. That's why you should look over your money every two months.

Go over your goals again, move your investments around if necessary, and make sure your insurance is still valid. Your financial plan will stay in line with your life and income growth if you stay flexible.

There will always be problems, even if you have a good plan. When you know what issues you can expect, you can better prepare and make better financial decisions. Let's look at some of the most common money problems that salaried workers have right now.

Must Read: Understanding the Basics of Financial Planning and Its Importance

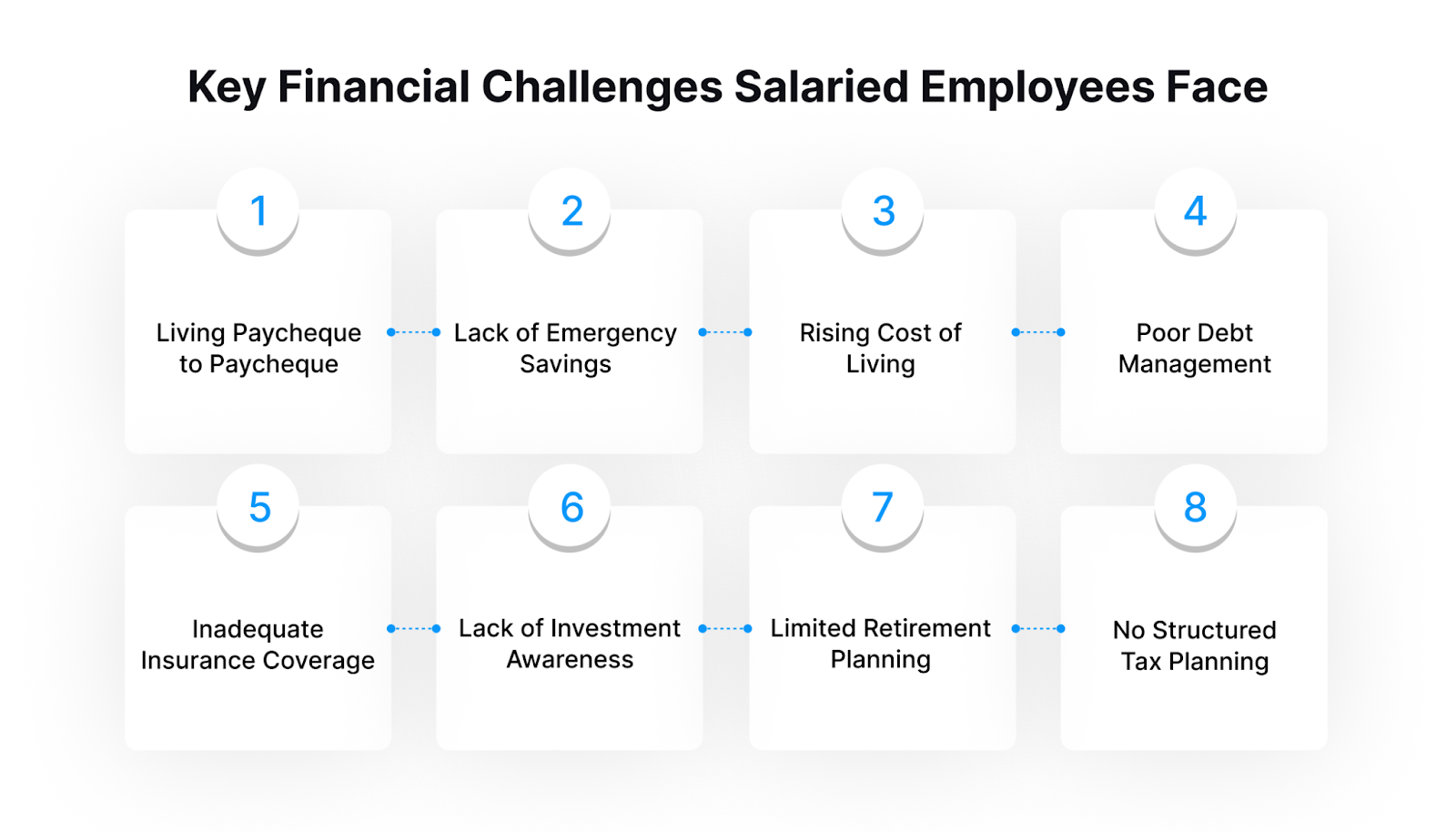

Key Financial Challenges Salaried Employees Face

Managing money isn't always easy, even if you have a steady income. A lot of salaried workers find it hard to balance their short-term goals, savings, and daily expenses. These are some of the most common money problems you might be having, and why recognising them is the first thing you need to do to fix them.

1. Living Paycheque to Paycheque

Many professionals find themselves running out of money before the next salary arrives. This often happens when there’s no structured budget or emergency savings. It leads to dependency on credit cards or borrowing, which creates more financial stress over time.

2. Lack of Emergency Savings

A medical emergency, job loss, or unexpected home repair can quickly drain your finances if you don’t have a backup. Without an emergency fund, you may end up taking high-interest loans or delaying important payments.

3. Rising Cost of Living

With increasing rent, fuel prices, and lifestyle expenses, it’s becoming harder to save. Even small, daily costs like food deliveries or online subscriptions can add up and eat into your budget without you realising it.

4. Poor Debt Management

Credit cards and easy EMIs make borrowing convenient, but without proper control, debt can snowball quickly. High-interest repayments can leave you with little room to save or invest, affecting your financial stability.

5. Inadequate Insurance Coverage

Many salaried employees skip health or life insurance, thinking their employer-provided policy is enough. However, most corporate plans have limited coverage, leaving you vulnerable to large expenses during emergencies.

6. Lack of Investment Awareness

Some employees rely solely on savings accounts or fixed deposits, missing out on higher-earning opportunities like SIPs, mutual funds, or NPS. Without investing, your money loses value over time due to inflation.

7. Limited Retirement Planning

Retirement may seem far away, but delaying savings for it means you’ll need to save more later. Without early planning, you risk not having enough funds to maintain your lifestyle after you stop working.

8. No Structured Tax Planning

Rushing to save tax at the end of the year often leads to poor investment choices. Without a proper tax plan, you might end up paying more than necessary or missing out on useful deductions.

The first step to building financial security is to understand these problems. You can use these problems to your advantage for long-term economic growth if you plan well, get the right tools, and stick to good habits.

You can deal with problems if you're smart, but small money mistakes are what hold you back most of the time. Seeing them early on can help you stay on track and keep you from having to deal with money problems later on.

Must Read: Understanding Financial Literacy: Importance And Benefits

Common Financial Planning Mistakes Salaried Employees Make

A few small money mistakes can quietly get in the way of your financial goals, even if you're making good money. Why is this good news? It's easy to fix them once you see them. Let's look at some mistakes that salaried workers often make when planning their finances and how you can avoid them.

1. Ignoring a Monthly Budget

Not having a budget is like driving without directions. Many people spend first and save later, leaving little at the end of the month. Creating a realistic budget helps you track expenses, prioritise savings, and stay in control of your money.

2. Relying Too Much on Credit

Using credit cards or instant loans for lifestyle expenses may feel convenient, but it can quickly lead to debt traps. Paying only the minimum due each month results in high interest charges and long-term financial stress.

3. Neglecting Emergency Savings

Things can go wrong at any time in life, like getting a medical bill, losing your job, or having to pay for family costs. If you don't have an emergency fund, you might have to borrow money at high interest rates, which can make your finances less stable.

4. Not Reviewing Financial Goals

Setting financial goals is important, but reviewing them regularly is just as crucial. Salary increases, new responsibilities, or major life events like marriage or parenthood can change your priorities. Revisiting your plan ensures your goals remain relevant.

5. Mixing Insurance with Investment

Many people buy traditional insurance plans, thinking they’re also great investments. In reality, combining the two often leads to poor returns and inadequate coverage. Keep insurance for protection and investments for wealth creation.

6. Avoiding Tax Planning Until the Last Minute

Waiting until March to save tax often results in rushed and uninformed decisions. Tax planning should start at the beginning of the financial year so that you can spread investments and choose wisely.

7. Not Investing Early Enough

Putting things off is one of the worst things you can do with your money. You can start investing early, even if it's just a little. This gives your money more time to grow through compounding. If you wait too long, you might miss out on growth that is worth it.

8. Ignoring Inflation

Keeping all your savings in a bank account or low-yield instruments can’t keep up with rising prices. Over time, inflation reduces your purchasing power. Investing in inflation-beating options such as mutual funds or NPS helps your money retain real value.

Avoiding these common mistakes doesn't require a lot of complicated financial knowledge. All you need is to be aware of them and be consistent. Every month, your salary can work harder for you if you have a plan and stick to it.

Even if you do everything right, you might still have to pay for something unexpected. That's why having access to responsible short-term credit can be so helpful. This is how Pocketly makes it easy for you to address those issues.

Must Read: Refinance: Definition, How It Works, Types, and Example

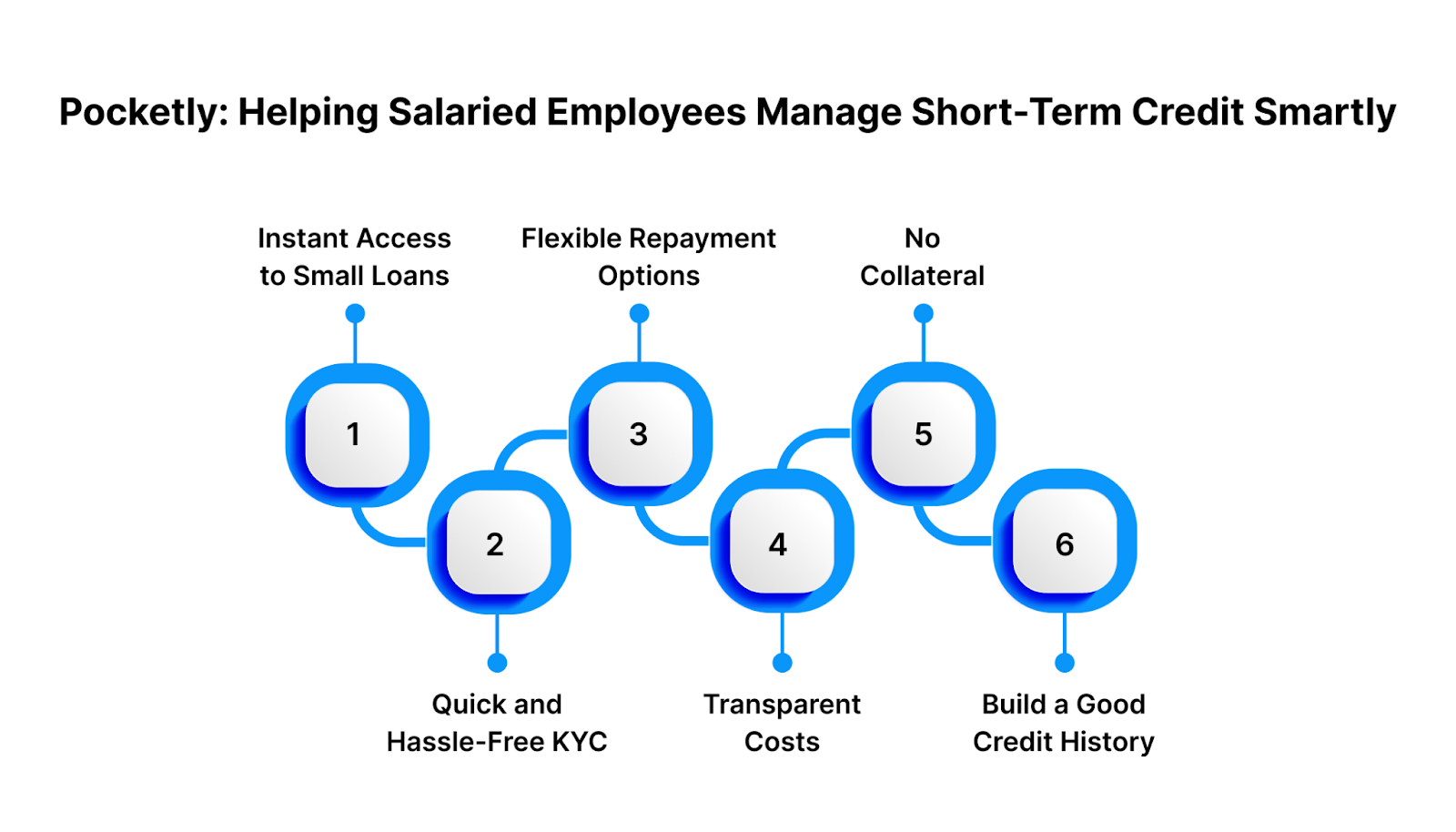

Pocketly: Helping Salaried Employees Manage Short-Term Credit Smartly

Unexpected costs, like a medical emergency, car repair, or a shortfall at the end of the month before payday, can happen even if you carefully plan your finances. This is where Pocketly comes in to help you handle your short-term money needs in a smart way.

Here’s how Pocketly makes managing credit simple, quick, and stress-free:

- Instant Access to Small Loans: You can borrow amounts starting from ₹1,000 up to ₹25,000, depending on your needs. The whole process, from applying to getting the money, is done online and only takes a few minutes.

- Quick and Hassle-Free KYC: Forget paperwork. You only need to complete a quick online KYC to verify your identity before receiving funds directly into your bank account.

- Flexible Repayment Options: Choose repayment tenures between 2 to 6 months. This flexibility ensures your EMIs remain manageable without affecting your monthly budget.

- Transparent Costs: Pocketly clearly displays all applicable charges before you confirm the loan. There are no hidden fees, and the interest rate is 2% per month. The processing fee is between 1% and 8%.

- No Collateral or Credit History Required: Even if you’re new to credit, you can still apply. Pocketly assesses applications through alternative data models instead of relying solely on traditional credit scores.

- Build a Good Credit History: Paying your bills on time helps you build a good credit history early on, which is helpful when you apply for loans or credit cards in the future.

You don't have to borrow money from family, friends, or high-interest loans when you need it with Pocketly. Instead, you get fast, fair, and flexible credit while also learning how to handle your money well.

Download the Pocketly app to experience simple, transparent, and responsible borrowing designed for India’s young workforce.

Conclusion

Financial planning is about control, clarity, and confidence over your money, not restriction. Smart income, savings, investments, and expense planning create a financial safety net that helps you live stress-free today and secure your future.

Salaried workers often face irregular expenses, month-end shortages, and unexpected bills. What matters is preparation and response. Having the right tools and a structured financial plan keeps you ahead.

Pocketly helps you handle short-term financial gaps without worry. It keeps you financially secure with fast approvals, flexible repayment options, and no hidden fees.

Download the Pocketly app today on Android or iOS to take charge of your short-term finances and move one step closer to financial freedom.

FAQs

1. How can salaried employees start financial planning?

Find out your monthly income and expenses. Create a simple budget, pay off high-interest debts, save for emergencies, and invest monthly. Small, consistent steps matter most over time.

2. What percentage of my salary should go into savings and investments?

Try to save and invest 20–30% of your monthly income. Spend 50% on needs, 30% on wants, and 20% on savings or investing. Customise this ratio for your lifestyle and goals.

3. Which investment options are best for salaried employees in India?

SIPs, PPFs, NPSs, and tax-saving ELSS funds are good starting points. Depending on risk tolerance and financial goals, each offers long-term growth and tax benefits.

4. How can I manage month-end cash shortages responsibly?

Track spending and set discretionary spending limits early in the month. If you still need money, avoid borrowing from friends or using high-interest credit cards. Instead, try Pocketly, a transparent, short-term credit option for responsible borrowing.

5. How can Pocketly help with financial planning for salaried individuals?

Pocketly provides short-term personal loans from ₹1,000 to ₹25,000 with clear terms, no collateral, and flexible repayment options. It helps you handle unexpected expenses, cash flow, and financial stability without disrupting your budget.