If you're struggling with your loan repayments or your financial situation has changed, transferring your loan to someone else might offer a way out. This can occur in conditions such as losing a job, facing a reduction in income, or dealing with unexpected medical emergencies. It can also happen during a career transition, the start of a new business, or the assumption of additional family responsibilities.

In such cases, transferring the loan to someone with a more stable financial position can provide the relief you need, allowing you to regain control over your finances. In India, it's possible to transfer a loan balance to another person, providing a fresh start without the burden of repayments.

Whether you're facing unexpected financial challenges, planning a significant life change, or simply looking for more manageable terms, transferring your loan can be a viable solution. However, it’s essential to understand the entire process, the requirements, and the potential impact on both you and the person you're transferring the loan to.

This blog will walk you through the necessary steps, eligibility criteria, and what to expect when transferring a loan balance to another person. Keep reading to learn how you can make this transition smoothly and responsibly.

What is a Loan Transfer?

A loan transfer involves shifting the responsibility for repaying a loan from the original borrower to another person. Essentially, this means that someone else takes over the loan and becomes the new borrower, assuming all repayment obligations and associated risks.

In a typical loan transfer, the new borrower takes on the same loan terms, such as the interest rate, tenure, and amount due, as the original borrower. It's important to note that not all loans are eligible for transfer. The process varies depending on the type of loan (e.g., personal loan, home loan, or car loan) and the lender's policies.

This can be an attractive option if you find yourself unable to meet your financial commitments but know someone willing and able to take over the loan. However, both parties, the original borrower and the new borrower, need to understand the terms, the lender's approval process, and any potential fees involved.

Transferring a loan balance to another person is the best solution in certain situations. Still, it's essential to distinguish this from other financial options, such as refinancing or taking out a new loan. Let's break down the differences to help you understand which path is most suitable for your needs.

Transferring a Loan Balance to Another Person vs. Refinancing or Taking a New Loan

When dealing with a loan balance transfer, it's essential to distinguish it from refinancing or taking a completely new loan. While both may sound similar, the processes, requirements, and outcomes vary significantly.

| Criteria | Loan Transfer to Another Person | Refinancing | Taking a New Loan |

|---|---|---|---|

| Definition | Transferring loan responsibility from the original borrower to another person. | Taking out a new loan to pay off the existing loan with new terms. | A new loan is applied for to pay off the previous loan or for other purposes. |

| Loan Terms | Remains the same (interest rate, tenure, etc.). | Terms can change (lower interest rate, different tenure). | New terms based on the new loan’s conditions. |

| Eligibility Criteria | The new borrower must meet the lender’s criteria (credit score, income, etc.). | Borrowers must qualify for new loan terms based on their current financial situation. | Requires approval based on the borrower's creditworthiness. |

| Required Documentation | Typically minimal; involves transferring the responsibility. | Requires documentation for a new loan (income proof, credit check, etc.). | Full documentation for a new loan (credit check, income proof, etc.). |

| Pros | Simple process, no need for new terms, minimal paperwork. | Possible to secure better terms such as lower interest rates or better repayment options. | Flexibility in loan amount, new repayment structure. |

| Cons | Not always allowed by the lender, and the new borrower must meet the lender's criteria. | May involve fees, a credit check, and new approval process. | It can involve a lengthy process, higher interest rates if credit score drops. |

| Impact on Loan Amount | No change in loan amount unless negotiated. | May adjust loan amounts based on needs. | Loan amount can vary based on what is applied for. |

| Credit Impact | Minimal; depends on the new borrower’s creditworthiness. | Can affect credit score due to the new loan application. | A new loan could impact credit score, particularly if the borrower defaults. |

In deciding whether to transfer your loan balance, it’s essential to understand which types of loans are eligible for such transfers.

Common Types of Loans Eligible for Transfer

Not all loans can be transferred to another person, and each type has specific rules and conditions for transfer. Let’s explore some common loan types that typically allow for transfer, helping you understand your options better:

- Personal Loans: Many personal loans are transferable, provided the new borrower meets the lender's eligibility criteria. These loans often have flexible terms, making them easier to transfer.

- Home Loans: Home loans can often be transferred to another person, but this process typically involves more paperwork and a deeper financial check. The lender will assess the new borrower's ability to handle such a significant loan.

- Car Loans: Car loans are commonly eligible for transfer. Similar to home loans, the new borrower must be able to afford the monthly payments and meet the required financial criteria.

Each type of loan has its own set of rules, and lenders may impose conditions based on the specific terms of the loan. Understanding these details can help guide you through the loan transfer process more smoothly.

Given the different loan types that may be eligible for transfer, you might wonder why someone would consider transferring a loan balance in the first place.

If you want to know more about the types of loans, Read our guide on “Differences, Meanings, and Types of Loans and Advances in Banking”

Why Would You Want to Transfer a Loan to Another Person?

Understanding the underlying reasons can help you assess if this is the right option for your situation. Let's take a look at some of the key reasons why transferring a loan to another person might be beneficial or necessary:

- Change in Financial Circumstances

- A major life change, such as a job loss, health issues, or unexpected financial strain, may make it difficult to manage loan repayments. In such cases, transferring the loan to someone with a stable income might relieve financial pressure.

- Transferring Debt Responsibility

- Sometimes, individuals may want to pass on the responsibility of debt to someone else, especially in cases where the borrower no longer wants to maintain ownership of the loan or feels that the other person is better suited for it.

- Improved Loan Terms

- If the new borrower has a better credit score or more favorable financial standing, transferring the loan might result in lower interest rates or better terms. This can be especially helpful for reducing the overall cost of the loan.

- Family or Relationship Reasons

- In some cases, loans are transferred to family members or loved ones as a means of helping them. This could occur when a family member takes over the loan on behalf of a relative, either out of necessity or as part of a financial agreement.

Understanding the reasons for transferring a loan can help you decide if it’s the right choice for you and ensure you take the proper steps to complete the process smoothly.

As you explore the reasons behind loan transfers, it's also important to consider the advantages that come with such a decision.

Whether you’re in need of financial relief or looking to simplify your loan obligations, Pocketly offers flexible and fast loan options that can help you manage your finances. Get started today by downloading the Pocketly app.

Benefits of Transferring a Loan

Transferring a loan to another person isn't just a matter of shifting responsibility; it can offer various benefits for both the borrower and the individual taking over the loan. Let's examine the potential advantages that make loan transfers a desirable option for some:

1. Debt Diversification for the Original Borrower

Transferring a loan can help diversify your financial liabilities. For someone who might have multiple loans, moving one debt to another person can reduce the number of active debts, simplifying your financial management and focusing on fewer obligations.

2. Improved Cash Flow for the Original Borrower

If the loan transfer results in lower interest rates or longer repayment terms for the new borrower, the original borrower can benefit from more flexible financial arrangements. This might allow the borrower to reallocate funds to other essential areas like investments or savings.

3. Avoiding Default and Preserving Credit Score

By transferring the loan to someone with better financial standing or more reliable payment history, the original borrower can avoid the risk of defaulting on the loan. This helps protect the borrower’s credit score and financial reputation, which would otherwise take a hit due to missed or delayed payments.

4. Access to Specialised Loan Solutions

Certain lenders may offer loan products specifically designed for individuals with specific financial situations, like business loans or loans for education. By transferring the loan to someone eligible for such products, the loan could benefit from these specialized solutions, potentially offering lower interest rates or more favorable terms

5. Tax Benefits for the New Borrower

Depending on the type of loan and the jurisdiction, the new borrower may be able to claim certain tax deductions or benefits. For example, home loan transfers often come with tax benefits for the new borrower, making it financially advantageous for them to take on the loan.

Transferring a loan can offer various benefits, both to those in need of financial relief and to those seeking more favorable loan terms. While the benefits of transferring a loan can be appealing, it's essential to understand the criteria that need to be met for the transfer process to be successful.

For more tips on managing loans, explore Indian Personal Loans for Bad Credit with Guaranteed Approval, where we explain how personal loan transfers can help those with less-than-ideal credit scores.

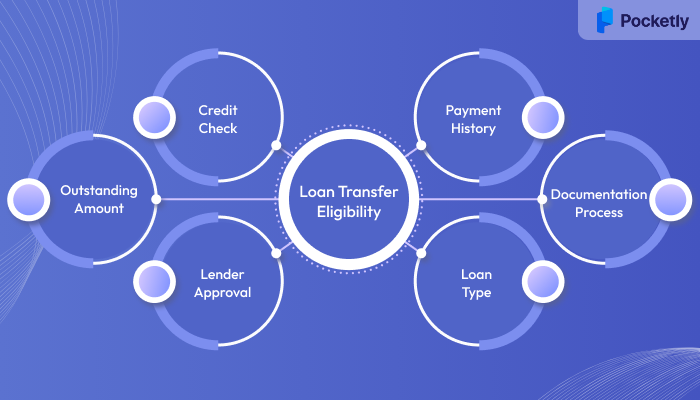

Eligibility Criteria for Loan Transfer

Meeting these eligibility requirements ensures a smooth transition and can help avoid complications down the road. Let's explore the key factors that determine whether a loan can be transferred from one individual to another:

1. Creditworthiness of the New Borrower

One of the most crucial factors in a loan transfer is the creditworthiness of the individual who will take over the loan. Lenders will assess the new borrower’s credit score, income level, and financial stability to ensure they can handle the loan repayment.

2. Outstanding Loan Amount

The loan transfer process typically requires that the loan be active and not in arrears. Lenders will consider the outstanding loan amount and ensure that the new borrower can meet the repayment terms before approving the transfer.

3. Approval from the Lender

The lender must approve the loan transfer, as they need to be confident that the new borrower can take on the financial obligations. This usually involves a review of the new borrower’s financial background and a formal application process.

4. No Existing Defaults or Missed Payments

If the original borrower has missed payments or has a history of defaults, it could complicate the loan transfer. Lenders generally prefer a clean record to ensure that the transition is smooth and the new borrower can proceed without any complications.

5. Legal and Documentation Process

The loan transfer also involves the legal documentation process. The original borrower and the new one will need to sign agreements outlining the terms of the transfer. This process ensures that both parties understand their obligations, and the lender’s interests are protected.

6. Type of Loan

Not all loans are eligible for transfer. While personal loans, home loans, and car loans are often transferable, specific loan types (like student loans or government-funded loans) may not allow for such changes.

Building on the eligibility criteria, understanding how the loan transfer process actually works is crucial for ensuring a smooth transition. Below, we’ll break down the typical steps involved in transferring a loan to another person, so you know exactly what to expect from start to finish.

Are you unsure if you meet the criteria for loan transfer? Don’t worry! Pocketly offers flexible loan solutions customized to your needs, whether you’re transferring a loan or seeking financial flexibility.

How Does a Loan Transfer to Another Person Work?

The process of transferring a loan is systematic, and ensuring that every step is properly followed will help ensure a smooth transition for both parties involved. Let’s break down the essential steps that you need to follow to transfer your loan successfully, ensuring that both the current and new borrowers meet all the required criteria. Here’s a step-by-step guide to walk you through the process:

Step 1: Contacting the Lender and Expressing the Intention to Transfer the Loan

The first step is to approach your lender and inform them of your intention to transfer the loan. This can typically be done through customer service or your assigned loan manager. It's important to explain why you're seeking the transfer and provide details about the person to whom the loan will be transferred.

Actionable Tip: Be clear and honest about your reasons for the transfer and ensure that the person you're transferring to is aware of the responsibilities involved.

Step 2: Verifying Eligibility with the Lender

The lender will review both your credit history and the creditworthiness of the new borrower to determine if they meet the necessary requirements. This may involve a background check and verification of income, as well as an assessment of the new borrower's debt-to-income ratio.

Actionable Tip: Ensure that the new borrower’s financial situation is stable and meets the lender’s criteria to avoid delays or rejections.

Step 3: Submitting the Necessary Documents for Approval

Both the original borrower and the new borrower must provide documentation for the transfer process. Common documents include identity proofs, proof of income, the loan agreement, and a no-objection certificate from the current borrower (if applicable). These documents help the lender verify that all parties involved are legally eligible for the transfer.

Actionable Tip: Gather all required documents beforehand to ensure the transfer process is smooth and timely. This might include proof of address, bank statements, and credit reports.

Step 4: Completing the Documentation for the Transfer

After the lender verifies eligibility and the documents are in order, both parties will be required to sign a loan transfer agreement. This legal document outlines the terms of the transfer, including the repayment schedule, the remaining loan amount, and the responsibilities of the new borrower.

Actionable Tip: Thoroughly review the loan transfer agreement before signing, and make sure all terms are clear to both parties. This is a legally binding document that defines the obligations of the new borrower.

Step 5: Receiving Confirmation and Finalizing the Transfer

Once all the documentation is completed and signed, the lender will issue a confirmation that the loan has been successfully transferred to the new borrower. The original borrower will be released from liability, and the new borrower will assume full responsibility for the loan moving forward.

Actionable Tip: Ensure you receive written confirmation from the lender that the transfer has been finalized, and keep this documentation for future reference.

By following these steps, you can successfully transfer a loan to another person while ensuring that all parties involved are legally protected and the process remains transparent. Understanding each stage helps avoid complications and ensures a smooth transition. When it comes to transferring a loan, the process isn't complete without the necessary documentation. Having the correct paperwork in place ensures that the loan transfer is legally binding and smooth.

Documentation Required for a Loan Transfer

When transferring a loan, proper documentation is essential to ensure that the process is legally recognized and that both parties are protected. The lender will typically require several documents to verify both the transfer and the eligibility of the person taking over the loan. Here's a look at the common documentation required for a smooth loan transfer:

1. Identity Proof of Both Parties:

- Both the original borrower and the new borrower will need to provide government-issued identity proofs (e.g., Aadhar card, passport, voter ID).

- This helps establish the identity of both parties involved in the transfer.

2. Address Proof:

- Recent address proof for both individuals may be required (e.g., utility bills, bank statements, rental agreement).

- This ensures that the new borrower can be contacted easily and that their residential details are verified.

3. Income Proof of the New Borrower:

- Lenders will want to assess the financial capability of the person taking over the loan.

- Common documents include salary slips, tax returns, bank statements, or proof of business income.

4. Loan Repayment History of the Original Borrower:

- Lenders may require proof of the original borrower's repayment history.

- This could include past loan statements, evidence of timely payments, or any arrears.

5. Loan Agreement and Terms:

- Both parties will need to review the original loan agreement to ensure that all terms can be legally transferred.

- It includes the loan balance, interest rates, tenure, and repayment terms.

6. Bank Details:

- Bank details for both parties, including the account number for the new borrower, are necessary for the payment transfer process.

- This is crucial for setting up automatic payments, if applicable.

7. NOC (No Objection Certificate) from the Lender:

- A No Objection Certificate (NOC) from the lender is essential for confirming that they approve of the loan transfer and that there are no outstanding issues.

- This document validates the lender’s consent for the transfer.

By providing the above documents, you ensure that both parties have the necessary legal backing for the loan transfer. Proper documentation guarantees that the lender can process the request efficiently, while protecting both parties from future disputes.

To ensure a smooth loan transfer process, it's crucial to be aware of the potential costs associated with the transaction.

Potential Fees and Charges Involved in Loan Transfer

While many lenders facilitate loan transfers, there can be fees associated with the procedure, which may vary depending on the lender and type of loan. Let’s explore the possible fees involved and how they can impact both the borrower and the new individual taking over the loan:

1. Processing Fee:

- Lenders often charge a processing fee for initiating the loan transfer, similar to how they charge for a new loan. This fee covers administrative costs and the processing of paperwork.

- The fee can vary depending on the lender and loan type, typically ranging from 1% to 3% of the loan amount.

2. Prepayment Penalty:

- If the original borrower decides to pay off the loan before transferring it, some lenders may charge a prepayment penalty.

- This is to compensate the lender for the interest lost due to early repayment, and the amount could be a percentage of the remaining loan balance.

3. Stamp Duty and Legal Fees:

- In some cases, transferring the loan may require legal documentation and formalities that are subject to stamp duty.

- Legal fees for drafting new contracts or agreements might also be charged, depending on the complexity of the loan transfer process.

4. Valuation Fees:

- For secured loans (e.g., home loans, car loans), a valuation of the collateral might be required to assess its current market value.

- The borrower typically bears the cost of the valuation, and it can vary depending on the property type.

5. Miscellaneous Charges:

- Additional charges might be applicable for credit checks, loan account closure, or any other administrative work related to the transfer.

- These fees are usually disclosed upfront by the lender and can range from nominal amounts to a few thousand rupees, depending on the loan amount and lender’s policy.

To ensure a smooth loan transfer process, it's crucial to be aware of the potential costs associated with the transaction.

Before transferring, check out Difference Between Private Finance and Personal Finance where we explain how fees and charges differ when it comes to personal versus private loan transfers.

Risks and Considerations Before Transferring a Loan

Before moving ahead with a loan transfer, it’s essential to evaluate the potential risks and ensure you're fully aware of the possible consequences. While transferring a loan can provide flexibility, it also comes with several factors that could impact both the borrower and the person assuming the loan. Let’s take a closer look at some of these important considerations:

1. Impact on Credit Score

Transferring a loan could affect both the original borrower’s and the new borrower’s credit scores. If the original borrower has missed payments, a low credit score, or poor repayment history, these factors might impact the person taking over the loan as well.

It’s vital to assess how this transfer might affect your creditworthiness in the long run, especially since the loan’s payment history will reflect on both parties.

2. Changes in Loan Terms

When transferring a loan, lenders may modify the terms. Changes could include adjustments to the interest rate, repayment period, or loan amount. These changes might affect the affordability or the flexibility of the loan for the new borrower. Before agreeing to the transfer, it’s important to review these terms carefully to ensure they align with your financial goals and capabilities.

3. Transfer Fees and Associated Costs

Loan transfers often come with processing fees, prepayment penalties, or legal fees. These costs can increase the overall cost of transferring the loan. Ensure you understand all applicable fees beforehand to determine if the transfer is financially viable.

4. Eligibility Requirements

The person taking over the loan must meet the lender's eligibility criteria, which may include a satisfactory credit score, sufficient income, and other financial requirements. If the new borrower doesn’t meet these criteria, the transfer may not be approved, potentially leaving both parties in a difficult situation.

5. Legal Implications

The loan transfer process can be legally complicated depending on the type of loan and the lender involved. Any legal disputes could arise if proper documentation or procedures aren’t followed. It’s crucial that both the original borrower and the new borrower fully understand the legal aspects of the loan transfer process to avoid future issues.

6. Financial Strain on the New Borrower

Taking out a loan is a serious commitment. If the new borrower faces financial difficulties after assuming the loan, it could lead to default, damaging their credit score or triggering legal actions. Ensure that the person taking over the loan is financially stable and able to meet the repayment terms without risking financial strain.

While transferring a loan to another person can be a viable solution in certain situations, it’s not always the best or only option available.

Facing challenges with your loan transfer process? Pocketly offers fast and easy loan solutions with no hassle. Get the financial support you need, whether you’re managing a loan transfer or handling other urgent financial needs.

Alternatives to Loan Transfer to Another Person

There are several alternatives you can consider, depending on your specific circumstances. Each of these alternatives comes with its own set of benefits and drawbacks, so it's crucial to carefully evaluate them before making a decision. Let’s explore some of the alternatives to transferring a loan:

- Refinancing Your Loan: Modify the terms of your loan (e.g., interest rate or repayment period) to better fit your current financial situation.

- Loan Restructuring: Negotiate with the lender to adjust the loan’s terms, like extending the repayment period or reducing the monthly EMI.

- Debt Consolidation: Combine multiple loans into one with a single interest rate, making it easier to manage and potentially reducing monthly payments.

- Loan Co-Signing: Add someone as a co-signer to take responsibility if you default, but still retain control of the loan.

- Personal Loan for the New Borrower: The person you want to transfer the loan to can apply for their own personal loan to settle the debt.

These alternatives can offer more flexibility and a simpler process than transferring a loan to another person, so be sure to evaluate which one works best for you.

If you’re exploring alternatives to loan transfer, Pocketly can provide a hassle-free financial solution for your immediate needs. Let’s look at how Pocketly can simplify your financial journey.

Pocketly: A Flexible Financial Solution

When you're facing financial pressure and can't rely on a loan transfer, Pocketly offers a convenient solution. Here's how Pocketly can help:

- Quick Loans with Minimal Documentation: Get access to instant loans with basic documentation, including KYC details, making the process swift and easy.

- Flexible Repayment Options: Select repayment terms that suit your financial situation, ensuring you don’t feel burdened.

- Competitive Interest Rates: Pocketly offers loans at interest rates that are easy to manage, without the heavy financial strain of traditional loans.

- No Collateral Required: Unlike many financial solutions, Pocketly doesn’t require collateral, making it more accessible for salaried individuals or anyone in need of quick funds.

- Loan Amounts from ₹1,000 to ₹25,000: Whether you need a small or larger amount, Pocketly provides the flexibility to meet your financial needs without complicated procedures.

Pocketly ensures that you don't have to rely on complex loan transfers, with a straightforward process that works in your favor. Contact us today to access quick funds with ease.

Conclusion

Transferring a loan to another person may seem like an ideal solution to alleviate your financial burden, but it's essential to carefully consider the process, requirements, and potential risks before proceeding. Understanding the eligibility, documentation, and possible alternatives ensures that you're making an informed decision that aligns with your needs.

However, if you're looking for a quick and flexible solution without the complexity of a loan transfer, Pocketly offers an excellent alternative. Whether you need emergency funds, manage unexpected expenses, or are simply seeking financial support, Pocketly provides an easy and accessible way to secure the funds you need without lengthy approval processes.

Download the Pocketly app today on Android or iOS and take control of your financial future, hassle-free.

FAQs

Can I transfer my loan balance to another person?

Yes, you can transfer a loan balance to another person if the lender allows it. This process usually requires the new borrower to meet certain eligibility criteria.

What types of loans can be transferred?

Common loans eligible for transfer include personal loans, home loans, and car loans. However, the specific eligibility may vary depending on the lender.

How long does it take to transfer a loan?

The loan transfer process can take anywhere from a few days to a few weeks, depending on the lender's internal policies and the documentation involved.

Are there any fees associated with loan transfers?

Yes, there may be processing fees and charges involved in transferring a loan to another person. Always confirm the charges with your lender before proceeding.

What if the loan transfer is denied?

If the loan transfer is not approved, you may need to explore alternatives like refinancing or taking out a new loan to settle the current one.