Building a strong credit score opens doors to better financial opportunities, such as lower interest rates on loans, higher credit limits, and loan approvals for mortgages and car loans. But do secured cards build credit scores? The answer is yes! With just a small deposit, a secured credit card allows you to start improving your creditworthiness by demonstrating responsible borrowing habits.

This type of card helps you build credit without needing a perfect credit history, and over time, making timely payments will gradually boost your score.

In this blog, you'll gain insight into the benefits of secured credit cards, learn how to use them to build your credit, explore other methods to improve your score, and more.

Key Takeaways

- Secured Cards Build Credit: Secured credit cards help establish or rebuild credit by reporting payments to major credit bureaus, benefiting both newcomers and those with poor credit.

- Responsible Use is Key: To maximize credit-building, maintain low utilization (under 30%), make timely payments, and track your progress regularly through credit monitoring.

- Immediate Financial Flexibility: Secured cards provide a safe and flexible way to manage finances, but they require an upfront deposit and come with higher interest rates compared to unsecured cards.

- Alternative Credit-Building Methods: Besides secured cards, becoming an authorized user, and using credit builder loans can also help improve your credit.

- Potential for Upgrade: After consistent responsible use, many secured cards can give you a smooth transition to unsecured cards, increasing your credit limit without additional deposits.

What are Secured Credit Cards?

It is a type of credit card that requires a deposit. The deposit acts as collateral, which means if you don’t pay your bill, the lender can use that deposit to cover the balance.

The credit limit on a secured card is equal to the amount of your deposit, meaning if you deposit ₹10,000, your credit limit will be ₹10,000. It works like a regular credit card, where you can make purchases and pay off the balance over time.

The best part is that you don’t need a strong credit history to qualify. You can build your score by showing responsible behavior and gradually improving your score.

What are the Key Benefits of Secured Credit Cards?

Secured credit cards are a great way to rebuild your credit history. Not just that, but it also enhances security, offers easier access, and has practical financial features. Here’s a closer look at the advantages they offer:

Credit Building & Improvement

They help establish credit history for those new to credit or without a credit score. And for those with poor credit, secured cards will improve your financial standing through responsible use. In addition to reporting payment activity to major credit bureaus, it can also enhance credit scores.

Easy Access & Approval

Secured cards are easier to qualify for compared to unsecured cards, even for individuals with limited or poor credit history. The application process is simplified requiring minimal documentation, such as details of a Fixed Deposit. There’s no need for income proof, and many cards offer quick approval due to the collateral backing.

Financial Features & Security

Secured cards provide better protection than cash or debit cards against theft or unauthorised transactions. They also offer an interest-free period of up to 45-50 days on purchases. Additionally, the Fixed Deposit earns interest while the card is used, giving dual financial benefits.

Other Advantages

Secured cards offer a credit limit of 75 - 85% of the Fixed Deposit amount. Many have low or no annual fees, and some offer additional perks like rewards, cashback, fuel surcharge waivers, and lounge access. Larger purchases can often be converted into easy credit card EMI.

Success with secured credit cards isn't automatic; it requires a strategic approach. Following a structured plan can speed up your progress and maximize your credit score improvement.

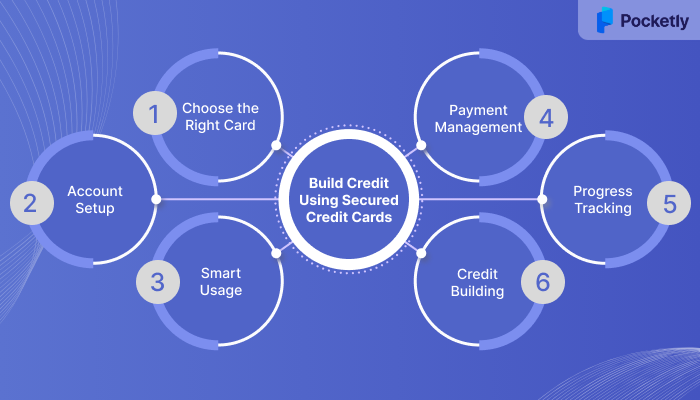

How to Build Credit Using Secured Credit Cards

A secured credit card is a strategic process that requires discipline and understanding of key credit principles. Here's a step-by-step approach to maximise your credit-building potential:

Step 1: Choose the Right Card: When selecting a secured credit card, it’s crucial to pick one that reports your payment activity to 3 credit bureaus like Experian, TransUnion, and Equifax. After 6 - 12 months, some cards can also be converted to unsecured, making them ideal for credit growth.

Step 2: Set Up Your Account Properly: Once you’ve selected your card, make your security deposit, which usually sets your credit limit. Starting with a deposit of at least ₹25,000. After activating your card, set up online banking for easy tracking and set up alerts to stay on top of payment dates.

Step 3: Establish Smart Usage Patterns: Use your secured card regularly, as inactivity doesn’t contribute to building your credit history. To optimize your credit score, keep your credit utilization below 30% of your limit, ideally under 10%. For example, if your limit is ₹50,000, try to keep your balance below ₹5,000.

Step 4: Master Payment Management: Timely payments account for 35% of your credit score. Always aim to pay off the full balance to avoid interest charges, and if you can’t, pay more than the minimum at least. Make payments before the statement’s closing date or multiple payments throughout the month to retain near-zero balances.

Step 5: Monitor and Track Progress: Free credit monitoring services can help you spot any changes, and you can expect to see improvements within 2-3 months of responsible usage. Always review your statements for accuracy, keep an eye on your credit utilization ratio, and monitor interest earned on your fixed deposit.

Step 6: Long-Term Credit Building: Even after improving your credit score, continue using your card responsibly. Gradually increase your credit limits through additional deposits if needed, and diversify your credit mix over time with different types of accounts. Never close your oldest accounts, as they positively impact your credit age.

Secured credit cards are highly effective, but they're not the only path to building credit. There are other complementary approaches that can work alongside.

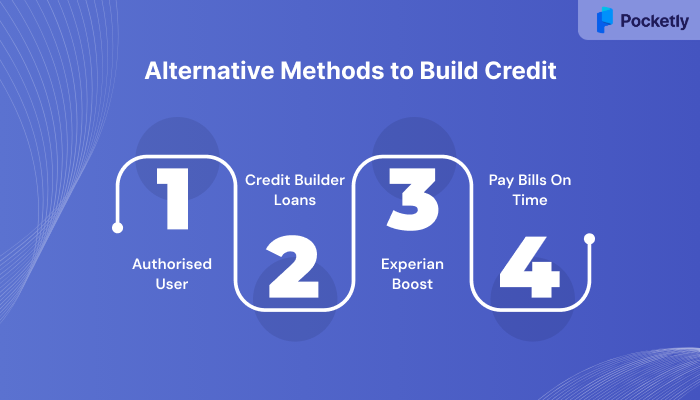

Alternative Methods to Build Credit

Building a credit score is quintessential for accessing better financial opportunities, and these alternative methods provide accessible ways to improve your credit.

- Authorised User: Get added as an add-on user on a family member's card to benefit from their positive credit history.

- Credit Builder Loans: These small loans, reported to credit bureaus, help establish a credit history through timely repayments.

- Experian Boost: Add on-time utility and phone bill payments to your credit report, thereby increasing your score.

- Pay Bills On Time: Timely payments for rent, utilities, and subscriptions can improve your credit if reported to the bureaus.

Secured credit cards, despite their many advantages, do come with certain limitations that could impact your financial strategy.

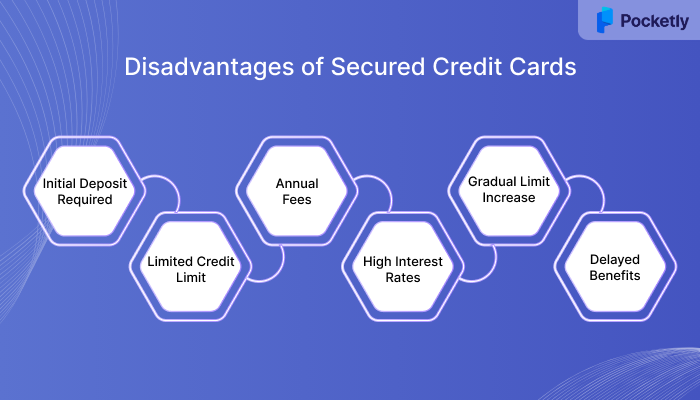

Disadvantages of Secured Credit Cards

While secured credit cards offer a way to build credit, they come with certain drawbacks. Let’s take a look:

- Initial Deposit Required: Secured credit cards require an upfront deposit, which can tie up your savings until you upgrade to an unsecured card.

- Limited Credit Limit: Your credit limit is tied to the deposit amount, which may not provide enough flexibility for larger purchases.

- Annual Fees: Some secured credit cards charge heavy annual fees, which further add to the overall cost of using the card.

- High Interest Rates: Secured credit cards have higher interest rates compared to unsecured cards, making it expensive if you carry a balance.

- Slow Credit Limit Increase: While some cards allow you to increase your limit, it takes time and responsible use before you can access higher credit limits.

- No Immediate Access to Unsecured Benefits: Although many issuers offer a path to unsecured cards, it takes several months of responsible use to qualify for the upgrade.

Sometimes you need additional financial flexibility while working on your credit score, especially when unexpected expenses arise. This is where financial tools become invaluable in supporting your overall financial health.

How Pocketly Can Help You Manage Finances While Building Your Credit

Maintaining good credit can be challenging, especially for students managing limited resources. While secured credit cards are one way to boost your credit, they may not always be accessible or flexible for everyone. This is where Pocketly comes in, offering instant loans to manage unexpected expenses.

- Offers loans ranging from ₹1,000 to ₹25,000, providing flexible options for various financial needs.

- Enjoy a hassle-free application process with a 2-click sign-up and no complex documentation.

- Get approval for your loan in minutes, ensuring quick access to funds for urgent needs.

- Affordable interest rates from 2% per month make it a cost-effective solution.

- Choose a loan repayment plan as per your financial situation, with terms designed to be manageable and stress-free.

- The processing fee ranges from 1% to 8%, keeping the cost of borrowing transparent and low.

- Pocketly’s loans are unsecured, so there’s no need to risk personal assets when borrowing.

Conclusion

Secured credit cards can be a powerful for building or rebuilding your credit score, especially for those new to credit or looking to improve their financial standing. If you understand how they work and use them responsibly, you can establish a solid credit history, manage your finances better, and eventually move on to unsecured credit cards.

Download Pocketly today on Android or iOS and experience financial solutions at your fingertips.

FAQ’s

1. Will a secured credit card improve my credit score?

The increase in your credit score from using a secured credit card can vary. With responsible usage, some people may see their score rise by up to 100 points in a few months.

2. What is the fastest way to build credit?

The fastest way is to be consistent, make on-time payments, and keep your credit utilization under 30%. Becoming an authorised user or being an add-on in someone else's account, and regularly checking your credit report for errors, also help build credit quickly.

3. How long should I keep my secured card?

You should keep your secured card open as long as possible, even after improving your credit score. This helps maintain a longer credit history, which is beneficial for your overall credit score.

4. Which bank-secured credit card is best?

The best secured credit card depends on your needs. Cards like SBI and Kotak offer cashback rewards and opportunities for upgrades, while others are known for their ease of use and potential for credit limit increases. Choose based on your financial goals and preferences.

5. Does a secured credit card increase CIBIL?

Yes, a secured card increases your CIBIL score with timely payments and low credit utilization. Your responsible use of the card will be reported to CIBIL and contribute to a better credit score over time.