Running a business often means facing unexpected financial challenges, like covering payroll, buying inventory, or handling emergency expenses. Have you ever found yourself struggling to secure quick funding when cash flow is tight? This is where short-term business loans provide a much-needed solution.

With repayment terms ranging from 3 months to 3 years, these loans can bridge the gap and keep your operations running smoothly. While the wide range of options can feel overwhelming, understanding the core essentials can make the process more manageable.

In this article, we’ll break down the key features, types, and interest rates of short-term loans, and guide you through the eligibility and application process, so you can make informed borrowing decisions when you need them most.

Key Takeaways

- With repayment periods ranging from 3 months to 3 years, these loans help businesses address immediate financial needs without long-term commitments.

- Rates typically range from 2% to 3% per month for unsecured loans, with secured loans offering lower rates due to collateral.

- Businesses can choose from term loans, lines of credit, invoice financing, merchant cash advances, and microloans, each catering to specific needs like cash flow management or inventory purchases.

- A good credit score, stable income, and a few years of business history are generally required to qualify for short-term loans.

- Many short-term loans, especially digital ones, have simplified applications with minimal documentation, making access to funds faster and easier for businesses in need.

What is a Short-Term Business Loan?

A short-term business loan is a type of financing designed to help businesses address immediate financial needs, such as covering operational costs, inventory purchases, or payroll, and to manage cash flow fluctuations.

These loans are offered with repayment periods ranging from 3 months to 3 years, providing quick access to funds without long-term financial commitment. Short-term loans are ideal for businesses that need fast, flexible solutions to keep operations running smoothly during times of financial strain or unpredictability.

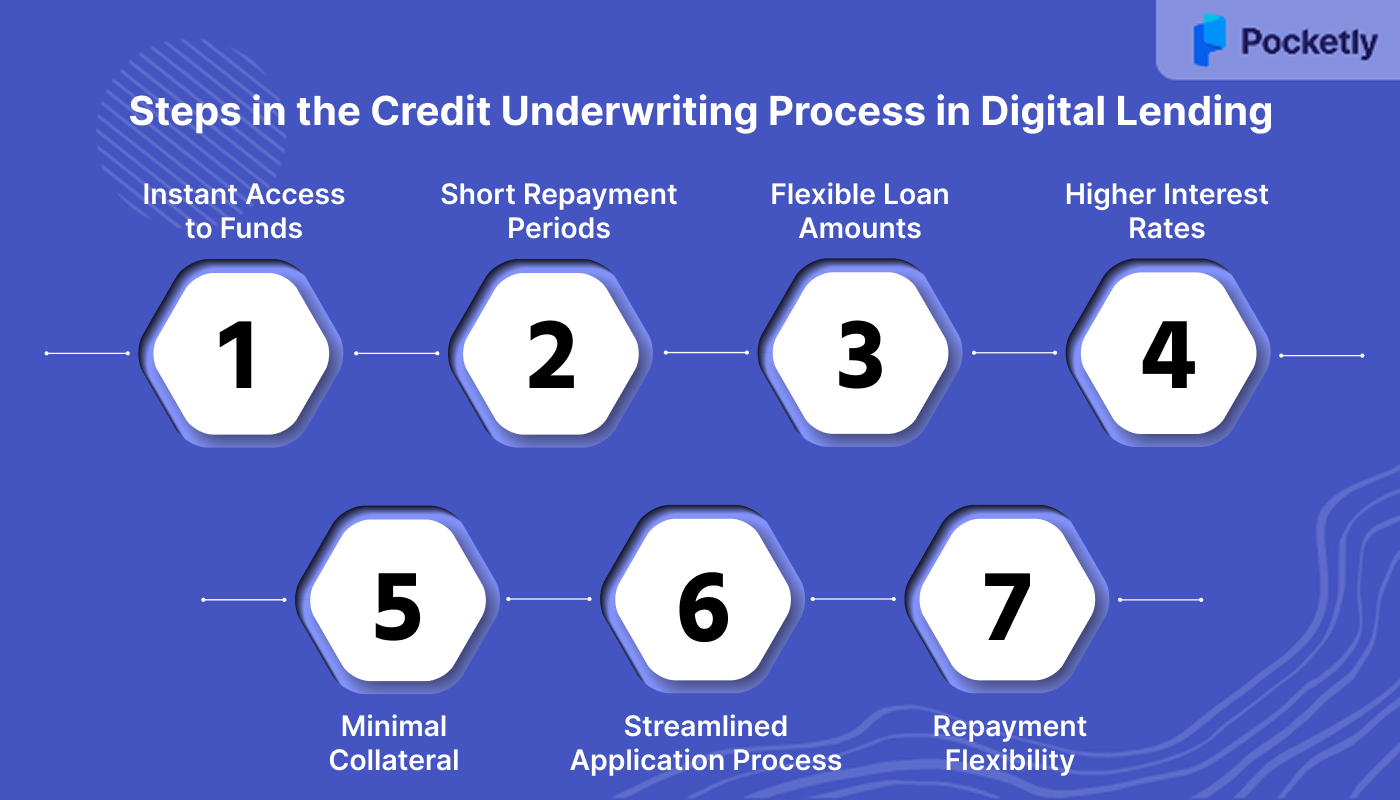

What are the Key Features of Short-Term Business Loans?

Short-term business loans come with several key features that make them a flexible and accessible financing option for businesses needing quick financial relief. Here are the main features:

- Instant Access to Funds: Short-term loans are designed for fast approval and disbursement, allowing businesses to get the capital they need in a matter of days or weeks.

- Short Repayment Periods: Typically ranging from 3 months to 3 years, short-term loans offer a relatively short repayment window, making them ideal for covering immediate, time-sensitive expenses.

- Flexible Loan Amounts: Depending on the lender and the business’s financial health, businesses can access loans ranging from small amounts to larger sums, often between ₹10,000 and ₹50 lakhs or more.

- Higher Interest Rates: While short-term loans provide quick access to capital, they tend to have higher interest rates than long-term loans, reflecting the speed of approval and the shorter repayment period.

- Minimal Collateral: Many short-term loans require little to no collateral, making them accessible even for businesses with limited assets. However, some lenders may ask for a personal guarantee or a lien on business assets.

- Streamlined Application Process: The application process is generally simpler and quicker compared to traditional loans. Businesses usually need to provide basic financial information and documentation, often without extensive paperwork.

- Repayment Flexibility: Short-term loans may offer flexible repayment structures, such as daily, weekly, or monthly payments, depending on the lender and the business's cash flow cycles.

These features make short-term loans a valuable option for businesses looking to address immediate needs without committing to long-term debt.

One such instant, short-term loan provider is Pocketly, a digital lending platform that makes quick financial relief more accessible than ever. With interest rates starting at just 2% per month, you can manage immediate expenses, have minimal KYC requirements, and receive instant personal loan disbursement.

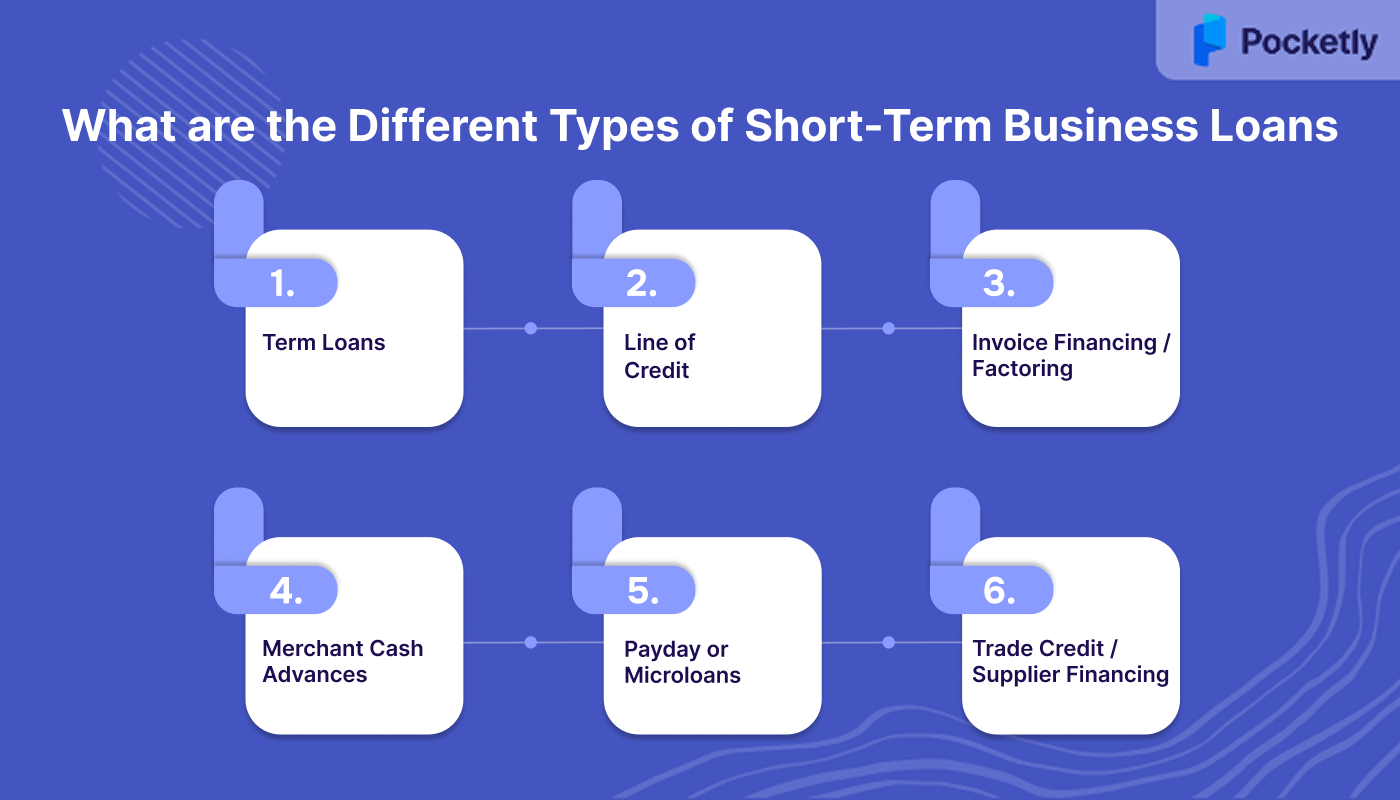

What are the Different Types of Short-Term Business Loans

Short-term business loans come in several forms to address specific financial needs. Term loans and microloans provide quick funds for urgent expenses, while others offer flexible access to capital for managing cash flow fluctuations. Depending on your needs, there are several types available:

Term Loans

Term loans are traditional short-term loans where a lender provides a fixed sum upfront, which is repaid over a short duration, typically 3 months to 3 years, along with interest. They can be secured, backed by collateral, or unsecured, depending on the lender and the business’s financial profile.

Use case: Covering urgent operational expenses or seasonal inventory purchases.

Line of Credit (LOC)

A line of credit gives businesses flexible access to funds up to a pre-approved limit. Unlike a fixed-term loan, you only pay interest on the amount you withdraw, not the entire credit limit. This flexibility makes LOCs ideal for managing temporary cash flow shortages, covering unexpected expenses, or bridging gaps between receivables and payables.

Use case: Handling fluctuating operational costs or bridging delayed receivables.

Invoice Financing / Factoring

Invoice financing, often called factoring, allows businesses to borrow against their unpaid invoices. A lender provides an advance, usually 70–90% of the invoice value, giving immediate liquidity. Once the customer pays the invoice, the lender collects the payment and releases the remaining balance, minus fees.

Use case: Businesses with slow-paying clients can maintain liquidity.

Merchant Cash Advances (MCA)

Merchant Cash Advances provide an upfront cash sum to businesses in exchange for a percentage of future credit card or debit card sales. Repayment is tied directly to daily sales, meaning the amount deducted varies with business performance. While convenient and quick, MCAs often carry higher costs compared to traditional loans due to the short-term risk assumed by the lender.

Use case: Retail or e-commerce businesses with steady card transactions needing immediate capital.

Payday or Microloans

Payday or microloans are small, short-duration loans typically ranging from ₹10,000 to ₹1 lakh in India. They are designed to address urgent and unforeseen expenses, such as emergency repairs, vendor payments, or bridging small cash flow gaps. These loans are quick to process, often fully digital, and require minimal documentation. While they provide immediate relief, interest rates tend to be higher, reflecting the ease and speed of access.

Use case: Covering emergency operational costs or sudden vendor payments.

Trade Credit / Supplier Financing

Trade credit or supplier financing is an arrangement where suppliers allow businesses to purchase goods or services on deferred payment terms. While not a traditional bank loan, it functions like short-term financing by easing immediate cash outflows. This type of credit is beneficial for inventory purchases, allowing businesses to pay suppliers after a set period, typically 30, 60, or 90 days, while maintaining smooth operations.

Use case: Purchasing inventory or raw materials without incurring an immediate cash outflow.

Understanding these loan types helps you identify the right financing tool, but the real impact on your business comes down to costs and repayment terms. Interest rates and tenure directly affect your monthly cash flow and total repayment burden.

What are the Interest Rates and Tenure of Short-Term Business Loans?

Interest rates are the primary cost of a business loan and should be carefully assessed by any borrower. Secured business or SME loans carry annual interest rates between 10% and 30%, as they are backed by collateral. Unsecured micro-business loans, on the other hand, are considered higher risk and have interest rates ranging from 12% to 42% per year.

The rate a lender offers depends on several factors, including the business type, loan amount, creditworthiness, and income consistency. Choosing the lowest eligible rate is essential for minimizing repayment costs and easing the financial burden.

| Loan Type | Interest Rate | Tenure | Key Features |

| Secured Term Loans | 10.75% – 22.50% p.a. | 12–60 months | Requires collateral; lower rates due to reduced lender risk; suitable for capital expenditures or expansion. |

| Unsecured Term Loans | 13.00% – 28.00% p.a. | 12–36 months | No collateral needed; higher rates reflect increased risk; ideal for working capital or short-term needs. |

When considering a short-term business loan, you have to evaluate not only the interest rates and tenure but also the additional charges that may apply.

| Charge Type | Description | Amount |

| Processing Fee | One-time fee charged for loan processing | Up to 3% of the loan amount |

| Prepayment Charges | Fee for prepaying the loan before the scheduled tenure | 2-5% of the outstanding amount |

| Late Payment Charges | Penalty for delayed EMI payments | 2-5% of the EMI amount |

| Documentation Charges | Fee for legal and documentation work | Varies by lender |

Also Read: What is an Unsecured Installment Loan and How It Works

Knowing the costs involved helps you budget effectively, but securing these favorable rates requires proper preparation and documentation. Lenders need comprehensive information about your business to assess risk and determine loan terms.

What are the Documents Required for Short-Term Business Loans?

To apply for a short-term business loan, you’ll typically need to submit the following documents:

- Certificate of incorporation, partnership deed, or proprietorship registration to confirm the legal existence of your business.

- A document outlining your objectives, financial projections, market analysis, and repayment strategy to demonstrate business stability.

- Identity and address proofs (e.g., Aadhaar, PAN, passport, voter ID, or license) for all business owners.

- Past years' profit and loss statements, balance sheets, and cash flow reports to show the business’s financial health.

- Recent bank statements (usually 6–12 months) to verify the business’s cash flow.

- GST registration details and returns for the relevant periods to ensure tax compliance.

- Ownership deed or lease agreement to verify the location of your business.

- Documentation of the assets or property offered as collateral if applying for a secured loan.

- Industry-specific permits and licenses are required by law.

- Details of any existing loans or debts to assess repayment capability.

- Future revenue, expense, and cash flow estimates to show how the loan will impact your business.

- References or testimonials to vouch for your business’s credibility and reputation.

Now that your documents are ready, meeting the fundamental eligibility requirements determines whether you can access these loans in the first place. Lenders evaluate multiple aspects of your business and personal financial profile to gauge repayment capability.

Eligibility Criteria for Short-Term Business Loans

Securing a short-term business loan in India involves meeting specific eligibility criteria set by financial institutions. While these criteria can vary slightly across lenders, the following are commonly required:

- Applicant Type: Self-employed individuals, sole proprietors, partnerships, private limited companies, and limited liability partnerships (LLPs) are eligible to apply.

- Age: Applicants should typically be between 23 and 65 years of age at the time of loan application. Some lenders may extend this range up to 80 years, considering the loan tenure.

- Nationality: Only Indian citizens or residents are eligible for business loans.

- Business Vintage: A minimum of 1 to 3 years of continuous business operations is generally required.

- Annual Income: A minimum annual income or turnover is often stipulated, varying by lender. For instance, HDFC Bank requires a minimum annual income of ₹1.5 lakh, while IDFC FIRST Bank expects a turnover of ₹1 crore or more.

- Profitability: The business should have demonstrated financial stability by being profitable over the last two years.

- Credit Score: A good credit score is crucial. Lenders often require a CIBIL score of 685 or higher, with some institutions like Bajaj Finserv preferring scores above 720 for higher loan amounts.

- Existing Liabilities: Lenders assess the applicant's existing debt obligations to ensure they can handle additional repayment commitments.

- Banking Relationship: A positive banking relationship, demonstrated through consistent transactions and good account conduct, can enhance eligibility.

While meeting eligibility requirements opens the door to loan approval, each step in the loan journey presents opportunities to strengthen your application and avoid common pitfalls that delay funding. A well-executed application process can mean the difference between quick approval and prolonged waiting periods when cash flow is critical.

Steps to Avail a Short-Term Business Loan

To avail a short-term business loan in India, follow these structured steps to ensure a smooth application and approval process:

Step 1: Assess Your Financial Needs

Start by defining the specific purpose of the loan, whether it’s for working capital, inventory, equipment, or business expansion. Calculate the exact amount required and determine a feasible repayment plan. This will help you understand the loan type and lender options you should consider.

Step 2: Check Eligibility and Gather Documents

Before applying, ensure that your business meets the lender's eligibility criteria, such as minimum business vintage and credit score. Prepare the necessary documentation, including KYC documents and business proof. Some lenders may also require collateral documents if you’re applying for a secured loan.

Step 3: Choose the Right Loan Type

Based on your financial needs, select the loan type that best fits your situation. You may consider term loans, lines of credit, invoice financing, merchant cash advances, or microloans. Each has different features, loan repayment modes, and suitability for various business needs.

Step 4: Research Lenders and Compare Options

Explore different lenders, banks, non-banking financial companies (NBFCs), and digital lenders like Pocketly. Compare their interest rates, loan amounts, repayment tenures, and processing fees to find the most suitable option for your business.

Step 5: Submit Your Loan Application

Once you’ve chosen a lender, apply for the loan either online or at a branch. Fill out the application form, submit your documents, and specify the loan amount and purpose. Many digital lenders allow you to complete the entire process online for convenience.

Step 6: Wait for Approval and Disbursal

After submission, the lender will verify your application and assess your creditworthiness. If approved, you will be notified of the loan terms. Once approved, the loan amount is typically disbursed to your bank account.

Step 7: Utilize Funds Responsibly

Use the loan amount as planned to ensure business growth. Timely use of funds for the right purposes increases your chances of future loan approvals and helps you stay on track with your financial goals.

Step 8: Repay the Loan on Time

Adhere to the agreed repayment schedule. Make regular payments to avoid penalties and maintain a good credit record, which will be beneficial for securing future loans.

Following these steps positions you for successful loan acquisition, but choosing the right lending partner can make the entire experience smoother and more cost-effective. Digital lending platforms like Pocketly have transformed the traditional loan system by eliminating delays and offering transparent, technology-driven solutions.

Pocketly: Your Trusted Digital Lending Partner for Quick, Flexible Short-Term Loans

Pocketly provides a seamless and efficient solution for individuals and businesses who want to have quick access to capital for the smooth running of operations. Whether you're looking for a salaried loan, a loan for the self-employed, or running a small business, Pocketly offers flexible loan options designed to meet your immediate financial needs with minimal hassle.

Key Features:

- Loan Amount: Borrow anywhere between ₹1,000 and ₹25,000 based on your needs.

- Interest Rate: Starting at just 2% per month, ensuring affordable repayments.

- Processing Fees: Transparent fee structure ranging from 1% to 8%, with no hidden charges.

- Flexible Loan Amount: Tailored to your financial needs, whether it’s for personal expenses, emergencies, or business requirements.

- Minimal KYC: Simple KYC process with minimal documentation required to save you time.

- 2-Click Sign-Up: Quick and easy application with a two-click sign-up process that saves you time and effort.

Conclusion

In summary, short-term business loans provide quick financial relief for businesses facing unexpected expenses, cash flow challenges, or urgent operational costs. With various loan types and flexible options available, these loans allow businesses to maintain smooth operations without long-term commitments. Understanding the features, interest rates, tenures, and eligibility criteria helps businesses make informed decisions and secure the right financing.

Pocketly offers a simple, fast, and flexible solution for businesses and individuals in need of personal loans. With minimal KYC, loans starting at just 2% per month, and a two-click sign-up process, it’s your go-to platform for instant financial relief. Download now on iOS or Android to get started today!

FAQs

1. What are the benefits of having a shorter-term loan?

Short-term loans provide quick access to capital with a faster repayment cycle, helping businesses manage immediate financial needs without long-term debt. They also allow businesses to maintain more flexible cash flow and reduce overall interest payments due to the shorter tenure.

2. Can I get a 0% interest loan?

While 0% interest loans are rare, some lenders offer promotional or introductory 0% interest rates for specific loan products. However, such offers usually come with conditions like a short repayment period or higher fees that may offset the benefit of 0% interest.

3. How many months is a short-term loan?

Short-term loans typically range from 3 months to 3 years. The exact tenure depends on the loan type, lender, and your repayment ability, with most loans falling between 6 and 18 months for quicker repayment.

4. How are short-term loans calculated?

Short-term loans are calculated based on the loan amount, interest rate, and repayment tenure. Lenders determine the monthly EMI by factoring in the interest rate applied to the principal amount, with the repayment period affecting the EMI size.

5. What are the two most common types of interest?

The two most common types of interest are simple interest, which is calculated only on the principal amount, and compound interest, which is calculated on both the principal and the accumulated interest.