An unsecured installment loan is a practical financial option designed to help you manage unexpected expenses or reach personal goals. If you're a young professional, student, or self-employed individual, you can access funds quickly without needing collateral.

Whether you're dealing with month-end expenses, paying for education, or bridging a cash flow gap, unsecured installment loans offer an easy way to borrow money. With fixed monthly payments, you can plan your finances better, ensuring you stay on track without the stress of large, lump-sum repayments.

In this blog, we’ll explain what an unsecured installment loan is, the benefits they offer, and how you can make the most of them to handle your financial needs.

Key Takeaways

- No Collateral Needed: Unsecured installment loans don’t require assets like property or cars, making them accessible to those without collateral.

- Fixed Repayment Schedule: These loans offer predictable monthly payments, helping you manage your finances with clarity and ease.

- Loan Amounts and Terms Vary: It can range from ₹1,000 - ₹25,000, with repayment periods from 12 to 84 months, depending on the lender and your profile.

- Interest Rates Based on Credit: Your credit score plays a vital role in your interest rate. The higher your score, the better rates and lower borrowing costs.

- Quick Approval Process: The application process is typically fast, with minimal documentation, making it ideal for urgent financial needs.

What is an Unsecured Installment Loan?

This type of loan doesn’t require you to put up any assets, like your car or house, as collateral. Instead, the lender trusts you to repay the loan based on your creditworthiness. An unsecured loan is paid in fixed monthly payments, known as installments, over a set period.

How Does an Unsecured Installment Loan Work?

The unsecured installment loan is basically receiving the full loan amount upfront, for personal needs, or covering unexpected expenses, and others.

Once the full loan amount is received, you repay it through fixed monthly payments (EMIs) over a set period, ranging from 12 to 84 months. Each installment includes portions of both the loan principal and the interest accrued. Your credit score can impact the interest you are offered. If you have a higher score, you may qualify for lower interest rates, while lower scores could lead to higher rates.

This makes the loan predictable, with a clear repayment schedule. The loan is considered closed-end credit, meaning the loan account is fully closed once repaid, and cannot be reused like revolving credit, such as credit cards. This fixed structure helps borrowers manage their finances with clear terms and steady payments.

Also Read: Differences and Advantages of Installment Credit

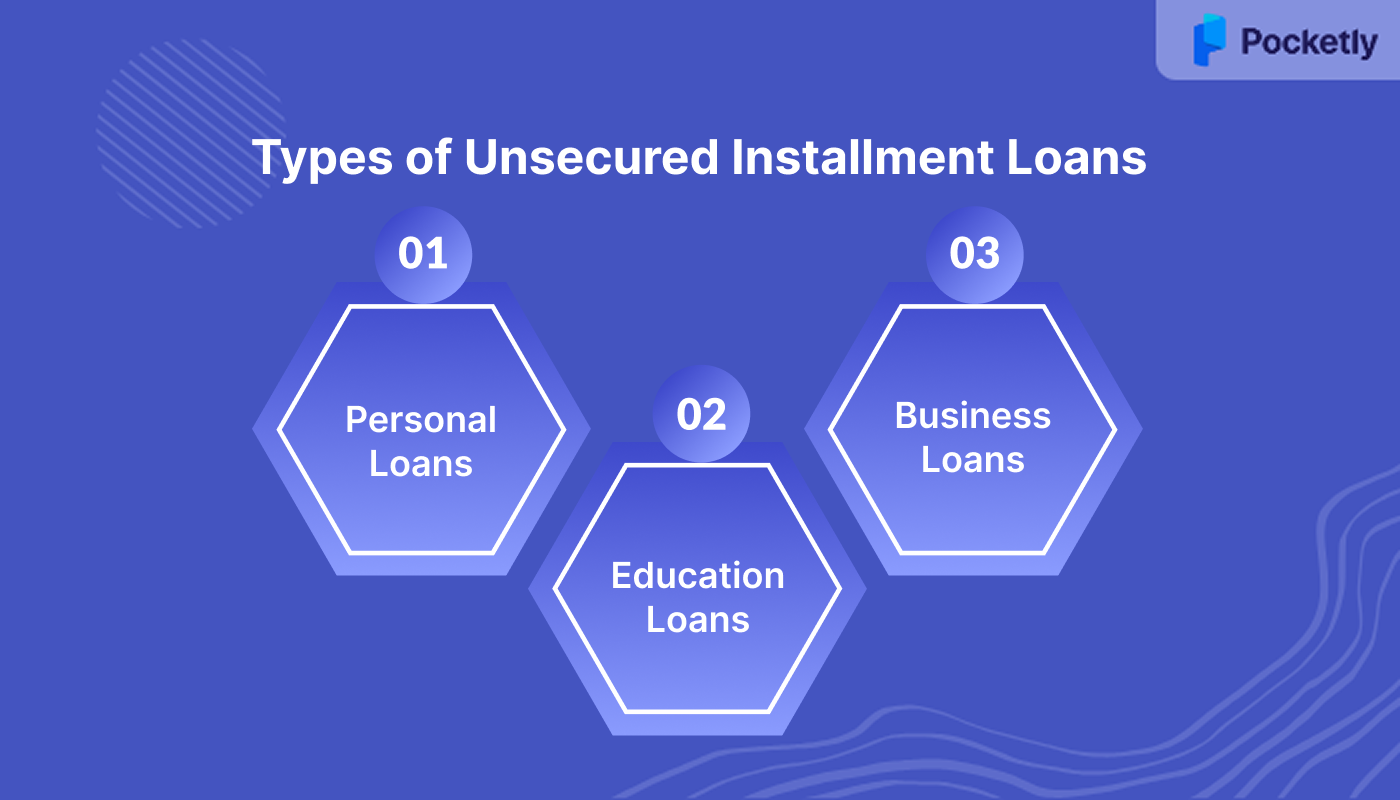

Different Types of Unsecured Installment Loans

Unsecured installment loans come in various forms, each designed for specific financial needs. Here's a brief look at the types of unsecured installment loans available.

Personal Loans

Personal loans offer flexible borrowing options for various purposes, including debt consolidation, home improvement, or emergency expenses. With no collateral required, they provide an easy and predictable way to access funds.

- Loan Amounts: Range from ₹40,000 to ₹55 lakhs, depending on the lender and borrower profile.

- Repayment Terms: Fixed monthly payments with tenures from 12 to 96 months.

- Interest Rates: Usually range from 10.5% to 20%, based on creditworthiness.

Education Loans

Education loans provide funds for higher education, covering tuition fees, living expenses, and other study-related costs. These loans offer repayment options and are ideal for students looking to pursue education both in India and abroad.

- Loan Amounts: Up to ₹1 crore, covering tuition fees, living expenses, and study-related costs.

- Moratorium Period: No repayments during the course period, with grace periods for job search after course completion.

- Interest Rates: Unsecured loans starting from 11.25% annually.

Business Loans

Unsecured business loans are for small and medium-sized businesses with working capital, equipment purchases, or business expansion. With flexible repayment modes and no collateral, these loans help entrepreneurs access the funds needed to grow their businesses and manage day-to-day operations without risking personal assets.

- Loan Types: Includes working capital loans, equipment financing, and MSME loans.

- Repayment Terms: Loans are typically repaid within 12 to 96 months.

- Interest Rates: Starting at 13.5%, based on business stability and credit history.

While these loan options cater to a range of needs, accessing them isn't automatic. Lenders have established specific criteria that borrowers must meet to qualify for unsecured loans.

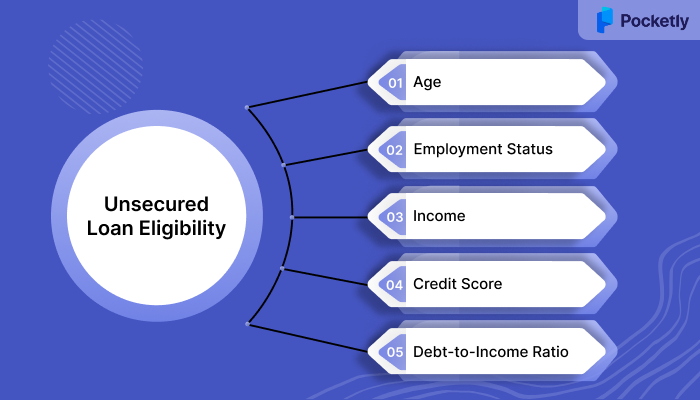

Eligibility for an Unsecured Installment Loan

To qualify for an unsecured installment loan, lenders require some criteria to be met, such as age, employment status, income, and credit score. The following outlines the key factors that influence your eligibility.

1. Age: Applicants are generally expected to be between 21 and 60 years old. Some lenders may allow applications from individuals up to 65 years of age at the time the loan is fully repaid.

2. Employment Status: Both salaried and self-employed are eligible to apply. Salaried applicants typically need at least two years of job experience, while self-employed individuals must have been in business for a minimum of three years.

3. Income: A reliable and sufficient income is necessary. Many lenders, for example, require salaried applicants to earn a minimum income per month to be considered for a loan.

4. Credit Score: A higher credit score improves your chances of approval. While the exact requirements vary by lender, a FICO credit score of 600+ is considered ideal for securing favourable loan terms.

5. Debt-to-Income Ratio: Lenders often assess your debt-to-income (DTI) ratio, which is the percentage of your income that goes toward servicing existing debt. A lower DTI ratio <40% improves your chances of loan approval.

Pocketly offers a hassle-free application process with no collateral required, making it an ideal choice for young professionals, students, and self-employed individuals. With flexible personal loans, quick approval, and competitive interest rates at just 2% per month, Pocketly gives access to funds with minimal paperwork and terms.

What is the Application Process for an Unsecured Installment Loan?

Applying for an unsecured installment loan involves simple steps. Here's a general guide to help you through the process:

Step 1: Determine Loan Amount and Purpose

Assess your financial requirements and decide how much money you need to borrow. Common reasons include consolidating debt, covering unexpected expenses, or making a large purchase. Understanding the loan purpose helps you select the right loan terms.

Step 2: Check Eligibility

Review the eligibility requirements of the lender, like age, employment status, and debt-to-income ratio.

Step 3: Choose a Lender

Research different lending institutions, such as banks, credit unions, or online lenders, to compare loan terms, interest rates, and fees. Make sure the lender offers unsecured installment loans and check their reputation for customer service.

Step 4: Fill Out the Application

Complete the application, either online or in person, with your personal and financial details. You'll need to provide personal information, employment details, monthly income, and expenses.

Step 5: Submit Required Documents

Provide the necessary documents for verification, including Proof of identity (e.g., Aadhaar card, PAN card), Proof of address (e.g., utility bill, passport) , and Income proof (e.g., payslips, bank statements).

Step 6: Wait for Approval

The lending institution or bank will assess your application and creditworthiness, usually through a soft or hard credit check. Some lenders may offer instant approval or a decision within a few days, depending on the application process.

Step 7: Review Loan Offer

Once the loan is approved, the lending institution will present you with the loan terms, the repayment period, the interest rate, and the monthly installment amounts. Review the terms carefully.

Step 8: Sign the Agreement

Once you're satisfied with the loan offer, accept the terms and sign the agreement. Before signing, understand the repayment and any additional fees. Once the agreement is signed, the loan will be disbursed to your bank account, and you’ll begin repaying the loan through fixed monthly installments.

The application process may seem routine, but rushing through it without proper consideration can lead to financial strain later. Take time to evaluate factors beforehand.

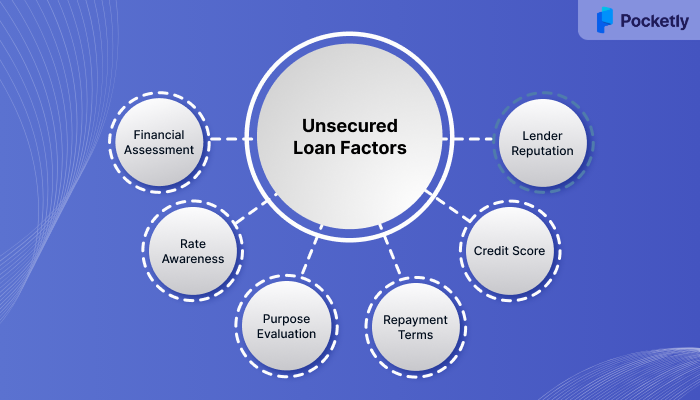

Important Factors to Consider Before Applying for Unsecured Installment Loans

Before applying for an unsecured installment loan, it’s important to assess your financial health and ensure you can afford the personal loan without compromising your financial stability. Consider the following factors:

- Assess Your Financial Health: Evaluate your income and existing debts to check if you can afford the loan payments. Consider future financial changes, like an income dip, to be certain you can manage the loan even during difficult times.

- Understand Interest Rates and Fees: Compare the APR (Annual Percentage Rate) across lenders to understand the total cost of the loan, including interest and fees. Borrowers with good credit qualify for lower APRs, making the loan more affordable in the long run.

- Evaluate Loan Purpose and Alternatives: Determine whether the loan is necessary for consolidating debt or funding large purchases. Consider alternatives like secured loans, which may offer lower rates but require collateral.

- Repayment Terms: Review the loan’s repayment schedule, including the monthly installments and the loan duration. Ensure the terms fit within your financial capacity so you can make timely payments without straining your budget.

- Credit Score: Check your score before applying. A higher score improves your chances of approval, gets better interest rates, and reduces the total cost of the loan.

- Lender Reputation: Look for customer reviews and check for any regulatory complaints. Opt for lenders with positive feedback to avoid potential issues with loan processing or repayment.

This careful evaluation helps you make informed decisions, but it's equally important to understand what makes unsecured installment loans attractive to millions of borrowers despite their higher interest rates compared to secured alternatives.

Benefits of Unsecured Installment Loans

Unsecured installment loans offer several advantages, making them an attractive option for those in need of quick financing. Unlike secured loans, these loans don’t require collateral, and the fixed repayment structure allows borrowers to plan their finances with certainty. Here’s a look at the benefits they offer:

- No need for collateral, reducing the risk of losing personal assets.

- Fixed monthly payments to manage your budget and avoid surprise costs.

- The loan amount is provided upfront, giving you immediate access to the funds you need.

- Competitive interest, especially for borrowers with good credit scores.

- Flexible repayment modes ranging from a few months to several years, allowing you to choose the most manageable option.

- Helps build or improve your credit score when paid on time, benefiting future borrowing potential.

- Quick approval and disbursal processes make it ideal for emergency situations or urgent financial needs.

- No restrictions on how the loan can be used, offering freedom to cover a wide range of personal expenses.

However, these advantages come with their own set of trade-offs. Being aware of the potential drawbacks ensures you approach these loans with realistic expectations and proper planning.

Challenges of Unsecured Installment Loans

Unsecured installment loans offer great flexibility but come with their own set of challenges. Here are the key challenges to consider:

- A higher rate of interest makes this loan more expensive over time.

- Stricter eligibility criteria, including a good credit score and stable income, can limit access for some borrowers.

- Late payments or missed installments can damage your credit score, leading to higher borrowing costs in the future.

Despite these challenges, choosing the right lender can significantly improve your borrowing experience and help you navigate potential pitfalls more effectively.

Why Choose Pocketly for Unsecured Installment Loans

Pocketly makes accessing personal loans easy, with flexible loan repayment modes. With a simple application process and minimal documentation, you can secure loans from ₹1,000 to ₹25,000 without the need for collateral and with minimal processing of (1-8%) of the loan amount.

Here is the application process of Pocketly:

- Download the Pocketly App.

- Fill out the online application with minimal details such as your personal information, income proof, and employment status.

- Complete the quick KYC (Know Your Customer) process using digital documents like your PAN card or Aadhaar card.

- Once your application is reviewed, you'll receive fast approval, usually within minutes.

- The loan will be disbursed to your account instantly, thus helping you with urgent financial needs.

Conclusion

Unsecured installment loans provide a flexible and predictable financial solution for students and individuals who need access to funds without offering collateral. These loans cover unexpected expenses, debt consolidation, or cash flow management.

However, carefully evaluate the loan terms, interest rates, and eligibility requirements before committing. With clear repayment schedules and competitive interest rates, unsecured installment loans can be a valuable tool for managing your finances.

Pocketly offers a simple, hassle-free way to access personal loans, with instant approval in minutes and loan repayment modes. Whether you are looking for a salaried loan or a self-employed loan, we can help you secure the funds you need without collateral. Download the Pocketly app on iOS or Android today!

FAQs

1. How Do Installment Loans Affect Your Credit Score?

Installment loans can affect positively or negatively on your credit score. Timely repayments help improve your score, as they contribute to a positive payment history. On the other hand, missed or late payments can harm your score, leading to higher borrowing costs in the future.

2. Is It Possible to Get an Installment Loan with Bad Credit?

Yes, it's possible to get a loan even with bad credit, but the terms may not be ideal. Lenders may offer higher interest rates or ask for a co-signer to reduce their risk.

3. What are the consequences if an Unsecured Loan Is Not Paid?

An unsecured loan, if not paid, the lender will report missed payments to credit bureaus, thus lowering your credit score. After repeated missed payments, the lender may pursue debt recovery options, such as sending the account to collections or taking legal action.

4. What legal action can be taken if you fail to pay an EMI?

Lenders may file a case for recovery of the outstanding amount, leading to potential court orders or asset seizure in extreme cases, depending on the terms of the loan agreement.

5. Can I Pause Loan Repayments?

Generally, loan repayments cannot be paused, but some lenders may offer temporary relief options, such as a repayment holiday or deferral, during times of financial hardship. It’s important to contact the lender to discuss available options before missing any payments.