Introduction

Digital payments have changed the way people use money every day. Instead of carrying cash or waiting for change, you can now pay with just a few taps on your phone or a quick swipe of your card. This makes transactions faster, easier, and more secure for all parties involved.

So, what is digital payment? It is a method of paying or receiving money through electronic means, rather than using physical cash. Common examples include UPI transfers, mobile wallets, debit or credit cards, and internet banking. These options enable people to send or receive money at any time, from anywhere.

In India, digital payments have proliferated in the last few years. More students, professionals, and businesses are using them because they save time and provide a simple way to manage daily expenses. Understanding the meaning, various types, and primary functions of digital payments can help you make more informed financial choices in today's increasingly cashless world.

At a Glance

- Digital payments let you send or receive money electronically without using cash, through methods like UPI, mobile wallets, cards, and internet banking.

- They work by securely transferring funds between bank accounts using payment networks, with confirmation in seconds.

- Popular types in India include UPI, wallets, debit/credit cards, net banking, QR code payments, contactless payments, prepaid cards, and Buy Now Pay Later (BNPL).

- Benefits include convenience, instant transfers, safety, easy expense tracking, flexibility, and supporting India’s cashless economy.

- Challenges involve fraud risks, internet issues, lack of awareness, transaction limits, and technical errors, but these can be managed with safe practices.

- Pocketly supports digital payments by offering small loans (₹1,000–₹25,000), instant approvals, direct bank transfers, digital repayment options, and transparent costs.

What is Digital Payment?

A digital payment is a way of paying money without using cash. In this method, both the person who pays and the person who receives the money use digital modes, such as phones, computers, or cards. The money moves directly from one bank account to another through an electronic system.

For example, when you send money through UPI, swipe your debit card at a shop, or use a mobile wallet like Paytm or Google Pay, you are making a digital payment.

Digital payments are quick, safe, and easy to track. They are now a standard part of daily life in India because they save time and remove the need to carry cash everywhere.

Understanding the meaning is just the start. Next, let’s see how digital payments actually work step by step.

Must Read: Guide to Best Digital Wallets in India

How Does Digital Payment Work?

Have you ever wondered how digital payments really work? Let’s break it down in a simple way.

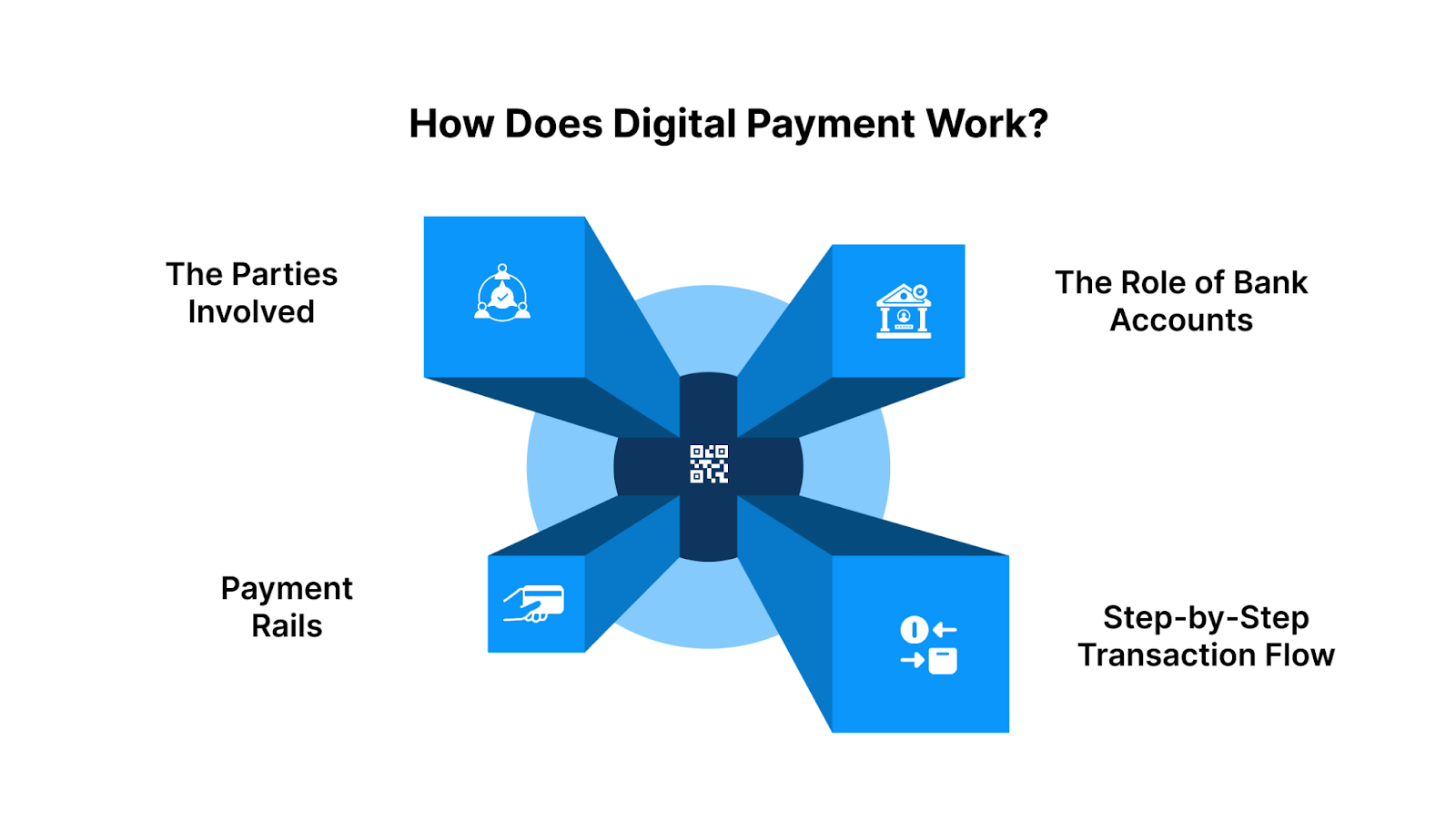

1. The Parties Involved

Every digital payment has a few essential players:

- You (the payer) – the person sending money.

- The merchant or receiver (payee) – the shop, business, or friend accepting the money.

- Banks – where both payer and receiver hold accounts.

- Payment networks – the systems (like UPI, card networks, or wallets) that connect banks and make sure the money moves safely.

These players work together behind the scenes so that the transaction feels instant and effortless for you.

2. The Role of Bank Accounts

For digital payments to occur, both the payer and the receiver must have bank accounts. Your account holds the money, while the bank ensures it is transferred securely when you make a payment. Online banking features like UPI, cards, or net banking turn your account into a tool for quick, cashless transactions.

3. Step-by-Step Transaction Flow

Here’s how a typical digital payment works:

- You start the payment – using UPI, a mobile wallet, a card, or net banking.

- Details are sent securely – the app or payment system passes your payment request to the bank and payment network.

- Balance check and transfer – the bank confirms you have enough balance, then moves the money from your account to the receiver's account.

- Confirmation message – both you and the receiver get a notification that the payment is successful.

The entire process usually happens in just a few seconds.

4. Payment Rails

Behind every digital payment is something called a payment rail. Think of it as the highway your money travels on. These rails connect banks and ensure that funds are directed to the correct account. Different rails are used for different types of payments:

- UPI and real-time systems – for instant transfers.

- Card networks (Visa, Mastercard, RuPay) – for debit and credit card payments.

- ACH or NEFT – for scheduled or larger payments that may take a little longer.

For Pocketly, digital payments are more than just convenience. They are the foundation of quick, safe, and transparent financial access. By understanding how digital payments work, users gain confidence in using them on a daily basis.

Once you know the process, it becomes clear why so many people prefer digital payments in their daily lives.

Must Read: What Is a Digital Wallet and How Does It Work

Why Choose Digital Payments?

Digital payments have become an essential part of daily life in India. Here are the main reasons why more people are opting for them over cash.

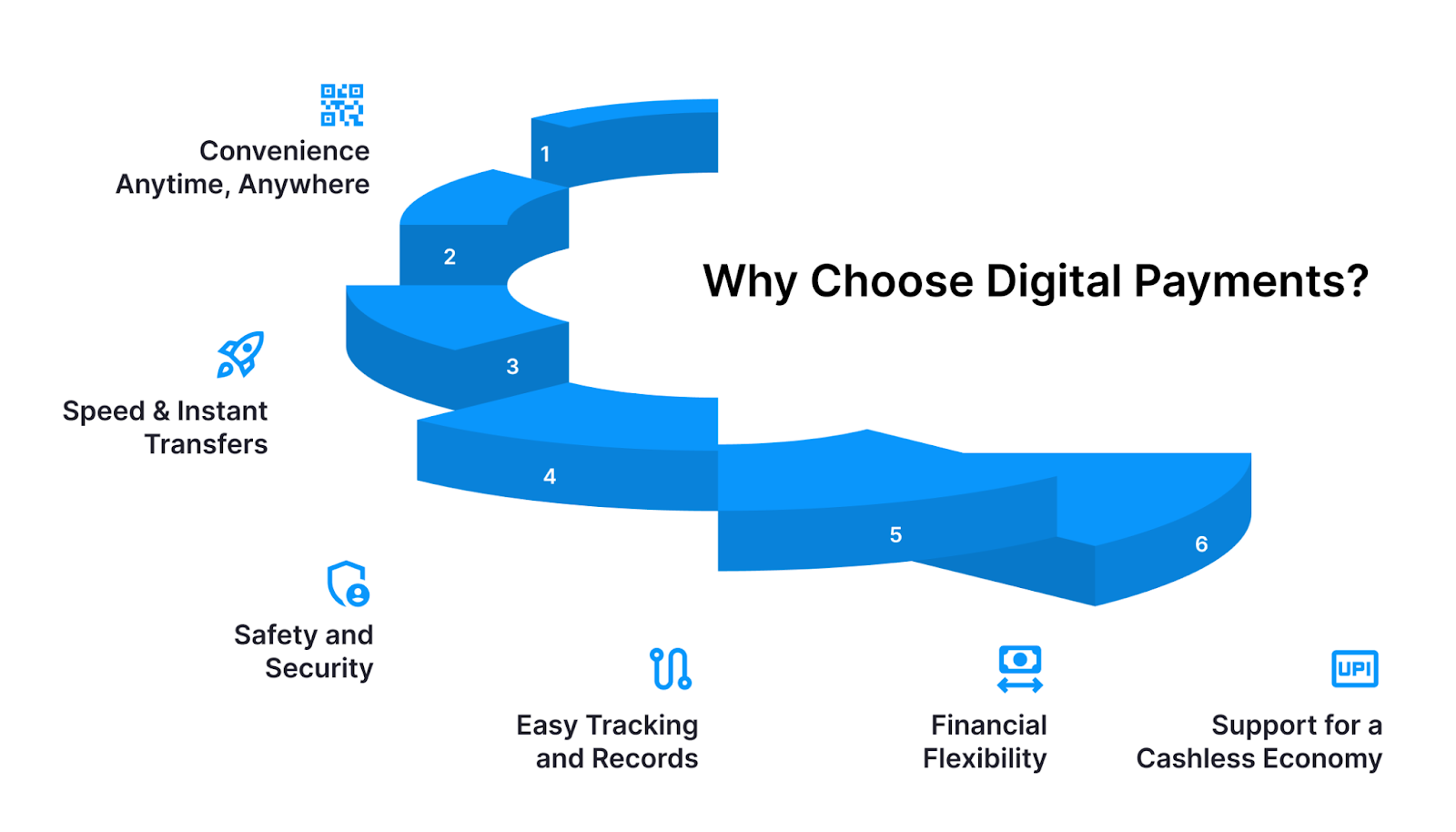

1. Convenience Anytime, Anywhere

You don't need to carry cash or look for change. With a phone or card, you can pay instantly for food, travel, bills, or online shopping, even late at night.

2. Speed and Instant Transfers

Most digital payments, such as UPI, occur within seconds. This makes them perfect for urgent needs such as paying fees, clearing rent, or sending money to a friend in need.

3. Safety and Security

Banks and apps use PINs, OTPs, and encryption to safeguard your funds. If used carefully, digital payments are safer than carrying large amounts of cash.

4. Easy Tracking and Records

Every digital payment leaves a record in your app or bank statement. This helps you track your spending, plan budgets, and avoid confusion.

5. Financial Flexibility

- Students can handle pocket money, pay tuition fees, or split bills easily.

- Salaried professionals can manage EMIs, household expenses, and online subscriptions smoothly.

- Self-employed individuals can accept customer payments instantly through QR codes, improving cash flow.

6. Support for a Cashless Economy

By choosing digital payments, you’re also supporting India’s move toward a transparent, modern, and cash-light economy.

Knowing the advantages is helpful, but it’s equally important to explore the different types of digital payments available in India.

Must Read: What is Buy Now Pay Later and How It Works

Types of Digital Payments

Digital payments come in many forms, each designed to facilitate easier and more secure money transfers.

Here are the main types you will come across in India:

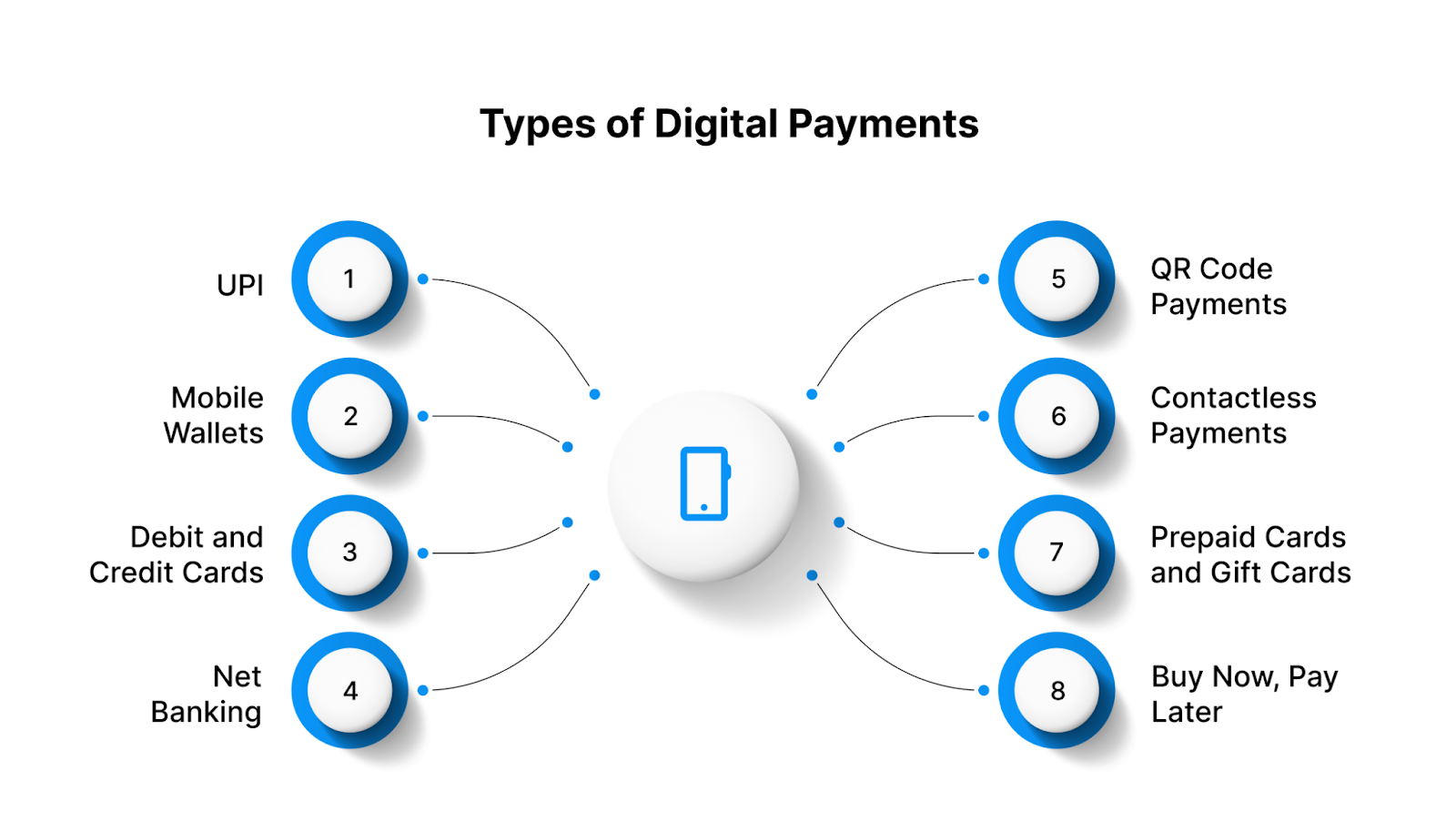

1. UPI (Unified Payments Interface)

UPI is one of the most popular digital payment methods today. It allows you to send or receive money instantly using a mobile number, UPI ID, or by scanning a QR code. The best part is that UPI works 24/7 and is usually free of cost. Students often use it to split bills with friends, while professionals find it convenient for quick transactions, such as paying rent or utility bills. Popular UPI apps include Google Pay, PhonePe, and Paytm.

2. Mobile Wallets

A mobile wallet works like a small digital purse that stores money virtually. You can add funds to the wallet and use it for mobile recharges, online shopping, or paying bills. Wallets are handy when you don’t want to share your bank account details for every transaction. Many young users prefer wallets like Paytm Wallet or Amazon Pay Wallet for convenience and cashback offers.

3. Debit and Credit Cards

Cards are a widespread way of making both online and offline payments. Debit cards allow you to spend money directly from your bank account, while credit cards let you borrow and pay later. They can be swiped, tapped for contactless payments, or used online by entering card details. Salaried professionals and self-employed individuals often rely on cards for larger expenses such as shopping, travel, or emergency payments.

4. Net Banking

Net banking, also known as internet banking, enables direct transfers between bank accounts. The common methods are NEFT, RTGS, and IMPS. While it may take a little longer than UPI in some cases, it is trusted for larger or scheduled payments like paying rent, business expenses, or school fees. Net banking also provides detailed transaction records, which are helpful for budgeting.

5. QR Code Payments

QR code payments have become increasingly popular in shops, restaurants, and among local vendors. To complete the payment, simply scan the QR code displayed by the merchant using your UPI or wallet app and approve the transaction. For self-employed individuals and small businesses, this method is beneficial because they can receive payments instantly without needing a card machine.

6. Contactless Payments (NFC)

Contactless payments use NFC (near-field communication) technology. With this, you simply tap your debit or credit card, or even your phone, at a payment machine to complete the transaction. It is quick, secure, and ideal for small purchases like groceries, metro tickets, or coffee at a café. Many young professionals like this option because it saves time.

7. Prepaid Cards and Gift Cards

Prepaid cards and gift cards are loaded with a set amount of money and can be used just like a debit card. They are commonly given as gifts or used by individuals who want to control their spending. For example, parents might provide prepaid cards to students to manage their monthly expenses more safely and with a clear limit.

8. Buy Now, Pay Later (BNPL)

BNPL is a new payment option that allows you to buy something today and pay for it later, either in whole or in easy instalments. This method is especially popular among young professionals who want to purchase gadgets, clothes, or other products online without paying the full amount upfront. BNPL offers flexibility, but it should be used wisely to prevent overspending.

With these options in mind, let’s now highlight the key benefits that digital payments bring to users.

Benefits of Digital Payments

Digital payments make life easier, safer, and more organised.

Here are the main benefits you should know about:

1. Convenience in Daily Life

Digital payments save time and effort. You don’t need to carry cash or look for change when paying for food, travel, or shopping. With just your phone or card, you can complete transactions in seconds, be it day or night. This makes them perfect for students paying small bills or professionals handling busy schedules.

2. Instant Money Transfers

One of the most significant advantages of digital payments is speed. Transfers through UPI or wallets happen instantly, even on weekends or holidays. This is especially helpful when you need to send money to a friend in a hurry, pay rent at the last minute, or settle a pending bill quickly.

3. Safety and Security

Most digital payment systems use PINs, passwords, OTPs, or biometric checks to make sure only you can complete the transaction. This reduces the risk of theft compared to carrying cash. As long as you don’t share your personal details, digital payments can be one of the safest ways to manage money.

4. Easy Tracking of Expenses

Every digital payment leaves a clear record in your app or bank account. You can see where your money is going, which helps you plan budgets and avoid overspending. For students learning money management, or self-employed individuals tracking business income, this feature is very useful.

5. Flexibility for Different Needs

Digital payments offer many options like UPI, wallets, cards, or net banking, so you can choose the one that suits you best. Students may prefer UPI for small transactions, while salaried professionals often rely on cards for bigger expenses. Self-employed people benefit from QR codes, which make it easy to receive money from customers.

6. Supporting a Cashless Economy

By choosing digital payments, you also support India’s move towards a modern, transparent, and less cash-dependent economy. This shift enables businesses, banks, and customers to work more efficiently, resulting in benefits for all parties involved.

Digital payments make transactions faster, safer, and easier to manage. For young Indians, whether they are students, professionals, or entrepreneurs, they offer financial freedom and control that cash alone cannot provide.

Although digital payments offer numerous benefits, they also present a few challenges that you should be aware of.

Must Read: How Secured Credit Cards Build Credit Score

Challenges in Digital Payments

While digital payments have made life easier, they also come with specific challenges that users should be aware of. Being aware of these issues helps you stay safe and make more informed financial decisions.

1. Cybersecurity Risks

One of the biggest challenges is the risk of fraud. Hackers and scammers sometimes try to trick people into sharing their PIN, OTP, or card details. Fake apps and phishing links can also put your money at risk. This is why it’s essential to use only trusted apps, double-check details before making a payment, and never share sensitive information.

2. Internet and Connectivity Issues

Digital payments rely on a stable internet connection or mobile network. In rural areas or during network failures, payments may fail or get delayed. This can be frustrating, especially when trying to pay bills or complete urgent transactions.

3. Lack of Digital Awareness

Not everyone is fully aware of how digital payments work. Some people may not know how to use UPI apps, QR codes, or internet banking safely. This lack of awareness sometimes leads to mistakes, such as sending money to the wrong person or falling victim to scams.

4. Transaction Limits and Charges

Many digital payment systems have daily transaction limits. For example, UPI often has a daily limit of ₹1 lakh, depending on the bank. Additionally, while most UPI transfers are free, some wallets or cards may charge small fees for specific transactions. These limits and charges can be inconvenient for users making larger payments.

5. Technical Errors

Sometimes payments fail due to technical issues in the bank’s system or the payment app. You may see money deducted from your account, but the payee may not receive it. Though banks usually resolve such issues within a few days, it can cause stress if the amount is large or urgent.

The good news is that these challenges can be managed. Let’s go through some simple tips to overcome them.

Tips to Overcome Challenges

Digital payments may have risks, but with a few smart habits, you can stay safe and make the most of them. Here are some tips to help you:

1. Stay Alert Against Fraud

Never share your PIN, OTP, or passwords with anyone. Always double-check the receiver’s name before confirming a payment. Use only trusted apps from official app stores and avoid clicking on unknown links.

2. Keep Backup Options

Sometimes payments fail due to poor internet or server issues. It’s helpful to keep more than one digital payment app on your phone, or carry a debit/credit card as a backup.

3. Learn and Educate Yourself

Take a little time to understand how UPI, QR codes, and cards work. If you’re unsure, ask your bank or a trusted individual to explain. Knowing the basics helps you avoid mistakes and stay confident while making payments.

4. Watch Out for Limits and Fees

Be aware of daily limits for UPI and other payment modes. If you’re making a large transfer, plan using NEFT or RTGS through net banking. Also, check if your wallet or card charges fees for certain services so you can avoid surprises.

5. Save Proof of Payment

Always keep the SMS or email confirmation after completing a digital payment. If a transaction is ever disputed or fails, this proof helps banks resolve the issue more quickly.

How Can Pocketly Help with Digital Payments?

Pocketly makes digital payments smoother, faster, and safer for young Indians. With every loan disbursed directly into your bank account, Pocketly ensures you can handle expenses digitally, without depending on cash.

Here’s how Pocketly supports digital payments:

Direct Bank Transfers

Every loan amount is credited straight to your bank account, so you can instantly use UPI, debit cards, or net banking for payments. No delays, no middle steps. Just quick access to money when you need it.

Small, Flexible Loan Amounts

If it’s ₹1,000 for a quick recharge or ₹25,000 for a larger expense, Pocketly provides funds that fit your needs. This makes it easy to manage daily digital transactions without relying on friends or family for help.

Seamless Digital Repayments

Repay your EMIs online through UPI, cards, or net banking. The fully digital repayment system makes it simple to stay on track and avoid missed deadlines, which also supports your credit growth.

Transparent Costs

With clear interest rates and processing fees shown upfront, you always know what you’re paying. This builds trust and makes it easier to plan your digital expenses without surprises.

Instant Approvals for Urgent Needs

Pocketly loans are approved and disbursed in minutes, giving you the power to manage emergencies, like paying rent, utility bills, or educational fees, through digital platforms without delay.

Building Stronger Digital Habits

By using Pocketly’s loans responsibly and repaying digitally, you create a reliable track record. This not only boosts your credit score but also strengthens your confidence in managing money digitally.

Pocketly combines credit access with digital convenience, helping you stay financially independent while making payments faster and easier in a cashless world.

Access quick loans, repay digitally, and grow your credit score with Pocketly. Download the iOS or Android app now.

Conclusion

Digital payments have become an essential part of everyday life in India. They make sending and receiving money faster, safer, and more convenient than using cash. From students managing daily expenses to professionals paying bills and self-employed individuals running businesses, digital payments offer solutions for everyone.

Of course, there are challenges, such as fraud risks, internet issues, and transaction limits. However, with the proper habits, such as staying alert, using trusted apps, and maintaining accurate payment records, these challenges can be easily managed.

With Pocketly, handling expenses becomes even simpler. Get instant access to ₹1,000–₹25,000 directly in your bank account, repay digitally with flexible options, and build your credit score along the way. Download the Pocketly app today on iOS or Android and experience a more innovative way to manage your digital payments.

FAQs

1. What is digital payment in simple words?

A digital payment is a way of sending or receiving money without using cash. The transfer happens online through UPI, cards, wallets, or internet banking.

2. What are the main types of digital payments in India?

The most common types include UPI, mobile wallets, debit/credit cards, net banking, QR code payments, contactless (tap-and-pay) payments, prepaid cards, and Buy Now Pay Later (BNPL) options.

3. Is UPI a digital payment method?

Yes. UPI (Unified Payments Interface) is one of the most widely used digital payment systems in India. It allows instant money transfers using a phone number, UPI ID, or QR code.

4. Are digital payments safe?

Digital payments are safe if you use trusted apps, keep your phone secure, and never share sensitive details like PINs or OTPs. Most transactions are protected with encryption and multi-step verification.

5. What are the benefits of using digital payments?

They are fast, convenient, and secure. Digital payments also leave a clear record of transactions, which helps with budgeting and financial planning.

6. Can digital payments be used for small transactions?

Yes. Digital payments are widely used for small daily expenses, such as buying groceries, paying for public transportation, or splitting a meal bill with friends.