Traditional loan approval processes can be slow, frustrating, and often leave borrowers feeling uncertain about their financial future. The good news is, digital lending is changing that. You've probably experienced the delays and limitations of conventional credit assessments, but now, thanks to digital underwriting, creditworthiness can be evaluated in real time using advanced algorithms and diverse data sources.

This shift not only speeds up the process but also opens doors for borrowers who might have struggled with traditional methods.

In this blog, we’ll explore how digital underwriting is transforming lending decisions, making them faster, smarter, and more accessible.

Key Takeaways

- Digital Underwriting Transforms Lending: Traditional manual underwriting is being replaced by AI-driven systems, which enable faster, more accurate loan decisions using real-time data analysis.

- Broader Data Sources for Better Risk Assessment: Digital lenders use not only credit scores but also alternative data like transaction histories, utility payments, and social signals to assess creditworthiness.

- Faster Loan Approvals: Digital underwriting speeds up approval times from days or weeks to minutes by automating key processes, making credit more accessible to borrowers.

- Increased Financial Inclusion: By leveraging alternative data, digital underwriting opens up access to loans for individuals and businesses with limited or no traditional credit histories.

- Enhanced Fraud Detection: AI-powered systems detect fraud and inconsistencies in real-time, significantly reducing the chances of false approvals and improving security in the lending process.

What is the Meaning of Credit Underwriting Process in Digital Lending?

The credit underwriting process in digital lending involves assessing a borrower’s creditworthiness using advanced technology and data-driven algorithms. Unlike traditional methods that rely primarily on credit scores and basic financial information, digital underwriting evaluates transaction history, payment behaviour, and social signals or online activity.

This process is automated, allowing lenders to make quicker and more accurate lending decisions in real time. The result is a streamlined approval process that provides greater accessibility to loans for individuals and businesses.

Traditional vs. Digital Underwriting: Key Differences Explained

The traditional underwriting process has long been the standard for assessing creditworthiness, relying on a limited set of data and manual evaluations. However, Digital underwriting is changing that with modern technologies like AI and machine learning. Here is a brief comparison.

| Aspect | Traditional Underwriting | Digital Underwriting |

| Data Sources | Primarily relies on limited data like credit scores, tax returns, and financial statements. | Uses a wider range of data, including transaction histories, social media activity, utility payments, and even mobile phone usage. |

| Process | Manual evaluation by underwriters is often slow and prone to human error. | Automated, AI-driven decision-making that analyzes vast amounts of data in real-time. |

| Speed of Approval | Takes longer due to manual checks and document verification. | Fast approval process, often within minutes, due to automation and instant data analysis. |

| Inclusivity | Limited to borrowers with established credit histories. | More inclusive, providing access to credit for those with limited or no traditional credit history by using alternative data. |

| Accuracy of Risk Assessment | Risk assessment can be less accurate as it relies mainly on static data. | More accurate, as it uses up-to-date data, real-time analysis, and predictive models to assess risk. |

| Cost | Higher operational costs due to manual labour and paperwork. | Lower operational costs through automation and streamlined processes. |

These fundamental differences in approach naturally lead to questions about what specific elements drive digital underwriting's superior performance. The answer lies in a sophisticated ecosystem of interconnected factors that work together to create a comprehensive picture of borrower creditworthiness, each playing a crucial role in the decision-making process.

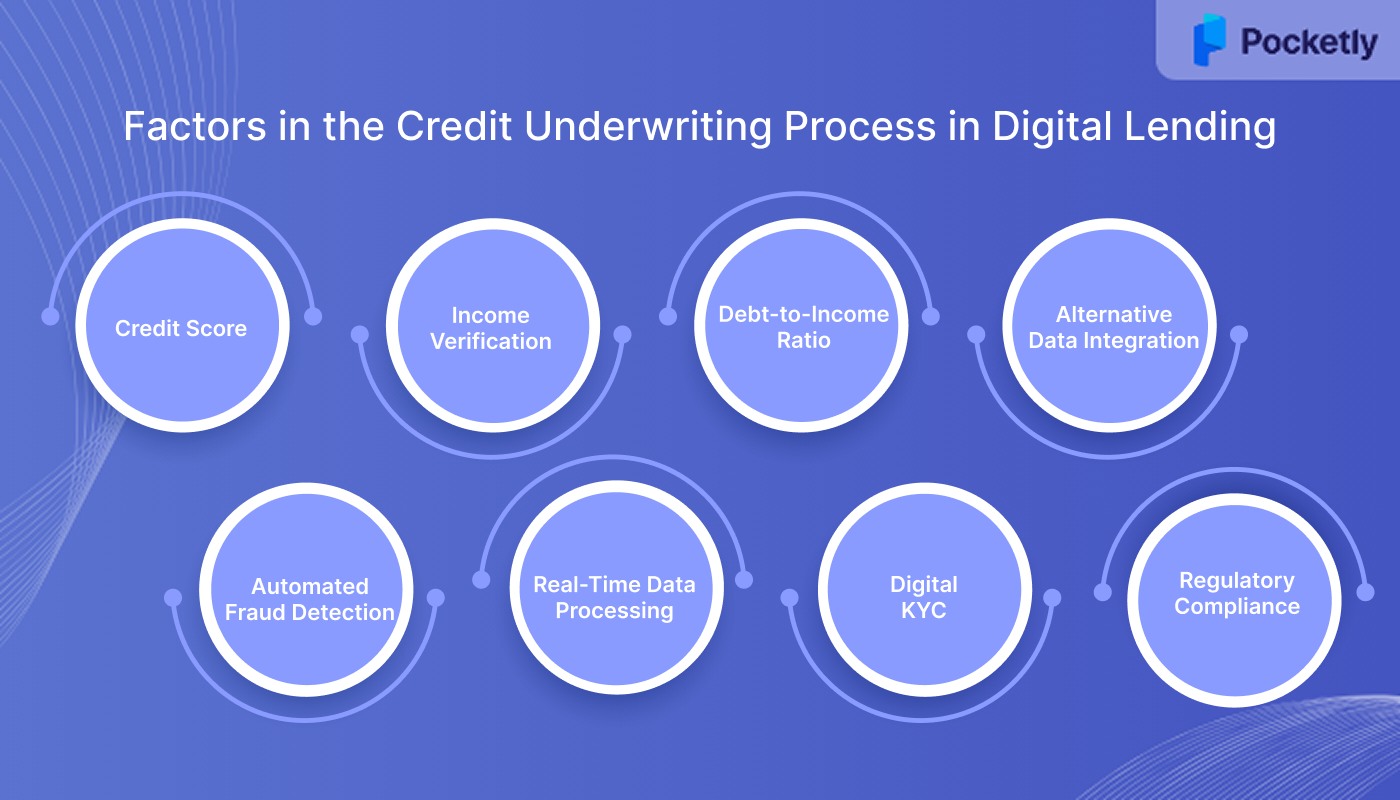

What are the Factors in the Credit Underwriting Process in Digital Lending?

The credit underwriting process in digital lending relies on several key factors that help lenders assess a borrower’s creditworthiness quickly and accurately. These factors include:

Credit Score and Payment History Analysis

Traditional credit scoring still plays a significant role, but is enhanced by a broader look at repayment patterns. Lenders analyse data from credit bureaus like CIBIL, Equifax, and Experian, focusing on missed payments, recovery after defaults, and payment consistency.

For example, fintech firms like NeoGrowth use Point-of-Sale (PoS) machine data to track merchant payment patterns and assess credit risk.

Income Verification and Employment Stability

Income verification has become faster and more accurate with automated access to financial records, such as payroll data, GST filings, and ITR uploads.

For instance, the government’s Digital Credit Assessment Model for MSMEs uses real-time data pulled directly from these sources. Employment verification has also evolved, with APIs checking job stability and consistency, particularly for freelancers and gig workers.

Debt-to-Income Ratio and Financial Capacity

Lenders now analyse bank transactions automatically, categorising them into income and expenses. AI-driven systems track spending patterns, such as recurring bills, and detect signs of financial stress (e.g., frequent overdrafts or high credit utilisation). This provides a more accurate picture of a borrower’s financial capacity.

Alternative Data Integration

Over 84% of lenders are now using alternative data sources, including utility payments, mobile recharge patterns, and digital transaction histories, to assess creditworthiness.

For example, electricity bill payments and online shopping behaviour can indicate a borrower’s financial responsibility, helping lenders assess those without traditional credit histories.

Automated Fraud Detection and Risk Assessment

AI-powered systems now track unusual transaction patterns and document discrepancies to flag potential fraud. For example, sudden location changes or multiple loan applications from the same device trigger additional verification. This automated system minimises false positives while improving fraud detection accuracy.

Real-Time Data Processing and Decision Engines

Digital underwriting platforms now leverage real-time data processing, enabling lenders to make immediate decisions. Using APIs and cloud computing, the entire approval process, which traditionally took days, is completed in seconds.

The system evaluates a borrower’s creditworthiness based on comprehensive data, including credit scores, income, and transaction history.

Digital KYC and Identity Verification

Digital KYC processes, such as Aadhaar-based e-KYC and video verification, ensure quick and secure identity authentication. These processes use biometric data, liveness detection, and real-time government database checks to streamline the verification process, reducing approval times significantly.

Regulatory Compliance and Risk Management

With the introduction of the RBI’s Digital Lending Guidelines, lenders are required to adhere to strict compliance measures, including data protection and mandatory reporting. Automated compliance systems help ensure that digital lenders remain aligned with these regulations while reducing the risk of legal issues.

Now that we’ve outlined the critical factors used in the underwriting process, it’s important for borrowers to know how they can take action to improve their credit profile.

How Borrowers Can Strengthen Their Credit Profile

Borrowers who understand the credit underwriting factors can take steps to improve their eligibility for loans with better terms. Practical measures include:

- Paying EMIs, credit card bills, and other obligations promptly to maintain a strong credit score.

- Keeping debt levels manageable, ideally below 40% of income, to show financial stability.

- Showing consistent income through regular employment or steady business revenue.

- Building a track record with small, manageable credit products, such as secured credit cards or responsibly using BNPL services.

While understanding credit improvement strategies is valuable, seeing how these factors come together in practice provides deeper insight into the lending process. By understanding how these elements come together, borrowers can gain deeper insight into the seamless loan approval experience

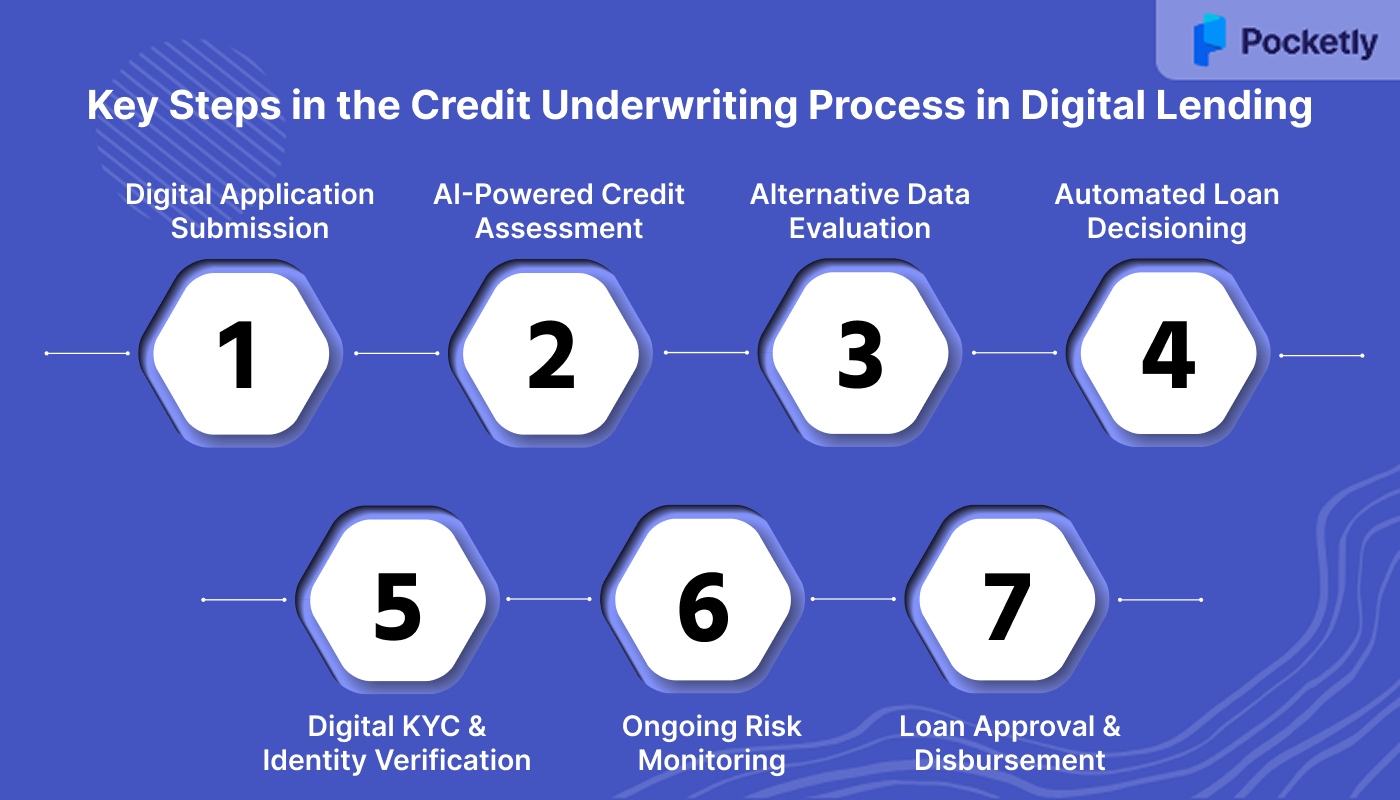

Key Steps in the Credit Underwriting Process in Digital Lending

Credit underwriting in digital lending has evolved from slow, manual evaluations to automated, AI-driven systems. Here’s how technology is transforming each key step for lenders and borrowers:

Step 1: Digital Application Submission

Borrowers now submit applications online, eliminating paperwork delays. Data is securely retrieved from bank statements, tax filings, and payment histories for instant processing.

Step 2: AI-Powered Credit Assessment

Artificial intelligence replaces manual review by analyzing thousands of data points at once. AI models can:

- Predict repayment behaviour using transaction histories and spending patterns.

- Detect inconsistencies and potential fraud in submitted documents.

- Offer more accurate risk assessment than traditional credit scores alone.

Step 3: Alternative Data Evaluation

For borrowers without formal credit histories, alternative data helps determine creditworthiness. Examples include:

- Utility and rent payment patterns.

- Digital transaction history, such as UPI, wallets, and BNPL activity.

- Bank account savings and spending trends.

This approach increases financial inclusion for gig workers, small business owners, and young professionals.

Step 4: Automated Loan Decisioning

Automated underwriting platforms process applications in real-time. The system evaluates creditworthiness and approves or rejects loans within minutes, reducing dependency on manual checks.

Step 5: Digital KYC and Identity Verification

Paper-based KYC is replaced by digital methods:

- Aadhaar-based e-KYC for instant verification.

- Video KYC for remote onboarding.

- AI-driven document verification to flag forged or inconsistent information.

This ensures faster, secure, and compliant onboarding for all borrowers.

Step 6: Ongoing Risk Monitoring

Post-approval, AI systems continuously monitor borrower activity. Sudden changes in income, transaction patterns, or repayment behaviour trigger alerts, helping lenders manage risk proactively.

Step 7. Loan Approval and Disbursement

Once the underwriting process confirms creditworthiness, the loan moves to approval and disbursement:

- The digital platform generates an approval decision instantly and communicates it to the borrower.

- Loan terms, interest rates, repayment schedules, and any conditions are clearly shared through the platform.

- Funds are transferred directly to the borrower’s bank account, often within minutes, reducing delays and paperwork.

- Automated notifications and dashboards allow borrowers to track disbursement status, ensuring transparency and confidence in the process.

This streamlined process delivers tangible advantages that extend far beyond simple time savings. The ripple effects of digital underwriting create value for every stakeholder, fundamentally changing how we think about credit access and financial inclusion in the modern economy.

What are the Benefits of Digital Underwriting

Digital underwriting has transformed how lenders assess credit, making the process faster, more accurate, and accessible. Here are the advantages that creates a more efficient and inclusive lending experience for both lenders and borrowers.

- Speeds up loan decisions by automating credit assessments, cutting approval time from days to minutes.

Example: Pocketly approve personal loans instantly using automated systems.

- Uses AI and machine learning for more accurate risk evaluation, reducing defaults and unfair rejections.

Example: NeoGrowth leverages AI models to predict repayment behaviour for merchants based on PoS transaction patterns.

- Incorporates alternative data, enabling borrowers without formal credit histories to access loans.

Example: UPI transaction history, utility payments, and rental records help first-time borrowers secure credit.

- Lowers operational costs while improving regulatory compliance and fraud detection.

Example: Video KYC and AI-driven document verification reduce manual checks, saving time and preventing fraud.

- Creates a more inclusive, efficient, and secure lending process for both lenders and borrowers.

Example: MSMEs and gig workers now gain access to working capital loans without traditional credit scores.

These benefits represent just the beginning of digital underwriting's potential. As technology continues to evolve at breakneck speed, emerging innovations are pushing the boundaries of what's possible in credit assessment, promising even more sophisticated and inclusive lending solutions for the future.

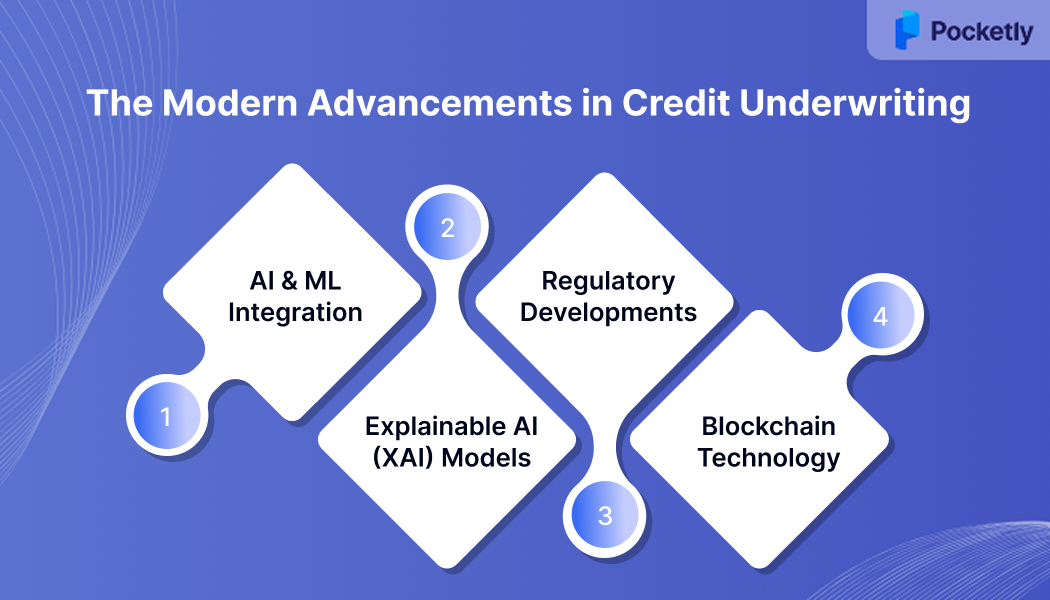

What are the Modern Advancements in Credit Underwriting?

Advancements in credit underwriting within digital lending have significantly transformed the financial system, moving from traditional, manual processes to more efficient, data-driven methodologies. These innovations aim to enhance the accuracy, speed, and inclusivity of lending decisions.

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: AI and ML algorithms analyze vast datasets, including alternative data sources, to assess creditworthiness more accurately. For instance, platforms like Upstart utilize education and employment history to predict loan repayment potential, expanding access to credit for individuals with limited traditional credit histories.

- Explainable AI (XAI) Models: To address concerns about transparency, lenders are adopting XAI techniques that make AI-driven decisions more interpretable. Methods like SHAP and LIME provide insights into how models arrive at specific credit decisions, ensuring fairness and regulatory compliance.

- Regulatory Developments and Standardization: Regulatory bodies are recognizing the importance of alternative data in credit assessments. For example, the Federal Housing Finance Agency's approval of VantageScore 4.0 for mortgage lending allows the inclusion of rental and utility payment histories, facilitating broader access to credit.

- Blockchain Technology: Blockchain is gradually making its way into credit underwriting, offering the potential to transform transparency and security in digital lending. By storing credit histories on a tamper-proof, decentralized network, it ensures that borrower data cannot be altered or manipulated. This further reduces dependence on traditional, centralized credit bureaus.

All these technological advances come together in real lending platforms that people use every day. Pocketly is a great example of how digital underwriting works in practice.

How Pocketly Enhances the Credit Underwriting Experience

Pocketly is a digital lending platform that enables borrowers to access personal loans instantly, with a streamlined process and flexible repayment terms. Whether you have a well-established credit history or are new to credit, Pocketly provides easy access to funds with minimal barriers.

Key Features of Pocketly

- Loan Amount: Borrow anywhere between ₹1,000 to ₹25,000, depending on your eligibility and need.

- Interest Rates: Loans start at just 2% per month, making it an affordable option for those in need of short-term funds.

- Processing Fee: Transparent fee structure ranging from 1% to 8%, with no hidden costs.

- Flexible EMI Options: Choose flexible repayment plans based on your financial situation, ensuring manageable installments.

- Minimal Documentation: Quick and easy application process with minimal KYC requirements, reducing paperwork and speeding up loan disbursal.

- Loan Repayment: Enjoy the convenience of automated, easy-to-track EMI repayments, allowing you to stay on top of your loan obligations.

- Instant Personal Loan Approval: Experience quick approval and disbursement, often within minutes, without the need for lengthy wait times.

Conclusion

Digital underwriting is reshaping the lending process by providing faster, smarter, and more inclusive credit assessments. The traditional loan approval process, often slow and based on limited data, has been replaced by a dynamic, data-driven approach that benefits both lenders and borrowers. With advancements like AI, alternative data, and automated processes, digital lending platforms are making credit more accessible and transparent.

Pocketly enhances this experience by offering instant personal loans with minimal documentation and flexible repayment terms. Whether you're new to credit or looking for a quick financial solution, Pocketly streamlines the process and ensures transparency and ease.

Download Pocketly now on iOS or Android to experience a faster, smarter, and more accessible way to secure loans.

FAQs

1. What are the 5 C's of credit underwriting?

The 5 C's of credit underwriting are Character, Capacity, Capital, Collateral, and Conditions. These factors help lenders assess a borrower’s ability to repay the loan, their financial stability, and the risk involved.

2. What are the three types of underwriting?

The three types of underwriting are Retail Underwriting (individual loans), Wholesale Underwriting (large-scale loans or for businesses), and Correspondent Underwriting (third-party loan originators that work with lenders).

3. How does digital underwriting ease smarter and safer growth?

Digital underwriting leverages AI, machine learning, and real-time data to make faster, more accurate lending decisions. It reduces human error, fraud risk, and operational costs, while improving scalability and speed in loan approvals.

4. What is a credit underwriting model?

A credit underwriting model is a system or algorithm used by lenders to evaluate a borrower’s creditworthiness. It combines factors like credit score, income, transaction history, and other data to predict the likelihood of repayment.

5. What is the difference between lending and underwriting?

Lending refers to the act of providing funds to a borrower, while underwriting is the process of assessing and evaluating the borrower’s creditworthiness and the risk involved in providing the loan.